Key Insights

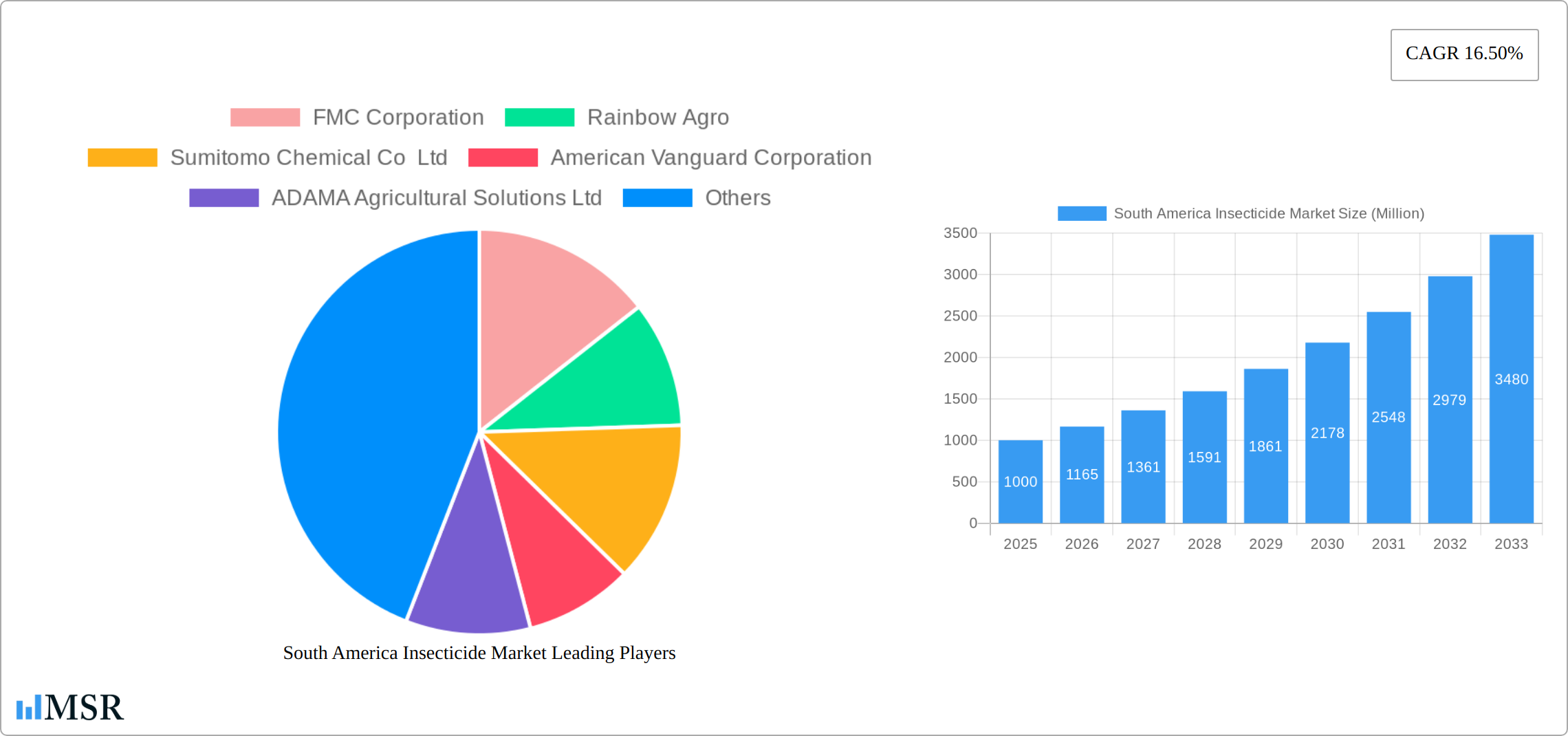

The South American insecticide market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 16.50% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of crop-damaging pests driven by climate change and evolving pest resistance necessitates greater insecticide usage across diverse agricultural sectors. Secondly, rising consumer demand for high-quality produce and increased agricultural output in major economies like Brazil and Argentina are driving the need for effective pest control solutions. Finally, technological advancements in insecticide formulation, such as targeted delivery systems (chemigation, foliar application) and the development of environmentally friendlier biopesticides, are contributing to market growth. However, stringent regulatory frameworks concerning pesticide usage and growing concerns regarding environmental and human health impacts pose significant challenges.

Market segmentation reveals that application modes such as chemigation and foliar application dominate, reflecting modern agricultural practices. Crop-wise, commercial crops, fruits & vegetables, and grains & cereals represent significant market segments due to their scale and vulnerability to pest infestations. Geographically, Brazil remains the largest market within South America, followed by Argentina, with the "Rest of South America" segment showing steady, albeit slower, growth. Key players like FMC Corporation, Bayer AG, Syngenta, and BASF are leveraging their research and development capabilities to maintain market share through innovation and expansion, while smaller regional players cater to specific crop needs and geographic demands. The forecast period (2025-2033) anticipates continued growth, driven by factors outlined above, but also subject to potential shifts in regulatory landscapes and the adoption of sustainable agricultural practices. This dynamic market necessitates continuous monitoring and adaptation for both established and emerging players.

South America Insecticide Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America insecticide market, offering invaluable insights for stakeholders across the agricultural and chemical sectors. From market dynamics and leading players to emerging trends and future growth potential, this report is an essential resource for strategic decision-making. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by application mode (chemigation, foliar, fumigation, seed treatment, soil treatment), crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental), and country (Argentina, Brazil, Chile, Rest of South America). Key players analyzed include FMC Corporation, Rainbow Agro, Sumitomo Chemical Co Ltd, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limited, Syngenta Group, Corteva Agriscience, and BASF SE. The report projects a market size of xx Million by 2025, with a CAGR of xx% during the forecast period.

South America Insecticide Market Market Concentration & Dynamics

The South American insecticide market exhibits a moderately concentrated landscape, with several multinational corporations holding significant market share. The top 10 players account for approximately xx% of the market in 2025. Market concentration is influenced by factors such as economies of scale, R&D capabilities, and extensive distribution networks. Innovation within the insecticide sector is driven by the need for more effective and environmentally friendly solutions to address evolving pest resistance and consumer demand for sustainable agriculture. Regulatory frameworks vary across South American countries, impacting product registration and market access. Substitute products, such as biological control agents and integrated pest management (IPM) techniques, are increasingly gaining traction, particularly due to growing consumer awareness of environmental concerns and regulatory pressure. End-user trends reflect the growing adoption of precision agriculture technologies and the increasing demand for high-yield crops. M&A activity in the sector has been moderate in recent years, with xx major deals recorded between 2019 and 2024.

- Market Share: Top 10 players hold approximately xx% in 2025.

- M&A Activity: xx major deals recorded between 2019 and 2024.

- Key Drivers: Growing demand for high-yield crops, increasing pest resistance, and consumer preference for sustainable agricultural practices.

- Challenges: Stringent regulations, competition from bio-pesticides, and supply chain disruptions.

South America Insecticide Market Industry Insights & Trends

The South America insecticide market is experiencing robust growth, driven by several key factors. Rising agricultural production and intensification, coupled with favorable climatic conditions in specific regions, have spurred increased demand for effective pest control solutions. Technological advancements in insecticide formulations, such as the development of more targeted and environmentally friendly products, are also contributing to market expansion. Consumer behavior is evolving, with a growing preference for sustainable and residue-free agricultural products. This is placing pressure on manufacturers to develop and market more eco-friendly insecticides. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, demonstrating the substantial growth potential. The CAGR during the forecast period (2025-2033) is estimated to be xx%. The market's growth is further influenced by government initiatives to promote agricultural productivity and food security within the region.

Key Markets & Segments Leading South America Insecticide Market

Brazil is the dominant market within South America, accounting for approximately xx% of the total market value in 2025, due to its large agricultural sector and extensive land area dedicated to crop production. Argentina and Chile also contribute significantly. Within the application modes, foliar application remains the largest segment, driven by its ease of use and effectiveness in controlling a wide range of pests. The seed treatment segment is witnessing significant growth due to increasing adoption of modern agricultural practices and the introduction of advanced seed treatment technologies. In terms of crop types, fruits and vegetables, and grains and cereals, are the leading segments, reflecting the substantial acreage devoted to their production.

- Dominant Country: Brazil (xx% of market value in 2025).

- Dominant Application Mode: Foliar application.

- Fastest Growing Segment: Seed treatment.

- Key Drivers for Brazil: Large agricultural sector, extensive arable land, government support for agricultural development.

- Key Drivers for Foliar Application: Ease of use, effectiveness against a wide range of pests.

- Key Drivers for Seed Treatment: Improved crop yields, enhanced disease resistance, and cost-effectiveness.

South America Insecticide Market Product Developments

Recent innovations in the South American insecticide market include the development of biological insecticides and the improvement of existing chemical insecticides. These new products often target specific pests, reducing the need for broad-spectrum chemicals. Advancements in formulation technologies have led to more effective and environmentally friendly products. This continuous innovation improves pest control efficacy while mitigating the environmental impacts of insecticide use. Companies are increasingly focusing on developing products with enhanced safety profiles for both humans and beneficial organisms.

Challenges in the South America Insecticide Market Market

The South America insecticide market faces several challenges, including stringent regulatory requirements for product registration, which can delay market entry and increase costs. Supply chain disruptions caused by geopolitical instability or extreme weather events can affect the availability of raw materials and finished products. Furthermore, intense competition from both domestic and international players puts downward pressure on prices. These challenges can significantly impact profitability and market growth. The estimated impact of these challenges on the market growth rate is xx%.

Forces Driving South America Insecticide Market Growth

The South American insecticide market is propelled by several key factors. Technological advancements like the development of targeted insecticides and environmentally friendly formulations have improved efficacy and reduced environmental impact. Economic growth and increasing agricultural productivity across South American countries lead to higher demand. Furthermore, supportive government policies and initiatives promoting sustainable agricultural practices facilitate market growth. For instance, Brazil's investment in agricultural technology and infrastructure has fueled insecticide demand.

Long-Term Growth Catalysts in South America Insecticide Market

Long-term growth in the South American insecticide market will be driven by ongoing innovation, leading to the development of more effective and sustainable pest management solutions. Strategic partnerships between multinational corporations and local distributors will enhance market penetration and distribution efficiency. Expansion into new markets, particularly in the rapidly developing agricultural regions of South America, will unlock substantial growth potential. Further adoption of precision agriculture techniques, improving application efficiency and targeting pest control efforts, also contributes to long-term growth.

Emerging Opportunities in South America Insecticide Market

Significant opportunities exist for companies offering biopesticides and other sustainable pest management solutions, driven by increasing environmental awareness and regulatory pressure. The growing adoption of precision agriculture techniques and the increasing use of data analytics for optimized pest management open up new opportunities. The development of insecticide formulations tailored to specific pest species and local conditions would significantly improve effectiveness and reduce environmental impact. Market expansion into less developed agricultural regions within South America also presents significant potential.

Leading Players in the South America Insecticide Market Sector

- FMC Corporation

- Rainbow Agro

- Sumitomo Chemical Co Ltd

- American Vanguard Corporation

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- UPL Limited

- Syngenta Group

- Corteva Agriscience

- BASF SE

Key Milestones in South America Insecticide Market Industry

- May 2022: UPL partnered with Bayer for Spirotetramat insecticide to develop new pest management solutions.

- May 2022: Corteva Agriscience in Brazil expanded its portfolio, services, and industrial infrastructure in seed treatment.

- January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

Strategic Outlook for South America Insecticide Market Market

The South America insecticide market holds significant growth potential, driven by evolving pest management needs, technological advancements, and supportive government policies. Companies adopting a strategic approach that incorporates innovation, sustainable practices, and targeted market expansion will be well-positioned to capture a significant share of this expanding market. Focusing on developing and delivering effective yet environmentally friendly solutions will be key to long-term success. Strategic partnerships and collaborations will prove crucial to navigating regulatory hurdles and expanding market reach.

South America Insecticide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

South America Insecticide Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Insecticide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Brazil's dominance in the market is fueled by the increasing demand for insecticides driven by the necessity for effective insect control

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Insecticide Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. Brazil South America Insecticide Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Insecticide Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Insecticide Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 FMC Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Rainbow Agro

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Sumitomo Chemical Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 American Vanguard Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 ADAMA Agricultural Solutions Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Bayer AG

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 UPL Limite

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Syngenta Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Corteva Agriscience

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 BASF SE

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 FMC Corporation

List of Figures

- Figure 1: South America Insecticide Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Insecticide Market Share (%) by Company 2024

List of Tables

- Table 1: South America Insecticide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Insecticide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 3: South America Insecticide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 4: South America Insecticide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 5: South America Insecticide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 6: South America Insecticide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: South America Insecticide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Argentina South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of South America South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South America Insecticide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 12: South America Insecticide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 13: South America Insecticide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 14: South America Insecticide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 15: South America Insecticide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Argentina South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Chile South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Colombia South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Uruguay South America Insecticide Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Insecticide Market?

The projected CAGR is approximately 16.50%.

2. Which companies are prominent players in the South America Insecticide Market?

Key companies in the market include FMC Corporation, Rainbow Agro, Sumitomo Chemical Co Ltd, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limite, Syngenta Group, Corteva Agriscience, BASF SE.

3. What are the main segments of the South America Insecticide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Brazil's dominance in the market is fueled by the increasing demand for insecticides driven by the necessity for effective insect control.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.May 2022: UPL partnered with Bayer for Spirotetramat insecticide to develop new pest management solutions. Through this long-term global data access and supply agreement with Bayer, specifically for addressing farmer demands regarding resistance management and difficult-to-control sucking pests, UPL will develop, register, and distribute new unique solutions, including Spirotetramat, using its experience in insecticides and worldwide research and development network.May 2022: Corteva Agriscience in Brazil expanded its portfolio, services, and industrial infrastructure to commercial partners to strengthen its activities in the seed treatment industry. For instance, the company strengthened its operations in the area of seed treatment with the new global brands LumiGEN and Ampl.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Insecticide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Insecticide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Insecticide Market?

To stay informed about further developments, trends, and reports in the South America Insecticide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence