Key Insights

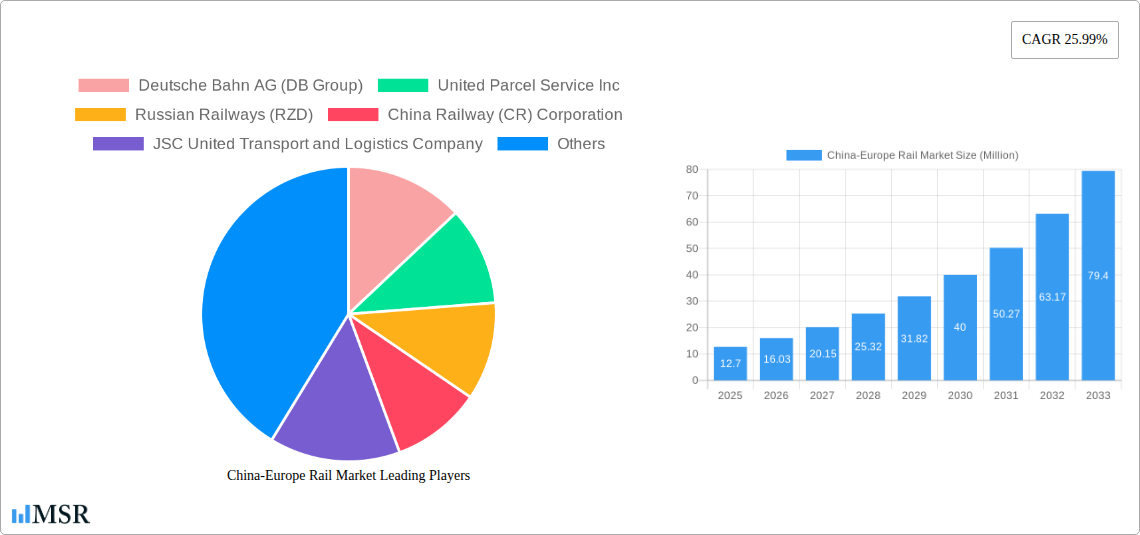

The China-Europe rail freight market is experiencing explosive growth, projected to reach an impressive $12.70 million in 2025 and sustain a remarkable Compound Annual Growth Rate (CAGR) of 25.99% through 2033. This robust expansion is primarily fueled by the continuous drive for more efficient, cost-effective, and environmentally sustainable logistics solutions that outpace traditional sea freight in transit times. The burgeoning Belt and Road Initiative (BRI) has significantly bolstered this trend, fostering increased trade volumes and improving infrastructure connectivity between China and Europe. Key drivers include the rising demand for intermodal transportation, the growing preference for containerized cargo due to its handling efficiency, and the increasing adoption of integrated logistics services that encompass both transportation and allied services. The market's segmentation is heavily influenced by the dominance of containerized cargo, which offers greater flexibility and security, alongside a growing demand for liquid bulk transport. The service sector is propelled by the core transportation segment, complemented by essential allied services like customs clearance, warehousing, and last-mile delivery, which are crucial for seamless cross-border operations.

China-Europe Rail Market Market Size (In Million)

While the market demonstrates exceptional growth, certain restraints need to be addressed. These include infrastructure limitations in specific regions, potential geopolitical uncertainties that can impact trade flows, and the need for further standardization of regulations and customs procedures across different countries. However, the prevailing trends are overwhelmingly positive. The increasing focus on reducing carbon footprints is steering businesses towards rail as a greener alternative to air and sea freight. Technological advancements, such as real-time tracking and advanced fleet management systems, are enhancing operational efficiency and visibility, further solidifying rail's appeal. Emerging trends like the development of specialized rail services for high-value goods and the expansion of intermodal hubs are expected to drive future growth. Leading players like Deutsche Bahn AG, United Parcel Service Inc., Russian Railways (RZD), and China Railway (CR) Corporation are actively investing in expanding their networks and enhancing their service offerings to capture this burgeoning market, particularly within the strategic region of China.

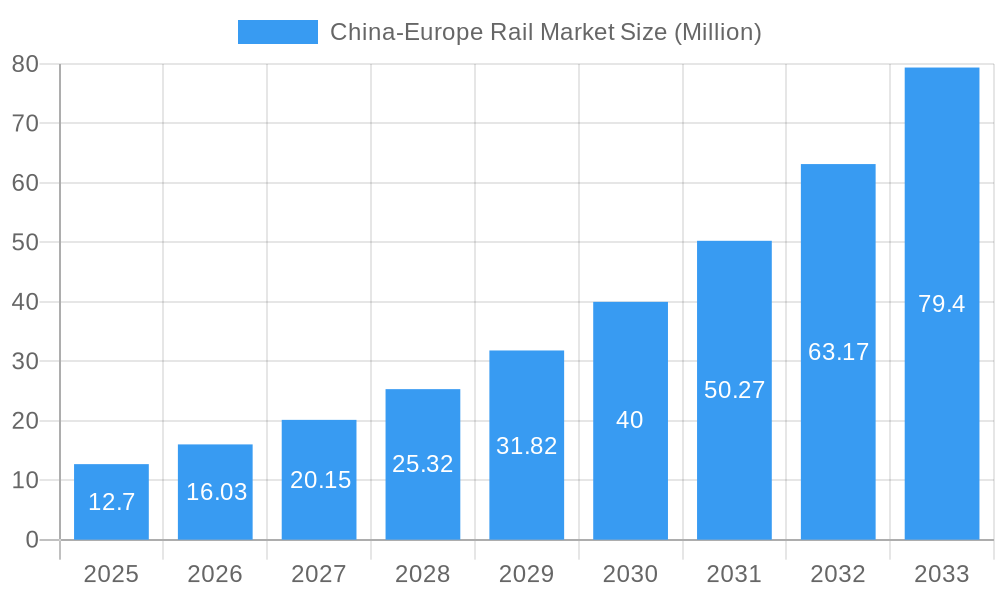

China-Europe Rail Market Company Market Share

Unlocking Global Trade: China-Europe Rail Market Analysis (2019-2033)

This comprehensive report delivers unparalleled insights into the China-Europe rail freight market, a critical artery for global e-commerce logistics and intermodal transportation. Examining the Study Period (2019–2033) with a Base Year (2025) and Forecast Period (2025–2033), this analysis provides actionable intelligence for stakeholders navigating this dynamic sector. Discover key market drivers, emerging trends, competitive landscapes, and strategic opportunities within the vital containerized (intermodal) and non-containerized cargo segments.

China-Europe Rail Market Market Concentration & Dynamics

The China-Europe rail market exhibits moderate concentration, with key players like China Railway (CR) Corporation, Russian Railways (RZD), and JSC United Transport and Logistics Company holding significant sway. The innovation ecosystem is rapidly evolving, fueled by advancements in digital logistics platforms and sustainable freight solutions. Regulatory frameworks are harmonizing, though regional variations persist, influencing cross-border transportation services. Substitute products, primarily ocean freight, remain a competitive force, but the speed and reliability of rail are increasingly valued for time-sensitive e-commerce shipments. End-user trends show a growing demand for integrated services allied to transportation, encompassing warehousing, customs clearance, and last-mile delivery. M&A activities are on the rise as companies seek to expand their network reach and service offerings. Recent deal counts indicate a strategic push for consolidation and capability enhancement.

- Key Dynamics:

- Growing emphasis on speed and reliability for e-commerce logistics.

- Increasing demand for integrated supply chain solutions.

- Harmonization of customs procedures and regulations.

- Investment in digital technologies for track-and-trace capabilities.

China-Europe Rail Market Industry Insights & Trends

The China-Europe rail market is poised for robust growth, projected to reach approximately USD 250 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 8.5% during the Forecast Period (2025–2033). This expansion is primarily driven by the accelerating demand for efficient and sustainable intermodal transportation solutions connecting manufacturing hubs in Asia with consumption centers in Europe. The surge in global e-commerce has amplified the need for faster transit times than traditional ocean freight, positioning rail as a compelling alternative. Technological disruptions, including the adoption of IoT for real-time cargo monitoring, AI-powered route optimization, and advancements in wagon technology, are enhancing operational efficiency and reducing transit times. Evolving consumer behaviors, particularly the preference for expedited delivery and transparent tracking, are further cementing the importance of reliable rail connections. The shift towards greener logistics also favors rail due to its lower carbon footprint compared to air and road transport for long-haul freight. The market size in the Base Year (2025) is estimated at USD 140 Billion.

- Market Growth Drivers:

- Exponential growth of e-commerce logistics and demand for faster delivery.

- Increasing adoption of intermodal transportation for cost and efficiency benefits.

- Growing environmental consciousness and demand for sustainable freight services.

- Geopolitical shifts and the desire for diversified supply chain networks.

- Government initiatives supporting Belt and Road Initiative (BRI) related infrastructure development.

Key Markets & Segments Leading China-Europe Rail Market

The Containerized (Intermodal) segment is the undisputed leader in the China-Europe rail market, accounting for an estimated 75% of market share in 2025. This dominance is driven by the standardization of containers, which facilitates seamless transitions between different modes of transport, crucial for intermodal transportation. The Transportation service type also leads, forming the core offering of the market, with an estimated 80% market share. Dominant regions include China's major manufacturing provinces and key European logistics hubs like Duisburg, Hamburg, and Warsaw.

Drivers for Containerized (Intermodal) Dominance:

- Economic Growth: Increased manufacturing output in China and consumer demand in Europe.

- Infrastructure Development: Extensive rail networks and intermodal terminals facilitating efficient cargo handling.

- Standardization: Ease of handling and transfer of standardized containers.

- Cost-Effectiveness: Compared to air freight for bulk shipments.

Drivers for Transportation Service Type Dominance:

- Core Requirement: The fundamental need for moving goods between continents.

- Network Expansion: Growing routes and service frequencies offered by rail operators.

- Competitive Pricing: Offering a viable alternative to other modes.

Dominance Analysis: China's role as the world's factory, coupled with Europe's significant consumer market, creates a constant flow of goods. The Containerized (Intermodal) segment's efficiency in handling this volume, along with the foundational role of Transportation services, solidifies their leading positions. The Services Allied to Transportation segment, while growing, is currently secondary to the core movement of goods. Non-containerized and Liquid Bulk segments represent niche markets with specific demands and infrastructure requirements, contributing a smaller but important share to the overall market value.

China-Europe Rail Market Product Developments

Significant product developments are enhancing the China-Europe rail market. Innovations in smart wagons equipped with IoT sensors for real-time tracking and condition monitoring are improving supply chain visibility and security. The development of specialized rolling stock for temperature-sensitive goods and heavy machinery is expanding cargo capabilities. Furthermore, the increasing focus on digital platforms for booking, management, and freight tracking is streamlining the entire logistics process. The emergence of hydrogen-powered locomotives, as exemplified by the Alstom and ENGIE partnership, signals a commitment to sustainable freight services and reducing the environmental impact of intermodal transportation.

Challenges in the China-Europe Rail Market Market

The China-Europe rail market faces several challenges that temper its growth trajectory. Regulatory hurdles and differing customs procedures across numerous countries create significant delays and add complexity to cross-border operations. Supply chain disruptions, including capacity constraints on certain routes, infrastructure limitations, and geopolitical uncertainties, can lead to longer transit times and increased costs. Fierce competition from established ocean freight services, which often offer lower per-unit costs for non-time-sensitive goods, remains a constant pressure. Capacity availability is estimated to be a constraint for approximately 15% of potential shipments during peak seasons.

- Key Barriers:

- Inconsistent customs regulations and documentation requirements.

- Limited network capacity on certain high-demand corridors.

- Rising operational costs due to fuel price volatility.

- Geopolitical instability impacting transit routes.

Forces Driving China-Europe Rail Market Growth

Several powerful forces are propelling the China-Europe rail market forward. The ongoing expansion of e-commerce logistics necessitates faster and more reliable transit than traditional shipping methods. The increasing demand for sustainable freight services favors rail's lower carbon footprint. Government initiatives, particularly those supporting the Belt and Road Initiative (BRI), are driving significant investment in rail infrastructure and connectivity. Furthermore, the growing complexity of global supply chains encourages diversification and the utilization of multiple transport modes, with rail playing a crucial role in intermodal transportation. Technological advancements in digitalization are also enhancing efficiency and customer experience.

Challenges in the China-Europe Rail Market Market

Long-term growth catalysts in the China-Europe rail market are anchored in continuous innovation and strategic market expansion. The ongoing development of advanced digital platforms for end-to-end supply chain management promises greater transparency and efficiency. Investments in smart infrastructure, including smart terminals and predictive maintenance for rolling stock, will further optimize operations. The exploration and implementation of alternative fuels, such as hydrogen for freight services, will address environmental concerns and enhance the market's sustainability appeal. Strategic partnerships and alliances, like the one between Shanghai Way-easy Supply Chain and Nurminen Logistics Plc, are crucial for expanding network reach and offering integrated solutions.

Emerging Opportunities in China-Europe Rail Market

Emerging opportunities in the China-Europe rail market are abundant and multifaceted. The growing demand for niche logistics solutions, such as temperature-controlled transport for pharmaceuticals and perishables, presents a significant growth avenue. The expansion of the Southern Trans-Caspian route offers a promising alternative, bypassing traditional transit points and potentially reducing transit times. Further digitalization of the entire supply chain, including blockchain for enhanced security and traceability, will unlock new efficiencies. The increasing focus on nearshoring and reshoring trends in some European industries may create new demand patterns for rail connectivity. Collaboration between rail operators and technology providers to develop advanced intermodal transportation solutions will also be a key opportunity.

Leading Players in the China-Europe Rail Market Sector

- Deutsche Bahn AG (DB Group)

- United Parcel Service Inc

- Russian Railways (RZD)

- China Railway (CR) Corporation

- JSC United Transport and Logistics Company

- Deutsche Post DHL Group

- Kerry Logistics

- Far East Land Bridge Ltd

- KORAIL

- InterRail Group

- Nunner Logistics

- Kazakhstan Temir Zholy (KTZ)

- Beijing Changjiu Logistics

- Hellmann Worldwide Logistics

- HLT International Logistics

- DSV

- Wuhan Han'ou International Logistics Co

Key Milestones in China-Europe Rail Market Industry

- June 2022: Shanghai Way-easy Supply Chain and Nurminen Logistics Plc announced a business alliance to enhance logistics and rail freight services between China and Europe, highlighting the strategic importance of collaboration and the potential of new routes like the Southern Trans-Caspian route.

- April 2022: Alstom and ENGIE formed a partnership to supply clean hydrogen for a fuel cell system for European rail freight. This initiative demonstrates a commitment to developing sustainable and environmentally friendly freight services, with Alstom developing hydrogen-powered rolling stock for non-electrified areas, impacting the future of intermodal transportation.

Strategic Outlook for China-Europe Rail Market Market

The strategic outlook for the China-Europe rail market is overwhelmingly positive, driven by sustained demand for efficient and sustainable global trade solutions. Continued investment in infrastructure, coupled with technological advancements in digitalization and green energy, will be critical growth accelerators. The market will likely witness further consolidation and strategic alliances as companies strive to offer comprehensive supply chain solutions and expand their network reach. Emphasis on route diversification and optimizing intermodal transportation efficiency will be paramount. The increasing preference for environmentally conscious freight services will also spur innovation in sustainable practices, solidifying rail's position as a vital link in global commerce for the foreseeable future.

China-Europe Rail Market Segmentation

-

1. Cargo Type

- 1.1. Containerized (Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Service Type

- 2.1. Transportation

- 2.2. Services Allied to Transportation

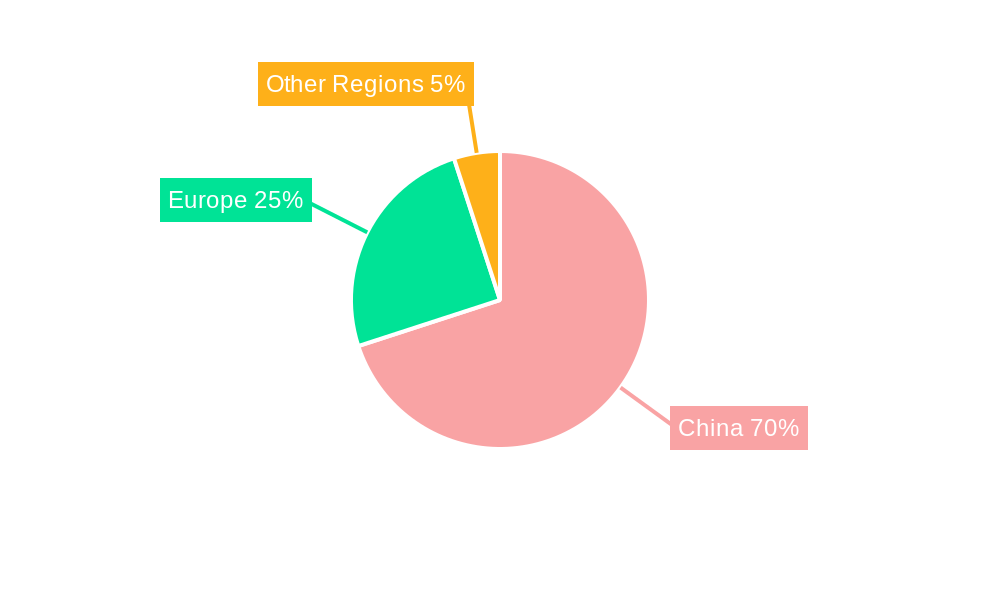

China-Europe Rail Market Segmentation By Geography

- 1. China

China-Europe Rail Market Regional Market Share

Geographic Coverage of China-Europe Rail Market

China-Europe Rail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing freight volume driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China-Europe Rail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cargo Type

- 5.1.1. Containerized (Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Transportation

- 5.2.2. Services Allied to Transportation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Cargo Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deutsche Bahn AG (DB Group)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Russian Railways (RZD)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Railway (CR) Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JSC United Transport and Logistics Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Deutsche Post DHL Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kerry Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Far East Land Bridge Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KORAIL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 InterRail Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nunner Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kazakhstan Temir Zholy (KTZ)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Beijing Changjiu Logistics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hellmann Worldwide Logistics

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 HLT International Logistics

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 DSV

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Wuhan Han'ou International Logistics Co

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Deutsche Bahn AG (DB Group)

List of Figures

- Figure 1: China-Europe Rail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China-Europe Rail Market Share (%) by Company 2025

List of Tables

- Table 1: China-Europe Rail Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 2: China-Europe Rail Market Volume Billion Forecast, by Cargo Type 2020 & 2033

- Table 3: China-Europe Rail Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: China-Europe Rail Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 5: China-Europe Rail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China-Europe Rail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: China-Europe Rail Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 8: China-Europe Rail Market Volume Billion Forecast, by Cargo Type 2020 & 2033

- Table 9: China-Europe Rail Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: China-Europe Rail Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 11: China-Europe Rail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China-Europe Rail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China-Europe Rail Market?

The projected CAGR is approximately 25.99%.

2. Which companies are prominent players in the China-Europe Rail Market?

Key companies in the market include Deutsche Bahn AG (DB Group), United Parcel Service Inc, Russian Railways (RZD), China Railway (CR) Corporation, JSC United Transport and Logistics Company, Deutsche Post DHL Group, Kerry Logistics, Far East Land Bridge Ltd, KORAIL, InterRail Group, Nunner Logistics, Kazakhstan Temir Zholy (KTZ), Beijing Changjiu Logistics, Hellmann Worldwide Logistics, HLT International Logistics, DSV, Wuhan Han'ou International Logistics Co.

3. What are the main segments of the China-Europe Rail Market?

The market segments include Cargo Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.70 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing freight volume driving the market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Shanghai Way-easy Supply Chain and Nurminen Logistics Plc announce a business alliance to improve logistics and rail freight services in China and Europe. As part of the business cooperation. Regarding rail connections to Europe, The Way-easy has a sizable customer base. In an environment where collaboration grows on the advantages of complementarity, the new Southern Trans-Caspian route is crucial and has future potential.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China-Europe Rail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China-Europe Rail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China-Europe Rail Market?

To stay informed about further developments, trends, and reports in the China-Europe Rail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence