Key Insights

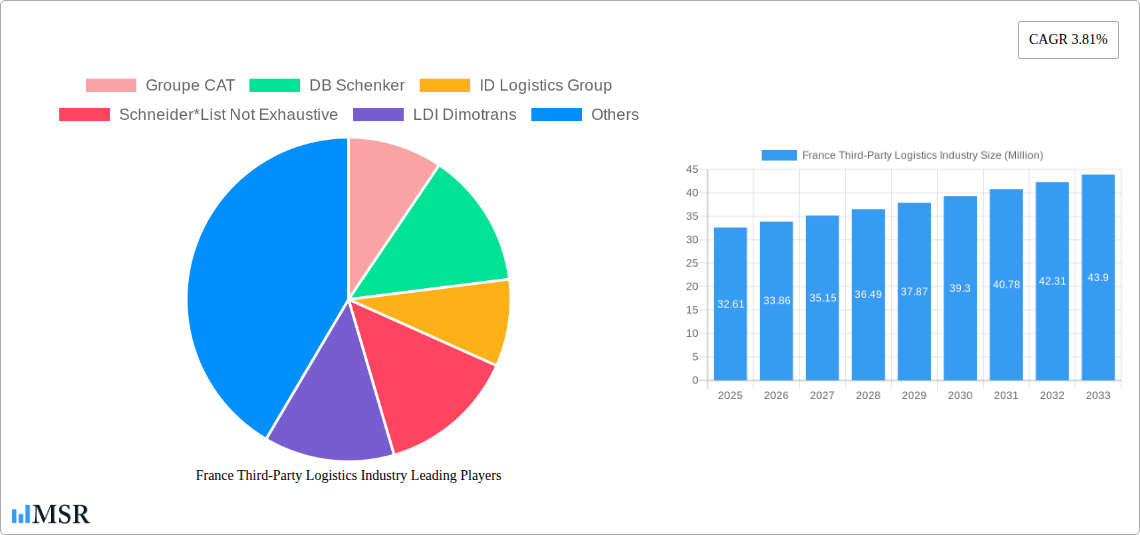

The French third-party logistics (3PL) market is poised for steady expansion, projected to reach approximately €32.61 million by 2025. This growth is underpinned by a compound annual growth rate (CAGR) of 3.81% throughout the forecast period of 2025-2033. The market's robust performance is primarily driven by the increasing demand for efficient supply chain solutions across a diverse range of industries. Key sectors such as Automobile, Retail, and Life Sciences and Healthcare are significantly contributing to this growth, leveraging 3PL providers for optimized domestic and international transportation management, as well as value-added warehousing and distribution services. The growing complexity of global supply chains, coupled with the imperative for cost optimization and enhanced customer service, are compelling businesses in France to increasingly outsource their logistics operations. Furthermore, advancements in technology, including digitalization and automation within logistics, are shaping industry trends and offering new avenues for growth and efficiency.

France Third-Party Logistics Industry Market Size (In Million)

Despite the positive trajectory, the French 3PL market faces certain restraints that necessitate strategic adaptation. These may include evolving regulatory landscapes, infrastructure limitations in specific regions, and the need for skilled labor to manage increasingly sophisticated logistics operations. However, the overarching trends favor continued market expansion. The emphasis on integrated logistics solutions, encompassing everything from raw material sourcing to final product delivery, is a significant trend. Companies are seeking partners who can offer end-to-end supply chain visibility and control. Major players like DB Schenker, DHL Supply Chain, and Geodis are actively investing in innovative solutions and expanding their service portfolios to meet these evolving demands. The strategic importance of France as a key European economic hub further solidifies the outlook for its 3PL sector, attracting both domestic and international service providers looking to capitalize on market opportunities.

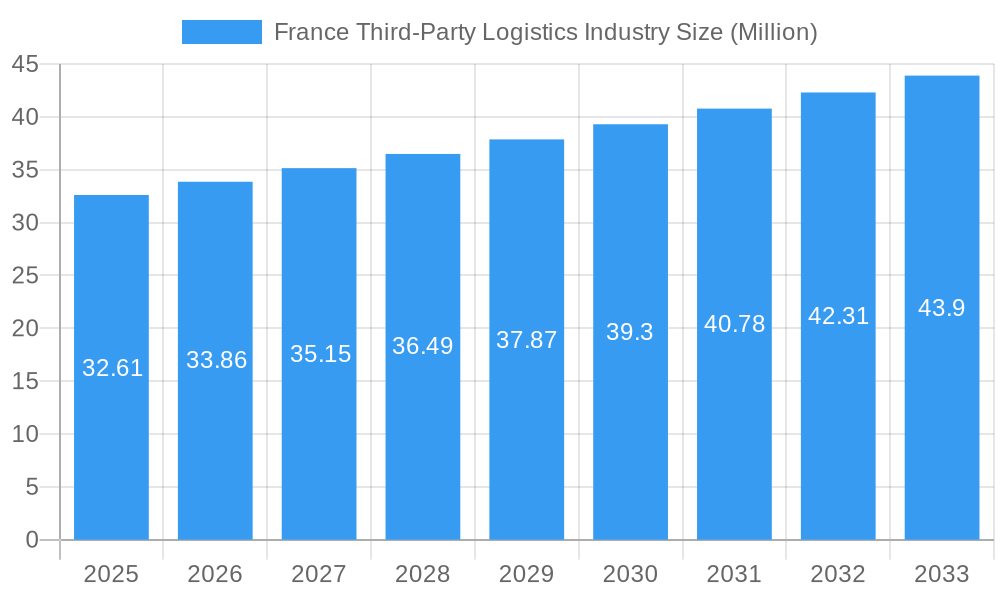

France Third-Party Logistics Industry Company Market Share

Unlock the Future of French Logistics: Comprehensive 3PL Market Report

This in-depth report provides an unparalleled analysis of the France Third-Party Logistics (3PL) industry, offering critical insights for logistics providers, manufacturers, retailers, and investors. Delve into the intricate dynamics, market concentration, and burgeoning opportunities within one of Europe's most significant logistics hubs. Our research covers the Study Period: 2019–2033, with Base Year: 2025, providing a robust Forecast Period: 2025–2033 and analyzing the Historical Period: 2019–2024.

France Third-Party Logistics Industry Market Concentration & Dynamics

The France Third-Party Logistics market exhibits a moderate to high concentration, with key players like DB Schenker, Geodis, and DHL Supply Chain commanding substantial market share. The landscape is characterized by a dynamic interplay of established giants and agile niche providers, fostering intense competition and driving innovation. Regulatory frameworks, particularly concerning environmental standards and labor laws, play a pivotal role in shaping operational strategies. The automobile and retail sectors remain dominant end-users, influencing service demand and supply chain complexities. Emerging trends in e-commerce and sustainability are reshaping the competitive arena, prompting significant investments in technology and infrastructure. Mergers and acquisitions (M&A) activity, while not consistently high, remains a strategic tool for market consolidation and expansion. M&A deal counts are predicted to reach xx between 2025-2033. The market share of the top 5 players is estimated at xx% in 2025. Key innovation ecosystems are centered around major logistics hubs and research institutions, fostering advancements in digitalization and automation. The presence of substitute products, such as in-house logistics operations, is increasingly challenged by the specialized expertise and cost-efficiency offered by third-party logistics providers.

France Third-Party Logistics Industry Industry Insights & Trends

The France Third-Party Logistics industry is poised for significant growth, with an estimated market size of €XX Billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is fueled by a confluence of robust economic activity, escalating consumer demand for faster and more reliable deliveries, and the increasing complexity of global supply chains. Technological disruptions are at the forefront of this evolution. The adoption of Artificial Intelligence (AI) for route optimization, predictive analytics for inventory management, and the Internet of Things (IoT) for real-time tracking are revolutionizing operational efficiency and transparency. Automation in warehousing, including robotics and automated guided vehicles (AGVs), is becoming increasingly prevalent, addressing labor shortages and enhancing throughput. Evolving consumer behaviors, marked by a preference for personalized services and omnichannel shopping experiences, are compelling 3PL providers to offer more flexible and integrated solutions. The rise of the circular economy and increasing environmental consciousness among consumers and businesses alike are also driving demand for sustainable logistics practices, including green transportation and reverse logistics. Furthermore, the ongoing digitalization of trade processes and the integration of blockchain technology are enhancing supply chain visibility and security. The shift towards more resilient and agile supply chains, particularly in the wake of recent global disruptions, is a major driver, prompting businesses to outsource their logistics needs to specialized providers who can offer greater flexibility and risk mitigation. The growing emphasis on data-driven decision-making is enabling 3PLs to provide more strategic value to their clients, moving beyond mere transportation and warehousing to offering comprehensive supply chain management solutions.

Key Markets & Segments Leading France Third-Party Logistics Industry

The France Third-Party Logistics industry is experiencing dominant growth across several key segments and end-user industries.

Dominant Services Segment: Value-added Warehousing and Distribution is emerging as a critical growth driver, reflecting the increasing need for sophisticated inventory management, order fulfillment, and last-mile delivery solutions. This segment is vital for e-commerce businesses and retailers seeking to optimize their supply chains.

Leading End-User Industries:

- Automobile: This sector consistently drives demand for complex logistics, including just-in-time delivery of components, finished vehicle logistics, and after-sales support. The French automotive industry's strong manufacturing base and export capabilities ensure sustained demand for specialized 3PL services.

- Retail: The explosive growth of e-commerce has placed immense pressure on the retail sector's supply chains. French retailers are increasingly relying on 3PL providers to manage online order fulfillment, returns, and omnichannel logistics, ensuring timely and cost-effective delivery to consumers.

- Life Sciences and Healthcare: This segment is characterized by stringent regulatory requirements and the need for specialized handling of temperature-sensitive goods and pharmaceuticals. 3PL providers offering compliance, cold chain logistics, and secure storage are in high demand.

Regional Dominance: While the entire nation benefits from a robust logistics infrastructure, the Île-de-France region, with its dense population and economic activity, along with major port cities like Marseille, represent key hubs for 3PL operations and demand.

Drivers of Dominance:

- Economic Growth: Strong overall economic performance in France directly translates to increased trade volumes and demand for logistics services across all sectors.

- Infrastructure: France boasts excellent transportation infrastructure, including a comprehensive network of highways, railways, and navigable waterways, facilitating efficient domestic and international transportation management.

- E-commerce Penetration: The high adoption rate of online shopping in France necessitates advanced warehousing and distribution capabilities to meet consumer expectations for speed and convenience.

- Globalization: France's position as a key player in international trade fuels the demand for efficient international transportation management and customs clearance services.

France Third-Party Logistics Industry Product Developments

Product innovations in the France 3PL sector are increasingly focused on enhancing efficiency, visibility, and sustainability. This includes the deployment of advanced Warehouse Management Systems (WMS) integrated with Artificial Intelligence for predictive inventory management and optimized picking routes. Digital platforms facilitating seamless integration between shippers and carriers, offering real-time tracking and automated booking, are gaining traction. Furthermore, the development of eco-friendly transportation solutions, such as electric vehicles for last-mile delivery and optimized route planning to reduce carbon emissions, is a key area of innovation. The application of IoT sensors for real-time monitoring of cargo conditions, especially for temperature-sensitive goods in the Life Sciences and Healthcare sector, is also a significant development. These advancements provide a competitive edge by improving service quality, reducing operational costs, and meeting evolving client demands for sustainable and transparent logistics.

Challenges in the France Third-Party Logistics Industry Market

The France Third-Party Logistics market faces several significant challenges. Regulatory hurdles, including increasingly stringent environmental regulations and complex labor laws, can increase operational costs and compliance burdens. Supply chain disruptions, stemming from geopolitical events, natural disasters, or port congestion, continue to pose a risk to timely deliveries and cost stability. Intense competitive pressures among a fragmented market can lead to price wars and pressure on profit margins, particularly for smaller players. Furthermore, the shortage of skilled labor, especially for truck drivers and warehouse personnel, remains a persistent issue impacting operational capacity. The rising cost of fuel and energy also presents a significant challenge, directly impacting transportation expenses and overall profitability.

Forces Driving France Third-Party Logistics Industry Growth

Several powerful forces are propelling the growth of the France Third-Party Logistics industry. The relentless expansion of e-commerce and omnichannel retail necessitates sophisticated fulfillment and delivery solutions that 3PLs are uniquely positioned to provide. Globalization and international trade continue to create demand for efficient international transportation management and customs brokerage. The increasing emphasis on supply chain resilience and risk mitigation encourages businesses to outsource to specialized providers capable of navigating complex global networks. Technological advancements, including automation, AI, and IoT, are enabling 3PLs to offer enhanced efficiency, visibility, and value-added services, attracting more clients. Finally, a growing focus on sustainability and green logistics is creating opportunities for 3PLs that can offer environmentally conscious solutions.

Challenges in the France Third-Party Logistics Industry Market

The long-term growth catalysts for the France Third-Party Logistics industry are deeply rooted in innovation and strategic adaptation. The continued development and adoption of digitalization and automation across all facets of logistics operations will be crucial, from warehouse robotics to AI-powered route optimization. Strategic partnerships and collaborations between 3PLs, technology providers, and end-user industries will foster synergistic growth and create integrated supply chain solutions. Market expansions, both domestically within France and internationally, by offering specialized services to emerging sectors, will unlock new revenue streams. Furthermore, the ability of 3PLs to proactively address the growing demand for sustainable logistics practices will not only meet regulatory requirements but also attract environmentally conscious clients, positioning them for sustained long-term success.

Emerging Opportunities in France Third-Party Logistics Industry

Emerging opportunities in the France Third-Party Logistics industry are diverse and promising. The growth of specialized logistics for niche sectors, such as pharmaceuticals, temperature-controlled food products, and oversized industrial goods, presents significant potential. The increasing adoption of circular economy principles is creating demand for advanced reverse logistics and recycling services. The ongoing digital transformation of industries is leading to a greater need for integrated supply chain visibility and data analytics, where 3PLs can play a crucial consultative role. The development of urban logistics solutions to address congestion and last-mile delivery challenges in densely populated areas also offers a fertile ground for innovation. Furthermore, the continued rise of cross-border e-commerce presents opportunities for 3PLs to offer seamless international fulfillment and customs clearance services.

Leading Players in the France Third-Party Logistics Industry Sector

- Groupe CAT

- DB Schenker

- ID Logistics Group

- Schneider

- LDI Dimotrans

- GEFCO

- DHL Supply Chain

- Geodis

- Bansard International

- Bollore Logistics

- HLOG

Key Milestones in France Third-Party Logistics Industry Industry

- 2019: Increased investment in warehouse automation and robotics by major players to enhance efficiency.

- 2020: Significant surge in e-commerce logistics demand due to the COVID-19 pandemic, accelerating digital adoption.

- 2021: Growing focus on sustainable logistics solutions, with investments in electric vehicles and route optimization software.

- 2022: Consolidation and M&A activities as larger players acquire smaller, specialized companies to expand service offerings.

- 2023: Increased adoption of AI and big data analytics for predictive logistics and improved supply chain visibility.

- 2024: Enhanced focus on last-mile delivery solutions and urban logistics networks to meet consumer demand for faster deliveries.

Strategic Outlook for France Third-Party Logistics Industry Market

The strategic outlook for the France Third-Party Logistics industry is overwhelmingly positive, driven by a clear trajectory towards greater digitalization, sustainability, and specialization. Future growth will be accelerated by the continued integration of advanced technologies like AI and IoT, enabling predictive analytics and enhanced supply chain visibility. Companies that can offer innovative, green logistics solutions will gain a significant competitive advantage. Strategic opportunities lie in expanding specialized service offerings for high-growth sectors and forging deeper partnerships across the supply chain. The industry's ability to adapt to evolving consumer demands for speed, convenience, and ethical practices will be paramount to its continued success.

France Third-Party Logistics Industry Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Automobile

- 2.2. Chemicals

- 2.3. Construction

- 2.4. Energy

- 2.5. Manufacturing

- 2.6. Life Sciences and Healthcare

- 2.7. Retail

- 2.8. Technology

- 2.9. Others

France Third-Party Logistics Industry Segmentation By Geography

- 1. France

France Third-Party Logistics Industry Regional Market Share

Geographic Coverage of France Third-Party Logistics Industry

France Third-Party Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Warehousing Trends in France

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Third-Party Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automobile

- 5.2.2. Chemicals

- 5.2.3. Construction

- 5.2.4. Energy

- 5.2.5. Manufacturing

- 5.2.6. Life Sciences and Healthcare

- 5.2.7. Retail

- 5.2.8. Technology

- 5.2.9. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Groupe CAT

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ID Logistics Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LDI Dimotrans

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GEFCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DHLSupply Chain

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Geodis

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bansard International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bollore Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HLOG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Groupe CAT

List of Figures

- Figure 1: France Third-Party Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Third-Party Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: France Third-Party Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: France Third-Party Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: France Third-Party Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: France Third-Party Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 5: France Third-Party Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: France Third-Party Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Third-Party Logistics Industry?

The projected CAGR is approximately 3.81%.

2. Which companies are prominent players in the France Third-Party Logistics Industry?

Key companies in the market include Groupe CAT, DB Schenker, ID Logistics Group, Schneider*List Not Exhaustive, LDI Dimotrans, GEFCO, DHLSupply Chain, Geodis, Bansard International, Bollore Logistics, HLOG.

3. What are the main segments of the France Third-Party Logistics Industry?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.61 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

Warehousing Trends in France.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Third-Party Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Third-Party Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Third-Party Logistics Industry?

To stay informed about further developments, trends, and reports in the France Third-Party Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence