Key Insights

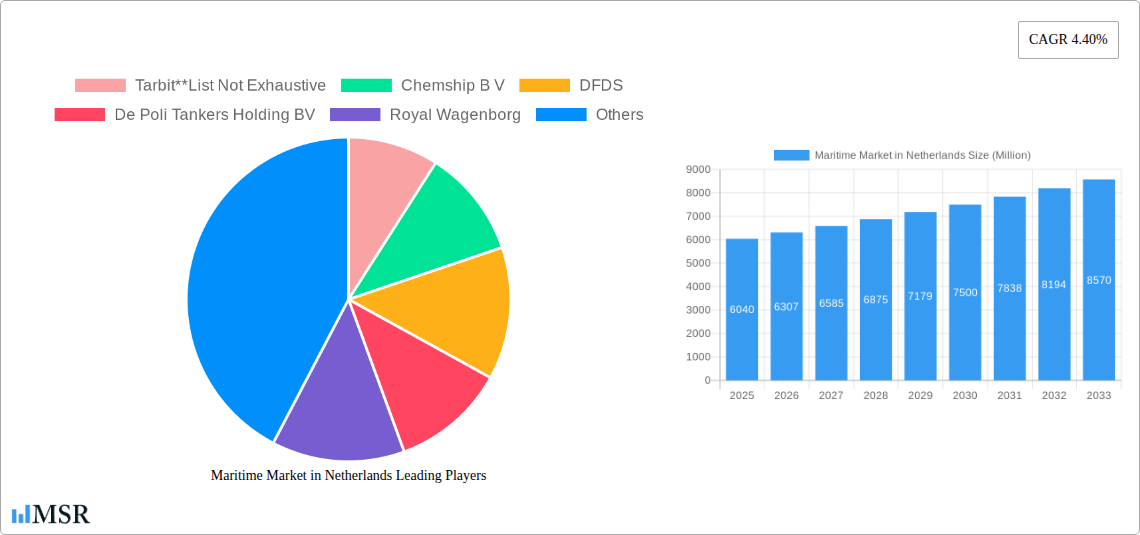

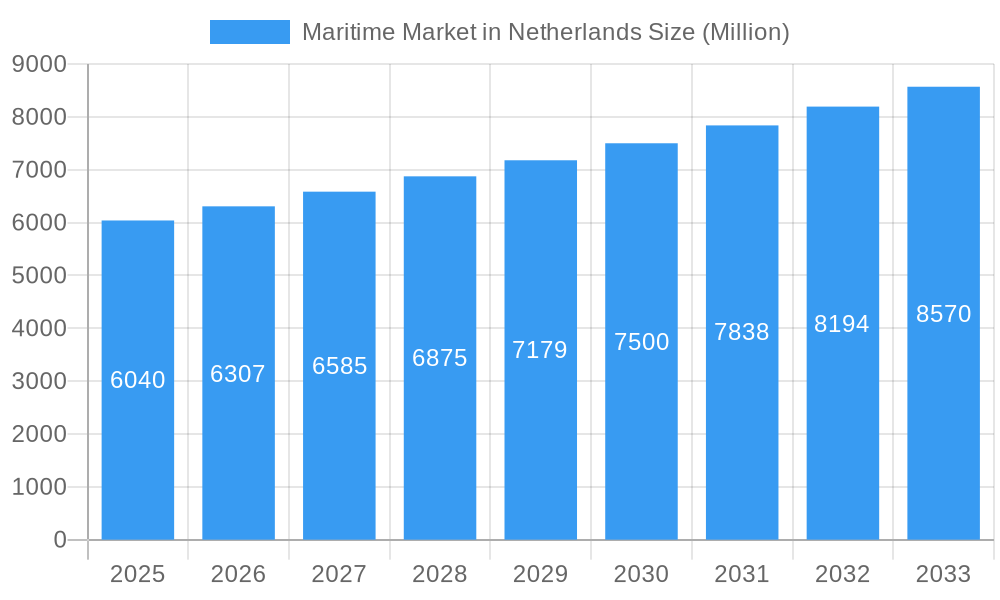

The Dutch maritime market is poised for robust expansion, projected to reach a substantial size of USD 6.04 billion by 2025, with a steady Compound Annual Growth Rate (CAGR) of 4.40% anticipated throughout the forecast period of 2025-2033. This growth trajectory is fueled by several key drivers, including the increasing demand for efficient and sustainable freight transport services, the continuous need for vessel leasing and rental services to support fluctuating trade volumes, and the ongoing development and expansion of cargo handling infrastructure. The Netherlands, with its strategically vital ports and extensive inland waterways, plays a pivotal role in global and European trade, making its maritime sector a critical economic engine. Emerging trends such as the adoption of digitalization in shipping operations, the increasing emphasis on green shipping initiatives, and the growth of specialized cargo transport are further bolstering this market. While the market is largely driven by positive economic and trade factors, potential restraints could emerge from stricter environmental regulations and the volatility of global shipping rates, necessitating adaptive strategies from market players.

Maritime Market in Netherlands Market Size (In Billion)

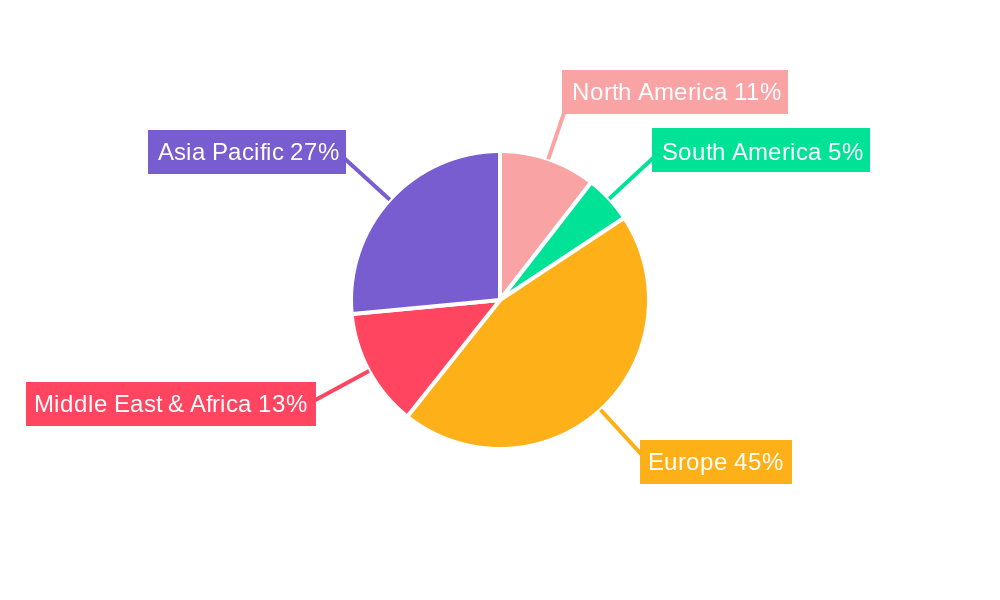

The Dutch maritime landscape is characterized by a diverse range of service segments, with Freight Transport Services expected to hold a dominant position due to the Netherlands' status as a major European logistics hub. Vessel Leasing and Rental Services are also crucial, enabling flexibility and efficiency for shipping companies. Cargo Handling, encompassing port operations and logistics, remains a fundamental component of the market's infrastructure. Support services, including maritime insurance, brokerage, and maintenance, will continue to underpin the entire ecosystem. Leading companies like Tarbit, Chemship B.V., DFDS, and Royal Wagenborg are actively shaping this market through strategic investments and innovations. Geographically, Europe, particularly the Benelux region where the Netherlands is situated, is expected to command the largest market share, underscoring its central role. The Asia Pacific region, driven by China's manufacturing prowess and growing trade volumes, also presents significant growth potential for Dutch maritime businesses.

Maritime Market in Netherlands Company Market Share

Unlocking the Dutch Maritime Nexus: A Comprehensive Market Report (2019-2033)

Dive deep into the dynamic maritime market in Netherlands with our latest, in-depth report. Covering the historical period of 2019-2024 and extending to a robust forecast period of 2025-2033, this analysis provides unparalleled insights for industry stakeholders. We meticulously examine freight transport services, vessel leasing and rental services, and cargo handling within the Netherlands' critical maritime infrastructure. Discover the driving forces, emerging opportunities, and strategic imperatives shaping this vital sector, with a strong focus on Rotterdam port and its global significance.

Maritime Market in Netherlands Market Concentration & Dynamics

The maritime market in Netherlands exhibits a moderately concentrated landscape, characterized by a blend of established global players and agile domestic operators. Key companies like Royal Wagenborg, Unifeeder, and DFDS hold significant market share in freight transport services, leveraging extensive networks and integrated logistics solutions. The vessel leasing and rental services segment sees players such as Chemship B V and De Poli Tankers Holding BV catering to specialized cargo needs. Innovation ecosystems thrive around the port of Rotterdam, fostering collaboration between shipping lines, technology providers, and research institutions focused on sustainable shipping and digitalization in maritime. Regulatory frameworks, guided by European Union directives and Dutch national policies, increasingly emphasize environmental compliance and safety standards, impacting operational costs and investment decisions. Substitute products, while limited in direct maritime applications, include intermodal transport solutions. End-user trends reveal a growing demand for efficient, reliable, and eco-friendly cargo transportation solutions, driving investments in greener fleets and digital tracking. Mergers and acquisitions (M&A) activities, while not dominant, have occurred periodically, with Nirint Shipping B V's strategic acquisitions aimed at expanding its service portfolio. The maritime market in Netherlands is characterized by an average market share for top 5 players at approximately 65% in freight transport, and the M&A deal count stands at an estimated 5 major transactions within the historical period.

Maritime Market in Netherlands Industry Insights & Trends

The maritime market in Netherlands is poised for significant growth, driven by its strategic geographical location, world-class infrastructure, and strong commitment to innovation. The market size of the Dutch maritime sector is projected to reach an impressive 150 Million by the estimated year of 2025, with a steady Compound Annual Growth Rate (CAGR) of approximately 5.5% anticipated throughout the forecast period (2025-2033). This expansion is fueled by several key factors. Firstly, the Netherlands' role as a primary gateway to Europe for global trade ensures a continuous flow of freight transport services. The port of Rotterdam, Europe's largest, acts as a crucial hub for imports and exports, directly contributing to the volume of goods handled and the demand for vessel leasing and rental services. Secondly, technological disruptions are revolutionizing the industry. The adoption of digitalization in maritime, including advanced logistics platforms, AI-powered route optimization, and autonomous shipping technologies, is enhancing efficiency, reducing operational costs, and improving safety. This is creating new service opportunities and driving demand for specialized maritime technology solutions. Thirdly, evolving consumer and business behaviors are playing a pivotal role. There is an increasing emphasis on supply chain resilience, sustainability, and speed. Businesses are seeking more integrated and transparent cargo handling and transport solutions, leading to a greater demand for multimodal transport options and customized logistics services. The growth in e-commerce also indirectly boosts maritime trade volumes. Furthermore, government initiatives and investments in upgrading port infrastructure, promoting sustainable shipping technologies, and developing a skilled maritime workforce are creating a conducive environment for sustained growth. The Dutch government's commitment to achieving carbon neutrality by 2050 is also driving innovation in green maritime technologies, such as alternative fuels and emission reduction systems, creating new market segments and investment opportunities. The increasing complexity of global supply chains and the need for efficient last-mile delivery are also bolstering the demand for specialized freight transport services within the Netherlands.

Key Markets & Segments Leading Maritime Market in Netherlands

The maritime market in Netherlands is undeniably led by Freight Transport Services, a segment consistently driven by the nation's pivotal role in global and European trade. This dominance is rooted in several key factors:

- Economic Growth: Robust economic activity within the Netherlands and its neighboring European countries directly translates to higher demand for the movement of goods, both raw materials and finished products.

- Infrastructure Excellence: The unparalleled depth and efficiency of ports like Rotterdam provide the foundational capacity for large-scale freight transport, making it the preferred entry and exit point for a vast array of commodities.

- Global Connectivity: The Netherlands' strategic location on major shipping routes ensures a continuous inflow and outflow of cargo, solidifying its position as a crucial node in international supply chains.

- Intermodal Integration: Seamless integration with inland waterways, rail, and road networks allows for efficient multimodal transport, further enhancing the attractiveness of Dutch ports for comprehensive freight transport services.

The Vessel Leasing and Rental Services segment, while secondary to overall freight volume, is crucial for specialized needs and operational flexibility. Key drivers here include:

- Specialized Cargo Requirements: Industries requiring the transport of specific or hazardous materials, such as chemicals and oil, depend on specialized vessels, leading to sustained demand for leasing and rental agreements.

- Fleet Optimization: Shipping companies utilize leasing and rental to manage fleet capacity, adapt to fluctuating market demands, and access newer, more efficient vessel technologies without significant capital outlay.

- Short-Term Contracts: The need for agile solutions for project-based logistics or temporary capacity gaps fuels the rental market.

Cargo Handling services are intrinsically linked to the volume of goods passing through Dutch ports. The efficiency and technological sophistication of cargo handling operations directly impact turnaround times and overall logistics costs.

- Efficiency and Automation: Investments in advanced port machinery, automated terminal operations, and digital tracking systems streamline cargo handling, increasing throughput and reducing delays.

- Value-Added Services: Beyond basic loading and unloading, ports offer warehousing, distribution, and customs clearance, making them comprehensive logistics hubs.

Support Services form the backbone of the entire maritime ecosystem, encompassing a wide range of activities necessary for smooth maritime operations.

- Maintenance and Repair: A thriving network of shipyards and repair facilities ensures the operational readiness of the maritime fleet.

- Bunkering and Supplies: Essential services for refueling and provisioning ships are critical for maintaining continuous voyages.

- Maritime Technology and Consultancy: The innovation hub in the Netherlands fosters a strong demand for maritime technology solutions and expert consultancy.

The dominance of Freight Transport Services is evident in its market share, estimated at over 70% of the total maritime services revenue in the Netherlands, with Cargo Handling following at approximately 20%. The remaining 10% is distributed between Vessel Leasing and Rental Services and Support Services.

Maritime Market in Netherlands Product Developments

Product developments in the maritime market in Netherlands are increasingly focused on sustainability and digitalization. Innovations include advanced hull coatings for reduced drag, electric and hybrid propulsion systems, and digital platforms for real-time cargo tracking and route optimization. The integration of AI for predictive maintenance and autonomous navigation systems is also gaining traction. These advancements not only enhance operational efficiency and reduce emissions but also provide a competitive edge for companies embracing these technologies, contributing to a smarter maritime future.

Challenges in the Maritime Market in Netherlands Market

The maritime market in Netherlands faces several significant challenges. Navigating stringent environmental regulations, particularly regarding emissions and waste disposal, requires substantial investment in greener technologies. Supply chain disruptions, exacerbated by geopolitical events and infrastructure bottlenecks, can lead to increased costs and delivery delays, impacting the reliability of freight transport services. Intense competition from other European ports and alternative transport modes also exerts pressure on pricing and service offerings. The estimated annual impact of these challenges on operational costs can range from 5% to 10% of total revenue.

Forces Driving Maritime Market in Netherlands Growth

Several forces are driving the growth of the maritime market in Netherlands. The continuous expansion of global trade, particularly with Asia, coupled with the Netherlands' status as a primary European gateway, is a fundamental driver. Technological advancements, such as the increasing adoption of digitalization in maritime and the development of cleaner fuel alternatives, are enhancing efficiency and sustainability, creating new service opportunities. Government support through infrastructure investments and favorable policies for sustainable shipping further bolsters the sector's growth trajectory. The growing demand for resilient and efficient supply chains post-pandemic also reinforces the importance of well-established maritime hubs like those in the Netherlands.

Challenges in the Maritime Market in Netherlands Market

Long-term growth catalysts in the maritime market in Netherlands are deeply intertwined with innovation and strategic expansion. The ongoing transition towards sustainable shipping, including the widespread adoption of alternative fuels like green hydrogen and ammonia, presents a significant opportunity for Dutch ports and companies to lead in developing and implementing these technologies. Furthermore, strategic partnerships and collaborations, both domestically and internationally, will be crucial for expanding service offerings and accessing new markets. Continued investment in the digitalization of maritime operations, including the implementation of blockchain for enhanced supply chain transparency and the utilization of big data analytics, will drive efficiency and create new value propositions for stakeholders.

Emerging Opportunities in Maritime Market in Netherlands

Emerging opportunities in the maritime market in Netherlands are abundant. The growing emphasis on the circular economy presents avenues for developing specialized cargo handling and transport solutions for recycled materials. The expansion of offshore wind energy projects requires significant maritime support, creating demand for specialized vessels and services. Furthermore, the development of smart port technologies and integrated logistics platforms offers opportunities to enhance efficiency and provide data-driven solutions to clients. The increasing demand for intermodal connectivity, linking sea transport with inland waterways, rail, and road, also presents growth prospects for integrated freight transport services.

Leading Players in the Maritime Market in Netherlands Sector

- Tarbit

- Chemship B V

- DFDS

- De Poli Tankers Holding BV

- Royal Wagenborg

- Unifeeder

- Nirint Shipping B V

- Wilson Agency BV

- Arklow Shipping

- Interstream Barging

Key Milestones in Maritime Market in Netherlands Industry

- 2019: Launch of the Port of Rotterdam's "Smartest Port" initiative, focusing on digitalization and automation.

- 2020: Royal Wagenborg's investment in a new fleet of eco-friendly vessels, emphasizing sustainable shipping.

- 2021: Chemship B V expands its chemical tanker fleet to meet growing demand for specialized freight transport services.

- 2022: Unifeeder strengthens its feeder network in Northern Europe, improving connectivity for cargo handling and distribution.

- 2023: DFDS invests in shore power facilities at its Dutch terminals, reducing emissions for docked vessels.

- 2024: Arklow Shipping announces plans to integrate advanced tracking and logistics software across its fleet.

Strategic Outlook for Maritime Market in Netherlands Market

The strategic outlook for the maritime market in Netherlands is highly positive, driven by a confluence of factors including its established infrastructure, innovative spirit, and commitment to sustainability. Growth accelerators will be powered by the continued push towards sustainable shipping and the integration of advanced digital technologies. Companies that prioritize investments in greener fleets, efficient cargo handling solutions, and data-driven logistics will be best positioned to capitalize on future market potential. Strategic opportunities lie in further enhancing intermodal connectivity, developing specialized services for emerging industries like offshore wind, and fostering collaborations that drive innovation in freight transport services. The Netherlands is set to remain a preeminent hub in the global maritime landscape.

Maritime Market in Netherlands Segmentation

-

1. Service

- 1.1. Freight Transport Services

- 1.2. Vessel Leasing and Rental Services

- 1.3. Cargo Ha

- 1.4. Supporti

Maritime Market in Netherlands Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Maritime Market in Netherlands Regional Market Share

Geographic Coverage of Maritime Market in Netherlands

Maritime Market in Netherlands REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in trade activities boosting the market; Increase in infrastructure development and increasing foreign investments

- 3.3. Market Restrains

- 3.3.1. Inadequate transportation infrastructure affecting the market; Regulatory challenges affecting the market

- 3.4. Market Trends

- 3.4.1. Cross Border E-commerce Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Maritime Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Freight Transport Services

- 5.1.2. Vessel Leasing and Rental Services

- 5.1.3. Cargo Ha

- 5.1.4. Supporti

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Maritime Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Freight Transport Services

- 6.1.2. Vessel Leasing and Rental Services

- 6.1.3. Cargo Ha

- 6.1.4. Supporti

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America Maritime Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Freight Transport Services

- 7.1.2. Vessel Leasing and Rental Services

- 7.1.3. Cargo Ha

- 7.1.4. Supporti

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Maritime Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Freight Transport Services

- 8.1.2. Vessel Leasing and Rental Services

- 8.1.3. Cargo Ha

- 8.1.4. Supporti

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa Maritime Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Freight Transport Services

- 9.1.2. Vessel Leasing and Rental Services

- 9.1.3. Cargo Ha

- 9.1.4. Supporti

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific Maritime Market in Netherlands Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Freight Transport Services

- 10.1.2. Vessel Leasing and Rental Services

- 10.1.3. Cargo Ha

- 10.1.4. Supporti

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tarbit**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chemship B V

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DFDS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 De Poli Tankers Holding BV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Royal Wagenborg

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unifeeder

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nirint Shipping B V

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wilson Agency BV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arklow Shipping

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Interstream Barging

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tarbit**List Not Exhaustive

List of Figures

- Figure 1: Global Maritime Market in Netherlands Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Maritime Market in Netherlands Revenue (Million), by Service 2025 & 2033

- Figure 3: North America Maritime Market in Netherlands Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Maritime Market in Netherlands Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Maritime Market in Netherlands Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Maritime Market in Netherlands Revenue (Million), by Service 2025 & 2033

- Figure 7: South America Maritime Market in Netherlands Revenue Share (%), by Service 2025 & 2033

- Figure 8: South America Maritime Market in Netherlands Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Maritime Market in Netherlands Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Maritime Market in Netherlands Revenue (Million), by Service 2025 & 2033

- Figure 11: Europe Maritime Market in Netherlands Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe Maritime Market in Netherlands Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Maritime Market in Netherlands Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Maritime Market in Netherlands Revenue (Million), by Service 2025 & 2033

- Figure 15: Middle East & Africa Maritime Market in Netherlands Revenue Share (%), by Service 2025 & 2033

- Figure 16: Middle East & Africa Maritime Market in Netherlands Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Maritime Market in Netherlands Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Maritime Market in Netherlands Revenue (Million), by Service 2025 & 2033

- Figure 19: Asia Pacific Maritime Market in Netherlands Revenue Share (%), by Service 2025 & 2033

- Figure 20: Asia Pacific Maritime Market in Netherlands Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Maritime Market in Netherlands Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Maritime Market in Netherlands Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Maritime Market in Netherlands Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Maritime Market in Netherlands Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Global Maritime Market in Netherlands Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Maritime Market in Netherlands Revenue Million Forecast, by Service 2020 & 2033

- Table 9: Global Maritime Market in Netherlands Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Maritime Market in Netherlands Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global Maritime Market in Netherlands Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Maritime Market in Netherlands Revenue Million Forecast, by Service 2020 & 2033

- Table 25: Global Maritime Market in Netherlands Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Maritime Market in Netherlands Revenue Million Forecast, by Service 2020 & 2033

- Table 33: Global Maritime Market in Netherlands Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Maritime Market in Netherlands Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Maritime Market in Netherlands?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Maritime Market in Netherlands?

Key companies in the market include Tarbit**List Not Exhaustive, Chemship B V, DFDS, De Poli Tankers Holding BV, Royal Wagenborg, Unifeeder, Nirint Shipping B V, Wilson Agency BV, Arklow Shipping, Interstream Barging.

3. What are the main segments of the Maritime Market in Netherlands?

The market segments include Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in trade activities boosting the market; Increase in infrastructure development and increasing foreign investments.

6. What are the notable trends driving market growth?

Cross Border E-commerce Growth.

7. Are there any restraints impacting market growth?

Inadequate transportation infrastructure affecting the market; Regulatory challenges affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Maritime Market in Netherlands," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Maritime Market in Netherlands report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Maritime Market in Netherlands?

To stay informed about further developments, trends, and reports in the Maritime Market in Netherlands, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence