Key Insights

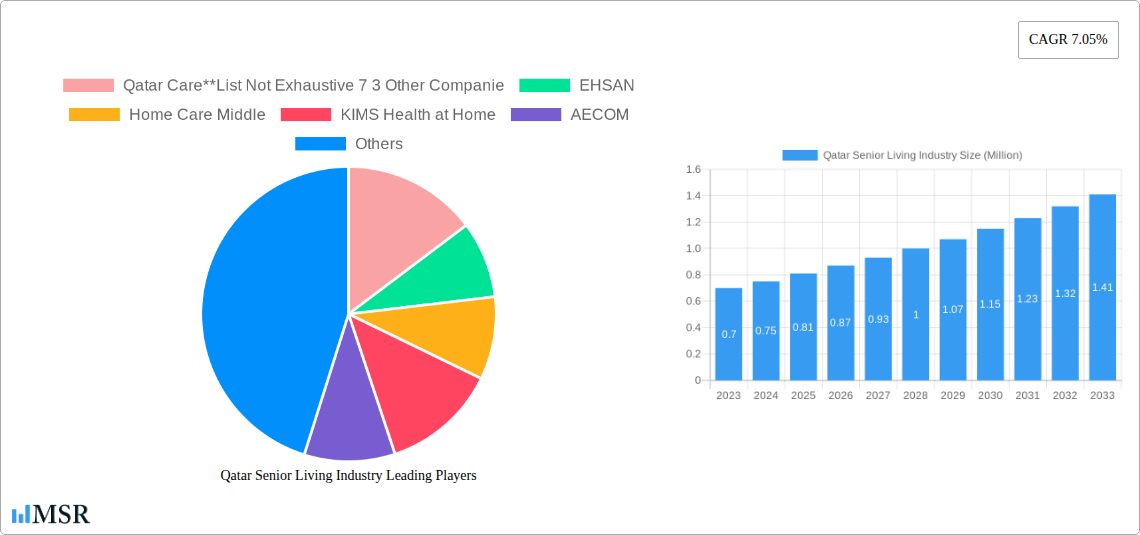

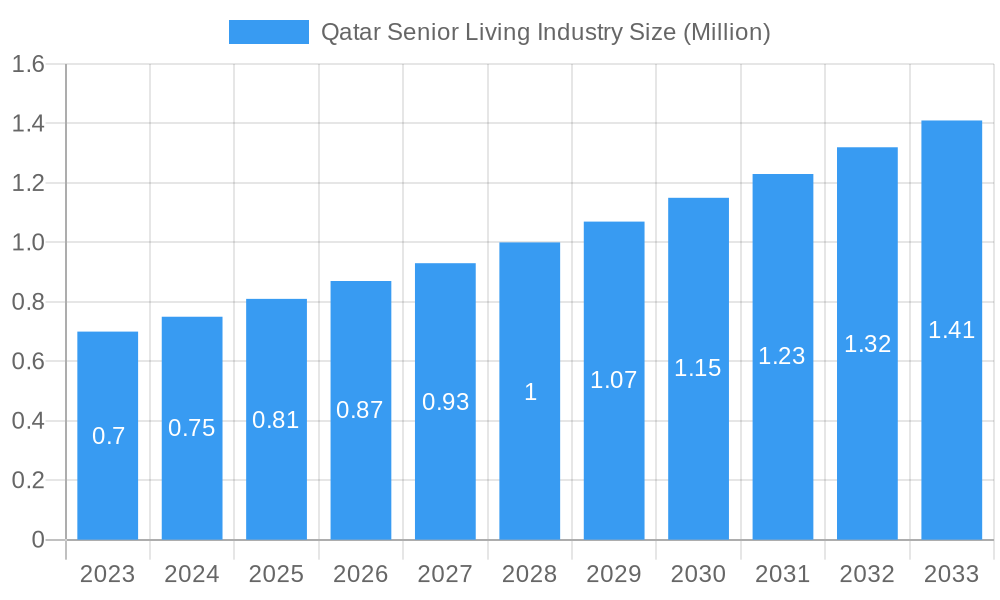

The Qatar Senior Living Industry is poised for substantial growth, with a current market size of approximately $0.81 million and a projected Compound Annual Growth Rate (CAGR) of 7.05% through 2033. This robust expansion is primarily driven by an aging population, increasing life expectancy, and a growing awareness of specialized senior care services. The demand for assisted living, independent living, memory care, and nursing care facilities is on the rise as families seek high-quality, supportive environments for their elderly loved ones. Key cities like Doha, Al Rayyan, Umm Salal Muhammad, and Al Wakrah are expected to be focal points for this development, reflecting the concentration of population and the availability of infrastructure. The market is further bolstered by government initiatives aimed at improving healthcare access and promoting a higher quality of life for seniors.

Qatar Senior Living Industry Market Size (In Million)

The industry's trajectory is also influenced by evolving societal norms, with a greater acceptance of professional senior living solutions. While the market is relatively nascent, it presents significant opportunities for both local and international players. Trends indicate a move towards more integrated care models, offering a continuum of services to cater to diverse needs, from independent living to comprehensive nursing care. The presence of established companies like Qatar Care, EHSAN, Home Care Middle, KIMS Health at Home, and AECOM, alongside emerging players, suggests a competitive landscape focused on innovation and service excellence. Despite the promising outlook, potential restraints may include the high cost of developing and operating specialized facilities, regulatory hurdles, and the need for a skilled workforce. Addressing these challenges will be crucial for sustained market advancement and for fully capitalizing on the immense potential within the Qatar senior living sector.

Qatar Senior Living Industry Company Market Share

Unveiling the Future: Qatar Senior Living Industry Market Research Report 2019-2033

This comprehensive report delivers in-depth market analysis and strategic insights into Qatar's burgeoning senior living industry. Spanning the historical period of 2019–2024 and forecasting through 2033, with a base and estimated year of 2025, this study is an essential resource for investors, operators, policymakers, and stakeholders seeking to capitalize on this rapidly evolving sector. Discover key market dynamics, emerging trends, crucial growth drivers, and leading players shaping the future of senior care in Qatar.

Qatar Senior Living Industry Market Concentration & Dynamics

The Qatar senior living industry is exhibiting moderate market concentration, characterized by a growing number of dedicated providers and increasing private sector investment. Innovation ecosystems are developing, driven by collaborations between healthcare providers and technology firms to enhance resident care and operational efficiency. Regulatory frameworks are evolving to support the expansion of senior living facilities, with a focus on quality standards and resident safety. Substitute products, such as traditional home care services and family-based care, remain prevalent but are increasingly being complemented by specialized senior living options. End-user trends highlight a growing demand for a variety of housing and care models, including assisted living, independent living, memory care, and nursing care, driven by an aging population and rising disposable incomes. Merger and acquisition (M&A) activities are anticipated to increase as established players seek to expand their footprint and new entrants vie for market share. The market share of the top 3 companies is projected to be around 65% by 2033, with a notable trend towards consolidation in the nursing care segment. M&A deal counts are expected to rise from an estimated 1 transaction in the historical period to 4-6 annually during the forecast period.

Qatar Senior Living Industry Industry Insights & Trends

The Qatar senior living industry is poised for significant growth, projected to reach an estimated 15.5 Billion QAR by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 12.5% from its 2025 estimated value of 7.2 Billion QAR. This expansion is primarily fueled by a confluence of demographic shifts and socio-economic advancements. Qatar's aging population, a direct consequence of increasing life expectancy and declining fertility rates, forms the bedrock of this demand. By 2033, the population aged 65 and above is expected to constitute 15% of the total population, a substantial increase from approximately 5% in 2019. Technological disruptions are actively reshaping the industry, with the adoption of smart home technologies for resident safety and remote monitoring, telemedicine for enhanced healthcare access, and AI-powered tools for personalized care plans. Evolving consumer behaviors are a critical trend; seniors and their families are increasingly seeking integrated living solutions that offer not just accommodation but also a continuum of care, social engagement, and wellness programs. The preference for premium services, including specialized memory care and advanced nursing facilities, is on the rise, reflecting a desire for dignity, comfort, and comprehensive support. Furthermore, government initiatives promoting healthcare infrastructure development and encouraging private sector participation are acting as significant catalysts. The market size in 2024 is estimated at 6.1 Billion QAR, with a historical CAGR of 10.2% from 2019.

Key Markets & Segments Leading Qatar Senior Living Industry

Doha stands as the undisputed dominant region within the Qatar senior living industry, commanding an estimated 70% of the market share. This dominance is attributed to its status as the nation's capital, housing the majority of the country's wealth, advanced healthcare infrastructure, and a higher concentration of expatriate residents who often have different family support structures.

- Doha's Dominance Drivers:

- Economic Hub: Concentrated wealth and higher disposable incomes enable greater affordability for premium senior living services.

- Healthcare Infrastructure: Access to world-class hospitals and specialized medical facilities, crucial for nursing care and memory care segments.

- Expatriate Population: A significant expatriate demographic often relies on professional senior living solutions due to geographical distance from extended family.

- Infrastructure Development: Ongoing urban development and a higher density of modern residential and commercial properties create a favorable environment for senior living facilities.

Within the property types, Assisted Living is projected to be the leading segment, capturing approximately 35% of the market by 2033. This is driven by the growing need for support services that enable seniors to maintain independence while receiving assistance with daily activities. Independent Living follows closely, accounting for an estimated 30%, catering to active seniors seeking a community environment and access to amenities. The Nursing Care segment, crucial for residents requiring comprehensive medical attention, is expected to grow at a significant pace, reaching 25% of the market share. Memory Care, though currently a smaller segment, is anticipated to witness the highest growth rate due to the increasing prevalence of dementia and Alzheimer's diseases, projected to reach 10% by 2033.

In terms of city-specific dominance beyond Doha:

- Al Rayyan is emerging as a significant secondary market, projected to capture 15% of the market share by 2033. Its growing population and developing infrastructure are attracting senior living developers.

- Al Wakrah, with its coastal appeal and developing amenities, is expected to account for 10% of the market.

- Umm Salal Muhammad, while smaller, presents niche opportunities for specialized senior living developments, estimated at 5% market share.

Qatar Senior Living Industry Product Developments

Product innovations in the Qatar senior living industry are increasingly focused on enhancing the quality of life and safety of elderly residents. This includes the integration of smart home technologies for improved monitoring and assistance, such as voice-activated controls, fall detection sensors, and automated medication dispensers. Telehealth platforms are being developed to facilitate remote medical consultations and continuous health tracking, reducing the need for frequent hospital visits. Furthermore, specialized therapeutic environments are being designed for memory care units, incorporating sensory gardens and familiar, comforting aesthetics to aid cognitive well-being. The market relevance of these developments lies in their ability to address the growing demand for personalized, technology-enabled, and high-quality care solutions, offering a competitive edge to providers who adopt these advancements.

Challenges in the Qatar Senior Living Industry Market

The Qatar senior living industry faces several challenges that could impede its growth trajectory. A significant hurdle is the scarcity of skilled labor, particularly trained caregivers and specialized medical professionals in geriatrics, leading to increased recruitment costs and potential service quality compromises. High operational costs, including real estate, staffing, and specialized equipment, can impact profitability and affordability for a wider segment of the population. Regulatory complexities and evolving licensing requirements can also create barriers to entry and expansion for new and existing providers. Furthermore, shifting consumer perceptions and preferences towards home-based care, especially among certain cultural demographics, require continuous education and marketing efforts to highlight the benefits of structured senior living environments.

Forces Driving Qatar Senior Living Industry Growth

The Qatar senior living industry is propelled by several powerful growth forces. Demographic shifts, characterized by an increasing life expectancy and a growing elderly population, are the primary driver, creating a sustained demand for senior care services. Rising disposable incomes and a growing middle class enhance the affordability of specialized senior living options. Government initiatives and support, including favorable policies and investment incentives for healthcare and social services, are crucial accelerators. Furthermore, technological advancements in healthcare and smart home solutions are enabling more efficient, personalized, and safer senior living experiences, attracting both providers and residents. The increasing awareness and acceptance of diverse senior living models, such as assisted and independent living, are also contributing significantly to market expansion.

Challenges in the Qatar Senior Living Industry Market

Long-term growth catalysts in the Qatar senior living industry are rooted in sustainable innovation and strategic market expansion. The development of integrated care models that seamlessly combine housing, healthcare, and social activities will be crucial for long-term appeal. Investing in continuous staff training and development to build a specialized and dedicated workforce will ensure sustained quality of care. Strategic partnerships between senior living providers, healthcare institutions, and technology companies can foster innovation and service diversification. Furthermore, exploring niche markets and specialized services, such as for individuals with specific chronic conditions or cultural preferences, will open new avenues for growth. The increasing focus on preventive health and wellness programs within senior living communities also represents a significant long-term growth opportunity.

Emerging Opportunities in Qatar Senior Living Industry

Emerging opportunities in the Qatar senior living industry are ripe for exploitation. The development of boutique and specialized senior living facilities catering to specific needs, such as pet-friendly communities or those with a strong focus on arts and culture, presents a significant niche. The integration of advanced preventative health technologies and personalized wellness programs, including fitness and nutrition coaching, is a growing trend. There's also a substantial opportunity in developing affordable senior housing solutions that combine essential care with cost-effectiveness to cater to a broader demographic. Furthermore, the potential for cross-border collaborations and knowledge sharing with established senior living markets can accelerate best practice adoption. Finally, the growing demand for respite care services and short-term rehabilitation facilities offers another avenue for market expansion.

Leading Players in the Qatar Senior Living Industry Sector

- Qatar Care

- EHSAN

- Home Care Middle

- KIMS Health at Home

- AECOM

Key Milestones in Qatar Senior Living Industry Industry

- June 2023: The Primary Health Care Corporation’s (PHCC) Preventive Health Directorate launched the pilot phase of the Ejlal Home Oral Health Care Services Programme for the Elderly, in cooperation with the Home Health Care Services Department. This initiative aims to improve oral health outcomes for seniors, reducing associated health risks and enhancing overall well-being.

- August 2023: The second series of the “Hikma” training program is expected to commence in early September. This program, a collaboration between the Center for Empowerment and Care of the Elderly “Ihsan” and the Doha Institute for Graduate Studies, features four key programs: The Expert Advisor, My Experience, My Knowledge, Bridges, and The Performing Identity of the Elderly. Its objective is to strengthen the communication network between young people and the elderly, fostering intergenerational understanding and engagement.

Strategic Outlook for Qatar Senior Living Industry Market

The strategic outlook for the Qatar senior living industry is exceptionally promising, driven by robust underlying market fundamentals and a proactive government agenda. Future growth will be accelerated by strategic investments in infrastructure that supports diverse senior living models, from independent living communities to specialized nursing and memory care facilities. The industry's ability to attract and retain a highly skilled workforce through enhanced training and attractive employment packages will be a critical success factor. Furthermore, fostering innovation through public-private partnerships, particularly in the adoption of smart technologies and telehealth, will be key to delivering personalized and high-quality care. Embracing a patient-centric approach, focusing on resident well-being, social engagement, and continuous improvement, will solidify Qatar's position as a leading destination for senior living in the region.

Qatar Senior Living Industry Segmentation

-

1. Property Type

- 1.1. Assisted Living

- 1.2. Independent Living

- 1.3. Memory Care

- 1.4. Nursing Care

-

2. City

- 2.1. Doha

- 2.2. Al Rayyan

- 2.3. Umm Salal Muhammad

- 2.4. Al Wakrah

Qatar Senior Living Industry Segmentation By Geography

- 1. Qatar

Qatar Senior Living Industry Regional Market Share

Geographic Coverage of Qatar Senior Living Industry

Qatar Senior Living Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Increase in Senior Population and Life Expectancy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Senior Living Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Assisted Living

- 5.1.2. Independent Living

- 5.1.3. Memory Care

- 5.1.4. Nursing Care

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Doha

- 5.2.2. Al Rayyan

- 5.2.3. Umm Salal Muhammad

- 5.2.4. Al Wakrah

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Qatar Care**List Not Exhaustive 7 3 Other Companie

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EHSAN

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Home Care Middle

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KIMS Health at Home

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AECOM

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Qatar Care**List Not Exhaustive 7 3 Other Companie

List of Figures

- Figure 1: Qatar Senior Living Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Qatar Senior Living Industry Share (%) by Company 2025

List of Tables

- Table 1: Qatar Senior Living Industry Revenue Million Forecast, by Property Type 2020 & 2033

- Table 2: Qatar Senior Living Industry Revenue Million Forecast, by City 2020 & 2033

- Table 3: Qatar Senior Living Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Qatar Senior Living Industry Revenue Million Forecast, by Property Type 2020 & 2033

- Table 5: Qatar Senior Living Industry Revenue Million Forecast, by City 2020 & 2033

- Table 6: Qatar Senior Living Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Senior Living Industry?

The projected CAGR is approximately 7.05%.

2. Which companies are prominent players in the Qatar Senior Living Industry?

Key companies in the market include Qatar Care**List Not Exhaustive 7 3 Other Companie, EHSAN, Home Care Middle, KIMS Health at Home, AECOM.

3. What are the main segments of the Qatar Senior Living Industry?

The market segments include Property Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Increase in Senior Population and Life Expectancy.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

June 2023: The Primary Health Care Corporation’s (PHCC) Preventive Health Directorate has launched the pilot phase of the Ejlal Home Oral Health Care Services Programme for the Elderly in cooperation with the Home Health Care Services Department.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Senior Living Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Senior Living Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Senior Living Industry?

To stay informed about further developments, trends, and reports in the Qatar Senior Living Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence