Key Insights

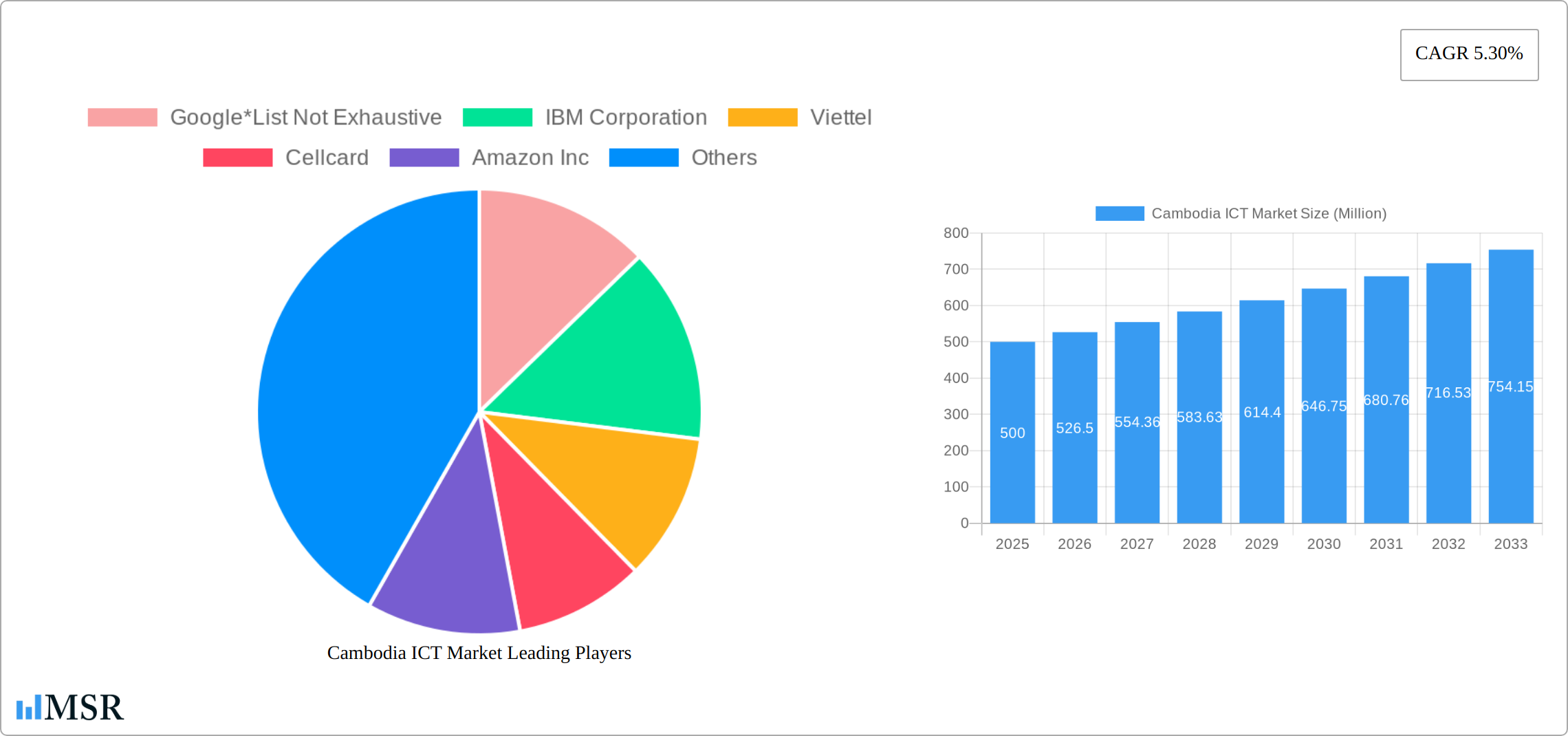

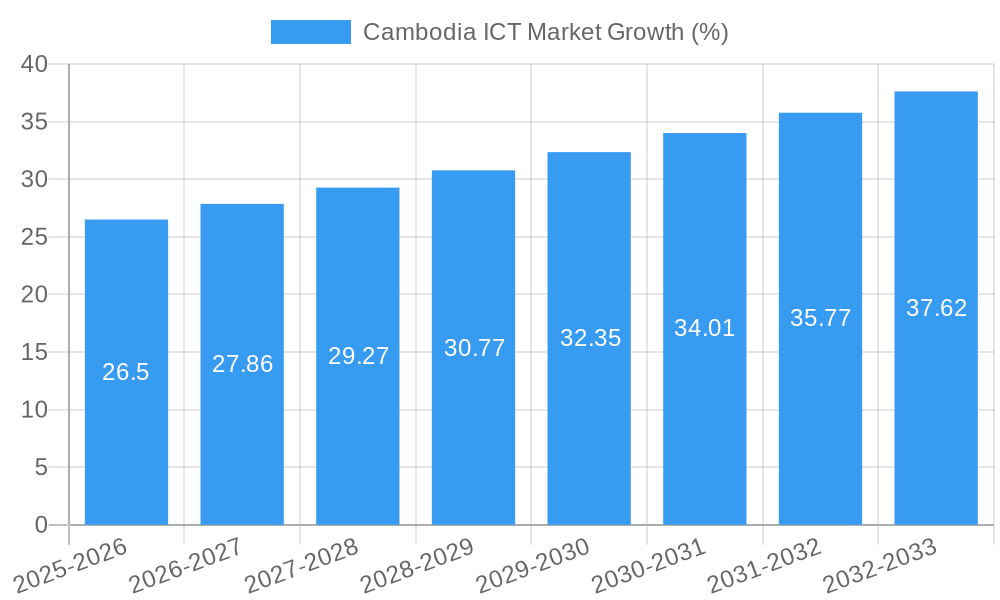

The Cambodian ICT market, valued at approximately $X million in 2025 (assuming a logical extrapolation based on the provided CAGR of 5.30% and the unspecified market size 'XX'), is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.30% from 2025 to 2033. This growth is driven by increasing smartphone penetration, rising internet usage, government initiatives promoting digitalization, and the expanding adoption of cloud computing and other advanced technologies across various sectors. Key industry segments include hardware, software, IT services, and telecommunication services, with significant contributions from both large enterprises and small and medium-sized enterprises (SMEs). The BFSI (Banking, Financial Services, and Insurance), IT and Telecom, and Government sectors are leading adopters of ICT solutions, followed by Retail and E-commerce, Manufacturing, and Energy and Utilities. Competitive dynamics are shaped by a mix of global giants like Google, IBM, Amazon, and Huawei, alongside regional players such as Viettel, Cellcard, SEATEL, CooTel, and Smart Axiata. The increasing demand for digital transformation and the government's focus on building digital infrastructure are expected to continue fueling market expansion in the forecast period.

The Cambodian ICT market's growth trajectory is influenced by several factors. Increased foreign direct investment (FDI) in the technology sector is attracting both international and domestic companies, contributing to infrastructure development and service expansion. However, challenges remain, including infrastructure limitations in certain areas, a relatively low level of digital literacy among the population, and the need for continuous skill development to meet the evolving demands of the industry. Overcoming these hurdles will be crucial for sustaining the current growth momentum and unlocking the full potential of the Cambodian ICT market. The continued expansion of 4G and emerging 5G networks, coupled with affordable data plans, is expected to further stimulate market growth by enabling wider access to digital services and fostering innovation across multiple sectors.

Cambodia ICT Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Cambodia ICT market, covering market dynamics, industry trends, key segments, leading players, and future growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for businesses, investors, and policymakers seeking to understand and capitalize on the burgeoning Cambodian ICT sector. The report leverages data from the historical period (2019-2024) to predict the market's future trajectory. The market is valued at xx Million in 2025 and projected to reach xx Million by 2033.

Cambodia ICT Market Concentration & Dynamics

The Cambodian ICT market exhibits a dynamic interplay of established players and emerging local businesses. Market concentration is moderate, with a few dominant players like Google, IBM Corporation, Viettel, and Smart Axiata holding significant market share, though the exact figures remain xx. However, the landscape is characterized by increasing competition from smaller, agile firms specializing in niche segments. The innovation ecosystem is rapidly developing, fueled by government initiatives promoting digitalization and increased foreign investment. The regulatory framework, while evolving, presents both opportunities and challenges, with ongoing efforts to enhance clarity and streamline processes. Substitute products and services exert limited pressure, with the demand for ICT solutions consistently growing. End-user trends reflect a growing preference for cloud-based solutions, mobile technologies, and digital financial services. M&A activity is moderate, with an estimated xx deals recorded between 2019 and 2024, indicating increasing consolidation within the sector.

- Market Share (2024): Google (xx%), Smart Axiata (xx%), Viettel (xx%), IBM (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Key Regulatory Developments: [Insert specific regulatory changes and their impact]

Cambodia ICT Market Industry Insights & Trends

The Cambodian ICT market is experiencing robust growth, driven by factors such as rising internet penetration, increasing smartphone adoption, and the government's push for digital transformation. The market size, estimated at xx Million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, including the rise of 5G, cloud computing, and artificial intelligence, are reshaping the industry landscape, creating new opportunities for innovation and growth. Consumer behavior is evolving towards greater reliance on digital platforms for communication, commerce, and entertainment. This shift presents challenges and opportunities for ICT providers, requiring them to adapt their offerings to meet the evolving needs of consumers. The increasing use of e-commerce and digital financial services (DFS) is accelerating the demand for robust ICT infrastructure. Government initiatives focusing on digital literacy and infrastructure development further contribute to the market's expansion. Challenges include the need for increased cybersecurity measures and digital infrastructure improvements in rural areas.

Key Markets & Segments Leading Cambodia ICT Market

The Cambodian ICT market is characterized by diverse segments and industries exhibiting significant growth potential.

By Type:

- Telecommunication Services: This segment dominates the market due to high mobile penetration and expanding broadband infrastructure.

- Software: Growing demand for enterprise resource planning (ERP), customer relationship management (CRM), and other software solutions fuels the expansion of this segment.

- IT Services: Increased outsourcing and the need for digital transformation services contribute to this segment's growth.

- Hardware: This sector sees growth driven by rising demand for smartphones, computers, and network equipment.

By Size of Enterprise:

- Small and Medium Enterprises (SMEs): This segment represents a significant portion of the market, though large enterprises are adopting ICT solutions at an increasing rate.

By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance): The sector is undergoing rapid digital transformation, driving growth in ICT solutions.

- IT and Telecom: This sector serves as a major consumer of ICT products and services.

- Government: Government initiatives for digital governance are boosting the demand for ICT solutions.

- Retail and E-commerce: The growing e-commerce sector significantly boosts the demand for ICT infrastructure and services.

- Manufacturing: The manufacturing sector is increasingly adopting automation and digital technologies, driving ICT adoption.

Drivers:

- Strong economic growth

- Rising internet and mobile penetration

- Government support for digitalization

- Increasing investments in infrastructure

Cambodia ICT Market Product Developments

The Cambodian ICT market is experiencing rapid product innovation, driven by a confluence of factors. Advanced cloud-based solutions are transforming business operations, offering scalability and cost-effectiveness. The rollout of 5G networks is dramatically increasing internet speeds and bandwidth, enabling new applications and services. Artificial intelligence (AI) and machine learning (ML) are being integrated into various sectors, from agriculture to finance, enhancing efficiency and productivity. Furthermore, a key trend is the development of localized solutions tailored to the specific needs and linguistic preferences of the Cambodian population. This hyper-localization strategy is crucial for bridging the digital divide and ensuring widespread accessibility. Affordable and accessible ICT solutions remain a central focus for both private companies and government initiatives.

Challenges in the Cambodia ICT Market

The Cambodian ICT market faces several challenges including limited digital literacy in certain segments of the population, infrastructure gaps, especially in rural areas, and a relatively underdeveloped cybersecurity infrastructure. These factors can impede growth and create potential vulnerabilities. The regulatory landscape, while improving, could benefit from further clarity and harmonization. Competition remains intense, particularly from international players. These limitations could potentially reduce market growth by xx% by 2033 if not addressed.

Forces Driving Cambodia ICT Market Growth

Several powerful forces are propelling the growth of Cambodia's ICT market. Significant government investment in digital infrastructure, including broadband expansion and digital literacy programs, is a primary driver. The government's Digital Economy and Society Policy 2021-2035 provides a strategic framework for this development. Rising internet and mobile penetration rates, coupled with the increasing affordability of smartphones, are fueling demand for ICT services. The burgeoning e-commerce sector and the rapid expansion of financial technology (FinTech) solutions are creating significant opportunities for growth. The adoption of cloud computing and other innovative technologies, such as the Internet of Things (IoT), is further accelerating market expansion. Increased foreign direct investment (FDI) in the ICT sector also plays a significant role.

Long-Term Growth Catalysts in Cambodia ICT Market

Long-term growth in the Cambodian ICT market hinges on continuous infrastructure development, particularly extending broadband access to underserved areas. Strategic partnerships between international and local companies can accelerate innovation and skills development. Expansion into new market segments, such as healthcare and education, offers significant growth potential. The cultivation of a skilled ICT workforce will be vital for sustained growth.

Emerging Opportunities in Cambodia ICT Market

Numerous lucrative opportunities are emerging within the Cambodian ICT market. The FinTech sector, with its potential for financial inclusion and improved access to financial services, is particularly promising. E-health initiatives, focused on improving healthcare access and delivery through technology, are gaining momentum. Similarly, e-governance solutions are streamlining government processes and enhancing citizen services. The proliferation of IoT devices presents exciting opportunities for smart city development and improved resource management. Developing localized software and applications that cater to the unique needs of the Cambodian market offers significant potential for growth. Investing in cybersecurity solutions and promoting digital literacy are crucial for ensuring a secure and inclusive digital environment.

Leading Players in the Cambodia ICT Market Sector

- IBM Corporation

- Viettel

- Cellcard

- Amazon Inc

- SEATEL

- CooTel

- Huawei

- Smart Axiata

- Sony Corporation

- Local Cambodian Tech Startups (Noteworthy mention of specific companies if possible)

Key Milestones in Cambodia ICT Market Industry

- August 2022: MDP Cambodia Co., Ltd. partners with SA Solutions for Asia to provide Alibaba Cloud Services in Cambodia.

- December 20, 2022: TAR UMT partners with IG Tech Group, boosting local technological innovation.

Strategic Outlook for Cambodia ICT Market

The Cambodian ICT market presents a dynamic and promising landscape for investors and businesses. Sustained economic growth, strong government support, and a rapidly expanding digital economy create a favorable environment for investment. Successful players will need to adopt a strategic approach, focusing on building strong partnerships with local players, adapting their products and services to the specific needs of the Cambodian market, and investing in infrastructure development and skills training. Prioritizing cybersecurity and data privacy will be essential for long-term success. Companies that effectively navigate the challenges and capitalize on the emerging opportunities are poised to benefit significantly from the market's continued expansion and maturation.

Cambodia ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Cambodia ICT Market Segmentation By Geography

- 1. Cambodia

Cambodia ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consistent Digital Transformation Initiatives; Robust Telecommunication Network

- 3.3. Market Restrains

- 3.3.1. Infections and Kidney Problems Associated with their Prolonged Use might Act as a Restraint for Market Growth

- 3.4. Market Trends

- 3.4.1. Cybersecurity is Expected to Observe a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cambodia ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Cambodia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Google*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Viettel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cellcard

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amazon Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SEATEL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CooTel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Smart Axiata

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sony Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Google*List Not Exhaustive

List of Figures

- Figure 1: Cambodia ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Cambodia ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Cambodia ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Cambodia ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Cambodia ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: Cambodia ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Cambodia ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Cambodia ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Cambodia ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Cambodia ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 9: Cambodia ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 10: Cambodia ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cambodia ICT Market?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the Cambodia ICT Market?

Key companies in the market include Google*List Not Exhaustive, IBM Corporation, Viettel, Cellcard, Amazon Inc, SEATEL, CooTel, Huawei, Smart Axiata, Sony Corporation.

3. What are the main segments of the Cambodia ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consistent Digital Transformation Initiatives; Robust Telecommunication Network.

6. What are the notable trends driving market growth?

Cybersecurity is Expected to Observe a Significant Growth.

7. Are there any restraints impacting market growth?

Infections and Kidney Problems Associated with their Prolonged Use might Act as a Restraint for Market Growth.

8. Can you provide examples of recent developments in the market?

December 20, 2022: Tunku Abdul Rahman University of Management and Technology (TAR UMT) has marked a milestone with its first partnership with a Cambodian industrial partner. TAR UMT, which was recently upgraded from a university college to a varsity, signed a memorandum of agreement (MoA) with IG Tech Group, a Cambodian group of technology and innovation businesses that are growing quickly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cambodia ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cambodia ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cambodia ICT Market?

To stay informed about further developments, trends, and reports in the Cambodia ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence