Key Insights

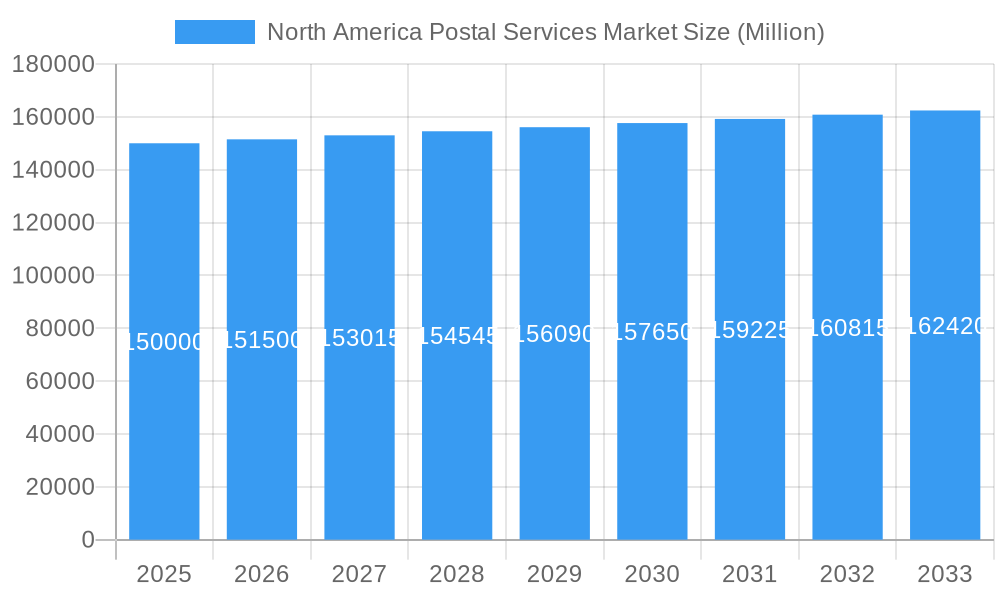

The North American postal services market, comprising express and standard delivery for letters and parcels (domestic and international), exhibits consistent expansion. This growth is propelled by escalating e-commerce, particularly cross-border transactions, and the indispensable need for efficient delivery networks. The market is forecast to achieve a Compound Annual Growth Rate (CAGR) of 1.14%. Leading entities including USPS, FedEx, UPS, DHL, and Canada Post are continually optimizing their offerings and infrastructure to address evolving customer and business demands, investing in advancements such as automated sorting and enhanced tracking. Market segmentation by service type (express vs. standard) and item (letter vs. parcel) highlights the diverse service portfolios tailored to specific needs. Parcel delivery dominates, driven by the rapid surge in online retail and the requirement for swift, secure package transit. Despite challenges like fluctuating fuel costs and competitive pressures from independent couriers, the market outlook remains optimistic, supported by ongoing digital transformation and the enduring demand for reliable postal solutions.

North America Postal Services Market Market Size (In Billion)

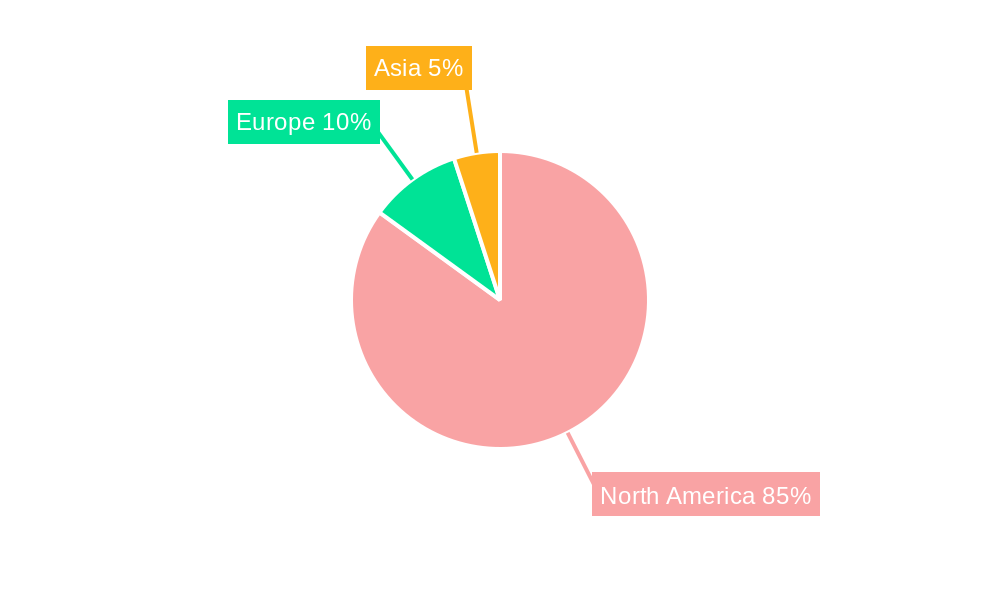

Regional growth across North America is projected to be uniform, with anticipated variations across sub-regions. As the continent's largest economy, the United States will remain a substantial contributor to market value. Canada and Mexico also present robust growth prospects, influenced by their expanding e-commerce sectors and increasing international trade. Intense competition among established providers fuels continuous service enhancements, strategic pricing, and alliances. Regulatory shifts and technological innovations will further shape the competitive environment, presenting both opportunities and challenges for incumbents and new entrants. Market projections for the forecast period (2025-2033) indicate a sustained upward trajectory, underscoring a positive future for the North American postal services market. The market size is estimated at 87.88 billion in the base year 2025.

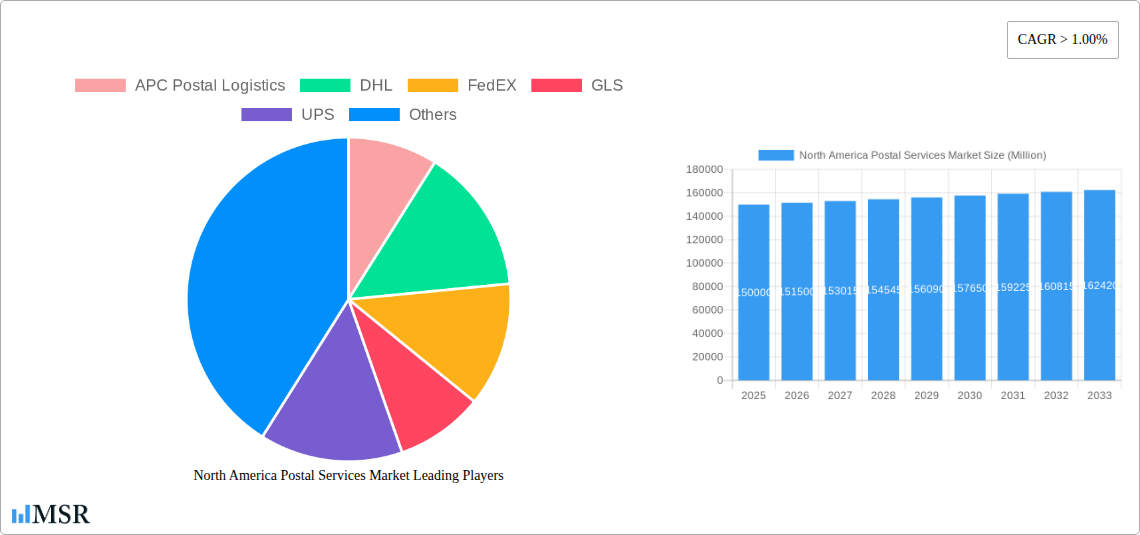

North America Postal Services Market Company Market Share

North America Postal Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America postal services market, encompassing market size, growth drivers, key players, and future trends. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The market is segmented by type (Express Postal Services, Standard Postal Services), item (Letter, Parcel), and destination (Domestic, International). Key players analyzed include, but are not limited to: APC Postal Logistics, DHL, FedEx, GLS, UPS, Grenada Postal Corporation, Santa Lucia Post, Correos de Mexico, USPS, Estafeta, Paquetexpress, Canada Post Corporation, and Purolator. The report's value surpasses USD xx Million in 2025 and is expected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Postal Services Market Market Concentration & Dynamics

The North American postal services market exhibits a moderately concentrated structure, dominated by major players like USPS, Canada Post, FedEx, UPS, and DHL. These companies hold a significant market share, cumulatively accounting for approximately xx% of the total market revenue in 2025. However, smaller regional players and specialized logistics providers are also emerging, particularly in the rapidly growing e-commerce sector.

The market dynamics are shaped by several factors:

- Innovation Ecosystems: Continuous investment in automation, technological advancements (e.g., AI-powered sorting, drone delivery), and data analytics is transforming operational efficiency and service offerings.

- Regulatory Frameworks: Government regulations related to pricing, service standards, and data privacy significantly impact market operations. Changes in these regulations can create both opportunities and challenges.

- Substitute Products: The rise of private courier services and alternative delivery models (e.g., crowdsourced delivery) poses a competitive threat, especially for standard postal services.

- End-User Trends: E-commerce growth and evolving consumer expectations for faster and more reliable deliveries are driving demand for express postal services and innovative last-mile solutions.

- M&A Activities: Consolidation through mergers and acquisitions is expected to continue, especially among smaller players seeking economies of scale and expanded service offerings. The number of M&A deals in the sector averaged xx per year during the historical period (2019-2024).

North America Postal Services Market Industry Insights & Trends

The North American postal services market is experiencing significant transformation fueled by the explosive growth of e-commerce and evolving consumer expectations. Market size in 2025 is estimated at USD xx Million, driven primarily by the increasing volume of parcels. The market is projected to grow at a CAGR of xx% from 2025 to 2033, reaching USD xx Million by the end of the forecast period. This growth is fueled by several key factors:

- E-commerce Boom: The continued expansion of online retail is the primary driver of market growth, particularly for parcel delivery services. Consumers increasingly expect fast and reliable delivery options, boosting demand for express and specialized services.

- Technological Disruptions: Automation, AI, and data analytics are improving efficiency, optimizing delivery routes, and enhancing tracking capabilities. Innovative technologies like drone delivery are emerging as potential game-changers.

- Changing Consumer Behavior: Consumers demand greater convenience and transparency. This has spurred demand for services such as real-time tracking, flexible delivery options, and improved customer service. The growing preference for same-day and next-day delivery also fuels market expansion.

- Government Initiatives: Government investment in postal infrastructure and support for technological advancements are contributing to market growth. Policy changes aimed at fostering competition and innovation are shaping the market landscape.

Key Markets & Segments Leading North America Postal Services Market

The United States holds the largest market share within North America, followed by Canada and Mexico. The parcel segment is experiencing the fastest growth, driven by e-commerce expansion.

Dominant Segments & Drivers:

- By Type: Express postal services are experiencing faster growth than standard services due to e-commerce.

- Drivers: Demand for faster delivery, increased online shopping.

- By Item: Parcel delivery dominates the market, significantly outpacing letter mail volume.

- Drivers: Growth of e-commerce, increased online retail sales.

- By Destination: Domestic deliveries comprise a larger share of the market than international shipments, but both segments are experiencing robust growth.

- Drivers: Growth of e-commerce, expanding international trade.

Dominance Analysis: The dominance of the parcel segment is linked directly to the rapid expansion of the e-commerce industry. The US market’s leadership is a reflection of its large economy and high levels of online retail activity.

North America Postal Services Market Product Developments

Significant product innovations are transforming the postal services landscape. The USPS Connect Local service, launched in 2022, highlights the industry's response to e-commerce growth and the need for cost-effective next-day delivery. New tracking technologies, improved logistics software, and the development of automated sorting facilities contribute to improved efficiency and service quality. These innovations provide competitive advantages by enhancing speed, reliability, and cost-effectiveness. The integration of sustainable practices, such as the use of electric vehicles and the development of eco-friendly packaging solutions, is also gaining importance.

Challenges in the North America Postal Services Market Market

The North America postal services market faces several challenges:

- Increasing Competition: Private courier companies and emerging delivery models pose significant competition, especially for cost-sensitive customers.

- Rising Labor Costs: Maintaining a large workforce and providing competitive wages presents ongoing challenges.

- Infrastructure Limitations: Updating and maintaining aging infrastructure is crucial for meeting the demands of growing package volume. This can be particularly costly.

- Regulatory Hurdles: Navigating complex regulatory environments can slow down innovation and market entry for new players. This is especially true for international shipments.

Forces Driving North America Postal Services Market Growth

Several factors contribute to the market's continued growth:

- E-commerce Expansion: The ongoing growth of e-commerce is the primary driver, demanding increased parcel delivery capacity.

- Technological Advancements: Automation and AI are improving efficiency and reducing costs.

- Government Support: Investments in infrastructure and supportive policies enhance market competitiveness.

Long-Term Growth Catalysts in the North America Postal Services Market

Long-term growth will be driven by ongoing technological innovations, strategic partnerships (e.g., collaborations with e-commerce platforms), and expansion into new markets and service offerings (e.g., specialized delivery solutions for pharmaceuticals or high-value goods). Sustainable practices and investments in renewable energy are also key to long-term success and a positive public image.

Emerging Opportunities in North America Postal Services Market

Emerging trends and opportunities include:

- Last-Mile Delivery Solutions: Improving efficiency and cost-effectiveness of last-mile delivery is crucial, presenting opportunities for innovative technologies and partnerships.

- Specialized Delivery Services: Meeting the needs of specific sectors, such as healthcare or high-value goods, opens up specialized market niches.

- Cross-Border E-commerce: Facilitating seamless cross-border e-commerce delivery presents significant growth opportunities.

- Sustainable Practices: Consumers are increasingly prioritizing environmentally friendly delivery options, presenting opportunities for green logistics.

Leading Players in the North America Postal Services Market Sector

- APC Postal Logistics

- DHL

- FedEx

- GLS

- UPS

- Grenada Postal Corporation

- Santa Lucia Post

- Correos de Mexico

- USPS

- Estafeta

- Paquetexpress

- Canada Post Corporation

- Purolator

Key Milestones in North America Postal Services Market Industry

February 2022: USPS launches USPS Connect Local, Regional, and National programs, along with USPS Connect Returns for faster, more affordable package delivery and returns. This initiative directly addresses the increasing demand for efficient and cost-effective next-day delivery options driven by the e-commerce boom.

May 2022: Canada Post unveils its new USD 470 Million zero-carbon parcel sorting facility, demonstrating significant investment in sustainable infrastructure and increasing capacity to meet the growing demand for parcel services. The facility’s substantial capacity increase underlines the significant expansion anticipated in the e-commerce sector and the postal industry's adaptation to meet this growth.

Strategic Outlook for North America Postal Services Market Market

The North America postal services market holds significant future potential. Continued growth in e-commerce, coupled with technological advancements and strategic partnerships, will drive market expansion. Companies that invest in innovative solutions, enhance customer experience, and embrace sustainable practices will be best positioned to capitalize on this growth. The focus on last-mile delivery optimization, specialized services, and international expansion will be key strategic differentiators.

North America Postal Services Market Segmentation

-

1. Type

- 1.1. Express Postal Services

- 1.2. Standard Postal Services

-

2. Item

- 2.1. Letter

- 2.2. Parcel

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. Geography

- 4.1. US

- 4.2. Canada

- 4.3. Mexico

North America Postal Services Market Segmentation By Geography

- 1. US

- 2. Canada

- 3. Mexico

North America Postal Services Market Regional Market Share

Geographic Coverage of North America Postal Services Market

North America Postal Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Air cargo Transportation

- 3.3. Market Restrains

- 3.3.1. High Operation and Maintainance Cost

- 3.4. Market Trends

- 3.4.1. eCommerce Opens Opportunities for Postal Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Express Postal Services

- 5.1.2. Standard Postal Services

- 5.2. Market Analysis, Insights and Forecast - by Item

- 5.2.1. Letter

- 5.2.2. Parcel

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. US

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. US

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. US North America Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Express Postal Services

- 6.1.2. Standard Postal Services

- 6.2. Market Analysis, Insights and Forecast - by Item

- 6.2.1. Letter

- 6.2.2. Parcel

- 6.3. Market Analysis, Insights and Forecast - by Destination

- 6.3.1. Domestic

- 6.3.2. International

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. US

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Express Postal Services

- 7.1.2. Standard Postal Services

- 7.2. Market Analysis, Insights and Forecast - by Item

- 7.2.1. Letter

- 7.2.2. Parcel

- 7.3. Market Analysis, Insights and Forecast - by Destination

- 7.3.1. Domestic

- 7.3.2. International

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. US

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Express Postal Services

- 8.1.2. Standard Postal Services

- 8.2. Market Analysis, Insights and Forecast - by Item

- 8.2.1. Letter

- 8.2.2. Parcel

- 8.3. Market Analysis, Insights and Forecast - by Destination

- 8.3.1. Domestic

- 8.3.2. International

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. US

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 APC Postal Logistics

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 DHL

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 FedEX

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 GLS

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 UPS

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Grenada Postal Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Santa Lucia Post

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Correos de Mexico

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 USPS

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Estafeta

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Paquetexpress**List Not Exhaustive

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Canada Post Corporation

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Purolator

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.1 APC Postal Logistics

List of Figures

- Figure 1: North America Postal Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Postal Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 3: North America Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: North America Postal Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Postal Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: North America Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 8: North America Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: North America Postal Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 13: North America Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 14: North America Postal Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: North America Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 18: North America Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 19: North America Postal Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Postal Services Market?

The projected CAGR is approximately 1.14%.

2. Which companies are prominent players in the North America Postal Services Market?

Key companies in the market include APC Postal Logistics, DHL, FedEX, GLS, UPS, Grenada Postal Corporation, Santa Lucia Post, Correos de Mexico, USPS, Estafeta, Paquetexpress**List Not Exhaustive, Canada Post Corporation, Purolator.

3. What are the main segments of the North America Postal Services Market?

The market segments include Type, Item, Destination, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Air cargo Transportation.

6. What are the notable trends driving market growth?

eCommerce Opens Opportunities for Postal Services.

7. Are there any restraints impacting market growth?

High Operation and Maintainance Cost.

8. Can you provide examples of recent developments in the market?

February 2022: In a bid to capture more packages for next-day delivery, the United States Postal Service has created a new, cheaper parcel service called 'USPS Connect Local.' The service will enable shippers to get next-day, first-class service on document packages of up to 13 ounces for USD 2.95, according to an order from the Postal Regulatory Commission. The USPS also will offer expedited service on shipments under new 'USPS Connect Regional' and 'USPS Connect National' programs. The agency also created a fourth program to help speed product return parcels. The program is called 'USPS Connect Returns' and promises free return package pickups by letter carriers or drop-offs at post offices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Postal Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Postal Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Postal Services Market?

To stay informed about further developments, trends, and reports in the North America Postal Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence