Key Insights

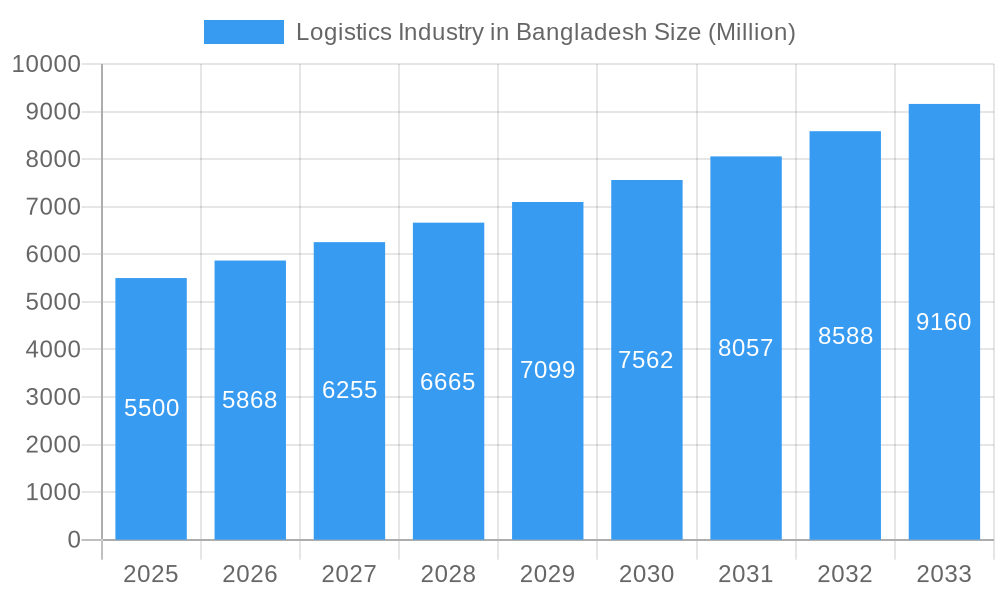

The Bangladesh logistics industry is projected for substantial growth, with an estimated market size of $378.26 billion and a Compound Annual Growth Rate (CAGR) of 9.6% from the base year 2024 through 2033. Key growth drivers include increasing export-import volumes driven by a robust manufacturing sector, particularly in apparel and textiles, and rising foreign direct investment. Government initiatives focused on infrastructure development, such as port modernization and multimodal transportation networks, further support this upward trend. The expanding e-commerce sector necessitates efficient last-mile delivery and warehousing solutions, while specialized logistics services for healthcare and automotive industries are in growing demand. The establishment of special economic zones and industrial parks is also concentrating logistics activities, requiring advanced supply chain management.

Logistics Industry in Bangladesh Market Size (In Billion)

The industry faces challenges including infrastructural bottlenecks such as road congestion and port capacity limitations, leading to increased transit times and operational costs. A scarcity of skilled logistics professionals and slower adoption of advanced technologies like automation and digitalization are also significant hurdles. Key trends include the rise of integrated logistics solutions offering end-to-end supply chain management through 3PL and 4PL providers. Demand for cold chain logistics is increasing to support the pharmaceutical and food industries, alongside a gradual shift towards sustainable logistics practices. Market segmentation indicates a dominance in freight transport, primarily road and shipping, followed by freight forwarding and warehousing, with value-added services demonstrating strong growth potential.

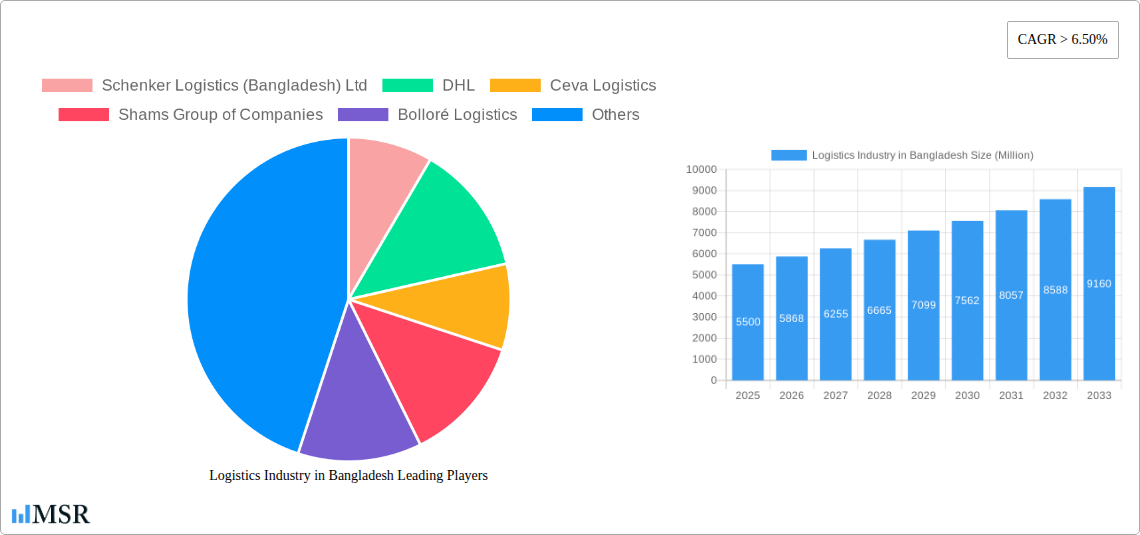

Logistics Industry in Bangladesh Company Market Share

This comprehensive report provides in-depth analysis of the Bangladesh logistics market for the study period 2019-2033, featuring a base year of 2024 and a forecast from 2024-2033. It offers critical insights for supply chain professionals, freight forwarders, manufacturers, and investors, covering freight transport (road, shipping, inland water, air, rail), freight forwarding, warehousing, and value-added services. End-user segmentation includes manufacturing and automotive, oil and gas, mining and quarrying, construction, distributive trade (wholesale and retail), healthcare and pharmaceutical, and others. This guide details market concentration, innovation, regulatory frameworks, and M&A activities, offering actionable intelligence for navigating the logistics landscape in Bangladesh.

Logistics Industry in Bangladesh Market Concentration & Dynamics

The logistics industry in Bangladesh exhibits a moderately concentrated market, with a significant portion of the market share held by a few major players, including Schenker Logistics (Bangladesh) Ltd, DHL, Ceva Logistics, Shams Group of Companies, Bolloré Logistics, Tower Freight Logistics Ltd, FedEx, A H Khan & Co, Agility, MOL Logistics Co Ltd, Nippon Express Bangladesh Ltd, Asia Pacific Logistics (list not exhaustive), United Parcel Service of America Inc, Blue Ocean Freight System Ltd, and 3i Logistics Group. The innovation ecosystem is rapidly evolving, driven by increasing demand for efficient supply chain management and cold chain logistics. Regulatory frameworks are undergoing continuous improvement to streamline customs procedures and facilitate trade, though challenges remain in areas like port infrastructure development and inland waterway connectivity. Substitute products, such as in-house logistics operations, are being challenged by the cost-effectiveness and specialized expertise offered by third-party logistics (3PL) providers. End-user trends are shifting towards greater reliance on integrated logistics solutions, particularly within the manufacturing and automotive sectors, and the distributive trade (wholesale and retail) due to e-commerce growth. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to consolidate their market positions and expand service offerings. While specific M&A deal counts are still emerging, the trend indicates a move towards larger, more integrated logistics entities. The market share of key players is dynamic, influenced by their investment in technology and expansion of warehousing capabilities, especially in strategic locations like Chattogram.

Logistics Industry in Bangladesh Industry Insights & Trends

The Bangladesh logistics market is poised for significant growth, projected to reach an estimated USD XX Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is primarily fueled by robust economic growth, a burgeoning manufacturing sector, and increasing cross-border trade. Technological disruptions are playing a pivotal role, with the adoption of digital platforms for freight tracking, warehouse management systems, and route optimization enhancing efficiency and transparency. E-commerce proliferation is a major market growth driver, demanding faster and more reliable delivery services, thereby boosting the freight transport and last-mile delivery segments. Evolving consumer behaviors, characterized by an increasing preference for online shopping, are compelling businesses to invest more in sophisticated supply chain logistics. The garment industry, a cornerstone of Bangladesh's economy, continues to be a dominant consumer of logistics services, driving demand for efficient ocean freight and air cargo solutions. The government's focus on improving infrastructure, including ports and road networks, is further accelerating market growth by reducing transit times and operational costs for logistics companies. The increasing trend of outsourcing logistics functions by businesses, coupled with the growing demand for specialized services like cold chain logistics for the healthcare and pharmaceutical sectors, presents substantial opportunities. The oil and gas sector also contributes to the market's expansion through its demand for specialized transportation and storage solutions. The integration of advanced technologies like Artificial Intelligence (AI) and the Internet of Things (IoT) is set to revolutionize warehouse automation and inventory management, leading to greater operational efficiency and cost savings. The increasing foreign direct investment in various industries necessitates a robust and sophisticated logistics infrastructure to support their operations.

Key Markets & Segments Leading Logistics Industry in Bangladesh

The logistics industry in Bangladesh is characterized by the significant dominance of specific segments driven by underlying economic activities and infrastructure development.

Freight Transport:

- Shipping and Inland Water: This segment is a leading force due to Bangladesh's extensive riverine network and the critical importance of the Chattogram Port. The government's continuous efforts to enhance port capacity and develop inland waterways infrastructure directly fuel growth in this area, making it a primary mode for bulk cargo and raw material transportation.

- Road Freight: This segment holds substantial importance, particularly for last-mile delivery and connecting manufacturing hubs to ports and distribution centers. The growing automotive sector and the expansion of the highway network are key drivers.

Freight Forwarding:

- This segment is experiencing robust growth, driven by the increasing complexity of international trade and the need for specialized expertise in customs clearance, documentation, and multimodal transportation. The garment industry's reliance on efficient global distribution makes freight forwarding a cornerstone of the logistics ecosystem.

Warehousing:

- The demand for modern warehousing facilities is escalating, spurred by the growth of e-commerce and the need for efficient inventory management. The November 2022 development of a new 100,000-square-foot facility in Chattogram by A.P. Moller-Maersk highlights the strategic importance and expansion within this segment, offering proximity to ports and excellent connectivity.

End-User Dominance:

- Distributive Trade (Wholesale and Retail): This sector is a major contributor to logistics demand, amplified by the rapid expansion of the e-commerce landscape. The need for efficient supply chain solutions to manage a vast array of consumer goods is paramount.

- Manufacturing and Automotive: As a key economic driver, the manufacturing sector, especially the textile and garment industry, requires comprehensive logistics support for both inbound raw materials and outbound finished goods. The automotive sector's increasing presence further bolsters demand for specialized logistics.

- Healthcare and Pharmaceutical: The growing population and increasing healthcare expenditure are driving demand for specialized cold chain logistics and secure transportation of pharmaceuticals, making this a critical and growing segment.

The growth in these segments is intrinsically linked to overarching economic development, government initiatives for infrastructure improvement, and the evolving needs of key industries within Bangladesh.

Logistics Industry in Bangladesh Product Developments

Recent product developments in the Bangladesh logistics industry are centered on enhancing efficiency and visibility. Companies are investing in integrated logistics management software that offers real-time cargo tracking and inventory management. The introduction of advanced warehouse management systems (WMS), incorporating barcode scanning and RFID technology, is improving stock accuracy and reducing handling times. Furthermore, there is a growing focus on developing specialized logistics solutions, such as temperature-controlled transport for the pharmaceutical and healthcare sectors, ensuring the integrity of sensitive goods. The adoption of digital platforms for booking and managing shipments is also a key development, simplifying processes for clients and enhancing operational agility.

Challenges in the Logistics Industry in Bangladesh Market

The logistics industry in Bangladesh faces several significant challenges that impact its growth and efficiency. Inadequate port infrastructure and congestion at major ports lead to extended transit times and increased costs. The underdeveloped state of inland waterway transport and the lack of a comprehensive rail freight network limit multimodal integration. Regulatory hurdles, including complex customs procedures and inconsistent enforcement, create inefficiencies. High operational costs due to fuel prices, vehicle maintenance, and unofficial charges further strain the market. The shortage of skilled logistics professionals and the limited adoption of advanced technologies by some smaller players also pose considerable restraints. The estimated impact of these challenges can lead to delays of up to XX% in delivery times and an increase in logistics costs by as much as XX% for businesses.

Forces Driving Logistics Industry in Bangladesh Growth

Several powerful forces are propelling the logistics industry in Bangladesh forward. The nation's robust economic growth and its position as a major manufacturing hub, particularly in ready-made garments (RMG), are fundamental drivers. The rapid expansion of e-commerce necessitates more efficient and widespread distribution networks. Government initiatives focused on improving infrastructure, including port modernization, highway expansion, and the development of economic zones, are creating a more conducive environment for logistics operations. Increased foreign direct investment (FDI) across various sectors, from textiles to pharmaceuticals, demands sophisticated supply chain solutions. Furthermore, a growing awareness among businesses about the cost-saving and efficiency benefits of outsourcing logistics functions to specialized 3PL providers is a significant catalyst.

Challenges in the Logistics Industry in Bangladesh Market

The logistics industry in Bangladesh is confronted by long-term growth catalysts that, while presenting challenges, also pave the way for future expansion and innovation. The need to overcome infrastructure deficits, particularly in port capacity and intermodal connectivity, is driving investment in modernization and expansion projects. The increasing demand for sustainable logistics practices is pushing companies to explore greener transportation options and energy-efficient warehousing solutions. The ongoing digital transformation, though in its nascent stages for some, presents a long-term opportunity for companies that embrace technology adoption, automation, and data analytics to enhance operational efficiency and customer service. Developing a highly skilled workforce through specialized training programs will be crucial for supporting the industry's evolution towards more complex and technologically driven operations.

Emerging Opportunities in Logistics Industry in Bangladesh

The logistics industry in Bangladesh is ripe with emerging opportunities driven by evolving market dynamics and technological advancements. The expansion of the e-commerce sector presents a significant opportunity for developing specialized last-mile delivery solutions and integrated fulfillment centers. Growing demand from the healthcare and pharmaceutical sectors for cold chain logistics and temperature-controlled transportation offers a niche market for specialized providers. The government's focus on promoting "Digital Bangladesh" is fostering the adoption of technology, creating opportunities for logistics tech startups and innovative digital platforms for freight management. As Bangladesh continues to attract foreign investment, there will be an increased need for sophisticated supply chain management services catering to multinational corporations. Furthermore, exploring opportunities in cross-border logistics with neighboring countries presents avenues for regional expansion.

Leading Players in the Logistics Industry in Bangladesh Sector

- Schenker Logistics (Bangladesh) Ltd

- DHL

- Ceva Logistics

- Shams Group of Companies

- Bolloré Logistics

- Tower Freight Logistics Ltd

- FedEx

- A H Khan & Co

- Agility

- MOL Logistics Co Ltd

- Nippon Express Bangladesh Ltd

- Asia Pacific Logistics

- United Parcel Service of America Inc

- Blue Ocean Freight System Ltd

- 3i Logistics Group

Key Milestones in Logistics Industry in Bangladesh Industry

- November 2022: A.P. Moller-Maersk is increasing the size of its Bangladeshi warehouse operations with the construction of a new 100,000-square-foot facility in Chattogram. The new facility is conveniently situated close to the Chattogram Port and is connected to the Dhaka-Chattagram Highway via the Outer Ring Road and Karnaphuli Tunnel, providing quick access to Bangladesh's garment exporters based out of the nearby industrial hubs. This signifies a major investment in expanding warehousing capacity and improving connectivity for key export industries.

- October 2022: Yusen Logistics Co., Ltd. launched its own consolidated direct (*) ocean freight forwarding service from Chattogram port in Bangladesh to Tokyo and Kobe ports. Currently, the majority of Less-than-Container Load (LCL) ocean freight forwarding services from Bangladesh are CO-LOAD multi-country consolidation services out of the ports of Singapore and Port Klang, however, there are worries about cargo loss and damage, as well as scheduling issues. This development marks a significant step towards offering more direct and controlled LCL services, aiming to mitigate existing concerns about cargo integrity and delivery reliability.

Strategic Outlook for Logistics Industry in Bangladesh Market

The strategic outlook for the logistics industry in Bangladesh is highly positive, with significant potential for growth and diversification. Key accelerators include continued investment in infrastructure development, particularly port modernization and the expansion of the road and rail networks, which will enhance transit times and reduce operational costs. The ongoing digital transformation presents opportunities for logistics companies to embrace technology, including automation, AI, and data analytics, to improve efficiency, transparency, and customer satisfaction. Strategic partnerships and collaborations between local and international players will be crucial for knowledge transfer and market penetration. Focusing on specialized services, such as cold chain logistics for the growing healthcare and pharmaceutical sectors, and e-commerce logistics solutions, will unlock new revenue streams. The government's commitment to ease of doing business and trade facilitation will further bolster confidence and attract investment, solidifying Bangladesh's position as a key player in the regional supply chain.

Logistics Industry in Bangladesh Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Construction

- 2.4. Distributive Trade (Wholesale and Retail)

- 2.5. Healthcare and Pharmaceutical

- 2.6. Others E

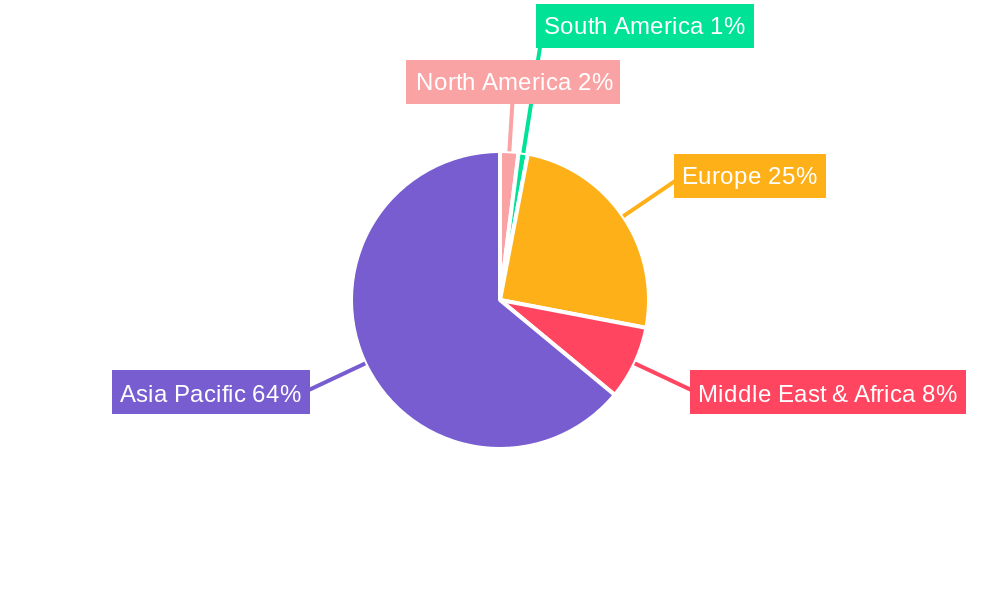

Logistics Industry in Bangladesh Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Logistics Industry in Bangladesh Regional Market Share

Geographic Coverage of Logistics Industry in Bangladesh

Logistics Industry in Bangladesh REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. International Trade Growth; Trade Agreements cresting impact on customs procedures and creating opportunities for customs brokers

- 3.3. Market Restrains

- 3.3.1. Corruption and Informal Practices; Compliance and Documentation

- 3.4. Market Trends

- 3.4.1. Increased shipping and inland water freight transport is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics Industry in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Construction

- 5.2.4. Distributive Trade (Wholesale and Retail)

- 5.2.5. Healthcare and Pharmaceutical

- 5.2.6. Others E

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. North America Logistics Industry in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Freight Transport

- 6.1.1.1. Road

- 6.1.1.2. Shipping and Inland Water

- 6.1.1.3. Air

- 6.1.1.4. Rail

- 6.1.2. Freight Forwarding

- 6.1.3. Warehousing

- 6.1.4. Value-added Services and Other Functions

- 6.1.1. Freight Transport

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Manufacturing and Automotive

- 6.2.2. Oil and Gas, Mining, and Quarrying

- 6.2.3. Construction

- 6.2.4. Distributive Trade (Wholesale and Retail)

- 6.2.5. Healthcare and Pharmaceutical

- 6.2.6. Others E

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. South America Logistics Industry in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Freight Transport

- 7.1.1.1. Road

- 7.1.1.2. Shipping and Inland Water

- 7.1.1.3. Air

- 7.1.1.4. Rail

- 7.1.2. Freight Forwarding

- 7.1.3. Warehousing

- 7.1.4. Value-added Services and Other Functions

- 7.1.1. Freight Transport

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Manufacturing and Automotive

- 7.2.2. Oil and Gas, Mining, and Quarrying

- 7.2.3. Construction

- 7.2.4. Distributive Trade (Wholesale and Retail)

- 7.2.5. Healthcare and Pharmaceutical

- 7.2.6. Others E

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe Logistics Industry in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Freight Transport

- 8.1.1.1. Road

- 8.1.1.2. Shipping and Inland Water

- 8.1.1.3. Air

- 8.1.1.4. Rail

- 8.1.2. Freight Forwarding

- 8.1.3. Warehousing

- 8.1.4. Value-added Services and Other Functions

- 8.1.1. Freight Transport

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Manufacturing and Automotive

- 8.2.2. Oil and Gas, Mining, and Quarrying

- 8.2.3. Construction

- 8.2.4. Distributive Trade (Wholesale and Retail)

- 8.2.5. Healthcare and Pharmaceutical

- 8.2.6. Others E

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Middle East & Africa Logistics Industry in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Freight Transport

- 9.1.1.1. Road

- 9.1.1.2. Shipping and Inland Water

- 9.1.1.3. Air

- 9.1.1.4. Rail

- 9.1.2. Freight Forwarding

- 9.1.3. Warehousing

- 9.1.4. Value-added Services and Other Functions

- 9.1.1. Freight Transport

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Manufacturing and Automotive

- 9.2.2. Oil and Gas, Mining, and Quarrying

- 9.2.3. Construction

- 9.2.4. Distributive Trade (Wholesale and Retail)

- 9.2.5. Healthcare and Pharmaceutical

- 9.2.6. Others E

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Asia Pacific Logistics Industry in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Freight Transport

- 10.1.1.1. Road

- 10.1.1.2. Shipping and Inland Water

- 10.1.1.3. Air

- 10.1.1.4. Rail

- 10.1.2. Freight Forwarding

- 10.1.3. Warehousing

- 10.1.4. Value-added Services and Other Functions

- 10.1.1. Freight Transport

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Manufacturing and Automotive

- 10.2.2. Oil and Gas, Mining, and Quarrying

- 10.2.3. Construction

- 10.2.4. Distributive Trade (Wholesale and Retail)

- 10.2.5. Healthcare and Pharmaceutical

- 10.2.6. Others E

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Schenker Logistics (Bangladesh) Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ceva Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shams Group of Companies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bolloré Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tower Freight Logistics Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FedEx

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 A H Khan & Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agility

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MOL Logistics Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nippon Express Bangladesh Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Asia Pacific Logistics**List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 United Parcel Service of America Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Blue Ocean Freight System Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 3i Logistics Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Schenker Logistics (Bangladesh) Ltd

List of Figures

- Figure 1: Global Logistics Industry in Bangladesh Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Logistics Industry in Bangladesh Revenue (billion), by Function 2025 & 2033

- Figure 3: North America Logistics Industry in Bangladesh Revenue Share (%), by Function 2025 & 2033

- Figure 4: North America Logistics Industry in Bangladesh Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Logistics Industry in Bangladesh Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Logistics Industry in Bangladesh Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Logistics Industry in Bangladesh Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Logistics Industry in Bangladesh Revenue (billion), by Function 2025 & 2033

- Figure 9: South America Logistics Industry in Bangladesh Revenue Share (%), by Function 2025 & 2033

- Figure 10: South America Logistics Industry in Bangladesh Revenue (billion), by End User 2025 & 2033

- Figure 11: South America Logistics Industry in Bangladesh Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America Logistics Industry in Bangladesh Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Logistics Industry in Bangladesh Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Logistics Industry in Bangladesh Revenue (billion), by Function 2025 & 2033

- Figure 15: Europe Logistics Industry in Bangladesh Revenue Share (%), by Function 2025 & 2033

- Figure 16: Europe Logistics Industry in Bangladesh Revenue (billion), by End User 2025 & 2033

- Figure 17: Europe Logistics Industry in Bangladesh Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Logistics Industry in Bangladesh Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Logistics Industry in Bangladesh Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Logistics Industry in Bangladesh Revenue (billion), by Function 2025 & 2033

- Figure 21: Middle East & Africa Logistics Industry in Bangladesh Revenue Share (%), by Function 2025 & 2033

- Figure 22: Middle East & Africa Logistics Industry in Bangladesh Revenue (billion), by End User 2025 & 2033

- Figure 23: Middle East & Africa Logistics Industry in Bangladesh Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa Logistics Industry in Bangladesh Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Logistics Industry in Bangladesh Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Logistics Industry in Bangladesh Revenue (billion), by Function 2025 & 2033

- Figure 27: Asia Pacific Logistics Industry in Bangladesh Revenue Share (%), by Function 2025 & 2033

- Figure 28: Asia Pacific Logistics Industry in Bangladesh Revenue (billion), by End User 2025 & 2033

- Figure 29: Asia Pacific Logistics Industry in Bangladesh Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Logistics Industry in Bangladesh Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Logistics Industry in Bangladesh Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Function 2020 & 2033

- Table 2: Global Logistics Industry in Bangladesh Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Function 2020 & 2033

- Table 5: Global Logistics Industry in Bangladesh Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Function 2020 & 2033

- Table 11: Global Logistics Industry in Bangladesh Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Function 2020 & 2033

- Table 17: Global Logistics Industry in Bangladesh Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Function 2020 & 2033

- Table 29: Global Logistics Industry in Bangladesh Revenue billion Forecast, by End User 2020 & 2033

- Table 30: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Function 2020 & 2033

- Table 38: Global Logistics Industry in Bangladesh Revenue billion Forecast, by End User 2020 & 2033

- Table 39: Global Logistics Industry in Bangladesh Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Logistics Industry in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics Industry in Bangladesh?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Logistics Industry in Bangladesh?

Key companies in the market include Schenker Logistics (Bangladesh) Ltd, DHL, Ceva Logistics, Shams Group of Companies, Bolloré Logistics, Tower Freight Logistics Ltd, FedEx, A H Khan & Co, Agility, MOL Logistics Co Ltd, Nippon Express Bangladesh Ltd, Asia Pacific Logistics**List Not Exhaustive, United Parcel Service of America Inc, Blue Ocean Freight System Ltd, 3i Logistics Group.

3. What are the main segments of the Logistics Industry in Bangladesh?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 378.26 billion as of 2022.

5. What are some drivers contributing to market growth?

International Trade Growth; Trade Agreements cresting impact on customs procedures and creating opportunities for customs brokers.

6. What are the notable trends driving market growth?

Increased shipping and inland water freight transport is driving the market.

7. Are there any restraints impacting market growth?

Corruption and Informal Practices; Compliance and Documentation.

8. Can you provide examples of recent developments in the market?

November 2022: A.P. Moller-Maersk is increasing the size of its Bangladeshi warehouse operations with the construction of a new 100,000-square-foot facility in Chattogram. The new facility is conveniently situated close to the Chattogram Port and is connected to the Dhaka-Chattagram Highway via the Outer Ring Road and Karnaphuli Tunnel, providing quick access to Bangladesh's garment exporters based out of the nearby industrial hubs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics Industry in Bangladesh," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics Industry in Bangladesh report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics Industry in Bangladesh?

To stay informed about further developments, trends, and reports in the Logistics Industry in Bangladesh, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence