Key Insights

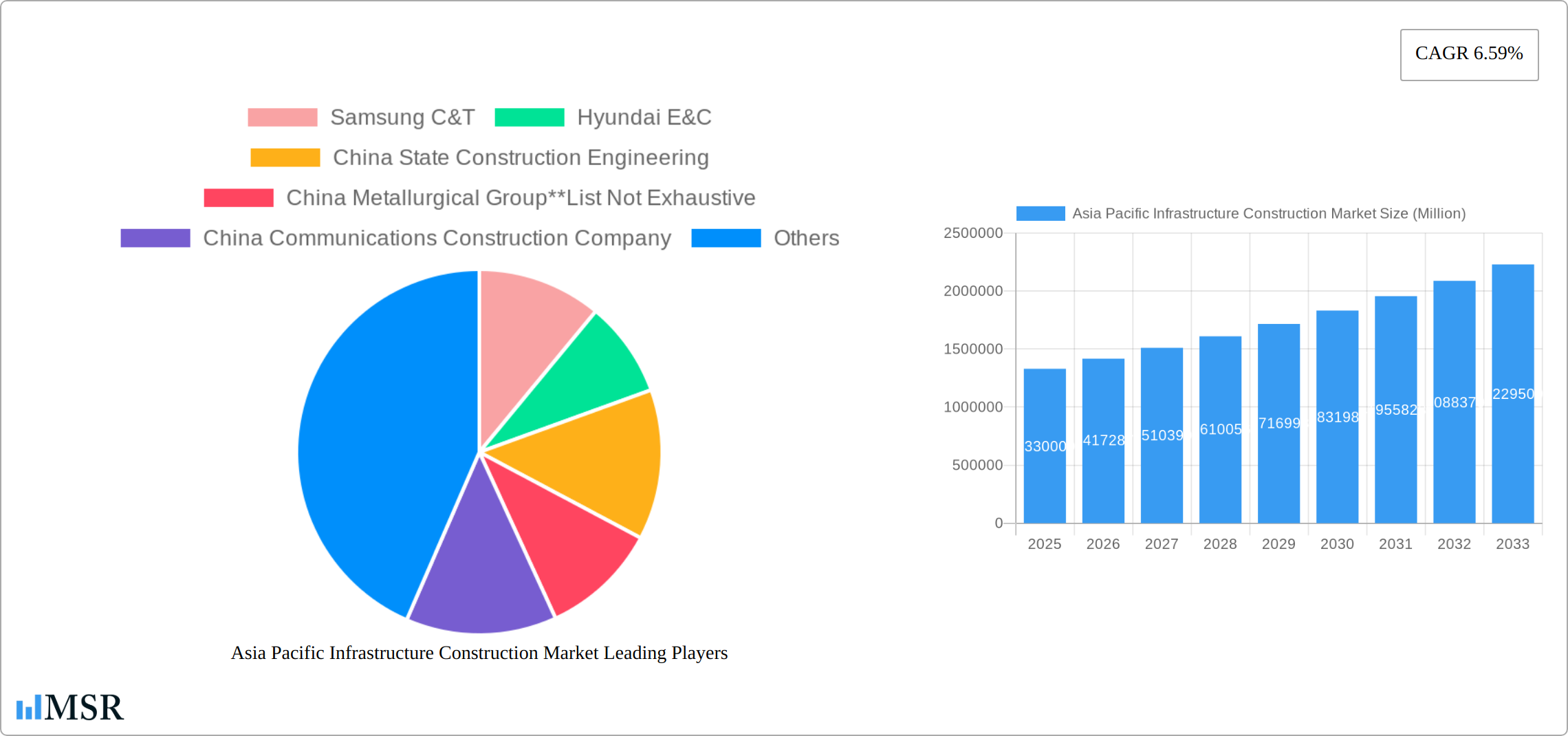

The Asia-Pacific infrastructure construction market is experiencing robust growth, projected to reach a market size of $1.33 trillion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.59% from 2025 to 2033. This expansion is driven by several key factors. Firstly, significant government investments in social infrastructure projects across the region, particularly in transportation (roads, railways, airports), water management, and energy, are fueling demand. Secondly, rapid urbanization and population growth in countries like China, India, and the Philippines necessitate the continuous development of robust infrastructure to support these expanding populations. Thirdly, increasing private sector participation through Public-Private Partnerships (PPPs) is further accelerating project development and deployment. The market is segmented by infrastructure type (telecommunications, social infrastructure, including transportation and water management), and geographically, with China, India, and other Southeast Asian nations representing significant growth pockets. While economic fluctuations and potential material cost increases pose challenges, the long-term outlook for the Asia-Pacific infrastructure construction market remains highly positive, driven by the region’s sustained economic growth and its commitment to infrastructure development.

Major players like Samsung C&T, Hyundai E&C, and various Chinese state-owned enterprises dominate the market, leveraging their extensive experience and resources. However, increasing competition from regional and international firms is also evident. The market's future will likely see greater adoption of sustainable and technologically advanced construction methods, a heightened focus on project efficiency, and an increasing emphasis on regulatory compliance and environmental sustainability. Strategic partnerships and technological innovation will be crucial for companies to maintain a competitive edge in this dynamic and expanding market. The continued growth of e-commerce and digitalization will also positively impact the demand for improved telecommunications infrastructure, contributing further to the overall market expansion.

Asia Pacific Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific infrastructure construction market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key segments, leading players, and future growth potential. The market is segmented by infrastructure type (Transportation Infrastructure, Waterways, Social Infrastructure, Other social infrastructures, Extraction Infrastructure), country (China, India, Philippines, Japan, South Korea, Rest of Asia Pacific), and telecoms manufacturing infrastructure. The report features key players such as Samsung C&T, Hyundai E&C, China State Construction Engineering, China Metallurgical Group, China Communications Construction Company, L&T, Shanghai Construction Group, Obayashi Corporation, Power Construction Corporation of China, and China Petroleum Engineering Corporation. This is not an exhaustive list.

Asia Pacific Infrastructure Construction Market Concentration & Dynamics

The Asia Pacific infrastructure construction market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. China State Construction Engineering and China Communications Construction Company, for example, command substantial portions of the market due to their extensive project portfolios and government affiliations. However, the market also features a significant number of smaller, regional players, creating a competitive environment.

Market Concentration Metrics (Estimated 2025):

- Top 5 players: xx% market share

- Top 10 players: xx% market share

Innovation Ecosystems & Regulatory Frameworks:

The market is characterized by a dynamic innovation ecosystem, with ongoing advancements in construction technologies, materials, and project management techniques. However, varying regulatory frameworks across the Asia Pacific region present challenges for standardization and efficient project execution. These regulations often impact project timelines and costs.

Substitute Products & End-User Trends:

While direct substitutes for traditional construction methods are limited, the increasing adoption of prefabricated components and modular construction represents a significant shift. End-user trends indicate a growing demand for sustainable and resilient infrastructure, driving innovation in green building materials and practices.

M&A Activities:

The Asia Pacific infrastructure construction sector has witnessed a considerable number of mergers and acquisitions (M&As) in recent years (xx deals in 2024). These transactions often aim to expand geographical reach, enhance technological capabilities, and consolidate market share.

Asia Pacific Infrastructure Construction Market Industry Insights & Trends

The Asia Pacific infrastructure construction market is experiencing robust growth, driven by rapid urbanization, rising disposable incomes, and government initiatives focused on infrastructure development. The market size in 2025 is estimated at xx Million USD, with a CAGR of xx% projected from 2025 to 2033. Technological advancements, such as Building Information Modeling (BIM) and the use of robotics and automation, are transforming construction practices, improving efficiency and reducing costs. However, challenges such as labor shortages, material price fluctuations, and supply chain disruptions pose significant threats to market growth. Evolving consumer behaviors, particularly a heightened focus on sustainability and environmental responsibility, are influencing project designs and construction methods. The market is responding with innovative solutions that prioritize energy efficiency and reduced environmental impact.

Key Markets & Segments Leading Asia Pacific Infrastructure Construction Market

China remains the dominant market in the Asia Pacific region, accounting for a significant portion of the total market size, driven by massive government investment in infrastructure projects across various segments. India is another key market exhibiting substantial growth potential due to its expanding economy and ambitious infrastructure development plans.

Key Market Drivers:

- China: Government investment in high-speed rail, smart cities, and renewable energy infrastructure.

- India: Focus on improving transportation networks, expanding urban infrastructure, and rural electrification.

- Other APAC Countries: Investment in port development, telecommunications networks, and tourism-related infrastructure.

Dominance Analysis:

China's dominance stems from its sheer size and substantial government spending on infrastructure. However, India and other Southeast Asian nations are quickly closing the gap, making them attractive markets for construction companies. Within the segments, transportation infrastructure continues to be the largest, followed by social infrastructure. The extraction infrastructure segment is showing steady growth, driven by increased demand for resources.

Asia Pacific Infrastructure Construction Market Product Developments

Recent product innovations include advanced building materials, such as high-performance concrete and sustainable composites, improving construction efficiency and reducing environmental impact. The integration of technology, such as BIM and IoT sensors, is enhancing project management, cost control, and safety measures. These advancements provide significant competitive advantages, allowing companies to offer more efficient, cost-effective, and sustainable solutions.

Challenges in the Asia Pacific Infrastructure Construction Market Market

The Asia Pacific infrastructure construction market faces several challenges including regulatory complexities, which vary significantly across countries, leading to delays and increased project costs. Supply chain disruptions, particularly concerning the availability of raw materials, pose significant risks. Intense competition, particularly in larger markets like China and India, necessitates strategic partnerships and technological advancements for companies to maintain market share. The availability and cost of skilled labor are also considerable concerns.

Forces Driving Asia Pacific Infrastructure Construction Market Growth

Several key factors drive market growth, including significant government investments in infrastructure projects across the region, rapid urbanization leading to increased demand for housing, commercial spaces, and public infrastructure, and technological advancements which improve construction efficiency and reduce project timelines. Furthermore, rising disposable incomes across the region are fueling demand for improved infrastructure and housing.

Long-Term Growth Catalysts in the Asia Pacific Infrastructure Construction Market

Long-term growth will be fueled by sustained government investment in large-scale infrastructure projects such as high-speed rail networks, smart cities, and renewable energy infrastructure. Strategic partnerships and technology adoption will enable companies to offer innovative, sustainable, and cost-effective solutions. Expansion into developing markets will further broaden the market's potential for significant growth.

Emerging Opportunities in Asia Pacific Infrastructure Construction Market

Emerging opportunities exist in sustainable construction practices, the adoption of modular construction methods, and the utilization of advanced technologies such as BIM and AI for project management and optimization. There's also potential for growth in developing markets outside major economies, and increased focus on the development of resilient infrastructure to withstand natural disasters.

Leading Players in the Asia Pacific Infrastructure Construction Market Sector

- Samsung C&T

- Hyundai E&C

- China State Construction Engineering

- China Metallurgical Group

- China Communications Construction Company

- L&T

- Shanghai Construction Group

- Obayashi Corporation

- Power Construction Corporation of China

- China Petroleum Engineering Corporation

Key Milestones in Asia Pacific Infrastructure Construction Market Industry

- 2021-Q3: Launch of a major high-speed rail project in India.

- 2022-Q1: Successful completion of a large-scale renewable energy project in China.

- 2023-Q2: Significant investment in smart city development in Singapore.

- 2024-Q4: Merger between two major construction companies in Japan. (Specifics not available)

Strategic Outlook for Asia Pacific Infrastructure Construction Market Market

The Asia Pacific infrastructure construction market presents significant long-term growth potential, driven by continued government investment, technological advancements, and increasing private sector participation. Strategic partnerships, focused innovation, and expansion into emerging markets will be crucial for success. Companies that embrace sustainable practices and utilize advanced technologies will be best positioned to capitalize on the opportunities this market offers.

Asia Pacific Infrastructure Construction Market Segmentation

-

1. Infrastructure segment

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defence

- 1.1.4. Other social infrastructures

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Power Generation

- 1.3.2. Electricity Transmission & Disribution

- 1.3.3. Gas

- 1.3.4. Telecoms

-

1.4. Manufacturing Infrastructure

- 1.4.1. Metal and Ore Production

- 1.4.2. Petroleum Refining

- 1.4.3. Chemical Manufacturing

- 1.4.4. Industrial Parks and clusters

- 1.4.5. Other manufacturing infrastructures

-

1.1. Social Infrastructure

Asia Pacific Infrastructure Construction Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population

- 3.2.2 along with a rising middle class

- 3.3. Market Restrains

- 3.3.1. Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Infrastructure Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defence

- 5.1.1.4. Other social infrastructures

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Power Generation

- 5.1.3.2. Electricity Transmission & Disribution

- 5.1.3.3. Gas

- 5.1.3.4. Telecoms

- 5.1.4. Manufacturing Infrastructure

- 5.1.4.1. Metal and Ore Production

- 5.1.4.2. Petroleum Refining

- 5.1.4.3. Chemical Manufacturing

- 5.1.4.4. Industrial Parks and clusters

- 5.1.4.5. Other manufacturing infrastructures

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 6. China Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Samsung C&T

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hyundai E&C

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 China State Construction Engineering

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 China Metallurgical Group**List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 China Communications Construction Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 L&T

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Shanghai Construction Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Obayashi Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Power Construction Corporation of China

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 China Petroleum Engineering Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Samsung C&T

List of Figures

- Figure 1: Asia Pacific Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 3: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Infrastructure segment 2019 & 2032

- Table 13: Asia Pacific Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: New Zealand Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia Pacific Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Infrastructure Construction Market?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Asia Pacific Infrastructure Construction Market?

Key companies in the market include Samsung C&T, Hyundai E&C, China State Construction Engineering, China Metallurgical Group**List Not Exhaustive, China Communications Construction Company, L&T, Shanghai Construction Group, Obayashi Corporation, Power Construction Corporation of China, China Petroleum Engineering Corporation.

3. What are the main segments of the Asia Pacific Infrastructure Construction Market?

The market segments include Infrastructure segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population. along with a rising middle class.

6. What are the notable trends driving market growth?

Increasing Investments in Infrastructure Sector.

7. Are there any restraints impacting market growth?

Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence