Key Insights

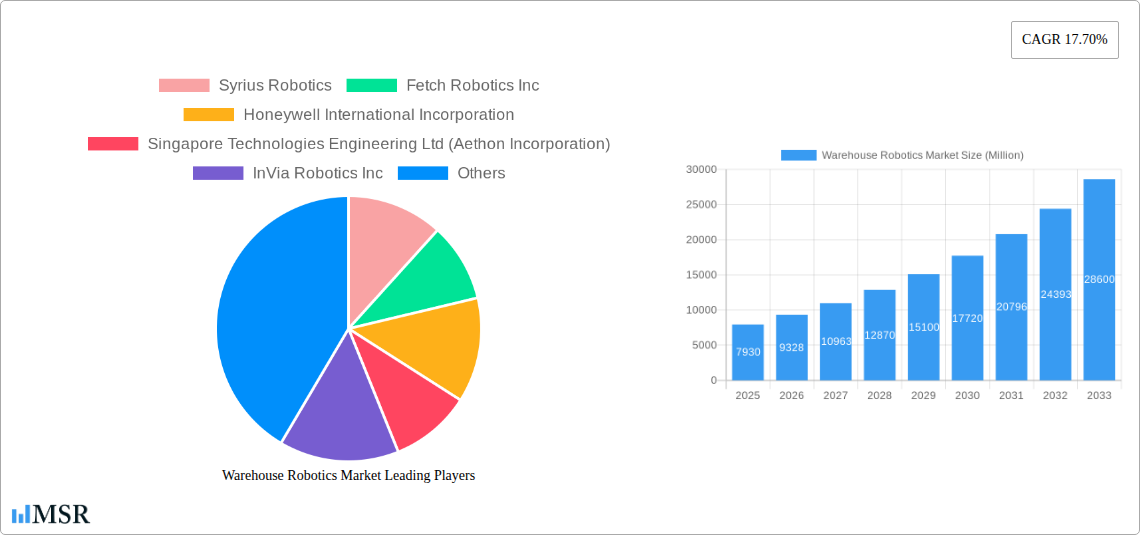

The global warehouse robotics market is experiencing robust growth, projected to reach \$7.93 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 17.70% from 2025 to 2033. This expansion is driven by several key factors. E-commerce continues its explosive growth, demanding faster and more efficient order fulfillment. Simultaneously, labor shortages and rising labor costs incentivize businesses to automate warehouse operations. The increasing adoption of advanced technologies like artificial intelligence (AI), machine learning (ML), and computer vision enhances robotic capabilities, enabling more complex tasks and improved accuracy. Furthermore, the modular and scalable nature of many robotic systems allows businesses of all sizes to integrate automation incrementally, reducing upfront investment risk. The market is segmented by type (industrial robots, sortation systems, conveyors, palletizers, ASRS, mobile robots), function (storage, packaging, trans-shipment), and end-user industry (food & beverage, automotive, retail, electronics, pharmaceuticals). The North American market currently holds a significant share, fueled by high e-commerce penetration and technological advancements. However, Asia-Pacific is projected to witness substantial growth, driven by burgeoning economies and increasing manufacturing activity in countries like China and India.

The competitive landscape is dynamic, with established players like Fanuc, ABB, and Yaskawa alongside innovative startups like Locus Robotics and Geek+. Strategic partnerships and mergers and acquisitions are common, highlighting the market's maturity and ongoing consolidation. While the initial investment in warehouse robotics can be substantial, the long-term return on investment (ROI) is significant, considering reduced operational costs, improved efficiency, and enhanced accuracy. Continued advancements in robotics technology, coupled with decreasing hardware costs, are expected to further drive market expansion in the coming years. Challenges remain, such as the need for robust integration with existing warehouse management systems (WMS) and the ongoing development of more sophisticated and adaptable robotic systems to handle diverse product types and warehouse layouts. However, the overall market outlook remains exceptionally positive, indicating a continued surge in warehouse automation through robotics across various sectors and geographies.

Warehouse Robotics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Warehouse Robotics Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, leading players, technological advancements, and future growth opportunities within the rapidly evolving landscape of warehouse automation. The market is segmented by type (Industrial Robots, Sortation Systems, Conveyors, Palletizers, Automated Storage and Retrieval System (ASRS), Mobile Robots (AGVs and AMRs)), function (Storage, Packaging, Trans-shipment, Other Functions), and end-user industry (Food and Beverage, Automotive, Retail, Electrical and Electronics, Pharmaceutical, Other End-user Industries). The report projects significant growth, reaching xx Million by 2033, with a CAGR of xx% during the forecast period (2025-2033).

Warehouse Robotics Market Market Concentration & Dynamics

The Warehouse Robotics market exhibits a moderately concentrated structure, with several key players holding significant market share. However, the market is also characterized by a dynamic competitive landscape, fueled by continuous innovation and strategic mergers and acquisitions (M&A). The past five years have witnessed xx M&A deals, indicating a strong appetite for consolidation and expansion within the sector. Leading players like Amazon Robotics LLC (Kiva Systems), Fetch Robotics Inc, and ABB Limited are vying for dominance through strategic product development and aggressive market penetration. Regulatory frameworks, particularly concerning data privacy and safety standards for autonomous robots, are evolving and shaping market dynamics. Substitute products, such as traditional manual handling systems, are facing increasing pressure due to the cost-effectiveness and efficiency gains offered by robotic solutions. End-user trends, such as the growth of e-commerce and the increasing demand for faster delivery times, are strongly driving market growth.

- Market Share of Top 5 Players: xx%

- Number of M&A Deals (2019-2024): xx

- Average Deal Size (Million USD): xx

Warehouse Robotics Market Industry Insights & Trends

The global Warehouse Robotics market is experiencing exponential growth, driven by several key factors. The escalating demand for efficient warehouse operations, fueled by the boom in e-commerce and the need for faster order fulfillment, is a primary driver. Technological advancements, including the development of sophisticated AI-powered robots, advanced sensors, and improved software capabilities, are enhancing robotic capabilities and driving adoption. Furthermore, the rising labor costs and the challenges associated with finding and retaining skilled warehouse workers are making automation an increasingly attractive solution. The market size in 2024 was estimated at xx Million, and this is projected to reach xx Million by 2033, representing a significant market opportunity. Consumer behavior changes, particularly the increase in online shopping and the expectation for same-day or next-day delivery, are accelerating this trend. The market is characterized by rapid technological innovation, leading to a constantly evolving product landscape and driving higher adoption rates.

Key Markets & Segments Leading Warehouse Robotics Market

The North American region currently dominates the Warehouse Robotics market, driven by high e-commerce penetration, robust technological infrastructure, and the presence of major players. However, the Asia-Pacific region is experiencing rapid growth, fueled by substantial investments in warehouse automation across countries like China and Japan.

Leading Segments:

- By Type: Mobile Robots (AGVs and AMRs) and ASRS are experiencing the fastest growth, driven by their versatility and ability to handle various warehouse tasks.

- By Function: Storage and packaging are currently the largest segments, reflecting the high demand for automated solutions in these areas.

- By End-user Industry: The e-commerce and retail sectors are driving high demand for warehouse robotics solutions, followed closely by the food and beverage and automotive industries.

Drivers:

- High labor costs

- Increased e-commerce sales

- Demand for faster delivery times

- Technological advancements

- Government initiatives promoting automation

The dominance of these segments and regions is further fueled by factors such as favorable government policies, improving infrastructure, and the growing adoption of automation across various industries.

Warehouse Robotics Market Product Developments

Recent years have witnessed significant innovations in warehouse robotics, with the introduction of more sophisticated robots capable of performing complex tasks, improved software for better coordination and control, and the integration of AI and machine learning for enhanced decision-making. These advancements are improving efficiency, reducing operational costs, and enabling greater flexibility in warehouse operations, leading to a competitive advantage for early adopters. The development of collaborative robots (cobots) that can work safely alongside human workers is also gaining traction, further expanding the applications of warehouse robotics.

Challenges in the Warehouse Robotics Market Market

The Warehouse Robotics market faces several challenges, including high initial investment costs, the need for skilled labor for implementation and maintenance, and potential integration issues with existing warehouse management systems. Supply chain disruptions can also impact the availability of components, hindering timely deployment. Furthermore, concerns about job displacement due to automation and the need for robust safety protocols for autonomous robots are also factors to consider. These challenges could potentially slow down market growth in the short term.

Forces Driving Warehouse Robotics Market Growth

The Warehouse Robotics market's growth is driven primarily by increasing e-commerce activity, demanding faster fulfillment speeds. Furthermore, labor shortages and rising wages encourage automation. Technological advancements, especially in AI and machine learning, continuously improve robot capabilities and efficiency, reducing operational costs and boosting ROI. Finally, supportive government policies and incentives aimed at encouraging automation in various industries further accelerate market expansion.

Long-Term Growth Catalysts in Warehouse Robotics Market

Long-term growth in the Warehouse Robotics market hinges on continued technological innovations, fostering more sophisticated and adaptable robotic systems. Strategic partnerships and collaborations between robotics companies and warehouse operators are vital to optimizing deployment and integration. Expansion into new geographical markets, particularly in developing economies undergoing rapid industrialization, presents immense growth opportunities.

Emerging Opportunities in Warehouse Robotics Market

Emerging opportunities exist in the development of specialized robots for handling diverse product types and warehouse environments. Integration with advanced analytics and data management systems for optimizing operations and predicting maintenance needs will also drive market growth. The expansion into new applications, such as last-mile delivery and automated returns processing, represents significant potential.

Leading Players in the Warehouse Robotics Market Sector

- Syrius Robotics

- Fetch Robotics Inc

- Honeywell International Incorporation

- Singapore Technologies Engineering Ltd (Aethon Incorporation)

- InVia Robotics Inc

- Omron Adept Technologies

- Toshiba Corporation

- Locus Robotics

- Hangzhou Hikrobot Technology Co Ltd

- Amazon Robotics LLC (Kiva Systems)

- Yaskawa Electric Corporation (Yaskawa Motoman)

- Fanuc Corporation

- Geek+ Inc

- TGW Logistics Group GMBH

- ABB Limited

- Grey Orange Pte Ltd

- Kuka AG

Key Milestones in Warehouse Robotics Market Industry

- June 2022: Amazon.com Inc. announced new warehouse robots, Proteus and Cardinal, enhancing fulfillment center efficiency for e-commerce packages.

- August 2022: GEODIS & Locus Robotics agreed to deploy 1,000 LocusBots globally over 24 months, expanding market presence and client base.

- February 2023: DHL Supply Chain deployed Boston Dynamics' Stretch robot for truck carton unloading, following a USD 15 Million investment in Boston Dynamics' robotics solutions.

Strategic Outlook for Warehouse Robotics Market Market

The future of the Warehouse Robotics market looks promising, with continued growth driven by technological advancements and the increasing need for efficient warehouse operations. Strategic partnerships, investments in R&D, and expansion into new markets will be crucial for companies seeking to capitalize on this significant market opportunity. The focus will be on developing more intelligent, adaptable, and cost-effective robotic solutions that can meet the evolving needs of the warehouse industry.

Warehouse Robotics Market Segmentation

-

1. Type

- 1.1. Industrial Robots

- 1.2. Sortation Systems

- 1.3. Conveyors

- 1.4. Palletizers

- 1.5. Automated Storage and Retrieval System (ASRS)

- 1.6. Mobile Robots (AGVs and AMRs)

-

2. Function

- 2.1. Storage

- 2.2. Packaging

- 2.3. Trans-shipment

- 2.4. Other Functions

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Automotive

- 3.3. Retail

- 3.4. Electrical and Electronics

- 3.5. Pharmaceutical

- 3.6. Other End-user Industries

Warehouse Robotics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. South Korea

- 3.3. Japan

- 3.4. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Warehouse Robotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of SKUs; Increasing Investments in Technology and Robotics

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Requirements; Hight Cost

- 3.4. Market Trends

- 3.4.1. Food and beverage industry is Expected to Hold a Substantial Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Robots

- 5.1.2. Sortation Systems

- 5.1.3. Conveyors

- 5.1.4. Palletizers

- 5.1.5. Automated Storage and Retrieval System (ASRS)

- 5.1.6. Mobile Robots (AGVs and AMRs)

- 5.2. Market Analysis, Insights and Forecast - by Function

- 5.2.1. Storage

- 5.2.2. Packaging

- 5.2.3. Trans-shipment

- 5.2.4. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Automotive

- 5.3.3. Retail

- 5.3.4. Electrical and Electronics

- 5.3.5. Pharmaceutical

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Industrial Robots

- 6.1.2. Sortation Systems

- 6.1.3. Conveyors

- 6.1.4. Palletizers

- 6.1.5. Automated Storage and Retrieval System (ASRS)

- 6.1.6. Mobile Robots (AGVs and AMRs)

- 6.2. Market Analysis, Insights and Forecast - by Function

- 6.2.1. Storage

- 6.2.2. Packaging

- 6.2.3. Trans-shipment

- 6.2.4. Other Functions

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Automotive

- 6.3.3. Retail

- 6.3.4. Electrical and Electronics

- 6.3.5. Pharmaceutical

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Industrial Robots

- 7.1.2. Sortation Systems

- 7.1.3. Conveyors

- 7.1.4. Palletizers

- 7.1.5. Automated Storage and Retrieval System (ASRS)

- 7.1.6. Mobile Robots (AGVs and AMRs)

- 7.2. Market Analysis, Insights and Forecast - by Function

- 7.2.1. Storage

- 7.2.2. Packaging

- 7.2.3. Trans-shipment

- 7.2.4. Other Functions

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Automotive

- 7.3.3. Retail

- 7.3.4. Electrical and Electronics

- 7.3.5. Pharmaceutical

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Industrial Robots

- 8.1.2. Sortation Systems

- 8.1.3. Conveyors

- 8.1.4. Palletizers

- 8.1.5. Automated Storage and Retrieval System (ASRS)

- 8.1.6. Mobile Robots (AGVs and AMRs)

- 8.2. Market Analysis, Insights and Forecast - by Function

- 8.2.1. Storage

- 8.2.2. Packaging

- 8.2.3. Trans-shipment

- 8.2.4. Other Functions

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Automotive

- 8.3.3. Retail

- 8.3.4. Electrical and Electronics

- 8.3.5. Pharmaceutical

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Industrial Robots

- 9.1.2. Sortation Systems

- 9.1.3. Conveyors

- 9.1.4. Palletizers

- 9.1.5. Automated Storage and Retrieval System (ASRS)

- 9.1.6. Mobile Robots (AGVs and AMRs)

- 9.2. Market Analysis, Insights and Forecast - by Function

- 9.2.1. Storage

- 9.2.2. Packaging

- 9.2.3. Trans-shipment

- 9.2.4. Other Functions

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverage

- 9.3.2. Automotive

- 9.3.3. Retail

- 9.3.4. Electrical and Electronics

- 9.3.5. Pharmaceutical

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Industrial Robots

- 10.1.2. Sortation Systems

- 10.1.3. Conveyors

- 10.1.4. Palletizers

- 10.1.5. Automated Storage and Retrieval System (ASRS)

- 10.1.6. Mobile Robots (AGVs and AMRs)

- 10.2. Market Analysis, Insights and Forecast - by Function

- 10.2.1. Storage

- 10.2.2. Packaging

- 10.2.3. Trans-shipment

- 10.2.4. Other Functions

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food and Beverage

- 10.3.2. Automotive

- 10.3.3. Retail

- 10.3.4. Electrical and Electronics

- 10.3.5. Pharmaceutical

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Syrius Robotics

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Fetch Robotics Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Honeywell International Incorporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Singapore Technologies Engineering Ltd (Aethon Incorporation)

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 InVia Robotics Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Omron Adept Technologies

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Toshiba Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Locus Robotics

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Hangzhou Hikrobot Technology Co Ltd

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Kiva Systems (Amazon Robotics LLC)

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Yaskawa Electric Corporation (Yaskawa Motoman)

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Fanuc Corporation

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Geek+ Inc

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 TGW Logistics Group GMBH

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 ABB Limited

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.16 Grey Orange Pte Ltd

- 17.2.16.1. Overview

- 17.2.16.2. Products

- 17.2.16.3. SWOT Analysis

- 17.2.16.4. Recent Developments

- 17.2.16.5. Financials (Based on Availability)

- 17.2.17 Kuka AG

- 17.2.17.1. Overview

- 17.2.17.2. Products

- 17.2.17.3. SWOT Analysis

- 17.2.17.4. Recent Developments

- 17.2.17.5. Financials (Based on Availability)

- 17.2.1 Syrius Robotics

List of Figures

- Figure 1: Global Warehouse Robotics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Warehouse Robotics Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Warehouse Robotics Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Warehouse Robotics Market Revenue (Million), by Function 2024 & 2032

- Figure 17: North America Warehouse Robotics Market Revenue Share (%), by Function 2024 & 2032

- Figure 18: North America Warehouse Robotics Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: North America Warehouse Robotics Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: North America Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Warehouse Robotics Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Warehouse Robotics Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Warehouse Robotics Market Revenue (Million), by Function 2024 & 2032

- Figure 25: Europe Warehouse Robotics Market Revenue Share (%), by Function 2024 & 2032

- Figure 26: Europe Warehouse Robotics Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Europe Warehouse Robotics Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Europe Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Warehouse Robotics Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Warehouse Robotics Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Warehouse Robotics Market Revenue (Million), by Function 2024 & 2032

- Figure 33: Asia Warehouse Robotics Market Revenue Share (%), by Function 2024 & 2032

- Figure 34: Asia Warehouse Robotics Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: Asia Warehouse Robotics Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: Asia Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Warehouse Robotics Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Warehouse Robotics Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Warehouse Robotics Market Revenue (Million), by Function 2024 & 2032

- Figure 41: Latin America Warehouse Robotics Market Revenue Share (%), by Function 2024 & 2032

- Figure 42: Latin America Warehouse Robotics Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 43: Latin America Warehouse Robotics Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 44: Latin America Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Latin America Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East and Africa Warehouse Robotics Market Revenue (Million), by Type 2024 & 2032

- Figure 47: Middle East and Africa Warehouse Robotics Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: Middle East and Africa Warehouse Robotics Market Revenue (Million), by Function 2024 & 2032

- Figure 49: Middle East and Africa Warehouse Robotics Market Revenue Share (%), by Function 2024 & 2032

- Figure 50: Middle East and Africa Warehouse Robotics Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 51: Middle East and Africa Warehouse Robotics Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 52: Middle East and Africa Warehouse Robotics Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Middle East and Africa Warehouse Robotics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Warehouse Robotics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Warehouse Robotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Warehouse Robotics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 4: Global Warehouse Robotics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Warehouse Robotics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Warehouse Robotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Warehouse Robotics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 53: Global Warehouse Robotics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 54: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: United States Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Canada Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Warehouse Robotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global Warehouse Robotics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 59: Global Warehouse Robotics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 60: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 61: United Kingdom Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Germany Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: France Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Global Warehouse Robotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 65: Global Warehouse Robotics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 66: Global Warehouse Robotics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 67: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 68: China Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: South Korea Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Japan Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Australia and New Zealand Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Global Warehouse Robotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 73: Global Warehouse Robotics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 74: Global Warehouse Robotics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 75: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Global Warehouse Robotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 77: Global Warehouse Robotics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 78: Global Warehouse Robotics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 79: Global Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Warehouse Robotics Market?

The projected CAGR is approximately 17.70%.

2. Which companies are prominent players in the Warehouse Robotics Market?

Key companies in the market include Syrius Robotics, Fetch Robotics Inc, Honeywell International Incorporation, Singapore Technologies Engineering Ltd (Aethon Incorporation), InVia Robotics Inc, Omron Adept Technologies, Toshiba Corporation, Locus Robotics, Hangzhou Hikrobot Technology Co Ltd, Kiva Systems (Amazon Robotics LLC), Yaskawa Electric Corporation (Yaskawa Motoman), Fanuc Corporation, Geek+ Inc, TGW Logistics Group GMBH, ABB Limited, Grey Orange Pte Ltd, Kuka AG.

3. What are the main segments of the Warehouse Robotics Market?

The market segments include Type, Function, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of SKUs; Increasing Investments in Technology and Robotics.

6. What are the notable trends driving market growth?

Food and beverage industry is Expected to Hold a Substantial Market Share.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Requirements; Hight Cost.

8. Can you provide examples of recent developments in the market?

February 2023: DHL Supply Chain installed the Boston Dynamics' Stretch robot, designed for truck carton unloading. Just one year after DHL Supply Chain announced its USD 15 million investment in robotics solutions from Boston Dynamics, the robot has been successfully deployed. Stretch robots are used in the application to remove packages from trailers' backs and deposit them on a flexible conveyor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Warehouse Robotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Warehouse Robotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Warehouse Robotics Market?

To stay informed about further developments, trends, and reports in the Warehouse Robotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence