Key Insights

The Latin American facade market, valued at approximately $25.88 billion in 2024, is projected for robust expansion, with a Compound Annual Growth Rate (CAGR) of 7.7% from 2024 to 2033. Key growth drivers include escalating urbanization and infrastructure development in major economies such as Brazil, Mexico, and Argentina, spurring demand for new construction and advanced facade solutions. A growing emphasis on energy efficiency and sustainable building practices is also accelerating the adoption of ventilated facades and high-performance thermal materials, particularly in environmentally conscious nations like Chile and Peru. Furthermore, the increasing demand for modern architectural aesthetics and the influence of global design trends are fostering innovation in facade materials and designs. Challenges include raw material price volatility, regional economic instability, and potential supply chain disruptions. The market is segmented by type (ventilated, non-ventilated), material (wood, glass, metal, stone, ceramic), and end-user (residential, commercial, industrial), with regional variations expected in segment dominance. Leading companies are poised to leverage these opportunities through product innovation and market expansion.

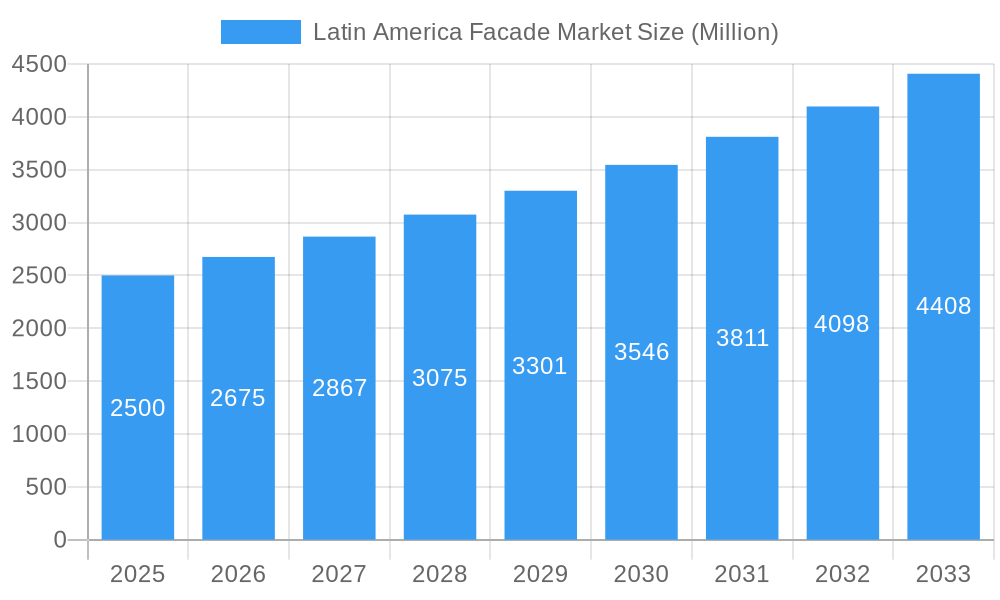

Latin America Facade Market Market Size (In Billion)

Government initiatives supporting sustainable construction, regional economic growth, and evolving consumer preferences will significantly shape market dynamics. The diverse material palette offers flexibility in design and cost. Wood, valued for its aesthetics and sustainability, competes with the durability and modern appeal of glass and metal. Stone and ceramic provide distinct visual options, while emerging materials continue to be developed. The residential sector remains a key driver, supported by rising disposable incomes and housing quality demands. However, the commercial and industrial sectors are anticipated to experience substantial growth due to new construction and refurbishment projects. Detailed analysis of country-specific economic conditions and building regulations within Latin America is crucial for understanding regional market nuances and investment potential.

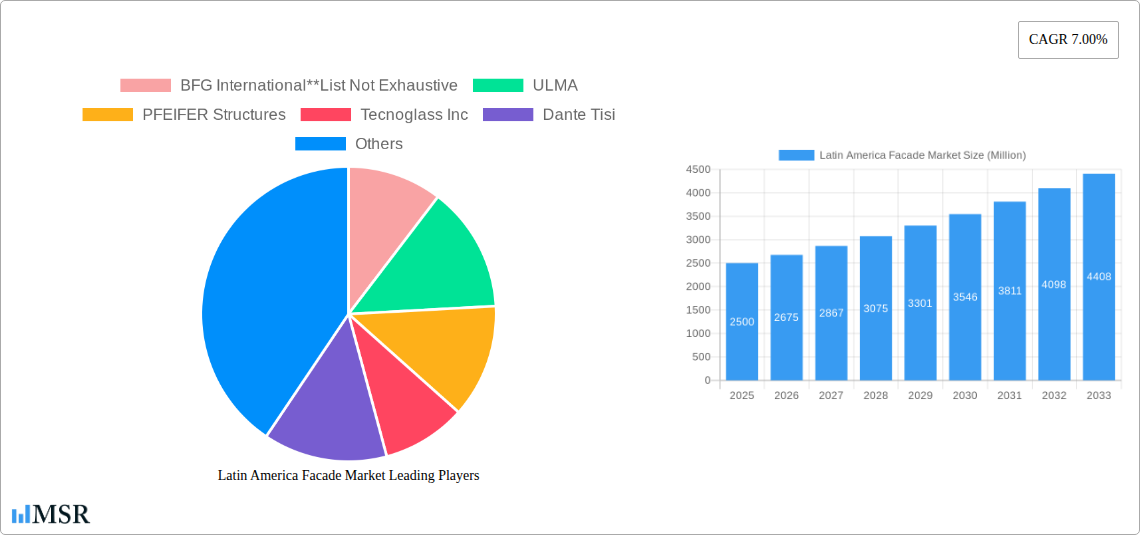

Latin America Facade Market Company Market Share

Latin America Facade Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Latin America facade market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market size, growth drivers, key segments, leading players, and emerging trends. The report utilizes data-driven analysis to forecast market growth and identify key opportunities. The total market size in 2025 is estimated at xx Million, demonstrating significant potential for investment and expansion.

Latin America Facade Market Market Concentration & Dynamics

The Latin America facade market exhibits a moderately concentrated landscape, with several large players holding significant market share. However, the presence of numerous smaller, specialized firms fosters competition and innovation. Market share data for 2025 indicates that the top 5 players collectively hold approximately xx% of the market, while the remaining share is dispersed among numerous smaller companies. Innovation is driven by the adoption of advanced materials and sustainable technologies. Regulatory frameworks, though varying across Latin American nations, generally prioritize building codes and safety standards influencing material selection and installation practices. Substitute products, such as traditional cladding methods, face increasing competition from modern facade systems. Consumer preferences are shifting towards aesthetically pleasing, energy-efficient, and durable facades. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation: Focus on sustainable, energy-efficient materials.

- Regulatory Landscape: Varies across countries, emphasizing safety and building codes.

- Substitute Products: Traditional cladding methods face increasing competition.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Latin America Facade Market Industry Insights & Trends

The Latin America facade market is projected to experience robust growth throughout the forecast period (2025-2033), driven by factors including rising urbanization, burgeoning construction activity, and increasing demand for aesthetically appealing and energy-efficient buildings. The market size is expected to reach xx Million by 2033, representing a CAGR of xx% from 2025. Technological disruptions, such as the adoption of Building Information Modeling (BIM) and advanced manufacturing techniques, are streamlining design and installation processes. Evolving consumer preferences are demanding more sustainable and technologically advanced facade solutions, fostering innovation in material science and construction practices. The market is witnessing a notable rise in the popularity of ventilated facades and the use of high-performance glass and metal materials.

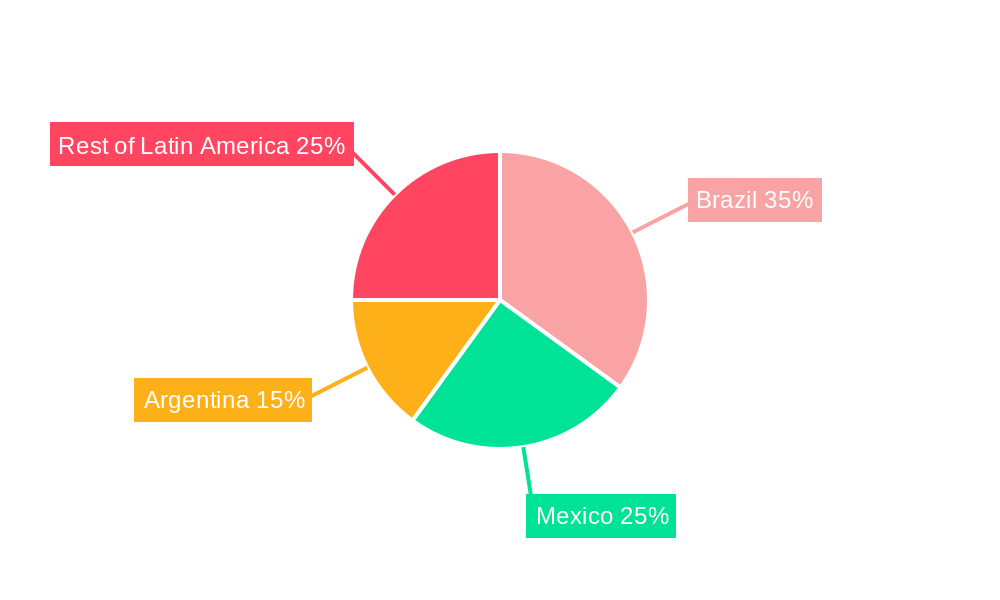

Key Markets & Segments Leading Latin America Facade Market

Mexico and Brazil are the dominant markets within Latin America, accounting for the largest share of the facade market in terms of revenue and project volume. The ventilated facade segment holds the largest market share, driven by its superior energy efficiency and aesthetic appeal. Glass and metal remain the most widely used materials, due to their durability, versatility, and aesthetic characteristics.

Key Growth Drivers:

- Mexico & Brazil: Significant construction activity and urbanization.

- Ventilated Facades: Superior energy efficiency and aesthetic appeal.

- Glass & Metal: Durability, versatility, and aesthetics.

- Commercial Sector: Strong growth in office and retail construction.

Dominance Analysis:

Mexico and Brazil drive market growth due to high construction volumes and government investments in infrastructure. The preference for ventilated facades reflects the increasing emphasis on energy efficiency and sustainability. The prevalence of glass and metal highlights their functional and aesthetic appeal, reflecting contemporary architectural trends. The commercial sector dominates end-user demand, reflecting the expansion of modern office spaces and retail complexes.

Latin America Facade Market Product Developments

Recent product innovations focus on improving energy efficiency, durability, and aesthetic appeal. New materials, such as high-performance glass and self-cleaning coatings, are gaining traction. Advanced manufacturing techniques, such as prefabrication and modular design, are enhancing installation efficiency and reducing project timelines. These advancements provide competitive advantages by offering superior performance and reduced lifecycle costs.

Challenges in the Latin America Facade Market Market

The Latin America facade market faces challenges such as fluctuating raw material prices, supply chain disruptions, and economic volatility in certain regions. Regulatory inconsistencies across different countries also add complexity to project implementation. Furthermore, intense competition among various facade system suppliers can impact profit margins. These factors contribute to project cost uncertainties and potential delays.

Forces Driving Latin America Facade Market Growth

Key growth drivers include increasing urbanization, robust construction activity fueled by economic growth, and government initiatives promoting sustainable building practices. Technological advancements in material science and construction techniques, as well as the rising demand for energy-efficient buildings, also contribute to market expansion.

Challenges in the Latin America Facade Market Market

Long-term growth catalysts include the continued adoption of sustainable building practices, expansion into new markets, and the development of innovative facade systems. Strategic partnerships between facade manufacturers and construction firms are further enhancing market potential.

Emerging Opportunities in Latin America Facade Market

Emerging opportunities lie in the growing demand for eco-friendly facades, the adoption of smart building technologies, and the expansion into less developed regions of Latin America. Innovative designs and custom facade solutions offer significant potential for growth.

Leading Players in the Latin America Facade Market Sector

- BFG International

- ULMA

- PFEIFER Structures

- Tecnoglass Inc

- Dante Tisi

- Shackerley (Holdings) Group

- Mallol Arquitectos

- Au-Mex

- Roofway

- Estudio Marshall & Associates

- Ventanar

Key Milestones in Latin America Facade Market Industry

- 2020: Increased adoption of BIM technology in facade design.

- 2021: Launch of several new energy-efficient facade systems.

- 2022: Several mergers and acquisitions among key players.

- 2023: Growing focus on sustainable and recyclable facade materials.

Strategic Outlook for Latin America Facade Market Market

The Latin America facade market presents significant growth potential, driven by urbanization, infrastructure development, and a growing focus on sustainability. Strategic opportunities include the development of innovative facade systems, expansion into new markets, and fostering strategic partnerships. The market is poised for continued expansion, driven by technological advancements and evolving consumer demands.

Latin America Facade Market Segmentation

-

1. Type

- 1.1. Ventilated

- 1.2. Non-Ventilated

- 1.3. Others

-

2. Material

- 2.1. Wood

- 2.2. Glass

- 2.3. Metal

- 2.4. Stone

- 2.5. Ceramic

- 2.6. Others

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Latin America Facade Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Facade Market Regional Market Share

Geographic Coverage of Latin America Facade Market

Latin America Facade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Increasing Construction Sector Boosting the Demand for Facade Installations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Facade Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ventilated

- 5.1.2. Non-Ventilated

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Wood

- 5.2.2. Glass

- 5.2.3. Metal

- 5.2.4. Stone

- 5.2.5. Ceramic

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BFG International**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ULMA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PFEIFER Structures

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tecnoglass Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dante Tisi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shackerley (Holdings) Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mallol Arquitectos

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Au-Mex

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Roofway

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Estudio Marshall & Associates

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ventanar

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 BFG International**List Not Exhaustive

List of Figures

- Figure 1: Latin America Facade Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Facade Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Latin America Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Latin America Facade Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Latin America Facade Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Latin America Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Latin America Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Latin America Facade Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Latin America Facade Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Facade Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Facade Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Latin America Facade Market?

Key companies in the market include BFG International**List Not Exhaustive, ULMA, PFEIFER Structures, Tecnoglass Inc, Dante Tisi, Shackerley (Holdings) Group, Mallol Arquitectos, Au-Mex, Roofway, Estudio Marshall & Associates, Ventanar.

3. What are the main segments of the Latin America Facade Market?

The market segments include Type, Material, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

Increasing Construction Sector Boosting the Demand for Facade Installations.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Facade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Facade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Facade Market?

To stay informed about further developments, trends, and reports in the Latin America Facade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence