Key Insights

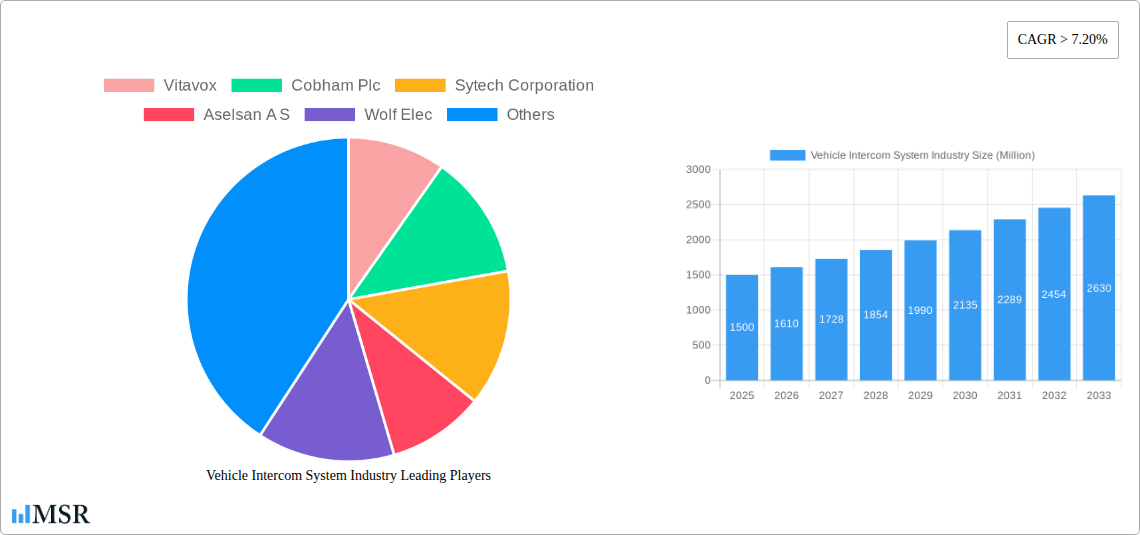

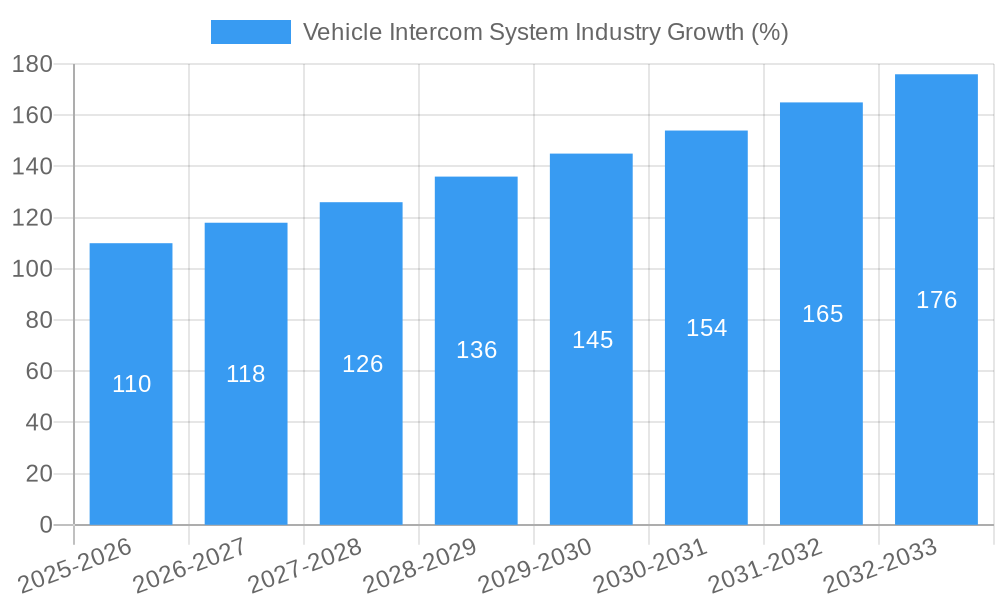

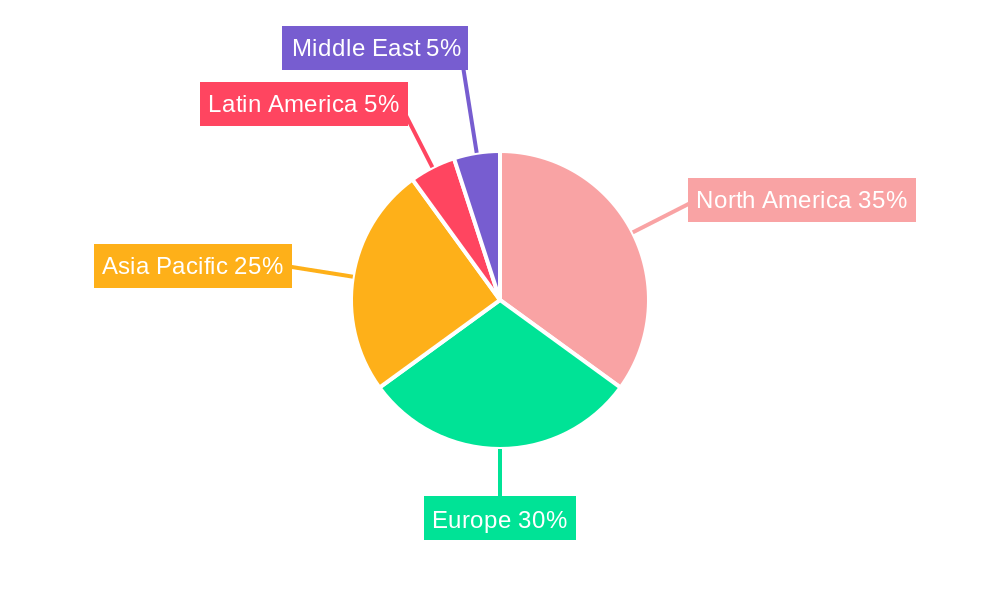

The global Vehicle Intercom System market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 7.20% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for enhanced safety and communication features in military and commercial vehicles is a significant factor. Furthermore, the rising adoption of advanced technologies like digital communication systems and wireless connectivity within vehicles is boosting market growth. The integration of intercom systems into airport ground support vehicles and emergency response units further fuels market expansion. Segmentation reveals strong growth across application areas, with military vehicles leading due to stringent communication needs and safety regulations. Wireless systems are gaining traction over wired systems because of their flexibility and improved user experience. Similarly, digital technology surpasses analog due to higher bandwidth and reliability. Geographic analysis indicates North America and Europe currently hold the largest market share, driven by high vehicle production and adoption of advanced technologies. However, rapid infrastructure development and increasing vehicle ownership in Asia-Pacific are expected to significantly boost the regional market in the forecast period. Competitive forces are evident with established players like Cobham, Thales, and Gentex alongside specialized firms like Aselsan and Sytech. These companies are actively investing in R&D to develop innovative solutions and maintain their market positions amidst increasing competition.

The market's growth trajectory is influenced by several factors. Government regulations promoting safer vehicles are supporting adoption, particularly in the commercial and emergency vehicle sectors. Technological advancements such as improved noise cancellation and integration with other vehicle systems are enhancing the functionality and appeal of intercom systems. However, high initial investment costs associated with advanced systems and the potential for cybersecurity vulnerabilities could pose challenges to market growth. To overcome these hurdles, manufacturers are focusing on cost-effective solutions and robust cybersecurity measures. The market is poised for continued growth, with the integration of intelligent features like voice recognition and improved data analytics promising to further enhance the capabilities of vehicle intercom systems in the coming years. This blend of technological innovation, regulatory support, and increasing awareness of safety needs suggests a sustained upward trend for the foreseeable future.

Vehicle Intercom System Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Vehicle Intercom System industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The global market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Key players like Vitavox, Cobham Plc, Sytech Corporation, and Thales Group are analyzed, alongside market segmentation by application (Military Vehicles, Commercial Vehicles, Airport Ground Support Vehicles, Emergency Vehicles), component type (Wired, Wireless), and technology (Analog, Digital).

Vehicle Intercom System Industry Market Concentration & Dynamics

The Vehicle Intercom System market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The top five companies account for approximately xx% of the global market in 2025. However, the presence of several smaller, specialized players fosters competition and innovation.

- Market Share: The market share distribution is dynamic, with ongoing M&A activity influencing the competitive landscape. The top three players are estimated to collectively hold around xx% of the market share in 2025.

- Innovation Ecosystems: Significant innovation is driven by advancements in digital technologies, wireless communication, and enhanced audio processing capabilities. Collaboration between technology providers and vehicle manufacturers is crucial for integrating advanced intercom systems.

- Regulatory Frameworks: Regulations regarding vehicle safety and communication standards influence the design and adoption of intercom systems. Compliance with these standards is a major factor for market players. Variations in regulations across different regions may affect market penetration.

- Substitute Products: While dedicated intercom systems remain the primary solution, alternative communication technologies (e.g., cellular networks, satellite communication) present some level of substitution, particularly in specific applications.

- End-User Trends: Increasing demand for enhanced safety features and improved communication capabilities in various vehicle types is a major driver of market growth. The demand for networked systems and integration with other vehicle subsystems is increasing rapidly.

- M&A Activities: The industry has witnessed a moderate level of M&A activity in recent years, with companies seeking to expand their product portfolio and market reach. An estimated xx M&A deals occurred between 2019 and 2024.

Vehicle Intercom System Industry Insights & Trends

The global Vehicle Intercom System market is experiencing robust growth, driven by several key factors. The market size is estimated at xx Million in 2025, and is projected to reach xx Million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period. Several factors contribute to this growth trajectory:

- Rising demand for enhanced safety and communication in vehicles: Across various vehicle types, safety concerns are pushing adoption of advanced communication systems.

- Technological advancements: Digital and wireless technologies are providing improved performance and functionalities, leading to increased adoption.

- Growing adoption in specialized vehicle segments: Airport ground support, military vehicles and emergency services are adopting these systems at a rapidly increasing pace.

- Government regulations and mandates: Certain regulations regarding vehicle safety are mandating the installation of intercom systems, boosting market demand.

- Increased integration with other vehicle systems: The increasing trend of networking intercom systems with other vehicle systems improves overall performance and safety.

Key Markets & Segments Leading Vehicle Intercom System Industry

The Military Vehicles segment dominates the Vehicle Intercom System market, driven by the critical need for secure and reliable communication in military operations. The North American and European regions are key markets, reflecting high defense spending and technological advancements.

By Application:

- Military Vehicles: High demand due to the need for secure and reliable communications in battlefield environments. This segment is the largest revenue generator.

- Commercial Vehicles: Growing demand from logistics and transportation sectors due to improved safety and driver assistance features.

- Airport Ground Support Vehicles: Essential for efficient coordination of ground operations. The growth here is fueled by the increasing volume of air traffic and safety concerns.

- Emergency Vehicles: Critical for emergency response teams, facilitating coordination and efficient deployment.

By Component Type: Wireless systems are experiencing faster growth due to enhanced flexibility and ease of installation compared to wired systems.

By Technology: The shift from analog to digital is rapid due to improved performance and features. Digital systems are the primary growth engine.

Regional Dominance: North America and Europe are currently the leading regions, but Asia-Pacific shows promising growth potential. This is driven by increasing infrastructure development, economic growth, and government investments in defense and public safety.

Vehicle Intercom System Industry Product Developments

Recent product developments highlight a focus on improving audio quality, expanding functionalities (noise cancellation, encryption), and integrating with existing vehicle systems. Wireless intercom systems with enhanced range and security features are gaining popularity. Manufacturers are also focusing on smaller, lighter, and more robust designs. This focus on miniaturization and improved durability caters to specific applications and enhances overall system performance.

Challenges in the Vehicle Intercom System Industry Market

The Vehicle Intercom System market faces challenges, including supply chain disruptions impacting component availability and escalating raw material costs. Furthermore, intense competition and the need for continuous innovation exert pressure on profit margins. Regulatory compliance across various regions adds complexity and necessitates significant investment in certifications. The total impact of these factors on market growth in 2025 is estimated to be around xx Million USD.

Forces Driving Vehicle Intercom System Industry Growth

Technological advancements, such as the integration of advanced digital signal processing and wireless communication technologies, are key growth drivers. Increasing government spending on defense and public safety, particularly in emerging economies, fuels market expansion. Furthermore, stringent safety regulations in many countries are mandating the adoption of advanced intercom systems.

Long-Term Growth Catalysts in the Vehicle Intercom System Industry

Long-term growth will be propelled by innovations in wireless communication, such as 5G integration, which will improve reliability and performance. Strategic partnerships between technology providers and vehicle manufacturers will be vital in integrating and standardizing intercom systems. Expansion into new markets, particularly in developing regions with growing infrastructure needs, will also significantly impact industry growth.

Emerging Opportunities in Vehicle Intercom System Industry

The integration of intercom systems with other vehicle subsystems (e.g., GPS, cameras) is an emerging opportunity, offering enhanced situational awareness and safety. The development of specialized intercom systems for niche applications, such as autonomous vehicles and drones, also presents substantial growth opportunities. Lastly, the growing demand for secure and encrypted communications in various sectors, like military and government, is another key opportunity.

Leading Players in the Vehicle Intercom System Industry Sector

- Vitavox

- Cobham Plc

- Sytech Corporation

- Aselsan A S

- Wolf Elec

- Teldat

- Harris Corporation

- MER Grou

- Gentex Corporation

- Thales Group

- Elbit Systems

- Leonardo DRS

- Communications-Applied Technology

- David Clark

Key Milestones in Vehicle Intercom System Industry Industry

- September 2022: The United States Army awarded a contract to Collins Aerospace for AN/PRC-162 ground radios, impacting the demand for related communication technologies, including intercom systems.

- August 2022: The Ukrainian military received Kirpi armored vehicles equipped with intercom systems, showcasing the importance of these systems in military applications.

Strategic Outlook for Vehicle Intercom System Market

The Vehicle Intercom System market is poised for continued growth, driven by technological advancements, increasing demand for enhanced safety features, and expansion into new applications. Strategic partnerships and investments in research and development will be crucial for maintaining a competitive edge and capitalizing on future market opportunities. The focus should be on developing robust, reliable, and secure systems integrated seamlessly with broader vehicle communication and safety architectures.

Vehicle Intercom System Industry Segmentation

-

1. Application

- 1.1. Military Vehicles

- 1.2. Commercial Vehicles

- 1.3. Airport Ground Support Vehicles

- 1.4. Emergency Vehicles

-

2. Component Type

- 2.1. Wired

- 2.2. Wireless

-

3. Technology

- 3.1. Analog

- 3.2. Digital

Vehicle Intercom System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Vehicle Intercom System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Investment and Demand of Vehicle Intercom System Will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military Vehicles

- 5.1.2. Commercial Vehicles

- 5.1.3. Airport Ground Support Vehicles

- 5.1.4. Emergency Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Analog

- 5.3.2. Digital

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.4.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military Vehicles

- 6.1.2. Commercial Vehicles

- 6.1.3. Airport Ground Support Vehicles

- 6.1.4. Emergency Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Wired

- 6.2.2. Wireless

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. Analog

- 6.3.2. Digital

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military Vehicles

- 7.1.2. Commercial Vehicles

- 7.1.3. Airport Ground Support Vehicles

- 7.1.4. Emergency Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Wired

- 7.2.2. Wireless

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. Analog

- 7.3.2. Digital

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military Vehicles

- 8.1.2. Commercial Vehicles

- 8.1.3. Airport Ground Support Vehicles

- 8.1.4. Emergency Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Wired

- 8.2.2. Wireless

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. Analog

- 8.3.2. Digital

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military Vehicles

- 9.1.2. Commercial Vehicles

- 9.1.3. Airport Ground Support Vehicles

- 9.1.4. Emergency Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Wired

- 9.2.2. Wireless

- 9.3. Market Analysis, Insights and Forecast - by Technology

- 9.3.1. Analog

- 9.3.2. Digital

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military Vehicles

- 10.1.2. Commercial Vehicles

- 10.1.3. Airport Ground Support Vehicles

- 10.1.4. Emergency Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Component Type

- 10.2.1. Wired

- 10.2.2. Wireless

- 10.3. Market Analysis, Insights and Forecast - by Technology

- 10.3.1. Analog

- 10.3.2. Digital

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. United Arab Emirates Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Military Vehicles

- 11.1.2. Commercial Vehicles

- 11.1.3. Airport Ground Support Vehicles

- 11.1.4. Emergency Vehicles

- 11.2. Market Analysis, Insights and Forecast - by Component Type

- 11.2.1. Wired

- 11.2.2. Wireless

- 11.3. Market Analysis, Insights and Forecast - by Technology

- 11.3.1. Analog

- 11.3.2. Digital

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. North America Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Russia

- 13.1.5 Spain

- 13.1.6 Rest of Europe

- 14. Asia Pacific Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 India

- 14.1.2 China

- 14.1.3 Japan

- 14.1.4 South Korea

- 14.1.5 Rest of Asia Pacific

- 15. Latin America Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 16. Middle East Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. United Arab Emirates Vehicle Intercom System Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 Saudi Arabia

- 17.1.2 Rest of Middle East

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Vitavox

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Cobham Plc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Sytech Corporation

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Aselsan A S

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Wolf Elec

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Teldat

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Harris Corporation

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 MER Grou

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Gentex Corporation

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Thales Group

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Elbit Systems

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Leonardo DRS

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Communications-Applied Technology

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 David Clark

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.1 Vitavox

List of Figures

- Figure 1: Global Vehicle Intercom System Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: United Arab Emirates Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: United Arab Emirates Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Vehicle Intercom System Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Vehicle Intercom System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Vehicle Intercom System Industry Revenue (Million), by Component Type 2024 & 2032

- Figure 17: North America Vehicle Intercom System Industry Revenue Share (%), by Component Type 2024 & 2032

- Figure 18: North America Vehicle Intercom System Industry Revenue (Million), by Technology 2024 & 2032

- Figure 19: North America Vehicle Intercom System Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 20: North America Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Vehicle Intercom System Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Vehicle Intercom System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Vehicle Intercom System Industry Revenue (Million), by Component Type 2024 & 2032

- Figure 25: Europe Vehicle Intercom System Industry Revenue Share (%), by Component Type 2024 & 2032

- Figure 26: Europe Vehicle Intercom System Industry Revenue (Million), by Technology 2024 & 2032

- Figure 27: Europe Vehicle Intercom System Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 28: Europe Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Vehicle Intercom System Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Vehicle Intercom System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Vehicle Intercom System Industry Revenue (Million), by Component Type 2024 & 2032

- Figure 33: Asia Pacific Vehicle Intercom System Industry Revenue Share (%), by Component Type 2024 & 2032

- Figure 34: Asia Pacific Vehicle Intercom System Industry Revenue (Million), by Technology 2024 & 2032

- Figure 35: Asia Pacific Vehicle Intercom System Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 36: Asia Pacific Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Pacific Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Vehicle Intercom System Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Latin America Vehicle Intercom System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Latin America Vehicle Intercom System Industry Revenue (Million), by Component Type 2024 & 2032

- Figure 41: Latin America Vehicle Intercom System Industry Revenue Share (%), by Component Type 2024 & 2032

- Figure 42: Latin America Vehicle Intercom System Industry Revenue (Million), by Technology 2024 & 2032

- Figure 43: Latin America Vehicle Intercom System Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 44: Latin America Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 45: Latin America Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East Vehicle Intercom System Industry Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East Vehicle Intercom System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East Vehicle Intercom System Industry Revenue (Million), by Component Type 2024 & 2032

- Figure 49: Middle East Vehicle Intercom System Industry Revenue Share (%), by Component Type 2024 & 2032

- Figure 50: Middle East Vehicle Intercom System Industry Revenue (Million), by Technology 2024 & 2032

- Figure 51: Middle East Vehicle Intercom System Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 52: Middle East Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 53: Middle East Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: United Arab Emirates Vehicle Intercom System Industry Revenue (Million), by Application 2024 & 2032

- Figure 55: United Arab Emirates Vehicle Intercom System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 56: United Arab Emirates Vehicle Intercom System Industry Revenue (Million), by Component Type 2024 & 2032

- Figure 57: United Arab Emirates Vehicle Intercom System Industry Revenue Share (%), by Component Type 2024 & 2032

- Figure 58: United Arab Emirates Vehicle Intercom System Industry Revenue (Million), by Technology 2024 & 2032

- Figure 59: United Arab Emirates Vehicle Intercom System Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 60: United Arab Emirates Vehicle Intercom System Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: United Arab Emirates Vehicle Intercom System Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Vehicle Intercom System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Vehicle Intercom System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Vehicle Intercom System Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 4: Global Vehicle Intercom System Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 5: Global Vehicle Intercom System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Russia Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: India Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Saudi Arabia Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Middle East Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Vehicle Intercom System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Vehicle Intercom System Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 32: Global Vehicle Intercom System Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 33: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Vehicle Intercom System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Global Vehicle Intercom System Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 38: Global Vehicle Intercom System Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 39: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Russia Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Vehicle Intercom System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 47: Global Vehicle Intercom System Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 48: Global Vehicle Intercom System Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 49: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: India Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: China Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Japan Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Vehicle Intercom System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 56: Global Vehicle Intercom System Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 57: Global Vehicle Intercom System Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 58: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Brazil Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Argentina Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Vehicle Intercom System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global Vehicle Intercom System Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 63: Global Vehicle Intercom System Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 64: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 65: Global Vehicle Intercom System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 66: Global Vehicle Intercom System Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 67: Global Vehicle Intercom System Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 68: Global Vehicle Intercom System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 69: Saudi Arabia Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Rest of Middle East Vehicle Intercom System Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Intercom System Industry?

The projected CAGR is approximately > 7.20%.

2. Which companies are prominent players in the Vehicle Intercom System Industry?

Key companies in the market include Vitavox, Cobham Plc, Sytech Corporation, Aselsan A S, Wolf Elec, Teldat, Harris Corporation, MER Grou, Gentex Corporation, Thales Group, Elbit Systems, Leonardo DRS, Communications-Applied Technology, David Clark.

3. What are the main segments of the Vehicle Intercom System Industry?

The market segments include Application, Component Type, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Investment and Demand of Vehicle Intercom System Will Drive the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In September 2022, The United States Army awarded a contract to Collins Aerospace to deliver AN/PRC-162 ground radios to support its handheld, manpack, and small form fit (HMS) program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vehicle Intercom System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vehicle Intercom System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vehicle Intercom System Industry?

To stay informed about further developments, trends, and reports in the Vehicle Intercom System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence