Key Insights

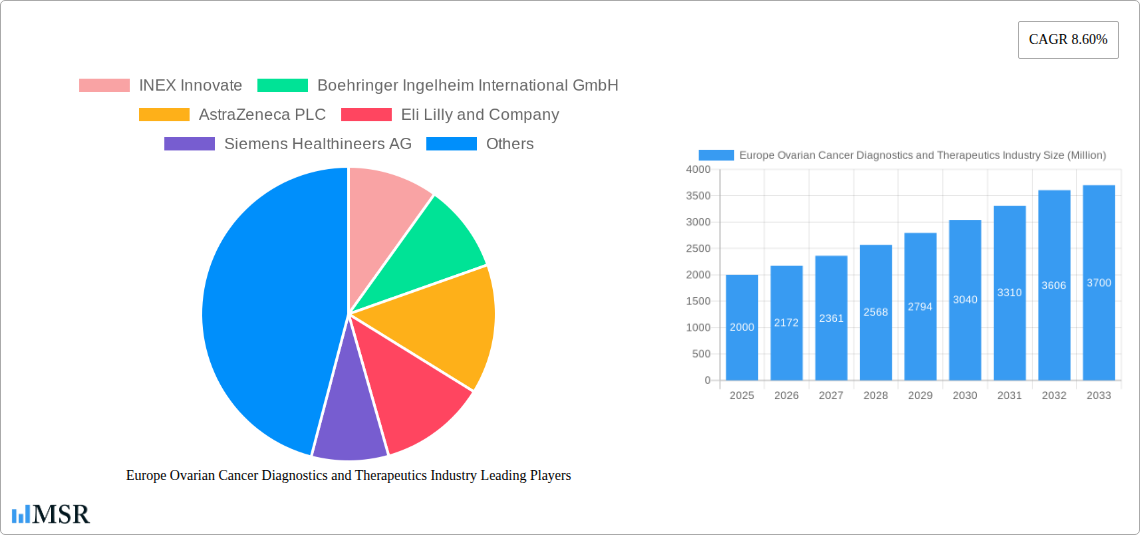

The European ovarian cancer diagnostics and therapeutics market is experiencing robust growth, driven by increasing prevalence of ovarian cancer, advancements in diagnostic technologies, and the emergence of targeted therapies. The market, valued at approximately €[Estimate based on Market Size XX and value unit - Assume XX is a large number, say 2000, for illustration. Then the 2025 market size would be approximately 2000 million Euros]. in 2025, is projected to exhibit a compound annual growth rate (CAGR) of 8.60% from 2025 to 2033, reaching an estimated value of approximately €[Calculate future value using CAGR: 2000 * (1 + 0.086)^8 ≈ 3700 million Euros]. This expansion is fueled by several key factors. Improved screening methods, including advanced imaging techniques like MRI and CT scans, coupled with the development of more sensitive biomarker tests, are leading to earlier and more accurate diagnoses. Furthermore, the pipeline of novel therapeutics, encompassing targeted therapies, immunotherapies, and improved chemotherapeutic agents, is significantly contributing to improved patient outcomes and driving market growth. The segment focusing on Epithelial Ovarian Tumors represents a significant portion of the market due to its higher prevalence compared to other ovarian cancer types. Therapeutic modalities are projected to hold a larger market share compared to diagnostic tools, reflecting the increasing demand for effective treatment options.

The major players within the European market, including AstraZeneca, Boehringer Ingelheim, and others, are actively investing in research and development, expanding their product portfolios, and focusing on strategic collaborations to maintain their market positions. Geographic variations exist within Europe, with Germany, France, and the UK representing significant market segments. However, the increasing awareness about ovarian cancer and better healthcare infrastructure across various European countries are expected to drive growth in other regions like the Netherlands and Sweden. While challenges such as high treatment costs and the need for improved patient access to advanced therapies remain, the overall market outlook for ovarian cancer diagnostics and therapeutics in Europe remains positive, promising substantial growth opportunities in the coming years. The aging population in Europe also plays a significant role, contributing to the increased incidence of cancer overall and thus fueling market demand.

Europe Ovarian Cancer Diagnostics and Therapeutics Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Ovarian Cancer Diagnostics and Therapeutics market, offering invaluable insights for stakeholders across the industry. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils market dynamics, growth drivers, and key opportunities within the €XX Million market. The report meticulously examines various segments, including epithelial ovarian tumors, ovarian germ cell tumors, and other cancer types, alongside diagnostic and therapeutic modalities. Leading players such as AstraZeneca PLC, Boehringer Ingelheim International GmbH, and Pfizer Inc. are profiled, providing a clear understanding of the competitive landscape.

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Market Concentration & Dynamics

The European ovarian cancer diagnostics and therapeutics market exhibits a moderately concentrated structure, with a few major multinational pharmaceutical and diagnostic companies holding significant market share. The estimated market share of the top 5 players in 2025 is approximately 60%, indicating a considerable level of consolidation. However, the presence of several smaller, specialized companies contributes to a dynamic competitive environment.

Innovation within the ecosystem is driven by substantial R&D investments from large pharmaceutical companies and emerging biotech firms focusing on targeted therapies and improved diagnostic tools. The regulatory landscape, largely influenced by the European Medicines Agency (EMA), plays a pivotal role in shaping market access and product approvals. Substitute products, including traditional chemotherapies and alternative treatment approaches, exert competitive pressure.

End-user trends, primarily dictated by evolving treatment protocols and growing awareness of ovarian cancer, heavily influence market growth. The market has witnessed a significant number of M&A activities in recent years, with approximately xx M&A deals closed between 2019 and 2024, primarily focused on acquiring innovative technologies and expanding market access. This trend is expected to continue, fueled by the pursuit of novel therapies and diagnostic advancements.

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Industry Insights & Trends

The European ovarian cancer diagnostics and therapeutics market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033, reaching an estimated value of €XX Million by 2033. This growth is primarily driven by several factors. Increased prevalence of ovarian cancer, coupled with heightened public awareness and improved screening programs, contributes significantly to market expansion. Advances in targeted therapies, such as PARP inhibitors and immunotherapy, are revolutionizing treatment paradigms, leading to improved patient outcomes and increased market demand. Furthermore, technological advancements in diagnostics, particularly in molecular imaging and biomarker detection, enhance early diagnosis and personalized treatment, thus further fueling market expansion. The rising geriatric population across Europe, which is particularly susceptible to ovarian cancer, also presents a key growth driver. Finally, supportive government initiatives and increased healthcare spending in several European countries are creating a favorable environment for market growth.

Key Markets & Segments Leading Europe Ovarian Cancer Diagnostics and Therapeutics Industry

The largest segment within the European ovarian cancer market is Epithelial Ovarian Tumors, accounting for approximately xx% of the total market value in 2025. This dominance stems from the higher prevalence of this cancer type compared to Ovarian Germ Cell Tumors and Other Cancer Types. Within the modality segments, Therapeutics holds a larger market share than Diagnosis, reflecting the significant investment in drug development and the higher cost of novel therapies.

Drivers for Epithelial Ovarian Tumors segment:

- High prevalence of the cancer type.

- Increased awareness and improved screening.

- Continued advancements in targeted therapies.

Dominance Analysis:

Germany, France, and the UK are the leading markets within Europe, owing to their well-established healthcare infrastructure, high healthcare expenditure, and sizable patient populations. These countries also exhibit higher rates of ovarian cancer diagnosis and treatment, thereby driving demand for both diagnostics and therapeutics. The strong presence of major pharmaceutical and diagnostic companies within these nations further contributes to market dominance.

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Product Developments

Recent years have witnessed significant advancements in ovarian cancer diagnostics and therapeutics. Novel targeted therapies, including PARP inhibitors and immunotherapy agents, are offering improved treatment outcomes compared to traditional chemotherapy. Liquid biopsies are gaining traction as a non-invasive method for early cancer detection and monitoring treatment response. Furthermore, advancements in imaging technologies, such as PET/CT scans, are enabling more precise diagnosis and staging of the disease. These developments are enhancing the effectiveness and personalization of cancer treatment, thereby contributing to improved patient survival rates and shaping the competitive landscape.

Challenges in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry Market

The European ovarian cancer diagnostics and therapeutics market faces several challenges. High drug prices and limited access to innovative therapies pose significant barriers, particularly in countries with constrained healthcare budgets. Strict regulatory pathways for drug approvals and reimbursement processes can delay market entry for new products. Furthermore, the complexities of ovarian cancer biology and the heterogeneity of the disease make it challenging to develop universally effective treatments. Competition amongst established pharmaceutical companies and emerging biotech firms adds another layer of complexity to market dynamics.

Forces Driving Europe Ovarian Cancer Diagnostics and Therapeutics Industry Growth

Several factors are driving the growth of the European ovarian cancer diagnostics and therapeutics market. Technological advancements in targeted therapies, diagnostics, and personalized medicine are significantly influencing market expansion. Favorable healthcare policies and increasing healthcare expenditure in several European nations are creating a conducive environment for market growth. Furthermore, rising awareness of ovarian cancer, improved screening programs, and enhanced patient advocacy initiatives are contributing to increased diagnosis rates and treatment adoption.

Challenges in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry Market

Long-term growth catalysts include the continuous development and adoption of novel therapeutic agents, including immunotherapies and innovative drug delivery systems. Strategic partnerships between pharmaceutical companies and research institutions are fostering collaborations and accelerating the discovery of new treatments. Expansion into emerging markets and a focus on unmet medical needs will further drive market growth in the coming years.

Emerging Opportunities in Europe Ovarian Cancer Diagnostics and Therapeutics Industry

Emerging opportunities lie in the development of personalized medicine approaches that leverage genomic data and biomarker profiles to tailor therapies to individual patients. The use of artificial intelligence (AI) and machine learning in diagnostics and treatment prediction is also creating significant opportunities. Further development of early detection methods and improved screening strategies will play a crucial role in improving patient outcomes. Expansion into underserved markets and investment in innovative drug delivery systems will also unlock significant market potential.

Leading Players in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry Sector

- INEX Innovate

- Boehringer Ingelheim International GmbH

- AstraZeneca PLC

- Eli Lilly and Company

- Siemens Healthineers AG

- Johnson & Johnson (Janssen Pharmaceuticals)

- Ovation Diagnostics

- Bristol Myers Squibb Company

- F. Hoffmann-La Roche Ltd

- Amneal Pharmaceuticals LLC

- GlaxoSmithKline PLC

- Pfizer Inc

Key Milestones in Europe Ovarian Cancer Diagnostics and Therapeutics Industry Industry

- August 2022: Inceptua Group commercially launched Apealea in Germany for the treatment of adult patients with the first relapse of platinum-sensitive epithelial ovarian cancer. This launch signifies the introduction of a new therapeutic option, impacting treatment paradigms and market competition.

- May 2022: BioMoti Ltd partnered with a global pharmaceutical company to collaborate on the development of its lead ovarian cancer candidate, BMT101, to clinical phase 2a proof-of-concept. This collaboration highlights the ongoing innovation within the industry and the potential for new therapeutic agents.

Strategic Outlook for Europe Ovarian Cancer Diagnostics and Therapeutics Industry Market

The future of the European ovarian cancer diagnostics and therapeutics market is bright, characterized by continuous innovation and a growing demand for effective treatments. The market is poised for significant growth, driven by advancements in targeted therapies, personalized medicine, and improved diagnostic tools. Strategic partnerships and collaborations will play a crucial role in accelerating the development and market entry of novel products. Companies focusing on unmet medical needs and leveraging technological advancements will be well-positioned to capitalize on the considerable growth opportunities within this dynamic market.

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Segmentation

-

1. Cancer Type

- 1.1. Epithelial Ovarian Tumors

- 1.2. Ovarian Germ Cell Tumors

- 1.3. Other Cancer Types

-

2. Modality

-

2.1. Diagnosis

- 2.1.1. Biopsy

- 2.1.2. Blood Tests

- 2.1.3. Ultrasound

- 2.1.4. PET

- 2.1.5. CT Scan

- 2.1.6. Other Diagnosis

-

2.2. Therapeutics

- 2.2.1. Chemotherapy

- 2.2.2. Radiation Therapy

- 2.2.3. Immunotherapy

- 2.2.4. Hormonal Therapy

- 2.2.5. Other Therapeutics

-

2.1. Diagnosis

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Ovarian Cancer Diagnostics and Therapeutics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Ovarian Cancer; Greater Use of Combination Therapies for the Treatment of Ovarian Cancer; Rising Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Lack of Accurate Diagnosis of Ovarian Cancer

- 3.4. Market Trends

- 3.4.1. Immunotherapy is Expected to Hold Significant Share of the European Ovarian Cancer Diagnostics and Therapeutics Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cancer Type

- 5.1.1. Epithelial Ovarian Tumors

- 5.1.2. Ovarian Germ Cell Tumors

- 5.1.3. Other Cancer Types

- 5.2. Market Analysis, Insights and Forecast - by Modality

- 5.2.1. Diagnosis

- 5.2.1.1. Biopsy

- 5.2.1.2. Blood Tests

- 5.2.1.3. Ultrasound

- 5.2.1.4. PET

- 5.2.1.5. CT Scan

- 5.2.1.6. Other Diagnosis

- 5.2.2. Therapeutics

- 5.2.2.1. Chemotherapy

- 5.2.2.2. Radiation Therapy

- 5.2.2.3. Immunotherapy

- 5.2.2.4. Hormonal Therapy

- 5.2.2.5. Other Therapeutics

- 5.2.1. Diagnosis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Cancer Type

- 6. Germany Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Cancer Type

- 6.1.1. Epithelial Ovarian Tumors

- 6.1.2. Ovarian Germ Cell Tumors

- 6.1.3. Other Cancer Types

- 6.2. Market Analysis, Insights and Forecast - by Modality

- 6.2.1. Diagnosis

- 6.2.1.1. Biopsy

- 6.2.1.2. Blood Tests

- 6.2.1.3. Ultrasound

- 6.2.1.4. PET

- 6.2.1.5. CT Scan

- 6.2.1.6. Other Diagnosis

- 6.2.2. Therapeutics

- 6.2.2.1. Chemotherapy

- 6.2.2.2. Radiation Therapy

- 6.2.2.3. Immunotherapy

- 6.2.2.4. Hormonal Therapy

- 6.2.2.5. Other Therapeutics

- 6.2.1. Diagnosis

- 6.1. Market Analysis, Insights and Forecast - by Cancer Type

- 7. United Kingdom Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Cancer Type

- 7.1.1. Epithelial Ovarian Tumors

- 7.1.2. Ovarian Germ Cell Tumors

- 7.1.3. Other Cancer Types

- 7.2. Market Analysis, Insights and Forecast - by Modality

- 7.2.1. Diagnosis

- 7.2.1.1. Biopsy

- 7.2.1.2. Blood Tests

- 7.2.1.3. Ultrasound

- 7.2.1.4. PET

- 7.2.1.5. CT Scan

- 7.2.1.6. Other Diagnosis

- 7.2.2. Therapeutics

- 7.2.2.1. Chemotherapy

- 7.2.2.2. Radiation Therapy

- 7.2.2.3. Immunotherapy

- 7.2.2.4. Hormonal Therapy

- 7.2.2.5. Other Therapeutics

- 7.2.1. Diagnosis

- 7.1. Market Analysis, Insights and Forecast - by Cancer Type

- 8. France Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Cancer Type

- 8.1.1. Epithelial Ovarian Tumors

- 8.1.2. Ovarian Germ Cell Tumors

- 8.1.3. Other Cancer Types

- 8.2. Market Analysis, Insights and Forecast - by Modality

- 8.2.1. Diagnosis

- 8.2.1.1. Biopsy

- 8.2.1.2. Blood Tests

- 8.2.1.3. Ultrasound

- 8.2.1.4. PET

- 8.2.1.5. CT Scan

- 8.2.1.6. Other Diagnosis

- 8.2.2. Therapeutics

- 8.2.2.1. Chemotherapy

- 8.2.2.2. Radiation Therapy

- 8.2.2.3. Immunotherapy

- 8.2.2.4. Hormonal Therapy

- 8.2.2.5. Other Therapeutics

- 8.2.1. Diagnosis

- 8.1. Market Analysis, Insights and Forecast - by Cancer Type

- 9. Italy Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Cancer Type

- 9.1.1. Epithelial Ovarian Tumors

- 9.1.2. Ovarian Germ Cell Tumors

- 9.1.3. Other Cancer Types

- 9.2. Market Analysis, Insights and Forecast - by Modality

- 9.2.1. Diagnosis

- 9.2.1.1. Biopsy

- 9.2.1.2. Blood Tests

- 9.2.1.3. Ultrasound

- 9.2.1.4. PET

- 9.2.1.5. CT Scan

- 9.2.1.6. Other Diagnosis

- 9.2.2. Therapeutics

- 9.2.2.1. Chemotherapy

- 9.2.2.2. Radiation Therapy

- 9.2.2.3. Immunotherapy

- 9.2.2.4. Hormonal Therapy

- 9.2.2.5. Other Therapeutics

- 9.2.1. Diagnosis

- 9.1. Market Analysis, Insights and Forecast - by Cancer Type

- 10. Spain Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Cancer Type

- 10.1.1. Epithelial Ovarian Tumors

- 10.1.2. Ovarian Germ Cell Tumors

- 10.1.3. Other Cancer Types

- 10.2. Market Analysis, Insights and Forecast - by Modality

- 10.2.1. Diagnosis

- 10.2.1.1. Biopsy

- 10.2.1.2. Blood Tests

- 10.2.1.3. Ultrasound

- 10.2.1.4. PET

- 10.2.1.5. CT Scan

- 10.2.1.6. Other Diagnosis

- 10.2.2. Therapeutics

- 10.2.2.1. Chemotherapy

- 10.2.2.2. Radiation Therapy

- 10.2.2.3. Immunotherapy

- 10.2.2.4. Hormonal Therapy

- 10.2.2.5. Other Therapeutics

- 10.2.1. Diagnosis

- 10.1. Market Analysis, Insights and Forecast - by Cancer Type

- 11. Rest of Europe Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Cancer Type

- 11.1.1. Epithelial Ovarian Tumors

- 11.1.2. Ovarian Germ Cell Tumors

- 11.1.3. Other Cancer Types

- 11.2. Market Analysis, Insights and Forecast - by Modality

- 11.2.1. Diagnosis

- 11.2.1.1. Biopsy

- 11.2.1.2. Blood Tests

- 11.2.1.3. Ultrasound

- 11.2.1.4. PET

- 11.2.1.5. CT Scan

- 11.2.1.6. Other Diagnosis

- 11.2.2. Therapeutics

- 11.2.2.1. Chemotherapy

- 11.2.2.2. Radiation Therapy

- 11.2.2.3. Immunotherapy

- 11.2.2.4. Hormonal Therapy

- 11.2.2.5. Other Therapeutics

- 11.2.1. Diagnosis

- 11.1. Market Analysis, Insights and Forecast - by Cancer Type

- 12. Germany Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 INEX Innovate

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Boehringer Ingelheim International GmbH

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 AstraZeneca PLC

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Eli Lilly and Company

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Siemens Healthineers AG

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Johnson and Johnson (Janssen Pharmaceuticals)

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Ovation Diagnostics

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Bristol Myers Squibb Company

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 F Hoffman-La Roche Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Amneal Pharmaceuticals LLC

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 GlaxoSmithKline PLC

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Pfizer Inc

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.1 INEX Innovate

List of Figures

- Figure 1: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 4: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2019 & 2032

- Table 5: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Modality 2019 & 2032

- Table 6: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2019 & 2032

- Table 7: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: France Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 26: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2019 & 2032

- Table 27: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Modality 2019 & 2032

- Table 28: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2019 & 2032

- Table 29: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 32: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2019 & 2032

- Table 33: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Modality 2019 & 2032

- Table 34: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2019 & 2032

- Table 35: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 38: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2019 & 2032

- Table 39: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Modality 2019 & 2032

- Table 40: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2019 & 2032

- Table 41: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 44: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2019 & 2032

- Table 45: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Modality 2019 & 2032

- Table 46: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2019 & 2032

- Table 47: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 49: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 50: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2019 & 2032

- Table 51: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Modality 2019 & 2032

- Table 52: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2019 & 2032

- Table 53: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 56: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2019 & 2032

- Table 57: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Modality 2019 & 2032

- Table 58: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2019 & 2032

- Table 59: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ovarian Cancer Diagnostics and Therapeutics Industry?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry?

Key companies in the market include INEX Innovate, Boehringer Ingelheim International GmbH, AstraZeneca PLC, Eli Lilly and Company, Siemens Healthineers AG, Johnson and Johnson (Janssen Pharmaceuticals), Ovation Diagnostics, Bristol Myers Squibb Company, F Hoffman-La Roche Ltd, Amneal Pharmaceuticals LLC, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Europe Ovarian Cancer Diagnostics and Therapeutics Industry?

The market segments include Cancer Type, Modality.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Ovarian Cancer; Greater Use of Combination Therapies for the Treatment of Ovarian Cancer; Rising Geriatric Population.

6. What are the notable trends driving market growth?

Immunotherapy is Expected to Hold Significant Share of the European Ovarian Cancer Diagnostics and Therapeutics Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Accurate Diagnosis of Ovarian Cancer.

8. Can you provide examples of recent developments in the market?

August 2022: Inceptua Group commercially launched Apealea in Germany for the treatment of adult patients with the first relapse of platinum-sensitive epithelial ovarian cancer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ovarian Cancer Diagnostics and Therapeutics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry?

To stay informed about further developments, trends, and reports in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence