Key Insights

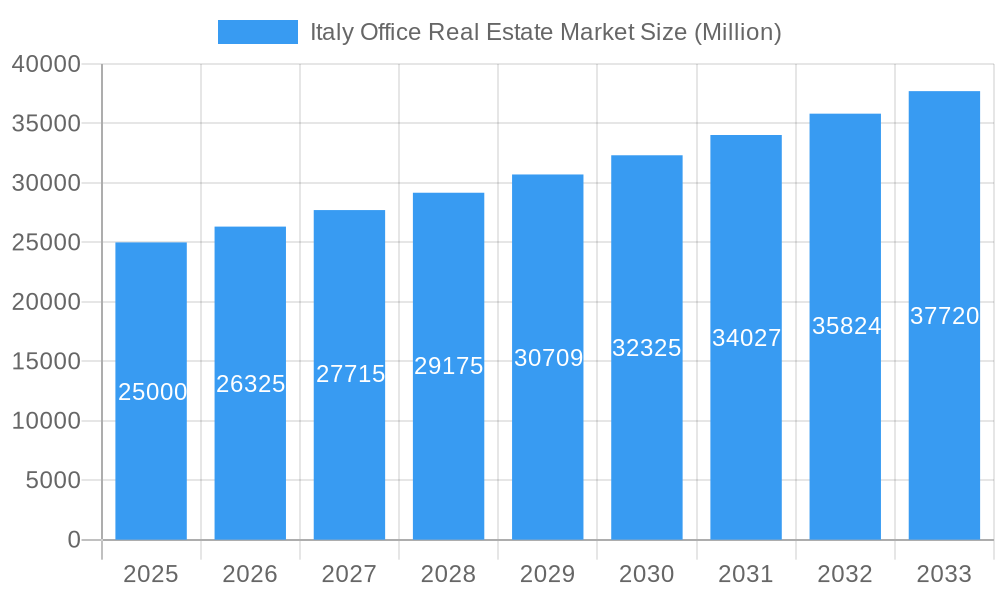

The Italian office real estate market is projected for significant expansion, with an estimated market size of $17.1 billion in 2025. The market is anticipated to grow at a compound annual growth rate (CAGR) of 5.29% through 2033. This growth is driven by post-pandemic economic recovery, increasing demand for modern, flexible, and sustainable office spaces. Key factors include evolving hybrid work models, urban regeneration initiatives in major cities like Rome and Milan, and a growing emphasis on ESG-compliant buildings that prioritize sustainability and employee well-being.

Italy Office Real Estate Market Market Size (In Billion)

Challenges include economic uncertainty and geopolitical shifts. The widespread adoption of remote and hybrid work requires landlords to adapt by offering agile, collaborative workspaces. However, the Italian economy's resilience, strategic European location, and supportive government initiatives are expected to mitigate these risks. The market is segmented by major cities, with Milan and Rome predicted to lead in transaction volumes and rental growth, driven by their economic and political importance.

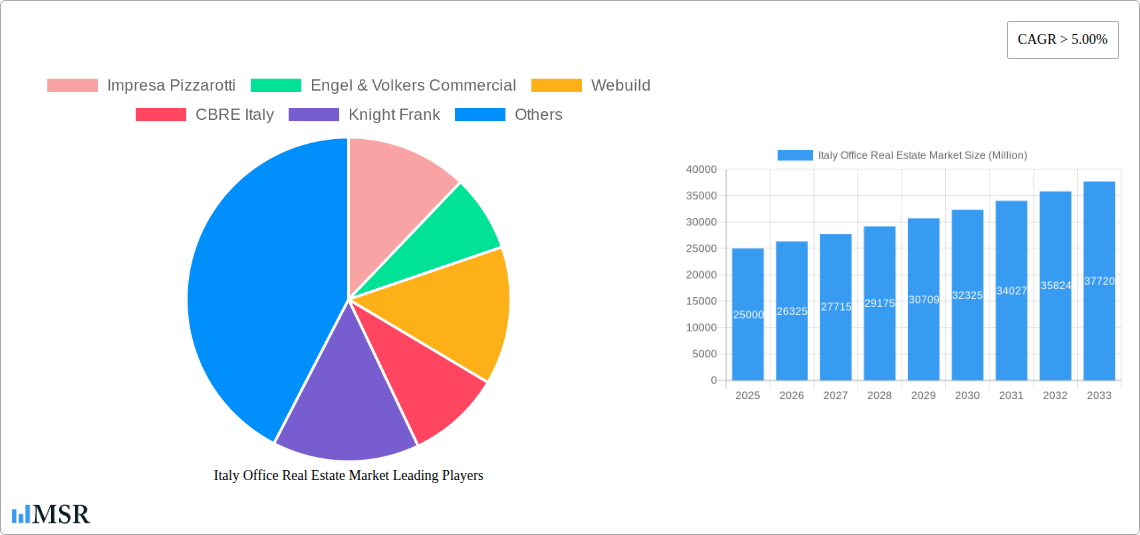

Italy Office Real Estate Market Company Market Share

Unlocking Italy's Office Real Estate Potential: A Comprehensive Market Analysis (2019-2033)

Gain unparalleled insights into the dynamic Italian office real estate market. This in-depth report, covering the period 2019-2033 with a base year of 2025, provides a strategic roadmap for investors, developers, and corporate occupiers navigating the evolving landscape. Discover key trends, leading players, and future growth catalysts in Rome, Milan, Naples, Turin, and beyond. Essential reading for anyone seeking to capitalize on the Italian commercial property sector.

Italy Office Real Estate Market Market Concentration & Dynamics

The Italian office real estate market exhibits a moderate level of concentration, with a few dominant players controlling significant portions of prime office space, particularly in key gateway cities. Innovation ecosystems are gradually strengthening, driven by a growing demand for flexible workspaces, sustainable buildings, and smart technology integration. Regulatory frameworks, while historically complex, are seeing incremental improvements aimed at fostering foreign investment and streamlining development processes. Substitute products, such as co-working spaces and remote work policies, continue to influence demand for traditional office footprints, pushing landlords to adapt their offerings. End-user trends are strongly leaning towards employee well-being, hybrid work models, and ESG (Environmental, Social, and Governance) compliance, impacting design, amenities, and location choices. Mergers and acquisitions (M&A) activities, though not at peak levels, have seen notable transactions, signaling consolidation and strategic realignment within the sector. For example, the EUR 119 Million (USD 126 Million) acquisition of a Milan office building by Macquarie Asset Management in November 2022 exemplifies this trend.

Italy Office Real Estate Market Industry Insights & Trends

The Italian office real estate market is poised for steady growth, driven by a confluence of economic recovery, evolving business needs, and a renewed focus on urban regeneration. The market size, estimated at XX Billion Euros for the base year 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. Key growth drivers include the sustained demand for Grade A office spaces in prime locations, particularly within Milan and Rome, fueled by multinational corporations seeking to establish or expand their Italian presence. Technological disruptions are fundamentally reshaping the sector. The increasing adoption of proptech solutions, from smart building management systems to virtual tours and AI-driven space optimization tools, is enhancing efficiency and tenant experience. Furthermore, the widespread embrace of hybrid work models is not necessarily diminishing the need for office space but rather transforming its purpose, with a greater emphasis on collaborative hubs, flexible layouts, and amenity-rich environments that foster employee engagement and attract talent. Evolving consumer behaviors, particularly among a younger, more environmentally conscious workforce, are creating a strong demand for sustainable buildings that offer enhanced well-being features, natural light, and access to green spaces. This shift is pushing developers and investors to prioritize ESG credentials, leading to a premium for green-certified properties and driving retrofitting initiatives for existing stock. The post-pandemic landscape has also seen a surge in demand for flexible lease terms and adaptable spaces, encouraging landlords to offer more varied solutions beyond traditional long-term leases. The ongoing digitalization of real estate transactions and property management further streamlines processes and improves market accessibility.

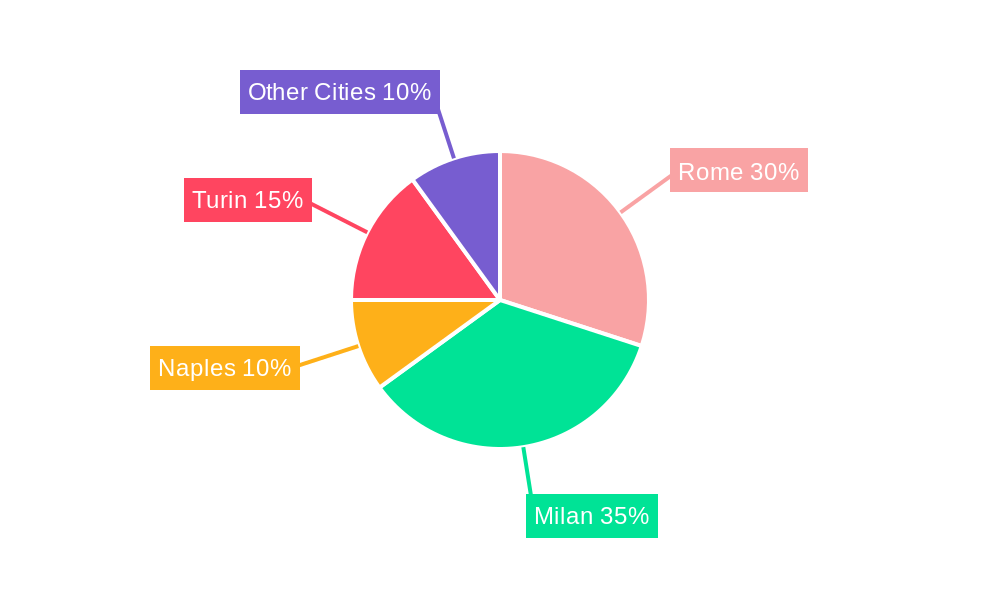

Key Markets & Segments Leading Italy Office Real Estate Market

The Milan office real estate market stands as the undisputed leader, consistently outperforming other Italian cities in terms of investment volume, rental growth, and demand for prime office space. Its status as a global financial and fashion capital, coupled with its robust infrastructure and international connectivity, makes it an attractive hub for domestic and international businesses.

Milan:

- Economic Growth: Milan boasts a strong and diversified economy, attracting significant foreign direct investment and housing the headquarters of numerous major corporations.

- Infrastructure: Its world-class transportation network, including international airports, high-speed rail, and an extensive public transit system, ensures excellent connectivity for employees and clients.

- Talent Pool: The city offers access to a highly skilled and diverse talent pool, a crucial factor for businesses seeking to expand.

- Innovation Hub: Milan is a thriving center for innovation, particularly in sectors like technology, finance, and design, fostering a dynamic business environment.

- Development Pipeline: Ongoing development projects, particularly in areas like Porta Nuova and CityLife, are continuously adding modern, sustainable office stock to the market, catering to the demand for high-quality workspaces. The acquisition of an office building in Piazza Trento, Porta Romana, by BC Partners European Real Estate I and Kervis Group in February 2022 underscores the confidence in Milan's office and residential markets.

Rome: As the capital city and a major political and administrative center, Rome maintains a strong and steady demand for office space, particularly from government bodies, legal firms, and international organizations. While its growth might be more measured than Milan's, its stability and central role ensure continued relevance.

Turin: Experiencing a resurgence, Turin is attracting interest from technology and automotive sectors, benefiting from its industrial heritage and growing innovation ecosystem.

Naples: While historically lagging behind Milan and Rome, Naples is showing signs of development, with potential driven by its strategic location and increasing interest from specific niche industries.

Other Cities: Emerging urban centers and regional hubs are gradually gaining traction as businesses look to diversify and access different talent pools, presenting opportunities for selective investment and development.

Italy Office Real Estate Market Product Developments

The Italian office real estate market is witnessing a significant evolution in product offerings, driven by a demand for more agile, sustainable, and employee-centric spaces. Innovations are centered on creating flexible office layouts that can be easily reconfigured to accommodate hybrid work models and fluctuating team sizes. Smart building technology is becoming integral, with advancements in integrated building management systems, occupancy sensors, and smart lighting and HVAC controls to optimize energy efficiency and tenant comfort. The integration of biophilic design principles, incorporating natural elements and green spaces within offices, is also a key development, enhancing employee well-being and productivity. Furthermore, there is a growing emphasis on mixed-use developments that combine office spaces with residential, retail, and recreational amenities, creating vibrant urban ecosystems.

Challenges in the Italy Office Real Estate Market Market

- Regulatory Hurdles: Complex bureaucratic processes and lengthy approval times for new developments and renovations can significantly slow down project timelines and increase costs.

- Economic Uncertainty: Fluctuations in the broader European and global economic landscape can impact investor confidence and tenant demand, leading to hesitancy in long-term commitments.

- Aging Stock: A substantial portion of existing office inventory requires significant investment in modernization and retrofitting to meet current sustainability and technological standards, posing a challenge for landlords.

- Skilled Labor Shortages: For large-scale construction and renovation projects, a scarcity of skilled labor can lead to delays and increased construction expenses.

Forces Driving Italy Office Real Estate Market Growth

- Economic Recovery & FDI: A strengthening Italian economy and increasing foreign direct investment are bolstering demand for prime office spaces from both domestic and international companies.

- Hybrid Work Model Evolution: The ongoing adaptation to hybrid work is driving demand for higher-quality, amenity-rich offices that serve as collaborative hubs and attract talent, rather than simply providing desk space.

- ESG Mandates: Growing pressure from investors, regulators, and employees for sustainable and environmentally responsible buildings is accelerating the demand for green-certified offices and driving investment in energy-efficient retrofits.

- Urban Regeneration Initiatives: Government and private sector investments in urban regeneration projects, particularly in key cities like Milan, are creating new attractive business districts and modern office opportunities.

Challenges in the Italy Office Real Estate Market Market

The long-term growth catalysts for the Italian office real estate market lie in its adaptability and strategic positioning. Continued innovation in proptech, particularly in areas like AI-driven space utilization analytics and smart building management, will enhance operational efficiency and tenant satisfaction. Partnerships between public and private sectors for urban development and infrastructure improvements will create more desirable and accessible business locations. Market expansion into secondary cities, supported by improved connectivity and specific industry cluster development, offers new avenues for growth. The increasing global focus on sustainable investing will further drive demand for certified green buildings, making them a cornerstone of future development and investment strategies.

Emerging Opportunities in Italy Office Real Estate Market

Emerging opportunities in the Italian office real estate market are centered on the growing demand for flexible workspaces, often referred to as "coliving for offices," catering to the rise of hybrid work and the gig economy. The development of "smart buildings" equipped with advanced IoT technologies for energy efficiency, security, and tenant experience presents a significant avenue. Furthermore, the increasing focus on employee well-being is driving demand for office spaces that incorporate biophilic design, wellness amenities, and access to natural light and green spaces. The potential for repurposing underutilized retail or industrial spaces into modern, collaborative office environments also offers an attractive opportunity for adaptive reuse projects.

Leading Players in the Italy Office Real Estate Market Sector

- Impresa Pizzarotti

- Engel & Volkers Commercial

- Webuild

- CBRE Italy

- Knight Frank

- Rizzani de Eccher

- Savills plc

- Astaldi

- JLL Italy

Key Milestones in Italy Office Real Estate Market Industry

- November 2022: Macquarie Asset Management purchased a major Milan office building for approximately EUR 119 Million (USD 126 Million) through an Italian real estate fund, signaling continued international investor confidence in the Milanese market, particularly its high-quality properties and strong demand.

- February 2022: BC Partners European Real Estate I (BCPERE I) and Kervis Group finalized the acquisition of an office building in Milan's Piazza Trento, Porta Romana, from Europ Assistance Italy. This transaction highlighted strong conviction in the stability of Milan's office and residential markets.

Strategic Outlook for Italy Office Real Estate Market Market

The strategic outlook for the Italian office real estate market is one of measured growth and continuous adaptation. Key growth accelerators include the ongoing digitalization of the real estate sector, which enhances transparency and transaction efficiency, and the increasing emphasis on ESG principles, making sustainable office spaces a prime investment target. Strategic opportunities lie in the development of innovative, flexible, and technology-integrated office solutions that cater to the evolving needs of businesses and their workforces. Continued investment in urban regeneration and infrastructure development will further enhance the attractiveness of key cities like Milan and Rome, ensuring sustained demand for high-quality commercial property.

Italy Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Rome

- 1.2. Milan

- 1.3. Naples

- 1.4. Turin

- 1.5. Other Cities

Italy Office Real Estate Market Segmentation By Geography

- 1. Italy

Italy Office Real Estate Market Regional Market Share

Geographic Coverage of Italy Office Real Estate Market

Italy Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Occupier and Investment Focus in Milan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Rome

- 5.1.2. Milan

- 5.1.3. Naples

- 5.1.4. Turin

- 5.1.5. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Impresa Pizzarotti

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Engel & Volkers Commercial

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Webuild

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CBRE Italy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Knight Frank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rizzani de Eccher

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Savills plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Astaldi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JLL Italy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Impresa Pizzarotti

List of Figures

- Figure 1: Italy Office Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Office Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 2: Italy Office Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Italy Office Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 4: Italy Office Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Office Real Estate Market?

The projected CAGR is approximately 5.29%.

2. Which companies are prominent players in the Italy Office Real Estate Market?

Key companies in the market include Impresa Pizzarotti, Engel & Volkers Commercial, Webuild, CBRE Italy, Knight Frank, Rizzani de Eccher, Savills plc, Astaldi, JLL Italy.

3. What are the main segments of the Italy Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Occupier and Investment Focus in Milan.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

November 2022 - A major Milan office building was purchased by Macquarie Asset Management through an Italian real estate fund for roughly EUR 119 million (USD 126 Million). It has been an active participant in the Italian real estate market for a number of years, and it has now added this historic house to its portfolio of properties in the region. One of the most desirable gateway cities in Europe is Milan, with many opportunities to find higher-quality apartments with strong demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Italy Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence