Key Insights

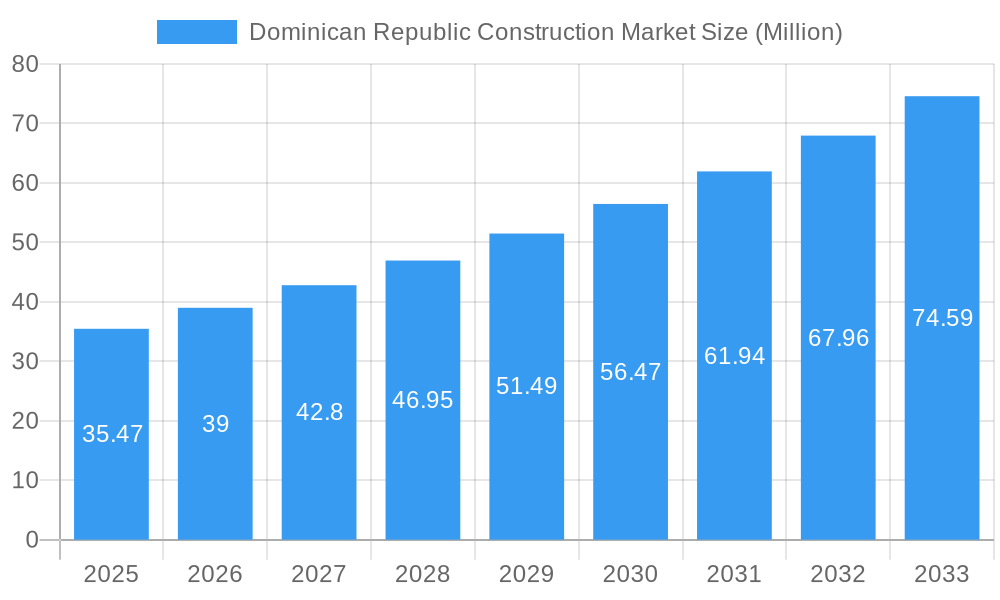

The Dominican Republic construction market is poised for robust expansion, with an estimated market size of USD 35.47 million in 2025 and projected to grow at a Compound Annual Growth Rate (CAGR) exceeding 9.81% through 2033. This significant growth is fueled by a confluence of factors, including substantial government investment in infrastructure development, particularly in transportation networks and energy projects. The residential sector is experiencing a surge driven by increasing urbanization, a growing middle class with rising disposable incomes, and attractive real estate investment opportunities for both local and international buyers. Commercial construction is also on an upward trajectory, spurred by the expansion of tourism, retail, and hospitality sectors, necessitating the development of new hotels, shopping centers, and entertainment venues. Furthermore, ongoing industrial development, driven by manufacturing and logistics, contributes to the demand for new facilities and expansions. The energy and utilities sector is seeing considerable activity as the nation works towards modernizing its power generation, transmission, and distribution infrastructure, including a growing focus on renewable energy sources.

Dominican Republic Construction Market Market Size (In Million)

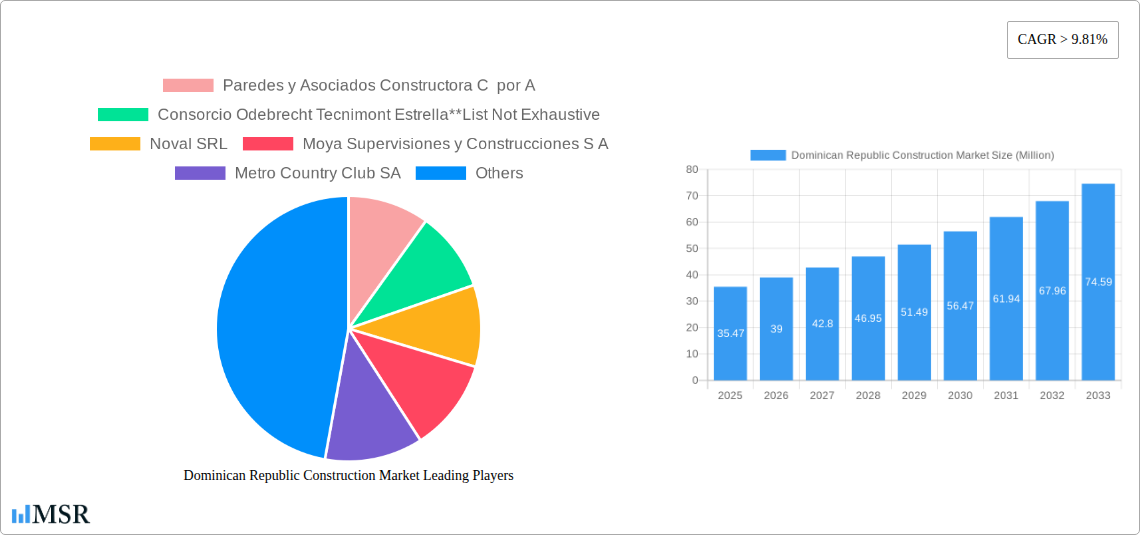

Despite this positive outlook, the market faces certain restraints. A primary challenge revolves around the availability and cost of skilled labor, which can impact project timelines and budgets. Fluctuations in the prices of construction materials, influenced by global supply chain dynamics and local economic conditions, also present a recurring hurdle. Furthermore, navigating complex regulatory frameworks and obtaining necessary permits can sometimes lead to project delays. However, the inherent demand across all key segments – Residential, Commercial, Industrial, Infrastructure (Transportation), and Energy and Utilities – coupled with favorable government policies aimed at attracting foreign investment and stimulating economic growth, are expected to outweigh these challenges. Key players such as Paredes y Asociados Constructora C por A, Consorcio Odebrecht Tecnimont Estrella, and Noval SRL are actively participating in shaping the market, indicating a competitive landscape with significant opportunities for established and emerging companies alike.

Dominican Republic Construction Market Company Market Share

Unveiling the Dominican Republic Construction Market: A Comprehensive Industry Analysis

Dive deep into the dynamic Dominican Republic construction market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis provides invaluable insights for investors, developers, contractors, and policymakers. Explore market concentration, industry trends, segment dominance, product innovations, challenges, growth drivers, emerging opportunities, leading players, and key milestones shaping the future of construction in the Dominican Republic.

Dominican Republic Construction Market Market Concentration & Dynamics

The Dominican Republic construction market exhibits a moderately concentrated landscape, with a few dominant players alongside a robust presence of mid-sized and smaller enterprises. Market concentration is influenced by the significant capital investment required for large-scale infrastructure and commercial construction projects, favoring established firms with proven track records and access to financing. Innovation is increasingly driven by the adoption of sustainable building materials and digital construction technologies, though the ecosystem is still maturing. Regulatory frameworks, particularly those concerning permits, environmental impact assessments, and land use, play a crucial role in shaping development. While substitute products exist in material selection, the core construction methodologies remain relatively consistent. End-user trends lean towards demand for modern, energy-efficient, and aesthetically pleasing residential and commercial spaces. Mergers and acquisitions (M&A) activities are present but not yet a defining characteristic of the market, with occasional consolidation observed in sectors experiencing rapid growth or facing increased competition. The market share distribution is fluid, with major infrastructure tenders often attracting a significant portion of the revenue.

Dominican Republic Construction Market Industry Insights & Trends

The Dominican Republic construction market is poised for substantial growth, driven by a confluence of robust economic expansion, increasing foreign investment, and ambitious government initiatives. The residential construction sector continues to be a bedrock, fueled by a growing middle class, urbanization, and a burgeoning tourism industry that stimulates demand for hospitality and vacation properties. Commercial construction is experiencing a renaissance, with significant investments in retail spaces, office buildings, and mixed-use developments to cater to the evolving business landscape. The infrastructure development segment, particularly transportation projects, is a major catalyst. The government's commitment to enhancing connectivity and logistics through road networks, bridges, and port modernization is a key growth driver. The energy and utilities sector is also witnessing considerable activity, with investments in renewable energy projects and upgrades to existing power grids. Technological disruptions are increasingly influencing the market, with a growing adoption of Building Information Modeling (BIM), prefabrication techniques, and advanced construction machinery to improve efficiency and reduce project timelines. Evolving consumer behaviors are evident in the demand for smart homes, sustainable designs, and integrated living spaces. The market size is projected to reach approximately USD 10 Billion in 2025, with an estimated Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. The Dominican Republic construction market size is projected to expand significantly as the nation continues its development trajectory.

Key Markets & Segments Leading Dominican Republic Construction Market

The Infrastructure (Transportation) segment is emerging as a dominant force in the Dominican Republic construction market, propelled by the government's strategic focus on enhancing national connectivity and facilitating economic growth.

- Economic Growth & Investment: Sustained economic growth attracts foreign direct investment, which in turn fuels demand for improved transportation networks to support trade and tourism.

- Government Initiatives: Ambitious public-private partnership (PPP) programs and infrastructure master plans are directly investing in and incentivizing large-scale transportation projects.

- Tourism Sector: The vital tourism industry necessitates efficient transportation links for both arrivals and internal movement, driving the development of roads, airports, and associated infrastructure.

- Logistics and Trade: Improving the movement of goods and services is paramount for economic competitiveness, leading to significant investment in ports, highways, and logistics hubs.

The dominance of Infrastructure (Transportation) is underscored by recent significant developments, such as the planned construction of the DOP 21.5 billion (USD 391 million) Ámbar divided highway connecting Santiago de los Caballeros and Puerto Plata, initiated by the DGAPP. This project exemplifies the scale and strategic importance of transportation infrastructure. The Residential segment remains a strong performer, driven by population growth, urbanization, and the demand for modern housing solutions, particularly in tourist-centric areas. The Commercial sector is also buoyant, with increasing development of retail and office spaces to support the expanding economy. The Energy and Utilities sector is experiencing a steady upswing, particularly in renewable energy integration and grid modernization. The Industrial segment, while smaller, is influenced by manufacturing and logistics expansion. The overall growth trajectory indicates a multi-faceted market where infrastructure development plays a pivotal role in unlocking further potential across all sectors.

Dominican Republic Construction Market Product Developments

Product developments in the Dominican Republic construction market are increasingly focused on enhancing sustainability, efficiency, and resilience. Innovations include the growing adoption of green building materials like recycled aggregates and low-VOC paints, driven by environmental consciousness and regulatory push. Advanced prefabrication techniques and modular construction are gaining traction, offering faster project completion times and improved quality control. Furthermore, the integration of smart building technologies, such as automated climate control and energy management systems, is becoming a key differentiator in the residential and commercial segments. These technological advancements aim to reduce operational costs, improve occupant comfort, and minimize the environmental footprint of construction projects, providing a competitive edge in an evolving market.

Challenges in the Dominican Republic Construction Market Market

The Dominican Republic construction market faces several key challenges that can impact project timelines and profitability.

- Regulatory Hurdles: Navigating complex and sometimes lengthy permitting processes can lead to delays and increased administrative costs.

- Supply Chain Volatility: Fluctuations in the availability and cost of raw materials, particularly imported components, can disrupt project schedules and budgets.

- Skilled Labor Shortages: A consistent demand for skilled labor across various trades can lead to higher labor costs and potential project delays if not adequately addressed through training and development.

- Access to Financing: Securing adequate and timely financing for large-scale projects can be a barrier for some developers and contractors, especially smaller enterprises.

Forces Driving Dominican Republic Construction Market Growth

Several powerful forces are propelling the growth of the Dominican Republic construction market.

- Robust Economic Growth: A consistently expanding economy fuels both public and private sector investment in construction projects.

- Government Infrastructure Investment: Significant public spending on infrastructure development, including transportation networks and utilities, is a primary growth catalyst.

- Foreign Direct Investment (FDI): Growing investor confidence in the Dominican Republic's economic stability attracts substantial FDI, particularly in tourism, real estate, and renewable energy sectors, which directly translates into construction demand.

- Urbanization and Population Growth: Increasing urbanization and a rising population create sustained demand for residential, commercial, and public facilities.

- Tourism Sector Expansion: The thriving tourism industry continues to drive demand for hotels, resorts, entertainment venues, and associated infrastructure.

Challenges in the Dominican Republic Construction Market Market

Long-term growth catalysts in the Dominican Republic construction market are rooted in strategic advancements and market expansions. The continued embrace and integration of digitalization and advanced construction technologies, such as AI-driven project management and drone-based surveying, promise to enhance productivity and cost-effectiveness. Strategic partnerships between local developers and international firms can bring new expertise, capital, and access to global best practices. Furthermore, the expansion into untapped regions within the country and the development of niche sectors like sustainable and affordable housing offer significant avenues for sustained growth. Policy reforms aimed at streamlining land acquisition and permitting processes will also play a crucial role in fostering a more conducive environment for sustained development.

Emerging Opportunities in Dominican Republic Construction Market

Emerging opportunities in the Dominican Republic construction market are diverse and promising. The increasing global emphasis on renewable energy presents substantial opportunities for the development of solar, wind, and potentially waste-to-energy facilities. The green building sector is gaining momentum, with growing demand for energy-efficient and sustainable construction solutions in both residential and commercial projects. Furthermore, the government's focus on modernizing its public infrastructure, including water management systems and waste treatment facilities, offers significant project pipelines. The digitalization of construction processes also presents opportunities for technology providers and specialized service firms. Additionally, the potential for developing affordable housing solutions to meet the needs of a growing population remains a significant, albeit challenging, opportunity.

Leading Players in the Dominican Republic Construction Market Sector

- Paredes y Asociados Constructora C por A

- Consorcio Odebrecht Tecnimont Estrella

- Noval SRL

- Moya Supervisiones y Construcciones S A

- Metro Country Club SA

- Constructora Rizek y Asociados SRL

- Abi Karram Morilla Ingenieros Arquitectos S A

- Constructora Samredo S A

- Therrestra SAS

- Contratistas Civiles y Mecanicos SA

Key Milestones in Dominican Republic Construction Market Industry

- August 2023: Guyana signed a memorandum of understanding (MoU) with the Dominican Republic to explore the construction of a 50,000 barrel per day (bpd) refinery in Guyana. The Dominican Republic Government could potentially own at least a 51% stake, signaling international collaboration and investment potential.

- May 2023: The Dominican Republic’s PPP agency DGAPP launched the process to award the construction and operation of the DOP 21.5 billion (USD 391 million) Ámbar divided highway. This signifies a major infrastructure development initiative to enhance connectivity on the north coast.

- March 2023: Grupo Estrella subsidiary Cemento PANAM plans to execute a 1.23 Mt/yr grinding plant project in the Dominican Republic. China-based Sinoma Construction won the contract to deliver this significant industrial project, highlighting international participation in the sector.

Strategic Outlook for Dominican Republic Construction Market Market

The strategic outlook for the Dominican Republic construction market is one of sustained and dynamic growth, driven by a combination of robust economic fundamentals and forward-looking government policies. The ongoing investment in infrastructure development, particularly in transportation and energy, will continue to be a key growth accelerator, creating a ripple effect across allied sectors. The increasing adoption of sustainable construction practices and technologies presents a significant opportunity for market players to differentiate themselves and capture the growing demand for eco-friendly developments. Furthermore, the government's commitment to fostering private-public partnerships (PPPs) is expected to unlock further opportunities for large-scale projects. Strategic market entry and expansion, coupled with continuous innovation in building materials and methodologies, will be crucial for stakeholders to capitalize on the immense potential of this vibrant construction market in the coming years.

Dominican Republic Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities

Dominican Republic Construction Market Segmentation By Geography

- 1. Dominica

Dominican Republic Construction Market Regional Market Share

Geographic Coverage of Dominican Republic Construction Market

Dominican Republic Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Rise in commercial construction projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Dominican Republic Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Dominica

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Paredes y Asociados Constructora C por A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Consorcio Odebrecht Tecnimont Estrella**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Noval SRL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Moya Supervisiones y Construcciones S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metro Country Club SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Constructora Rizek y Asociados SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abi Karram Morilla Ingenieros Arquitectos S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Constructora Samredo S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Therrestra SAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Contratistas Civiles y Mecanicos SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Paredes y Asociados Constructora C por A

List of Figures

- Figure 1: Dominican Republic Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Dominican Republic Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Dominican Republic Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Dominican Republic Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Dominican Republic Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Dominican Republic Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dominican Republic Construction Market?

The projected CAGR is approximately > 9.81%.

2. Which companies are prominent players in the Dominican Republic Construction Market?

Key companies in the market include Paredes y Asociados Constructora C por A, Consorcio Odebrecht Tecnimont Estrella**List Not Exhaustive, Noval SRL, Moya Supervisiones y Construcciones S A, Metro Country Club SA, Constructora Rizek y Asociados SRL, Abi Karram Morilla Ingenieros Arquitectos S A, Constructora Samredo S A, Therrestra SAS, Contratistas Civiles y Mecanicos SA.

3. What are the main segments of the Dominican Republic Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Rise in commercial construction projects.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

August 2023: Guyana signed a memorandum of understanding (MoU) with the Dominican Republic to explore the construction of a 50,000 barrel per day (bpd) refinery in Guyana. As per the terms of the agreement, the Dominican Republic Government could own at least a 51% stake in the refinery project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dominican Republic Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dominican Republic Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dominican Republic Construction Market?

To stay informed about further developments, trends, and reports in the Dominican Republic Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence