Key Insights

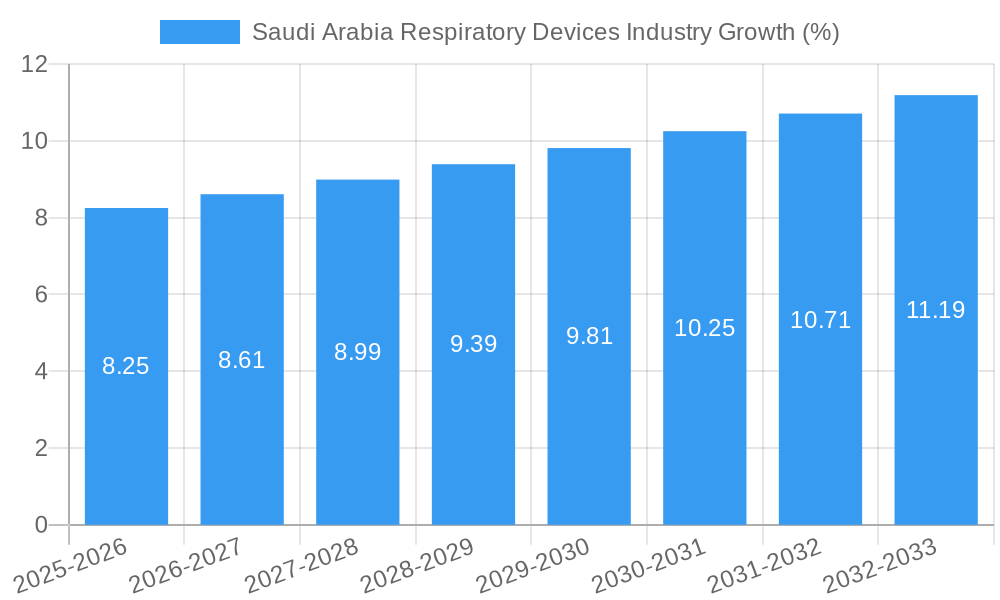

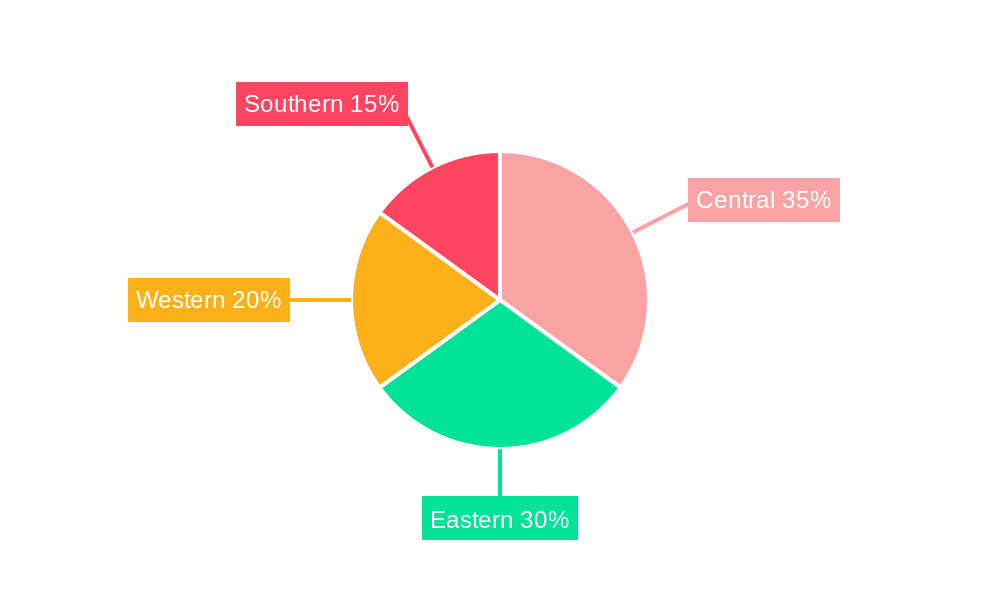

The Saudi Arabian respiratory devices market, valued at approximately $150 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.5% from 2025 to 2033. This expansion is driven by several key factors. Rising prevalence of chronic respiratory diseases like asthma, COPD, and cystic fibrosis, coupled with an aging population, fuels the demand for diagnostic and therapeutic respiratory devices. Increased healthcare expenditure and government initiatives promoting healthcare infrastructure development within the Kingdom further contribute to market growth. Technological advancements in respiratory device technology, including the introduction of smart inhalers and telehealth monitoring systems, are also significantly impacting market dynamics. The market is segmented by device type (diagnostic and monitoring devices, therapeutic devices, and disposables), with therapeutic devices currently dominating the market share due to the high prevalence of chronic respiratory conditions requiring ongoing treatment. The regional distribution across Saudi Arabia shows varying market penetration across Central, Eastern, Western, and Southern regions, with Central and Eastern regions potentially showing higher growth due to higher population density and healthcare infrastructure concentration.

Market restraints include high device costs, particularly for advanced technologies, potential challenges associated with the adoption of new technologies in some segments of the population, and limited awareness among some individuals regarding the benefits of early disease management and preventive measures. However, government initiatives focused on improving healthcare accessibility and disease awareness campaigns are expected to mitigate these challenges to a degree. Key players such as Invacare Corporation, ResMed Inc., GE Healthcare, Philips, Medtronic, Fisher & Paykel Healthcare, Drägerwerk, and GlaxoSmithKline are actively competing in this market, each focusing on product innovation and market expansion strategies to secure a greater market share. The forecast period of 2025-2033 presents significant opportunities for market expansion, particularly given the expected surge in chronic respiratory disease prevalence and ongoing government investments in improving the nation's healthcare system.

This in-depth report provides a comprehensive analysis of the Saudi Arabia respiratory devices industry, offering invaluable insights for stakeholders including manufacturers, distributors, investors, and healthcare professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current state and future trajectory, incorporating crucial data from the historical period (2019-2024). The report's findings are supported by rigorous market research and analysis, providing actionable intelligence to navigate this dynamic sector. The market is estimated at xx Million in 2025 and is projected to witness significant growth over the forecast period.

Saudi Arabia Respiratory Devices Industry Market Concentration & Dynamics

The Saudi Arabian respiratory devices market exhibits a moderately concentrated landscape, with key players like Invacare Corporation, ResMed Inc, GE Healthcare, Koninklijke Philips N V, Medtronic PLC, Fisher & Paykel Healthcare Limited, Dragerwerk AG, and GlaxoSmithKline PLC holding significant market share. However, the market is witnessing increasing participation from smaller, specialized firms, particularly in the diagnostics and monitoring segment.

The market's dynamics are shaped by several factors:

- Innovation Ecosystem: Saudi Arabia is investing heavily in healthcare infrastructure and technological advancements, fostering innovation within the respiratory devices sector.

- Regulatory Frameworks: Stringent regulatory approvals and quality standards ensure patient safety but can also present challenges for market entry.

- Substitute Products: The availability of alternative therapies and treatments can influence market share and growth.

- End-User Trends: Increasing prevalence of chronic respiratory diseases and a rising geriatric population drive demand.

- M&A Activities: Consolidation and strategic partnerships are expected to increase market concentration, with an estimated xx M&A deals projected between 2025 and 2033. Market share data for individual companies is currently being analyzed and will be available in the full report.

Saudi Arabia Respiratory Devices Industry Industry Insights & Trends

The Saudi Arabian respiratory devices market is experiencing robust growth, driven primarily by the rising prevalence of chronic respiratory illnesses like asthma and COPD, coupled with increasing healthcare expenditure and government initiatives promoting better healthcare access. The market size is projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period (2025-2033). Technological advancements such as the introduction of smart inhalers and remote patient monitoring systems are further fueling market expansion. Changing consumer behavior, with a growing preference for home-based respiratory care, is also significantly impacting the market. Further driving growth is the increasing awareness among the population about respiratory health and the availability of advanced diagnostic and therapeutic options. Governmental support for healthcare infrastructure development, including the expansion of hospitals and clinics, is another major contributor to the market's growth trajectory.

Key Markets & Segments Leading Saudi Arabia Respiratory Devices Industry

The Saudi Arabian respiratory devices market is segmented by type into diagnostic and monitoring devices, therapeutic devices, and disposables. Currently, the therapeutic devices segment holds the largest market share, primarily driven by the high prevalence of chronic respiratory diseases.

Drivers for each segment:

- Diagnostic and Monitoring Devices: Increased adoption of advanced diagnostic tools, rising healthcare expenditure, and growing focus on early disease detection.

- Therapeutic Devices: High prevalence of chronic respiratory conditions, increasing demand for effective treatments, and rising healthcare spending.

- Disposables: Consistent demand due to the consumable nature of products, increasing patient base, and growing preference for convenient, single-use devices.

Dominance Analysis: The therapeutic devices segment is expected to maintain its dominant position throughout the forecast period due to its indispensable role in managing chronic respiratory conditions. This segment's strong growth is fueled by increasing demand for sophisticated and effective treatment options. The specific percentage market share held by each segment will be provided in detail within the complete report.

Saudi Arabia Respiratory Devices Industry Product Developments

Significant technological advancements are transforming the respiratory devices landscape in Saudi Arabia. Innovations in smart inhalers, portable ventilators, and connected devices offer enhanced patient monitoring, improved treatment efficacy, and greater convenience. The integration of artificial intelligence and machine learning in respiratory diagnostics and therapeutics is rapidly gaining traction, paving the way for personalized and preventative healthcare. These advancements provide competitive advantages to manufacturers, contributing to market differentiation and customer satisfaction.

Challenges in the Saudi Arabia Respiratory Devices Industry Market

The Saudi Arabian respiratory devices market faces several challenges. Regulatory hurdles and stringent approval processes can delay product launches and increase costs. Supply chain disruptions, particularly exacerbated by global events, can impact product availability and affordability. Intense competition among established players and new entrants necessitates continuous innovation and strategic differentiation to maintain market share. These factors, when combined, can negatively impact market growth and profitability. Further analysis into these challenges, including quantifiable impact assessments, will be present in the full report.

Forces Driving Saudi Arabia Respiratory Devices Industry Growth

Several factors are propelling growth in the Saudi Arabia respiratory devices industry. Technological advancements, such as the development of minimally invasive diagnostic and therapeutic tools, are significantly enhancing patient outcomes and market appeal. Economic growth and increasing healthcare expenditure are making advanced respiratory devices more accessible to a wider population. Favorable government policies and regulatory support encouraging healthcare innovation are also bolstering market growth. The increasing prevalence of respiratory illnesses is a primary driver, pushing demand for advanced therapies and medical devices.

Challenges in the Saudi Arabia Respiratory Devices Industry Market

Long-term growth in the Saudi Arabia respiratory devices market is contingent upon addressing several challenges. Continued investment in research and development is crucial for developing innovative and cost-effective devices. Strategic partnerships and collaborations between manufacturers, healthcare providers, and government bodies are essential to improve access and affordability. Expanding market reach through effective distribution networks and patient education initiatives will play a key role in long-term growth.

Emerging Opportunities in Saudi Arabia Respiratory Devices Industry

Emerging opportunities include expanding into the underserved rural markets, leveraging telemedicine for remote patient monitoring, and focusing on personalized medicine solutions. Developing innovative devices tailored to the specific needs of the Saudi Arabian population will be critical. Exploring new technologies like AI-driven diagnostics and wearable sensors can create significant growth opportunities for companies.

Leading Players in the Saudi Arabia Respiratory Devices Industry Sector

- Invacare Corporation

- ResMed Inc

- GE Healthcare

- Koninklijke Philips N V

- Medtronic PLC

- Fisher & Paykel Healthcare Limited

- Dragerwerk AG

- GlaxoSmithKline PLC

Key Milestones in Saudi Arabia Respiratory Devices Industry Industry

- March 2022: Avon Protection showcased its respiratory and head protection portfolio at the World Defense Show in Riyadh, highlighting the growing demand for specialized respiratory equipment.

- February 2022: Starpharma secured an exclusive distribution agreement for VIRALEZE nasal spray, signifying the market's openness to innovative antiviral solutions.

Strategic Outlook for Saudi Arabia Respiratory Devices Industry Market

The Saudi Arabian respiratory devices market exhibits substantial growth potential, driven by the confluence of increasing prevalence of respiratory diseases, technological advancements, and government initiatives. Strategic partnerships and investments in research and development will be key for manufacturers seeking to capitalize on this growth. Focus on providing affordable and accessible respiratory solutions tailored to the unique needs of the Saudi Arabian population is crucial for long-term success.

Saudi Arabia Respiratory Devices Industry Segmentation

-

1. Type

-

1.1. By Diagnostic and Monitoring Devices

- 1.1.1. Spirometers

- 1.1.2. Sleep Test Devices

- 1.1.3. Peak Flow Meters

- 1.1.4. Pulse Oximeters

- 1.1.5. Capnographs

- 1.1.6. Other Diagnostic and Monitoring Devices

-

1.2. By Therapeutic Devices

- 1.2.1. CPAP Devices

- 1.2.2. BiPAP Devices

- 1.2.3. Humidifiers

- 1.2.4. Nebulizers

- 1.2.5. Oxygen Concentrators

- 1.2.6. Ventilators

- 1.2.7. Inhalers

- 1.2.8. Other Therapeutic Devices

-

1.3. By Disposables

- 1.3.1. Masks

- 1.3.2. Breathing Circuits

- 1.3.3. Other Disposables

-

1.1. By Diagnostic and Monitoring Devices

Saudi Arabia Respiratory Devices Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Respiratory Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Respiratory Disorders; Rising Government Initiatives and Large Patient Population

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Inhalers Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. By Diagnostic and Monitoring Devices

- 5.1.1.1. Spirometers

- 5.1.1.2. Sleep Test Devices

- 5.1.1.3. Peak Flow Meters

- 5.1.1.4. Pulse Oximeters

- 5.1.1.5. Capnographs

- 5.1.1.6. Other Diagnostic and Monitoring Devices

- 5.1.2. By Therapeutic Devices

- 5.1.2.1. CPAP Devices

- 5.1.2.2. BiPAP Devices

- 5.1.2.3. Humidifiers

- 5.1.2.4. Nebulizers

- 5.1.2.5. Oxygen Concentrators

- 5.1.2.6. Ventilators

- 5.1.2.7. Inhalers

- 5.1.2.8. Other Therapeutic Devices

- 5.1.3. By Disposables

- 5.1.3.1. Masks

- 5.1.3.2. Breathing Circuits

- 5.1.3.3. Other Disposables

- 5.1.1. By Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Central Saudi Arabia Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Invacare Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ResMed Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 GE Healthcare

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koninklijke Philips N V

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Medtronic PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fisher & Paykel Healthcare Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dragerwerk AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 GlaxoSmithKline PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Invacare Corporation

List of Figures

- Figure 1: Saudi Arabia Respiratory Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Respiratory Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Respiratory Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Respiratory Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Respiratory Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Saudi Arabia Respiratory Devices Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Saudi Arabia Respiratory Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Respiratory Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Saudi Arabia Respiratory Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Saudi Arabia Respiratory Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Central Saudi Arabia Respiratory Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Central Saudi Arabia Respiratory Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Eastern Saudi Arabia Respiratory Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Saudi Arabia Respiratory Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Western Saudi Arabia Respiratory Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Western Saudi Arabia Respiratory Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Southern Saudi Arabia Respiratory Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Southern Saudi Arabia Respiratory Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia Respiratory Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Saudi Arabia Respiratory Devices Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 19: Saudi Arabia Respiratory Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Saudi Arabia Respiratory Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Respiratory Devices Industry?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Saudi Arabia Respiratory Devices Industry?

Key companies in the market include Invacare Corporation, ResMed Inc, GE Healthcare, Koninklijke Philips N V, Medtronic PLC, Fisher & Paykel Healthcare Limited, Dragerwerk AG, GlaxoSmithKline PLC.

3. What are the main segments of the Saudi Arabia Respiratory Devices Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Respiratory Disorders; Rising Government Initiatives and Large Patient Population.

6. What are the notable trends driving market growth?

Inhalers Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices.

8. Can you provide examples of recent developments in the market?

In March 2022, Avon Protection demonstrated its respiratory and head protection portfolio, including Avon Protection's FM50 respirator, MP-PAPR, and the F90 helmet at the first World Defense Show in Riyadh, Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Respiratory Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Respiratory Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Respiratory Devices Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Respiratory Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence