Key Insights

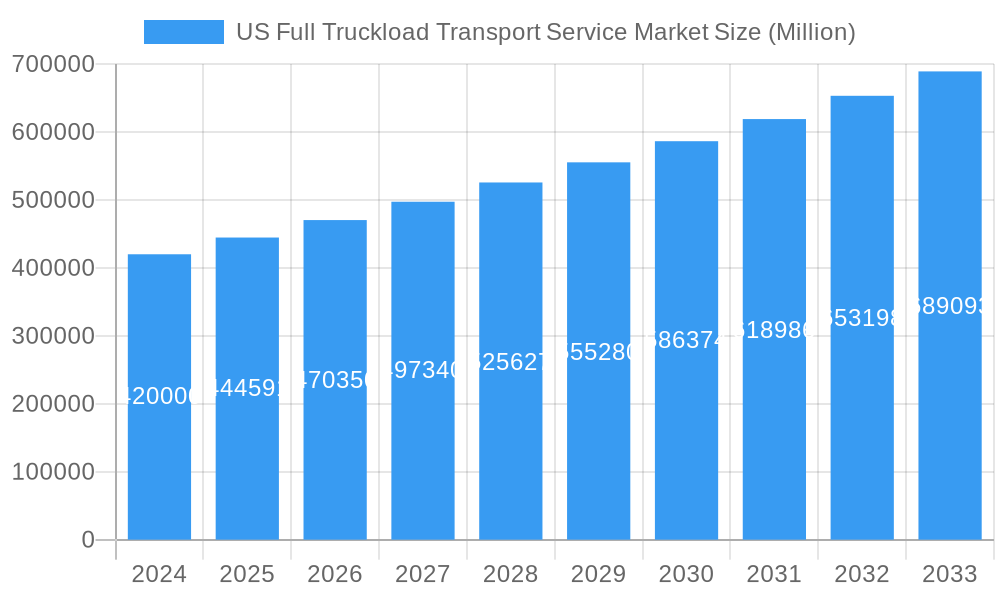

The U.S. Full Truckload (FTL) transport service market is projected to reach $448.65 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2.3% through 2033. This growth is driven by sustained demand from key sectors, including manufacturing and retail, which are integral to the efficient movement of large-volume freight. The burgeoning e-commerce sector further amplifies the need for FTL services, necessitating larger and more frequent shipments. Advancements in fleet management technology and real-time tracking are elevating operational efficiency, thereby enhancing the appeal of FTL solutions. Evolving consumer preferences and consistent demand for goods across diverse industries solidify FTL's critical role within the national supply chain.

US Full Truckload Transport Service Market Market Size (In Billion)

Significant restraints such as driver shortages and rising fuel costs present ongoing challenges that may affect service availability and pricing. The increasing complexity of logistics networks and the imperative for enhanced sustainability also necessitate continuous adaptation by service providers. Notwithstanding these obstacles, the inherent efficiency and cost-effectiveness of FTL services for transporting substantial cargo volumes ensure their enduring relevance and growth potential. Strategic investments in fleet modernization, route optimization, and workforce development are paramount for market participants to leverage the sector's favorable outlook and maintain competitive differentiation.

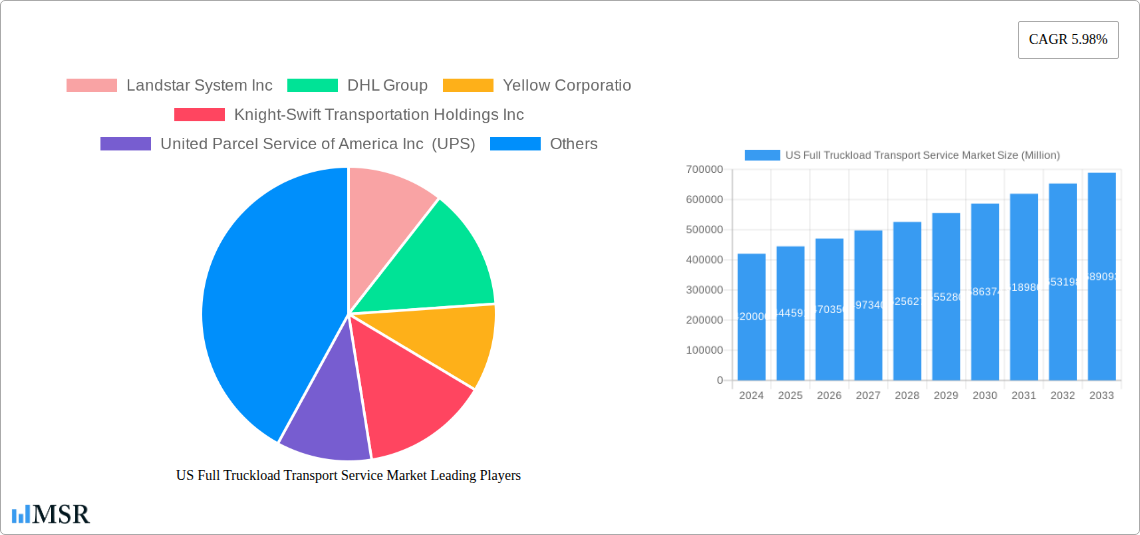

US Full Truckload Transport Service Market Company Market Share

Unlocking Efficiency: Comprehensive US Full Truckload Transport Service Market Report 2019-2033

This in-depth report offers a definitive analysis of the US Full Truckload (FTL) Transport Service Market, exploring its intricate dynamics, key growth drivers, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this research provides invaluable insights for industry stakeholders, logistics providers, and businesses reliant on efficient freight solutions. Discover market segmentation by end-user industry and destination, understand crucial industry developments, and gain a strategic edge with actionable intelligence. The US FTL market is poised for significant evolution, driven by technological innovation, shifting consumer demands, and robust economic activity.

US Full Truckload Transport Service Market Market Concentration & Dynamics

The US Full Truckload Transport Service Market exhibits a moderate level of market concentration, with a blend of large, established players and a significant number of smaller, regional carriers. Key industry players such as Landstar System Inc, DHL Group, Knight-Swift Transportation Holdings Inc, United Parcel Service of America Inc (UPS), and C H Robinson command substantial market share, driven by their extensive networks, technological investments, and diverse service offerings. However, the presence of numerous independent owner-operators and mid-sized companies ensures a competitive landscape, fostering innovation and specialized solutions. The innovation ecosystem is rapidly evolving, with a growing emphasis on digital freight matching platforms, real-time tracking, and predictive analytics to optimize operations. Regulatory frameworks, including Hours of Service (HOS) regulations and environmental standards, continue to shape operational strategies and investment priorities. Substitute products, such as Less Than Truckload (LTL) services and intermodal transport, offer alternatives for specific freight needs, influencing market share dynamics. End-user industry trends, particularly the surge in e-commerce and the demand for just-in-time deliveries, are significant drivers. Mergers and acquisitions (M&A) activities are ongoing, with larger entities acquiring smaller competitors to expand their geographic reach and service capabilities. For instance, the acquisition of MNX Global Logistics by UPS signifies a strategic move to bolster its time-critical and healthcare logistics segments. The market is projected to see continued consolidation, alongside the emergence of new entrants leveraging disruptive technologies.

US Full Truckload Transport Service Market Industry Insights & Trends

The US Full Truckload Transport Service Market is experiencing robust growth, projected to reach an estimated $450 Billion in 2025, with a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025-2033. This expansion is fueled by several key market growth drivers, including the sustained demand from a recovering and growing economy, the ever-increasing volume of e-commerce necessitating efficient last-mile and middle-mile solutions, and the consistent need for raw materials and finished goods across diverse manufacturing sectors. Technological disruptions are fundamentally reshaping the industry. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is optimizing route planning, enhancing load matching, and predicting potential delays, leading to increased efficiency and reduced operational costs. Advanced telematics and IoT devices provide real-time visibility into shipment status, temperature, and driver behavior, bolstering security and customer satisfaction. Autonomous trucking technologies, while still in early stages of deployment, represent a significant long-term trend that could revolutionize capacity and cost structures. Evolving consumer behaviors, characterized by a preference for faster delivery times and greater transparency in the supply chain, are compelling FTL providers to invest in agile operations and advanced tracking capabilities. The resilience of the supply chain has also become a paramount concern for businesses, leading to increased reliance on dependable FTL services that can navigate disruptions effectively. The ongoing digitalization of freight operations, from load booking to freight auditing, is creating a more streamlined and data-driven industry.

Key Markets & Segments Leading US Full Truckload Transport Service Market

The US Full Truckload Transport Service Market is predominantly driven by Domestic destinations, accounting for a substantial portion of freight movements. This is largely attributed to the vast consumer base and intricate manufacturing and distribution networks spread across the United States.

End User Industry Dominance:

- Manufacturing: This sector is a perennial powerhouse, requiring the consistent movement of raw materials to production facilities and the distribution of finished goods to wholesalers, retailers, and direct consumers. The sheer volume and complexity of goods manufactured in the US make it a leading contributor to FTL demand.

- Drivers: Economic growth, industrial output, consumer demand for manufactured goods, global supply chain integration.

- Wholesale and Retail Trade: The burgeoning e-commerce landscape and traditional retail distribution channels create a consistent and high-volume demand for FTL services. From large distribution centers to local store replenishment, this segment is critical.

- Drivers: E-commerce growth, consumer spending, inventory management strategies, seasonal demand fluctuations.

- Construction: The ongoing infrastructure development projects and the demand for building materials from residential and commercial construction sites significantly contribute to FTL volumes.

- Drivers: Government infrastructure spending, housing market trends, commercial real estate development, natural disaster recovery efforts.

Destination Dominance:

- Domestic: The extensive network of highways and the geographical expanse of the US necessitate a massive domestic FTL operation. This segment supports the internal flow of goods, from agricultural products to manufactured goods and retail inventory.

- Drivers: Intra-state and inter-state commerce, consumer markets, industrial hubs, geographic distribution of resources.

While International destinations also represent a significant segment, particularly for cross-border trade with Canada and Mexico, and for goods entering or exiting the US via ports, the sheer volume and frequency of domestic movements solidify its leading position in the US Full Truckload Transport Service Market. The Oil and Gas and Mining and Quarrying sectors, while having specific and often volatile FTL needs, represent more niche segments compared to the broad-based demand from manufacturing and retail. The Agriculture, Fishing, and Forestry sector also contributes, though its FTL requirements are often seasonal and location-specific. The Others category encompasses a wide array of specialized freight, contributing incrementally to the overall market.

US Full Truckload Transport Service Market Product Developments

Product developments in the US Full Truckload Transport Service Market are increasingly focused on enhancing efficiency, visibility, and sustainability. Key innovations include the deployment of AI-powered route optimization software, which leverages real-time traffic data and predictive analytics to minimize transit times and fuel consumption. Advanced trailer telematics provide real-time monitoring of temperature, humidity, and shock, crucial for sensitive cargo like pharmaceuticals and perishables. Digital freight brokerage platforms are streamlining the load booking and management process, offering instant quotes and automated tendering. Furthermore, the emergence of electric and alternative fuel trucks is beginning to address environmental concerns and reduce the carbon footprint of FTL operations, signifying a shift towards greener logistics solutions.

Challenges in the US Full Truckload Transport Service Market Market

The US Full Truckload Transport Service Market faces several significant challenges that impact growth and operational efficiency. A persistent issue is the driver shortage, a complex problem stemming from an aging workforce, demanding working conditions, and recruitment difficulties, leading to capacity constraints and increased labor costs, estimated to impact market capacity by 10-15%. Rising fuel costs and increasing insurance premiums directly affect operating expenses, squeezing profit margins for carriers. Infrastructure limitations, including congested highways and deteriorating road conditions, contribute to longer transit times and increased wear and tear on vehicles. Furthermore, complex regulatory environments, encompassing safety regulations and emissions standards, necessitate ongoing investment in compliance and technology. The intense competition among carriers, both large and small, often leads to price wars, making it challenging to maintain profitability. The volatility of freight demand, influenced by economic fluctuations and seasonal shifts, can create periods of overcapacity or scarcity, impacting pricing and resource allocation.

Forces Driving US Full Truckload Transport Service Market Growth

Several powerful forces are propelling the growth of the US Full Truckload Transport Service Market. The burgeoning e-commerce sector continues to be a primary engine, driving unprecedented demand for rapid and reliable delivery of goods nationwide. Economic expansion across various industries, including manufacturing and construction, directly translates into increased freight volumes. Technological advancements, particularly in areas like AI for route optimization, predictive maintenance, and digital freight matching platforms, are enhancing efficiency and reducing operational costs, making FTL services more attractive. Globalization and complex supply chains necessitate robust transportation networks for both inbound raw materials and outbound finished products. The increasing focus on supply chain resilience, prompted by recent global disruptions, is leading businesses to seek dependable FTL partners capable of ensuring timely deliveries and mitigating risks.

Challenges in the US Full Truckload Transport Service Market Market

Beyond immediate operational hurdles, the US Full Truckload Transport Service Market must also address long-term growth catalysts. The ongoing digital transformation of the logistics industry, including the adoption of blockchain for enhanced transparency and the proliferation of IoT devices for real-time tracking, promises to unlock new levels of efficiency and customer service. Strategic partnerships and collaborations between carriers, shippers, and technology providers are fostering innovation and creating more integrated supply chain solutions. The gradual introduction and acceptance of autonomous trucking technology holds the potential to significantly alleviate driver shortages and reduce operational costs in the long run, although widespread adoption will require substantial regulatory and infrastructure developments. Expanding into niche markets with specialized FTL services, such as temperature-controlled or hazardous materials transport, offers opportunities for premium pricing and differentiation.

Emerging Opportunities in US Full Truckload Transport Service Market

Emerging opportunities in the US Full Truckload Transport Service Market are abundant, driven by evolving market demands and technological innovation. The significant growth in temperature-controlled logistics for pharmaceuticals, healthcare products, and specialized food items presents a lucrative avenue for specialized FTL providers. The increasing emphasis on sustainability is creating opportunities for carriers investing in electric and alternative fuel vehicles, appealing to environmentally conscious shippers. The development and adoption of advanced data analytics and predictive modeling offer immense potential for optimizing routes, forecasting demand, and improving customer service, leading to more efficient and cost-effective operations. The expanding reach of cross-border e-commerce and the need for efficient movement of goods into and out of neighboring countries, particularly Mexico and Canada, present a growing international FTL market. Furthermore, the integration of AI-powered freight visibility platforms that provide end-to-end tracking and proactive disruption alerts are becoming a critical differentiator for service providers.

Leading Players in the US Full Truckload Transport Service Market Sector

- Landstar System Inc

- DHL Group

- Yellow Corporation

- Knight-Swift Transportation Holdings Inc

- United Parcel Service of America Inc (UPS)

- Werner Enterprises

- C H Robinson

- ArcBest®

- J B Hunt Transport Inc

- Ryder System

Key Milestones in US Full Truckload Transport Service Market Industry

- February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes, significantly enhancing operational efficiency for shippers.

- October 2023: Ryder Systems continues to expand its multiclient warehouse network, adding a 400,000-square-foot distribution center in Aurora, Ill. The newly built facility is the latest addition to a now six-building campus totaling 2.4 million square feet, primarily serving shippers of consumer packaged goods (CPG), including food and beverage, food ingredients, health and beauty, household products, and general retail merchandise, bolstering logistics infrastructure.

- September 2023: UPS has entered into an agreement to acquire MNX Global Logistics (MNX), a global time-critical logistics provider. MNX’s capabilities in radio-pharmaceuticals and temperature-controlled logistics will help UPS’ healthcare segment and clinical trial logistics subsidiary Marken meet the growing demand for these services. The transaction is expected to close by the end of the year, signifying strategic expansion in specialized logistics.

Strategic Outlook for US Full Truckload Transport Service Market Market

The strategic outlook for the US Full Truckload Transport Service Market is overwhelmingly positive, driven by sustained demand and continuous innovation. Future growth will be significantly influenced by the adoption of advanced technologies such as AI, IoT, and potentially autonomous vehicles to address capacity constraints and improve efficiency. Investments in sustainable logistics solutions, including alternative fuel fleets, will become increasingly crucial to meet evolving environmental regulations and corporate social responsibility goals. Strategic partnerships and acquisitions will continue to shape the competitive landscape, with a focus on expanding service offerings, geographic reach, and technological capabilities. The emphasis on data-driven decision-making and end-to-end supply chain visibility will remain paramount, enabling providers to offer superior customer service and optimize operations. The market is poised for continued expansion, presenting substantial opportunities for companies that can adapt to these dynamic trends and deliver reliable, efficient, and sustainable FTL solutions.

US Full Truckload Transport Service Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

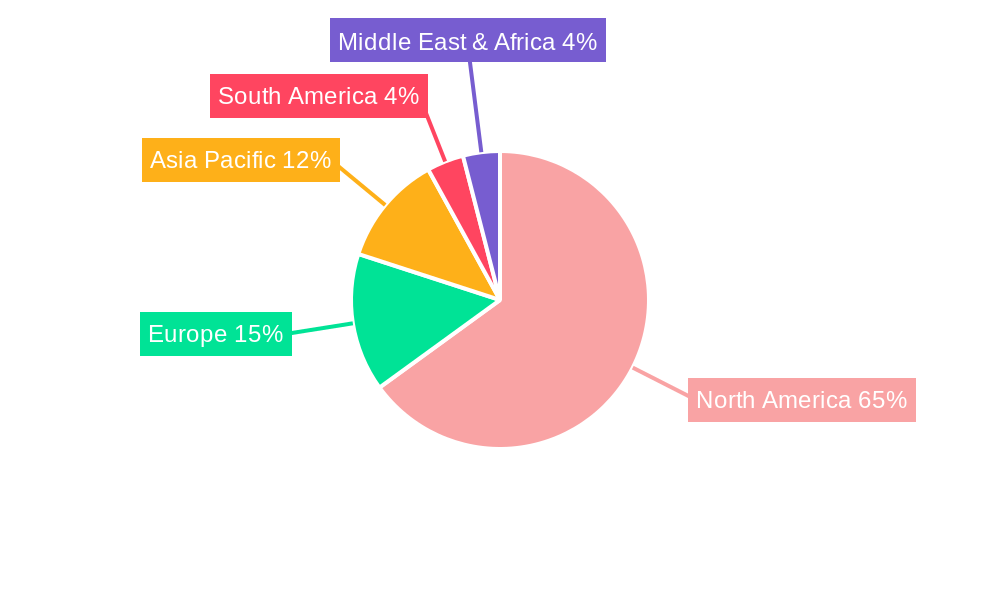

US Full Truckload Transport Service Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Full Truckload Transport Service Market Regional Market Share

Geographic Coverage of US Full Truckload Transport Service Market

US Full Truckload Transport Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Landstar System Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Yellow Corporatio

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Knight-Swift Transportation Holdings Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 United Parcel Service of America Inc (UPS)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Werner Enterprises

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 C H Robinson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ArcBest®

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 J B Hunt Transport Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ryder Systems

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Landstar System Inc

List of Figures

- Figure 1: Global US Full Truckload Transport Service Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Full Truckload Transport Service Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 3: North America US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America US Full Truckload Transport Service Market Revenue (billion), by Destination 2025 & 2033

- Figure 5: North America US Full Truckload Transport Service Market Revenue Share (%), by Destination 2025 & 2033

- Figure 6: North America US Full Truckload Transport Service Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America US Full Truckload Transport Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Full Truckload Transport Service Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 9: South America US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 10: South America US Full Truckload Transport Service Market Revenue (billion), by Destination 2025 & 2033

- Figure 11: South America US Full Truckload Transport Service Market Revenue Share (%), by Destination 2025 & 2033

- Figure 12: South America US Full Truckload Transport Service Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America US Full Truckload Transport Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Full Truckload Transport Service Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 15: Europe US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Europe US Full Truckload Transport Service Market Revenue (billion), by Destination 2025 & 2033

- Figure 17: Europe US Full Truckload Transport Service Market Revenue Share (%), by Destination 2025 & 2033

- Figure 18: Europe US Full Truckload Transport Service Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe US Full Truckload Transport Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Full Truckload Transport Service Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 21: Middle East & Africa US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 22: Middle East & Africa US Full Truckload Transport Service Market Revenue (billion), by Destination 2025 & 2033

- Figure 23: Middle East & Africa US Full Truckload Transport Service Market Revenue Share (%), by Destination 2025 & 2033

- Figure 24: Middle East & Africa US Full Truckload Transport Service Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Full Truckload Transport Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Full Truckload Transport Service Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 27: Asia Pacific US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: Asia Pacific US Full Truckload Transport Service Market Revenue (billion), by Destination 2025 & 2033

- Figure 29: Asia Pacific US Full Truckload Transport Service Market Revenue Share (%), by Destination 2025 & 2033

- Figure 30: Asia Pacific US Full Truckload Transport Service Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific US Full Truckload Transport Service Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Full Truckload Transport Service Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global US Full Truckload Transport Service Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 6: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global US Full Truckload Transport Service Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 11: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 12: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global US Full Truckload Transport Service Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 17: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 18: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global US Full Truckload Transport Service Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 29: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 30: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global US Full Truckload Transport Service Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 38: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 39: Global US Full Truckload Transport Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Full Truckload Transport Service Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Full Truckload Transport Service Market?

The projected CAGR is approximately 2.3%.

2. Which companies are prominent players in the US Full Truckload Transport Service Market?

Key companies in the market include Landstar System Inc, DHL Group, Yellow Corporatio, Knight-Swift Transportation Holdings Inc, United Parcel Service of America Inc (UPS), Werner Enterprises, C H Robinson, ArcBest®, J B Hunt Transport Inc, Ryder Systems.

3. What are the main segments of the US Full Truckload Transport Service Market?

The market segments include End User Industry, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 448.65 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.October 2023: Ryder Systems continues to expand its multiclient warehouse network, adding a 400,000-square-foot distribution center in Aurora, Ill. The newly built facility is the latest addition to a now six-building campus totaling 2.4 million square feet, primarily serving shippers of consumer packaged goods (CPG), including food and beverage, food ingredients, health and beauty, household products, and general retail merchandise.September 2023: UPS has entered into an agreement to acquire MNX Global Logistics (MNX), a global time-critical logistics provider. MNX’s capabilities in radio-pharmaceuticals and temperature-controlled logistics will help UPS’ healthcare segment and clinical trial logistics subsidiary Marken meet the growing demand for these services. The transaction is expected to close by the end of the year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Full Truckload Transport Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Full Truckload Transport Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Full Truckload Transport Service Market?

To stay informed about further developments, trends, and reports in the US Full Truckload Transport Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence