Key Insights

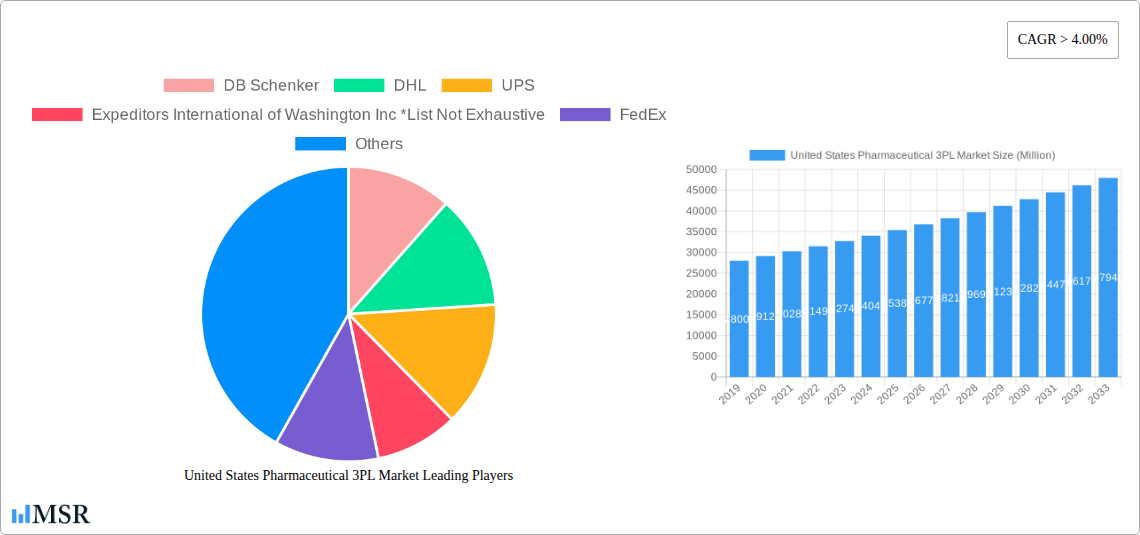

The United States pharmaceutical third-party logistics (3PL) market is poised for substantial growth, projected to surpass USD 35,000 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 4.00%. This robust expansion is primarily driven by the increasing complexity of pharmaceutical supply chains, the growing demand for specialized cold chain logistics to maintain the integrity of temperature-sensitive drugs, and the continuous need for efficient domestic and international transportation management. The pharmaceutical industry's stringent regulatory requirements and the relentless pursuit of cost optimization further propel the adoption of 3PL services, as companies seek to outsource these critical functions to experienced providers. Value-added warehousing and distribution services are also gaining prominence, offering enhanced inventory management, kitting, and specialized packaging solutions tailored to the unique needs of pharmaceutical products.

United States Pharmaceutical 3PL Market Market Size (In Billion)

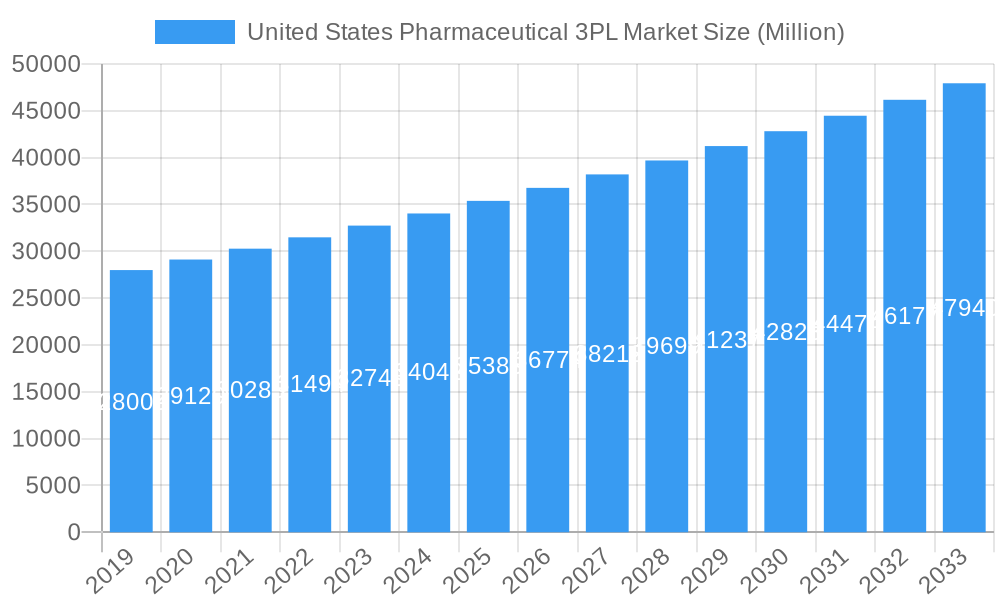

The market is segmented into key areas including Domestic Transportation Management and International Transportation Management, highlighting the cross-border nature of pharmaceutical distribution. A significant portion of the market is dedicated to Value-added Warehousing and Distribution, underscoring the specialized services required for pharmaceuticals. The supply chain is further divided into Cold Chain and Non-cold Chain segments, with the cold chain segment experiencing accelerated growth due to the rise of biologics, vaccines, and other temperature-sensitive therapeutics. Leading players such as DB Schenker, DHL, UPS, Expeditors International of Washington Inc., FedEx, CEVA Logistics, Kuehne + Nagel, Agility, Kerry Logistics, and C.H. Robinson are actively shaping the market landscape through strategic investments, technological advancements, and the expansion of their specialized pharmaceutical logistics capabilities. The United States, as a major hub for pharmaceutical manufacturing and consumption, represents a significant regional market within this dynamic sector.

United States Pharmaceutical 3PL Market Company Market Share

Gain an unparalleled advantage in the dynamic United States Pharmaceutical 3PL Market with our comprehensive, data-driven report. This in-depth analysis provides actionable intelligence on pharmaceutical logistics, cold chain solutions, supply chain optimization, and healthcare logistics management from 2019 to 2033, with a laser focus on the base year 2025. Dive deep into the market's intricacies, from emerging trends to strategic growth drivers, and empower your business decisions.

United States Pharmaceutical 3PL Market Market Concentration & Dynamics

The United States Pharmaceutical 3PL market is characterized by a moderate level of concentration, with key players like DB Schenker, DHL, UPS, FedEx, CEVA Logistics, Kuehne + Nagel, Agility, Kerry Logistics, C H Robinson, and Expeditors International of Washington Inc. holding significant market share. Innovation is driven by the continuous need for enhanced temperature-controlled logistics, compliance with stringent FDA regulations, and the integration of advanced technologies like blockchain and AI for enhanced visibility and security. The regulatory framework, while complex, is a crucial element shaping market entry and operational standards. Substitute products, such as in-house logistics solutions, are less prevalent due to the specialized requirements of pharmaceutical distribution. End-user trends are leaning towards specialty pharmaceutical logistics, personalized medicine delivery, and a growing demand for efficient cold chain management. Merger and acquisition (M&A) activities are anticipated to continue as larger players seek to expand their service portfolios and geographic reach, consolidating market power. The market has witnessed approximately xx M&A deals in the historical period, indicating ongoing strategic consolidation.

United States Pharmaceutical 3PL Market Industry Insights & Trends

The United States Pharmaceutical 3PL market is projected to experience robust growth, driven by an escalating demand for biologics, vaccines, and temperature-sensitive pharmaceuticals, alongside an aging population and the increasing prevalence of chronic diseases. The market size was valued at approximately USD 35,000 Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025–2033. Technological disruptions, including the adoption of IoT for real-time temperature monitoring, AI-powered route optimization, and sophisticated warehouse management systems (WMS), are revolutionizing pharmaceutical supply chain management. Evolving consumer behaviors, particularly the rise of e-pharmacies and direct-to-patient delivery models, are also creating new avenues for third-party logistics providers (3PLs). The increasing complexity of the global pharmaceutical supply chain, coupled with the need for enhanced compliance and cost efficiency, further fuels the adoption of specialized pharmaceutical logistics services. The integration of advanced data analytics is becoming paramount for predictive maintenance, inventory management, and risk mitigation, enabling a more resilient and responsive healthcare logistics network.

Key Markets & Segments Leading United States Pharmaceutical 3PL Market

The Cold Chain segment is a dominant force within the United States Pharmaceutical 3PL Market, driven by the exponential growth of biologics, vaccines, and advanced therapies that require stringent temperature control throughout their journey. This segment's dominance is further amplified by the increasing focus on temperature-controlled transportation management and the need for specialized cold storage warehousing and distribution.

- Drivers for Cold Chain Dominance:

- Biopharmaceutical Boom: The rise of advanced therapies, gene therapies, and complex biologics necessitates sophisticated cold chain infrastructure.

- Vaccine Distribution: The ongoing need for vaccine distribution, including the latest advancements in mRNA technology, requires unwavering cold chain integrity.

- Regulatory Mandates: Strict FDA and international regulations for temperature-sensitive products mandate robust cold chain capabilities.

- Global Supply Chain Complexity: Ensuring the integrity of high-value, temperature-sensitive pharmaceuticals across extended supply chains.

In terms of Function, Value-added Warehousing and Distribution plays a critical role, encompassing services beyond mere storage, such as kitting, labeling, serialization, and returns management. This segment's importance is directly linked to the increasing complexity of pharmaceutical product packaging and distribution requirements. Domestic Transportation Management also holds significant sway due to the vast geographical expanse of the United States and the need for timely and compliant delivery of pharmaceuticals across various states.

- Dominance Analysis:

- Cold Chain: The inherent nature of many modern pharmaceuticals necessitates a significant investment in and expertise in cold chain logistics, making it a cornerstone of the market. Companies excelling in refrigerated transportation and frozen storage solutions are exceptionally well-positioned.

- Value-added Warehousing and Distribution: As pharmaceutical products become more complex and personalized, the demand for specialized warehousing services that go beyond simple storage is escalating. This includes services like temperature-controlled packaging, order fulfillment for specialty pharmacies, and recall management.

- Domestic Transportation Management: The sheer volume of pharmaceutical products that need to be moved within the US, from manufacturing facilities to distribution centers and ultimately to healthcare providers and patients, makes this a continuously high-demand service. Ensuring timely and compliant delivery is paramount for patient safety.

United States Pharmaceutical 3PL Market Product Developments

Recent product developments in the United States Pharmaceutical 3PL market are significantly enhancing efficiency and compliance. Innovations include advanced track-and-trace technologies leveraging blockchain for immutable record-keeping, AI-powered predictive analytics for demand forecasting and inventory optimization, and specialized temperature-controlled packaging solutions designed to maintain product integrity during transit. The development of smart sensors and IoT devices for real-time monitoring of temperature, humidity, and shock throughout the supply chain is also a key advancement. These technological leaps are not only improving operational efficiency but also bolstering the security and reliability of pharmaceutical supply chain solutions.

Challenges in the United States Pharmaceutical 3PL Market Market

The United States Pharmaceutical 3PL market faces several formidable challenges, including:

- Regulatory Hurdles: Navigating the complex and ever-evolving landscape of FDA regulations, state-specific requirements, and international compliance standards can be costly and time-consuming.

- Supply Chain Disruptions: Global events, geopolitical instability, and natural disasters can significantly disrupt the pharmaceutical supply chain, leading to delays and shortages.

- Talent Shortage: A scarcity of skilled professionals in specialized areas like cold chain logistics and pharmaceutical regulatory compliance poses a significant challenge.

- Rising Operational Costs: Increasing fuel prices, labor costs, and the investment required for advanced technology contribute to higher operational expenses for 3PL providers.

- Cybersecurity Threats: Protecting sensitive patient data and supply chain information from cyberattacks is a critical concern for all stakeholders.

Forces Driving United States Pharmaceutical 3PL Market Growth

Several powerful forces are propelling the growth of the United States Pharmaceutical 3PL market. The increasing demand for biologics and specialty drugs, which are often temperature-sensitive and require meticulous handling, is a primary driver. The growing global pharmaceutical market, coupled with the expanding reach of e-pharmacies and direct-to-patient models, necessitates robust and agile healthcare logistics solutions. Furthermore, the continuous need for supply chain efficiency, cost optimization, and enhanced regulatory compliance pushes pharmaceutical manufacturers to outsource their logistics operations to specialized 3PL providers. Technological advancements in areas like AI, IoT, and blockchain are also enabling more sophisticated and reliable pharmaceutical distribution networks, further fueling market expansion.

Challenges in the United States Pharmaceutical 3PL Market Market

Long-term growth catalysts in the United States Pharmaceutical 3PL market are rooted in innovation and strategic expansion. The increasing adoption of advanced technologies, such as AI for predictive analytics and route optimization, and IoT for real-time monitoring, will continue to enhance efficiency and reduce risks. Partnerships between pharmaceutical manufacturers and 3PL providers are expected to deepen, leading to more integrated and customized supply chain solutions. Market expansions into emerging areas, such as last-mile delivery for home healthcare and the logistics of novel drug delivery systems, will also contribute to sustained growth. The focus on sustainability within the supply chain, including the development of eco-friendly packaging and transportation methods, represents another significant long-term growth catalyst.

Emerging Opportunities in United States Pharmaceutical 3PL Market

Emerging opportunities within the United States Pharmaceutical 3PL market are ripe for exploration. The burgeoning market for personalized medicine and cell and gene therapies presents a unique demand for highly specialized, end-to-end specialty pharmaceutical logistics. The continued growth of telehealth and the direct-to-patient delivery model creates opportunities for 3PLs to develop sophisticated last-mile delivery networks for pharmaceuticals and medical devices. Furthermore, the increasing focus on supply chain resilience and risk mitigation post-pandemic opens doors for providers offering robust contingency planning and real-time visibility solutions. The integration of digital twins for supply chain simulation and optimization is another promising area, allowing for proactive problem-solving and enhanced operational efficiency.

Leading Players in the United States Pharmaceutical 3PL Market Sector

- DB Schenker

- DHL

- UPS

- Expeditors International of Washington Inc

- FedEx

- CEVA Logistics

- Kuehne + Nagel

- Agility

- Kerry Logistics

- C H Robinson

Key Milestones in United States Pharmaceutical 3PL Market Industry

- December 2021: FedEx Corp. significantly expanded its air cargo hub at Miami International Airport with a USD 72 million investment. This expansion doubled the hub's size to 282,000 square feet and includes its largest cold storage section, spanning 70,000 square feet, enhancing its capabilities for pharmaceutical cargo handling and cold chain logistics.

- May 2021: UPS bolstered its specialty pharmaceutical offerings by launching UPS Cold Chain Solutions. This initiative integrated comprehensive cold chain technologies, best-in-class capabilities, and expanded global facilities to provide complete, end-to-end temperature-controlled logistics, crucial for the distribution of sensitive pharmaceuticals.

Strategic Outlook for United States Pharmaceutical 3PL Market Market

The strategic outlook for the United States Pharmaceutical 3PL market is exceptionally promising, driven by continuous innovation and evolving healthcare needs. Growth accelerators include the increasing demand for complex biologics, the expansion of e-pharmacies, and the imperative for robust cold chain management. Strategic opportunities lie in leveraging advanced technologies like AI and blockchain to enhance supply chain visibility, security, and efficiency. Furthermore, 3PL providers that can offer comprehensive, end-to-end solutions, including specialized cold chain logistics services and value-added distribution, will be well-positioned for success. The market is expected to see continued consolidation and strategic alliances as companies strive to broaden their service portfolios and geographical reach, solidifying the role of pharmaceutical 3PLs in the future of healthcare delivery.

United States Pharmaceutical 3PL Market Segmentation

-

1. Function

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. Supply Chain

- 2.1. Cold Chain

- 2.2. Non-cold Chain

United States Pharmaceutical 3PL Market Segmentation By Geography

- 1. United States

United States Pharmaceutical 3PL Market Regional Market Share

Geographic Coverage of United States Pharmaceutical 3PL Market

United States Pharmaceutical 3PL Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Transportation Ordered

- 3.4. Market Trends

- 3.4.1. The United States is Leading in the Pharmaceutical Market Across the World

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Pharmaceutical 3PL Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by Supply Chain

- 5.2.1. Cold Chain

- 5.2.2. Non-cold Chain

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UPS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expeditors International of Washington Inc *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 C H Robinson

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: United States Pharmaceutical 3PL Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Pharmaceutical 3PL Market Share (%) by Company 2025

List of Tables

- Table 1: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Supply Chain 2020 & 2033

- Table 3: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Supply Chain 2020 & 2033

- Table 6: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Pharmaceutical 3PL Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the United States Pharmaceutical 3PL Market?

Key companies in the market include DB Schenker, DHL, UPS, Expeditors International of Washington Inc *List Not Exhaustive, FedEx, CEVA Logistics, Kuehne + Nagel, Agility, Kerry Logistics, C H Robinson.

3. What are the main segments of the United States Pharmaceutical 3PL Market?

The market segments include Function, Supply Chain.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies.

6. What are the notable trends driving market growth?

The United States is Leading in the Pharmaceutical Market Across the World.

7. Are there any restraints impacting market growth?

High Cost Associated with the Transportation Ordered.

8. Can you provide examples of recent developments in the market?

December 2021: FedEx Corp. began operations at its substantially bigger air cargo hub at Miami International Airport. The USD 72 million addition, two years under development and roughly the size of two football fields, doubles the hub's size to 282,000 square feet. The hub includes FedEx's largest cold storage section, covering 70,000 square feet - the equivalent of 33 tennis courts - of refrigerated and frozen storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Pharmaceutical 3PL Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Pharmaceutical 3PL Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Pharmaceutical 3PL Market?

To stay informed about further developments, trends, and reports in the United States Pharmaceutical 3PL Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence