Key Insights

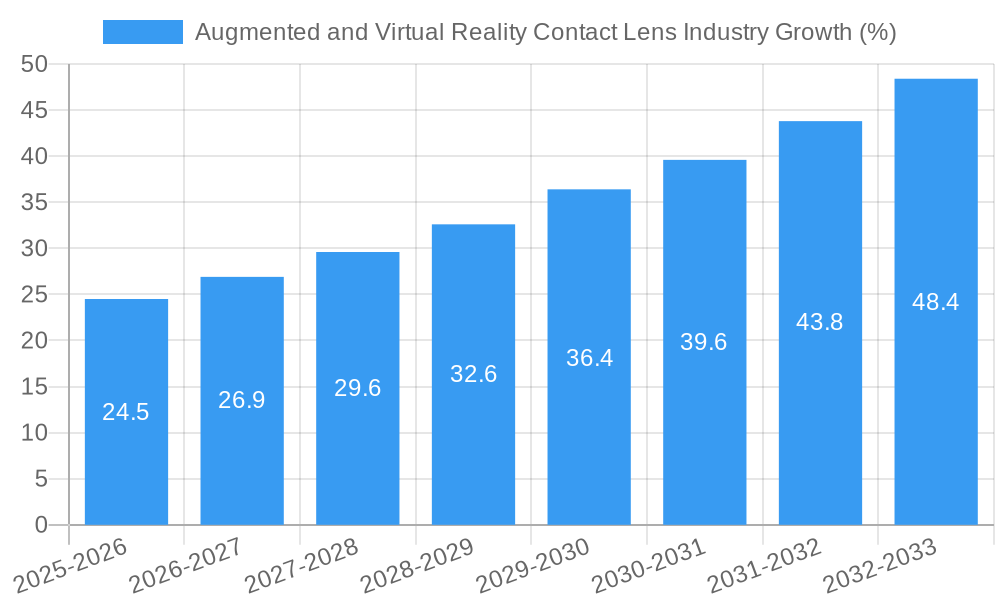

The Augmented and Virtual Reality (AR/VR) contact lens market is poised for significant growth, driven by advancements in miniaturization, improved display technologies, and increasing demand for immersive experiences. The market, currently estimated at $XX million in 2025 (a figure requiring external validation based on your "XX" placeholder – a reasonable estimation based on similar tech markets could be in the low hundreds of millions), is projected to experience a Compound Annual Growth Rate (CAGR) of 9.80% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the integration of advanced sensors and microprocessors within contact lenses enables real-time data capture for applications like continuous glucose monitoring and intraocular pressure monitoring, opening up opportunities in healthcare. Secondly, the increasing popularity of AR/VR technologies across entertainment, gaming, and education further fuels demand for seamless and comfortable user interfaces, which contact lenses uniquely provide. Finally, continuous innovation in materials science, leading to more comfortable and biocompatible lenses, is overcoming earlier limitations. The market is segmented by lens type (Rigid Gas-Permeable, daily-wear soft lenses, extended-wear lenses, others), application (continuous glucose monitoring, continuous intraocular pressure monitoring, and others), and end-user (hospitals, ophthalmology clinics, and other end-users). Leading companies like Johnson & Johnson, Sony, and Samsung are actively investing in R&D, contributing significantly to market expansion. However, challenges remain including regulatory hurdles, high production costs, and potential consumer concerns regarding long-term eye health.

Despite the challenges, the long-term prospects for the AR/VR contact lens market remain positive. The convergence of miniaturization, improved power sources, and increased bandwidth capabilities will continue to drive innovation. Further advancements in biocompatibility and user experience will likely lead to wider adoption across various applications. The North American market is anticipated to hold a dominant share initially, followed by Asia Pacific, driven by technological advancements and increasing disposable incomes. Strategic partnerships between technology companies and healthcare providers will be crucial for market penetration. The future will likely witness more sophisticated AR/VR contact lenses offering enhanced functionalities and improved user comfort, paving the way for widespread adoption across diverse sectors.

Augmented and Virtual Reality Contact Lens Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Augmented and Virtual Reality (AR/VR) contact lens industry, projecting a market valued at xx Million by 2033. The study period spans 2019-2033, with 2025 serving as both the base and estimated year. This report is essential for industry stakeholders, investors, and researchers seeking actionable insights into this rapidly evolving sector. The report utilizes rigorous data analysis and expert insights to forecast market trends and identify key opportunities.

Augmented and Virtual Reality Contact Lens Industry Market Concentration & Dynamics

The AR/VR contact lens market is currently characterized by a moderately concentrated landscape, with key players like Mojo Vision, Johnson & Johnson, and Samsung vying for market share. However, the entrance of numerous startups and the potential for rapid technological advancements suggest a shift towards a more fragmented market in the coming years. The market exhibits a dynamic innovation ecosystem, driven by significant R&D investments from both established players and emerging companies. Regulatory frameworks, while still evolving, play a crucial role in shaping market entry and product development strategies. Substitute products, such as AR/VR headsets, represent a significant competitive challenge, requiring lens manufacturers to offer unique value propositions centered on comfort, convenience, and seamless integration. End-user trends are shifting towards personalized healthcare solutions and miniaturized wearables. M&A activities are expected to increase as larger companies seek to acquire smaller players with innovative technologies and established market presence. While precise market share figures are proprietary, the number of M&A deals in the sector is projected to reach xx per year by 2030.

- Market Concentration: Moderately concentrated, shifting towards fragmentation.

- Innovation Ecosystem: Highly dynamic, fueled by significant R&D.

- Regulatory Framework: Evolving, influencing product development.

- Substitute Products: AR/VR headsets pose a competitive threat.

- End-User Trends: Preference for personalized healthcare and miniaturized devices.

- M&A Activity: Expected to increase significantly.

Augmented and Virtual Reality Contact Lens Industry Industry Insights & Trends

The global AR/VR contact lens market is experiencing robust growth, driven by several key factors. Technological advancements in miniaturized displays, advanced sensors, and power-efficient microprocessors are paving the way for more sophisticated and functional lenses. The increasing prevalence of chronic diseases like diabetes and glaucoma is fuelling demand for continuous health monitoring applications using these lenses. Consumer behavior is shifting toward seamless integration of technology into daily life, increasing the acceptance of AR/VR contact lenses as a convenient and unobtrusive platform. Market size is projected to reach xx Million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is further supported by the rising adoption of smart wearables and the growing investments from leading technology companies. The convergence of AR/VR, health tech, and wearable computing is creating exciting opportunities for innovation and expansion.

Key Markets & Segments Leading Augmented and Virtual Reality Contact Lens Industry

The North American region currently dominates the AR/VR contact lens market, driven by factors such as robust healthcare infrastructure, high technological adoption rates, and significant investments in R&D. However, Asia-Pacific is expected to experience the fastest growth in the coming years due to the large patient population, increasing healthcare spending, and growing awareness of AR/VR technologies.

Dominant Segments:

- Type: Daily-wear soft lenses are currently the largest segment due to high user preference, but extended-wear lenses are gaining traction due to continuous health monitoring capabilities.

- Application: Continuous glucose monitoring (CGM) is a leading application, with continuous intraocular pressure (IOP) monitoring gaining significant momentum.

- End User: Hospitals and ophthalmology clinics are primary users, with other end-users like individual consumers slowly adopting these technologies.

Drivers for Growth:

- North America: Strong healthcare infrastructure, high technology adoption, substantial R&D investment.

- Asia-Pacific: Large patient base, expanding healthcare expenditure, rising AR/VR awareness.

- Europe: Growing demand for personalized healthcare and advanced medical technologies.

Augmented and Virtual Reality Contact Lens Industry Product Developments

Recent years have witnessed remarkable advancements in AR/VR contact lens technology. Mojo Vision's Mojo Lens prototype, showcasing industry-first features, highlights the rapid progress in miniaturization, power efficiency, and seamless user integration. Innovega's iOptik smart contact lens, with positive phase 2 clinical trial results, signals a significant step towards commercialization for both visually impaired and normally sighted users. These advancements demonstrate the potential for AR/VR contact lenses to revolutionize healthcare, entertainment, and daily interactions. The emphasis is shifting towards creating comfortable, unobtrusive devices with longer battery life and improved functionalities.

Challenges in the Augmented and Virtual Reality Contact Lens Industry Market

The AR/VR contact lens industry faces several hurdles. Stringent regulatory approvals for medical devices create significant time and cost constraints. Supply chain disruptions, especially concerning specialized components, can impact production and market availability. Intense competition from established players and emerging startups necessitates continuous innovation to maintain a competitive edge. These challenges can potentially slow down market growth by xx% if not appropriately addressed.

Forces Driving Augmented and Virtual Reality Contact Lens Industry Growth

The AR/VR contact lens market’s growth is driven by technological advancements like improved display technologies and miniaturized sensors, coupled with increasing demand for continuous health monitoring. Economic factors, such as rising healthcare spending and disposable incomes, further fuel this growth. Favorable regulatory policies promoting innovation in medical devices also contribute significantly. Examples include government funding of R&D in medical wearables and easing of approval processes for innovative products.

Challenges in the Augmented and Virtual Reality Contact Lens Industry Market

Long-term growth hinges on overcoming existing challenges and capitalizing on emerging opportunities. Strategic partnerships, focusing on joint development and market access, are essential. Expansion into new markets, particularly in developing economies, represents a significant growth catalyst. Continuous innovation, emphasizing enhanced functionalities and user experience, is crucial for sustaining market leadership.

Emerging Opportunities in Augmented and Virtual Reality Contact Lens Industry

The market presents exciting opportunities. The integration of AI and machine learning into contact lens technology opens doors for advanced diagnostics and personalized treatment. Expansion into new applications, such as augmented reality gaming and immersive experiences, broadens the market’s potential. Catering to niche user groups, including visually impaired individuals, adds another layer of growth potential.

Leading Players in the Augmented and Virtual Reality Contact Lens Industry Sector

- Mojo Vision

- International Business Machines (IBM) Corporation

- InWith Corporation

- EP Global Communications Inc (EPGL)

- RaayonNova LLC

- Johnson & Johnson

- Sony Group Corporation

- Samsung

- Innovega Inc

- Huawei Biomed

- Sensimed

Key Milestones in Augmented and Virtual Reality Contact Lens Industry Industry

- March 2022: Mojo Vision unveils its advanced Mojo Lens prototype, a significant step towards commercializing the world's first true smart contact lens. This milestone demonstrates advancements in miniaturization and integration of AR/VR functionalities.

- January 2022: Innovega Inc. reports positive phase 2 clinical trial results for its iOptik smart contact lens, highlighting progress in commercializing contact lenses for visually impaired and normally sighted users. This showcases the potential of AR/VR technology in addressing visual impairments and enhancing visual experiences.

Strategic Outlook for Augmented and Virtual Reality Contact Lens Industry Market

The future of the AR/VR contact lens market is bright, characterized by significant growth potential. Strategic collaborations between technology companies, healthcare providers, and regulatory bodies will be crucial in driving market expansion and innovation. Focus on addressing unmet clinical needs and improving user experience will be key to maximizing market penetration and fostering long-term success. The market is poised for significant expansion as technological advancements continue to improve comfort, functionality, and affordability.

Augmented and Virtual Reality Contact Lens Industry Segmentation

-

1. Type

- 1.1. Rigid Gas-Permeable (RGP)

- 1.2. Daily-wear Soft Lenses

- 1.3. Extended-wear Lenses

- 1.4. Others

-

2. Application

- 2.1. Continuous Glucose Monitoring

- 2.2. Continuous Intraocular Pressure Monitoring

-

3. End User

- 3.1. Hospitals

- 3.2. Ophthalmology Clinics

- 3.3. Other End Users

Augmented and Virtual Reality Contact Lens Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Augmented and Virtual Reality Contact Lens Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Eye Disorders; Increasing Research and Development for Smart Contact Lenses

- 3.3. Market Restrains

- 3.3.1. High Cost of Smart Contact Lenses and Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Continuous Glucose Monitoring Segment is Expected to Hold a Significant Market Share in the Smart Contact Lenses Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rigid Gas-Permeable (RGP)

- 5.1.2. Daily-wear Soft Lenses

- 5.1.3. Extended-wear Lenses

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Continuous Glucose Monitoring

- 5.2.2. Continuous Intraocular Pressure Monitoring

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Ophthalmology Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Rigid Gas-Permeable (RGP)

- 6.1.2. Daily-wear Soft Lenses

- 6.1.3. Extended-wear Lenses

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Continuous Glucose Monitoring

- 6.2.2. Continuous Intraocular Pressure Monitoring

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Ophthalmology Clinics

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Rigid Gas-Permeable (RGP)

- 7.1.2. Daily-wear Soft Lenses

- 7.1.3. Extended-wear Lenses

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Continuous Glucose Monitoring

- 7.2.2. Continuous Intraocular Pressure Monitoring

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Ophthalmology Clinics

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Rigid Gas-Permeable (RGP)

- 8.1.2. Daily-wear Soft Lenses

- 8.1.3. Extended-wear Lenses

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Continuous Glucose Monitoring

- 8.2.2. Continuous Intraocular Pressure Monitoring

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Ophthalmology Clinics

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Rigid Gas-Permeable (RGP)

- 9.1.2. Daily-wear Soft Lenses

- 9.1.3. Extended-wear Lenses

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Continuous Glucose Monitoring

- 9.2.2. Continuous Intraocular Pressure Monitoring

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Ophthalmology Clinics

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Rigid Gas-Permeable (RGP)

- 10.1.2. Daily-wear Soft Lenses

- 10.1.3. Extended-wear Lenses

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Continuous Glucose Monitoring

- 10.2.2. Continuous Intraocular Pressure Monitoring

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Ophthalmology Clinics

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Augmented and Virtual Reality Contact Lens Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Mojo Vision

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 International Business Machines (IBM) Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 InWith Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 EP Global Communications Inc (EPGL)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 RaayonNova LLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Johnson & Johnson

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Sony Group Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Samsung

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Innovega Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Huawei Biomed

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Sensimed

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Mojo Vision

List of Figures

- Figure 1: Global Augmented and Virtual Reality Contact Lens Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by End User 2024 & 2032

- Figure 17: North America Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by End User 2024 & 2032

- Figure 18: North America Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by End User 2024 & 2032

- Figure 25: Europe Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by End User 2024 & 2032

- Figure 26: Europe Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by End User 2024 & 2032

- Figure 33: Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by End User 2024 & 2032

- Figure 34: Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by End User 2024 & 2032

- Figure 41: Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by End User 2024 & 2032

- Figure 42: Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Type 2024 & 2032

- Figure 45: South America Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Type 2024 & 2032

- Figure 46: South America Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Application 2024 & 2032

- Figure 47: South America Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: South America Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by End User 2024 & 2032

- Figure 49: South America Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by End User 2024 & 2032

- Figure 50: South America Augmented and Virtual Reality Contact Lens Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Augmented and Virtual Reality Contact Lens Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 35: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 42: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 62: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 67: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 68: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 69: Global Augmented and Virtual Reality Contact Lens Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Augmented and Virtual Reality Contact Lens Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Augmented and Virtual Reality Contact Lens Industry?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the Augmented and Virtual Reality Contact Lens Industry?

Key companies in the market include Mojo Vision, International Business Machines (IBM) Corporation, InWith Corporation, EP Global Communications Inc (EPGL), RaayonNova LLC, Johnson & Johnson, Sony Group Corporation, Samsung, Innovega Inc, Huawei Biomed, Sensimed.

3. What are the main segments of the Augmented and Virtual Reality Contact Lens Industry?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Eye Disorders; Increasing Research and Development for Smart Contact Lenses.

6. What are the notable trends driving market growth?

Continuous Glucose Monitoring Segment is Expected to Hold a Significant Market Share in the Smart Contact Lenses Market.

7. Are there any restraints impacting market growth?

High Cost of Smart Contact Lenses and Lack of Awareness.

8. Can you provide examples of recent developments in the market?

March 2022: Mojo Vision, the Invisible Computing Company, introduced its most advanced prototype of Mojo Lens, the world's first true smart contact lens, including an array of new, industry-first features. The Mojo Lens prototype is a critical milestone for the company in its development, testing, and validation process. It is an innovation positioned at the intersection of smartphones, Augmented Reality/Virtual Reality, smart wearables, and health tech.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Augmented and Virtual Reality Contact Lens Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Augmented and Virtual Reality Contact Lens Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Augmented and Virtual Reality Contact Lens Industry?

To stay informed about further developments, trends, and reports in the Augmented and Virtual Reality Contact Lens Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence