Key Insights

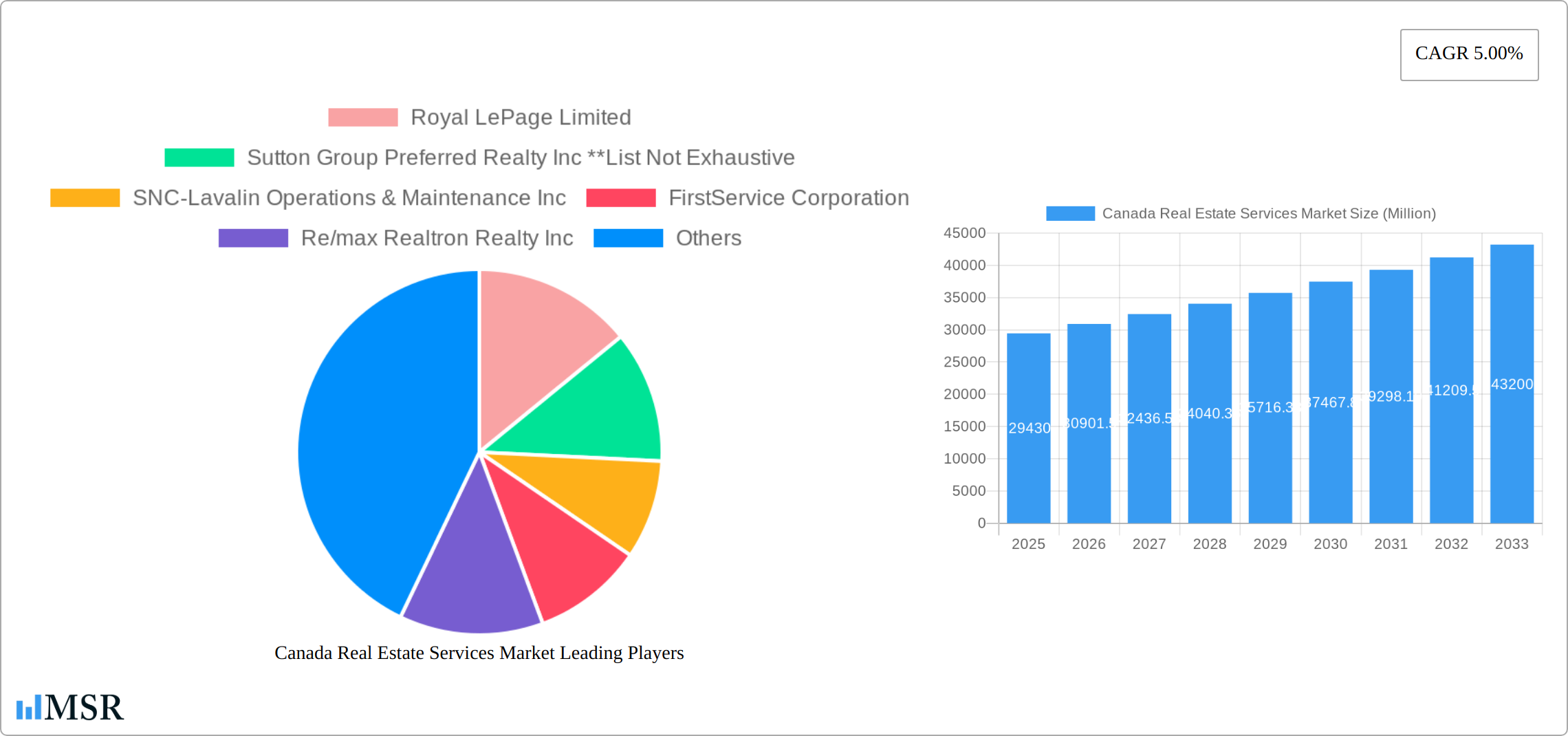

The Canadian real estate services market, valued at $29.43 billion in 2025, is projected to experience robust growth, driven by a consistent Compound Annual Growth Rate (CAGR) of 5.00% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Canada's dynamic population growth, particularly in major urban centers, continuously increases demand for residential and commercial properties, thus boosting the need for property management, valuation, and other related services. Secondly, increasing foreign investment in Canadian real estate contributes significantly to market expansion. The rise of PropTech (Property Technology), incorporating innovative tools and platforms for property searches, management, and transactions, also plays a vital role in market growth. Furthermore, government initiatives aimed at improving housing affordability and infrastructure development indirectly stimulate the real estate services sector. However, economic fluctuations and potential interest rate hikes could act as restraints, potentially affecting market growth in certain periods. Segmentation analysis reveals significant contributions from both residential and commercial property sectors, with property management consistently forming a major revenue stream. Key players like Royal LePage, Sutton Group, Colliers International, and Cushman & Wakefield are strategically positioned to capitalize on these growth opportunities. Regional variations exist, with Eastern and Western Canada likely exhibiting higher growth rates due to population density and economic activity compared to Central Canada.

The forecast period of 2025-2033 anticipates substantial expansion across all segments. The residential sector is expected to maintain its dominance, driven by ongoing population growth and increasing urbanization. Commercial real estate services will also benefit from sustained economic activity and investments in infrastructure projects. The "Other Services" segment, encompassing areas like property consulting and legal services related to real estate, is projected to experience a rise in demand. Competitive dynamics will likely remain intense, with established players focusing on mergers and acquisitions and expansion of service portfolios to maintain their market share. New entrants in the PropTech space will challenge the status quo through disruptive technologies, potentially reshaping the landscape of real estate services in the coming years. Successfully navigating the evolving regulatory environment and adapting to fluctuating market conditions will be crucial for sustained success in this dynamic market.

Canada Real Estate Services Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian real estate services market, offering valuable insights for investors, industry professionals, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market dynamics, key segments, leading players, and emerging opportunities. The study includes detailed forecasts, highlighting growth drivers and challenges shaping the future of this dynamic sector. This report is crucial for navigating the complexities of the Canadian real estate landscape and capitalizing on emerging trends.

Canada Real Estate Services Market Concentration & Dynamics

This section assesses the competitive landscape of the Canadian real estate services market, examining market concentration, innovation, regulatory influences, and the impact of mergers and acquisitions (M&A) activity. The market is characterized by a mix of large multinational corporations and smaller, regional players. Market share data for 2024 suggests a moderately concentrated market, with the top five firms holding approximately xx% of the total market share. However, significant regional variations exist, with higher concentrations in major metropolitan areas like Toronto and Vancouver.

- Market Concentration: Moderately concentrated, with the top 5 firms holding approximately xx% of the market share in 2024.

- Innovation Ecosystems: A growing focus on PropTech is driving innovation, with companies adopting AI, big data, and blockchain technologies.

- Regulatory Frameworks: Federal and provincial regulations significantly impact market operations, particularly concerning licensing, consumer protection, and fair housing practices.

- Substitute Products: The rise of online platforms and direct-to-consumer services poses some competitive pressure on traditional real estate services.

- End-User Trends: Increasing demand for specialized services (e.g., property management for high-rise buildings) and personalized experiences is shaping market demand.

- M&A Activity: The number of M&A deals in the Canadian real estate services market averaged xx per year during the historical period (2019-2024), indicating ongoing consolidation. This activity is primarily driven by the pursuit of economies of scale and expansion into new geographic markets or service offerings.

Canada Real Estate Services Market Industry Insights & Trends

The Canadian real estate services market experienced substantial growth during the historical period (2019-2024), driven by factors such as robust economic growth, population increase, and rising urbanization. The market size reached an estimated CA$xx Million in 2024. The compound annual growth rate (CAGR) during this period is projected at xx%. Several technological disruptions, including the increased adoption of digital marketing and virtual tours, have transformed industry practices. Changes in consumer behavior, such as the growing preference for online property searches and remote property management services, further influence market trends. The forecast period (2025-2033) anticipates continued growth, albeit at a potentially slower pace than the historical period, with the market size expected to reach CA$xx Million by 2033. This moderation might be attributed to fluctuating interest rates and potential economic slowdowns.

Key Markets & Segments Leading Canada Real Estate Services Market

The Canadian real estate services market is geographically diverse, with significant activity across major provinces, especially Ontario and British Columbia. Within the market, the residential segment dominates by revenue, followed by the commercial sector. Other types of real estate services contribute significantly but at a smaller scale. Similarly, Property Management and Valuation Services are significant service sectors.

By Type:

- Residential: Dominant segment, driven by population growth, increasing household formations, and rising demand for housing in urban centers. Economic growth in major cities is a key driver.

- Commercial: Strong growth potential, particularly in major cities with expanding business sectors and increasing demand for office and retail spaces. Infrastructure development plays a vital role.

- Other Types: This segment includes industrial, multi-family, and other specialized property types, offering varied growth prospects based on specific market conditions.

By Service:

- Property Management: Significant and growing segment, driven by increasing demand for professional property management services from both residential and commercial property owners. Increased urbanization contributes significantly to this trend.

- Valuation Services: A vital segment within the real estate ecosystem, driven by the need for accurate property valuations for transactions, financing, and taxation purposes. Market fluctuations affect this sector's growth.

- Other Services: Encompasses various ancillary services like mortgage brokerage, legal services, and real estate consulting.

Canada Real Estate Services Market Product Developments

The Canadian real estate services market is witnessing a wave of technological advancements, including the widespread use of virtual tours, advanced search tools, data analytics platforms, and customer relationship management (CRM) systems. These innovations enhance efficiency, improve service delivery, and provide a more personalized customer experience, creating a competitive edge for firms that are ahead of the curve.

Challenges in the Canada Real Estate Services Market

The Canadian real estate services market faces challenges such as fluctuating interest rates, economic uncertainty, and increasing competition from online platforms. Regulatory hurdles can also impede growth, while supply chain disruptions (particularly concerning construction materials) impact the commercial sector. These factors collectively affect market stability and growth trajectories.

Forces Driving Canada Real Estate Services Market Growth

Key growth drivers include ongoing urbanization, population growth, and increasing demand for residential and commercial properties in major cities. Government initiatives promoting affordable housing and infrastructure development also stimulate market activity. Furthermore, the adoption of innovative technologies continues to drive efficiency and productivity within the sector.

Long-Term Growth Catalysts in the Canada Real Estate Services Market

Long-term growth will be fueled by continued technological innovation, strategic partnerships between traditional firms and PropTech companies, and expanding service offerings to cater to evolving market demands. Expansion into new geographic markets and specialized niche areas will also contribute to sustaining long-term growth.

Emerging Opportunities in Canada Real Estate Services Market

Emerging opportunities lie in specialized real estate sectors, such as sustainable and green buildings, multi-family housing, and technology-driven property management solutions. Expanding into underserved markets, particularly rural areas and smaller cities, presents further growth potential. There is also a growing market for data analytics and market intelligence services within the industry.

Leading Players in the Canada Real Estate Services Sector

- Royal LePage Limited

- Sutton Group Preferred Realty Inc

- SNC-Lavalin Operations & Maintenance Inc

- FirstService Corporation

- Re/max Realtron Realty Inc

- Colliers International Group Inc

- Cushman & Wakefield ULC

- Triovest Realty Advisors Inc

- Cadillac Fairview Corporation Ltd

- Living Realty Inc

Key Milestones in Canada Real Estate Services Industry

- July 2023: Cadillac Fairview launched its CF Concierge Platform, enhancing workplace experiences in 27 office complexes. This highlights the growing adoption of technology to improve services.

- March 2023: Cadillac Fairview acquired Lincoln Property Company's residential division, signifying significant M&A activity and expansion within the sector.

Strategic Outlook for Canada Real Estate Services Market

The Canadian real estate services market offers substantial growth potential over the forecast period. Strategic opportunities exist for companies to leverage technological advancements, expand into new market segments, and consolidate their market positions through strategic acquisitions. Focus on providing personalized, technology-enhanced services will be key to success in the increasingly competitive market.

Canada Real Estate Services Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Commercial

- 1.3. Other Types

-

2. Service

- 2.1. Property Management

- 2.2. Valauation Services

- 2.3. Other Services

Canada Real Estate Services Market Segmentation By Geography

- 1. Canada

Canada Real Estate Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing new construction activity as well as expansion of new startups and small enterprises; Increasing demand for affordable housing units

- 3.3. Market Restrains

- 3.3.1. Lack of housing spaces and mortgage regulation

- 3.4. Market Trends

- 3.4.1. Increasing Contribution to GDP from the Real Estate Sector to Provide Opportunities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Real Estate Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Property Management

- 5.2.2. Valauation Services

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Eastern Canada Canada Real Estate Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Real Estate Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Real Estate Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Royal LePage Limited

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Sutton Group Preferred Realty Inc **List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 SNC-Lavalin Operations & Maintenance Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 FirstService Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Re/max Realtron Realty Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Colliers International Group Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Cushman & Wakefield ULC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Triovest Realty Advisors Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Cadillac Fairview Corporation Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Living Realty Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Royal LePage Limited

List of Figures

- Figure 1: Canada Real Estate Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Real Estate Services Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Real Estate Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Real Estate Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Canada Real Estate Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 4: Canada Real Estate Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Canada Real Estate Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Eastern Canada Canada Real Estate Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Canada Canada Real Estate Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Central Canada Canada Real Estate Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Real Estate Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Canada Real Estate Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 11: Canada Real Estate Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Real Estate Services Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Canada Real Estate Services Market?

Key companies in the market include Royal LePage Limited, Sutton Group Preferred Realty Inc **List Not Exhaustive, SNC-Lavalin Operations & Maintenance Inc, FirstService Corporation, Re/max Realtron Realty Inc, Colliers International Group Inc, Cushman & Wakefield ULC, Triovest Realty Advisors Inc, Cadillac Fairview Corporation Ltd, Living Realty Inc.

3. What are the main segments of the Canada Real Estate Services Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing new construction activity as well as expansion of new startups and small enterprises; Increasing demand for affordable housing units.

6. What are the notable trends driving market growth?

Increasing Contribution to GDP from the Real Estate Sector to Provide Opportunities.

7. Are there any restraints impacting market growth?

Lack of housing spaces and mortgage regulation.

8. Can you provide examples of recent developments in the market?

July 2023: Cadillac Fairview announced that the company has successfully implemented its CF Concierge Platform at 27 office complexes across its Canadian portfolio. Developed in partnership with HqO, the leading workplace experience platform, CF Concierge is a mobile app designed to support building occupants with an enhanced workplace experience, offering access to digital amenities and services in CF office buildings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Real Estate Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Real Estate Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Real Estate Services Market?

To stay informed about further developments, trends, and reports in the Canada Real Estate Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence