Key Insights

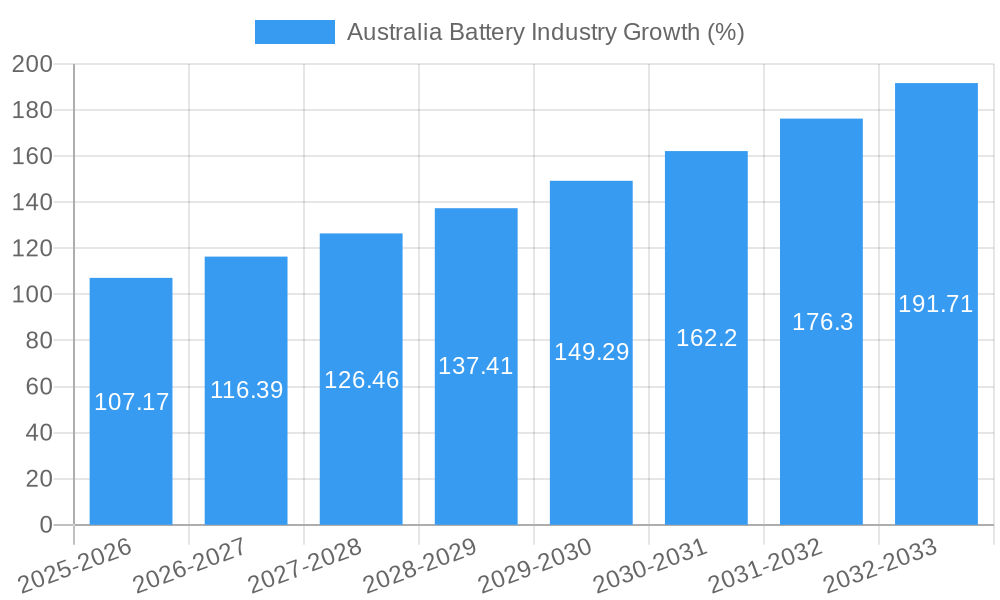

The Australian battery industry, valued at $1.29 billion in 2025, is poised for significant growth, projected to expand at a compound annual growth rate (CAGR) of 8.41% from 2025 to 2033. This robust expansion is fueled by several key drivers. The increasing adoption of renewable energy sources like solar and wind power necessitates efficient energy storage solutions, driving demand for stationary batteries in sectors such as telecom, UPS systems, and large-scale energy storage systems (ESS). Furthermore, the burgeoning electric vehicle (EV) market in Australia is a major catalyst, boosting demand for automotive batteries, including hybrid electric vehicles (HEV), plug-in hybrid electric vehicles (PHEV), and fully electric vehicles (EV). Growth in consumer electronics and industrial applications (motive power) also contributes to market expansion. Lithium-ion batteries are leading the technological advancements, gradually displacing lead-acid batteries in many applications due to their higher energy density and longer lifespan. However, challenges such as the high initial cost of lithium-ion batteries and the need for robust recycling infrastructure to mitigate environmental concerns act as restraints on the market's growth trajectory. The industry is characterized by a mix of both international and domestic players, with companies like Century Yuasa Batteries, EnerSys, and Robert Bosch competing in various segments. The market segmentation, including technology (Li-ion, lead-acid, others) and application (SLI, industrial, portable, automotive), reveals diverse opportunities for specialized players catering to niche segments. The continued government support for renewable energy and electric vehicle adoption is expected to further propel the market's growth in the coming years.

The Australian battery market's future depends heavily on the successful integration of renewable energy sources into the national grid and the widespread adoption of EVs. Government policies supporting sustainable technologies and incentives for consumers to switch to electric vehicles will play a critical role in shaping the industry's trajectory. Innovation in battery technology, particularly in improving the cost-effectiveness and lifespan of lithium-ion batteries, is crucial for maintaining the market's growth momentum. Furthermore, addressing concerns regarding battery recycling and resource management will be essential for ensuring the long-term sustainability of this vital sector. The competitive landscape, characterized by a mix of established international players and emerging domestic companies, promises dynamic market dynamics and innovation in the years to come. Strategic partnerships and investments in research and development will be instrumental in solidifying Australia's position in the global battery industry.

Australia Battery Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian battery industry, covering market dynamics, key segments, leading players, and future growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry stakeholders, investors, and policymakers seeking to navigate this rapidly evolving sector. The report leverages extensive data analysis, incorporating historical data (2019-2024) to provide accurate projections and actionable insights. The Australian battery market, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Australia Battery Industry Market Concentration & Dynamics

The Australian battery market displays a moderately concentrated landscape, with a few dominant players holding significant market share. However, the emergence of new entrants and technological advancements is fostering increased competition. Market concentration is further influenced by mergers and acquisitions (M&A) activities, with xx M&A deals recorded between 2019 and 2024. The regulatory framework, while evolving, plays a crucial role in shaping market dynamics. Government initiatives aimed at promoting renewable energy and electric vehicles are driving demand for batteries, particularly Li-ion batteries. Substitute products, such as fuel cells, pose a potential threat, but their limited market penetration currently limits their impact. End-user trends show a strong preference for high-performance, long-lasting batteries, particularly in the automotive and energy storage sectors.

- Market Share: Leading players such as Century Yuasa Batteries Pty Ltd, Enersys Australia Pty Ltd, and Exide Technologies hold a significant portion of the market share, but exact figures are confidential due to competitive factors.

- M&A Activity: xx M&A deals were recorded in the period 2019-2024, indicating a consolidation trend within the industry.

- Regulatory Landscape: The Australian government's focus on renewable energy and electric vehicles is shaping the demand for batteries and related technologies.

- Innovation Ecosystem: Collaboration between research institutions, startups, and established players is driving innovation in battery technology, with Li-ion batteries leading the way.

Australia Battery Industry Industry Insights & Trends

The Australian battery industry is experiencing significant growth driven by several factors. The increasing adoption of renewable energy sources, coupled with government initiatives supporting the transition to electric vehicles, is a primary driver. Technological advancements, particularly in Li-ion battery technology, are enhancing performance and reducing costs, further fueling market growth. Consumer preference for sustainable and efficient energy solutions is also contributing to market expansion. This shift is reflected in the rising demand for energy storage systems (ESS), particularly for residential and commercial applications. Furthermore, the growth of the telecommunications and UPS sectors is increasing the demand for stationary batteries. The market is also witnessing the emergence of new business models, such as battery-as-a-service, which are reshaping the industry landscape. The total market size, as previously mentioned, is projected to grow significantly in the coming years.

Key Markets & Segments Leading Australia Battery Industry

The Australian battery market is segmented by technology (Li-ion, lead-acid, others) and application (SLI, industrial, portable, automotive, other). Li-ion batteries dominate the market due to their higher energy density and longer lifespan, particularly within the EV and ESS sectors. Lead-acid batteries, however, remain significant in applications requiring lower cost and simpler technology. The industrial battery segment, driven by demand from motive power (forklifts, mining equipment), telecom, and UPS systems, represents a substantial market share. The automotive segment is experiencing rapid growth, fueled by the increasing adoption of hybrid, plug-in hybrid, and electric vehicles.

- Dominant Segments: Li-ion and Lead-acid batteries comprise the majority of the market. Industrial batteries (motive and stationary) and automotive batteries (EV, HEV, PHEV) are the most significant application segments.

- Growth Drivers:

- Increasing adoption of renewable energy sources (solar, wind).

- Government policies promoting electric vehicles and energy storage.

- Technological advancements leading to improved battery performance and cost reduction.

- Expanding infrastructure development (e.g., charging stations for EVs).

Australia Battery Industry Product Developments

Recent years have witnessed significant product innovations, particularly within Li-ion battery technology. Improvements in energy density, lifespan, and safety are enhancing the competitiveness of Australian-made batteries. New applications for batteries are constantly emerging, with a notable focus on grid-scale energy storage solutions to manage intermittent renewable energy generation. This technological advancement enhances the efficiency and reliability of energy storage systems. The focus on sustainable materials and manufacturing processes is increasing the sustainability profile of the sector.

Challenges in the Australia Battery Industry Market

The Australian battery industry faces challenges including securing a stable and reliable supply chain, particularly for critical raw materials. Regulatory hurdles and the high upfront capital costs associated with battery manufacturing are also significant barriers to entry. The industry is subject to intense competition from both domestic and international players, posing challenges to smaller companies. Additionally, fluctuating raw material prices impact profitability. These factors can collectively influence market growth and competitiveness.

Forces Driving Australia Battery Industry Growth

Several factors are driving the growth of the Australian battery industry. Government incentives aimed at promoting renewable energy and electric vehicles are creating a favorable market environment. Technological advancements in battery technology, such as improvements in energy density and lifespan, are increasing the adoption rate across diverse applications. The increasing demand for energy storage solutions for grid stabilization and resilience, coupled with economic growth and infrastructure development, further fuels the market expansion.

Challenges in the Australia Battery Industry Market

Long-term growth hinges on addressing key challenges. Continued investment in research and development is crucial for maintaining a competitive edge in battery technology. Strategic partnerships between manufacturers, technology providers, and energy companies are essential to building a resilient and efficient supply chain. Expansion into new international markets will strengthen the industry's long-term growth prospects.

Emerging Opportunities in Australia Battery Industry

Emerging opportunities include expanding into niche applications for batteries in sectors such as defense and aerospace. The development of innovative battery recycling technologies presents a significant opportunity to enhance sustainability. The growth of the battery-as-a-service model is unlocking new revenue streams and expanding market access. Meeting the growing demand for energy storage in remote communities and supporting grid modernization projects are also key opportunities.

Leading Players in the Australia Battery Industry Sector

- Century Yuasa Batteries Pty Ltd

- Enersys Australia Pty Ltd

- Sonnen Australia Pty Limited

- Soluna Australia Pty Ltd

- East Penn Manufacturing Company

- Robert Bosch (Australia) Pty Ltd

- PMB Defence

- R & J Batteries Pty Ltd

- Energy Renaissance Pty Ltd

- VARTA AG

- Crystal Solar Energy

- Battery Energy Power Solutions Pty

- Exide Technologies

Key Milestones in Australia Battery Industry Industry

- June 2023: Commissioning of the Hazelwood big battery (150 MW), Australia's first large-scale battery project.

- January 2023: Recharge Industries plans to build a 30 GWh lithium-ion battery cell factory in Australia.

Strategic Outlook for Australia Battery Industry Market

The Australian battery industry has tremendous growth potential. Continued government support, technological innovation, and strategic partnerships will be crucial for realizing this potential. The industry's success will depend on establishing a secure and sustainable supply chain, addressing environmental concerns, and fostering collaboration across the value chain. The focus on developing and commercializing advanced battery technologies positions Australia favorably within the global market.

Australia Battery Industry Segmentation

-

1. Technology

- 1.1. Li-Ion Battery

- 1.2. Lead-acid Battery

- 1.3. Other Technologies

-

2. Application

- 2.1. SLI Batteries

- 2.2. Industri

- 2.3. Portable Batteries (Consumer Electronics, etc.)

- 2.4. Automotive Batteries (HEV, PHEV, EV)

- 2.5. Other Applications

Australia Battery Industry Segmentation By Geography

- 1. Australia

Australia Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand from EV Sector4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Development in Battery Production Supply Chain

- 3.4. Market Trends

- 3.4.1. SLI Battery Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Battery Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Li-Ion Battery

- 5.1.2. Lead-acid Battery

- 5.1.3. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. SLI Batteries

- 5.2.2. Industri

- 5.2.3. Portable Batteries (Consumer Electronics, etc.)

- 5.2.4. Automotive Batteries (HEV, PHEV, EV)

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Century Yuasa Batteries Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enersys Australia Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonnen Australia Pty Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Soluna Australia Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 East Penn Manufacturing Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Bosch (Australia) Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PMB Defence

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 R & J Batteries Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Energy Renaissance Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VARTA AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Crystal Solar Energy*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Battery Energy Power Solutions Pty

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Exide Technologies

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Century Yuasa Batteries Pty Ltd

List of Figures

- Figure 1: Australia Battery Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Battery Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Battery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Battery Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Australia Battery Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Australia Battery Industry Volume Kiloton Forecast, by Technology 2019 & 2032

- Table 5: Australia Battery Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Australia Battery Industry Volume Kiloton Forecast, by Application 2019 & 2032

- Table 7: Australia Battery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia Battery Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 9: Australia Battery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australia Battery Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 11: Australia Battery Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 12: Australia Battery Industry Volume Kiloton Forecast, by Technology 2019 & 2032

- Table 13: Australia Battery Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Australia Battery Industry Volume Kiloton Forecast, by Application 2019 & 2032

- Table 15: Australia Battery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Australia Battery Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Battery Industry?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the Australia Battery Industry?

Key companies in the market include Century Yuasa Batteries Pty Ltd, Enersys Australia Pty Ltd, Sonnen Australia Pty Limited, Soluna Australia Pty Ltd, East Penn Manufacturing Company, Robert Bosch (Australia) Pty Ltd, PMB Defence, R & J Batteries Pty Ltd, Energy Renaissance Pty Ltd, VARTA AG, Crystal Solar Energy*List Not Exhaustive, Battery Energy Power Solutions Pty, Exide Technologies.

3. What are the main segments of the Australia Battery Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.29 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand from EV Sector4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

SLI Battery Application to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Lack of Development in Battery Production Supply Chain.

8. Can you provide examples of recent developments in the market?

June 2023: Engie, Eku Energy, and Fluence commissioned the Hazelwood big battery, Australia's first large-scale battery project, at the former coal site of a power station in the state of Victoria. The 150 MW battery claims several Australian firsts in its design and operation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Battery Industry?

To stay informed about further developments, trends, and reports in the Australia Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence