Key Insights

The United States rail freight transport market is poised for significant expansion, propelled by the escalating need for efficient, cost-effective, and sustainable long-haul logistics. Leveraging its extensive infrastructure and inherent capacity for high-volume goods, particularly bulk commodities, rail freight offers superior fuel efficiency and reduced environmental impact compared to other transport modes. This makes it an increasingly preferred choice for businesses prioritizing sustainability. Projections indicate a robust growth trajectory from 2025 to 2033, driven by surging e-commerce demands, government investment in rail modernization, and a growing emphasis on supply chain resilience. Advancements in tracking and automation technologies further enhance operational efficiency and cost-effectiveness, solidifying market expansion.

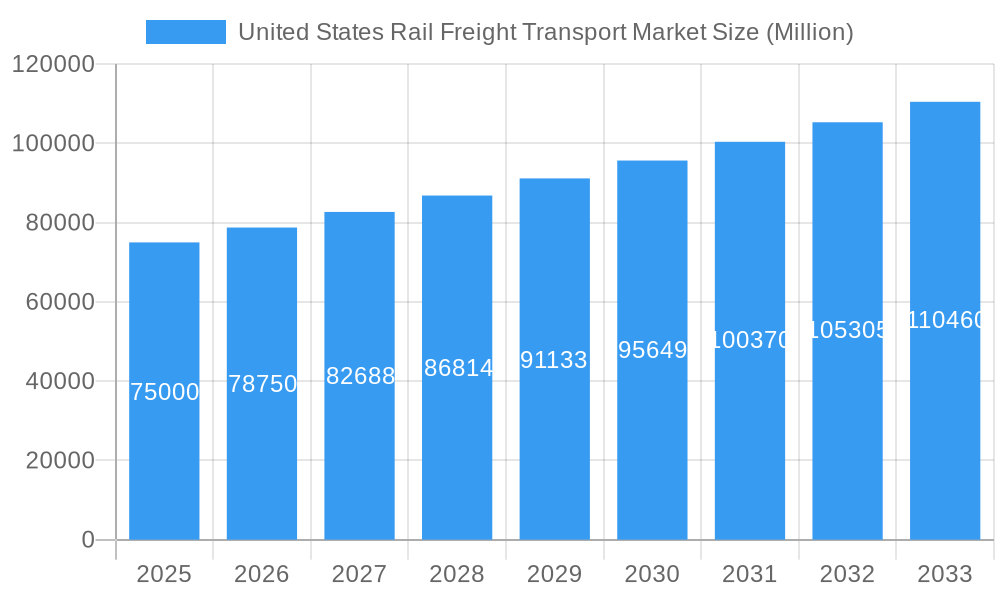

United States Rail Freight Transport Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market growth, with an estimated Compound Annual Growth Rate (CAGR) of 4.5%. Key drivers include substantial investments in infrastructure upgrades and capacity expansion, alongside the accelerating adoption of intermodal transportation solutions that integrate rail and trucking for optimized efficiency. Despite ongoing competition and infrastructure maintenance requirements, the US rail freight transport market presents a positive outlook, projecting a market size of $103 billion by 2025 and offering considerable opportunities over the next decade.

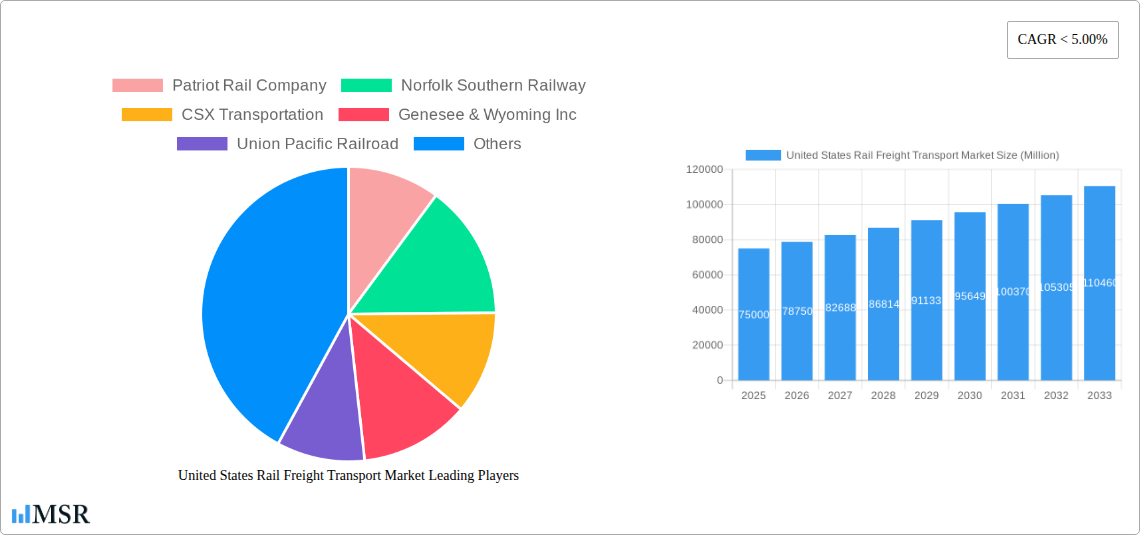

United States Rail Freight Transport Market Company Market Share

United States Rail Freight Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Rail Freight Transport Market, covering market size, segmentation, key players, growth drivers, and challenges. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and strategic decision-makers. The market is segmented by type of cargo (containerized, non-containerized, liquid bulk), destination (domestic, international), and service type (transportation, allied services). Key players analyzed include Patriot Rail Company, Norfolk Southern Railway, CSX Transportation, Genesee & Wyoming Inc, Union Pacific Railroad, BNSF Railway Company, Canadian National Railway, and Kansas City Southern (list not exhaustive). The report projects robust growth, driven by factors such as infrastructure development and technological advancements.

United States Rail Freight Transport Market Market Concentration & Dynamics

The US rail freight transport market exhibits moderate concentration, with a few major players holding significant market share. The market is characterized by a complex interplay of factors including innovation, evolving regulatory frameworks, the emergence of substitute transportation modes, and shifting end-user demands. Mergers and acquisitions (M&A) activity has played a significant role in shaping the competitive landscape.

- Market Concentration: The top five players account for approximately xx% of the market share in 2025 (estimated). The remaining share is distributed among numerous smaller players.

- Innovation Ecosystem: The market is witnessing increased investment in technological advancements, including the adoption of automation, data analytics, and sustainable solutions like battery-electric locomotives.

- Regulatory Framework: Government regulations concerning safety, environmental protection, and pricing significantly influence market dynamics. Changes in these regulations can create both opportunities and challenges for market players.

- Substitute Products: Road and maritime transport are key substitute modes, posing competitive pressure. Rail freight's competitive advantage rests on its capacity for long-haul, bulk transportation.

- End-User Trends: Evolving consumer preferences and supply chain strategies influence demand patterns across various cargo types and destinations. The increasing demand for faster delivery and efficient logistics solutions continues to shape the market.

- M&A Activities: The past five years have witnessed xx M&A deals in the US rail freight transport market, reflecting industry consolidation and strategic expansion.

United States Rail Freight Transport Market Industry Insights & Trends

The US rail freight transport market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated market size of USD xx Million by 2033. This growth is driven by several key factors:

- Infrastructure Development: Government investments in rail infrastructure modernization and expansion projects contribute significantly to increased capacity and efficiency, driving market growth.

- Technological Advancements: Adoption of advanced technologies such as precision railroading, automation, and predictive maintenance enhances operational efficiency and reduces costs, leading to higher market attractiveness.

- Evolving Consumer Behavior: The increasing demand for efficient and sustainable logistics solutions fuels the growth of rail freight transport as a preferred mode of transportation. The shift towards e-commerce and faster delivery times also contributes positively.

- Economic Growth: A robust US economy drives demand for freight transportation, leading to increased cargo volumes and market expansion.

- Government Initiatives: Various government programs and policies aimed at promoting sustainable transportation further support market growth.

Key Markets & Segments Leading United States Rail Freight Transport Market

By Type of Cargo: The containerized segment, which includes intermodal transport, dominates the market, accounting for approximately xx% of the total market share in 2025 (estimated). This is fueled by the growth in global trade and the increasing efficiency of intermodal transportation. The Non-containerized segment is showing growth, driven by bulk commodities and agricultural products. Liquid bulk transportation, while significant, represents a smaller share.

By Destination: Domestic freight transport commands the largest share, with international shipments constituting a smaller, yet growing portion. This growth in international rail freight is aided by cross-border infrastructure projects and trade agreements.

By Service Type: The transportation segment holds the majority share, while services allied to transportation (maintenance, switching, storage) also contribute significantly to market value. These allied services are essential for efficient rail operations. Growth in these segments is driven by improving operational efficiency and safety measures.

Drivers of growth for key segments:

- Economic Growth: Drives overall demand across all segments.

- Infrastructure Investments: Particularly important for containerized and domestic segments.

- Technological Advancements: Benefits all segments, particularly in improving efficiency and reducing costs.

- Government Policies: Supports sustainable practices in transportation and international trade, thereby impacting all segments.

United States Rail Freight Transport Market Product Developments

Recent advancements in rail freight technology include the introduction of battery-electric locomotives, aiming to reduce carbon emissions and enhance operational efficiency. This shift towards sustainable technologies is improving the environmental performance and long-term viability of rail freight transportation, simultaneously enhancing a company's competitive edge. Other developments include advanced signaling systems, data analytics platforms for predictive maintenance, and improved intermodal infrastructure.

Challenges in the United States Rail Freight Transport Market Market

The US rail freight transport market faces several challenges including aging infrastructure requiring significant investment for upgrades, fluctuating fuel prices impacting operational costs, and intense competition from other modes of transportation (road, maritime). Further, regulatory hurdles and occasional labor disputes can cause operational disruptions, impacting overall market growth. These challenges can result in an estimated xx% reduction in potential market expansion annually.

Forces Driving United States Rail Freight Transport Market Growth

Key growth drivers include substantial government investments in infrastructure modernization, the increasing adoption of innovative technologies for enhanced efficiency and sustainability, and the growing demand for reliable and cost-effective freight transportation solutions fueled by economic expansion.

Long-Term Growth Catalysts in the United States Rail Freight Transport Market

Long-term growth is expected to be driven by continued investment in high-speed rail and intermodal facilities, the expansion of rail networks to reach underserved regions, and collaborative partnerships between rail operators and logistics companies. Innovations in sustainable transportation technologies will also play a significant role.

Emerging Opportunities in United States Rail Freight Transport Market

Emerging opportunities include the increasing adoption of precision railroading techniques to optimize operations, the growth of e-commerce and its associated demand for efficient last-mile delivery solutions, and the expanding use of data analytics to improve network planning and resource allocation.

Leading Players in the United States Rail Freight Transport Market Sector

Key Milestones in United States Rail Freight Transport Market Industry

January 2022: Wabtec Corporation receives an order for 10 FLXdrive battery-electric locomotives from Union Pacific Railroad, signifying a significant step towards sustainable freight transportation and infrastructure modernization. This initiative is expected to reduce carbon emissions by 4,000t annually.

February 2022: BNSF Railway Company announces a USD 580 Million capital plan for efficiency and expansion initiatives, including double and triple-track additions, enhancing capacity and supporting traffic growth in key corridors. This investment signals confidence in future market growth and strengthens its competitive position.

Strategic Outlook for United States Rail Freight Transport Market Market

The US rail freight transport market is poised for significant growth, driven by favorable government policies, technological advancements, and a robust economy. Strategic opportunities lie in investing in infrastructure upgrades, adopting sustainable technologies, and fostering collaborations to optimize supply chain efficiency. Focusing on intermodal transport and expanding into underserved regions offers further potential for market expansion.

United States Rail Freight Transport Market Segmentation

-

1. Type of Cargo

- 1.1. Containerized (Includes Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Service Type

- 3.1. Transportation

- 3.2. Services

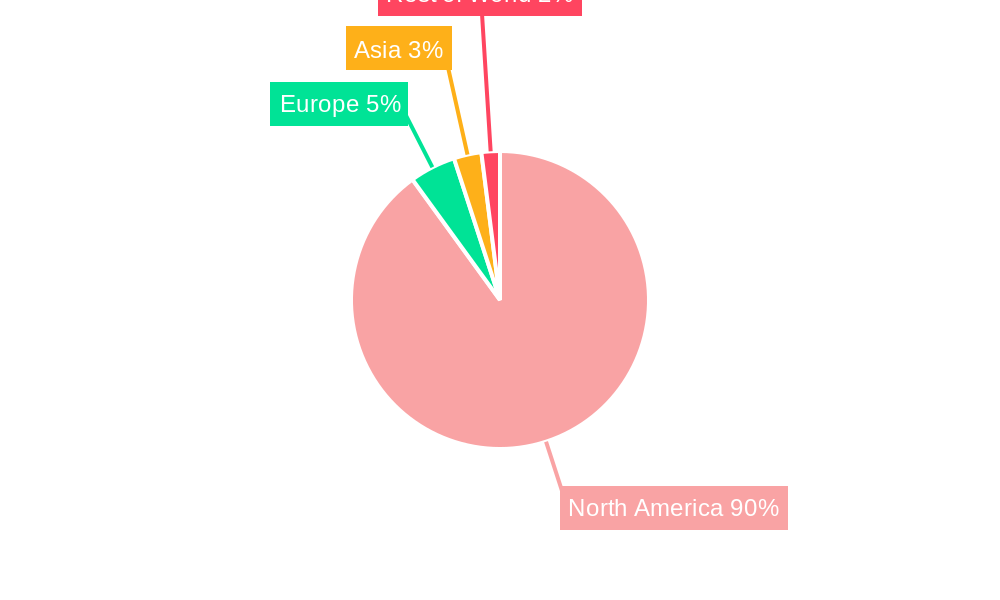

United States Rail Freight Transport Market Segmentation By Geography

- 1. United States

United States Rail Freight Transport Market Regional Market Share

Geographic Coverage of United States Rail Freight Transport Market

United States Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need for Reliable Connections between Carriers and Shippers; Demand for Real-time Visibility of Shipments

- 3.3. Market Restrains

- 3.3.1. High Fragmentation of the Logistics Industry; Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Demand on The US Freight Rail Network Increase

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Rail Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 5.1.1. Containerized (Includes Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Transportation

- 5.3.2. Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Patriot Rail Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Norfolk Southern Railway

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CSX Transportation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Genesee & Wyoming Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Union Pacific Railroad

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BNSF Railway Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canadian National Railway

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kansas City Southern**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Patriot Rail Company

List of Figures

- Figure 1: United States Rail Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Rail Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: United States Rail Freight Transport Market Revenue billion Forecast, by Type of Cargo 2020 & 2033

- Table 2: United States Rail Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: United States Rail Freight Transport Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 4: United States Rail Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Rail Freight Transport Market Revenue billion Forecast, by Type of Cargo 2020 & 2033

- Table 6: United States Rail Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 7: United States Rail Freight Transport Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: United States Rail Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Rail Freight Transport Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the United States Rail Freight Transport Market?

Key companies in the market include Patriot Rail Company, Norfolk Southern Railway, CSX Transportation, Genesee & Wyoming Inc, Union Pacific Railroad, BNSF Railway Company, Canadian National Railway, Kansas City Southern**List Not Exhaustive.

3. What are the main segments of the United States Rail Freight Transport Market?

The market segments include Type of Cargo, Destination, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 103 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Need for Reliable Connections between Carriers and Shippers; Demand for Real-time Visibility of Shipments.

6. What are the notable trends driving market growth?

Demand on The US Freight Rail Network Increase.

7. Are there any restraints impacting market growth?

High Fragmentation of the Logistics Industry; Data Security Concerns.

8. Can you provide examples of recent developments in the market?

January 2022 - Wabtec Corporation has received an order for 10 FLXdrive battery-electric locomotives from Union Pacific Railroad, a freight-hauling railroad in the US. The action will promote Union Pacific's efforts to lower greenhouse gas (GHG) emissions from operations while also upgrading the infrastructure of its train yards. Seven thousand battery cells will be used in each FLXdrive battery-electric locomotive. The US will be the exclusive producer of all the vehicles. The 10 battery-powered locomotives will be able to offset 4,000t of carbon emissions from Union Pacific's train yards each year when used together. Union Pacific is expected to receive the first units from Wabtec in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the United States Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence