Key Insights

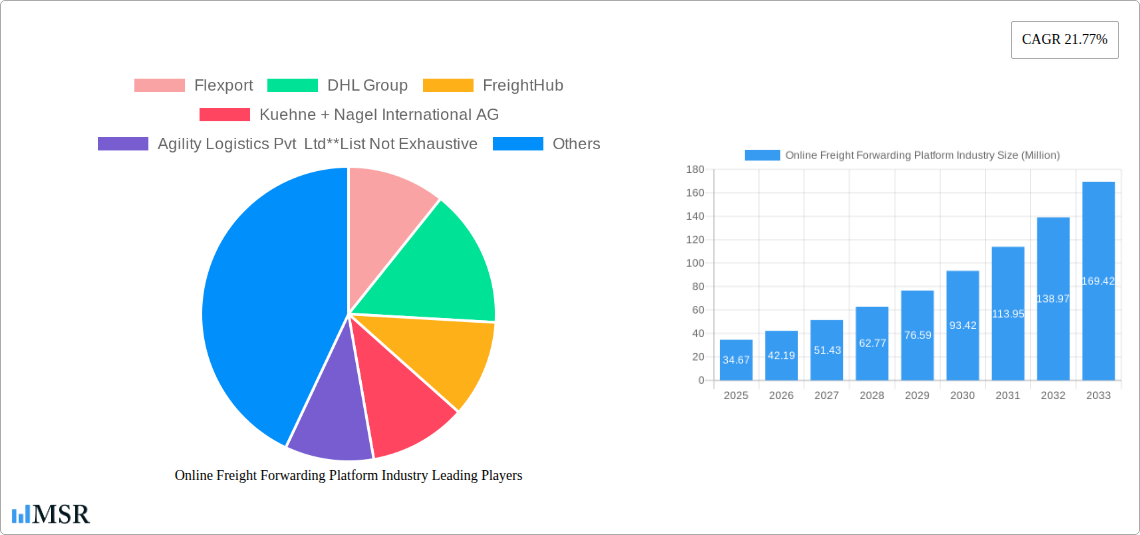

The Online Freight Forwarding Platform industry is poised for exceptional growth, with a current market size estimated at approximately USD 34.67 million in 2025. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 21.77% throughout the forecast period of 2025-2033, suggesting a rapid expansion and increasing adoption of digital solutions in freight management. This significant surge is primarily driven by the accelerating need for enhanced supply chain transparency, greater operational efficiency, and cost optimization within the logistics sector. The shift towards digital platforms offers businesses unprecedented real-time visibility of their shipments, streamlined booking processes, automated documentation, and improved communication channels with carriers and customers. Key trends fueling this growth include the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics and route optimization, the rise of e-commerce demanding faster and more flexible delivery solutions, and a growing preference for integrated, end-to-end digital logistics services. These platforms are fundamentally transforming traditional freight forwarding by democratizing access to global shipping services and empowering businesses of all sizes to compete more effectively in the international market.

Online Freight Forwarding Platform Industry Market Size (In Million)

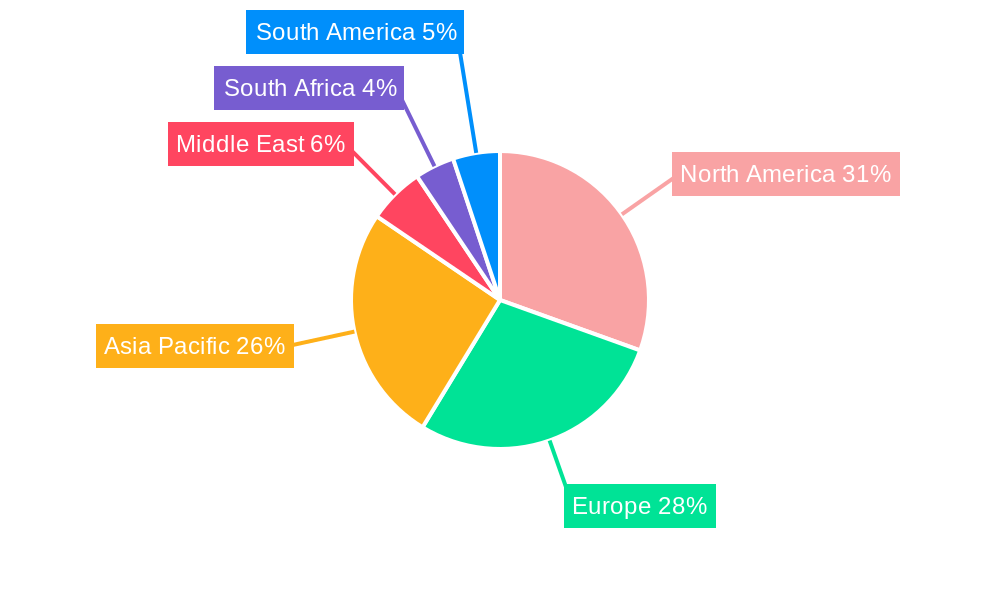

While the market exhibits strong positive momentum, certain restraints could temper its pace. These include the initial investment required for platform development and adoption, the complexity of integrating with existing legacy systems for some established logistics providers, and the cybersecurity concerns associated with handling sensitive shipment data. Furthermore, the need for standardization across different regions and modes of transport remains a challenge. Despite these hurdles, the overwhelming benefits of digital freight forwarding, such as reduced transit times, improved resource allocation, and enhanced customer satisfaction, are expected to outweigh these limitations. The industry is witnessing significant traction across various modes of transport, including land, sea, and air, with platforms offering comprehensive solutions. Leading companies like Flexport, DHL Group, and Kuehne + Nagel International AG are actively investing in and expanding their digital offerings, further solidifying the market's trajectory. Regional data indicates strong potential in North America, Europe, and Asia Pacific, driven by advanced infrastructure and high adoption rates of technology.

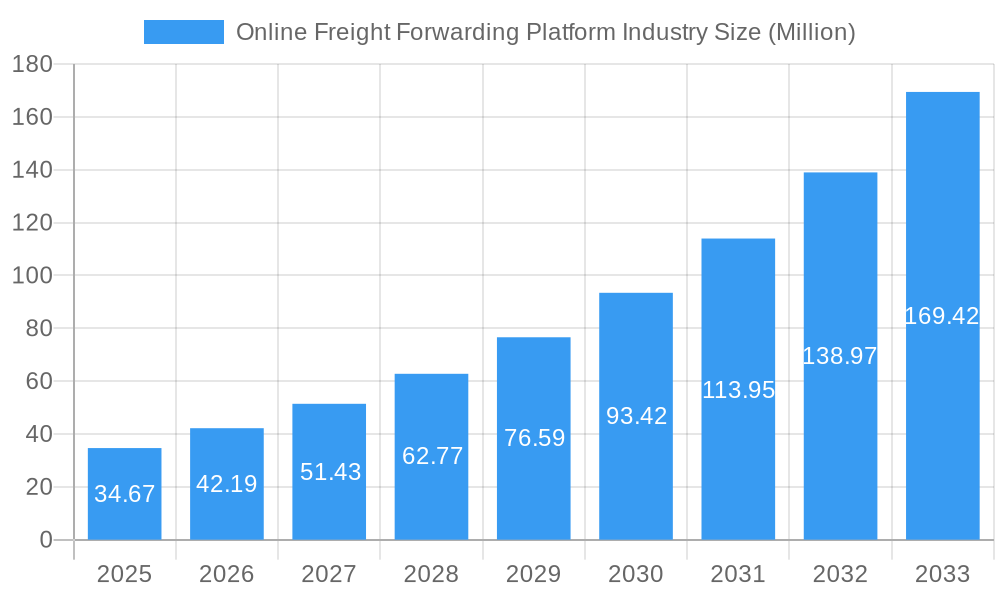

Online Freight Forwarding Platform Industry Company Market Share

This comprehensive report dives deep into the dynamic Online Freight Forwarding Platform Industry, a rapidly evolving sector reshaping global logistics. We provide unparalleled insights into market concentration, growth drivers, key segments, product innovations, challenges, and emerging opportunities, equipping industry stakeholders with actionable intelligence for strategic decision-making. Covering the historical period from 2019-2024 and forecasting through 2033, with a base year of 2025, this analysis is your definitive guide to navigating the future of digital freight.

Online Freight Forwarding Platform Industry Market Concentration & Dynamics

The Online Freight Forwarding Platform Industry exhibits a moderate to high market concentration, characterized by a blend of established global giants and agile digital disruptors. Leading players like Flexport, DHL Group, and Kuehne + Nagel International AG command significant market share through extensive networks and integrated service offerings. However, innovative platforms such as FreightHub, InstaFreight, and Twill are rapidly gaining traction by leveraging technology to offer enhanced transparency, efficiency, and user experience. The innovation ecosystem is vibrant, with continuous development in AI-powered route optimization, blockchain for enhanced security, and IoT for real-time cargo tracking. Regulatory frameworks are evolving to accommodate digital trade and e-commerce, with a growing emphasis on data privacy and cybersecurity. Substitute products, such as traditional freight brokers and in-house logistics departments, are increasingly adopting digital solutions to remain competitive. End-user trends are strongly leaning towards digital-first solutions, demanding greater visibility, predictive analytics, and seamless integration. Mergers and acquisitions (M&A) are a notable feature, with approximately 25 major M&A deals recorded in the historical period, indicating consolidation and strategic expansion efforts by key players to acquire technological capabilities or market reach.

Online Freight Forwarding Platform Industry Industry Insights & Trends

The Online Freight Forwarding Platform Industry is poised for substantial expansion, driven by an escalating demand for efficient, transparent, and cost-effective global logistics solutions. The market size is projected to reach $120 Million by the estimated year of 2025, with a projected Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period of 2025–2033. This robust growth is fueled by several key factors. The surge in global e-commerce, necessitating faster and more reliable international shipping, is a primary catalyst. Technological disruptions, including the widespread adoption of cloud computing, artificial intelligence (AI) for demand forecasting and route optimization, and the Internet of Things (IoT) for real-time shipment tracking, are transforming operational efficiencies. Evolving consumer behaviors, characterized by an expectation for instant gratification and end-to-end visibility, are compelling freight forwarders to embrace digital platforms. Furthermore, the increasing complexity of supply chains and the need for agile responses to geopolitical and economic shifts are pushing businesses towards digitized freight solutions. The integration of blockchain technology is also emerging as a significant trend, promising enhanced security, immutability of records, and streamlined customs processes.

Key Markets & Segments Leading Online Freight Forwarding Platform Industry

The Online Freight Forwarding Platform Industry is witnessing dominance across various modes of transport, with Sea Freight currently holding the largest market share due to its cost-effectiveness for bulk cargo and its integral role in international trade. However, Land Freight is experiencing rapid digital adoption, particularly in regions with well-developed road and rail infrastructure, driven by the increasing demand for last-mile delivery and intermodal transportation. Air Freight, while a premium segment, is seeing significant innovation in online booking and real-time tracking for high-value and time-sensitive goods.

Key Drivers for Dominance:

- Sea Freight:

- Economic Growth: Global trade expansion and increasing consumption of goods manufactured overseas.

- Infrastructure: Development of major ports and efficient intermodal connections to hinterlands.

- Cost-Effectiveness: Lower per-unit shipping costs for large volumes compared to other modes.

- Land Freight:

- E-commerce Boom: The exponential growth of online retail necessitates efficient domestic and cross-border trucking.

- Technological Advancements: Sophistication of fleet management software, GPS tracking, and telematics.

- Regional Integration: Trade agreements and improved cross-border logistics infrastructure.

- Air Freight:

- Time-Sensitivity: Critical for industries like pharmaceuticals, electronics, and perishables.

- Value of Goods: Higher willingness to pay for speed and security for high-value shipments.

- Technological Innovation: Development of specialized cargo handling and real-time monitoring.

The dominance of Sea Freight is underpinned by its established infrastructure and capacity to handle vast quantities of goods, making it the backbone of global supply chains. Land freight's rise is directly linked to the e-commerce revolution and the need for agile, localized distribution networks. Air freight, while smaller in volume, plays a crucial role in enabling rapid global commerce for specialized products.

Online Freight Forwarding Platform Industry Product Developments

Recent product developments in the Online Freight Forwarding Platform Industry focus on enhancing user experience and operational efficiency. Innovations include AI-driven dynamic pricing, automated documentation generation, and predictive analytics for shipment delays. Platforms like Flexport continue to invest in their digital dashboards, offering end-to-end visibility from booking to delivery. Kuehne + Nagel International AG is leveraging its KN Freight Net platform for seamless online quotation and booking. Emerging players like InstaFreight and Twill are differentiating themselves with user-friendly interfaces and integrated partner networks, making complex logistics more accessible. The market relevance of these developments lies in their ability to reduce manual effort, improve decision-making through data insights, and ultimately lower the total cost of shipping for businesses of all sizes.

Challenges in the Online Freight Forwarding Platform Industry Market

The Online Freight Forwarding Platform Industry faces several significant challenges. Regulatory hurdles, including varying customs procedures across different countries and evolving trade policies, can complicate international shipments. Supply chain disruptions, such as port congestion, geopolitical instability, and labor shortages, directly impact transit times and costs. Fierce competitive pressures from both established logistics providers and new digital entrants necessitate continuous innovation and cost optimization. The initial investment required for robust platform development and integration can also be a barrier for smaller players. Quantifiable impacts include an estimated 10-15% increase in operational costs due to unforeseen disruptions.

Forces Driving Online Freight Forwarding Platform Industry Growth

Several key forces are propelling the growth of the Online Freight Forwarding Platform Industry. The persistent rise of global e-commerce, demanding faster and more transparent shipping, is a primary driver. Technological advancements, including AI for route optimization, blockchain for enhanced security, and IoT for real-time tracking, are revolutionizing operational efficiencies. Economic globalization and the increasing interconnectedness of economies necessitate streamlined international logistics. Furthermore, government initiatives promoting digital trade and reducing trade barriers are creating a more conducive environment for online freight forwarding solutions.

Challenges in the Online Freight Forwarding Platform Industry Market

Long-term growth catalysts for the Online Freight Forwarding Platform Industry lie in sustained technological innovation and strategic market expansion. The continued evolution of AI and machine learning will enable more sophisticated predictive analytics, further optimizing supply chains. The expansion of e-commerce into emerging markets presents significant opportunities for platforms to establish a presence and cater to new customer bases. Strategic partnerships between freight forwarders, technology providers, and end-users will foster greater collaboration and create more integrated logistics ecosystems. The development of sustainable logistics solutions, driven by environmental concerns, will also become a crucial growth differentiator.

Emerging Opportunities in Online Freight Forwarding Platform Industry

Emerging opportunities in the Online Freight Forwarding Platform Industry are abundant. The burgeoning demand for specialized logistics services, such as cold chain logistics for pharmaceuticals and temperature-sensitive goods, presents a significant niche. The increasing adoption of autonomous vehicles and drones for last-mile delivery offers potential for enhanced efficiency and reduced costs. Furthermore, the development of sophisticated sustainability tracking and reporting features on platforms can cater to the growing corporate focus on environmental, social, and governance (ESG) factors. Exploring partnerships with e-commerce marketplaces to offer integrated shipping solutions is another promising avenue.

Leading Players in the Online Freight Forwarding Platform Industry Sector

- Flexport

- DHL Group

- FreightHub

- Kuehne + Nagel International AG

- Agility Logistics Pvt Ltd

- Fleet

- InstaFreight

- Turvo

- iContainers

- Twill

- KN Freight Net

- Transporteca

- Kontainers

Key Milestones in Online Freight Forwarding Platform Industry Industry

- 2019: Flexport secures significant funding to expand its platform capabilities.

- 2020: DHL Group invests heavily in digital transformation initiatives.

- 2021: FreightHub announces strategic partnerships to expand its European network.

- 2022: Kuehne + Nagel International AG launches enhancements to its KN Freight Net platform.

- 2023: Agility Logistics Pvt Ltd integrates advanced AI for route optimization.

- 2024: InstaFreight achieves significant growth in its European operations.

Strategic Outlook for Online Freight Forwarding Platform Industry Market

The strategic outlook for the Online Freight Forwarding Platform Industry is exceptionally positive, driven by the imperative for digitization in global trade. Future growth accelerators will include the widespread adoption of IoT for end-to-end supply chain visibility, AI-powered predictive analytics for proactive risk management, and blockchain for enhanced trust and security. Companies that can offer seamless, integrated, and data-driven solutions will thrive. Strategic opportunities lie in expanding into under-served markets, developing specialized solutions for niche industries, and fostering robust partnerships to create a more connected and efficient global logistics ecosystem.

Online Freight Forwarding Platform Industry Segmentation

-

1. Mode of Transport

- 1.1. Land

- 1.2. Sea

- 1.3. Air

Online Freight Forwarding Platform Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. Netherlands

- 2.4. United Kingdom

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Singapore

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. South Korea

- 3.9. Rest of Asia Pacific

- 4. Middle East

-

5. South Africa

- 5.1. Egypt

- 5.2. GCC Countries

- 5.3. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Chile

- 6.3. Rest of South America

Online Freight Forwarding Platform Industry Regional Market Share

Geographic Coverage of Online Freight Forwarding Platform Industry

Online Freight Forwarding Platform Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS

- 3.3. Market Restrains

- 3.3.1. 4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES

- 3.4. Market Trends

- 3.4.1. Growth in E-Commerce driving Digital Freight Forwarding Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Land

- 5.1.2. Sea

- 5.1.3. Air

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. South Africa

- 5.2.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. North America Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6.1.1. Land

- 6.1.2. Sea

- 6.1.3. Air

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 7. Europe Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 7.1.1. Land

- 7.1.2. Sea

- 7.1.3. Air

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 8. Asia Pacific Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 8.1.1. Land

- 8.1.2. Sea

- 8.1.3. Air

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 9. Middle East Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 9.1.1. Land

- 9.1.2. Sea

- 9.1.3. Air

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 10. South Africa Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 10.1.1. Land

- 10.1.2. Sea

- 10.1.3. Air

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 11. South America Online Freight Forwarding Platform Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 11.1.1. Land

- 11.1.2. Sea

- 11.1.3. Air

- 11.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Flexport

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DHL Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 FreightHub

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kuehne + Nagel International AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Agility Logistics Pvt Ltd**List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Fleet

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 InstaFreight

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Turvo

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 iContainers

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Twill

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 KN Freight Net

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Transporteca

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Kontainers

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Flexport

List of Figures

- Figure 1: Global Online Freight Forwarding Platform Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 3: North America Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 4: North America Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 7: Europe Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 8: Europe Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 11: Asia Pacific Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 12: Asia Pacific Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 15: Middle East Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 16: Middle East Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South Africa Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 19: South Africa Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 20: South Africa Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South Africa Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: South America Online Freight Forwarding Platform Industry Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 23: South America Online Freight Forwarding Platform Industry Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 24: South America Online Freight Forwarding Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Online Freight Forwarding Platform Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 4: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 9: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 17: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Australia Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Singapore Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Malaysia Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Indonesia Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: South Korea Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 28: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 30: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Egypt Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: GCC Countries Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 35: Global Online Freight Forwarding Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Chile Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of South America Online Freight Forwarding Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Freight Forwarding Platform Industry?

The projected CAGR is approximately 21.77%.

2. Which companies are prominent players in the Online Freight Forwarding Platform Industry?

Key companies in the market include Flexport, DHL Group, FreightHub, Kuehne + Nagel International AG, Agility Logistics Pvt Ltd**List Not Exhaustive, Fleet, InstaFreight, Turvo, iContainers, Twill, KN Freight Net, Transporteca, Kontainers.

3. What are the main segments of the Online Freight Forwarding Platform Industry?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.67 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS.

6. What are the notable trends driving market growth?

Growth in E-Commerce driving Digital Freight Forwarding Market.

7. Are there any restraints impacting market growth?

4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Freight Forwarding Platform Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Freight Forwarding Platform Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Freight Forwarding Platform Industry?

To stay informed about further developments, trends, and reports in the Online Freight Forwarding Platform Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence