Key Insights

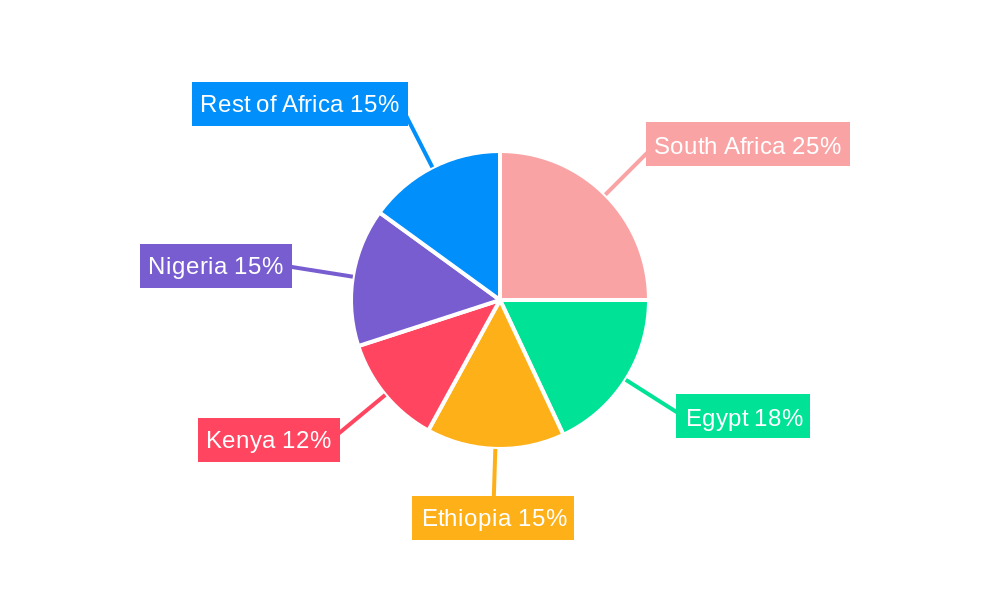

The African grain seed market, valued at approximately $X million in 2025 (estimated based on provided CAGR and market size), is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.70% from 2025 to 2033. This expansion is fueled by several key factors. Increasing demand for food security, driven by a burgeoning population and rising incomes in several African nations, is a primary driver. Government initiatives promoting agricultural modernization and improved farming techniques, including the adoption of high-yielding hybrid seeds and insect-resistant varieties, are further stimulating market growth. The prevalence of corn, rice, sorghum, and wheat cultivation across diverse African regions, coupled with the growing adoption of advanced breeding technologies like hybrids and open-pollinated varieties, contributes significantly to market expansion. While challenges such as climate change, limited access to irrigation, and inadequate infrastructure pose restraints, the overall growth trajectory remains positive, particularly in countries like South Africa, Egypt, Ethiopia, Kenya, and Nigeria, which are expected to be key contributors to market expansion.

Significant market segmentation exists across breeding technologies (hybrids, insect-resistant hybrids, open-pollinated varieties) and crop types (corn, rice, sorghum, wheat, other grains). Competition among leading seed companies, including Zamseed, Seed Co Limited, Groupe Limagrain, Bayer AG, and Syngenta, is intense, with companies investing heavily in research and development to enhance seed quality and introduce new varieties adapted to specific African agro-climatic conditions. The market's future hinges on continued investment in agricultural research, improved farmer access to credit and technology, and the successful implementation of policies that support sustainable agricultural practices and address climate change vulnerabilities. The market's growth potential is considerable, presenting lucrative opportunities for both established players and emerging seed companies operating within the African continent.

Africa Grain Seed Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa grain seed market, covering the period 2019-2033. With a focus on key segments, leading players, and emerging trends, this report is an invaluable resource for industry stakeholders, investors, and researchers seeking to understand the dynamics and future potential of this rapidly evolving market. The report includes detailed market sizing, forecasts, and competitive landscaping, leveraging extensive data and expert analysis. The market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The base year for this analysis is 2025, with historical data spanning 2019-2024.

Africa Grain Seed Market Market Concentration & Dynamics

The Africa grain seed market exhibits a moderately concentrated structure, with a few multinational corporations and regional players dominating market share. While precise market share figures vary by segment and country, key players such as Seed Co Limited, Bayer AG, Syngenta Group, and Corteva Agriscience hold significant positions. The market is characterized by an increasing focus on innovation, particularly in hybrid seed technologies and genetically modified (GM) varieties. Regulatory frameworks vary across African nations, impacting the adoption of GM seeds and the overall market dynamics. Substitute products, such as traditional open-pollinated varieties, continue to hold relevance, particularly in regions with limited access to advanced technologies. End-user trends are shaped by factors such as increasing demand for higher-yielding and disease-resistant varieties, driven by population growth and climate change.

- Market Concentration: Moderately concentrated, with top players holding significant shares (xx% combined market share in 2024 estimated).

- Innovation Ecosystems: Strong focus on hybrid seed technologies and GM varieties; increasing investments in R&D.

- Regulatory Frameworks: Vary significantly across countries, impacting GM seed adoption.

- Substitute Products: Traditional open-pollinated varieties remain relevant, particularly in some regions.

- End-User Trends: Growing demand for high-yielding and disease-resistant seeds.

- M&A Activities: xx M&A deals recorded between 2019 and 2024, indicating increasing consolidation.

Africa Grain Seed Market Industry Insights & Trends

The African grain seed market is experiencing robust growth, fueled by a confluence of factors. A burgeoning population and rapid urbanization are driving significantly increased demand for food grains, creating a pressing need for improved seed varieties with higher yields and resilience. Climate change, with its unpredictable weather patterns and increasingly frequent droughts, is severely impacting crop yields, making the adoption of climate-resilient seeds crucial for food security. Technological advancements, including the development of hybrid and genetically modified (GM) seeds, are revolutionizing agricultural practices, boosting crop productivity and efficiency. Furthermore, government initiatives aimed at modernizing agriculture and ensuring food security are providing vital support for market expansion. Evolving consumer preferences, with a growing emphasis on higher quality and more nutritious food, are also shaping market trends. While precise figures for market valuation in 2024 are unavailable, projections indicate substantial growth in the coming years, driven by the aforementioned factors. This growth is expected across various grain types, including maize, sorghum, millet, and rice, reflecting the diverse agricultural landscape of the continent.

Key Markets & Segments Leading Africa Grain Seed Market

South Africa, Egypt, Nigeria, and Ethiopia represent the largest national markets within the Africa grain seed sector. Corn, sorghum, and wheat are the leading crops in terms of seed demand, with significant growth potential also observed in rice and other grains. Hybrid seeds dominate the breeding technology segment due to their superior yield and disease resistance.

Leading Segments & Drivers:

- Country: South Africa (largest market due to advanced agricultural infrastructure and high adoption of modern technologies), Egypt (significant rice and wheat production), Nigeria (large population and substantial land under cultivation), Ethiopia (growing agricultural sector and government support).

- Crop: Corn (high demand for food and feed), Sorghum (drought tolerance makes it suitable for many regions), Wheat (essential staple food).

- Breeding Technology: Hybrids (superior yield and disease resistance compared to open-pollinated varieties).

Dominance Analysis: South Africa's dominance stems from its relatively developed agricultural infrastructure, higher farmer income, and greater access to advanced technologies. Egypt and Nigeria benefit from large populations and significant land suitable for grain cultivation. Ethiopia's growing agricultural sector and government initiatives are driving market expansion.

Africa Grain Seed Market Product Developments

Recent years have witnessed remarkable advancements in grain seed technology across Africa. Companies are investing heavily in the development of hybrid varieties that exhibit improved yield potential, enhanced pest and disease resistance, and superior drought tolerance. The introduction of genetically modified (GM) seeds is steadily gaining acceptance in several regions, offering significant improvements in crop productivity and reducing reliance on chemical pesticides. These developments are not only enhancing food security but also contributing to improved farmer livelihoods and economic growth in rural communities. The integration of precision agriculture technologies, including data analytics and digital tools, further refines seed selection, optimizes crop management practices, and maximizes yields. This focus on technological innovation is reshaping the agricultural landscape and positioning Africa for greater food self-sufficiency.

Challenges in the Africa Grain Seed Market Market

Several challenges hinder the growth of the Africa grain seed market. Regulatory hurdles and bureaucratic complexities related to seed registration and distribution can slow down market penetration. Poor infrastructure, including inadequate storage and transportation networks, increases logistical challenges and limits access to quality seeds for farmers. The prevalence of counterfeit seeds undermines market integrity and compromises the quality of produce. Competition from informal seed markets also exerts pressure on established players. These factors collectively impede market growth and reduce farmer adoption of improved seed varieties. Quantifiable impacts include reduced yields, increased production costs, and lower farm incomes.

Forces Driving Africa Grain Seed Market Growth

Several factors are driving market expansion. Technological advancements, such as the development of hybrid and GM varieties, are enhancing crop productivity and efficiency. Economic growth and rising disposable incomes are increasing demand for higher-quality food. Government policies supporting agricultural modernization and food security are further boosting market growth. These factors are creating a favorable environment for the expansion of the grain seed market in Africa. Examples include government subsidies for seed purchases, investments in agricultural research, and improved access to credit for farmers.

Long-Term Growth Catalysts in the Africa Grain Seed Market

Long-term growth will be driven by continued innovation in seed technology, strategic partnerships between public and private sectors to improve seed access and affordability, and market expansions into under-served regions. Increased investment in agricultural research and development will also play a critical role in developing improved seed varieties adapted to the diverse agro-ecological conditions across Africa.

Emerging Opportunities in Africa Grain Seed Market

Emerging opportunities include the expanding demand for climate-resilient seeds due to climate change and the growing adoption of precision agriculture technologies for efficient crop management. The increasing penetration of mobile technology creates opportunities for digital platforms that connect farmers with seed suppliers and provide agronomic advice.

Leading Players in the Africa Grain Seed Market Sector

- Zambia Seed Company Limited (Zamseed)

- Seed Co Limited

- Groupe Limagrain

- Bayer AG

- S&W Seed Co

- Syngenta Group

- Advanta Seeds - UPL

- Capstone Seeds

- Corteva Agriscience

- BASF SE

Key Milestones in Africa Grain Seed Market Industry

- October 2022: Bayer AG launched DKC80-23 Mzati the Pillar, an early-maturity, high-performance corn seed variety, in Malawi. This contributed to increased corn yields and strengthened Bayer's market position.

- March 2023: Pioneer Seeds (Corteva Agriscience) introduced 44 new corn seed hybrid varieties incorporating Vorceed Enlist corn technology, expanding its product portfolio and offering farmers advanced pest management solutions.

- May 2023: Capstone Seeds launched two genetically modified maize hybrids, CAP 9-242RRBT (fast yellow) and CAP 9-569RRBT (medium white), suitable for dryland planting. This expansion into GM technology enhanced Capstone's competitiveness.

- [Add another recent milestone here with details – Year, Company, Action, Impact]

Strategic Outlook for Africa Grain Seed Market Market

The Africa grain seed market holds immense potential for future growth. Continued technological advancements, coupled with supportive government policies and strategic partnerships, will unlock significant opportunities for market expansion. The focus on developing climate-resilient and high-yielding varieties, combined with improved access to quality seeds and agricultural services, will pave the way for a more sustainable and productive agricultural sector in Africa.

Africa Grain Seed Market Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.1.2. Herbicide Tolerant Hybrids

- 1.1.3. Insect Resistant Hybrids

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. Crop

- 2.1. Corn

- 2.2. Rice

- 2.3. Sorghum

- 2.4. Wheat

- 2.5. Other Grains & Cereals

-

3. Breeding Technology

-

3.1. Hybrids

- 3.1.1. Non-Transgenic Hybrids

- 3.1.2. Herbicide Tolerant Hybrids

- 3.1.3. Insect Resistant Hybrids

- 3.2. Open Pollinated Varieties & Hybrid Derivatives

-

3.1. Hybrids

-

4. Crop

- 4.1. Corn

- 4.2. Rice

- 4.3. Sorghum

- 4.4. Wheat

- 4.5. Other Grains & Cereals

Africa Grain Seed Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Grain Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Grain Seed Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.1.2. Herbicide Tolerant Hybrids

- 5.1.1.3. Insect Resistant Hybrids

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by Crop

- 5.2.1. Corn

- 5.2.2. Rice

- 5.2.3. Sorghum

- 5.2.4. Wheat

- 5.2.5. Other Grains & Cereals

- 5.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.3.1. Hybrids

- 5.3.1.1. Non-Transgenic Hybrids

- 5.3.1.2. Herbicide Tolerant Hybrids

- 5.3.1.3. Insect Resistant Hybrids

- 5.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.3.1. Hybrids

- 5.4. Market Analysis, Insights and Forecast - by Crop

- 5.4.1. Corn

- 5.4.2. Rice

- 5.4.3. Sorghum

- 5.4.4. Wheat

- 5.4.5. Other Grains & Cereals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. South Africa Africa Grain Seed Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Grain Seed Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Grain Seed Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Grain Seed Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Grain Seed Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Grain Seed Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Zambia Seed Company Limited (Zamseed

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Seed Co Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Groupe Limagrain

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bayer AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 S&W Seed Co

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Syngenta Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Advanta Seeds - UPL

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Capstone Seeds

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Corteva Agriscience

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BASF SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Zambia Seed Company Limited (Zamseed

List of Figures

- Figure 1: Africa Grain Seed Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Grain Seed Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Grain Seed Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Grain Seed Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Africa Grain Seed Market Revenue Million Forecast, by Breeding Technology 2019 & 2032

- Table 4: Africa Grain Seed Market Volume Kiloton Forecast, by Breeding Technology 2019 & 2032

- Table 5: Africa Grain Seed Market Revenue Million Forecast, by Crop 2019 & 2032

- Table 6: Africa Grain Seed Market Volume Kiloton Forecast, by Crop 2019 & 2032

- Table 7: Africa Grain Seed Market Revenue Million Forecast, by Breeding Technology 2019 & 2032

- Table 8: Africa Grain Seed Market Volume Kiloton Forecast, by Breeding Technology 2019 & 2032

- Table 9: Africa Grain Seed Market Revenue Million Forecast, by Crop 2019 & 2032

- Table 10: Africa Grain Seed Market Volume Kiloton Forecast, by Crop 2019 & 2032

- Table 11: Africa Grain Seed Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Africa Grain Seed Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 13: Africa Grain Seed Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Africa Grain Seed Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 15: South Africa Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 17: Sudan Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Sudan Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Uganda Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Uganda Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Tanzania Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: Kenya Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Kenya Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: Rest of Africa Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Africa Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: Africa Grain Seed Market Revenue Million Forecast, by Breeding Technology 2019 & 2032

- Table 28: Africa Grain Seed Market Volume Kiloton Forecast, by Breeding Technology 2019 & 2032

- Table 29: Africa Grain Seed Market Revenue Million Forecast, by Crop 2019 & 2032

- Table 30: Africa Grain Seed Market Volume Kiloton Forecast, by Crop 2019 & 2032

- Table 31: Africa Grain Seed Market Revenue Million Forecast, by Breeding Technology 2019 & 2032

- Table 32: Africa Grain Seed Market Volume Kiloton Forecast, by Breeding Technology 2019 & 2032

- Table 33: Africa Grain Seed Market Revenue Million Forecast, by Crop 2019 & 2032

- Table 34: Africa Grain Seed Market Volume Kiloton Forecast, by Crop 2019 & 2032

- Table 35: Africa Grain Seed Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Africa Grain Seed Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 37: Nigeria Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Nigeria Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 39: South Africa Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Africa Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 41: Egypt Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Egypt Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 43: Kenya Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Kenya Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 45: Ethiopia Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Ethiopia Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 47: Morocco Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Morocco Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 49: Ghana Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Ghana Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 51: Algeria Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Algeria Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 53: Tanzania Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Tanzania Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 55: Ivory Coast Africa Grain Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Ivory Coast Africa Grain Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Grain Seed Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Africa Grain Seed Market?

Key companies in the market include Zambia Seed Company Limited (Zamseed, Seed Co Limited, Groupe Limagrain, Bayer AG, S&W Seed Co, Syngenta Group, Advanta Seeds - UPL, Capstone Seeds, Corteva Agriscience, BASF SE.

3. What are the main segments of the Africa Grain Seed Market?

The market segments include Breeding Technology, Crop, Breeding Technology, Crop.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

May 2023: Capstone Seeds has two genetically modified cultivars, including CAP 9-242RRBT, which is a fast yellow maize hybrid, and CAP 9-569RRBT, a medium white maize hybrid for dry land plantings.March 2023: Pioneer Seeds, a subsidiary of Corteva Agriscience, launched 44 new corn seed hybrid varieties with new Vorceed Enlist corn technology to help manage corn rootworms.October 2022: Bayer AG launched an early maturity and high-performance corn seed variety, "DKC80-23 Mzati the Pillar," in the Malawi region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Grain Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Grain Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Grain Seed Market?

To stay informed about further developments, trends, and reports in the Africa Grain Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence