Key Insights

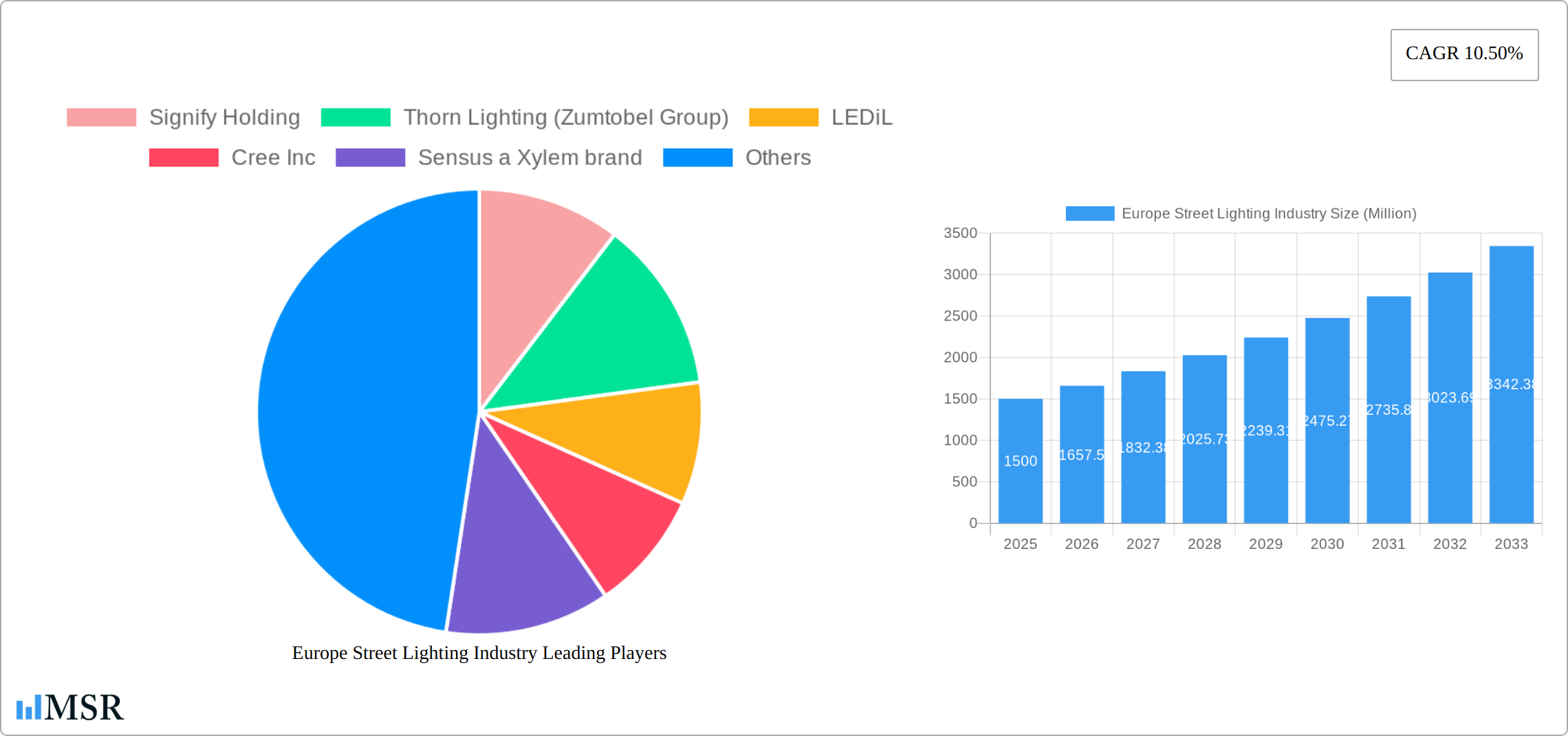

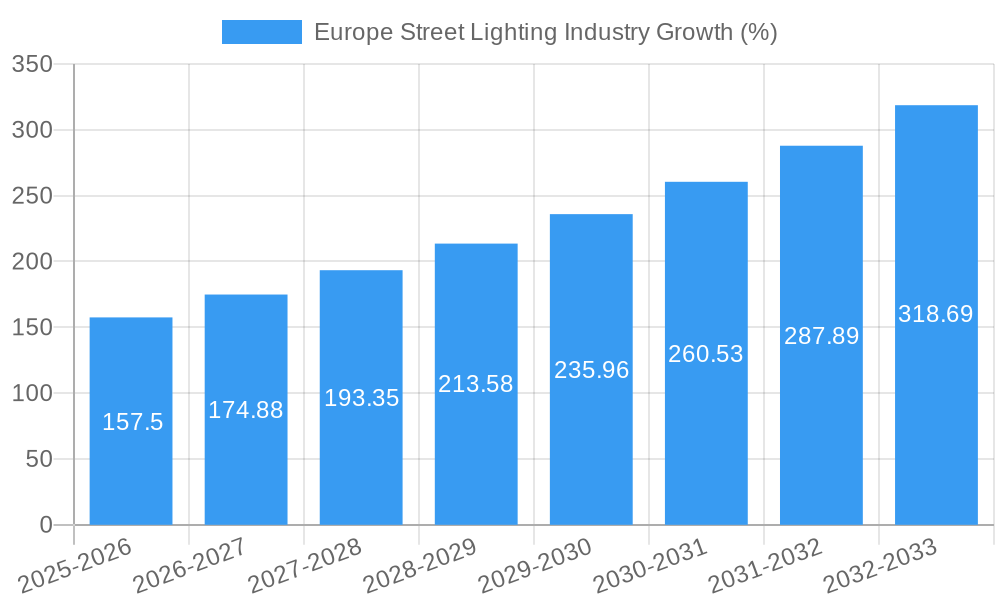

The European street lighting market is experiencing robust growth, driven by increasing urbanization, rising energy efficiency concerns, and the adoption of smart city initiatives. The market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market size), is projected to expand at a Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the widespread adoption of energy-efficient LED lighting solutions is significantly reducing operational costs for municipalities, making upgrades more financially viable. Secondly, the integration of smart lighting technologies, including remote monitoring and control systems, is enhancing operational efficiency and optimizing energy consumption. This is further boosted by government initiatives promoting sustainable infrastructure and smart city development across major European nations like Germany, France, and the UK. These initiatives often include funding and regulatory frameworks that incentivize the adoption of modern, energy-efficient street lighting systems.

However, the market's expansion is not without its challenges. High initial investment costs associated with replacing existing infrastructure and the complexities of integrating new smart technologies can act as restraints. Furthermore, the market is quite fragmented, with numerous players competing for market share, ranging from large multinational corporations like Signify and Osram to specialized regional suppliers. This competition can lead to fluctuating prices and varying levels of innovation across the market. Nevertheless, the long-term outlook for the European street lighting market remains positive, driven by continuous technological advancements, increasing environmental awareness, and ongoing government support for sustainable urban development. The shift towards smart and connected lighting systems promises to bring about improved public safety, enhanced energy efficiency, and a significant reduction in carbon emissions across European cities.

Europe Street Lighting Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the European street lighting industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a focus on market size, growth drivers, competitive landscape, and future trends, this report is an essential resource for strategic planning and decision-making. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report analyzes key segments, including lighting types, light sources, offerings, and key European countries (UK, Germany, France, Italy, and Rest of Europe). Leading players like Signify Holding, Thorn Lighting, and OSRAM are profiled, providing a complete overview of the industry's current state and future potential. The report's value exceeds €xx Million.

Europe Street Lighting Industry Market Concentration & Dynamics

The European street lighting market exhibits a moderately concentrated structure, with a few major players holding significant market share. Signify Holding, Thorn Lighting (Zumtobel Group), and OSRAM Gmbh are among the leading companies, collectively commanding an estimated xx% market share in 2025. However, the market also features several smaller, regional players, particularly in specialized segments like smart lighting solutions.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately concentrated market.

- Innovation Ecosystems: Strong R&D investments by major players, coupled with government support for energy-efficient technologies, fuel innovation in LED lighting and smart city solutions. The emergence of startups focused on smart controls and data analytics further enhances the innovative landscape.

- Regulatory Frameworks: EU regulations promoting energy efficiency and sustainability significantly impact the market, driving the adoption of energy-saving lighting technologies. Stringent standards on light pollution and environmental impact also influence product development and market dynamics.

- Substitute Products: While LED lighting dominates, alternative technologies such as solar-powered lighting systems pose a potential competitive threat. The relative cost-effectiveness and technological advancements of LED lighting currently limit the impact of substitutes.

- End-User Trends: Increasing demand for smart city solutions and energy-efficient infrastructure is driving growth in the smart street lighting segment. Municipalities are increasingly prioritizing sustainability and cost reduction in their street lighting infrastructure upgrades.

- M&A Activities: The industry has witnessed a moderate level of M&A activity in recent years, with strategic acquisitions primarily focused on expanding product portfolios and technological capabilities. An estimated xx M&A deals were recorded between 2019 and 2024.

Europe Street Lighting Industry Industry Insights & Trends

The European street lighting market is experiencing robust growth, driven by several key factors. The market size reached €xx Million in 2024 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching €xx Million by 2033. This growth is fueled by ongoing urbanization, increasing demand for energy-efficient lighting solutions, and the growing adoption of smart city technologies. Technological disruptions, such as the shift from traditional lighting technologies (HID, fluorescent) to energy-efficient LEDs, have significantly impacted the market. Furthermore, the integration of smart sensors, communication networks, and data analytics enhances the functionality and efficiency of street lighting systems, creating new market opportunities. Consumer behavior is also evolving, with a rising preference for environmentally friendly and technologically advanced lighting solutions. Municipalities are increasingly prioritizing sustainable and efficient infrastructure, including smart lighting systems offering energy savings, remote monitoring, and improved public safety.

Key Markets & Segments Leading Europe Street Lighting Industry

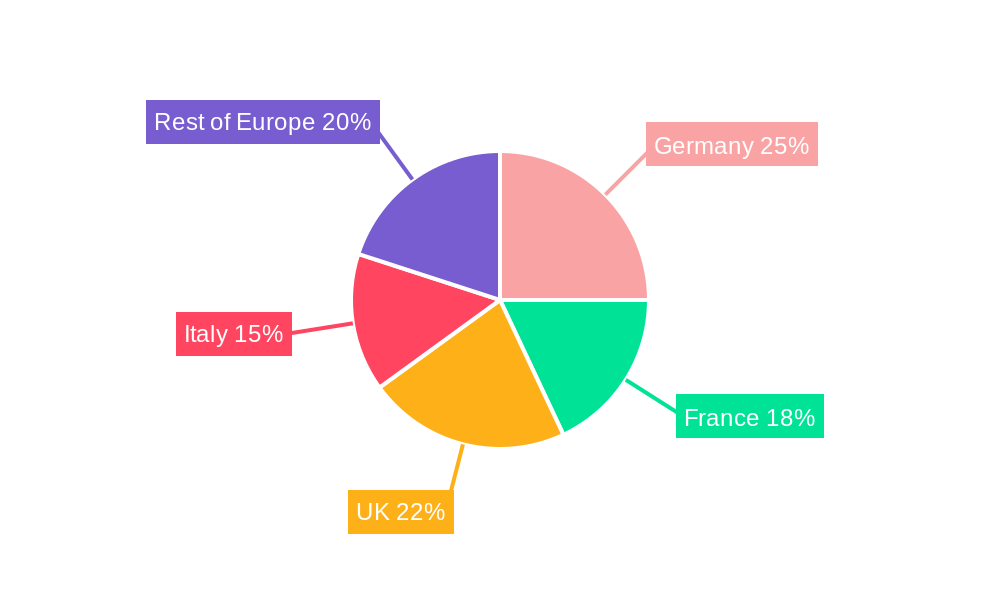

The LED lighting segment dominates the European street lighting market, accounting for an estimated xx% of total market revenue in 2025. The smart lighting segment is experiencing the fastest growth, driven by increasing investments in smart city infrastructure and the benefits of remote monitoring and control. Germany and the UK are the largest national markets, accounting for a combined xx% of total market revenue.

By Lighting Type:

- Smart Lighting: Strong growth driven by smart city initiatives, energy savings, and enhanced functionalities.

- Conventional Lighting: Market share is declining due to the shift towards energy-efficient LED technologies.

By Light Source:

- LEDs: Dominant market share due to energy efficiency, long lifespan, and cost-effectiveness.

- Fluorescent Lights & HID Lamps: Market share is gradually decreasing due to technological advancements in LEDs.

By Offering:

- Hardware: Largest market segment, comprising luminaires, poles, and other physical components.

- Control Systems (Software & Services): High growth potential driven by the increasing adoption of smart lighting systems.

By Country:

- Germany & UK: Largest markets due to robust infrastructure investments and advanced technological adoption.

- France & Italy: Significant markets with considerable growth potential.

- Rest of Europe: Displays diverse growth patterns, influenced by local regulations and economic conditions.

Drivers:

- Economic growth leading to increased infrastructure spending.

- Government initiatives promoting energy efficiency and smart city development.

- Growing environmental awareness driving the adoption of sustainable technologies.

Europe Street Lighting Industry Product Developments

Recent years have witnessed significant product innovations in the European street lighting industry. The shift towards LEDs has been accompanied by the integration of smart technologies, resulting in the development of smart lighting systems with enhanced features like remote control, dimming capabilities, and integrated sensors for monitoring and data analytics. This is exemplified by Signify's acquisition of Telensa, expanding its smart city solutions portfolio. The introduction of new luminaire designs, such as Cyclone Lighting's Kanata, focuses on aesthetics and energy efficiency while addressing the needs of historical urban settings. These developments improve lighting quality, reduce energy consumption, and enhance public safety.

Challenges in the Europe Street Lighting Industry Market

Despite the promising growth trajectory, the European street lighting industry faces several significant hurdles. Global supply chain disruptions, exacerbated by geopolitical events and escalating material costs, have a considerable impact on production timelines and pricing strategies. Fierce competition among established industry players and a growing number of new entrants exert significant pressure on profit margins. Moreover, evolving regulatory landscapes and stringent compliance requirements add complexity to operational processes, and securing the necessary funding for large-scale smart city projects often presents a considerable challenge. These factors contribute to a dynamic and sometimes unpredictable market environment, leading to uncertainties regarding profitability.

Forces Driving Europe Street Lighting Industry Growth

Technological advancements, particularly in LED and smart lighting technologies, serve as primary growth catalysts. Substantial government investments in energy efficiency programs and smart city infrastructure initiatives provide considerable market impetus. Furthermore, the increasing awareness of environmental concerns is driving the widespread adoption of sustainable lighting solutions. The clear economic benefits of energy savings realized through efficient lighting systems, combined with improvements in public safety and enhanced aesthetics, continue to attract substantial investment and fuel market growth.

Challenges in the Europe Street Lighting Industry Market

Despite the promising growth trajectory, the European street lighting industry faces several significant hurdles. Global supply chain disruptions, exacerbated by geopolitical events and escalating material costs, have a considerable impact on production timelines and pricing strategies. Fierce competition among established industry players and a growing number of new entrants exert significant pressure on profit margins. Moreover, evolving regulatory landscapes and stringent compliance requirements add complexity to operational processes, and securing the necessary funding for large-scale smart city projects often presents a considerable challenge. These factors contribute to a dynamic and sometimes unpredictable market environment, leading to uncertainties regarding profitability.

Emerging Opportunities in Europe Street Lighting Industry

The integration of cutting-edge smart technologies, including Artificial Intelligence (AI) and the Internet of Things (IoT), presents significant opportunities to enhance the functionalities of street lighting systems. The development and deployment of energy harvesting technologies and self-powered lighting solutions directly address crucial sustainability concerns. The emergence of new market segments, such as smart street furniture that integrates lighting with other essential urban services, offers additional avenues for growth and expansion.

Leading Players in the Europe Street Lighting Industry Sector

- Signify Holding

- Thorn Lighting (Zumtobel Group)

- LEDiL

- Cree Inc

- Sensus a Xylem brand

- Eaton Corporation PLC

- Luxtella (Le-tehnika)

- Acuity Brands Inc

- OSRAM Gmbh

- General Electric Company

Key Milestones in Europe Street Lighting Industry Industry

- July 2021: Signify acquires Telensa Holdings Ltd., expanding its smart city solutions portfolio.

- April 2022: Cyclone Lighting launches the Kanata luminaire, a sleek, energy-efficient product for historical urban settings.

Strategic Outlook for Europe Street Lighting Industry Market

The European street lighting market demonstrates strong growth potential, driven by a combination of technological advancements, sustainability initiatives, and the ongoing expansion of smart city infrastructure. Companies that prioritize innovation, cultivate strategic partnerships, and actively pursue market expansion will be exceptionally well-positioned to capitalize on future growth opportunities. The accelerating adoption of smart lighting systems and the seamless integration of advanced technologies offer substantial potential for long-term market growth and profitability.

Europe Street Lighting Industry Segmentation

-

1. Lighting Type

- 1.1. Conventional Lighting

- 1.2. Smart Lighting

-

2. Light Source

- 2.1. LEDs

- 2.2. Fluorescent Lights

- 2.3. HID Lamps

-

3. Offering

-

3.1. Hardware

- 3.1.1. Lights and Bulbs

- 3.1.2. Luminaries

- 3.1.3. Control Systems

- 3.2. Software and Services

-

3.1. Hardware

Europe Street Lighting Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Street Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Intelligent Solutions in Street Lighting Systems; Increasing Adoption of Smart City Infrastructure; Supportive regulatory framework and legislation by Governments

- 3.3. Market Restrains

- 3.3.1. Challenges Associated With LED Driver Failure and High Cost Associated With Installation

- 3.4. Market Trends

- 3.4.1. Smart Lighting Segments Holds the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Street Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Lighting Type

- 5.1.1. Conventional Lighting

- 5.1.2. Smart Lighting

- 5.2. Market Analysis, Insights and Forecast - by Light Source

- 5.2.1. LEDs

- 5.2.2. Fluorescent Lights

- 5.2.3. HID Lamps

- 5.3. Market Analysis, Insights and Forecast - by Offering

- 5.3.1. Hardware

- 5.3.1.1. Lights and Bulbs

- 5.3.1.2. Luminaries

- 5.3.1.3. Control Systems

- 5.3.2. Software and Services

- 5.3.1. Hardware

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Lighting Type

- 6. Germany Europe Street Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Street Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Street Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Street Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Street Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Street Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Street Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Signify Holding

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Thorn Lighting (Zumtobel Group)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 LEDiL

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cree Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sensus a Xylem brand

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Eaton Corporation PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Luxtella (Le-tehnika)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Acuity Brands Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 OSRAM Gmbh

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 General Electric Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Signify Holding

List of Figures

- Figure 1: Europe Street Lighting Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Street Lighting Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Street Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Street Lighting Industry Revenue Million Forecast, by Lighting Type 2019 & 2032

- Table 3: Europe Street Lighting Industry Revenue Million Forecast, by Light Source 2019 & 2032

- Table 4: Europe Street Lighting Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 5: Europe Street Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Street Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Street Lighting Industry Revenue Million Forecast, by Lighting Type 2019 & 2032

- Table 15: Europe Street Lighting Industry Revenue Million Forecast, by Light Source 2019 & 2032

- Table 16: Europe Street Lighting Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 17: Europe Street Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Street Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Street Lighting Industry?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the Europe Street Lighting Industry?

Key companies in the market include Signify Holding, Thorn Lighting (Zumtobel Group), LEDiL, Cree Inc, Sensus a Xylem brand, Eaton Corporation PLC, Luxtella (Le-tehnika), Acuity Brands Inc, OSRAM Gmbh, General Electric Company.

3. What are the main segments of the Europe Street Lighting Industry?

The market segments include Lighting Type, Light Source, Offering.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Intelligent Solutions in Street Lighting Systems; Increasing Adoption of Smart City Infrastructure; Supportive regulatory framework and legislation by Governments.

6. What are the notable trends driving market growth?

Smart Lighting Segments Holds the Largest Market Share.

7. Are there any restraints impacting market growth?

Challenges Associated With LED Driver Failure and High Cost Associated With Installation.

8. Can you provide examples of recent developments in the market?

April 2022 - Cyclone Lighting, one of the leaders in manufacturing outdoor luminaires, announced that it had released its Kanata luminaire. The product's design is a sleek, classic take on a traditional favorite and has been introduced to replace outdated luminaries such as Cobra Heads in historical urban settings. With outstanding photometric performance, Kanata luminaires are suitable for multiple street and roadway applications, including urban boulevards and alleyways, city streets, historic districts, and residential neighborhoods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Street Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Street Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Street Lighting Industry?

To stay informed about further developments, trends, and reports in the Europe Street Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence