Key Insights

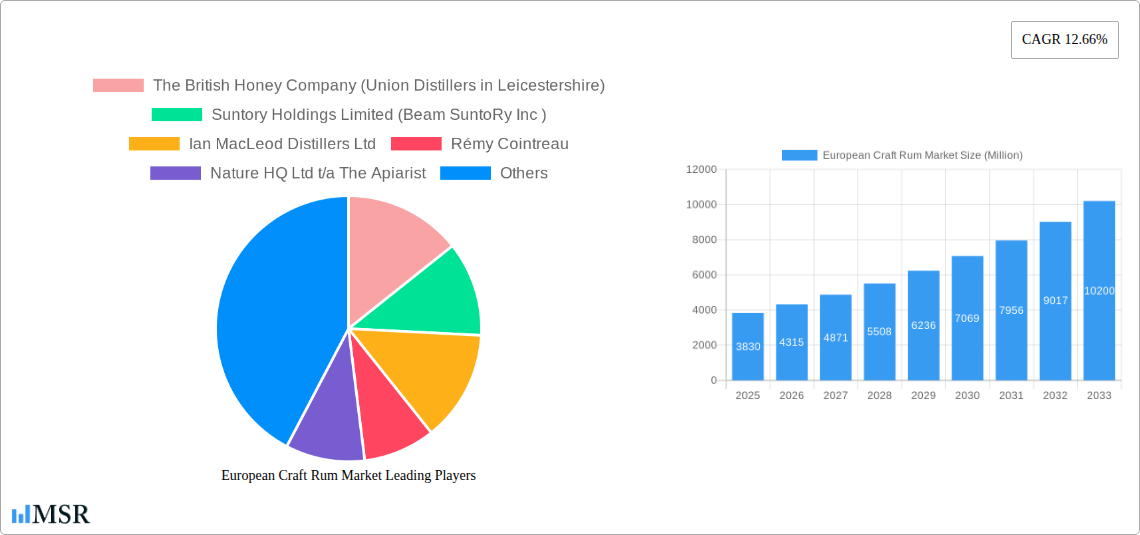

The European craft rum market, valued at €3.83 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 12.66% from 2025 to 2033. This expansion is driven by several key factors. A rising consumer preference for premium and artisanal spirits fuels demand for craft rums, which often boast unique flavor profiles and production methods differentiating them from mass-produced brands. The increasing popularity of rum-based cocktails within the on-trade sector (bars and restaurants) further contributes to market growth. Furthermore, a growing awareness of sustainable and ethically sourced products resonates with environmentally conscious consumers, leading to increased interest in craft rums produced with sustainable practices. The market is segmented by type (Whiskey, Gin, Vodka, Brandy, Rum, Other Types) and distribution channel (On-trade, Off-trade). Key players such as The British Honey Company, Suntory Holdings Limited, and Bacardi Limited compete in this dynamic market landscape. Growth is expected across major European markets including the United Kingdom, Germany, France, and Italy, reflecting a broad-based consumer shift towards premium and craft alcoholic beverages.

European Craft Rum Market Market Size (In Billion)

The relatively high CAGR suggests significant potential for further growth. However, challenges remain. Increased production costs for craft rum, potential fluctuations in raw material prices (sugarcane), and evolving consumer preferences could impact market trajectory. Competitiveness from established rum brands and the emergence of new craft distilleries will also shape market dynamics. Nevertheless, the combination of consumer demand for premium and unique products alongside the expanding on-trade sector makes the outlook for the European craft rum market strongly positive over the next decade. Successful companies will likely focus on building brand loyalty, leveraging sustainable practices, and creating innovative product offerings to maintain a competitive edge.

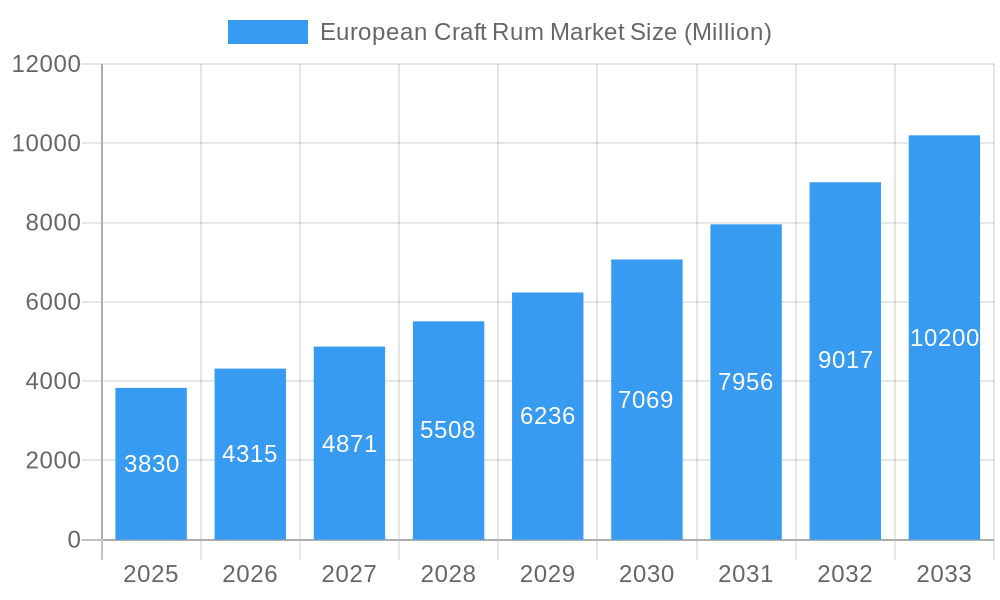

European Craft Rum Market Company Market Share

European Craft Rum Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European Craft Rum Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report offers a deep dive into market size, trends, and future growth potential. The report includes detailed analysis of key players, segments, and emerging opportunities. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

European Craft Rum Market Market Concentration & Dynamics

The European craft rum market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the presence of numerous smaller, artisanal distilleries contributes to a dynamic and competitive environment. Innovation is crucial, with companies constantly introducing new flavors, production techniques, and branding strategies to stand out. Regulatory frameworks, varying across European countries, significantly impact market access and product development. Substitute products, such as other spirits (whiskey, gin, vodka), compete for consumer preference, while emerging trends like sustainability and premiumization shape consumer choices. Mergers and acquisitions (M&A) activity plays a significant role in market consolidation and expansion, with larger companies acquiring smaller craft distilleries to increase their product portfolio and market reach.

- Market Share: The top 5 players collectively hold approximately xx% of the market share in 2025.

- M&A Deal Count: An estimated xx M&A deals occurred within the European craft rum market between 2019 and 2024.

- Innovation Ecosystems: Collaborative partnerships between distilleries, distributors, and retailers are fostering innovation in product development and marketing.

- Regulatory Frameworks: Harmonization of regulations across the EU remains a key challenge, with variations in labeling, taxation, and distribution impacting market dynamics.

European Craft Rum Market Industry Insights & Trends

The European craft rum market is experiencing robust growth driven by several factors. Increasing consumer demand for premium and artisanal spirits fuels market expansion. Technological advancements in distillation and production techniques allow for greater product diversity and efficiency. Evolving consumer preferences toward unique and high-quality products are driving innovation, with new flavors and blends continuously emerging. The market size in 2025 is estimated at xx Million, exhibiting a steady growth trajectory. Premiumization and the growing popularity of craft spirits are key trends shaping the market landscape. This is further fueled by the increasing disposable income within target demographics across Europe.

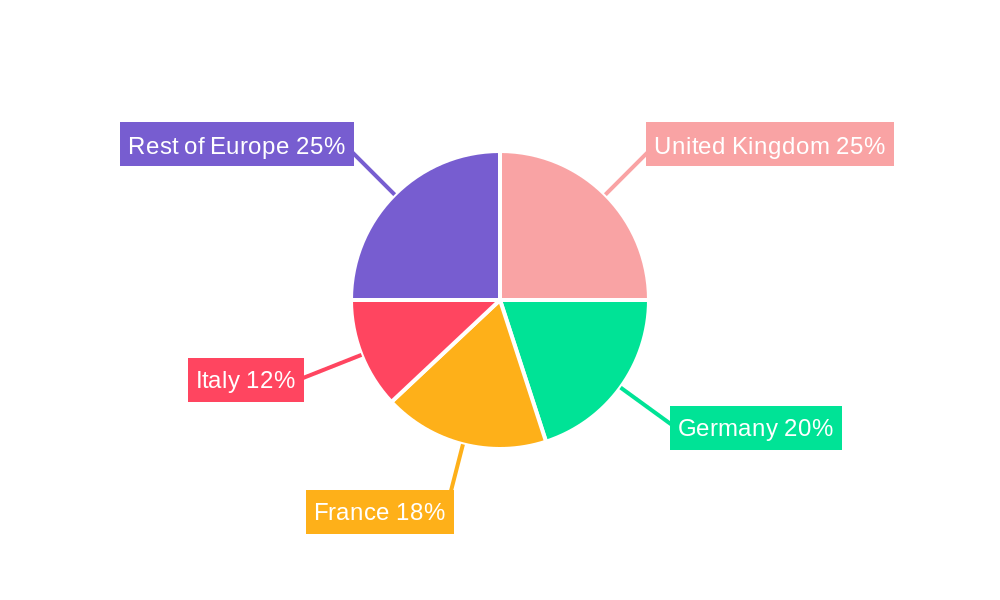

Key Markets & Segments Leading European Craft Rum Market

The United Kingdom, followed by France and Germany, are the leading markets for craft rum in Europe. The off-trade channel (retail sales) dominates distribution, driven by the convenience and accessibility it provides to consumers. Within product types, spiced and aged rums are currently leading the segment.

- Regional Drivers: Strong consumer spending in the UK, coupled with a well-developed distribution network, fuels its market dominance.

- Country-Specific Drivers: France's rich history with spirits and the increasing popularity of craft products in Germany contribute to their strong performance.

- Segment Drivers (Type): The preference for premium and complex flavor profiles contributes to the increasing demand for spiced and aged rums.

- Segment Drivers (Distribution): The convenience and widespread availability of off-trade channels make them a preferred distribution method among consumers.

European Craft Rum Market Product Developments

Recent years have witnessed a surge in product innovation within the European craft rum market. Distilleries are experimenting with unique flavor profiles, incorporating locally sourced ingredients, and employing advanced distillation techniques to differentiate their products. The focus on sustainability and ethical sourcing also drives product development, with an increasing number of craft rums highlighting their commitment to eco-friendly practices. These innovations contribute to a diverse and appealing product landscape, attracting a wider range of consumers.

Challenges in the European Craft Rum Market Market

The European craft rum market faces several challenges. Fluctuations in raw material prices, particularly sugarcane, pose a threat to profitability. Intense competition from established brands and new entrants requires continuous innovation and effective marketing strategies. Regulatory compliance and excise duties vary across different European countries, imposing complexities on market entry and expansion. Furthermore, supply chain disruptions, particularly post-pandemic, continue to present a challenge impacting both sourcing and distribution. The cumulative impact of these factors could potentially reduce market growth by xx% annually.

Forces Driving European Craft Rum Market Growth

Technological advancements in distillation and production, allowing for greater efficiency and new flavor profiles, contribute significantly to market growth. Increasing consumer disposable incomes and a growing preference for premium spirits fuel market expansion. Favorable regulatory environments in certain countries, streamlining licensing and distribution, also contribute to growth. The rise of e-commerce and direct-to-consumer (DTC) sales creates new avenues for growth and distribution.

Long-Term Growth Catalysts in the European Craft Rum Market

Long-term growth in the European craft rum market is driven by continuous product innovation, strategic partnerships, and expansion into new markets. Developing sustainable and ethically sourced products will resonate with growing consumer preferences. The exploration of new flavor profiles and production techniques enhances product appeal, expanding market reach.

Emerging Opportunities in European Craft Rum Market

Emerging opportunities lie in expanding into less-saturated European markets, tapping into the growing demand for premium spirits. Developing unique flavor profiles using local ingredients creates opportunities for regional specialization. The use of sustainable and organic practices offers a compelling proposition to environmentally conscious consumers.

Leading Players in the European Craft Rum Market Sector

- The British Honey Company (Union Distillers in Leicestershire)

- Suntory Holdings Limited (Beam Suntory Inc)

- Ian MacLeod Distillers Ltd

- Rémy Cointreau

- Nature HQ Ltd t/a The Apiarist

- JW Distillers Ltd

- Bacardi Limited

- The Edrington Group Limited

- Davide Campari-Milano NV

- Pernod Ricard

- Diageo PLC

Key Milestones in European Craft Rum Market Industry

- Feb 2021: British Honey Company acquires Union Distillers, expanding its product line and market reach.

- Sept 2021: Pernod Ricard acquires The Whiskey Exchange, strengthening its position in the craft spirits market.

- Mar 2022: The Apiarist expands its honey-infused spirits collection with a blended aged whiskey.

Strategic Outlook for European Craft Rum Market Market

The European craft rum market presents significant growth potential, driven by increasing consumer demand for premium and artisanal spirits. Strategic opportunities for players involve investing in product innovation, enhancing brand awareness through targeted marketing, and expanding distribution channels to reach new markets. Companies focusing on sustainability and ethical sourcing will gain a competitive edge. Further consolidation through M&A activity is anticipated, shaping the market landscape in the coming years.

European Craft Rum Market Segmentation

-

1. Type

- 1.1. Whiskey

- 1.2. Gin

- 1.3. Vodka

- 1.4. Brandy

- 1.5. Rum

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. On-trade Channels

- 2.2. Off-trade Channels

European Craft Rum Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Russia

- 5. Spain

- 6. Italy

- 7. Rest of Europe

European Craft Rum Market Regional Market Share

Geographic Coverage of European Craft Rum Market

European Craft Rum Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Increasing Number of Microbreweries Elevating the Demand for Craft Spirits

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Craft Rum Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whiskey

- 5.1.2. Gin

- 5.1.3. Vodka

- 5.1.4. Brandy

- 5.1.5. Rum

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade Channels

- 5.2.2. Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Spain

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany European Craft Rum Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Whiskey

- 6.1.2. Gin

- 6.1.3. Vodka

- 6.1.4. Brandy

- 6.1.5. Rum

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade Channels

- 6.2.2. Off-trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom European Craft Rum Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Whiskey

- 7.1.2. Gin

- 7.1.3. Vodka

- 7.1.4. Brandy

- 7.1.5. Rum

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade Channels

- 7.2.2. Off-trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France European Craft Rum Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Whiskey

- 8.1.2. Gin

- 8.1.3. Vodka

- 8.1.4. Brandy

- 8.1.5. Rum

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade Channels

- 8.2.2. Off-trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Russia European Craft Rum Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Whiskey

- 9.1.2. Gin

- 9.1.3. Vodka

- 9.1.4. Brandy

- 9.1.5. Rum

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade Channels

- 9.2.2. Off-trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain European Craft Rum Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Whiskey

- 10.1.2. Gin

- 10.1.3. Vodka

- 10.1.4. Brandy

- 10.1.5. Rum

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade Channels

- 10.2.2. Off-trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Italy European Craft Rum Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Whiskey

- 11.1.2. Gin

- 11.1.3. Vodka

- 11.1.4. Brandy

- 11.1.5. Rum

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade Channels

- 11.2.2. Off-trade Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe European Craft Rum Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Whiskey

- 12.1.2. Gin

- 12.1.3. Vodka

- 12.1.4. Brandy

- 12.1.5. Rum

- 12.1.6. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. On-trade Channels

- 12.2.2. Off-trade Channels

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 The British Honey Company (Union Distillers in Leicestershire)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Suntory Holdings Limited (Beam SuntoRy Inc )

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ian MacLeod Distillers Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Rémy Cointreau

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nature HQ Ltd t/a The Apiarist

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 JW Distillers Ltd*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bacardi Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Edrington Group Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Davide Campari-Milano NV

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pernod Ricard

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Diageo PLC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 The British Honey Company (Union Distillers in Leicestershire)

List of Figures

- Figure 1: European Craft Rum Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Craft Rum Market Share (%) by Company 2025

List of Tables

- Table 1: European Craft Rum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: European Craft Rum Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Craft Rum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: European Craft Rum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Craft Rum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: European Craft Rum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: European Craft Rum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: European Craft Rum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Craft Rum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: European Craft Rum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: European Craft Rum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: European Craft Rum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: European Craft Rum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 21: European Craft Rum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: European Craft Rum Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: European Craft Rum Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: European Craft Rum Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Craft Rum Market?

The projected CAGR is approximately 12.66%.

2. Which companies are prominent players in the European Craft Rum Market?

Key companies in the market include The British Honey Company (Union Distillers in Leicestershire), Suntory Holdings Limited (Beam SuntoRy Inc ), Ian MacLeod Distillers Ltd, Rémy Cointreau, Nature HQ Ltd t/a The Apiarist, JW Distillers Ltd*List Not Exhaustive, Bacardi Limited, The Edrington Group Limited, Davide Campari-Milano NV, Pernod Ricard, Diageo PLC.

3. What are the main segments of the European Craft Rum Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Increasing Number of Microbreweries Elevating the Demand for Craft Spirits.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

Mar 2022: An artisan label based in the United Kingdom, "The Apiarist," announced that it expanded its signature collection of honey-infused spirits by introducing blended aged whiskey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Craft Rum Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Craft Rum Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Craft Rum Market?

To stay informed about further developments, trends, and reports in the European Craft Rum Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence