Key Insights

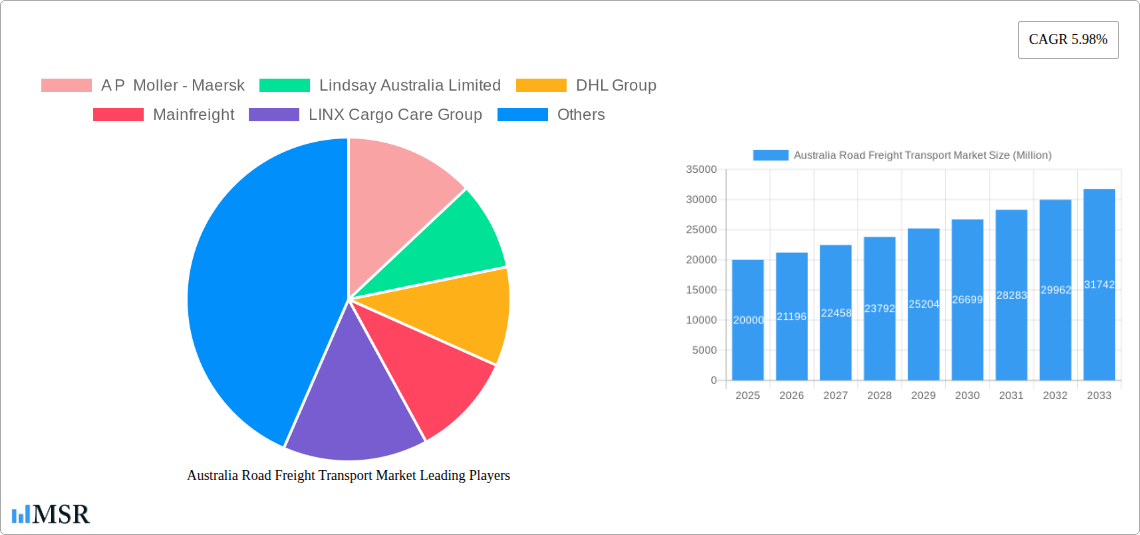

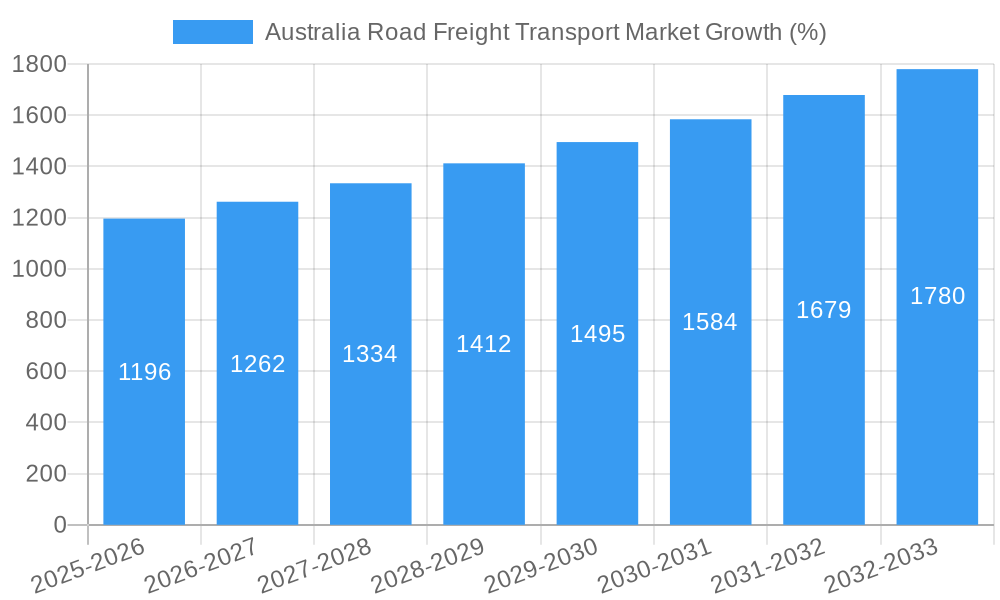

The Australian road freight transport market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector necessitates efficient and reliable last-mile delivery solutions, significantly boosting demand for road freight services. Simultaneously, Australia's robust mining and agricultural sectors consistently require substantial transportation of goods, contributing to market growth. Further propelling this market is the increasing adoption of temperature-controlled transport, driven by the need to preserve perishable goods, particularly in the agricultural and food processing industries. While challenges such as driver shortages and fluctuating fuel prices pose constraints, the overall market outlook remains positive, largely influenced by ongoing infrastructure development and government initiatives aimed at streamlining logistics operations. The market is segmented by temperature control (temperature-controlled and non-temperature controlled), end-user industry (agriculture, construction, manufacturing, etc.), destination (domestic), truckload specification (FTL, LTL), containerization (containerized, non-containerized), distance (long haul, short haul), and goods configuration (fluid and solid goods). The competitive landscape comprises both major international players and established domestic companies, reflecting a dynamic mix of scale and localized expertise.

The forecast period (2025-2033) anticipates a considerable expansion in the market size, driven primarily by consistent growth across all segments. The temperature-controlled segment is expected to witness faster growth compared to its non-temperature controlled counterpart, reflecting increasing demand for specialized logistics solutions. Within the end-user industries, the mining and agriculture sectors are projected to remain significant contributors to market volume. The adoption of advanced technologies such as route optimization software and telematics is expected to enhance operational efficiency and contribute to cost reduction for logistics providers, further supporting market expansion. However, sustained efforts are needed to address persistent challenges, such as driver shortages and infrastructure limitations, to ensure the sustained and responsible growth of the Australian road freight transport market.

Australia Road Freight Transport Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australian road freight transport market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market size, segmentation, key players, and future trends. The report uses Million (M) for all monetary values.

Australia Road Freight Transport Market Market Concentration & Dynamics

The Australian road freight transport market exhibits a moderately concentrated structure, with a few large players holding significant market share. However, a considerable number of smaller operators also contribute to the overall market volume. Market share data for 2024 indicates that the top five players – A P Moller - Maersk, Lindsay Australia Limited, DHL Group, Mainfreight, and Linfox Pty Ltd – collectively hold approximately xx% of the market. The level of concentration is influenced by factors such as economies of scale, technological advancements, and regulatory compliance.

Innovation Ecosystems: The market shows a growing emphasis on technological innovation, with companies investing in telematics, route optimization software, and autonomous vehicle technology. This is driven by the need for improved efficiency and reduced operational costs.

Regulatory Frameworks: Government regulations concerning driver hours, vehicle safety, and environmental standards significantly impact market dynamics. Changes in regulations can influence operational costs and the adoption of new technologies.

Substitute Products: While road freight remains the dominant mode of transport for many goods, competition exists from rail and sea freight, particularly for long-haul transport of bulk commodities. The choice of transport mode is influenced by factors such as cost, transit time, and the nature of the goods being transported.

End-User Trends: The increasing demand for faster and more reliable delivery services, coupled with the growth of e-commerce, drives market expansion. Changes in consumer preferences also affect the demand for specialized services, such as temperature-controlled transport.

M&A Activities: The Australian road freight transport market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years. Deal counts were estimated at xx in 2023. These activities often involve larger companies acquiring smaller firms to expand their market reach and service offerings.

Australia Road Freight Transport Market Industry Insights & Trends

The Australian road freight transport market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth was fueled by robust economic activity, infrastructure development, and the expansion of e-commerce. The market size in 2024 was estimated at A$ xx Million. The forecast period (2025-2033) is projected to witness continued growth, driven by factors such as increasing consumer spending, infrastructure investments, and the adoption of new technologies. However, challenges such as driver shortages and fluctuating fuel prices pose potential risks to future growth. Technological disruptions, including the increasing adoption of electric vehicles and autonomous driving technologies, are reshaping the industry landscape. Evolving consumer behaviors, particularly the rise of e-commerce and the demand for faster delivery options, also play a critical role. The market is anticipated to reach A$ xx Million by 2033.

Key Markets & Segments Leading Australia Road Freight Transport Market

Dominant Segments:

- Temperature Controlled: This segment is experiencing robust growth, driven by the increasing demand for fresh produce and pharmaceuticals.

- Full-Truck-Load (FTL): FTL remains the dominant truckload specification, particularly for long-haul transport.

- Domestic Destination: The domestic market constitutes the largest share of the overall market.

- Solid Goods: This constitutes the larger share of goods transported due to the prevalence of manufacturing and retail goods.

Growth Drivers:

- Economic Growth: A strong economy fuels demand for goods and services, driving the need for efficient freight transportation.

- Infrastructure Development: Investments in road infrastructure improve transport efficiency and reduce transit times.

- E-commerce Expansion: The growth of online retail increases demand for reliable and efficient last-mile delivery services.

- Mining and Quarrying: The robust mining sector generates significant demand for bulk freight transportation.

- Manufacturing: The manufacturing sector relies on efficient freight transport for raw materials and finished goods.

Detailed Dominance Analysis: The domestic, FTL, and solid goods segments are the most dominant due to the nature of Australia’s economy and its reliance on internal trade and manufacturing. The temperature-controlled segment is showing strong growth potential due to an increase in food exports.

Australia Road Freight Transport Market Product Developments

Recent innovations in the Australian road freight transport market focus on improving efficiency, reducing environmental impact, and enhancing safety. These include the adoption of telematics systems for real-time tracking and fleet management, the introduction of electric and alternative fuel vehicles, and the development of advanced driver-assistance systems. Companies are also investing in route optimization software and warehouse automation technologies to enhance operational efficiency and reduce costs. These advancements provide competitive advantages by improving service quality and reducing environmental footprints.

Challenges in the Australia Road Freight Transport Market Market

The Australian road freight transport market faces significant challenges, including a persistent driver shortage, escalating fuel costs, and increasing regulatory scrutiny. The driver shortage is impacting operational capacity and increasing labor costs, with estimates suggesting a xx% shortfall in available drivers. Fluctuating fuel prices significantly impact operational costs and profitability. Stricter environmental regulations are increasing compliance costs, pushing companies to invest in more fuel-efficient vehicles and alternative technologies.

Forces Driving Australia Road Freight Transport Market Growth

Several factors are driving the growth of the Australian road freight transport market. These include strong economic growth, expansion of e-commerce, and continued investment in infrastructure. Technological advancements, such as the adoption of telematics and autonomous vehicle technology, are enhancing efficiency and productivity. Government initiatives aimed at improving road safety and reducing emissions are also contributing to market growth.

Long-Term Growth Catalysts in Australia Road Freight Transport Market

Long-term growth in the Australian road freight transport market will be driven by technological innovations, strategic partnerships, and market expansion into new segments. The increased adoption of electric vehicles, autonomous driving technology, and digital logistics platforms will improve efficiency and reduce costs. Strategic alliances between freight companies and technology providers will enable the development of innovative solutions. Expanding into new markets and service offerings will create new opportunities for growth.

Emerging Opportunities in Australia Road Freight Transport Market

Emerging opportunities include the growing demand for specialized transportation services, such as temperature-controlled freight and hazardous materials handling. The increasing adoption of sustainable practices, such as using electric vehicles and alternative fuels, offers significant opportunities. Expansion into rural and remote areas presents further growth potential. Finally, the utilization of data analytics and artificial intelligence to optimize operations is another area with significant opportunities.

Leading Players in the Australia Road Freight Transport Market Sector

- A P Moller - Maersk

- Lindsay Australia Limited

- DHL Group

- Mainfreight

- LINX Cargo Care Group

- Scott's Refrigerated Logistics

- Linfox Pty Ltd

- Kings Transport and Logistics

- K&S Corporation Limited

- Toll Group

Key Milestones in Australia Road Freight Transport Market Industry

- September 2023: DHL Supply Chain introduces Volvo FL Electric trucks with enhanced battery range, accelerating the adoption of electric vehicles in the Australian market.

- October 2023: DHL Supply Chain secures a major contract with Alcon, expanding its market share and solidifying its position as a leading logistics provider.

- February 2024: DHL Supply Chain continues its decarbonization efforts by adding electric yard tractors and light-duty trucks to its fleet, promoting sustainable transportation practices.

Strategic Outlook for Australia Road Freight Transport Market Market

The Australian road freight transport market is poised for sustained growth, driven by ongoing economic expansion, technological advancements, and evolving consumer demands. Strategic opportunities exist for companies that can effectively leverage technology to improve efficiency, reduce costs, and offer innovative solutions. Focus on sustainability, driver recruitment and retention, and strategic partnerships will be crucial for success in this competitive market. The long-term outlook remains positive, with significant potential for growth and innovation.

Australia Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Australia Road Freight Transport Market Segmentation By Geography

- 1. Australia

Australia Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lindsay Australia Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mainfreight

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LINX Cargo Care Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Scott's Refrigerated Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Linfox Pty Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kings Transport and Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 K&S Corporation Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toll Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Australia Road Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Road Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Australia Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Australia Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Australia Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Australia Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Australia Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Australia Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Australia Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Australia Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Australia Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Australia Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 13: Australia Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 14: Australia Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 15: Australia Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 16: Australia Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 17: Australia Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 18: Australia Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Road Freight Transport Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Australia Road Freight Transport Market?

Key companies in the market include A P Moller - Maersk, Lindsay Australia Limited, DHL Group, Mainfreight, LINX Cargo Care Group, Scott's Refrigerated Logistics, Linfox Pty Ltd, Kings Transport and Logistics, K&S Corporation Limited, Toll Grou.

3. What are the main segments of the Australia Road Freight Transport Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

February 2024: DHL Supply Chain (DHL) is continuing the decarbonization of its Australian transport fleet by introducing additional new electric vehicles. The company has added two Terberg YT200EV electric yard tractors to its truck fleet and is supporting Australian electric vehicle manufacturing with the introduction of its first SEA Electric light duty truck to its last-mile fleet.October 2023: DHL Supply Chain has signed a contract to become the Australian logistics provider of global eye care company, Alcon. DHL will handle Alcon’s storage, inbound, outbound and inventory functions.September 2023: DHL Supply Chain (DHL) has energised its transition to electric vehicles with the first Australian delivery of Volvo FL Electric with second-generation battery packs. The updated battery packs provide an increase in range over the previous range of FL Electric.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Australia Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence