Key Insights

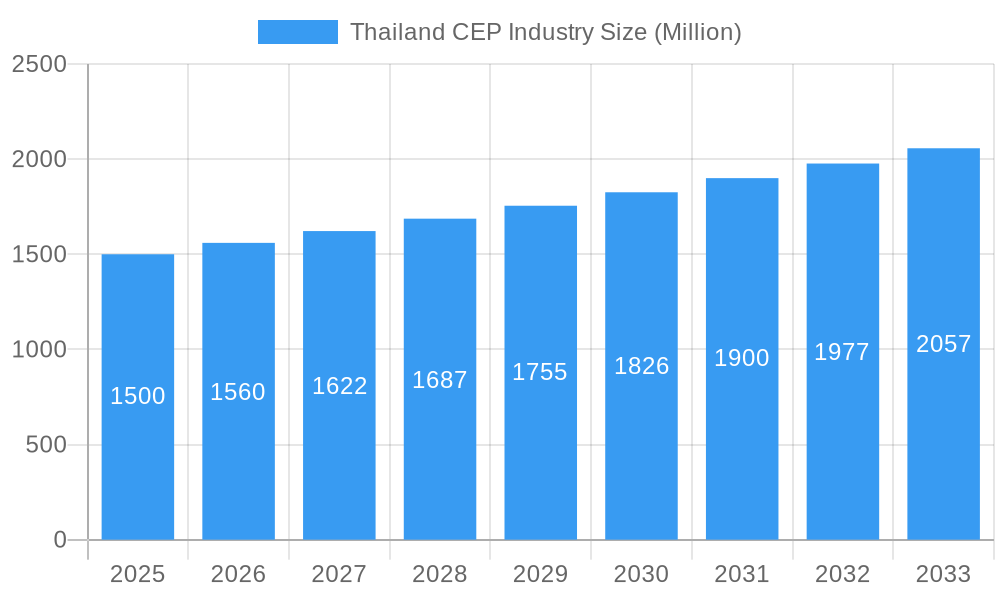

The Thailand Courier, Express, and Parcel (CEP) market is poised for significant expansion, driven by robust e-commerce growth and escalating demand for rapid delivery. Projecting a Compound Annual Growth Rate (CAGR) of 7.16%, the market, valued at $2.82 billion in the base year 2025, is set to reach substantial figures by 2033. Key growth catalysts include the continued proliferation of e-commerce, increased digital transactions across financial services and healthcare, and the imperative for faster, dependable deliveries across sectors like manufacturing, wholesale, and retail. Business-to-consumer (B2C) shipments are expected to dominate, with substantial increases in both domestic and international parcel volumes. Segment analysis highlights strong performance across air and road transportation, underscoring the need for diversified logistics solutions tailored to varied shipment requirements and delivery timelines. The competitive arena features established global entities such as UPS, DHL, and FedEx, alongside prominent domestic players like Nim Express and Flash Express, indicating a dynamic market ripe with opportunities.

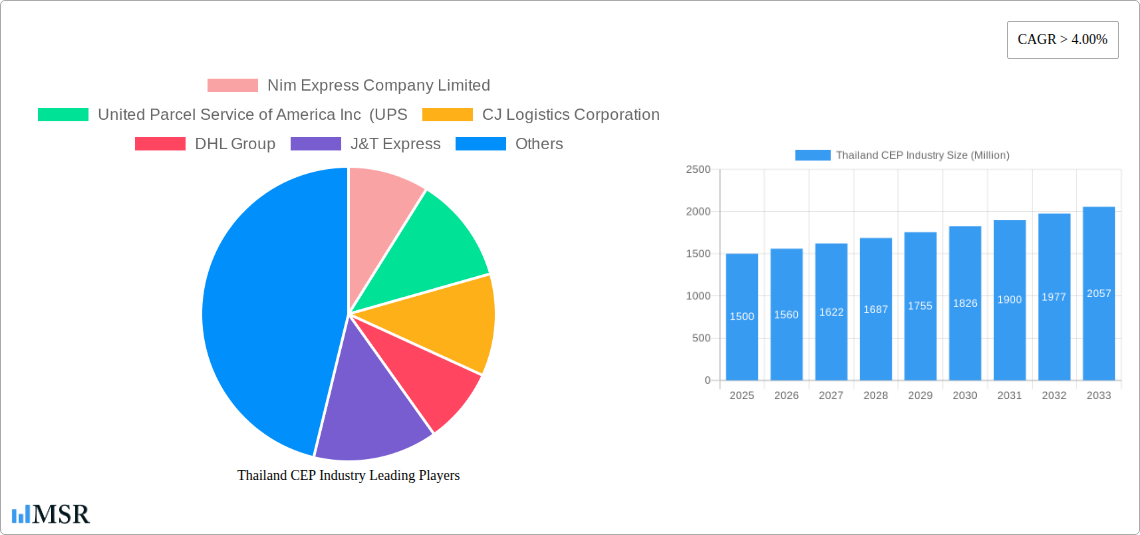

Thailand CEP Industry Market Size (In Billion)

Future market trajectory will be shaped by several influential factors. The expanding middle class and widespread smartphone adoption are fueling higher online shopping rates, directly translating to increased CEP demand. Government investments in infrastructure and logistics, coupled with technological advancements in tracking and automation, will further optimize CEP service efficiency and reach. Nonetheless, challenges such as volatile fuel prices, potential labor constraints, and maintaining service quality amidst escalating demand persist. Success will hinge on strategic technology investment, network optimization, and superior customer service capabilities. The ongoing expansion of express delivery services and the preference for same-day/next-day deliveries present a promising outlook for the Thai CEP industry, attracting continued investment and market consolidation.

Thailand CEP Industry Company Market Share

Thailand CEP Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Thailand Courier, Express, and Parcel (CEP) industry, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, growth drivers, key players, and emerging opportunities within this rapidly evolving sector. The report leverages extensive data analysis and industry expertise to provide actionable intelligence, forecasting market trends and offering strategic recommendations for navigating the competitive landscape. The total market size in 2025 is estimated at xx Million, with a CAGR of xx% projected from 2025 to 2033.

Thailand CEP Industry Market Concentration & Dynamics

The Thailand CEP industry exhibits a moderately concentrated market structure, with several key players commanding significant market share. While dominance is shared among several large international and domestic players, the market also accommodates numerous smaller players catering to niche segments. The competitive landscape is characterized by intense rivalry, fueled by technological advancements, price competition, and the ever-increasing demand for efficient and reliable delivery services. Innovation is a key driver, with companies investing heavily in technology to enhance delivery speed, tracking capabilities, and overall operational efficiency. The regulatory framework, while generally supportive of industry growth, undergoes periodic adjustments, impacting operational costs and compliance requirements. Substitute products, such as postal services and informal delivery networks, exist but have limited impact on the core CEP market. End-user trends indicate a strong preference for express delivery options, particularly within the booming e-commerce sector. M&A activity is relatively frequent, with larger players seeking to expand their market reach and service portfolios through acquisitions of smaller companies.

- Market Share (2025 Estimated):

- Thailand Post: xx%

- DHL Group: xx%

- FedEx: xx%

- J&T Express: xx%

- UPS: xx%

- Others: xx%

- M&A Deal Count (2019-2024): xx deals

Thailand CEP Industry Industry Insights & Trends

The Thailand CEP industry is experiencing robust growth, driven primarily by the exponential rise of e-commerce, expanding logistics infrastructure, and increasing consumer demand for faster and more reliable delivery services. Technological disruptions, such as the adoption of automation and AI-powered solutions, are significantly impacting operational efficiency and cost optimization. Evolving consumer behaviors, including the growing preference for same-day and next-day deliveries, are compelling CEP providers to enhance their service offerings and infrastructure. The market size in 2024 is estimated at xx Million, exhibiting a significant growth trajectory compared to the xx Million recorded in 2019.

Key Markets & Segments Leading Thailand CEP Industry

The Thailand CEP market is dominated by the domestic segment, reflecting the robust growth of e-commerce and the increasing reliance on express delivery services within the country. The B2C model also holds significant dominance, mirroring the widespread adoption of online shopping. The e-commerce end-user industry is the largest contributor, fueled by the rapid expansion of online retail in Thailand. Road transport is the most widely used mode of transport, given its cost-effectiveness and reach across the country. Express delivery options maintain significant popularity due to consumers' desire for rapid delivery times.

- Key Growth Drivers:

- Economic Growth: A steadily growing economy fuels increased consumer spending and e-commerce activity.

- E-commerce Boom: The rapid growth of online retail is driving demand for CEP services.

- Infrastructure Development: Investments in roads, logistics hubs, and technology infrastructure are enhancing delivery efficiency.

- Government Support: Government initiatives aimed at promoting logistics and e-commerce are creating a favorable business environment.

Thailand CEP Industry Product Developments

Recent product innovations include advancements in tracking technologies, improved last-mile delivery solutions, and the integration of AI-powered route optimization systems. Companies are increasingly focusing on developing specialized services catering to the needs of specific industries, such as healthcare and pharmaceuticals, requiring temperature-controlled transportation and secure handling. These innovations enhance operational efficiency, improve customer satisfaction, and solidify competitive advantages.

Challenges in the Thailand CEP Industry Market

The industry faces challenges including high operational costs, infrastructure limitations in certain regions, competition from established players and new entrants, and the need to navigate complex regulatory requirements. These factors can impact profitability and constrain growth, particularly for smaller operators. Supply chain disruptions and fluctuations in fuel prices add to operational complexities.

Forces Driving Thailand CEP Industry Growth

Technological advancements, particularly in automation and data analytics, are streamlining operations and enhancing efficiency. Government support for logistics infrastructure development and e-commerce promotion is creating a conducive business environment. Rising disposable incomes and increasing adoption of e-commerce continue to drive market expansion.

Challenges in the Thailand CEP Industry Market

Long-term growth hinges on sustained infrastructure investment, technological innovation, and the ability to adapt to changing consumer preferences. Strategic partnerships and expansions into new markets will play a key role in expanding market reach and driving long-term growth.

Emerging Opportunities in Thailand CEP Industry

Emerging opportunities lie in specialized logistics solutions for niche markets, the adoption of sustainable delivery practices, and the integration of advanced technologies such as drones and autonomous vehicles. The increasing demand for same-day and next-day delivery services also presents opportunities for companies to differentiate their offerings.

Leading Players in the Thailand CEP Industry Sector

- Nim Express Company Limited

- United Parcel Service of America Inc (UPS)

- CJ Logistics Corporation

- DHL Group

- J&T Express

- Thailand Post

- FedEx

- SF Express (KEX-SF)

- Best Inc

- Aqua Corporation (including Thai Parcel Public Company Limited)

- Flash Express

- JWD Group

Key Milestones in Thailand CEP Industry Industry

- November 2023: J&T Home partners with SABUY SPEED, expanding delivery network to over 22,000 branches. This significantly enhances last-mile delivery capabilities and market reach.

- August 2023: Thailand Post partners with Bor Kor Sor, leveraging expertise in routes and technology to increase delivery efficiency. This collaboration strengthens Thailand Post's capacity and service reach.

- July 2023: J&T Express expands its parcel pick-up points through the "J&T HOME" project, enhancing convenience for customers and expanding service coverage. This significantly improves accessibility and customer satisfaction.

Strategic Outlook for Thailand CEP Industry Market

The Thailand CEP industry is poised for sustained growth driven by favorable economic conditions, escalating e-commerce adoption, and ongoing technological innovation. Companies that effectively leverage technology, invest in infrastructure, and adapt to evolving consumer preferences will be best positioned to capture market share and drive future success. Strategic partnerships, expansions into underserved markets, and the development of specialized services will be crucial for achieving long-term growth and profitability.

Thailand CEP Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

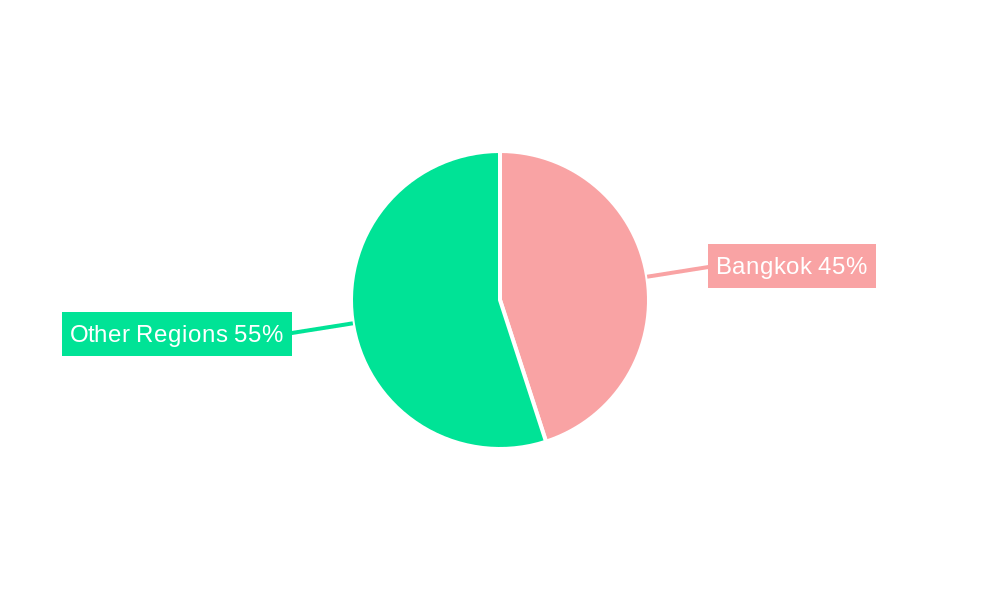

Thailand CEP Industry Segmentation By Geography

- 1. Thailand

Thailand CEP Industry Regional Market Share

Geographic Coverage of Thailand CEP Industry

Thailand CEP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand CEP Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nim Express Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service of America Inc (UPS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CJ Logistics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J&T Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thailand Post

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FedEx

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SF Express (KEX-SF)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Best Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aqua Corporation (including Thai Parcel Public Company Limited)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Flash Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 JWD Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nim Express Company Limited

List of Figures

- Figure 1: Thailand CEP Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Thailand CEP Industry Share (%) by Company 2025

List of Tables

- Table 1: Thailand CEP Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Thailand CEP Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Thailand CEP Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 4: Thailand CEP Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: Thailand CEP Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Thailand CEP Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Thailand CEP Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Thailand CEP Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Thailand CEP Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Thailand CEP Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 11: Thailand CEP Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: Thailand CEP Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Thailand CEP Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Thailand CEP Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand CEP Industry?

The projected CAGR is approximately 7.16%.

2. Which companies are prominent players in the Thailand CEP Industry?

Key companies in the market include Nim Express Company Limited, United Parcel Service of America Inc (UPS, CJ Logistics Corporation, DHL Group, J&T Express, Thailand Post, FedEx, SF Express (KEX-SF), Best Inc, Aqua Corporation (including Thai Parcel Public Company Limited), Flash Express, JWD Group.

3. What are the main segments of the Thailand CEP Industry?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

November 2023: J&T Home has partnered with SABUY SPEED, a subsidiary of Sabai Technology Public Company Limited, to accept and deliver parcels throughout Thailand 365 days, excluding public holidays at affiliated stores including Shipsmile, Plus Express, The Letter Post, Point Express, Speedy, Payspost and Paypoint, more than 22,000 branches nationwide.August 2023: Thailand Post Company Limited partnered with The Transport Company Limited (Bor Kor Sor) to provide delivery and parcel delivery services. The amount of consignment and delivery continued to increase steadily due to expertise in routes, vehicles, technology, and information, including service points.July 2023: J&T Express is expanding its parcel pick-up point agents through the "J&T HOME" project. To expand the J&T Express service network to cover all areas throughout Thailand they are converting existing vacant space into a parcel pick-up service point and would provide parcel transportation services with the highest quality and potential. It also creates convenience for J&T Express users at branches near their homes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand CEP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand CEP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand CEP Industry?

To stay informed about further developments, trends, and reports in the Thailand CEP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence