Key Insights

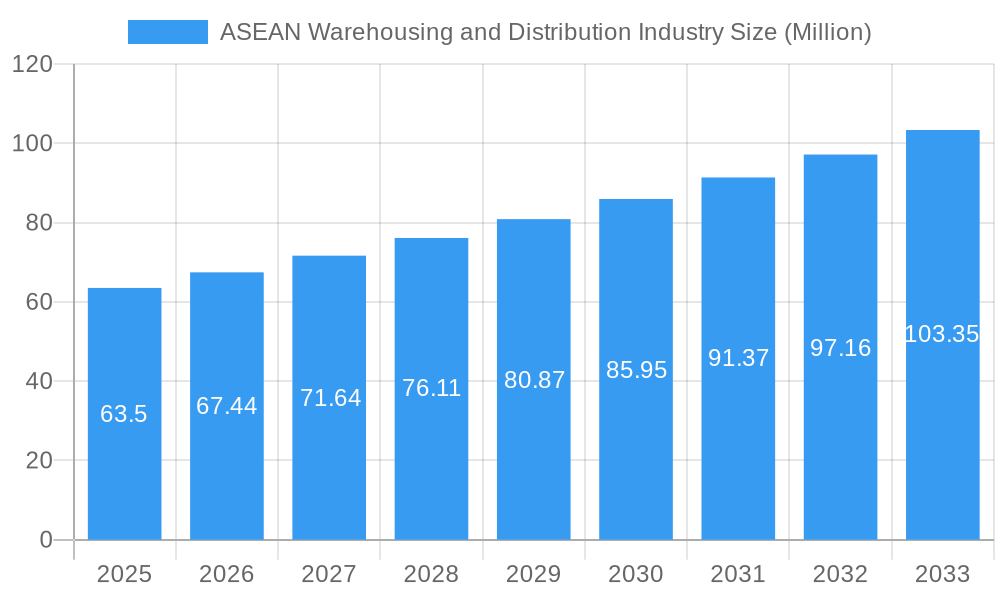

The ASEAN Warehousing and Distribution Industry is poised for substantial growth, with an estimated market size of USD 63.50 million in 2025, projected to expand at a robust Compound Annual Growth Rate (CAGR) of 6.20% through 2033. This upward trajectory is driven by a confluence of factors, including the region's burgeoning e-commerce sector, increasing foreign direct investment, and the expansion of manufacturing hubs. The rapid digitalization of supply chains, coupled with a growing demand for efficient and integrated logistics solutions, is creating significant opportunities for warehousing and distribution providers. Furthermore, the shift towards more sophisticated inventory management systems, including automation and advanced analytics, is enhancing operational efficiency and customer satisfaction. Emerging economies within ASEAN, such as Vietnam and Indonesia, are showing particularly strong growth potential due to their expanding middle class and increasing trade volumes, attracting considerable investment in modern warehousing infrastructure and advanced distribution networks.

ASEAN Warehousing and Distribution Industry Market Size (In Million)

Several key trends are shaping the ASEAN Warehousing and Distribution Industry. The increasing adoption of technology, such as Warehouse Management Systems (WMS), automation, and the Internet of Things (IoT), is revolutionizing operational efficiency and inventory accuracy. Sustainability is also becoming a paramount concern, with a growing emphasis on eco-friendly warehousing practices, including energy-efficient designs and optimized transportation routes to reduce carbon footprints. The development of multimodal logistics infrastructure, connecting sea, air, and land transportation, is further enhancing the seamless movement of goods across the region. However, the industry faces certain restraints, including rising operational costs, particularly for labor and real estate, and a shortage of skilled logistics professionals. Navigating complex regulatory frameworks across different ASEAN nations and ensuring robust cybersecurity measures for digitalized operations also present ongoing challenges. Despite these hurdles, the inherent growth drivers and strategic initiatives undertaken by leading players are expected to propel the market forward.

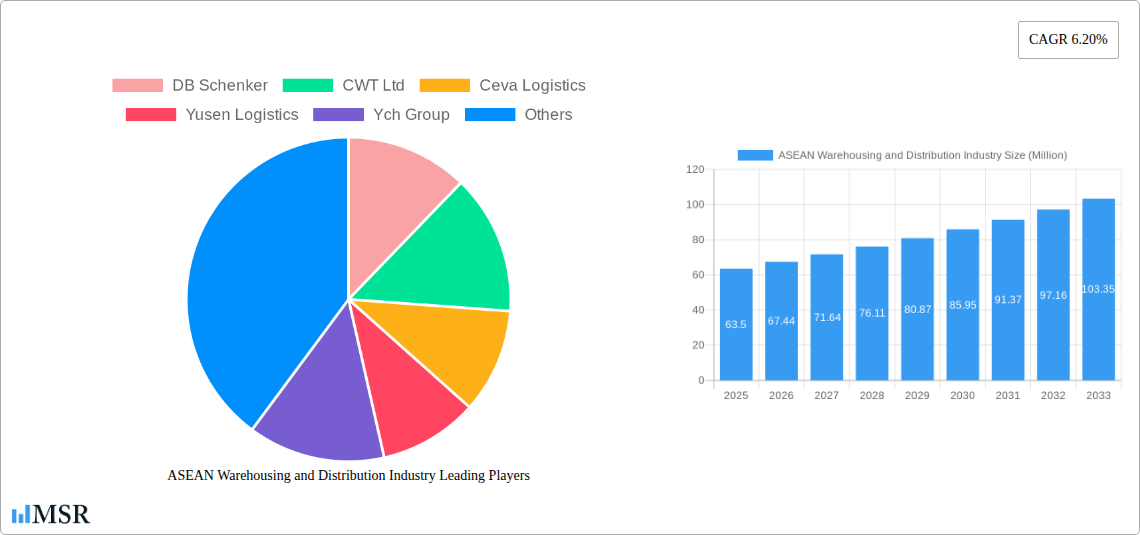

ASEAN Warehousing and Distribution Industry Company Market Share

Unlock critical insights into the dynamic ASEAN warehousing and distribution industry. This comprehensive report, covering the study period of 2019–2033 with a base year of 2025, provides in-depth analysis of market size, key trends, and future opportunities. Dive into the evolving landscape driven by robust economic growth, technological advancements, and shifting consumer demands across Singapore, Thailand, Malaysia, Vietnam, Indonesia, and the Philippines. Discover actionable strategies for stakeholders, including logistics providers, 3PL companies, e-commerce giants, and investors seeking to capitalize on this rapidly expanding Southeast Asian logistics market.

ASEAN Warehousing and Distribution Industry Market Concentration & Dynamics

The ASEAN warehousing and distribution industry exhibits a moderate to high market concentration, with a mix of large multinational corporations and agile local players vying for market share. Key industry players like DB Schenker, CWT Ltd, Ceva Logistics, Yusen Logistics, Ych Group, Gemadept, WHA Corporation, Kuehne + Nagel, Singapore Post, Agility, Kerry Logistics, CJ Century Logistics, Tiong Nam Logistics, and Keppel Logistics are at the forefront, alongside other significant entities like DHL Supply Chain. Innovation ecosystems are thriving, fueled by investments in automation, digitalization, and sustainable logistics solutions. Regulatory frameworks across ASEAN nations are evolving to support trade facilitation and supply chain efficiency, though variations persist. Substitute products, such as direct-to-consumer shipping models, are gaining traction but are largely complemented by established warehousing and distribution networks. End-user trends are heavily influenced by the exponential growth of e-commerce, demanding faster fulfillment and enhanced last-mile delivery capabilities. Merger and acquisition (M&A) activities are on the rise, with recent notable transactions indicating a consolidation trend and strategic expansion by major players to enhance their regional footprint and service offerings. The M&A deal count for the historical period is approximately 25.

ASEAN Warehousing and Distribution Industry Industry Insights & Trends

The ASEAN warehousing and distribution industry is poised for substantial growth, driven by several interconnected factors. The burgeoning e-commerce market in Southeast Asia stands as a primary growth catalyst, escalating demand for sophisticated fulfillment centers, efficient inventory management, and accelerated delivery services. Economic development across the region, marked by rising disposable incomes and a growing middle class, further fuels consumption and, consequently, the need for robust logistics infrastructure. Technological disruptions are reshaping the industry, with the adoption of Warehouse Management Systems (WMS), Automated Guided Vehicles (AGVs), Robotics, and Internet of Things (IoT) devices becoming crucial for enhancing operational efficiency, reducing costs, and improving accuracy. Artificial Intelligence (AI) and Machine Learning (ML) are being integrated for predictive analytics, route optimization, and demand forecasting. Evolving consumer behaviors, characterized by a preference for rapid delivery, personalized services, and seamless online-to-offline experiences, are compelling logistics providers to invest in advanced omnichannel fulfillment strategies. The market size for the ASEAN warehousing and distribution industry is projected to reach approximately $150 Billion in 2025, with a compound annual growth rate (CAGR) of around 8.5% projected for the forecast period of 2025–2033. The historical period from 2019–2024 saw a CAGR of approximately 7.2%.

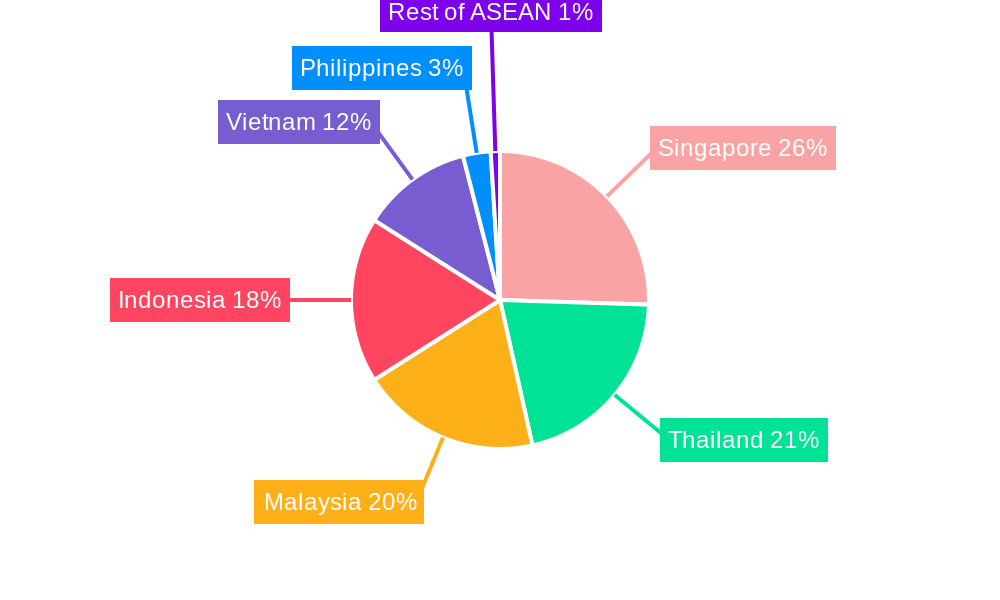

Key Markets & Segments Leading ASEAN Warehousing and Distribution Industry

Singapore consistently emerges as a dominant force in the ASEAN warehousing and distribution industry, often serving as a strategic hub for regional operations due to its advanced infrastructure, efficient port facilities, and business-friendly environment. Its sophisticated logistics ecosystem, coupled with a strong emphasis on technological adoption, makes it a leader in high-value warehousing and cold chain logistics. Thailand is experiencing significant growth, driven by its strategic location, manufacturing prowess, and expanding e-commerce sector, particularly in areas like automotive and electronics warehousing. Malaysia benefits from a well-developed infrastructure and a growing manufacturing base, making it a key player in contract logistics and integrated supply chain solutions. Vietnam is a rapidly ascending market, propelled by its young demographic, increasing foreign direct investment, and a burgeoning e-commerce landscape, leading to substantial demand for new warehouse facilities and distribution networks. Indonesia, with its vast archipelago and large population, presents immense opportunities and challenges in warehousing and distribution, with a growing focus on improving connectivity and last-mile delivery solutions, especially for its rapidly expanding e-commerce sector. The Philippines also shows strong potential, driven by its growing economy and increasing consumer spending, necessitating enhancements in logistics infrastructure. The Rest of ASEAN encompasses developing markets that are progressively adopting modern logistics practices.

- Singapore: Leading in technological adoption, financial services warehousing, and regional distribution hubs. Driven by its status as a global trade gateway and advanced technological infrastructure.

- Thailand: Strong in manufacturing-related warehousing, automotive logistics, and its expanding e-commerce fulfillment capabilities. Driven by its strategic geographical position and robust industrial base.

- Malaysia: Significant growth in contract logistics, pharmaceutical warehousing, and cross-border trade facilitation. Driven by its diversified economy and government support for logistics development.

- Vietnam: Rapid expansion in e-commerce fulfillment, FDI-driven industrial warehousing, and a growing demand for modern logistics facilities. Driven by its strong economic growth and young, tech-savvy population.

- Indonesia: Focus on overcoming geographical challenges for effective distribution, growth in consumer goods warehousing, and increasing e-commerce penetration. Driven by its large domestic market and rapid urbanization.

- Philippines: Emerging opportunities in retail distribution, B2C logistics, and the adoption of technology in warehousing. Driven by its growing middle class and increasing e-commerce adoption.

ASEAN Warehousing and Distribution Industry Product Developments

Product developments in the ASEAN warehousing and distribution industry are heavily focused on enhancing efficiency, sustainability, and customer experience. Innovations in automated storage and retrieval systems (AS/RS), drone delivery, and autonomous mobile robots (AMRs) are revolutionizing warehouse operations. The integration of IoT sensors provides real-time tracking of goods, inventory levels, and environmental conditions, ensuring optimal storage and transit. Furthermore, the development of specialized warehousing solutions, such as temperature-controlled facilities for pharmaceuticals and perishables, and highly secure vaults for high-value goods, is a key trend. The market relevance of these advancements lies in their ability to reduce operational costs, minimize errors, expedite delivery times, and cater to the increasingly complex demands of diverse industries, including e-commerce, automotive, and healthcare.

Challenges in the ASEAN Warehousing and Distribution Industry Market

The ASEAN warehousing and distribution industry faces several significant challenges that impact market growth and operational efficiency. Infrastructure Gaps in certain developing regions lead to higher transportation costs and longer lead times. Regulatory complexities and inconsistencies across different ASEAN nations can create barriers to seamless cross-border logistics. Skilled Labor Shortages in advanced warehousing and logistics technologies pose a significant constraint. Furthermore, increasing operational costs, including rising fuel prices and labor wages, put pressure on profit margins. The competitive landscape is intensifying, with pressure to maintain competitive pricing while investing in costly technological upgrades. Supply chain disruptions, exacerbated by geopolitical events and natural disasters, necessitate greater resilience and flexibility in logistics networks, a challenge estimated to cost the industry an average of 5% of annual revenue.

Forces Driving ASEAN Warehousing and Distribution Industry Growth

Several powerful forces are propelling the growth of the ASEAN warehousing and distribution industry. The undeniable surge in e-commerce penetration across the region is a primary driver, creating unprecedented demand for efficient fulfillment and delivery. Robust economic growth and increasing consumer spending are boosting overall trade volumes, necessitating more sophisticated logistics solutions. Government initiatives and investments in infrastructure development, including ports, roads, and digital networks, are creating a more conducive environment for logistics operations. Technological advancements, such as automation, AI, and data analytics, are enabling greater efficiency and cost-effectiveness, making logistics services more attractive. The growing trend of nearshoring and reshoring by global manufacturers seeking to diversify their supply chains also contributes to increased demand for warehousing and distribution services in ASEAN.

Challenges in the ASEAN Warehousing and Distribution Industry Market

Long-term growth catalysts for the ASEAN warehousing and distribution industry are deeply rooted in ongoing innovation and strategic market expansion. The continuous evolution and adoption of smart warehousing technologies, including AI-powered inventory management and robotic automation, will unlock new levels of efficiency and scalability. Strategic partnerships and collaborations between logistics providers, technology companies, and e-commerce platforms will foster integrated supply chain solutions. Market expansions into untapped or underserved areas within the ASEAN region, coupled with tailored logistics offerings, will drive growth. The increasing focus on sustainability and green logistics, including investments in electric vehicles and eco-friendly warehouse designs, will not only meet regulatory demands but also appeal to environmentally conscious consumers and businesses.

Emerging Opportunities in ASEAN Warehousing and Distribution Industry

Emerging opportunities in the ASEAN warehousing and distribution industry are abundant and diverse. The rapid growth of the gig economy and on-demand delivery services presents significant potential for last-mile logistics providers. The increasing demand for cold chain logistics, driven by the growth in the pharmaceutical and fresh food sectors, offers specialized growth avenues. The development of free trade zones and economic corridors within ASEAN will facilitate cross-border logistics and create opportunities for strategically located distribution hubs. The burgeoning circular economy is creating new demands for reverse logistics and returns management services. Furthermore, the increasing adoption of digital platforms for freight procurement and management is streamlining the industry and creating opportunities for tech-enabled logistics solutions.

Leading Players in the ASEAN Warehousing and Distribution Industry Sector

- DB Schenker

- CWT Ltd

- Ceva Logistics

- Yusen Logistics

- Ych Group

- Gemadept

- WHA Corporation

- Kuehne + Nagel

- Singapore Post

- Agility

- Kerry Logistics

- CJ Century Logistics

- Tiong Nam Logistics

- Keppel Logistics

- DHL Supply Chain

Key Milestones in ASEAN Warehousing and Distribution Industry Industry

- August 2022: A.P. Moller - Maersk (Maersk) successfully completed its acquisition of LF Logistics, a firm with premium capabilities in omnichannel fulfillment services, e-commerce, and inland shipping in the ASEAN region. This strategic move expanded Maersk's warehouse network by adding 223 warehouses, increasing its total facility count to 549, spread across 9.5 million square meters.

- April 2022: Geodis announced its acquisition of Keppel Logistics, a significant player in Southeast Asia with over 200,000 square meters of warehouse space in Singapore, Malaysia, and Australia. This acquisition significantly boosted Geodis's contract logistics presence and e-commerce fulfillment services across Singapore and Southeast Asia.

Strategic Outlook for ASEAN Warehousing and Distribution Industry Market

The strategic outlook for the ASEAN warehousing and distribution industry is exceptionally positive, driven by sustained economic expansion, escalating e-commerce adoption, and a continued push for technological innovation. Key growth accelerators include further investment in smart warehousing solutions, the expansion of multimodal transportation networks, and the development of integrated supply chain platforms. Opportunities lie in catering to specialized logistics needs, such as cold chain and pharmaceutical storage, and in leveraging data analytics for enhanced operational efficiency and predictive capabilities. Strategic partnerships and government support for logistics infrastructure development will be crucial in unlocking the full potential of this dynamic market, positioning ASEAN as a pivotal global logistics hub for years to come.

ASEAN Warehousing and Distribution Industry Segmentation

-

1. Geography

- 1.1. Singapore

- 1.2. Thailand

- 1.3. Malaysia

- 1.4. Vietnam

- 1.5. Indonesia

- 1.6. Philippines

- 1.7. Rest of ASEAN

ASEAN Warehousing and Distribution Industry Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Malaysia

- 4. Vietnam

- 5. Indonesia

- 6. Philippines

- 7. Rest of ASEAN

ASEAN Warehousing and Distribution Industry Regional Market Share

Geographic Coverage of ASEAN Warehousing and Distribution Industry

ASEAN Warehousing and Distribution Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the demand for the Air Cargo Capacity; The Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. Cargo Restrictions

- 3.4. Market Trends

- 3.4.1. Increase in Warehousing Space in Thailand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Singapore

- 5.1.2. Thailand

- 5.1.3. Malaysia

- 5.1.4. Vietnam

- 5.1.5. Indonesia

- 5.1.6. Philippines

- 5.1.7. Rest of ASEAN

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.2.2. Thailand

- 5.2.3. Malaysia

- 5.2.4. Vietnam

- 5.2.5. Indonesia

- 5.2.6. Philippines

- 5.2.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Singapore ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Singapore

- 6.1.2. Thailand

- 6.1.3. Malaysia

- 6.1.4. Vietnam

- 6.1.5. Indonesia

- 6.1.6. Philippines

- 6.1.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Thailand ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Singapore

- 7.1.2. Thailand

- 7.1.3. Malaysia

- 7.1.4. Vietnam

- 7.1.5. Indonesia

- 7.1.6. Philippines

- 7.1.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Malaysia ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Singapore

- 8.1.2. Thailand

- 8.1.3. Malaysia

- 8.1.4. Vietnam

- 8.1.5. Indonesia

- 8.1.6. Philippines

- 8.1.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Vietnam ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Singapore

- 9.1.2. Thailand

- 9.1.3. Malaysia

- 9.1.4. Vietnam

- 9.1.5. Indonesia

- 9.1.6. Philippines

- 9.1.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Indonesia ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Singapore

- 10.1.2. Thailand

- 10.1.3. Malaysia

- 10.1.4. Vietnam

- 10.1.5. Indonesia

- 10.1.6. Philippines

- 10.1.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Philippines ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 11.1.1. Singapore

- 11.1.2. Thailand

- 11.1.3. Malaysia

- 11.1.4. Vietnam

- 11.1.5. Indonesia

- 11.1.6. Philippines

- 11.1.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 12. Rest of ASEAN ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 12.1.1. Singapore

- 12.1.2. Thailand

- 12.1.3. Malaysia

- 12.1.4. Vietnam

- 12.1.5. Indonesia

- 12.1.6. Philippines

- 12.1.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 DB Schenker

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CWT Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ceva Logistics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Yusen Logistics

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Ych Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Gemadept

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 WHA Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kuehne + Nagel

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Singapore Post

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Agility

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Kerry Logistics

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 CJ Century Logistics

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Tiong Nam Logistics

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Keppel Logistics**List Not Exhaustive 6 3 Other Companies (Key Information/Overview

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 DHL Supply Chain

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 DB Schenker

List of Figures

- Figure 1: Global ASEAN Warehousing and Distribution Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Singapore ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 3: Singapore ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 4: Singapore ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Singapore ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Thailand ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 7: Thailand ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Thailand ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Thailand ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Malaysia ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 11: Malaysia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Malaysia ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Malaysia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Vietnam ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 15: Vietnam ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Vietnam ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Vietnam ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Indonesia ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 19: Indonesia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Indonesia ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Indonesia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Philippines ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 23: Philippines ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Philippines ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Philippines ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 27: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 28: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 29: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 2: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Warehousing and Distribution Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the ASEAN Warehousing and Distribution Industry?

Key companies in the market include DB Schenker, CWT Ltd, Ceva Logistics, Yusen Logistics, Ych Group, Gemadept, WHA Corporation, Kuehne + Nagel, Singapore Post, Agility, Kerry Logistics, CJ Century Logistics, Tiong Nam Logistics, Keppel Logistics**List Not Exhaustive 6 3 Other Companies (Key Information/Overview, DHL Supply Chain.

3. What are the main segments of the ASEAN Warehousing and Distribution Industry?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.50 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the demand for the Air Cargo Capacity; The Rise of E-commerce.

6. What are the notable trends driving market growth?

Increase in Warehousing Space in Thailand.

7. Are there any restraints impacting market growth?

Cargo Restrictions.

8. Can you provide examples of recent developments in the market?

August 2022: A.P. Moller - Maersk (Maersk) announced the successful completion of its acquisition of LF Logistics, a logistics firm with premium capabilities in omnichannel fulfillment services, e-commerce, and inland shipping in the ASEAN region. Following the acquisition, Maersk will expand its warehouse network by adding 223 warehouses to its current network and increasing the total number of facilities, spread across 9.5 million square meters, to 549.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Warehousing and Distribution Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Warehousing and Distribution Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Warehousing and Distribution Industry?

To stay informed about further developments, trends, and reports in the ASEAN Warehousing and Distribution Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence