Key Insights

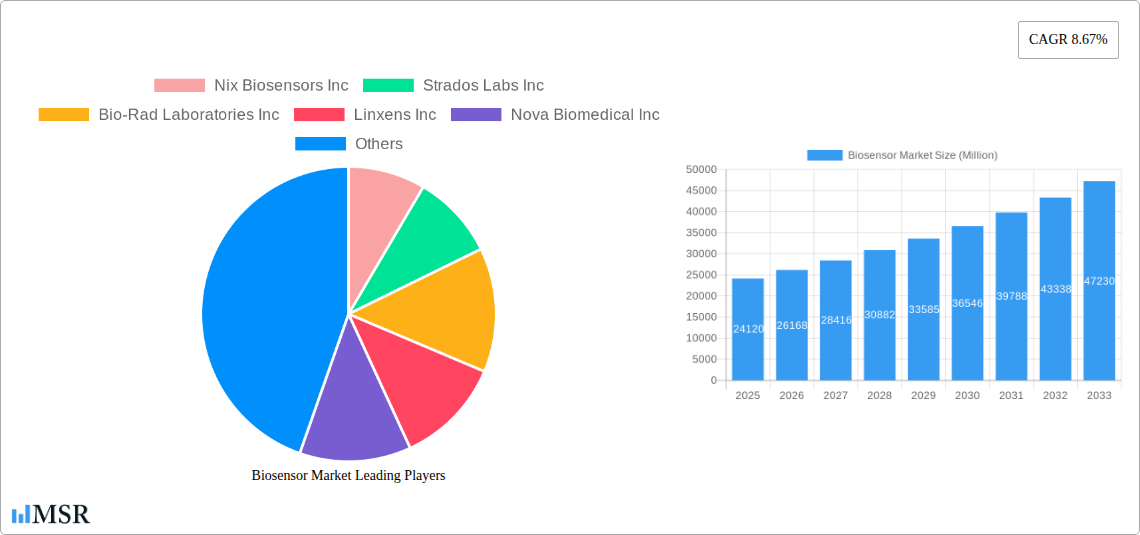

The biosensor market, valued at $24.12 billion in 2025, is projected to experience robust growth, driven by several key factors. Technological advancements leading to miniaturization, increased sensitivity, and improved accuracy of biosensors are significantly expanding their applications across diverse sectors. The rising prevalence of chronic diseases like diabetes and cardiovascular ailments fuels the demand for continuous and non-invasive monitoring, a key advantage offered by biosensors. Furthermore, the increasing adoption of point-of-care diagnostics and personalized medicine further accelerates market expansion. Government initiatives promoting healthcare infrastructure development and funding research in biosensor technology also contribute to market growth. Competition among established players and emerging companies is fostering innovation and driving down costs, making biosensors more accessible and affordable.

However, market growth is not without challenges. High initial investment costs associated with research and development, stringent regulatory approvals, and the need for skilled professionals to operate and interpret biosensor data can act as restraints. Moreover, the long-term reliability and accuracy of certain biosensor technologies remain areas of ongoing research and development. Despite these constraints, the overall market outlook remains positive, with the continuous evolution of biosensor technology and its expanding applications across various healthcare and non-healthcare domains promising significant growth over the forecast period (2025-2033). The projected CAGR of 8.67% suggests a substantial market expansion, exceeding $40 billion by 2033. This growth will be influenced by a continuous stream of product launches, strategic alliances, and technological collaborations within the industry.

Biosensor Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Biosensor Market, offering actionable insights for industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, key segments, leading players, and future growth potential. The global biosensor market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Biosensor Market Concentration & Dynamics

The Biosensor Market exhibits a moderately concentrated landscape, with several key players holding significant market share. Market concentration is influenced by factors such as technological advancements, regulatory approvals, and strategic mergers and acquisitions (M&A). The number of M&A deals in the biosensor sector has increased in recent years, indicating a drive for consolidation and expansion. Innovation ecosystems play a crucial role, fostering the development of novel biosensor technologies and applications. Stringent regulatory frameworks, particularly in healthcare, significantly impact market entry and product approval timelines. The presence of substitute products, such as traditional diagnostic methods, poses competitive pressure. End-user trends, driven by increasing demand for personalized medicine and point-of-care diagnostics, are shaping market growth.

- Market Share: Top 5 players account for approximately xx% of the market.

- M&A Activity: An estimated xx M&A deals were recorded between 2019 and 2024.

- Innovation: Focus on miniaturization, improved sensitivity, and wireless connectivity is driving innovation.

- Regulatory Landscape: Stringent regulatory approvals, especially in medical applications, pose a challenge.

Biosensor Market Industry Insights & Trends

The Biosensor Market is experiencing robust growth fueled by several key factors. The increasing prevalence of chronic diseases, coupled with the rising demand for rapid and accurate diagnostics, is a primary driver. Technological advancements, particularly in nanotechnology and microfluidics, are leading to the development of more sensitive and cost-effective biosensors. The shift towards personalized medicine and point-of-care diagnostics is further boosting market growth. Evolving consumer behavior, including increased health awareness and self-monitoring, contributes to the rising adoption of biosensors. The market size reached xx Million in 2024, and is projected to reach xx Million by 2025.

Key Markets & Segments Leading Biosensor Market

The North American region currently dominates the Biosensor Market, driven by factors including robust healthcare infrastructure, high technological advancements, and increased healthcare expenditure. Europe follows as a significant market. Within these regions, the glucose monitoring segment holds the largest share due to the high prevalence of diabetes.

- North America Drivers:

- Advanced healthcare infrastructure

- High adoption of technologically advanced biosensors

- Favorable regulatory environment

- Significant research & development investment

- Europe Drivers:

- Growing prevalence of chronic diseases

- Rising healthcare expenditure

- Government initiatives to support healthcare innovation

- Dominance Analysis: North America's strong regulatory environment and high disposable incomes contribute to its market leadership. Stronger governmental support for healthcare innovations in Europe positions it as a strong competitor.

Biosensor Market Product Developments

Recent years have witnessed significant product innovations in the biosensor market, including the development of wearable biosensors, implantable biosensors, and lab-on-a-chip devices. These advancements have expanded the applications of biosensors across various healthcare settings, from point-of-care diagnostics to continuous patient monitoring. Companies are focusing on improving the accuracy, sensitivity, and cost-effectiveness of biosensors to enhance their market competitiveness.

Challenges in the Biosensor Market Market

The Biosensor Market faces challenges including stringent regulatory approvals, high research and development costs, and the need for robust supply chains. These factors can impact product development timelines and profitability. Moreover, competitive pressures from established players and emerging competitors pose a significant hurdle to market entry for new entrants. The market also faces complexities in data security and privacy concerns. These hurdles result in an estimated xx% reduction in market growth each year.

Forces Driving Biosensor Market Growth

Technological advancements, such as the development of nanomaterials and microfluidics, are key growth drivers. The increasing prevalence of chronic diseases creates substantial demand for rapid and accurate diagnostic tools. Government initiatives supporting healthcare innovation and research and development investments further fuel market expansion. For example, the FDA approval of over-the-counter continuous glucose monitoring (CGM) systems signifies a major step forward.

Challenges in the Biosensor Market Market

Long-term growth will be driven by strategic partnerships between technology providers and healthcare organizations. Continued innovation in biosensor technology, especially in areas like personalized medicine, will unlock new market opportunities. Expanding into emerging markets with growing healthcare needs offers significant growth potential.

Emerging Opportunities in Biosensor Market

Emerging opportunities lie in the development of novel biosensors for early disease detection, personalized medicine, and environmental monitoring. The integration of artificial intelligence (AI) and machine learning (ML) into biosensor systems will enhance diagnostic capabilities. The growing demand for wearable and implantable biosensors presents significant growth potential.

Leading Players in the Biosensor Market Sector

- Nix Biosensors Inc

- Strados Labs Inc

- Bio-Rad Laboratories Inc

- Linxens Inc

- Nova Biomedical Inc

- Lifeasible Inc

- i-Sens Inc

- Lifesignals Inc

- Universal Biosensors Inc

- Dexcom Inc

- Aga Matrix Inc

- Dynamic Biosensors Inc

Key Milestones in Biosensor Market Industry

- March 2024: DexCom Inc. received FDA approval for Stelo, the first over-the-counter glucose biosensor. This significantly expands access to CGM technology for millions of individuals with Type 2 diabetes.

- June 2024: Abbott received FDA clearance for two new over-the-counter continuous glucose monitoring (CGM) systems – Lingo and Libre Rio. The Lingo system’s unique features and ease of use represent a significant advance in consumer-focused biosensor technology.

Strategic Outlook for Biosensor Market Market

The Biosensor Market is poised for significant growth, driven by continuous technological advancements and expanding applications across various sectors. Strategic partnerships, focused research and development, and expansion into new markets will be crucial for capturing market share and driving future success. The increasing adoption of personalized medicine and point-of-care diagnostics will further fuel market expansion.

Biosensor Market Segmentation

-

1. Product Type

- 1.1. Medical

- 1.2. Food Toxicity

- 1.3. Bioreactor

- 1.4. Agriculture

- 1.5. Environment

- 1.6. Other Product Types

-

2. Technology

- 2.1. Thermal

- 2.2. Electrochemical

- 2.3. Piezoelectric

- 2.4. Optical

-

3. End-user Industry

- 3.1. Home Healthcare Diagnostics

- 3.2. PoC Testing

- 3.3. Food Industry

- 3.4. Research Laboratories

- 3.5. Security & Biodefense

Biosensor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Biosensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases; Increasing Government and Public Health Initiatives

- 3.3. Market Restrains

- 3.3.1. Rising Prevalence of Chronic Diseases; Increasing Government and Public Health Initiatives

- 3.4. Market Trends

- 3.4.1. Medical is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biosensor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Medical

- 5.1.2. Food Toxicity

- 5.1.3. Bioreactor

- 5.1.4. Agriculture

- 5.1.5. Environment

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Thermal

- 5.2.2. Electrochemical

- 5.2.3. Piezoelectric

- 5.2.4. Optical

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Home Healthcare Diagnostics

- 5.3.2. PoC Testing

- 5.3.3. Food Industry

- 5.3.4. Research Laboratories

- 5.3.5. Security & Biodefense

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Biosensor Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Medical

- 6.1.2. Food Toxicity

- 6.1.3. Bioreactor

- 6.1.4. Agriculture

- 6.1.5. Environment

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Thermal

- 6.2.2. Electrochemical

- 6.2.3. Piezoelectric

- 6.2.4. Optical

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Home Healthcare Diagnostics

- 6.3.2. PoC Testing

- 6.3.3. Food Industry

- 6.3.4. Research Laboratories

- 6.3.5. Security & Biodefense

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Biosensor Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Medical

- 7.1.2. Food Toxicity

- 7.1.3. Bioreactor

- 7.1.4. Agriculture

- 7.1.5. Environment

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Thermal

- 7.2.2. Electrochemical

- 7.2.3. Piezoelectric

- 7.2.4. Optical

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Home Healthcare Diagnostics

- 7.3.2. PoC Testing

- 7.3.3. Food Industry

- 7.3.4. Research Laboratories

- 7.3.5. Security & Biodefense

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Biosensor Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Medical

- 8.1.2. Food Toxicity

- 8.1.3. Bioreactor

- 8.1.4. Agriculture

- 8.1.5. Environment

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Thermal

- 8.2.2. Electrochemical

- 8.2.3. Piezoelectric

- 8.2.4. Optical

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Home Healthcare Diagnostics

- 8.3.2. PoC Testing

- 8.3.3. Food Industry

- 8.3.4. Research Laboratories

- 8.3.5. Security & Biodefense

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand Biosensor Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Medical

- 9.1.2. Food Toxicity

- 9.1.3. Bioreactor

- 9.1.4. Agriculture

- 9.1.5. Environment

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Thermal

- 9.2.2. Electrochemical

- 9.2.3. Piezoelectric

- 9.2.4. Optical

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Home Healthcare Diagnostics

- 9.3.2. PoC Testing

- 9.3.3. Food Industry

- 9.3.4. Research Laboratories

- 9.3.5. Security & Biodefense

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Biosensor Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Medical

- 10.1.2. Food Toxicity

- 10.1.3. Bioreactor

- 10.1.4. Agriculture

- 10.1.5. Environment

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Thermal

- 10.2.2. Electrochemical

- 10.2.3. Piezoelectric

- 10.2.4. Optical

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Home Healthcare Diagnostics

- 10.3.2. PoC Testing

- 10.3.3. Food Industry

- 10.3.4. Research Laboratories

- 10.3.5. Security & Biodefense

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Biosensor Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Medical

- 11.1.2. Food Toxicity

- 11.1.3. Bioreactor

- 11.1.4. Agriculture

- 11.1.5. Environment

- 11.1.6. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Thermal

- 11.2.2. Electrochemical

- 11.2.3. Piezoelectric

- 11.2.4. Optical

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Home Healthcare Diagnostics

- 11.3.2. PoC Testing

- 11.3.3. Food Industry

- 11.3.4. Research Laboratories

- 11.3.5. Security & Biodefense

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Nix Biosensors Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Strados Labs Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bio-Rad Laboratories Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Linxens Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Nova Biomedical Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Lifeasible Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 i-Sens Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Lifesignals Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Universal Biosensors Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Dexcom Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Aga Matrix Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Dynamic Biosensors Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Nix Biosensors Inc

List of Figures

- Figure 1: Global Biosensor Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Biosensor Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Biosensor Market Revenue (Million), by Product Type 2024 & 2032

- Figure 4: North America Biosensor Market Volume (Billion), by Product Type 2024 & 2032

- Figure 5: North America Biosensor Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Biosensor Market Volume Share (%), by Product Type 2024 & 2032

- Figure 7: North America Biosensor Market Revenue (Million), by Technology 2024 & 2032

- Figure 8: North America Biosensor Market Volume (Billion), by Technology 2024 & 2032

- Figure 9: North America Biosensor Market Revenue Share (%), by Technology 2024 & 2032

- Figure 10: North America Biosensor Market Volume Share (%), by Technology 2024 & 2032

- Figure 11: North America Biosensor Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 12: North America Biosensor Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 13: North America Biosensor Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America Biosensor Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 15: North America Biosensor Market Revenue (Million), by Country 2024 & 2032

- Figure 16: North America Biosensor Market Volume (Billion), by Country 2024 & 2032

- Figure 17: North America Biosensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Biosensor Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Europe Biosensor Market Revenue (Million), by Product Type 2024 & 2032

- Figure 20: Europe Biosensor Market Volume (Billion), by Product Type 2024 & 2032

- Figure 21: Europe Biosensor Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe Biosensor Market Volume Share (%), by Product Type 2024 & 2032

- Figure 23: Europe Biosensor Market Revenue (Million), by Technology 2024 & 2032

- Figure 24: Europe Biosensor Market Volume (Billion), by Technology 2024 & 2032

- Figure 25: Europe Biosensor Market Revenue Share (%), by Technology 2024 & 2032

- Figure 26: Europe Biosensor Market Volume Share (%), by Technology 2024 & 2032

- Figure 27: Europe Biosensor Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 28: Europe Biosensor Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 29: Europe Biosensor Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Europe Biosensor Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 31: Europe Biosensor Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Europe Biosensor Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Europe Biosensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe Biosensor Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Asia Biosensor Market Revenue (Million), by Product Type 2024 & 2032

- Figure 36: Asia Biosensor Market Volume (Billion), by Product Type 2024 & 2032

- Figure 37: Asia Biosensor Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Asia Biosensor Market Volume Share (%), by Product Type 2024 & 2032

- Figure 39: Asia Biosensor Market Revenue (Million), by Technology 2024 & 2032

- Figure 40: Asia Biosensor Market Volume (Billion), by Technology 2024 & 2032

- Figure 41: Asia Biosensor Market Revenue Share (%), by Technology 2024 & 2032

- Figure 42: Asia Biosensor Market Volume Share (%), by Technology 2024 & 2032

- Figure 43: Asia Biosensor Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 44: Asia Biosensor Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 45: Asia Biosensor Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 46: Asia Biosensor Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 47: Asia Biosensor Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia Biosensor Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Asia Biosensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Biosensor Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Australia and New Zealand Biosensor Market Revenue (Million), by Product Type 2024 & 2032

- Figure 52: Australia and New Zealand Biosensor Market Volume (Billion), by Product Type 2024 & 2032

- Figure 53: Australia and New Zealand Biosensor Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 54: Australia and New Zealand Biosensor Market Volume Share (%), by Product Type 2024 & 2032

- Figure 55: Australia and New Zealand Biosensor Market Revenue (Million), by Technology 2024 & 2032

- Figure 56: Australia and New Zealand Biosensor Market Volume (Billion), by Technology 2024 & 2032

- Figure 57: Australia and New Zealand Biosensor Market Revenue Share (%), by Technology 2024 & 2032

- Figure 58: Australia and New Zealand Biosensor Market Volume Share (%), by Technology 2024 & 2032

- Figure 59: Australia and New Zealand Biosensor Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 60: Australia and New Zealand Biosensor Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 61: Australia and New Zealand Biosensor Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 62: Australia and New Zealand Biosensor Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 63: Australia and New Zealand Biosensor Market Revenue (Million), by Country 2024 & 2032

- Figure 64: Australia and New Zealand Biosensor Market Volume (Billion), by Country 2024 & 2032

- Figure 65: Australia and New Zealand Biosensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Australia and New Zealand Biosensor Market Volume Share (%), by Country 2024 & 2032

- Figure 67: Latin America Biosensor Market Revenue (Million), by Product Type 2024 & 2032

- Figure 68: Latin America Biosensor Market Volume (Billion), by Product Type 2024 & 2032

- Figure 69: Latin America Biosensor Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 70: Latin America Biosensor Market Volume Share (%), by Product Type 2024 & 2032

- Figure 71: Latin America Biosensor Market Revenue (Million), by Technology 2024 & 2032

- Figure 72: Latin America Biosensor Market Volume (Billion), by Technology 2024 & 2032

- Figure 73: Latin America Biosensor Market Revenue Share (%), by Technology 2024 & 2032

- Figure 74: Latin America Biosensor Market Volume Share (%), by Technology 2024 & 2032

- Figure 75: Latin America Biosensor Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 76: Latin America Biosensor Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 77: Latin America Biosensor Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 78: Latin America Biosensor Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 79: Latin America Biosensor Market Revenue (Million), by Country 2024 & 2032

- Figure 80: Latin America Biosensor Market Volume (Billion), by Country 2024 & 2032

- Figure 81: Latin America Biosensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Latin America Biosensor Market Volume Share (%), by Country 2024 & 2032

- Figure 83: Middle East and Africa Biosensor Market Revenue (Million), by Product Type 2024 & 2032

- Figure 84: Middle East and Africa Biosensor Market Volume (Billion), by Product Type 2024 & 2032

- Figure 85: Middle East and Africa Biosensor Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 86: Middle East and Africa Biosensor Market Volume Share (%), by Product Type 2024 & 2032

- Figure 87: Middle East and Africa Biosensor Market Revenue (Million), by Technology 2024 & 2032

- Figure 88: Middle East and Africa Biosensor Market Volume (Billion), by Technology 2024 & 2032

- Figure 89: Middle East and Africa Biosensor Market Revenue Share (%), by Technology 2024 & 2032

- Figure 90: Middle East and Africa Biosensor Market Volume Share (%), by Technology 2024 & 2032

- Figure 91: Middle East and Africa Biosensor Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 92: Middle East and Africa Biosensor Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 93: Middle East and Africa Biosensor Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 94: Middle East and Africa Biosensor Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 95: Middle East and Africa Biosensor Market Revenue (Million), by Country 2024 & 2032

- Figure 96: Middle East and Africa Biosensor Market Volume (Billion), by Country 2024 & 2032

- Figure 97: Middle East and Africa Biosensor Market Revenue Share (%), by Country 2024 & 2032

- Figure 98: Middle East and Africa Biosensor Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Biosensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Biosensor Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Biosensor Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Biosensor Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: Global Biosensor Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Global Biosensor Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 7: Global Biosensor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Global Biosensor Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 9: Global Biosensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Biosensor Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Global Biosensor Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Global Biosensor Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 13: Global Biosensor Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 14: Global Biosensor Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 15: Global Biosensor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Global Biosensor Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Biosensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Biosensor Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Global Biosensor Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global Biosensor Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 21: Global Biosensor Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: Global Biosensor Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 23: Global Biosensor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global Biosensor Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 25: Global Biosensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Biosensor Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Biosensor Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global Biosensor Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 29: Global Biosensor Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 30: Global Biosensor Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 31: Global Biosensor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 32: Global Biosensor Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 33: Global Biosensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Biosensor Market Volume Billion Forecast, by Country 2019 & 2032

- Table 35: Global Biosensor Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 36: Global Biosensor Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 37: Global Biosensor Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 38: Global Biosensor Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 39: Global Biosensor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 40: Global Biosensor Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 41: Global Biosensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Biosensor Market Volume Billion Forecast, by Country 2019 & 2032

- Table 43: Global Biosensor Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 44: Global Biosensor Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 45: Global Biosensor Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 46: Global Biosensor Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 47: Global Biosensor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 48: Global Biosensor Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 49: Global Biosensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global Biosensor Market Volume Billion Forecast, by Country 2019 & 2032

- Table 51: Global Biosensor Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 52: Global Biosensor Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 53: Global Biosensor Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 54: Global Biosensor Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 55: Global Biosensor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 56: Global Biosensor Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 57: Global Biosensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Biosensor Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biosensor Market?

The projected CAGR is approximately 8.67%.

2. Which companies are prominent players in the Biosensor Market?

Key companies in the market include Nix Biosensors Inc, Strados Labs Inc, Bio-Rad Laboratories Inc, Linxens Inc, Nova Biomedical Inc, Lifeasible Inc, i-Sens Inc, Lifesignals Inc, Universal Biosensors Inc, Dexcom Inc, Aga Matrix Inc, Dynamic Biosensors Inc.

3. What are the main segments of the Biosensor Market?

The market segments include Product Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases; Increasing Government and Public Health Initiatives.

6. What are the notable trends driving market growth?

Medical is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Rising Prevalence of Chronic Diseases; Increasing Government and Public Health Initiatives.

8. Can you provide examples of recent developments in the market?

June 2024: Abbott received clearance from the US Food and Drug Administration (FDA) for two new over-the-counter continuous glucose monitoring (CGM) systems – Lingo and Libre Rio. The Lingo system features a biosensor worn on the upper arm for 14 days, continuously streaming glucose data to a smartphone coaching application. This technology decodes the body's signals, offering insights into how individuals respond to food, exercise, and daily stressors. Lingo caters to consumers seeking to enhance their understanding of health and wellness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biosensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biosensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biosensor Market?

To stay informed about further developments, trends, and reports in the Biosensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence