Key Insights

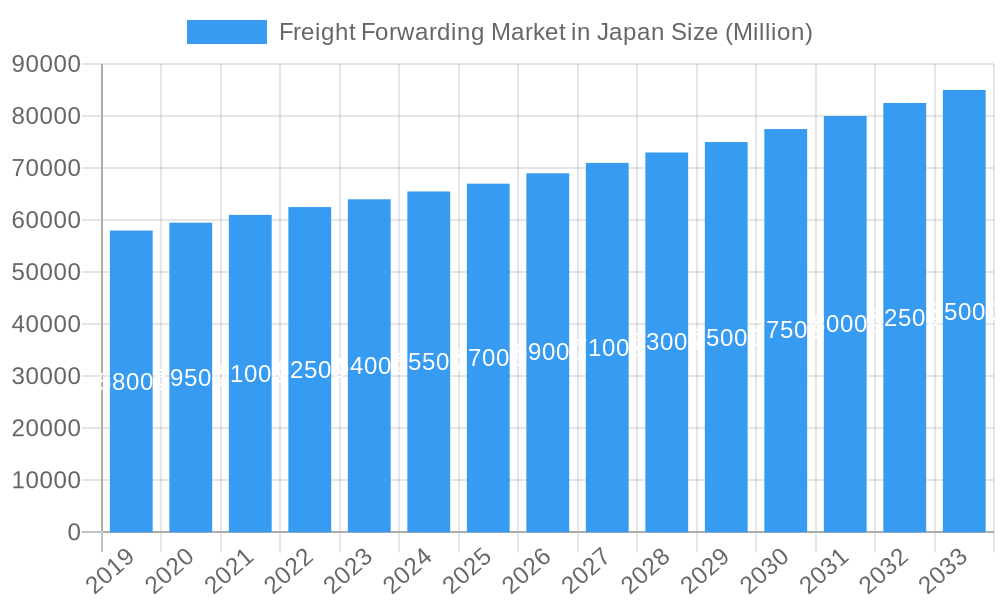

The Japanese freight forwarding market is projected for robust expansion, fueled by its strong manufacturing base and increasing global trade. With a projected CAGR of 2.76%, the market is set to grow from an estimated 331.3 billion in 2025 to over USD 400 billion by 2033. Key growth drivers include sustained demand for efficient logistics across automotive, electronics, and machinery manufacturing sectors. The expanding e-commerce landscape, especially for international shipments, is also boosting demand for Courier, Express, and Parcel (CEP) services. Investments in advanced warehousing, including temperature-controlled solutions, are vital for high-value and perishable goods exports, further supporting market growth.

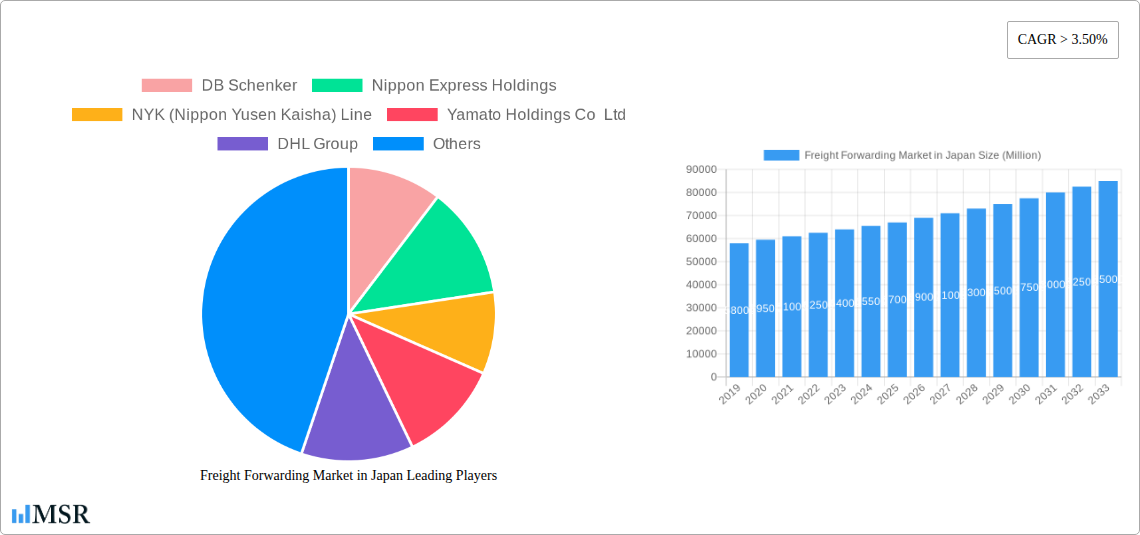

Freight Forwarding Market in Japan Market Size (In Billion)

Challenges include an aging workforce and logistics labor shortages, which may affect operational efficiency and costs. Rising fuel prices and stringent environmental regulations necessitate investment in greener transportation and route optimization. However, supply chain digitalization, integrating IoT, AI, and blockchain, is expected to enhance transparency and real-time tracking, mitigating challenges and opening new growth avenues. The adoption of multimodal transport solutions, combining air, sea, and road freight, will be crucial for optimizing delivery times and cost-effectiveness.

Freight Forwarding Market in Japan Company Market Share

Gain comprehensive insights into the Japanese freight forwarding market. This analysis details market drivers, key players, emerging trends, and strategic opportunities within Japan's logistics sector. It offers actionable intelligence for businesses navigating and capitalizing on evolving supply chain demands.

The Japanese freight forwarding market is undergoing significant growth and transformation, driven by technological innovation, shifting consumer behaviors, and a resilient manufacturing sector. This report provides an exhaustive analysis of market dynamics, key segments, product advancements, challenges, and opportunities from 2019 to 2033, with 2025 as the base year. It examines supply-demand interplay, the impact of digital solutions, and the growing emphasis on sustainability within Japan's logistics ecosystem.

Freight Forwarding Market in Japan Market Concentration & Dynamics

The Japanese freight forwarding market exhibits a moderately concentrated landscape, characterized by a blend of established global giants and strong domestic players. Nippon Express Holdings, NYK Line, Yamato Holdings, and SG Holdings Co Ltd command significant market share, leveraging their extensive networks and integrated logistics solutions. However, the market also witnesses continuous innovation driven by companies like DB Schenker, DHL Group, DSV A/S, Kuehne + Nagel, UPS, Kintetsu Group Holdings, and Mitsui O S K Lines Ltd, which actively invest in digital platforms and sustainable logistics. The innovation ecosystem is fueled by collaborations between logistics providers, technology firms, and end-user industries, fostering the development of advanced solutions for freight tracking, route optimization, and warehouse management. Regulatory frameworks, while robust, are evolving to accommodate technological advancements and sustainability mandates. Substitute products, primarily in the form of in-house logistics operations by large corporations, exist but are often outcompeted by the specialized expertise and economies of scale offered by dedicated freight forwarders. End-user trends indicate a growing demand for faster, more transparent, and environmentally conscious shipping solutions across all sectors, particularly within manufacturing and wholesale/retail trade. M&A activities, though not excessively high, are strategically focused on acquiring niche capabilities or expanding geographical reach. For instance, a hypothetical M&A deal in 2023 involving a specialized cold chain logistics provider could have been valued at approximately $50 Million, aiming to bolster capabilities in the pharmaceutical and food sectors. The number of significant M&A deals in the past five years is estimated to be around 5-8, focusing on digital transformation and specialized logistics services.

Freight Forwarding Market in Japan Industry Insights & Trends

The freight forwarding market in Japan is poised for substantial expansion, projected to reach an estimated market size of USD 180,000 Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This growth is primarily propelled by the nation's robust manufacturing sector, its position as a global trade hub, and an increasing demand for efficient and technologically advanced logistics solutions. The resurgence in global trade post-pandemic, coupled with the ongoing e-commerce boom, continues to fuel the need for sophisticated freight forwarding services. Digitalization is a paramount trend, with companies heavily investing in Artificial Intelligence (AI), blockchain, and the Internet of Things (IoT) to enhance visibility, automate processes, and improve operational efficiency. This includes advanced cargo tracking systems, predictive analytics for demand forecasting, and AI-powered route optimization. Furthermore, a growing emphasis on sustainability is reshaping the industry. Shippers are increasingly seeking forwarders who can offer eco-friendly transportation options, such as utilizing sustainable aviation fuel (SAF), optimizing load capacities, and reducing carbon emissions throughout the supply chain. The "last mile" delivery segment, particularly Courier, Express, and Parcel (CEP) services, is experiencing immense growth due to the proliferation of online retail, necessitating faster and more flexible delivery options. This is driving innovation in urban logistics, including the adoption of electric vehicles and optimized delivery networks. The oil and gas sector, while volatile, still represents a significant segment requiring specialized heavy-lift and project cargo forwarding. Construction logistics are also on an upward trajectory, driven by infrastructure development projects.

Key Markets & Segments Leading Freight Forwarding Market in Japan

The Wholesale and Retail Trade segment stands as a dominant force in the Japanese freight forwarding market, driven by the nation's advanced retail infrastructure and the burgeoning e-commerce sector. The sheer volume of goods moved for consumer consumption, coupled with the increasing complexity of omnichannel retail, necessitates highly efficient and responsive freight forwarding solutions. The Manufacturing sector also plays a pivotal role, acting as a cornerstone of Japan's economy and a significant contributor to its export volume. This includes intricate supply chains for automotive, electronics, and industrial machinery, requiring specialized handling, just-in-time deliveries, and often, cross-border freight forwarding.

Within the Logistics Function segment, Courier, Express, and Parcel (CEP) services, particularly for International destinations, are experiencing exponential growth. This is directly linked to the global reach of Japanese brands and the increasing demand for direct-to-consumer shipping. The Freight Forwarding function, by Mode of Transport, sees Air Freight as a critical component for high-value, time-sensitive goods, while Sea Freight remains the backbone for bulk cargo and long-haul international trade.

Drivers within these key segments include:

- Economic Growth and Consumer Spending: A strong domestic economy and robust consumer spending directly translate to higher demand for goods, thus increasing freight volumes.

- E-commerce Penetration: The continued rise of online shopping fuels the demand for efficient CEP services and last-mile delivery solutions.

- Global Trade Dynamics: Japan's active participation in international trade necessitates seamless cross-border freight forwarding, particularly for exports of manufactured goods.

- Technological Advancements: The adoption of digital platforms, AI, and automation in warehousing and logistics operations enhances efficiency and reduces costs, making freight forwarding services more attractive.

- Supply Chain Resilience: Recent global disruptions have highlighted the importance of diversified and resilient supply chains, leading businesses to seek more robust freight forwarding partnerships.

- Infrastructure Development: Ongoing investments in port modernization, high-speed rail, and road networks facilitate smoother and faster goods movement.

The Warehousing and Storage segment, especially Non-Temperature Controlled, is crucial for managing the vast quantities of goods handled by the wholesale and retail trade, further solidifying its leading position. The "Others" category within End User Industry encompasses various specialized sectors that rely on freight forwarding, such as healthcare and pharmaceuticals, which often require temperature-controlled logistics and stringent compliance.

Freight Forwarding Market in Japan Product Developments

Recent product developments in the Japanese freight forwarding market are heavily focused on enhancing digital capabilities and sustainability. Companies are actively launching and expanding digital platforms that offer real-time visibility, instant quoting, and automated booking processes. For example, Nippon Express's e-NX Quote service, now covering 35 countries/regions, exemplifies this trend by providing online quotes and incorporating CO2 emissions calculation functions, allowing clients to make informed, greener choices. DHL Japan's partnership for GoGreen Plus using sustainable aviation fuel (SAF) signifies a strong commitment to reducing the carbon footprint of air cargo, directly impacting their product offerings for environmentally conscious clients. These innovations not only streamline operations and improve customer experience but also provide a competitive edge in a market increasingly prioritizing efficiency and environmental responsibility.

Challenges in the Freight Forwarding Market in Japan Market

The Japanese freight forwarding market faces several challenges that could impede its growth trajectory. Regulatory hurdles, particularly concerning cross-border logistics and evolving customs procedures, can create complexities and delays. Intense competition among a large number of domestic and international players can lead to price wars and pressure on profit margins. Furthermore, supply chain disruptions, such as port congestion, labor shortages, and geopolitical instability, continue to pose significant risks. The aging population and a shrinking workforce in Japan also present a substantial challenge in securing skilled labor for operational roles within the logistics sector. The estimated annual cost of delays due to supply chain disruptions can range from USD 50 Million to USD 150 Million, impacting overall market efficiency.

Forces Driving Freight Forwarding Market in Japan Growth

Several key forces are propelling the growth of the freight forwarding market in Japan. Technological innovation, including the widespread adoption of AI, IoT, and blockchain, is enhancing operational efficiency, transparency, and customer service. Economic recovery and a resilient export-oriented economy fuel demand for goods movement, both domestically and internationally. Government initiatives promoting trade facilitation and infrastructure development, such as port upgrades and digital customs systems, further streamline logistics operations. The growing imperative for sustainability is also driving demand for eco-friendly logistics solutions, creating opportunities for forwarders who can offer reduced carbon emissions and greener transportation options. The continuous expansion of the e-commerce sector is a relentless driver of growth, necessitating rapid and reliable delivery services.

Challenges in the Freight Forwarding Market in Japan Market

Long-term growth catalysts for the Japanese freight forwarding market lie in strategic adaptations to evolving global and domestic landscapes. The increasing demand for resilient and agile supply chains presents an opportunity for forwarders to position themselves as strategic partners offering end-to-end solutions. Continued investment in digital transformation and automation will be crucial for maintaining competitiveness and improving operational efficiency. The growing global emphasis on Environmental, Social, and Governance (ESG) principles will likely lead to greater demand for sustainable logistics, rewarding companies that prioritize green shipping practices. Furthermore, partnerships and collaborations between logistics providers, technology companies, and industry stakeholders can foster innovation and unlock new market potentials, particularly in specialized sectors. Expansion into emerging Asian markets and diversification of service offerings beyond traditional freight movement will also contribute to sustained growth.

Emerging Opportunities in Freight Forwarding Market in Japan

Emerging opportunities in the Japanese freight forwarding market are centered around innovation and specialization. The growing demand for temperature-controlled logistics, particularly for pharmaceuticals and high-value perishables, presents a significant growth avenue. The ongoing digitalization of supply chains creates opportunities for value-added services such as advanced data analytics, supply chain visibility platforms, and predictive maintenance for logistics assets. As Japan focuses on circular economy initiatives, there will be an increasing need for specialized reverse logistics and waste management freight forwarding services. The growth of the Japanese semiconductor industry and its complex global supply chain also presents substantial opportunities for specialized freight forwarding catering to the unique requirements of this sector. Furthermore, leveraging cross-border e-commerce with neighboring Asian countries offers untapped potential for efficient and cost-effective shipping solutions.

Leading Players in the Freight Forwarding Market in Japan Sector

- DB Schenker

- Nippon Express Holdings

- NYK (Nippon Yusen Kaisha) Line

- Yamato Holdings Co Ltd

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- SG Holdings Co Ltd

- Kuehne + Nagel

- United Parcel Service of America Inc (UPS)

- Kintetsu Group Holdings Co Ltd

- Mitsui O S K Lines Ltd

Key Milestones in Freight Forwarding Market in Japan Industry

- February 2024: Nippon Express expanded its e-NX Quote digital forwarding service to 35 countries/regions, including a January 31 launch in Japan, adding a CO2 emissions calculation function to its online quoting capabilities.

- February 2024: DHL Japan and SCREEN Semiconductor Solutions Co., Ltd. signed a long-term contract for GoGreen Plus, a transportation service utilizing sustainable aviation fuel (SAF) to reduce CO2 emissions.

- January 2024: DHL Express deployed its final Boeing 777 freighter at its South Asia Hub in Singapore. This aircraft, with a 102-ton payload, joined four others to enhance inter-continental connectivity between Asia Pacific and the Americas, boosting international express shipping capacity by a total of 1,224 tons.

Strategic Outlook for Freight Forwarding Market in Japan Market

The strategic outlook for the Japanese freight forwarding market is characterized by a strong emphasis on digital transformation, sustainability, and operational resilience. Companies that invest in advanced technologies like AI and automation will be best positioned to enhance efficiency and offer competitive pricing. The growing global demand for environmentally friendly logistics will push forwarders to prioritize services that reduce carbon emissions, such as SAF utilization and optimized route planning. Building robust and agile supply chain solutions will be critical to mitigate the impact of potential disruptions. Strategic partnerships and mergers will continue to play a role in market consolidation and the acquisition of specialized capabilities. The market's future success will hinge on its ability to adapt to evolving customer needs, embrace technological advancements, and champion sustainable practices, ensuring Japan remains a pivotal hub for global logistics.

Freight Forwarding Market in Japan Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

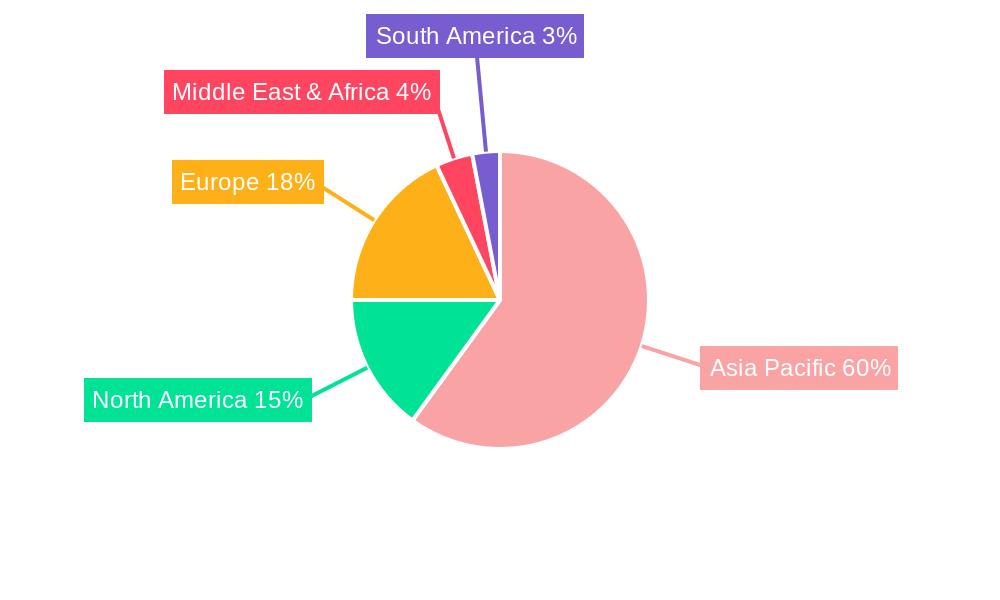

Freight Forwarding Market in Japan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Freight Forwarding Market in Japan Regional Market Share

Geographic Coverage of Freight Forwarding Market in Japan

Freight Forwarding Market in Japan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Freight Forwarding Market in Japan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Freight Forwarding Market in Japan Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Logistics Function

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.2.1.1. By Destination Type

- 6.2.1.1.1. Domestic

- 6.2.1.1.2. International

- 6.2.1.1. By Destination Type

- 6.2.2. Freight Forwarding

- 6.2.2.1. By Mode Of Transport

- 6.2.2.1.1. Air

- 6.2.2.1.2. Sea and Inland Waterways

- 6.2.2.1.3. Others

- 6.2.2.1. By Mode Of Transport

- 6.2.3. Freight Transport

- 6.2.3.1. Pipelines

- 6.2.3.2. Rail

- 6.2.3.3. Road

- 6.2.4. Warehousing and Storage

- 6.2.4.1. By Temperature Control

- 6.2.4.1.1. Non-Temperature Controlled

- 6.2.4.1. By Temperature Control

- 6.2.5. Other Services

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Freight Forwarding Market in Japan Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Logistics Function

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.2.1.1. By Destination Type

- 7.2.1.1.1. Domestic

- 7.2.1.1.2. International

- 7.2.1.1. By Destination Type

- 7.2.2. Freight Forwarding

- 7.2.2.1. By Mode Of Transport

- 7.2.2.1.1. Air

- 7.2.2.1.2. Sea and Inland Waterways

- 7.2.2.1.3. Others

- 7.2.2.1. By Mode Of Transport

- 7.2.3. Freight Transport

- 7.2.3.1. Pipelines

- 7.2.3.2. Rail

- 7.2.3.3. Road

- 7.2.4. Warehousing and Storage

- 7.2.4.1. By Temperature Control

- 7.2.4.1.1. Non-Temperature Controlled

- 7.2.4.1. By Temperature Control

- 7.2.5. Other Services

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Freight Forwarding Market in Japan Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Logistics Function

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.2.1.1. By Destination Type

- 8.2.1.1.1. Domestic

- 8.2.1.1.2. International

- 8.2.1.1. By Destination Type

- 8.2.2. Freight Forwarding

- 8.2.2.1. By Mode Of Transport

- 8.2.2.1.1. Air

- 8.2.2.1.2. Sea and Inland Waterways

- 8.2.2.1.3. Others

- 8.2.2.1. By Mode Of Transport

- 8.2.3. Freight Transport

- 8.2.3.1. Pipelines

- 8.2.3.2. Rail

- 8.2.3.3. Road

- 8.2.4. Warehousing and Storage

- 8.2.4.1. By Temperature Control

- 8.2.4.1.1. Non-Temperature Controlled

- 8.2.4.1. By Temperature Control

- 8.2.5. Other Services

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Freight Forwarding Market in Japan Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Logistics Function

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.2.1.1. By Destination Type

- 9.2.1.1.1. Domestic

- 9.2.1.1.2. International

- 9.2.1.1. By Destination Type

- 9.2.2. Freight Forwarding

- 9.2.2.1. By Mode Of Transport

- 9.2.2.1.1. Air

- 9.2.2.1.2. Sea and Inland Waterways

- 9.2.2.1.3. Others

- 9.2.2.1. By Mode Of Transport

- 9.2.3. Freight Transport

- 9.2.3.1. Pipelines

- 9.2.3.2. Rail

- 9.2.3.3. Road

- 9.2.4. Warehousing and Storage

- 9.2.4.1. By Temperature Control

- 9.2.4.1.1. Non-Temperature Controlled

- 9.2.4.1. By Temperature Control

- 9.2.5. Other Services

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Freight Forwarding Market in Japan Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Logistics Function

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.2.1.1. By Destination Type

- 10.2.1.1.1. Domestic

- 10.2.1.1.2. International

- 10.2.1.1. By Destination Type

- 10.2.2. Freight Forwarding

- 10.2.2.1. By Mode Of Transport

- 10.2.2.1.1. Air

- 10.2.2.1.2. Sea and Inland Waterways

- 10.2.2.1.3. Others

- 10.2.2.1. By Mode Of Transport

- 10.2.3. Freight Transport

- 10.2.3.1. Pipelines

- 10.2.3.2. Rail

- 10.2.3.3. Road

- 10.2.4. Warehousing and Storage

- 10.2.4.1. By Temperature Control

- 10.2.4.1.1. Non-Temperature Controlled

- 10.2.4.1. By Temperature Control

- 10.2.5. Other Services

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nippon Express Holdings

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NYK (Nippon Yusen Kaisha) Line

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yamato Holdings Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DHL Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SG Holdings Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kuehne + Nagel

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 United Parcel Service of America Inc (UPS)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kintetsu Group Holdings Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mitsui O S K Lines Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global Freight Forwarding Market in Japan Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Freight Forwarding Market in Japan Revenue (billion), by End User Industry 2025 & 2033

- Figure 3: North America Freight Forwarding Market in Japan Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America Freight Forwarding Market in Japan Revenue (billion), by Logistics Function 2025 & 2033

- Figure 5: North America Freight Forwarding Market in Japan Revenue Share (%), by Logistics Function 2025 & 2033

- Figure 6: North America Freight Forwarding Market in Japan Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Freight Forwarding Market in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Freight Forwarding Market in Japan Revenue (billion), by End User Industry 2025 & 2033

- Figure 9: South America Freight Forwarding Market in Japan Revenue Share (%), by End User Industry 2025 & 2033

- Figure 10: South America Freight Forwarding Market in Japan Revenue (billion), by Logistics Function 2025 & 2033

- Figure 11: South America Freight Forwarding Market in Japan Revenue Share (%), by Logistics Function 2025 & 2033

- Figure 12: South America Freight Forwarding Market in Japan Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Freight Forwarding Market in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Freight Forwarding Market in Japan Revenue (billion), by End User Industry 2025 & 2033

- Figure 15: Europe Freight Forwarding Market in Japan Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Europe Freight Forwarding Market in Japan Revenue (billion), by Logistics Function 2025 & 2033

- Figure 17: Europe Freight Forwarding Market in Japan Revenue Share (%), by Logistics Function 2025 & 2033

- Figure 18: Europe Freight Forwarding Market in Japan Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Freight Forwarding Market in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Freight Forwarding Market in Japan Revenue (billion), by End User Industry 2025 & 2033

- Figure 21: Middle East & Africa Freight Forwarding Market in Japan Revenue Share (%), by End User Industry 2025 & 2033

- Figure 22: Middle East & Africa Freight Forwarding Market in Japan Revenue (billion), by Logistics Function 2025 & 2033

- Figure 23: Middle East & Africa Freight Forwarding Market in Japan Revenue Share (%), by Logistics Function 2025 & 2033

- Figure 24: Middle East & Africa Freight Forwarding Market in Japan Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Freight Forwarding Market in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Freight Forwarding Market in Japan Revenue (billion), by End User Industry 2025 & 2033

- Figure 27: Asia Pacific Freight Forwarding Market in Japan Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: Asia Pacific Freight Forwarding Market in Japan Revenue (billion), by Logistics Function 2025 & 2033

- Figure 29: Asia Pacific Freight Forwarding Market in Japan Revenue Share (%), by Logistics Function 2025 & 2033

- Figure 30: Asia Pacific Freight Forwarding Market in Japan Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Freight Forwarding Market in Japan Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Freight Forwarding Market in Japan Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 3: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Freight Forwarding Market in Japan Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 6: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Freight Forwarding Market in Japan Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 11: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 12: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Freight Forwarding Market in Japan Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 17: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 18: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Freight Forwarding Market in Japan Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 29: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 30: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Freight Forwarding Market in Japan Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 38: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 39: Global Freight Forwarding Market in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Freight Forwarding Market in Japan Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Freight Forwarding Market in Japan?

The projected CAGR is approximately 2.76%.

2. Which companies are prominent players in the Freight Forwarding Market in Japan?

Key companies in the market include DB Schenker, Nippon Express Holdings, NYK (Nippon Yusen Kaisha) Line, Yamato Holdings Co Ltd, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), SG Holdings Co Ltd, Kuehne + Nagel, United Parcel Service of America Inc (UPS), Kintetsu Group Holdings Co Ltd, Mitsui O S K Lines Ltd.

3. What are the main segments of the Freight Forwarding Market in Japan?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 331.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

February 2024: Nippon Express will be expanding the number of countries and regions covered by its e-NX Quote digital forwarding service, which allows users to get quotes online, to 35 countries/regions starting with a January 31 launch in Japan. The service also now includes a CO2 emissions calculation function.February 2024: DHL Japan and SCREEN Semiconductor Solutions Co., Ltd. announced that they have signed a long-term contract for GoGreen Plus, a transportation service that reduces (inset) CO2 emissions associated with transportation through the use of sustainable aviation fuel (SAF).January 2024: DHL Express has commenced services for the final Boeing 777 freighter deployed at the South Asia Hub in Singapore. With a payload capability of 102 tons, the aircraft joins the four other Boeing 777 freighters already deployed in Singapore to boost inter-continental connectivity between the Asia Pacific and the Americas. Sporting a dual DHL-Singapore Airlines (SIA) livery, these five freighters provide a total of 1,224 tons of payload capacity to meet growing customer demand for international express shipping services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Freight Forwarding Market in Japan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Freight Forwarding Market in Japan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Freight Forwarding Market in Japan?

To stay informed about further developments, trends, and reports in the Freight Forwarding Market in Japan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence