Key Insights

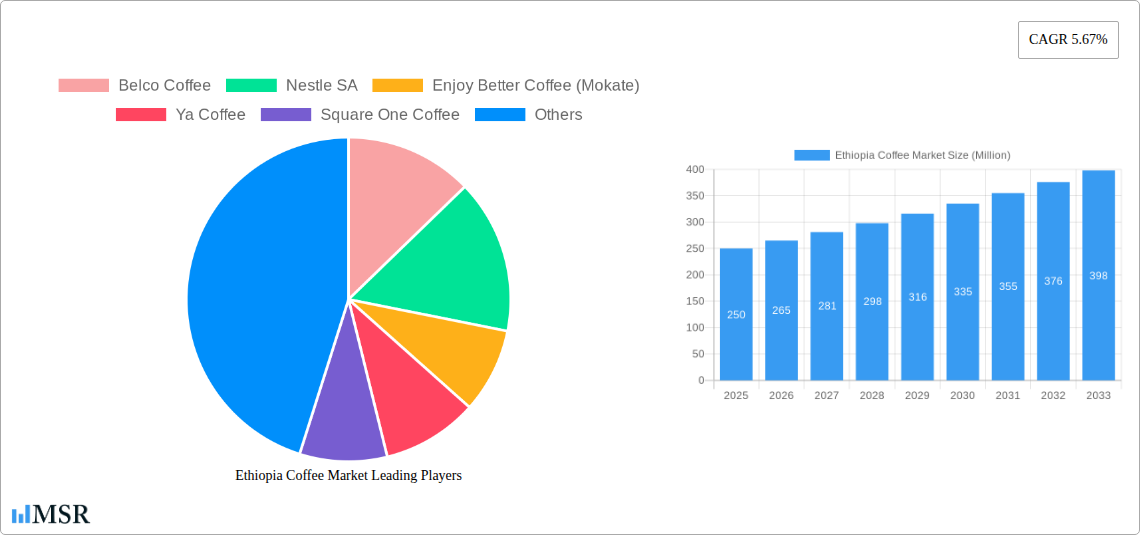

The Ethiopian coffee market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.67% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing domestic consumption, driven by a growing young population with rising disposable incomes and a burgeoning café culture, is a significant factor. Furthermore, the international demand for high-quality Ethiopian Arabica beans, renowned for their unique flavor profiles, continues to propel market growth. The rise of e-commerce platforms and specialized coffee retailers is also expanding market access, particularly for premium coffee segments. However, challenges remain. Fluctuations in global coffee prices and climatic variations impacting crop yields pose significant risks to the market's stability. Furthermore, competition from cheaper coffee imports and the need for improved infrastructure to support efficient processing and distribution present obstacles to sustained growth. The market is segmented by product type (whole-bean, ground, instant) and distribution channel (on-trade, off-trade). The whole-bean segment likely holds the largest market share, given Ethiopia's reputation for high-quality Arabica beans, while the off-trade channel (retail sales) is projected to witness significant growth driven by e-commerce and supermarket expansion. Key players such as Belco Coffee, Nestle SA, and numerous smaller cooperatives are vying for market share. The forecast period (2025-2033) anticipates continued growth, but sustainable practices and strategic investments in infrastructure and processing are crucial for maximizing the market's potential.

The significant growth potential of the Ethiopian coffee market is underpinned by the country's rich coffee heritage and increasing global appreciation for its unique Arabica beans. While challenges related to climate change, price volatility, and infrastructure limitations need to be addressed, the long-term outlook remains positive. Continued investments in sustainable farming practices, value addition, and marketing efforts will be crucial to unlocking the market's full potential and ensuring the prosperity of Ethiopian coffee farmers and businesses. Government initiatives focused on supporting the coffee industry, coupled with private sector investments in technology and infrastructure, will play a vital role in shaping the market's trajectory. The growing middle class in Ethiopia and the expansion of the global specialty coffee market create favorable conditions for future growth.

Ethiopia Coffee Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Ethiopia coffee market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a detailed study period spanning from 2019 to 2033 (base year 2025, forecast period 2025-2033, historical period 2019-2024), this report delivers a robust understanding of market size, growth drivers, key segments, and leading players. We delve into market concentration, competitive landscapes, and emerging opportunities, equipping you with the knowledge needed to make informed strategic decisions. The report projects a market value of XX Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Ethiopia Coffee Market Concentration & Dynamics

The Ethiopian coffee market presents a complex interplay of factors influencing its overall dynamics. Market concentration is relatively fragmented, with several local and international players vying for market share. Key players include Belco Coffee, Nestle SA (Nestle SA), Enjoy Better Coffee (Mokate), Ya Coffee, Square One Coffee, Wild Coffee Company, Hadero Coffee, Klatch Coffee, Oromia Coffee Farmers Cooperative Union, and Kalbe International. While precise market share data for each player is unavailable at this time, Nestle SA and other multinational corporations hold significant influence, although the local players still maintain a sizeable portion of the overall market.

The innovation ecosystem is gradually evolving, with a focus on improving coffee bean quality, processing techniques, and sustainable farming practices. Regulatory frameworks play a crucial role, impacting both domestic production and international trade. Substitute products, such as tea and other beverages, pose a competitive challenge. End-user trends, particularly a growing preference for specialty coffee and ethically sourced beans, are shaping the market landscape. The number of M&A deals in the sector has been xx in the last 5 years, with further consolidation expected in the coming years.

- Market Share: Precise figures unavailable, but a fragmented market with local and international players.

- M&A Deal Counts: xx in the last 5 years.

- Innovation: Focus on quality, processing, and sustainability.

- Regulatory Impact: Significant influence on production and trade.

- Substitute Products: Tea and other beverages.

- End-User Trends: Growing demand for specialty and ethically sourced coffee.

Ethiopia Coffee Market Industry Insights & Trends

The Ethiopian coffee market is experiencing substantial growth, fueled by several key factors. Increasing domestic consumption, driven by rising disposable incomes and a growing appreciation for specialty coffee, is a significant driver. Export demand, particularly to key markets in Europe and North America, further contributes to market expansion. Technological advancements in coffee processing and farming techniques are enhancing both productivity and quality. However, challenges remain, including climate change impacting yields and infrastructure limitations hindering efficient distribution. The market size was estimated at XX Million in 2024, projected to reach XX Million by 2025 and further grow to XX Million by 2033. The total market value is predicted to be XX Million by 2033.

The CAGR for the forecast period is estimated to be xx%. Consumer behavior shifts towards premiumization and sustainability influence product development and marketing strategies.

Key Markets & Segments Leading Ethiopia Coffee Market

Dominant Region/Segment: The domestic market (off-trade) holds the largest share, followed by export markets (on-trade), reflecting significant local consumption and international demand for Ethiopian coffee.

Product Type: Whole bean coffee remains popular for its freshness and high-quality appeal. However, ground coffee and instant coffee segments are experiencing increased demand due to convenience.

Distribution Channel: The off-trade channel (supermarkets, retail stores, etc.) dominates market share, although the on-trade (cafes and restaurants) is also growing, representing opportunities for specialty coffee offerings.

Drivers:

- Economic Growth: Rising disposable incomes boost coffee consumption.

- Infrastructure Development: Improved logistics and transportation facilitate distribution.

- Tourism: The increasing number of tourists contributes to coffee consumption in the on-trade sector.

The dominance of the domestic off-trade channel can be attributed to readily available coffee and widespread acceptance of locally grown varieties. The growth of the on-trade sector is driven by urbanization and a rising middle class seeking premium coffee experiences. The significant demand for whole-bean coffee highlights a preference for fresh, high-quality products, especially amongst specialty coffee enthusiasts.

Ethiopia Coffee Market Product Developments

Recent product innovations focus on enhancing coffee quality and extending product offerings. There's increased emphasis on sustainable farming practices and traceable origins to meet growing consumer demand for ethically sourced coffee. New roasting techniques and packaging technologies are also enhancing product shelf life and overall consumer experience, offering a competitive edge.

Challenges in the Ethiopia Coffee Market

Significant challenges impede the Ethiopian coffee market’s growth. These include inconsistent coffee bean quality due to variable farming practices and weather conditions, leading to a xx% decrease in production in some years. Supply chain inefficiencies, particularly transportation limitations in rural areas, significantly impact export capabilities and overall market access. The level of competition, both domestically and internationally, is a further constraint on expansion. Regulatory complexities and bureaucratic processes increase the cost and time involved in obtaining export permits.

Forces Driving Ethiopia Coffee Market Growth

The Ethiopian coffee market benefits from several key growth drivers. Government initiatives supporting the coffee industry, including the 15-year coffee development strategy and the new coffee training center, are fostering sector improvement. Increasing international demand for Ethiopian coffee, driven by its unique flavor profile and growing reputation for quality, is a major growth driver. The growing popularity of specialty coffee is increasing demand for premium Ethiopian varieties. The continuous innovations in processing and farming practices offer improved quality and yield.

Long-Term Growth Catalysts

Long-term growth in the Ethiopian coffee market relies on sustained government support, ongoing improvements in farming practices and technology, and a continuing rise in international demand. Strategic partnerships between local producers and international companies can unlock market access and enhance production capacity. Expanding into new export markets and further developing the domestic specialty coffee market represent significant opportunities. A key catalyst will be the adoption of climate-smart agriculture to mitigate the impact of climate change on coffee production.

Emerging Opportunities in Ethiopia Coffee Market

Significant opportunities exist for value-added products, such as ready-to-drink coffee, coffee-based beverages, and specialty blends. Growing demand for sustainable and ethical coffee offers a niche market to target. Utilizing innovative technology to improve traceability and transparency in the supply chain can enhance consumer trust and brand appeal. Exploring new export markets and developing the e-commerce sector can broaden market reach.

Leading Players in the Ethiopia Coffee Market Sector

- Belco Coffee

- Nestle SA (Nestle SA)

- Enjoy Better Coffee (Mokate)

- Ya Coffee

- Square One Coffee

- Wild Coffee Company

- Hadero Coffee

- Klatch Coffee

- Oromia Coffee Farmers Cooperative Union

- Kalbe International

Key Milestones in Ethiopia Coffee Market Industry

- June 2021: Launch of a state-of-the-art coffee training center to enhance sustainability and value chain.

- July 2022: Development of a 15-year coffee development strategy aiming to maximize production potential.

- August 2022: World Coffee Research (WCR) partners with Ethiopian institutions to improve coffee varieties. These initiatives underscore a concerted effort to improve the quality, sustainability, and overall competitiveness of the Ethiopian coffee sector.

Strategic Outlook for Ethiopia Coffee Market

The future of the Ethiopian coffee market is promising, fueled by a confluence of factors including a growing domestic market, increasing international demand, and strategic investments in infrastructure and technology. By leveraging sustainable farming practices, enhancing product quality, and strengthening its global brand reputation, Ethiopia can further solidify its position as a leading coffee producer and exporter, realizing its significant market potential.

Ethiopia Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole-bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

-

2. Distribution Channel

- 2.1. On-trade (Cafes and Foodservice)

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Off-trade Channels

Ethiopia Coffee Market Segmentation By Geography

- 1. Ethiopia

Ethiopia Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Strong Production Base in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ethiopia Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole-bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade (Cafes and Foodservice)

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Ethiopia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Belco Coffee

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enjoy Better Coffee (Mokate)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ya Coffee

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Square One Coffee

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wild Coffee Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hadero Coffee

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Klatch Coffee

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oromia Coffee Farmers Cooperative Union*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kalbe International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Belco Coffee

List of Figures

- Figure 1: Ethiopia Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ethiopia Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: Ethiopia Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ethiopia Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Ethiopia Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Ethiopia Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Ethiopia Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Ethiopia Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Ethiopia Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Ethiopia Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethiopia Coffee Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the Ethiopia Coffee Market?

Key companies in the market include Belco Coffee, Nestle SA, Enjoy Better Coffee (Mokate), Ya Coffee, Square One Coffee, Wild Coffee Company, Hadero Coffee, Klatch Coffee, Oromia Coffee Farmers Cooperative Union*List Not Exhaustive, Kalbe International.

3. What are the main segments of the Ethiopia Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Strong Production Base in the Country.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

August 2022: World Coffee Research (WCR) announced its plans to work with Ethiopia. In order to support their efforts to provide farmers with better varieties of coffee, WCR inked an agreement (MOU) with the Ethiopian Institute of Agricultural Research (EIAR) and the Jimma Agricultural Research Center (JARC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethiopia Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethiopia Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethiopia Coffee Market?

To stay informed about further developments, trends, and reports in the Ethiopia Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence