Key Insights

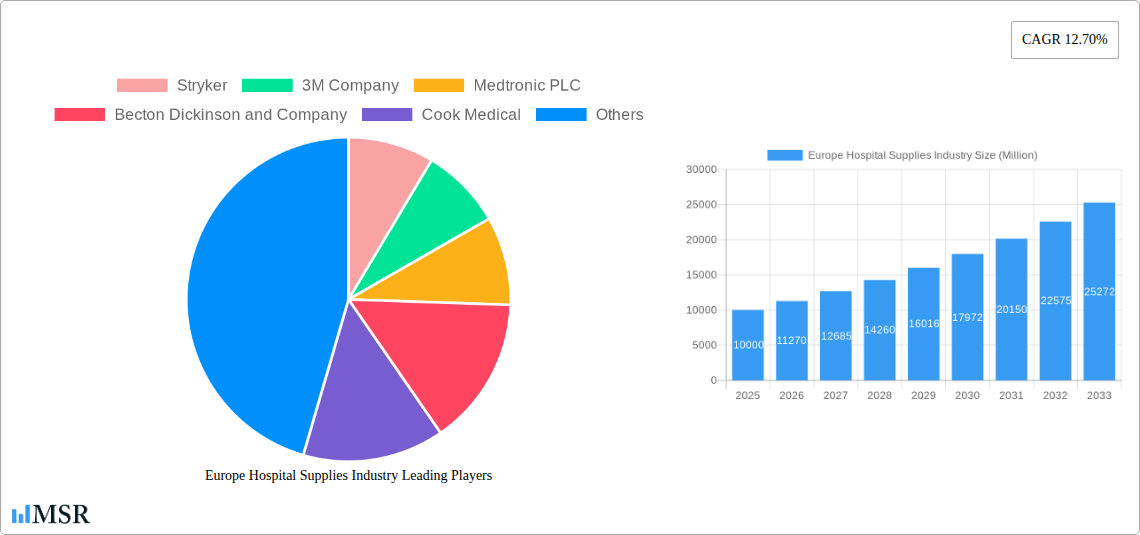

The European hospital supplies market, valued at approximately €XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 12.70% from 2025 to 2033. This expansion is fueled by several key factors. Aging populations across Europe are driving increased demand for healthcare services, leading to higher utilization of hospital supplies. Furthermore, advancements in medical technology, particularly in minimally invasive procedures and advanced diagnostics, are creating a need for sophisticated and specialized supplies. Growing prevalence of chronic diseases like diabetes and cardiovascular conditions also contributes significantly to market growth. Stringent regulatory frameworks ensuring patient safety and hygiene standards further stimulate demand for high-quality supplies. Market segmentation reveals that patient examination devices, operating room equipment, and sterilization & disinfectant equipment constitute major segments, reflecting the critical role these supplies play in various hospital settings. Competitive intensity is high, with major players like Stryker, 3M, Medtronic, and Becton Dickinson vying for market share through technological innovation, strategic partnerships, and geographical expansion. However, the market is subject to certain constraints such as fluctuating raw material prices and potential economic downturns that can impact healthcare spending.

The German, French, UK, and Italian markets are major contributors to the European hospital supplies market's overall value, reflecting these countries' larger healthcare infrastructure and higher spending on healthcare. The market's future growth will depend on continued technological innovation, especially in areas such as minimally invasive surgery and telehealth, which will drive demand for specialized equipment. Government policies aimed at improving healthcare infrastructure and promoting efficient healthcare resource management will also play a crucial role. The market's focus will increasingly be on sustainable and cost-effective solutions, driving growth in reusable and eco-friendly supplies. The competitive landscape will likely see further consolidation and strategic alliances as companies seek to enhance their market position and expand their product portfolios. Successful players will be those that effectively leverage technological advancements, adapt to changing regulations, and meet the evolving needs of healthcare providers and patients.

Europe Hospital Supplies Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Europe hospital supplies industry, covering market dynamics, key segments, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders seeking actionable insights and strategic guidance. The report analyzes a market valued at xx Million in 2025, projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Hospital Supplies Industry Market Concentration & Dynamics

The European hospital supplies market is characterized by a moderately concentrated landscape, with several multinational corporations holding significant market share. Key players like Stryker, 3M Company, Medtronic PLC, Becton Dickinson and Company, and Johnson & Johnson (Ethicon) dominate various segments. Market share analysis reveals that the top five players collectively account for approximately xx% of the total market revenue in 2025. The industry is witnessing substantial M&A activity, with an estimated xx merger and acquisition deals occurring between 2019 and 2024. Innovation ecosystems are vibrant, driven by investments in R&D and strategic partnerships to develop advanced medical technologies. Regulatory frameworks like the EU Medical Device Regulation (MDR) significantly impact market dynamics, creating both opportunities and challenges for manufacturers. Substitute products pose a competitive threat, particularly in less specialized segments. End-user trends, such as the increasing demand for minimally invasive surgical devices and digital healthcare solutions, are shaping market growth.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- M&A Activity: Approximately xx deals between 2019 and 2024.

- Regulatory Landscape: EU MDR significantly impacts market access and product development.

- Substitute Products: Competition from alternative solutions exists in some segments.

- End-User Trends: Growing preference for minimally invasive procedures and digital healthcare.

Europe Hospital Supplies Industry Industry Insights & Trends

The European hospital supplies market is experiencing robust growth fueled by several key factors. Aging populations across Europe are driving increased demand for healthcare services, consequently boosting the demand for hospital supplies. Technological advancements, such as the adoption of robotics in surgery and the integration of digital technologies in operating rooms, are creating new market opportunities. The rise of minimally invasive procedures further fuels demand for specialized instruments and supplies. Evolving consumer behaviors, with a heightened focus on patient safety and improved treatment outcomes, are also influencing market dynamics. The market's growth is further propelled by rising disposable incomes, improved healthcare infrastructure in several European nations, and increased government spending on healthcare. The market size was valued at xx Million in 2024 and is anticipated to reach xx Million by 2033.

Key Markets & Segments Leading Europe Hospital Supplies Industry

The German market represents the largest segment within the European hospital supplies industry, driven by strong healthcare infrastructure, high healthcare expenditure, and a sizable aging population. Other key markets include the UK, France, and Italy. Within product types, Operating Room Equipment and Patient Examination Devices command the largest market shares, reflecting the significant investments in advanced surgical technologies and diagnostic tools.

- Dominant Region: Germany

- Key Countries: UK, France, Italy, Spain

- Leading Segments:

- Operating Room Equipment: Driven by technological advancements and adoption of minimally invasive surgeries.

- Patient Examination Devices: Fueled by increased diagnostic procedures and early disease detection initiatives.

- Drivers: Aging population, rising healthcare expenditure, technological advancements, and improved healthcare infrastructure.

Europe Hospital Supplies Industry Product Developments

Recent years have witnessed significant product innovations within the European hospital supplies market. The development of minimally invasive surgical instruments, advanced imaging technologies, and smart medical devices are transforming the healthcare landscape. These innovations offer improved patient outcomes, reduced recovery times, and enhanced efficiency for healthcare providers. Companies are focusing on developing products with enhanced features, such as disposability, improved ergonomics, and integrated connectivity for data management and remote monitoring.

Challenges in the Europe Hospital Supplies Industry Market

The European hospital supplies industry faces several challenges. Stringent regulatory requirements, particularly under the EU MDR, pose hurdles for manufacturers in terms of compliance costs and market access. Supply chain disruptions, exacerbated by global events, can impact product availability and pricing. Intense competition among established players and emerging market entrants creates pricing pressures. These challenges collectively impact profitability and growth potential for businesses within the sector. The total estimated impact of these factors on market growth is projected to be approximately xx% between 2025 and 2033.

Forces Driving Europe Hospital Supplies Industry Growth

Several factors drive the growth of the European hospital supplies market. Technological advancements in medical devices and digital health solutions are creating opportunities for innovation and market expansion. Favorable government policies and increased healthcare funding are contributing to market growth. A growing elderly population is increasing demand for healthcare services and medical supplies. Furthermore, the increasing prevalence of chronic diseases necessitates the use of various medical devices and consumables, further boosting market growth.

Challenges in the Europe Hospital Supplies Industry Market

Long-term growth in the European hospital supplies market hinges on continued innovation, strategic partnerships, and expansion into new markets. Development of next-generation medical devices, adoption of digital health technologies, and exploring opportunities in emerging markets like Eastern Europe will be vital for sustained market expansion. Companies will need to proactively address regulatory challenges and manage supply chain complexities to achieve sustained, long-term growth.

Emerging Opportunities in Europe Hospital Supplies Industry

Emerging opportunities lie in the adoption of AI-driven diagnostics, telemedicine solutions, and personalized medicine. Expansion into underserved regions of Europe and the development of sustainable and eco-friendly products are promising avenues for growth. Focus on preventative healthcare and proactive health management will further drive demand for specific types of hospital supplies.

Leading Players in the Europe Hospital Supplies Industry Sector

- Stryker

- 3M Company

- Medtronic PLC

- Becton Dickinson and Company

- Cook Medical

- Johnson & Johnson (Ethicon)

- Smith & Nephew

- B Braun Melsungen AG

- Baxter International Inc

- Thermo Fisher Scientific Inc

- Boston Scientific Group

- Cardinal Health Inc

Key Milestones in Europe Hospital Supplies Industry Industry

- March 2022: Olympus launched its next-generation operating room (OR) integration solution, EASY SUITE, in the European region. EASYSUITE incorporates video management and routing, procedure recording, medical content management, and virtual collaboration. This launch signifies the growing adoption of digital technologies in operating rooms.

- June 2022: FUJIFILM Healthcare Europe partnered with the 'Augmented Operating Room' (BOpA) Innovation Chair to accelerate the development of digital technologies for surgery. This collaboration highlights the industry's focus on innovation and technological advancements within surgical procedures.

Strategic Outlook for Europe Hospital Supplies Industry Market

The European hospital supplies market is poised for continued growth, driven by technological advancements, demographic shifts, and increasing healthcare expenditure. Strategic opportunities lie in capitalizing on the growing demand for minimally invasive procedures, digital health solutions, and personalized medicine. Companies that invest in R&D, adopt innovative business models, and address regulatory challenges effectively will be well-positioned to capitalize on the market's long-term growth potential.

Europe Hospital Supplies Industry Segmentation

-

1. Product Type

- 1.1. Patient Examination Device

- 1.2. Operating Room Equipment

- 1.3. Mobility Aids and Transportation Equipment

- 1.4. Syringes and Needles

- 1.5. Sterilization and Disinfectant Equipment

- 1.6. Other Product Types

Europe Hospital Supplies Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Hospital Supplies Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Demand Owing to Chronic Disease and Rising Geriatric Population; Investment in Healthcare Infrastructure

- 3.3. Market Restrains

- 3.3.1. Emergence of Home Care Services; Stringent Regulatory Bodies

- 3.4. Market Trends

- 3.4.1. The Operating Room Equipment Segment is Expected to Witness High Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Patient Examination Device

- 5.1.2. Operating Room Equipment

- 5.1.3. Mobility Aids and Transportation Equipment

- 5.1.4. Syringes and Needles

- 5.1.5. Sterilization and Disinfectant Equipment

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Patient Examination Device

- 6.1.2. Operating Room Equipment

- 6.1.3. Mobility Aids and Transportation Equipment

- 6.1.4. Syringes and Needles

- 6.1.5. Sterilization and Disinfectant Equipment

- 6.1.6. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Patient Examination Device

- 7.1.2. Operating Room Equipment

- 7.1.3. Mobility Aids and Transportation Equipment

- 7.1.4. Syringes and Needles

- 7.1.5. Sterilization and Disinfectant Equipment

- 7.1.6. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Patient Examination Device

- 8.1.2. Operating Room Equipment

- 8.1.3. Mobility Aids and Transportation Equipment

- 8.1.4. Syringes and Needles

- 8.1.5. Sterilization and Disinfectant Equipment

- 8.1.6. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Patient Examination Device

- 9.1.2. Operating Room Equipment

- 9.1.3. Mobility Aids and Transportation Equipment

- 9.1.4. Syringes and Needles

- 9.1.5. Sterilization and Disinfectant Equipment

- 9.1.6. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Patient Examination Device

- 10.1.2. Operating Room Equipment

- 10.1.3. Mobility Aids and Transportation Equipment

- 10.1.4. Syringes and Needles

- 10.1.5. Sterilization and Disinfectant Equipment

- 10.1.6. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Patient Examination Device

- 11.1.2. Operating Room Equipment

- 11.1.3. Mobility Aids and Transportation Equipment

- 11.1.4. Syringes and Needles

- 11.1.5. Sterilization and Disinfectant Equipment

- 11.1.6. Other Product Types

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Europe Europe Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Germany Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. France Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. Italy Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. United Kingdom Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1. undefined

- 17. Netherlands Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1. undefined

- 18. Sweden Europe Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 18.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 18.1.1. undefined

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Stryker

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 3M Company

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Medtronic PLC

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Becton Dickinson and Company

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Cook Medical

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Johnson & Johnson (Ethicon)

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Smith & Nephew

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 B Braun Melsungen AG

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Baxter International Inc

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Thermo Fisher Scientific Inc

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Boston Scientific Group

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Cardinal Health Inc

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.1 Stryker

List of Figures

- Figure 1: Europe Hospital Supplies Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Hospital Supplies Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Hospital Supplies Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Hospital Supplies Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Hospital Supplies Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Europe Hospital Supplies Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Europe Hospital Supplies Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Hospital Supplies Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Europe Hospital Supplies Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Europe Hospital Supplies Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 23: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: Europe Hospital Supplies Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Europe Hospital Supplies Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 27: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Europe Hospital Supplies Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Europe Hospital Supplies Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 31: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Europe Hospital Supplies Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Europe Hospital Supplies Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 35: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Europe Hospital Supplies Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Europe Hospital Supplies Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 39: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: Europe Hospital Supplies Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 42: Europe Hospital Supplies Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 43: Europe Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Europe Hospital Supplies Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Hospital Supplies Industry?

The projected CAGR is approximately 12.70%.

2. Which companies are prominent players in the Europe Hospital Supplies Industry?

Key companies in the market include Stryker, 3M Company, Medtronic PLC, Becton Dickinson and Company, Cook Medical, Johnson & Johnson (Ethicon), Smith & Nephew, B Braun Melsungen AG, Baxter International Inc, Thermo Fisher Scientific Inc, Boston Scientific Group, Cardinal Health Inc.

3. What are the main segments of the Europe Hospital Supplies Industry?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Demand Owing to Chronic Disease and Rising Geriatric Population; Investment in Healthcare Infrastructure.

6. What are the notable trends driving market growth?

The Operating Room Equipment Segment is Expected to Witness High Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Emergence of Home Care Services; Stringent Regulatory Bodies.

8. Can you provide examples of recent developments in the market?

June 2022- FUJIFILM Healthcare Europe entered a partnership with the 'Augmented Operating Room' (BOpA) Innovation Chair to accelerate the development of digital technologies for surgery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Hospital Supplies Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Hospital Supplies Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Hospital Supplies Industry?

To stay informed about further developments, trends, and reports in the Europe Hospital Supplies Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence