Key Insights

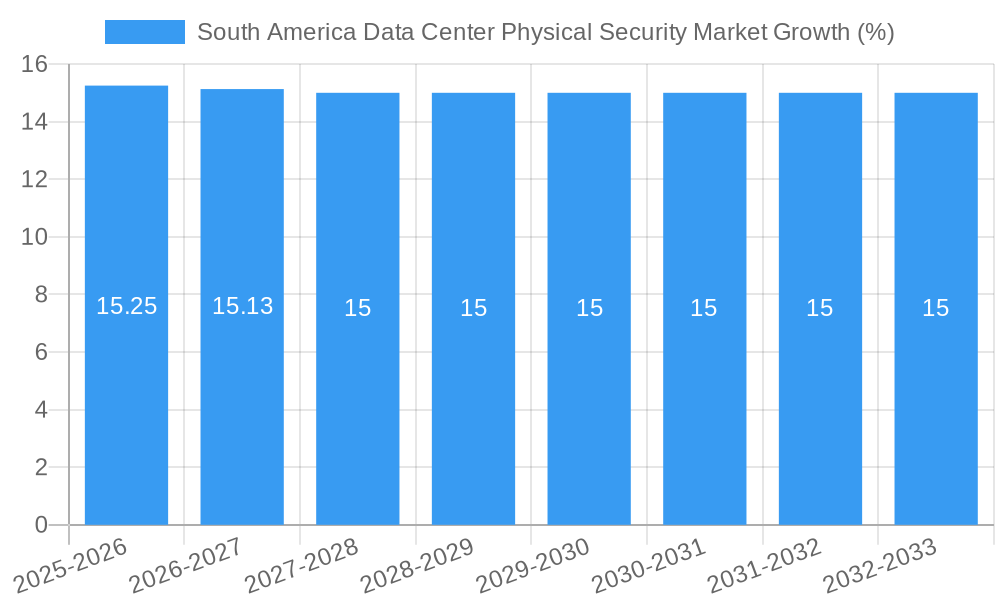

The South American data center physical security market, valued at $99.80 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 15.60% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of cloud computing and the rise of hyperscale data centers across Brazil, Chile, and other South American nations necessitate robust security measures. Furthermore, stringent government regulations regarding data protection and rising cyber threats are compelling data center operators to invest heavily in advanced physical security solutions. The demand for integrated security systems, encompassing video surveillance, access control, and perimeter security (mantraps, fences, and monitoring), is a significant growth driver. Key players like Honeywell, ABB, and Johnson Controls are leveraging this demand by offering comprehensive solutions and services, including consulting, professional services, and system integration. The BFSI (Banking, Financial Services, and Insurance) and IT & Telecommunication sectors are leading adopters, followed by government and healthcare. While the market faces challenges such as high initial investment costs and the need for skilled professionals, the overall growth trajectory remains positive, promising significant opportunities for market participants.

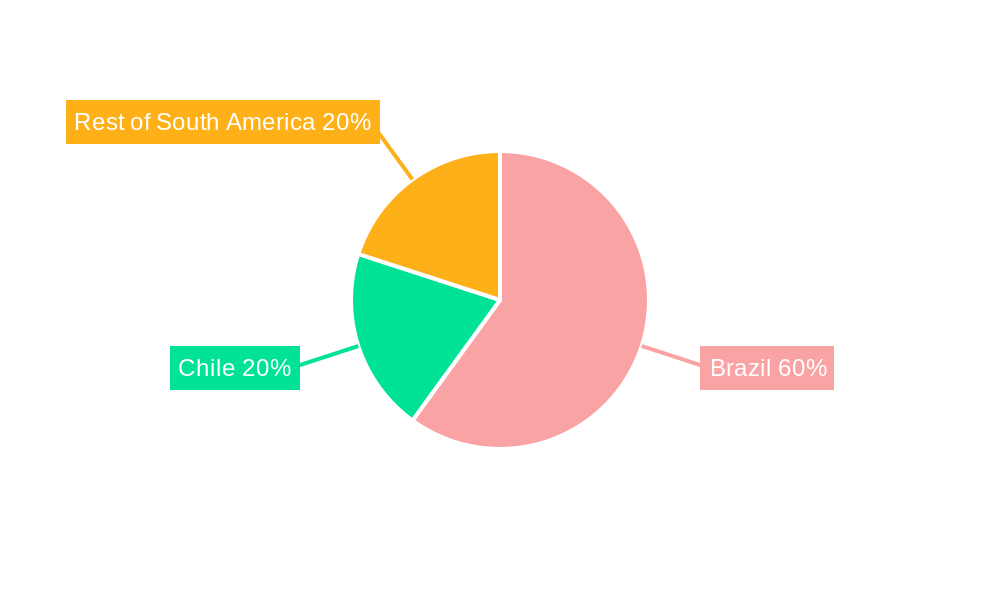

The market segmentation reveals interesting trends. While video surveillance and access control solutions currently dominate, the "Other Solution Types" segment, encompassing perimeter security solutions, is expected to witness accelerated growth due to its critical role in preventing unauthorized physical access. Similarly, within the service segment, the demand for professional services, including installation, maintenance, and support, is growing alongside the rise of complex security systems. Regional analysis suggests that Brazil remains the largest market within South America, fueled by a booming IT sector and increased government spending on infrastructure. However, other countries in the region, like Chile, are experiencing significant growth, driven by their expanding digital economies and increased foreign investment in data centers. The forecast period (2025-2033) promises considerable expansion, creating a compelling landscape for both established players and emerging technology providers.

South America Data Center Physical Security Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Data Center Physical Security Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, trends, key players, and future growth prospects. The report leverages extensive data analysis to forecast a market size of xx Million by 2033, achieving a CAGR of xx% during the forecast period (2025-2033).

South America Data Center Physical Security Market Concentration & Dynamics

The South America data center physical security market is characterized by a moderately concentrated landscape, with key players like Honeywell International Inc, ABB Ltd, and Johnson Controls International holding significant market share. However, the market exhibits a dynamic competitive environment fueled by continuous innovation and strategic mergers and acquisitions (M&A). In the historical period (2019-2024), we observed approximately xx M&A deals, resulting in xx% market share consolidation among the top 5 players. Regulatory frameworks vary across South American countries, influencing the adoption of specific security solutions. The substitute products, primarily traditional security methods, are facing a decline in market share due to increased demand for technologically advanced solutions. End-user trends show a growing preference for integrated security systems offering enhanced monitoring and control capabilities.

South America Data Center Physical Security Market Industry Insights & Trends

The South America Data Center Physical Security Market is experiencing robust growth driven by several key factors. The increasing adoption of cloud computing and the expanding data center infrastructure across Brazil and Chile are primary growth drivers. The market size in 2025 is estimated at xx Million, exhibiting a significant growth trajectory from xx Million in 2019. This growth is fueled by heightened concerns regarding data security and compliance regulations, alongside escalating cyber threats. Technological advancements in video surveillance (AI-powered analytics), access control (biometric systems), and perimeter security (smart fences) are disrupting traditional security approaches. The rising adoption of IoT and advanced analytics enhances situational awareness and predictive security capabilities. Consumer behavior is shifting towards integrated and managed security services, prioritizing proactive security measures and minimizing operational costs.

Key Markets & Segments Leading South America Data Center Physical Security Market

Dominant Regions/Countries: Brazil and Chile represent the largest markets in South America, driven by their robust IT infrastructure and growing data center footprint. Brazil's expanding economy and increasing digitalization are key drivers of demand. Chile's focus on technological advancement and its role as a regional hub for data centers also contribute significantly.

Dominant Segment by Solution Type: Video surveillance is the dominant solution type, fueled by its effectiveness in monitoring activities and providing evidence in case of incidents. Access control solutions are also experiencing strong growth, driven by the need for secure entry points and user authentication.

Dominant Segment by Service Type: Professional services, encompassing installation, maintenance, and integration, are a significant segment, reflecting the technical expertise required for implementing advanced security systems. Consulting services, offering strategic guidance on security planning and risk mitigation, are also growing in demand.

Dominant Segment by End User: The IT & Telecommunication sector is the leading end-user, closely followed by the BFSI and Government sectors. These sectors have stringent security requirements and substantial investments in data center infrastructure.

Drivers for Growth:

- Increasing investments in data center infrastructure across the region.

- Stringent government regulations related to data security and privacy.

- Rising adoption of cloud computing and digitalization across various sectors.

- Growing awareness regarding cyber threats and data breaches.

- Technological advancements in security solutions.

South America Data Center Physical Security Market Product Developments

Recent product innovations focus on integrating AI, machine learning, and IoT technologies into video surveillance, access control, and perimeter security systems. These advancements enhance situational awareness, automate threat detection, and enable proactive security measures. The market is witnessing an increasing integration of biometric authentication, enhancing security and improving user experience. These innovations provide enhanced security, cost efficiency, and simplified management, providing manufacturers with a significant competitive edge.

Challenges in the South America Data Center Physical Security Market Market

The market faces challenges such as high initial investment costs for advanced security systems, potentially hindering adoption by smaller organizations. Supply chain disruptions and the availability of skilled professionals for installation and maintenance remain concerns. Furthermore, intense competition and varying regulatory frameworks across different South American countries present hurdles for market players. These factors collectively impact the market growth, potentially reducing the market size by xx Million by 2033 if not addressed adequately.

Forces Driving South America Data Center Physical Security Market Growth

The market's growth is fueled by technological advancements, the expanding digital economy, and increased government investments in cybersecurity infrastructure. The rising adoption of cloud services and the need for robust data protection are key growth catalysts. Stringent data privacy regulations, like GDPR's influence, further drive the demand for sophisticated security solutions. Economic growth across major South American nations also positively impacts investment in physical security.

Long-Term Growth Catalysts in the South America Data Center Physical Security Market

Long-term growth will be propelled by continuous technological innovations, particularly AI-powered security solutions. Strategic partnerships between technology providers and security integrators will streamline deployments and accelerate adoption. The expansion of data center infrastructure across South America and the growing awareness of cybersecurity threats will drive sustained market expansion. Expansion into new markets within South America, coupled with the incorporation of emerging technologies such as blockchain for enhanced security, will contribute to long-term market growth.

Emerging Opportunities in South America Data Center Physical Security Market

Emerging trends include the increased adoption of cloud-based security management platforms, facilitating remote monitoring and control. The integration of advanced analytics for predictive security and the use of IoT sensors for real-time threat detection represent significant opportunities. A growing focus on integrated security solutions encompassing physical and cybersecurity will create new market avenues. The increasing adoption of biometric access control systems offers substantial growth potential.

Leading Players in the South America Data Center Physical Security Market Sector

- Honeywell International Inc

- ABB Ltd

- Johnson Controls International

- Securitas Technology

- Siemens AG

- Genetec Inc

- Schneider Electric

- Hangzhou Hikvision Digital Technology Co Ltd

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

Key Milestones in South America Data Center Physical Security Market Industry

- October 2023: Zwipe partnered with Schneider Electric's Security Solutions Group, introducing fingerprint-scanning smart cards to various sectors, including data centers. This signifies a shift towards advanced biometric security solutions.

- April 2023: Securitas signed a 5-year agreement with Microsoft for data center security across 31 countries. This highlights the growing demand for comprehensive and integrated security solutions in the data center sector.

Strategic Outlook for South America Data Center Physical Security Market Market

The South America Data Center Physical Security Market presents a promising long-term growth outlook, driven by ongoing technological innovation and increasing awareness of cybersecurity risks. Strategic investments in R&D, coupled with strategic partnerships and expansion into new markets, will be critical for success. Companies focusing on offering integrated, scalable, and cost-effective security solutions will be well-positioned to capitalize on the expanding market opportunities. The long-term growth trajectory is positive, with significant potential for continued expansion and market consolidation.

South America Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Other

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Other Service Types (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End User

South America Data Center Physical Security Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Access Control Systems; Advancements in Video Surveillance Systems Connected to Cloud Systems

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Physical Security Infrastructure

- 3.4. Market Trends

- 3.4.1. The IT & Telecom Segment to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Other Service Types (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End User

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Brazil South America Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Honeywell International Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ABB Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Johnson Controls International

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Securitas Technology

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Siemens AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Genetec Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Schneider Electric

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Hangzhou Hikvision Digital Technology Co Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Bosch Sicherheitssysteme GmbH

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Axis Communications AB

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Honeywell International Inc

List of Figures

- Figure 1: South America Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: South America Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: South America Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: South America Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: South America Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 11: South America Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 12: South America Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 13: South America Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Chile South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Colombia South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Peru South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Venezuela South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Ecuador South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Bolivia South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Paraguay South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Uruguay South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Data Center Physical Security Market?

The projected CAGR is approximately 15.60%.

2. Which companies are prominent players in the South America Data Center Physical Security Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Johnson Controls International, Securitas Technology, Siemens AG, Genetec Inc, Schneider Electric, Hangzhou Hikvision Digital Technology Co Ltd, Bosch Sicherheitssysteme GmbH, Axis Communications AB.

3. What are the main segments of the South America Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Access Control Systems; Advancements in Video Surveillance Systems Connected to Cloud Systems.

6. What are the notable trends driving market growth?

The IT & Telecom Segment to Hold Significant Share.

7. Are there any restraints impacting market growth?

High Costs Associated with Physical Security Infrastructure.

8. Can you provide examples of recent developments in the market?

October 2023: Zwipe partnered with Schneider Electric's Security Solutions Group. The France-based multinational Schneider Electric plans to introduce the Zwipe Access fingerprint-scanning smart card to its clientele. This card will be integrated with Schneider Electric's Continuum and Security Expert platforms, serving a client base from sectors including airports, transportation, healthcare, data centers, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the South America Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence