Key Insights

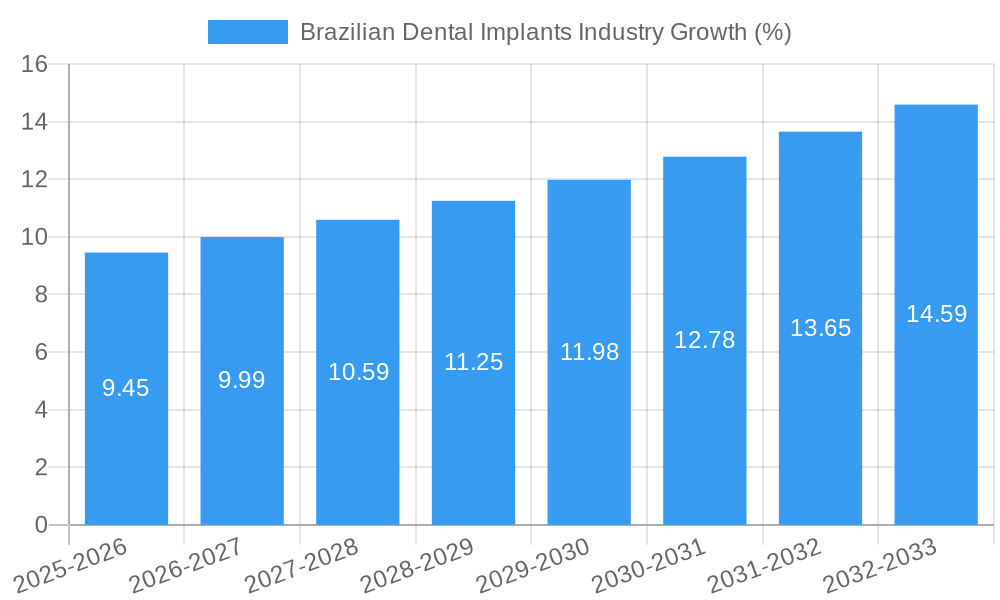

The Brazilian dental implants market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the rising prevalence of periodontal diseases and tooth loss, coupled with an increasing geriatric population, fuels demand for restorative dental solutions. Secondly, improved access to dental insurance and a growing awareness of aesthetic dentistry are significantly boosting market adoption. Technological advancements, including the introduction of minimally invasive implant procedures and sophisticated implant materials, are also contributing to market growth. Furthermore, a burgeoning middle class with increased disposable income is driving demand for premium dental care, including implant procedures. The market is segmented by treatment type (Orthodontic, Endodontic, Periodontic, Prosthodontic), end-user (Hospitals, Clinics, Other End-Users), and product type (General and Diagnostic Equipment, Other Dental Consumables, Other General and Diagnostic Equipment). Leading companies like Dentsply Sirona, Straumann, and others are actively competing in this dynamic market, shaping the landscape through innovation and strategic partnerships.

However, the market's growth trajectory is not without challenges. High treatment costs and a lack of dental insurance coverage in certain segments of the population present significant restraints. Furthermore, the regulatory environment concerning dental implant procedures and materials could influence market dynamics. Nevertheless, the long-term outlook remains positive, with the increasing affordability of dental implants and the expansion of dental infrastructure expected to propel significant growth over the forecast period. The market is expected to see increased penetration in smaller cities and towns. The competitive landscape is expected to remain robust, with established players consolidating their market share and new entrants seeking opportunities within the market segments.

Brazilian Dental Implants Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Brazilian dental implants industry, offering invaluable insights for stakeholders including manufacturers, investors, and healthcare professionals. With a detailed examination of market dynamics, key players, and future growth projections, this report is essential for navigating the complexities of this rapidly evolving sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The report projects a market size of approximately XX Million by 2025 and a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Brazilian Dental Implants Industry Market Concentration & Dynamics

The Brazilian dental implants market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Key players like Dentsply Sirona, Straumann Group (through Neodent), and Bicon LLC compete alongside numerous smaller, regional companies. The market share of the top 5 players is estimated to be around 60% in 2025. Innovation in materials science (e.g., zirconia implants), digital dentistry solutions (CAD/CAM), and minimally invasive techniques fuels market dynamism. Brazil's regulatory framework, ANVISA, plays a crucial role, impacting product approvals and market access. Substitute products, such as dentures and bridges, exert competitive pressure, albeit limited due to the superior longevity and aesthetics of implants. End-user preferences increasingly favor minimally invasive procedures and technologically advanced solutions. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024.

- Market Concentration: Top 5 players hold ~60% market share (2025 estimate).

- Innovation Ecosystem: Strong focus on digital dentistry, new materials (zirconia).

- Regulatory Framework: ANVISA (Brazilian Health Regulatory Agency) influences market access.

- Substitute Products: Dentures and bridges offer limited competition.

- End-User Trends: Preference for minimally invasive and technologically advanced treatments.

- M&A Activity: Approximately xx deals between 2019-2024.

Brazilian Dental Implants Industry Industry Insights & Trends

The Brazilian dental implants market is experiencing robust growth driven by factors such as increasing disposable incomes, rising awareness of dental health, and growing demand for aesthetically pleasing and functional restorations. Technological advancements, such as the introduction of digital workflows and innovative implant materials, further stimulate market expansion. Changing consumer preferences are pushing the industry towards more predictable, minimally invasive, and shorter treatment procedures. The market size is estimated at XX Million in 2025, indicating a substantial market potential. The CAGR is predicted to be XX% from 2025-2033, driven by favorable economic conditions and a growing middle class with increased spending power on healthcare. Technological disruptions, particularly in digital dentistry, are creating opportunities for streamlined workflows and improved patient outcomes. Evolving consumer behaviors emphasize the importance of personalized treatment plans and a focus on overall well-being.

Key Markets & Segments Leading Brazilian Dental Implants Industry

The Brazilian dental implants market demonstrates strong growth across various segments. The Prosthodontic segment is expected to dominate due to the increasing demand for full-arch restorations and implant-supported dentures. Clinics represent the leading end-user segment, owing to their widespread accessibility and comprehensive services. The South-East region of Brazil emerges as the most dominant geographical area, driven by higher population density, robust healthcare infrastructure, and increased awareness of dental health.

- Dominant Segment: Prosthodontic treatments, driven by demand for full-arch restorations.

- Leading End-User: Clinics, due to accessibility and service offerings.

- Key Geographic Region: South-East Brazil, owing to population density and infrastructure.

- Growth Drivers:

- Rising disposable incomes and healthcare spending.

- Expanding middle class with increased focus on aesthetics and health.

- Growing awareness of dental health and preventative care.

- Government initiatives promoting oral health.

- Development of advanced dental infrastructure.

Brazilian Dental Implants Industry Product Developments

Recent years have witnessed significant product innovations in the Brazilian dental implants market. Key advancements include the introduction of zirconia implants known for their enhanced strength and aesthetics, as exemplified by Neodent's launch of the Zi implant system in March 2022. The integration of digital technologies, such as CAD/CAM systems and guided surgery, has also improved treatment precision and efficiency. These innovations enhance treatment outcomes, increase patient satisfaction, and drive market growth. Furthermore, the development of minimally invasive surgical techniques reduces patient discomfort and recovery times.

Challenges in the Brazilian Dental Implants Industry Market

The Brazilian dental implants market faces several challenges. Regulatory hurdles associated with product approvals and pricing regulations can impede market entry and expansion. Supply chain disruptions, particularly in the sourcing of raw materials, can impact production and availability. Intense competition from both established international players and local manufacturers creates pricing pressure. The fluctuations of the Brazilian Real against other currencies adds uncertainty to import/export scenarios. These factors can limit growth and profitability for companies operating in this market.

Forces Driving Brazilian Dental Implants Industry Growth

Several key factors drive the growth of the Brazilian dental implants market. Technological advancements, specifically in digital dentistry and biomaterials, are improving treatment efficiency and outcomes. Economic growth and rising disposable incomes are increasing healthcare spending. Favorable government regulations and initiatives promoting oral health awareness are facilitating market expansion. These combined factors contribute to a positive outlook for the industry's sustained growth.

Challenges in the Brazilian Dental Implants Industry Market

Long-term growth hinges on addressing challenges. Strategic partnerships between manufacturers and clinics are crucial for efficient distribution and market penetration. Continuous innovation in implant materials and surgical techniques is needed to stay ahead of the competition. Expanding into underserved regions and providing affordable treatment options will broaden market reach. These initiatives will ensure sustainable growth in the long term.

Emerging Opportunities in Brazilian Dental Implants Industry

Emerging opportunities abound in the Brazilian dental implants industry. The increasing demand for personalized treatment plans, including digital dentistry and 3D-printed solutions, opens new avenues for growth. Expanding into underserved regions with limited access to quality dental care creates significant market potential. Investing in innovative marketing and patient education campaigns will enhance market awareness and adoption. These factors provide promising growth opportunities for innovative players.

Leading Players in the Brazilian Dental Implants Industry Sector

- EDLO ITM

- Coltene Brasil

- Baumer Dental Implants

- Dentsply Sirona

- Conexao

- Bicon LLC

- SDI Limited

- Derig Implantes do Brasil

- Angelus Dental

- Institut Straumann AG

- SIN Implant System

- ZimVie Inc

Key Milestones in Brazilian Dental Implants Industry Industry

- September 2022: DENTSPLY SIRONA Inc. announced new product launches within its digital dentistry portfolio at Dentsply Sirona World 2022, driving innovation in the sector.

- March 2022: Neodent (Straumann Group) launched the Zi zirconia implant system, highlighting advancements in implant materials and garnering global attention (1,600 viewers from 92 countries).

Strategic Outlook for Brazilian Dental Implants Industry Market

The Brazilian dental implants market presents significant growth potential over the next decade. Strategic investments in research and development, particularly in digital dentistry and biomaterials, will shape future market dynamics. Expansion into underserved regions and a focus on affordability will be crucial for achieving inclusive growth. By fostering strategic partnerships and enhancing patient education, companies can capitalize on the rising demand for high-quality dental implant solutions in Brazil.

Brazilian Dental Implants Industry Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

- 1.1.1. Dental Laser

- 1.1.2. Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic equipment

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Periodontic

- 2.4. Prosthodontic

-

3. End-User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End-Users

Brazilian Dental Implants Industry Segmentation By Geography

- 1. Brazil

Brazilian Dental Implants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Government Initiatives; High Number of Dentists and Growing Cosmetic Dentistry; Technological Advancements in Dentistry

- 3.3. Market Restrains

- 3.3.1. High Cost of Device

- 3.4. Market Trends

- 3.4.1. Periodontics Segment is Expected to Witness Considerable Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Laser

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic equipment

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Periodontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 EDLO ITM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Coltene Brasil

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Baumer Dental Implants

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dentsply Sirona

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Conexao

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bicon LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SDI Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Derig Implantes do Brasil

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Angelus Dental

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Institut Straumann AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SIN Implant System

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ZimVie Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 EDLO ITM

List of Figures

- Figure 1: Brazilian Dental Implants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazilian Dental Implants Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazilian Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazilian Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Brazilian Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 4: Brazilian Dental Implants Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Brazilian Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazilian Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazilian Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 8: Brazilian Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 9: Brazilian Dental Implants Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Brazilian Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian Dental Implants Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Brazilian Dental Implants Industry?

Key companies in the market include EDLO ITM, Coltene Brasil, Baumer Dental Implants, Dentsply Sirona, Conexao, Bicon LLC, SDI Limited, Derig Implantes do Brasil, Angelus Dental, Institut Straumann AG, SIN Implant System, ZimVie Inc.

3. What are the main segments of the Brazilian Dental Implants Industry?

The market segments include Product, Treatment, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Government Initiatives; High Number of Dentists and Growing Cosmetic Dentistry; Technological Advancements in Dentistry.

6. What are the notable trends driving market growth?

Periodontics Segment is Expected to Witness Considerable Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Device.

8. Can you provide examples of recent developments in the market?

September 2022- DENTSPLY SIRONA Inc. announced that at Dentsply Sirona World 2022, it would be launching new products and solutions as part of its digital universe, which are designed to bring innovation in dentistry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian Dental Implants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian Dental Implants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian Dental Implants Industry?

To stay informed about further developments, trends, and reports in the Brazilian Dental Implants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence