Key Insights

The Canadian Cold Chain Logistics Market is experiencing significant expansion, driven by escalating consumer demand for temperature-sensitive goods including fresh and processed foods, pharmaceuticals, and other perishables. Key growth drivers include the surge in e-commerce, necessitating robust cold chain solutions for efficient delivery of perishable items, and the expanding healthcare sector's demand for temperature-controlled pharmaceuticals and vaccines. Government initiatives focusing on food safety and investments in cold chain infrastructure further contribute to market growth. The market is segmented by service type (storage, transportation, value-added services), temperature range (chilled, frozen, ambient), and end-user industry (horticulture, dairy, meats, fish, poultry, processed foods, pharmaceuticals, life sciences, and chemicals). With a market size of $6.9 billion in the base year 2024, the Canadian Cold Chain Logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.4%. The presence of major industry players like Lineage Logistics and Americold Logistics highlights market maturity and consolidation potential. Growth is anticipated to be higher in urban centers and regions with substantial agricultural output.

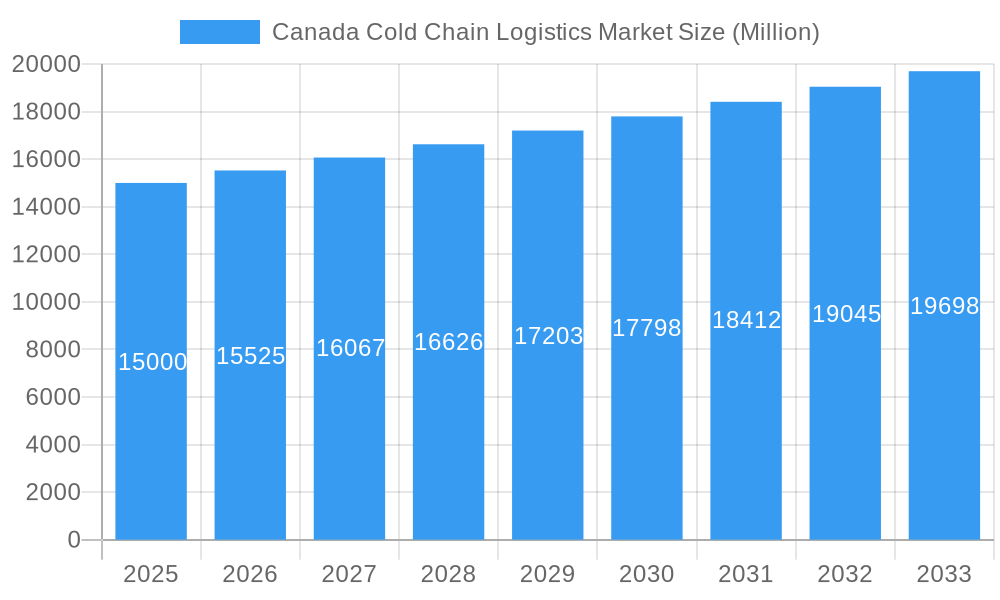

Canada Cold Chain Logistics Market Market Size (In Billion)

Critical challenges include maintaining precise temperature control to prevent product spoilage and quality degradation. Rising fuel costs and driver shortages pose risks to transportation efficiency and cost-effectiveness. Investment in technological advancements, such as real-time temperature monitoring and advanced logistics software, is vital for operational optimization and loss reduction. Adherence to evolving food safety regulations and meeting consumer demand for sustainable cold chain solutions are paramount for sustained success. The competitive landscape features a mix of multinational corporations and regional providers, fostering innovation and competition. The Canadian Cold Chain Logistics Market offers substantial opportunities for companies providing innovative, efficient, and reliable solutions to meet the increasing demand for temperature-sensitive products.

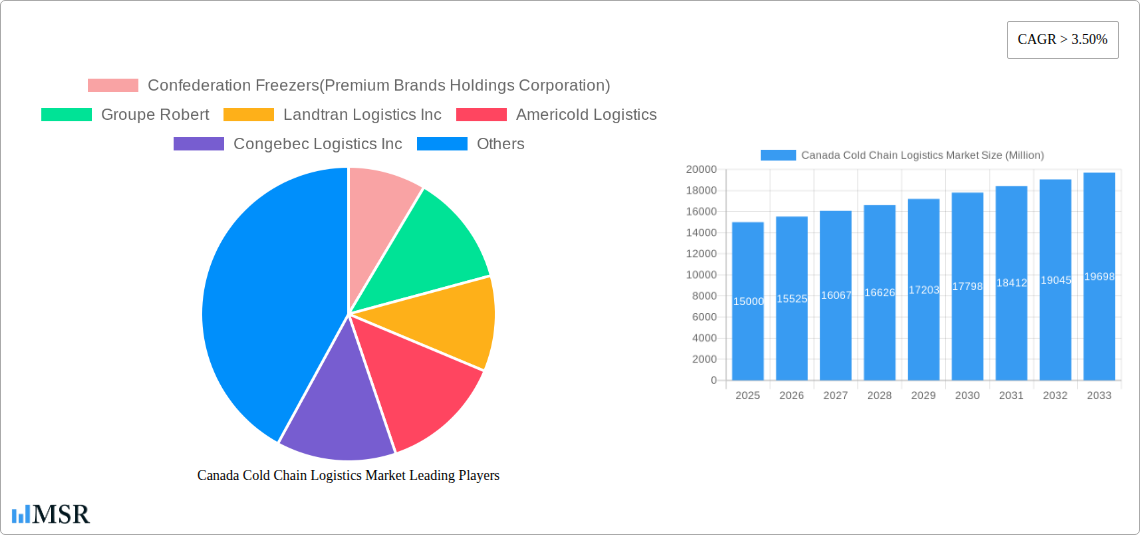

Canada Cold Chain Logistics Market Company Market Share

Canada Cold Chain Logistics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada Cold Chain Logistics Market, offering valuable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report examines market dynamics, key segments, leading players, and emerging opportunities. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report is crucial for businesses seeking to understand the Canadian cold chain logistics landscape and strategize for future growth.

Canada Cold Chain Logistics Market Market Concentration & Dynamics

The Canadian cold chain logistics market exhibits a moderately concentrated structure, with several large players commanding significant market share. Confederation Freezers (Premium Brands Holdings Corporation), Groupe Robert, Landtran Logistics Inc, Americold Logistics, Congebec Logistics Inc, Conestoga Cold Storage, MTE Logistix, Trenton Cold Storage Inc, Lineage Logistics Ltd, and Yusen Logistics (Canada) Inc are key players, though the market is not exclusively dominated by these firms. The market share of the top 5 players is estimated at approximately xx%.

Innovation Ecosystems: The market witnesses continuous innovation in areas such as temperature-controlled transportation technologies, automated warehousing systems, and real-time tracking and monitoring solutions. These innovations are driven by the increasing demand for enhanced efficiency, reduced spoilage, and improved traceability.

Regulatory Framework: Stringent regulations concerning food safety, transportation standards, and environmental concerns significantly impact market operations. Compliance with these regulations necessitates significant investments in technology and infrastructure.

Substitute Products: While direct substitutes are limited, the market faces indirect competition from improved preservation techniques and alternative transportation methods.

End-User Trends: The growing demand for fresh and processed food, along with the increasing focus on pharmaceuticals and life sciences, are key drivers of market growth. Consumer preferences for ethically sourced and sustainably produced products are also shaping market dynamics.

M&A Activities: The Canadian cold chain logistics sector has witnessed a moderate level of mergers and acquisitions in recent years, with approximately xx deals recorded between 2019 and 2024. This activity reflects consolidation efforts and expansion strategies by major players.

Canada Cold Chain Logistics Market Industry Insights & Trends

The Canadian cold chain logistics market is experiencing robust growth, propelled by several factors. The increasing demand for perishable goods, stringent quality control requirements, and technological advancements are driving market expansion. The market size in 2025 is estimated at xx Million, and it's projected to grow at a CAGR of xx% between 2025 and 2033.

The growing middle class and changing consumer lifestyles contribute to the rising demand for convenient and readily available food products, including fresh produce, meat, and dairy. Moreover, the expanding e-commerce sector necessitates efficient and reliable cold chain logistics to ensure the timely delivery of temperature-sensitive products. Technological disruptions, such as the adoption of IoT-enabled sensors, AI-powered route optimization software, and blockchain technology for improved traceability, are transforming the market's efficiency and sustainability.

Key Markets & Segments Leading Canada Cold Chain Logistics Market

The frozen segment dominates the market by temperature, driven by the substantial demand for frozen food products. Storage services represent the largest segment by service type, reflecting the need for secure and temperature-controlled warehousing solutions. The horticulture (fresh fruits & vegetables) and dairy products segments are the largest end-user markets, although pharmaceuticals and life sciences are experiencing rapid growth. The dominant region is Ontario, due to its large population, extensive infrastructure, and significant agricultural production.

- Growth Drivers:

- Economic Growth: Rising disposable incomes and increased consumer spending on food products fuel market expansion.

- Infrastructure Development: Investments in cold storage facilities, transportation networks, and technology enhance market capabilities.

- E-commerce Boom: The growth of online grocery shopping and food delivery services significantly boosts demand for cold chain logistics.

Canada Cold Chain Logistics Market Product Developments

Recent product developments in the Canadian cold chain logistics market focus on enhancing efficiency, traceability, and sustainability. Innovations include advanced refrigeration technologies, automated warehouse systems, IoT-based monitoring solutions, and sustainable packaging materials. These advancements improve cold chain integrity, minimize spoilage, and enhance operational efficiency, providing competitive advantages to logistics providers.

Challenges in the Canada Cold Chain Logistics Market Market

The Canadian cold chain logistics market faces challenges including stringent regulatory compliance requirements, fluctuations in fuel prices impacting transportation costs, and intense competition among logistics providers. These factors contribute to increased operational costs and potentially limit profit margins for some businesses.

Forces Driving Canada Cold Chain Logistics Market Growth

Key growth drivers include technological advancements such as AI-powered route optimization and IoT sensors, increasing demand for perishable goods, particularly fresh produce and seafood, and government initiatives promoting food safety and supply chain efficiency. The expansion of e-commerce is also a significant factor.

Challenges in the Canada Cold Chain Logistics Market Market

Long-term growth is fueled by strategic partnerships between logistics providers and food producers, continued investments in cold chain infrastructure, and innovation in areas such as sustainable packaging and transportation. Expansion into new markets and service offerings also presents significant growth opportunities.

Emerging Opportunities in Canada Cold Chain Logistics Market

Emerging opportunities include the increasing adoption of sustainable practices, such as using alternative fuels and reducing carbon emissions, and the integration of blockchain technology for enhanced traceability and transparency. The growing demand for specialized cold chain solutions for pharmaceuticals and life sciences also presents significant growth prospects.

Leading Players in the Canada Cold Chain Logistics Market Sector

- Confederation Freezers (Premium Brands Holdings Corporation)

- Groupe Robert

- Landtran Logistics Inc

- Americold Logistics

- Congebec Logistics Inc

- Conestoga Cold Storage

- MTE Logistix

- Trenton Cold Storage Inc

- Lineage Logistics Ltd

- Yusen Logistics (Canada) Inc

Key Milestones in Canada Cold Chain Logistics Market Industry

- 2020: Increased adoption of temperature monitoring technologies due to COVID-19 pandemic.

- 2021: Launch of several new cold storage facilities across major Canadian cities.

- 2022: Investment in sustainable transportation solutions by several key players.

- 2023: Implementation of new traceability standards for food products.

Strategic Outlook for Canada Cold Chain Logistics Market Market

The Canada Cold Chain Logistics Market presents significant growth opportunities driven by rising demand, technological innovations, and evolving consumer preferences. Companies can leverage strategic partnerships, investments in technology, and a focus on sustainability to capture a larger market share and enhance profitability in this dynamic sector. The future holds considerable potential for market expansion, particularly within the specialized segments of pharmaceuticals and life sciences.

Canada Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other End Users

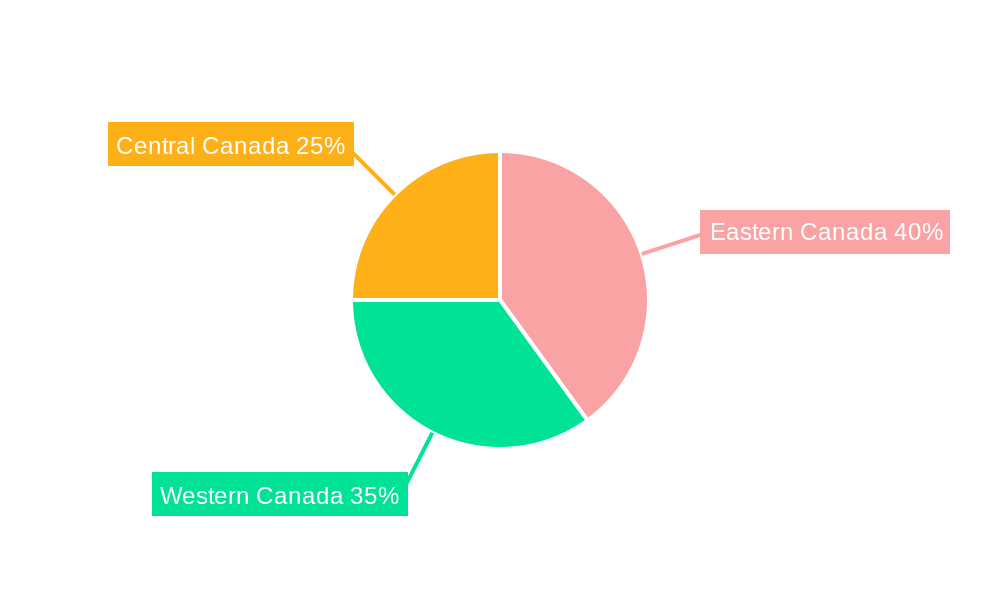

Canada Cold Chain Logistics Market Segmentation By Geography

- 1. Canada

Canada Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Canada Cold Chain Logistics Market

Canada Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. Rise in Exports of Perishable Goods Driving the Demand for Cold Chain Logistics Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Confederation Freezers(Premium Brands Holdings Corporation)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Groupe Robert

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Landtran Logistics Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Americold Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Congebec Logistics Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Conestoga Cold Storage

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MTE Logistix

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trenton Cold Storage Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lineage Logistics Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yusen Logistics(Canada) Inc **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Confederation Freezers(Premium Brands Holdings Corporation)

List of Figures

- Figure 1: Canada Cold Chain Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Cold Chain Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Canada Cold Chain Logistics Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 3: Canada Cold Chain Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Canada Cold Chain Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Cold Chain Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Canada Cold Chain Logistics Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 7: Canada Cold Chain Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Canada Cold Chain Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Cold Chain Logistics Market?

The projected CAGR is approximately 12.4%.

2. Which companies are prominent players in the Canada Cold Chain Logistics Market?

Key companies in the market include Confederation Freezers(Premium Brands Holdings Corporation), Groupe Robert, Landtran Logistics Inc, Americold Logistics, Congebec Logistics Inc, Conestoga Cold Storage, MTE Logistix, Trenton Cold Storage Inc, Lineage Logistics Ltd, Yusen Logistics(Canada) Inc **List Not Exhaustive.

3. What are the main segments of the Canada Cold Chain Logistics Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

Rise in Exports of Perishable Goods Driving the Demand for Cold Chain Logistics Services.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Canada Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence