Key Insights

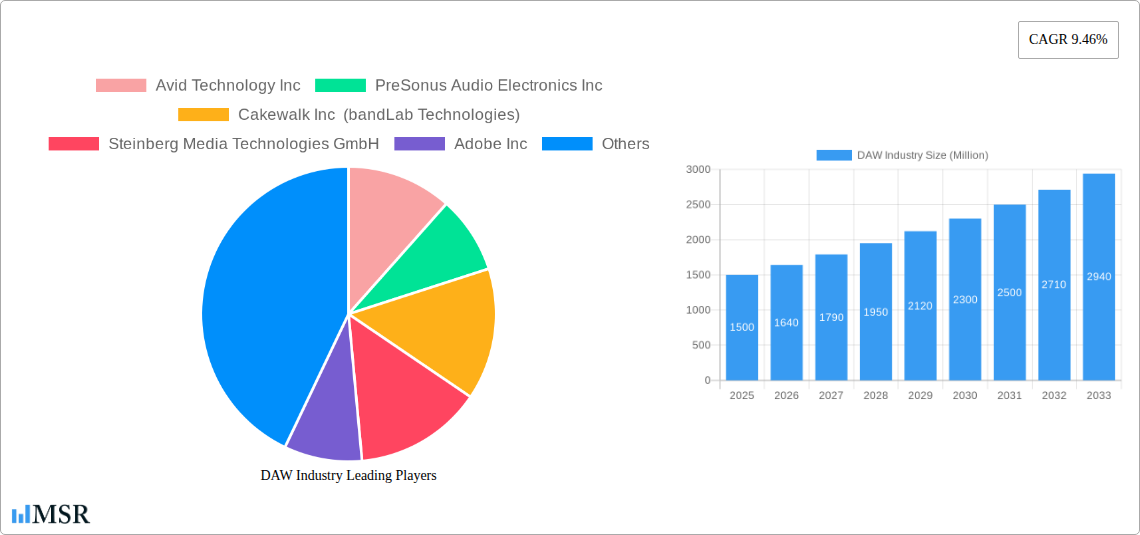

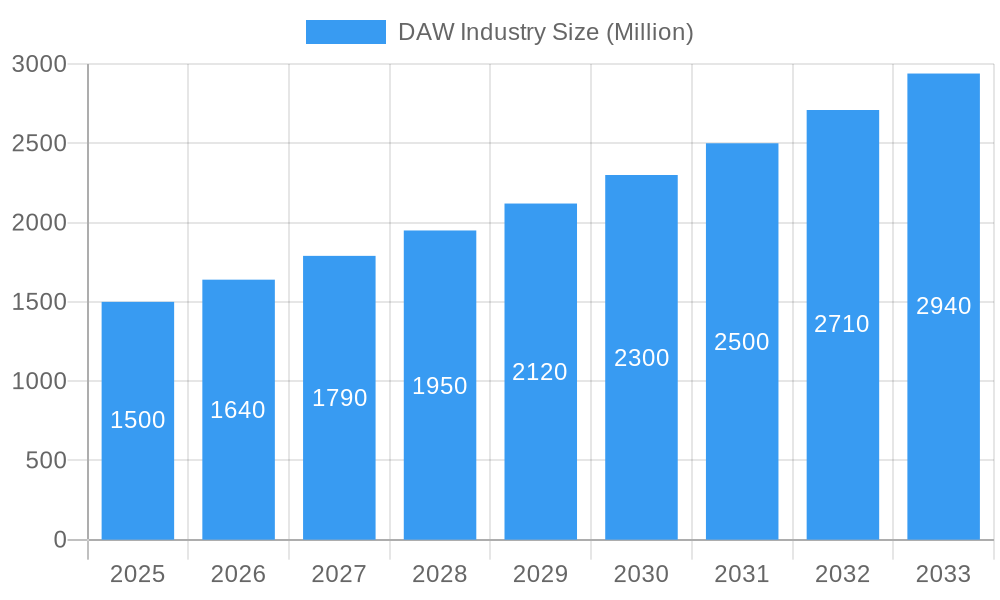

The global Digital Audio Workstation (DAW) market is poised for substantial expansion. Valued at approximately 4394.1 million in its base year of 2025, the market is projected to witness a compound annual growth rate (CAGR) of 9.4% through 2033. This robust growth trajectory is propelled by several key drivers, including the increasing affordability and accessibility of high-quality DAW software, alongside the rising popularity of music production and audio engineering for both professional and hobbyist endeavors. Technological advancements, such as enhanced audio processing, expanded plugin support, and seamless integration with production tools, are also significant contributors. The proliferation of cloud-based DAWs further bolsters the market by offering enhanced flexibility and collaborative capabilities for creators worldwide. The market is segmented by operating system (Mac, Windows, others) and end-user (professional audio engineers and mixers, electronic musicians, music studios, educational institutions, etc.). While macOS has historically led the professional segment, Windows-based solutions are rapidly gaining market share due to their cost-effectiveness and broader software compatibility.

DAW Industry Market Size (In Billion)

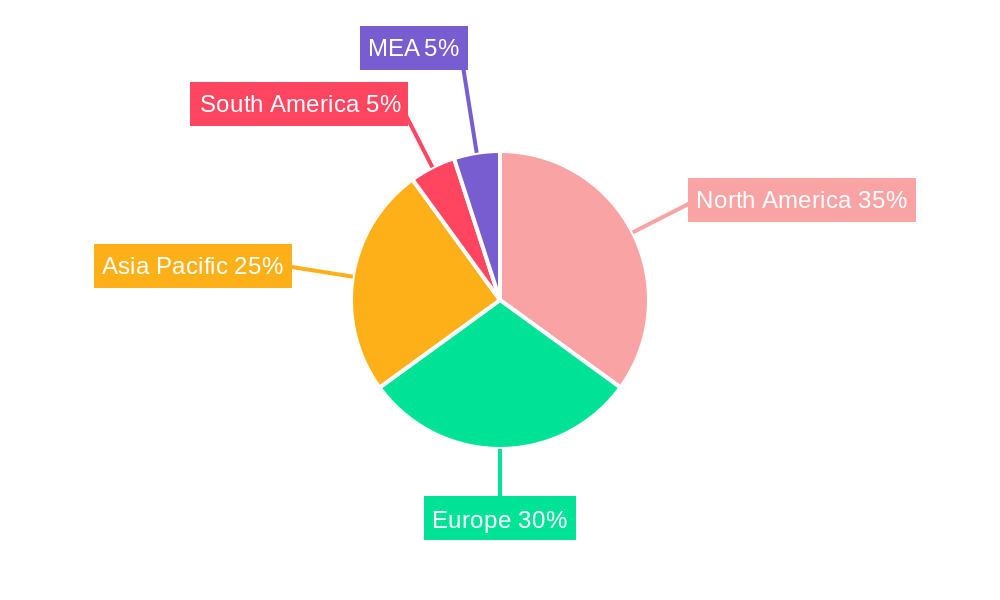

Despite the positive growth outlook, certain factors may temper market expansion. The substantial initial investment for professional-grade hardware and software can present a barrier to entry for emerging artists and smaller studios. Intense competition from established vendors and new market entrants contributes to a dynamic competitive landscape. Additionally, the increasing adoption of subscription-based licensing models introduces potential long-term cost uncertainties for users. Nevertheless, the DAW market's future remains bright, fueled by continuous innovation, a growing global user base, and the persistent appeal of digital music creation. Emerging economies in the Asia-Pacific and South America regions present significant opportunities for market penetration. The integration of artificial intelligence and machine learning into DAW software is anticipated to further elevate user experience and drive adoption in the coming years.

DAW Industry Company Market Share

DAW Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Digital Audio Workstation (DAW) industry, encompassing market size, key players, technological advancements, and future growth prospects. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025. It offers actionable insights for industry stakeholders, including manufacturers, software developers, and end-users. The global DAW market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

DAW Industry Market Concentration & Dynamics

The DAW industry exhibits a moderately concentrated market structure, with several key players holding significant market share. Avid Technology Inc., Steinberg Media Technologies GmbH, and Adobe Inc. are among the established leaders, though the market also accommodates numerous smaller players and niche solutions. Innovation is a key driver, with continuous improvements in audio processing, workflow efficiency, and integration with other professional tools shaping market dynamics. Regulatory frameworks concerning software licensing and data privacy play a minor role in the market. Substitute products, such as simpler audio editing software, exist but cater to a distinct user base. End-user trends indicate a growing demand for cloud-based DAWs and collaborative platforms, fueled by the rise of remote work and online music creation. M&A activity has been moderate, with xx major deals recorded between 2019 and 2024, reflecting a consolidation trend within the sector.

- Market Share (2024 Estimate):

- Avid Technology Inc.: xx%

- Steinberg Media Technologies GmbH: xx%

- Adobe Inc.: xx%

- Others: xx%

- M&A Deal Count (2019-2024): xx

DAW Industry Industry Insights & Trends

The DAW industry is experiencing robust growth, driven by several factors. The increasing popularity of music production and audio engineering as hobbies and professions is a key market driver. The rise of online music distribution platforms and streaming services has fostered a surge in demand for high-quality audio production tools. Technological advancements, such as improved audio processing algorithms, AI-powered features, and enhanced virtual instrument capabilities, are continuously enhancing the capabilities of DAW software. The global DAW market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, indicating a strong CAGR of xx%. This growth is further fueled by the increasing adoption of cloud-based DAWs, offering greater accessibility and collaboration features. Evolving consumer behaviors, such as a preference for subscription models and mobile accessibility, are shaping the market landscape.

Key Markets & Segments Leading DAW Industry

The North American market currently holds a dominant position in the DAW industry, driven by a robust music production industry and a high concentration of professional audio engineers and music schools. Within end-user segments, Professional/Audio Engineers and Mixers represent the largest market share, followed by Electronic Musicians and Music Studios.

- Dominant Region: North America

- Dominant End-User Segment: Professional/Audio Engineers and Mixers

Drivers for North American Dominance:

- Strong music production ecosystem

- High concentration of professional studios and music schools

- High disposable income and technological adoption rate.

Drivers for Professional/Audio Engineers and Mixers Segment Dominance:

- Professional requirement for high-quality audio production tools

- Higher budget allocation for advanced software and hardware.

Operating System Segmentation:

- Windows currently holds the largest market share due to its widespread adoption among professional users and affordability. However, Mac OS is gaining traction among creative professionals for its intuitive interface and tight ecosystem with other creative tools. "Other Operating Systems" represent a smaller but growing segment, primarily driven by Linux-based options for specialized applications.

DAW Industry Product Developments

Recent years have witnessed significant product innovations in the DAW sector. Companies are introducing AI-powered features for automated mixing and mastering, improving workflow efficiency, enhanced virtual instrument libraries, and seamless integration with other professional audio tools, such as plugins and hardware interfaces. These advancements provide competitive advantages, improving workflow and attracting new users, while simultaneously catering to the needs of demanding professionals and casual users.

Challenges in the DAW Industry Market

The DAW industry faces challenges, including intense competition among established players and rising new entrants. Maintaining a competitive edge requires continuous innovation and adaptation to changing user preferences. Supply chain disruptions can impact the availability of hardware components that integrate with DAW software. Furthermore, software piracy remains a significant concern, potentially affecting revenue streams for developers.

Forces Driving DAW Industry Growth

Several factors drive the growth of the DAW industry. Technological advancements, such as AI-powered features and improved audio processing, enhance user experience and functionality. The increasing affordability of high-quality hardware and software allows broader access to music production tools. Lastly, the growth of the digital music distribution market fuels demand for professional audio production tools.

Long-Term Growth Catalysts in the DAW Industry

Long-term growth will be fueled by continued innovation in AI-powered features within DAWs, expanding integration with other creative software, and exploring new distribution models like subscription services that cater to a broader audience. Strategic partnerships between DAW developers and hardware manufacturers will also strengthen market positions and provide complete, high-quality workflows for users.

Emerging Opportunities in DAW Industry

Emerging opportunities lie in mobile DAW applications, catering to the growing trend of mobile music creation. The integration of VR/AR technologies into DAWs opens new avenues for immersive audio experiences and enhanced creative workflows. The increasing demand for cloud-based collaborative platforms represents another significant opportunity for growth.

Leading Players in the DAW Industry Sector

Key Milestones in DAW Industry Industry

- August 2022: Spotify's Soundtrap introduced live collaboration, auto-save, and comments features, enhancing remote collaboration capabilities.

- April 2023: Avid Technology launched the MTRX II and MTRX Thunderbolt 3 module, expanding post-production audio capabilities.

- April 2023: Audio Design Desk 2.0 was released, featuring a streamlined UI, automated mixing, and integrations with industry-standard NLEs.

- June 2023: Triton Digital and Basis Technologies partnered to streamline audio advertising across various platforms.

Strategic Outlook for DAW Industry Market

The DAW industry is poised for continued growth, driven by technological advancements, evolving user preferences, and the expansion of the digital music market. Strategic opportunities exist in developing innovative features, expanding into new markets (e.g., mobile, VR/AR), and forging partnerships to enhance product offerings and broaden market reach. Focusing on cloud-based solutions and seamless integration with other creative tools will be crucial for long-term success.

DAW Industry Segmentation

-

1. Operating System

- 1.1. Mac

- 1.2. Windows

- 1.3. Other Operating Systems

-

2. End User

- 2.1. Professional/Audio Engineers and Mixers

- 2.2. Electronic Musicians

- 2.3. Music Studios

- 2.4. Music Schools

- 2.5. Other End Users

DAW Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

DAW Industry Regional Market Share

Geographic Coverage of DAW Industry

DAW Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for High Definition Video and Audio; Increased Use of Technology in Audio and Video Making

- 3.3. Market Restrains

- 3.3.1. Lack of Standardization of Communication Protocol across Different Platforms; Issues Related to Security and Privacy of Data to Hinder the Adoption of IoT Devices

- 3.4. Market Trends

- 3.4.1. MAC Operating System is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global DAW Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 5.1.1. Mac

- 5.1.2. Windows

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Professional/Audio Engineers and Mixers

- 5.2.2. Electronic Musicians

- 5.2.3. Music Studios

- 5.2.4. Music Schools

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 6. North America DAW Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operating System

- 6.1.1. Mac

- 6.1.2. Windows

- 6.1.3. Other Operating Systems

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Professional/Audio Engineers and Mixers

- 6.2.2. Electronic Musicians

- 6.2.3. Music Studios

- 6.2.4. Music Schools

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Operating System

- 7. Europe DAW Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operating System

- 7.1.1. Mac

- 7.1.2. Windows

- 7.1.3. Other Operating Systems

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Professional/Audio Engineers and Mixers

- 7.2.2. Electronic Musicians

- 7.2.3. Music Studios

- 7.2.4. Music Schools

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Operating System

- 8. Asia DAW Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operating System

- 8.1.1. Mac

- 8.1.2. Windows

- 8.1.3. Other Operating Systems

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Professional/Audio Engineers and Mixers

- 8.2.2. Electronic Musicians

- 8.2.3. Music Studios

- 8.2.4. Music Schools

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Operating System

- 9. Latin America DAW Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operating System

- 9.1.1. Mac

- 9.1.2. Windows

- 9.1.3. Other Operating Systems

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Professional/Audio Engineers and Mixers

- 9.2.2. Electronic Musicians

- 9.2.3. Music Studios

- 9.2.4. Music Schools

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Operating System

- 10. Middle East and Africa DAW Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Operating System

- 10.1.1. Mac

- 10.1.2. Windows

- 10.1.3. Other Operating Systems

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Professional/Audio Engineers and Mixers

- 10.2.2. Electronic Musicians

- 10.2.3. Music Studios

- 10.2.4. Music Schools

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Operating System

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Avid Technology Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PreSonus Audio Electronics Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cakewalk Inc (bandLab Technologies)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Steinberg Media Technologies GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Adobe Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Native Instruments GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MAGIX Software GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Apple Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Harrison Consoles Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Avid Technology Inc

List of Figures

- Figure 1: Global DAW Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America DAW Industry Revenue (million), by Operating System 2025 & 2033

- Figure 3: North America DAW Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 4: North America DAW Industry Revenue (million), by End User 2025 & 2033

- Figure 5: North America DAW Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America DAW Industry Revenue (million), by Country 2025 & 2033

- Figure 7: North America DAW Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe DAW Industry Revenue (million), by Operating System 2025 & 2033

- Figure 9: Europe DAW Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 10: Europe DAW Industry Revenue (million), by End User 2025 & 2033

- Figure 11: Europe DAW Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe DAW Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Europe DAW Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia DAW Industry Revenue (million), by Operating System 2025 & 2033

- Figure 15: Asia DAW Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 16: Asia DAW Industry Revenue (million), by End User 2025 & 2033

- Figure 17: Asia DAW Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia DAW Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Asia DAW Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America DAW Industry Revenue (million), by Operating System 2025 & 2033

- Figure 21: Latin America DAW Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 22: Latin America DAW Industry Revenue (million), by End User 2025 & 2033

- Figure 23: Latin America DAW Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America DAW Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Latin America DAW Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa DAW Industry Revenue (million), by Operating System 2025 & 2033

- Figure 27: Middle East and Africa DAW Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 28: Middle East and Africa DAW Industry Revenue (million), by End User 2025 & 2033

- Figure 29: Middle East and Africa DAW Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa DAW Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa DAW Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 2: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 3: Global DAW Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 5: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 6: Global DAW Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 8: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 9: Global DAW Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 11: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 12: Global DAW Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 14: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 15: Global DAW Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global DAW Industry Revenue million Forecast, by Operating System 2020 & 2033

- Table 17: Global DAW Industry Revenue million Forecast, by End User 2020 & 2033

- Table 18: Global DAW Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the DAW Industry?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the DAW Industry?

Key companies in the market include Avid Technology Inc, PreSonus Audio Electronics Inc, Cakewalk Inc (bandLab Technologies), Steinberg Media Technologies GmbH, Adobe Inc, Native Instruments GmbH, MAGIX Software GmbH, Apple Inc, Harrison Consoles Inc.

3. What are the main segments of the DAW Industry?

The market segments include Operating System, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4394.1 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for High Definition Video and Audio; Increased Use of Technology in Audio and Video Making.

6. What are the notable trends driving market growth?

MAC Operating System is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Standardization of Communication Protocol across Different Platforms; Issues Related to Security and Privacy of Data to Hinder the Adoption of IoT Devices.

8. Can you provide examples of recent developments in the market?

April 2023: AVID introduced Tools MTRX II and MTRX Thunderbolt 3 module, specifically designed for post-production users to enhance audio capabilities to get the prime sound possible. MTRX II empowers users with greater IO capacity, routing, and immersive monitoring flexibility. It allows capturing tools and software-based workflows, providing flexibility and expandability than MTRX.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "DAW Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the DAW Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the DAW Industry?

To stay informed about further developments, trends, and reports in the DAW Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence