Key Insights

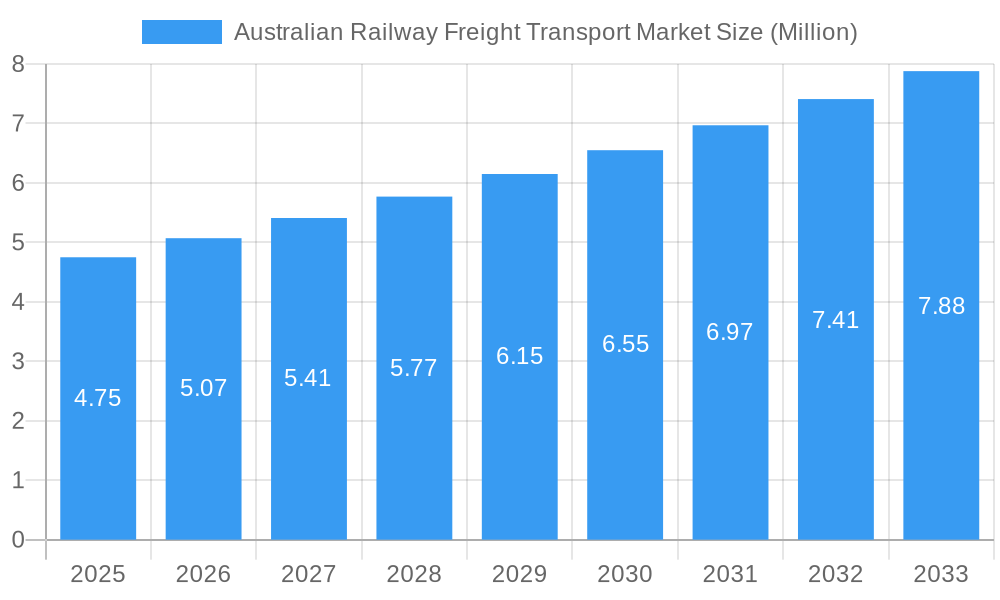

The Australian Railway Freight Transport Market is projected to reach a significant valuation of approximately USD 4.75 million in 2025, underscoring its critical role in the nation's logistics infrastructure. This market is expected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 6.63% anticipated over the forecast period of 2025-2033. This upward trajectory is primarily fueled by several key drivers, including the increasing demand for efficient and cost-effective movement of bulk commodities like coal, iron ore, and agricultural products, which are central to Australia's export economy. Furthermore, a growing emphasis on sustainable transportation solutions, coupled with government investments in rail network upgrades and expansion, is providing a significant impetus for market expansion. The continuous development of intermodal transport, integrating rail with other modes like road and sea, is enhancing supply chain efficiency and further bolstering the market's prospects.

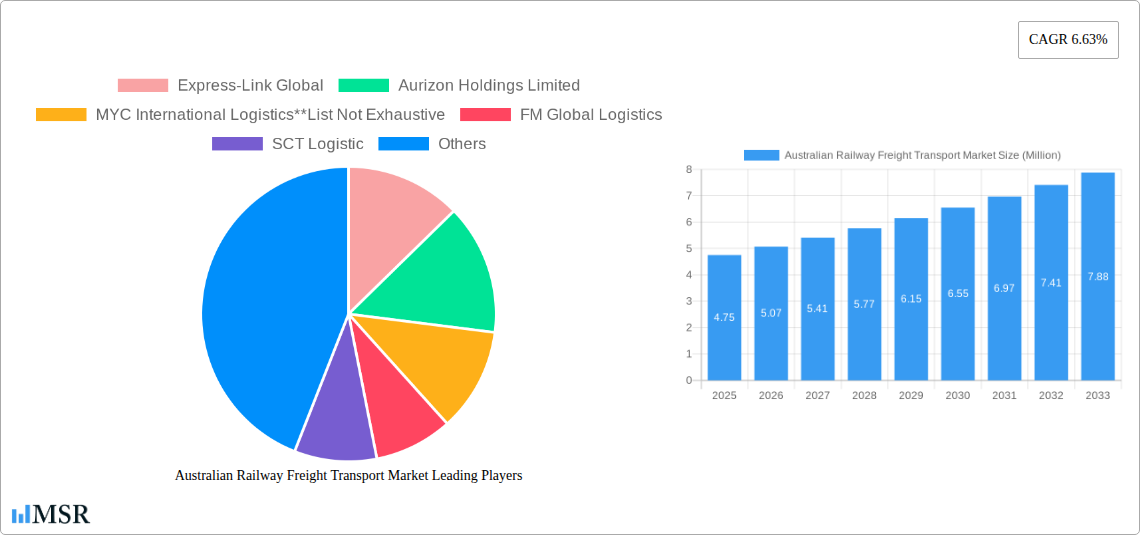

Australian Railway Freight Transport Market Market Size (In Million)

The market is segmented into distinct service types, encompassing transportation, and broader services, reflecting the multifaceted nature of the industry. The cargo type segment is diverse, with containerized (including intermodal) and non-containerized freight forming key components, alongside specialized handling of liquid bulk cargo. The demand across domestic and international destinations highlights the extensive reach of Australia's rail freight network. Despite the positive outlook, certain restraints such as the high initial capital investment for infrastructure development and the need for skilled labor to operate and maintain the rail systems present ongoing challenges. However, ongoing technological advancements in rolling stock, signaling, and logistics management, alongside a proactive approach to addressing infrastructure bottlenecks, are expected to mitigate these challenges and drive sustained growth in the Australian Railway Freight Transport Market.

Australian Railway Freight Transport Market Company Market Share

Here's an SEO-optimized and engaging report description for the Australian Railway Freight Transport Market:

Gain unparalleled insights into the Australian railway freight transport market, a critical component of the nation's logistics and supply chain infrastructure. This in-depth report, spanning 2019-2033, with a strong base year of 2025 and a detailed forecast period of 2025-2033, delivers a comprehensive market analysis. Discover key growth drivers, technological innovations, market dynamics, and strategic opportunities shaping the future of Australian rail freight. Essential for industry stakeholders, investors, and policymakers seeking to understand the Australian rail cargo market, intermodal transport Australia, and bulk freight rail services.

Australian Railway Freight Transport Market Market Concentration & Dynamics

The Australian railway freight transport market exhibits a moderate to high concentration, dominated by a few key players. Aurizon Holdings Limited and Pacific National Holdings Pty Ltd hold significant market shares, influencing pricing and service offerings. Innovation ecosystems are steadily developing, with a focus on digital transformation, automation, and efficiency improvements. Regulatory frameworks, while generally supportive of infrastructure development, can pose challenges for new entrants. Substitute products, primarily road and sea freight, continue to exert competitive pressure, particularly for shorter distances and specialized cargo. End-user trends indicate a growing demand for sustainable and cost-effective logistics solutions, pushing rail freight's inherent advantages. Merger and acquisition (M&A) activities have been sporadic but significant, aimed at consolidating market presence and expanding service portfolios. For instance, there have been approximately 3-5 notable M&A deals in the historical period. Aurizon Holdings Limited, for example, has been actively involved in strategic acquisitions to enhance its operational capabilities. Market share for the top 3 players is estimated to be around 70-80% in the base year of 2025.

Australian Railway Freight Transport Market Industry Insights & Trends

The Australian railway freight transport market is poised for substantial growth, driven by a confluence of economic, technological, and environmental factors. The estimated market size in 2025 is expected to reach AUD 15,000 Million, with a projected Compound Annual Growth Rate (CAGR) of 5.5% during the forecast period of 2025-2033. This robust expansion is fueled by increasing demand for bulk commodities exports, including iron ore and coal, which are predominantly transported via rail. Furthermore, the burgeoning e-commerce sector and the need for efficient intermodal transport Australia solutions are creating significant opportunities for containerized freight movement. Technological disruptions are playing a pivotal role, with advancements in digital freight matching platforms, AI-powered route optimization, and the adoption of predictive maintenance technologies enhancing operational efficiency and reducing costs. Evolving consumer behaviors, particularly the increasing preference for environmentally friendly transportation options, are also tipping the scales in favor of rail freight, which offers a lower carbon footprint compared to road transport. The ongoing investment in national rail infrastructure projects, aimed at improving connectivity and capacity, further underpins the market's positive trajectory. The market is also seeing a gradual shift towards specialized rail services for high-value goods, moving beyond traditional bulk commodities.

Key Markets & Segments Leading Australian Railway Freight Transport Market

The Australian railway freight transport market is primarily led by the Domestic destination segment, driven by the vast geographical distances and the economic imperative to move bulk commodities and manufactured goods efficiently across the continent. Within Services, Transportation is the dominant segment, encompassing the core rail haulage operations. The Cargo Type analysis reveals that Containerized (Includes Intermodal) freight is experiencing significant growth, propelled by the rise of e-commerce and the need for seamless integration with port operations and road networks. This segment benefits from increased investment in intermodal terminals and the efficiency gains offered by containerized logistics.

- Drivers for Domestic Transportation Dominance:

- Economic Growth & Resource Exports: Australia's strong reliance on resource exports (iron ore, coal) necessitates extensive rail networks for transportation to ports.

- Infrastructure Investment: Ongoing government and private investment in upgrading and expanding the national rail network enhances capacity and reach for domestic freight.

- Cost-Effectiveness: For long-haul movements of bulk and containerized goods, rail offers a more cost-effective solution compared to road transport.

- Environmental Sustainability: Growing awareness of carbon emissions favors rail's lower environmental impact for large-scale freight movements.

The International destination segment, while smaller in comparison for direct rail movements, plays a crucial indirect role through its connection to major ports for export and import activities, heavily reliant on efficient domestic rail links. The Non-containerized segment, particularly for bulk commodities, remains a cornerstone of the market, contributing significantly to the overall freight volumes. However, the growth trajectory for Liquid Bulk rail transport is also noteworthy, driven by specialized industries requiring efficient and safe transportation of liquids. The strategic importance of intermodal transport Australia cannot be overstated, as it bridges the gap between different modes of transport, optimizing supply chains.

Australian Railway Freight Transport Market Product Developments

Product developments in the Australian railway freight transport market are increasingly focused on enhancing efficiency, safety, and sustainability. Innovations include the deployment of advanced telematics for real-time tracking and monitoring of rolling stock, enabling predictive maintenance and optimizing operational performance. The development of lighter yet stronger wagon designs contributes to fuel efficiency and increased carrying capacity. Furthermore, advancements in digital platforms for freight booking and management are streamlining processes for shippers and logistics providers. These technological advancements are crucial for maintaining a competitive edge in the evolving logistics landscape.

Challenges in the Australian Railway Freight Transport Market Market

Despite strong growth prospects, the Australian railway freight transport market faces several challenges. Regulatory hurdles, particularly around track access and pricing, can impact market competitiveness and operational flexibility. Supply chain disruptions, exacerbated by factors like labor shortages and extreme weather events, can lead to service delays and increased costs. Competitive pressures from the road freight sector, especially for time-sensitive or last-mile deliveries, remain a constant concern. Furthermore, the substantial capital investment required for new rolling stock and infrastructure upgrades can be a barrier to entry for smaller players.

Forces Driving Australian Railway Freight Transport Market Growth

Several key forces are driving the growth of the Australian railway freight transport market. Technological advancements, including automation, AI, and digital freight platforms, are improving efficiency and reducing operational costs. Economic expansion, particularly in the mining and agricultural sectors, directly translates to increased demand for bulk commodity transport. Government initiatives and infrastructure investments aimed at expanding and modernizing the rail network are enhancing capacity and connectivity. The growing emphasis on environmental sustainability is also a significant driver, as rail freight offers a more eco-friendly alternative to road transport.

Challenges in the Australian Railway Freight Transport Market Market

Long-term growth catalysts for the Australian railway freight transport market lie in continued innovation and adoption of advanced technologies. Investments in green rail technologies, such as hydrogen-powered locomotives, could unlock new markets and meet stringent environmental targets. Strategic partnerships and collaborations between rail operators, shippers, and technology providers will foster greater integration and efficiency across the supply chain. Furthermore, market expansions into new commodity types and a focus on providing end-to-end logistics solutions will solidify rail's position in the market.

Emerging Opportunities in Australian Railway Freight Transport Market

Emerging opportunities in the Australian railway freight transport market are abundant and diverse. The development of new freight corridors and the expansion of existing ones present significant growth potential. The increasing demand for sustainable logistics solutions creates a strong market for rail's lower carbon footprint. Advances in digital freight marketplaces are streamlining the booking process and increasing transparency. Furthermore, the growing importance of regional logistics hubs and the need to connect them efficiently via rail offer untapped potential for specialized freight services.

Leading Players in the Australian Railway Freight Transport Market Sector

- Express-Link Global

- Aurizon Holdings Limited

- MYC International Logistics

- FM Global Logistics

- SCT Logistic

- Southern Shorthaul Railroad

- Wakefield Transport

- KTI Transport

- Innovation Transport Services

- Pacific National Holdings Pty Ltd

Key Milestones in Australian Railway Freight Transport Market Industry

- 2019: Significant investment announced for the Inland Rail project, aimed at boosting freight capacity.

- 2020: Increased adoption of digital freight management platforms by key operators to enhance efficiency.

- 2021: Aurizon Holdings Limited completes strategic acquisition to expand its bulk haulage network.

- 2022: Focus on sustainability intensifies, with exploration of alternative fuel technologies for rail operations.

- 2023: Pacific National Holdings Pty Ltd announces expansion of its intermodal services to meet growing e-commerce demand.

- 2024: Continued investment in track upgrades and modernization across key freight routes.

Strategic Outlook for Australian Railway Freight Transport Market Market

The strategic outlook for the Australian railway freight transport market is exceptionally positive, driven by a sustained demand for efficient and sustainable logistics. Growth accelerators include continued investment in infrastructure, the embrace of digital technologies for operational optimization, and a strong market push towards greener transportation solutions. The market is poised to benefit from the increasing volume of resource exports and the evolving needs of the e-commerce sector, further solidifying rail's indispensable role in the Australian supply chain.

Australian Railway Freight Transport Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Services

-

2. Cargo Type

- 2.1. Containerized (Includes Intermodal)

- 2.2. Non-containerized

- 2.3. Liquid Bulk

-

3. Destination

- 3.1. Domestic

- 3.2. International

Australian Railway Freight Transport Market Segmentation By Geography

- 1. Australia

Australian Railway Freight Transport Market Regional Market Share

Geographic Coverage of Australian Railway Freight Transport Market

Australian Railway Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. Increasing rail investment infrastructure has given positive outlook to rail freight transport market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australian Railway Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Containerized (Includes Intermodal)

- 5.2.2. Non-containerized

- 5.2.3. Liquid Bulk

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Express-Link Global

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aurizon Holdings Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MYC International Logistics**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FM Global Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SCT Logistic

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Southern Shorthaul Railroad

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wakefield Transport

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 KTI Transport

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Innovation Transport Services

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pacific National Holdings Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Express-Link Global

List of Figures

- Figure 1: Australian Railway Freight Transport Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australian Railway Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Australian Railway Freight Transport Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Australian Railway Freight Transport Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 3: Australian Railway Freight Transport Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Australian Railway Freight Transport Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Australian Railway Freight Transport Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Australian Railway Freight Transport Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 7: Australian Railway Freight Transport Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 8: Australian Railway Freight Transport Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australian Railway Freight Transport Market?

The projected CAGR is approximately 6.63%.

2. Which companies are prominent players in the Australian Railway Freight Transport Market?

Key companies in the market include Express-Link Global, Aurizon Holdings Limited, MYC International Logistics**List Not Exhaustive, FM Global Logistics, SCT Logistic, Southern Shorthaul Railroad, Wakefield Transport, KTI Transport, Innovation Transport Services, Pacific National Holdings Pty Ltd.

3. What are the main segments of the Australian Railway Freight Transport Market?

The market segments include Service, Cargo Type, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

Increasing rail investment infrastructure has given positive outlook to rail freight transport market.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australian Railway Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australian Railway Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australian Railway Freight Transport Market?

To stay informed about further developments, trends, and reports in the Australian Railway Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence