Key Insights

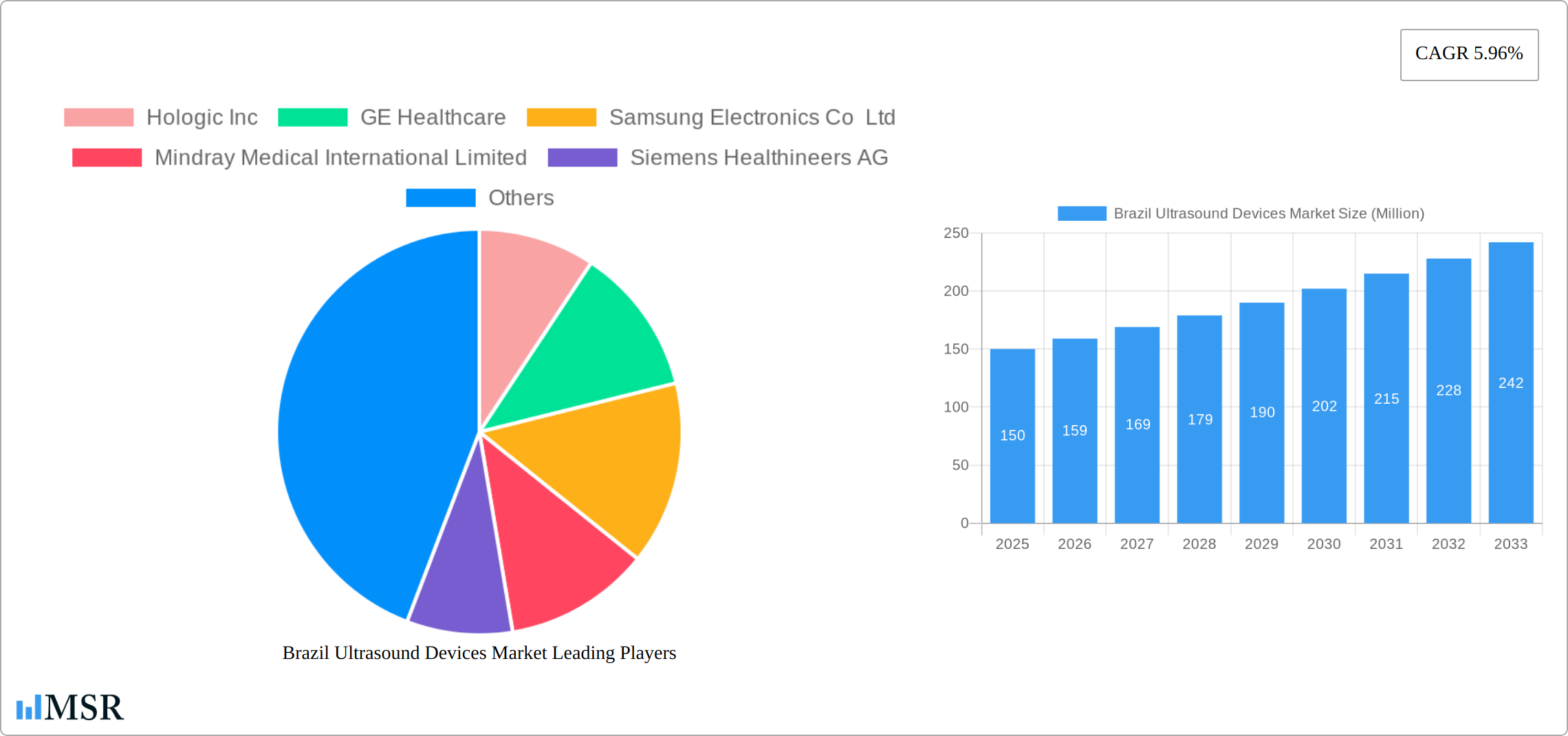

The Brazil ultrasound devices market, valued at approximately $150 million in 2025, is projected to experience robust growth, driven by a rising prevalence of chronic diseases necessitating diagnostic imaging, increasing government healthcare expenditure, and expanding private healthcare infrastructure. The market's Compound Annual Growth Rate (CAGR) of 5.96% from 2019 to 2024 suggests a continued upward trajectory, indicating a significant market opportunity for medical device manufacturers. Key growth drivers include the increasing adoption of advanced imaging technologies like 3D and 4D ultrasound, particularly within specialized medical fields such as cardiology and gynecology/obstetrics. Portable ultrasound devices are also gaining traction due to their enhanced mobility and accessibility in various healthcare settings, including remote areas. However, factors such as high device costs, limited reimbursement policies, and the need for skilled technicians could act as market restraints. The market is segmented by application (anesthesiology, cardiology, gynecology/obstetrics, radiology, and other applications), technology (2D, 3D, and 4D ultrasound imaging), and type (stationary and portable ultrasound). Major players like GE Healthcare, Samsung, Mindray, and Siemens actively compete within this dynamic market. The market's substantial growth potential is further fueled by a growing geriatric population and increasing awareness of preventative healthcare, leading to higher demand for early diagnosis and effective treatment.

The competitive landscape is characterized by the presence of both global giants and regional players, each vying for market share through technological innovation, strategic partnerships, and competitive pricing. Future market growth will likely depend on the successful integration of advanced features like artificial intelligence (AI) for image analysis, improved portability and user-friendliness, and the expansion of tele-ultrasound applications. The Brazilian government's initiatives to improve healthcare infrastructure and access to medical technology will also significantly influence the market's future trajectory. Strategic expansions into underserved regions and a focus on enhancing affordability through innovative financing models could further contribute to market expansion.

Brazil Ultrasound Devices Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Brazil ultrasound devices market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, key players, and future growth prospects. The study encompasses various segments, including application (Anesthesiology, Cardiology, Gynecology/Obstetrics, Radiology, Other Applications), technology (2D Ultrasound Imaging, 3D and 4D Ultrasound Imaging), and type (Stationary Ultrasound, Portable Ultrasound). The report also analyzes market concentration, regulatory landscape, technological advancements, and emerging opportunities within the Brazilian healthcare sector. Expect detailed financial projections, including market size and CAGR, and an in-depth examination of leading companies like Hologic Inc, GE Healthcare, Samsung Electronics Co Ltd, and others.

Brazil Ultrasound Devices Market Market Concentration & Dynamics

The Brazil ultrasound devices market exhibits a moderately concentrated landscape, dominated by a few multinational corporations and complemented by several domestic players. Market share data reveals that the top five players account for approximately xx% of the total market revenue in 2025. This concentration is driven by the significant capital investments required for research and development, manufacturing, and distribution. However, the market also shows signs of increasing competition, fueled by the entry of new players and the growing demand for advanced ultrasound technologies.

- Innovation Ecosystems: Brazil's innovation ecosystem for medical devices is rapidly evolving, with increasing investments in R&D and collaborations between academia and industry.

- Regulatory Frameworks: The regulatory environment, while stringent, is gradually streamlining the approval process for new medical devices, facilitating market entry for innovative products.

- Substitute Products: While ultrasound remains the preferred imaging modality for many applications, competition exists from other imaging technologies such as MRI and CT scans.

- End-User Trends: A growing preference for minimally invasive procedures and a rise in chronic diseases are driving the demand for advanced ultrasound systems.

- M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, with larger players consolidating their market share through acquisitions of smaller companies. The number of M&A deals in the period 2019-2024 totaled approximately xx.

Brazil Ultrasound Devices Market Industry Insights & Trends

The Brazilian ultrasound devices market is poised for significant growth, driven by several key factors. The market size is estimated at USD xx Million in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing healthcare expenditure, expanding healthcare infrastructure, a rising prevalence of chronic diseases requiring regular ultrasound diagnostics, and the growing adoption of advanced imaging technologies, particularly 3D and 4D ultrasound. Technological advancements, such as AI-powered image analysis and portable ultrasound systems, are further boosting market expansion. Furthermore, government initiatives promoting healthcare access and affordability contribute to market growth. Changing consumer preferences, including a demand for improved image quality and faster diagnostic capabilities, also significantly impact market dynamics.

Key Markets & Segments Leading Brazil Ultrasound Devices Market

The Brazilian ultrasound devices market is characterized by regional variations in demand and adoption rates. While data suggests xx as the dominant region, significant growth is expected across other regions, particularly in expanding urban areas and states with rising healthcare investments.

Dominant Segments:

- Application: Gynecology/Obstetrics and Cardiology consistently represent the largest segments, driven by high volumes of procedures and increasing awareness of the benefits of ultrasound.

- Technology: 2D ultrasound remains the most prevalent technology, but the demand for 3D and 4D ultrasound is rapidly expanding, particularly in specialized applications.

- Type: Stationary ultrasound dominates the market due to its superior image quality and features, however, portable ultrasound is gaining traction because of increasing demand in remote areas.

Key Drivers:

- Economic Growth: Brazil's economic growth, although fluctuating, contributes positively to healthcare spending.

- Government Initiatives: Increased public funding for healthcare infrastructure and improved access to healthcare services boost market demand.

- Technological Advancements: The introduction of innovative features, such as AI-powered image analysis, enhances the utility of ultrasound devices and fuels adoption.

Brazil Ultrasound Devices Market Product Developments

Recent product developments in the Brazilian ultrasound devices market have focused on enhancing image quality, improving portability, and integrating advanced features. Manufacturers are increasingly incorporating AI-powered image analysis capabilities to improve diagnostic accuracy and efficiency. The introduction of handheld and portable ultrasound systems is expanding access to ultrasound services in remote areas and improving point-of-care diagnostics. These advancements are aimed at providing clinicians with more efficient and effective tools for diagnosis and treatment.

Challenges in the Brazil Ultrasound Devices Market Market

The Brazil ultrasound devices market faces several challenges, including high import duties impacting device costs, limited reimbursement coverage by public health insurance which reduces accessibility, and complex regulatory processes for obtaining market approval. Supply chain disruptions can also impact device availability and pricing. Furthermore, intense competition among established players and the emergence of new entrants pose challenges to market participants. These factors, when combined, can hinder market growth and profitability.

Forces Driving Brazil Ultrasound Devices Market Growth

Several factors are driving the growth of the Brazil ultrasound devices market. Technological advancements, including the development of more portable and user-friendly devices, are expanding access to ultrasound imaging. Government initiatives promoting healthcare infrastructure development and increased healthcare spending further contribute to growth. The rising prevalence of chronic diseases requiring frequent diagnostic imaging is also a key driver. Moreover, expanding private healthcare sector and increasing adoption of minimally invasive procedures have fueled this growth.

Challenges in the Brazil Ultrasound Devices Market Market

Long-term growth in the Brazilian ultrasound market hinges on strategic partnerships between manufacturers, healthcare providers, and government agencies. This collaboration facilitates technology transfer, training, and service expansion. Further innovations in device design, particularly in portability and functionality, will be essential for sustained growth. Expanding market reach into underserved areas will unlock significant growth potential.

Emerging Opportunities in Brazil Ultrasound Devices Market

The increasing adoption of telemedicine and the rise of point-of-care ultrasound create significant opportunities for growth in the Brazil ultrasound market. The demand for specialized ultrasound applications, such as elastography and contrast-enhanced ultrasound, is growing. Furthermore, a focus on affordable and accessible ultrasound solutions for underserved populations presents a considerable market opportunity.

Leading Players in the Brazil Ultrasound Devices Market Sector

- Hologic Inc. (Hologic Inc.)

- GE Healthcare (GE Healthcare)

- Samsung Electronics Co Ltd (Samsung Electronics Co Ltd)

- Mindray Medical International Limited (Mindray Medical International Limited)

- Siemens Healthineers AG (Siemens Healthineers AG)

- Koninklijke Philips NV (Koninklijke Philips NV)

- Canon Medical Systems Corporation (Canon Medical Systems Corporation)

- Carestream Health Inc. (Carestream Health Inc.)

- Esaote SpA (Esaote SpA)

- Fujifilm Holdings Corporation (Fujifilm Holdings Corporation)

Key Milestones in Brazil Ultrasound Devices Market Industry

- March 2023: The Government of Minas Gerais invested USD 48.61 Million in healthcare infrastructure, including an imaging center equipped with ultrasound technology. This significantly boosts the availability of ultrasound services in the region.

- April 2023: Inauguration of a new emergency room at the Regional Hospital of Lapa São Sebastião in Curitiba, equipped with 24/7 ultrasound capabilities, expanding access to emergency ultrasound services.

Strategic Outlook for Brazil Ultrasound Devices Market Market

The Brazil ultrasound devices market presents substantial growth potential driven by increasing healthcare expenditure, technological advancements, and government initiatives. Strategic players should focus on product innovation, including portable and AI-enabled devices, to cater to diverse needs and expand market reach. Collaborations with healthcare providers and government agencies are crucial for market penetration and sustainable growth. The focus on cost-effective solutions and expanding access to ultrasound services in underserved areas will be vital for long-term success.

Brazil Ultrasound Devices Market Segmentation

-

1. Application

- 1.1. Anesthesiology

- 1.2. Cardiology

- 1.3. Gynecology/Obstetrics

- 1.4. Radiology

- 1.5. Other Applications

-

2. Technology

- 2.1. 2D Ultrasound Imaging

- 2.2. 3D and 4D Ultrasound Imaging

-

3. Type

- 3.1. Stationary Ultrasound

- 3.2. Portable Ultrasound

Brazil Ultrasound Devices Market Segmentation By Geography

- 1. Brazil

Brazil Ultrasound Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Chronic Diseases; Improving Healthcare Infrastructure and Healthcare Programs

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies

- 3.4. Market Trends

- 3.4.1. The Radiology Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Ultrasound Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Anesthesiology

- 5.1.2. Cardiology

- 5.1.3. Gynecology/Obstetrics

- 5.1.4. Radiology

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. 2D Ultrasound Imaging

- 5.2.2. 3D and 4D Ultrasound Imaging

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Stationary Ultrasound

- 5.3.2. Portable Ultrasound

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hologic Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GE Healthcare

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mindray Medical International Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Healthineers AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koninklijke Philips NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canon Medical Systems Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Carestream Health Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Esaote SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fujifilm Holdings Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hologic Inc

List of Figures

- Figure 1: Brazil Ultrasound Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Ultrasound Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Ultrasound Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Ultrasound Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Brazil Ultrasound Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Brazil Ultrasound Devices Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 5: Brazil Ultrasound Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Brazil Ultrasound Devices Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 7: Brazil Ultrasound Devices Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Brazil Ultrasound Devices Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 9: Brazil Ultrasound Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil Ultrasound Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Brazil Ultrasound Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Ultrasound Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Brazil Ultrasound Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Brazil Ultrasound Devices Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 15: Brazil Ultrasound Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Brazil Ultrasound Devices Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 17: Brazil Ultrasound Devices Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Brazil Ultrasound Devices Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 19: Brazil Ultrasound Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Ultrasound Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Ultrasound Devices Market?

The projected CAGR is approximately 5.96%.

2. Which companies are prominent players in the Brazil Ultrasound Devices Market?

Key companies in the market include Hologic Inc, GE Healthcare, Samsung Electronics Co Ltd, Mindray Medical International Limited, Siemens Healthineers AG, Koninklijke Philips NV, Canon Medical Systems Corporation, Carestream Health Inc, Esaote SpA, Fujifilm Holdings Corporation.

3. What are the main segments of the Brazil Ultrasound Devices Market?

The market segments include Application, Technology, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Chronic Diseases; Improving Healthcare Infrastructure and Healthcare Programs.

6. What are the notable trends driving market growth?

The Radiology Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies.

8. Can you provide examples of recent developments in the market?

In March 2023, the Government of Minas, Brazil, invested over BRL 232 million (USD 48.61 million) from the judicial agreement. Out of the fund, over BRL 218.7 million (USD 45.82 million) will be used to fund the building of Valdemar de Assis Barcelos Hospital Complex, which includes a municipal hospital, maternity, speciality centre, Imaging centre, clinical analysis laboratory and emergency care unit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Ultrasound Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Ultrasound Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Ultrasound Devices Market?

To stay informed about further developments, trends, and reports in the Brazil Ultrasound Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence