Key Insights

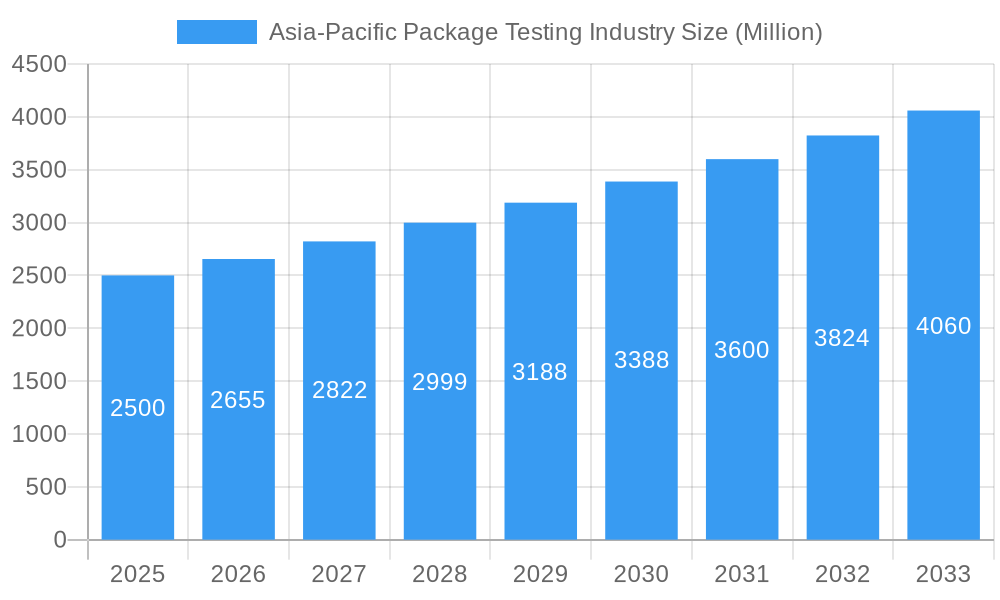

The Asia-Pacific package testing market, projected to reach $21.58 billion by 2033, is set to witness substantial growth with a Compound Annual Growth Rate (CAGR) of 5.25% from 2025 to 2033. This expansion is driven by the booming e-commerce sector, demanding robust quality control for product integrity during transit. Growing consumer emphasis on product quality and sustainability, alongside stringent government regulations on packaging materials and environmental impact, are key accelerators. Significant growth is observed in China, India, and Japan due to rapid industrialization and expanding manufacturing. The adoption of advanced packaging materials with enhanced barrier and sustainability features further fuels market expansion. Key service segments include physical performance, chemical, and environmental testing, serving crucial end-user industries like food & beverage, healthcare, and industrial manufacturing.

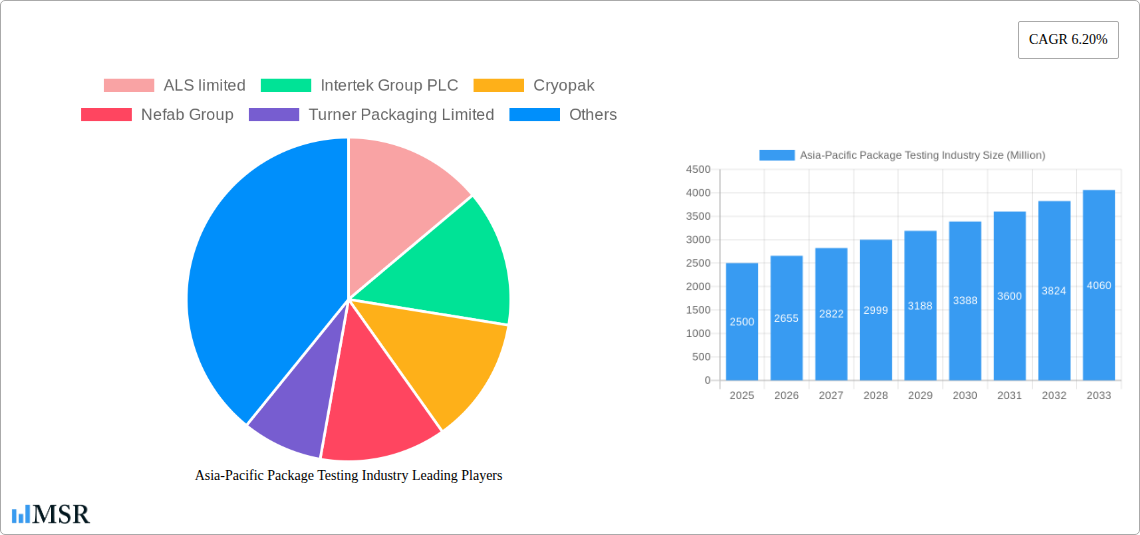

Asia-Pacific Package Testing Industry Market Size (In Billion)

Despite growth, challenges such as fluctuating raw material prices and complex cross-border regulatory compliance persist. The competitive landscape features a blend of global leaders and regional specialists. Market players are focusing on enhancing testing capabilities, adopting advanced technologies, and forming strategic alliances to maintain market share. The demand for specialized testing for emerging trends like eco-friendly and smart packaging is shaping the industry's future trajectory, with continued robust growth anticipated.

Asia-Pacific Package Testing Industry Company Market Share

Asia-Pacific Package Testing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific package testing industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth prospects. The report leverages robust data and industry expertise to deliver actionable intelligence, enabling informed decision-making within this rapidly evolving landscape. Expect detailed analysis across primary materials (glass, paper, plastic, metal), testing types (physical performance, chemical, environmental), and end-user industries (food & beverage, healthcare, industrial, personal & household products, others).

Asia-Pacific Package Testing Industry Market Concentration & Dynamics

The Asia-Pacific package testing market exhibits a moderately concentrated structure, with several multinational players commanding significant market share. While precise figures are proprietary, we estimate that the top five players control approximately xx% of the overall market in 2025. This concentration is driven by the economies of scale achieved by large companies, along with their extensive testing capabilities and global reach. However, the market also accommodates numerous smaller, specialized testing firms that cater to niche segments or regional demands.

Several factors influence market dynamics. The region's robust economic growth, particularly in emerging economies, fuels significant demand for package testing services. Stringent regulatory frameworks for product safety and environmental compliance further underpin industry growth. The constant evolution of packaging materials, driven by consumer preferences and sustainability initiatives, necessitates continuous innovation in testing methodologies.

The competitive landscape is marked by ongoing mergers and acquisitions (M&A) activity, with xx major deals recorded between 2019 and 2024. These strategic moves allow companies to expand their service portfolios, geographic reach, and technological capabilities. Substitute products, such as alternative testing methods or the use of self-testing technologies, pose a minor threat to the industry's growth.

Asia-Pacific Package Testing Industry Industry Insights & Trends

The Asia-Pacific package testing market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. The market size in 2025 is estimated at $xx Million, expected to reach $xx Million by 2033. Several factors contribute to this growth. Firstly, the rising consumer demand for packaged goods across various sectors, coupled with increased focus on e-commerce, drives the need for rigorous quality control and testing. Secondly, stringent government regulations regarding product safety and environmental compliance mandate comprehensive testing throughout the supply chain. Thirdly, ongoing technological advancements in testing methodologies and automation enhance efficiency and accuracy.

Evolving consumer preferences for sustainable and eco-friendly packaging are significantly influencing industry trends. This has led to a surge in demand for bio-based materials and recyclable packaging, requiring specialized testing to ensure functionality and environmental compliance. Technological disruptions, such as the adoption of advanced analytical techniques and digitalization of testing processes, are further shaping the market landscape. These technologies offer increased accuracy, reduced testing time, and enhanced data analysis capabilities.

Key Markets & Segments Leading Asia-Pacific Package Testing Industry

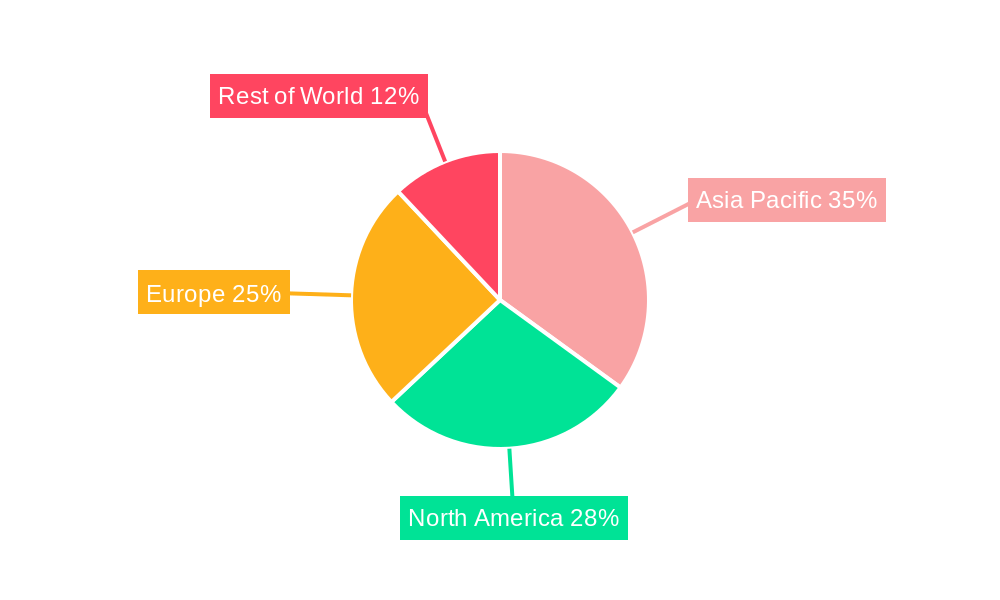

The Asia-Pacific package testing market demonstrates varied growth across different segments and regions. While detailed market share data is proprietary, China and India are expected to be the dominant markets, driven by high economic growth, burgeoning manufacturing sectors, and rising consumer spending. Other key countries include Japan, South Korea, Australia, and Singapore.

Dominant Segments:

- Primary Material: Plastic packaging testing holds a significant share due to the widespread use of plastic across various end-user industries. The growing demand for sustainable alternatives, such as biodegradable plastics, will drive further growth in this segment.

- Type of Testing: Physical performance testing maintains the largest market share, addressing critical parameters such as strength, durability, and shock resistance. Environmental testing is experiencing rapid growth driven by increasing concerns about environmental impact and regulations.

- End-user Industry: The food and beverage sector represents a major share, followed by the healthcare and industrial sectors.

Growth Drivers:

- Rapid economic growth in many Asia-Pacific countries.

- Increased consumer spending and demand for packaged goods.

- Stringent government regulations on product safety and environmental compliance.

- Rising e-commerce and supply chain complexities.

- Advancements in packaging technology and materials.

Asia-Pacific Package Testing Industry Product Developments

Recent product developments within the Asia-Pacific package testing industry focus on incorporating advanced technologies such as AI-powered analysis, automated testing systems, and sophisticated material characterization techniques. These advancements enhance the speed, accuracy, and efficiency of testing processes. Companies are also developing specialized testing services tailored to meet the specific needs of emerging packaging materials and applications. This includes services designed for recyclable and compostable packaging, fulfilling the rising demand for sustainable solutions in the packaging sector. The resulting competitive advantage lies in speed, accuracy, and specialized expertise.

Challenges in the Asia-Pacific Package Testing Industry Market

The Asia-Pacific package testing market faces several challenges. Regulatory inconsistencies across different countries create complexities in standardization and compliance. Supply chain disruptions, particularly concerning the availability of specialized testing equipment and skilled personnel, can impact operational efficiency. Intense competition from established players and the emergence of new entrants also poses a significant challenge. These factors, if not properly addressed, may impact the industry's growth by an estimated xx% in the coming years.

Forces Driving Asia-Pacific Package Testing Industry Growth

Several factors are driving the growth of the Asia-Pacific package testing industry. Firstly, increasing consumer awareness of product safety and quality, especially in emerging markets, fuels demand for rigorous testing. Secondly, e-commerce expansion significantly increases the volume of goods needing testing. Finally, the ongoing shift towards sustainable packaging necessitates robust testing to ensure both performance and environmental compliance.

Long-Term Growth Catalysts in the Asia-Pacific Package Testing Industry

The Asia-Pacific package testing industry's long-term growth will be fueled by continued technological advancements, strategic partnerships between testing companies and packaging manufacturers, and the expansion into new markets with emerging consumer demands. This collaborative approach, coupled with innovative testing methods, will be pivotal in driving the industry forward.

Emerging Opportunities in Asia-Pacific Package Testing Industry

Emerging opportunities abound in the Asia-Pacific package testing market. The increasing focus on circular economy principles and sustainable packaging offers new niches for specialized testing services. Similarly, the growth of e-commerce and its associated packaging requirements presents significant growth potential. Furthermore, expanding into less developed markets within the region provides untapped growth potential.

Leading Players in the Asia-Pacific Package Testing Industry Sector

- ALS limited

- Intertek Group PLC

- Cryopak

- Nefab Group

- Turner Packaging Limited

- National Technical Systems

- SGS SA

- DDL Inc

- Advance Packaging

- CSZ Testing Services Laboratories

Key Milestones in Asia-Pacific Package Testing Industry Industry

- May 2022: Intertek's contract extension for the Philippines' Bulk and Break Bulk Cargo Clearance Enhancement Program underscores the importance of quality assurance and streamlined processes in international trade. This boosts Intertek's market share and reputation.

- January 2023: SGS's expansion of fiber fragmentation testing services to new geographies through TMC approval strengthens its position as a leading provider of sustainable packaging solutions. This significantly increases its global reach and enhances its reputation for sustainability testing.

Strategic Outlook for Asia-Pacific Package Testing Industry Market

The Asia-Pacific package testing market presents significant long-term growth potential, driven by robust economic expansion, increased consumer spending, and stringent regulatory landscapes. Strategic opportunities exist for companies that invest in advanced technologies, develop specialized testing services for emerging packaging materials, and effectively navigate regulatory complexities across diverse markets. A focus on sustainability and digitalization will be key to success in this dynamic and evolving industry.

Asia-Pacific Package Testing Industry Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Industries

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Rest of Asia-Pacific

Asia-Pacific Package Testing Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Package Testing Industry Regional Market Share

Geographic Coverage of Asia-Pacific Package Testing Industry

Asia-Pacific Package Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Plastic Packaging is Expected to Witness Significant Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. China Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 6.1.1. Glass

- 6.1.2. Paper

- 6.1.3. Plastic

- 6.1.4. Metal

- 6.2. Market Analysis, Insights and Forecast - by Type of Testing

- 6.2.1. Physical Performance Testing

- 6.2.2. Chemical Testing

- 6.2.3. Environmental Testing

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Healthcare

- 6.3.3. Industrial

- 6.3.4. Personal and Household Products

- 6.3.5. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 7. India Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 7.1.1. Glass

- 7.1.2. Paper

- 7.1.3. Plastic

- 7.1.4. Metal

- 7.2. Market Analysis, Insights and Forecast - by Type of Testing

- 7.2.1. Physical Performance Testing

- 7.2.2. Chemical Testing

- 7.2.3. Environmental Testing

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Healthcare

- 7.3.3. Industrial

- 7.3.4. Personal and Household Products

- 7.3.5. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 8. Japan Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 8.1.1. Glass

- 8.1.2. Paper

- 8.1.3. Plastic

- 8.1.4. Metal

- 8.2. Market Analysis, Insights and Forecast - by Type of Testing

- 8.2.1. Physical Performance Testing

- 8.2.2. Chemical Testing

- 8.2.3. Environmental Testing

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Healthcare

- 8.3.3. Industrial

- 8.3.4. Personal and Household Products

- 8.3.5. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 9. Rest of Asia Pacific Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 9.1.1. Glass

- 9.1.2. Paper

- 9.1.3. Plastic

- 9.1.4. Metal

- 9.2. Market Analysis, Insights and Forecast - by Type of Testing

- 9.2.1. Physical Performance Testing

- 9.2.2. Chemical Testing

- 9.2.3. Environmental Testing

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverage

- 9.3.2. Healthcare

- 9.3.3. Industrial

- 9.3.4. Personal and Household Products

- 9.3.5. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ALS limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Intertek Group PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cryopak

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nefab Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Turner Packaging Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 National Technical Systems

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SGS SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DDL Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Advance Packaging

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 CSZ Testing Services Laboratories

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ALS limited

List of Figures

- Figure 1: Asia-Pacific Package Testing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Package Testing Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 3: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 7: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 8: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 12: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 13: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 17: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 18: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 22: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 23: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Package Testing Industry?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the Asia-Pacific Package Testing Industry?

Key companies in the market include ALS limited, Intertek Group PLC, Cryopak, Nefab Group, Turner Packaging Limited, National Technical Systems, SGS SA, DDL Inc, Advance Packaging, CSZ Testing Services Laboratories.

3. What are the main segments of the Asia-Pacific Package Testing Industry?

The market segments include Primary Material, Type of Testing, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Plastic Packaging is Expected to Witness Significant Adoption.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

January 2023 - A further five laboratories, located in Bangladesh, India, Turkey, the United States, and Vietnam, have been approved by The Microfibre Consortium (TMC), extending the scope of SGS's fiber fragmentation testing services to new geographies and industries. When TMC initially approved SGS's labs in Hong Kong, Shanghai, and Taipei City in 2021, SGS became the organization's first third-party laboratory. SGS offers practical solutions for the textile industry to reduce fiber fragmentation and its release into the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Package Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Package Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Package Testing Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Package Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence