Key Insights

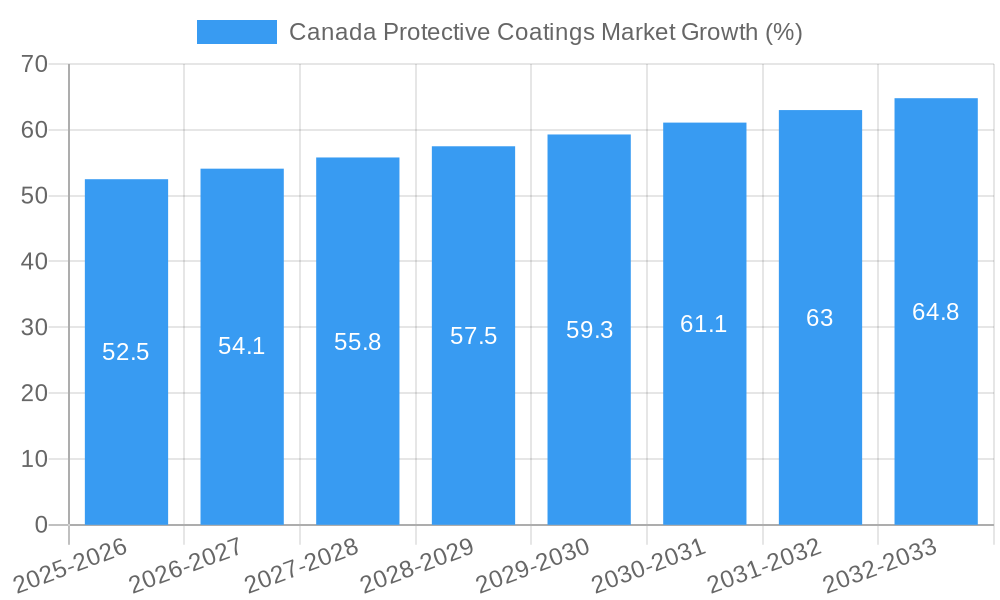

The Canada protective coatings market, valued at approximately $1.5 billion CAD in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 3.5% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the burgeoning infrastructure development projects across Canada, including road construction, bridge renovations, and building expansions, necessitate substantial protective coatings to ensure longevity and structural integrity. Secondly, the growing emphasis on corrosion prevention in the oil and gas, mining, and power sectors is significantly boosting demand. Stringent environmental regulations are further driving the adoption of eco-friendly water-borne and powder coatings, replacing traditional solvent-borne options. Market segmentation reveals a strong preference for epoxy and polyurethane resins due to their superior performance characteristics. However, the market faces challenges such as fluctuating raw material prices and potential labor shortages in the skilled trades, which may act as minor restraints on growth. The competitive landscape is marked by both international giants and regional players, with companies like Henkel, Axalta, Sherwin-Williams, and Jotun holding significant market shares. The forecast period anticipates consistent growth, driven by continued infrastructure investments and a heightened focus on asset protection across diverse industries.

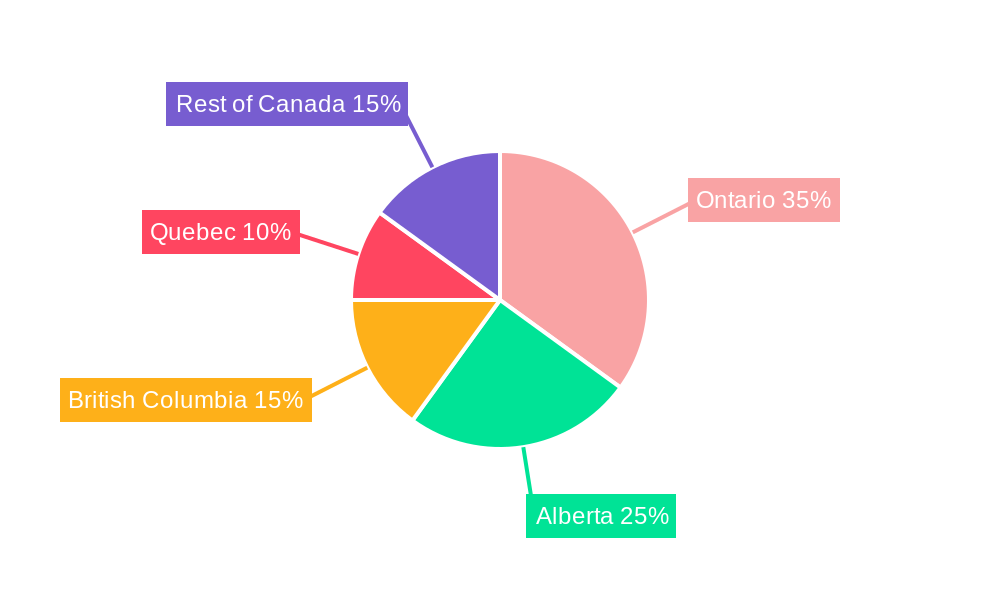

The regional distribution of the market within Canada will reflect existing industrial concentration. Provinces like Alberta, Saskatchewan, and Ontario, heavily reliant on resource extraction and industrial activities, will likely demonstrate higher per capita consumption of protective coatings. This trend is further supported by government initiatives promoting infrastructure upgrades and environmental sustainability, fostering demand for durable and eco-conscious coating solutions. The market's future is optimistic, with technological advancements in coating formulations and application techniques expected to further enhance efficiency and performance, contributing to continued market growth through 2033. Further diversification into specialized applications, such as protective coatings for renewable energy infrastructure, will also play a crucial role in market expansion.

Canada Protective Coatings Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Canada Protective Coatings Market, offering valuable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, trends, and opportunities. The Canadian protective coatings market, valued at xx Million in 2025, is projected to witness significant growth, reaching xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This report offers actionable intelligence across key segments, including resin type, technology, and end-user industries.

Canada Protective Coatings Market Market Concentration & Dynamics

The Canadian protective coatings market exhibits a moderately concentrated landscape, with key players holding significant market share. The market share distribution is as follows: PPG Industries Inc. holds approximately xx%, followed by Axalta Coatings Systems with xx%, Sherwin-Williams with xx%, and other major players such as Henkel AG & Co KGaA, Jotun, RPM International Inc., Kansai Paint Co Ltd., Nippon Paint Holdings Co Ltd., Cloverdale Paint Inc., Hempel A/S, and AkzoNobel NV sharing the remaining percentage.

Innovation in the sector is driven by a focus on sustainable and high-performance coatings, alongside advancements in application technologies. Regulatory frameworks, including environmental regulations and safety standards, significantly impact market dynamics. Substitute products, such as alternative corrosion protection methods, pose a moderate level of competition.

End-user trends are shifting towards specialized coatings catering to specific industry requirements, such as corrosion resistance, durability, and aesthetic appeal. M&A activity within the industry has been relatively moderate in recent years, with an average of xx deals annually during the historical period (2019-2024).

- Market Concentration: Moderately Concentrated

- M&A Deal Count (2019-2024): xx

- Key Innovation Areas: Sustainable coatings, advanced application technologies

Canada Protective Coatings Market Industry Insights & Trends

The Canadian protective coatings market is experiencing robust growth, primarily driven by the expansion of infrastructure projects, increasing demand from the oil and gas, mining, and power industries, and a growing focus on infrastructure maintenance and refurbishment. Technological advancements, such as the development of high-performance, eco-friendly coatings, are further fueling market expansion. Evolving consumer preferences toward durable, aesthetically pleasing, and environmentally conscious coatings also contribute to market growth.

Significant growth drivers include:

- Infrastructure Development: Government investments in infrastructure projects are creating significant demand for protective coatings.

- Oil & Gas Sector Expansion: Continued activity in the oil and gas sector necessitates robust corrosion protection measures.

- Emphasis on Sustainability: Growing awareness of environmental concerns is driving demand for eco-friendly coatings.

Key Markets & Segments Leading Canada Protective Coatings Market

The Canadian protective coatings market shows strong regional variations with Ontario and Alberta being the largest markets, largely driven by robust industrial activity and infrastructure development in these provinces.

By Resin Type: The Epoxy segment dominates the market, driven by its superior corrosion resistance and durability, followed by Acrylic and Polyurethane segments.

By Technology: Waterborne coatings are gaining significant traction due to their environmental benefits, although solvent-borne coatings still maintain a substantial market share owing to their superior performance characteristics in specific applications.

By End-user Industry: The Oil and Gas, Mining, and Infrastructure industries represent the largest end-user segments.

- Dominant Region: Ontario, Alberta

- Leading Resin Type: Epoxy

- Fastest Growing Technology: Water-borne

- Largest End-user Industry: Oil and Gas, Mining, Infrastructure

Canada Protective Coatings Market Product Developments

Recent product innovations focus on enhanced corrosion protection, improved durability, and reduced environmental impact. Advancements in nanotechnology and bio-based materials are leading to the development of high-performance, sustainable coatings. These innovations provide competitive advantages by offering superior performance and reduced environmental footprint.

Challenges in the Canada Protective Coatings Market Market

The Canadian protective coatings market faces challenges such as fluctuating raw material prices, potential supply chain disruptions, and intense competition among established and emerging players. Stringent environmental regulations and fluctuating energy prices add further complexity to market dynamics. These factors can impact profitability and market growth.

Forces Driving Canada Protective Coatings Market Growth

Key growth drivers include increasing government investments in infrastructure projects, growth in the oil & gas sector, and strong demand for protective coatings in other key industries. The ongoing focus on sustainability is driving demand for eco-friendly coatings, further boosting market growth.

Long-Term Growth Catalysts in Canada Protective Coatings Market

Long-term growth will be fueled by continued investment in infrastructure, technological advancements in coating formulations and application methods, and the growing adoption of sustainable practices within the industry. Strategic partnerships and collaborations will also play a crucial role in driving market expansion.

Emerging Opportunities in Canada Protective Coatings Market

Emerging opportunities lie in the development of specialized coatings for niche applications, such as high-performance coatings for extreme environments, and the growing adoption of digital technologies for improved application and monitoring. Expansion into new markets and regions within Canada also presents significant potential.

Leading Players in the Canada Protective Coatings Market Sector

- Henkel AG & Co KGaA

- Axalta Coatings Systems

- The Sherwin Williams

- Jotun

- RPM International Inc

- Kansai Paint Co Ltd

- PPG Industries Inc

- ChemPoint

- Nippon Paint Holdings Co Ltd

- Cloverdale Paint Inc

- HEMPEL A/S

- AkzoNobel NV

Key Milestones in Canada Protective Coatings Market Industry

- March 2022: PPG Industries expanded the AMERLOCK Series of Epoxy Protective Coatings to the Canadian market. This expansion significantly strengthens PPG's position in the high-performance coatings segment and caters to growing industry demands for corrosion protection.

Strategic Outlook for Canada Protective Coatings Market Market

The Canadian protective coatings market holds substantial growth potential. Strategic opportunities exist for companies to invest in research and development of innovative, sustainable coatings, expand their market reach, and explore strategic partnerships to enhance their market position. Companies focusing on delivering superior performance, environmentally friendly solutions, and efficient application methods are likely to achieve greater success in the years to come.

Canada Protective Coatings Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Acrylic

- 1.3. Alkyd

- 1.4. Polyurethane

- 1.5. Polyester

- 1.6. Other Resin Types

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

- 2.3. Powder

- 2.4. Other Technologies

-

3. End-user Industry

- 3.1. Oil and gas Industry

- 3.2. Mining Industry

- 3.3. Power Industry

- 3.4. Infrastructure Industry

- 3.5. Other End-user Industries

Canada Protective Coatings Market Segmentation By Geography

- 1. Canada

Canada Protective Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inceasing Oil & Gas activities acroos the country; Increasing investments in infrastructure sector

- 3.3. Market Restrains

- 3.3.1. Regulations Related to VOC Emissions; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Oil and Gas Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Protective Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Acrylic

- 5.1.3. Alkyd

- 5.1.4. Polyurethane

- 5.1.5. Polyester

- 5.1.6. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.2.3. Powder

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and gas Industry

- 5.3.2. Mining Industry

- 5.3.3. Power Industry

- 5.3.4. Infrastructure Industry

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Axalta Coatings Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Sherwin Williams

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RPM International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kansai Paint Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PPG Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ChemPoint

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nippon Paint Holdings Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cloverdale Paint Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HEMPEL A/S

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 AkzoNobel NV

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Canada Protective Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Protective Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Protective Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Protective Coatings Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Canada Protective Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: Canada Protective Coatings Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 5: Canada Protective Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Canada Protective Coatings Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 7: Canada Protective Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Canada Protective Coatings Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 9: Canada Protective Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Canada Protective Coatings Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Canada Protective Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Canada Protective Coatings Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: Canada Protective Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 14: Canada Protective Coatings Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 15: Canada Protective Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Canada Protective Coatings Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 17: Canada Protective Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Canada Protective Coatings Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 19: Canada Protective Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Canada Protective Coatings Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Protective Coatings Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Canada Protective Coatings Market?

Key companies in the market include Henkel AG & Co KGaA, Axalta Coatings Systems, The Sherwin Williams, Jotun, RPM International Inc, Kansai Paint Co Ltd, PPG Industries Inc, ChemPoint, Nippon Paint Holdings Co Ltd, Cloverdale Paint Inc, HEMPEL A/S, AkzoNobel NV.

3. What are the main segments of the Canada Protective Coatings Market?

The market segments include Resin Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Inceasing Oil & Gas activities acroos the country; Increasing investments in infrastructure sector.

6. What are the notable trends driving market growth?

Growing Oil and Gas Sector.

7. Are there any restraints impacting market growth?

Regulations Related to VOC Emissions; Other Restraints.

8. Can you provide examples of recent developments in the market?

March 2022: PPG Industries expanded the AMERLOCK Series of Epoxy Protective Coatings. The expansion covers the Canadian market as well. The PPG Amerlock coatings offer corrosion protection in tough environments. The coating works with a wide range of steel substrates, including carbon steel, stainless steel, and galvanized services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Protective Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Protective Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Protective Coatings Market?

To stay informed about further developments, trends, and reports in the Canada Protective Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence