Key Insights

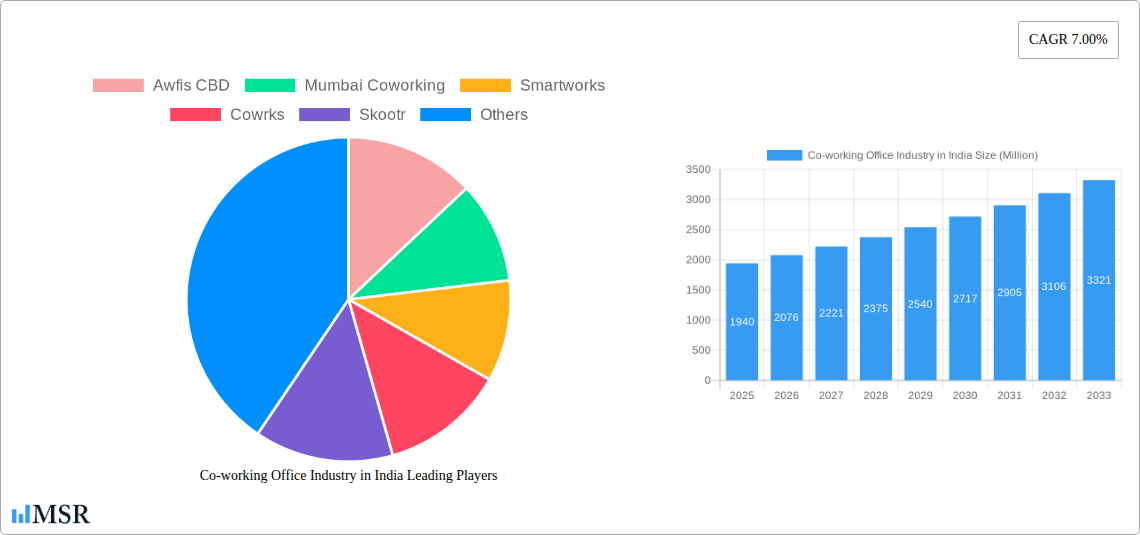

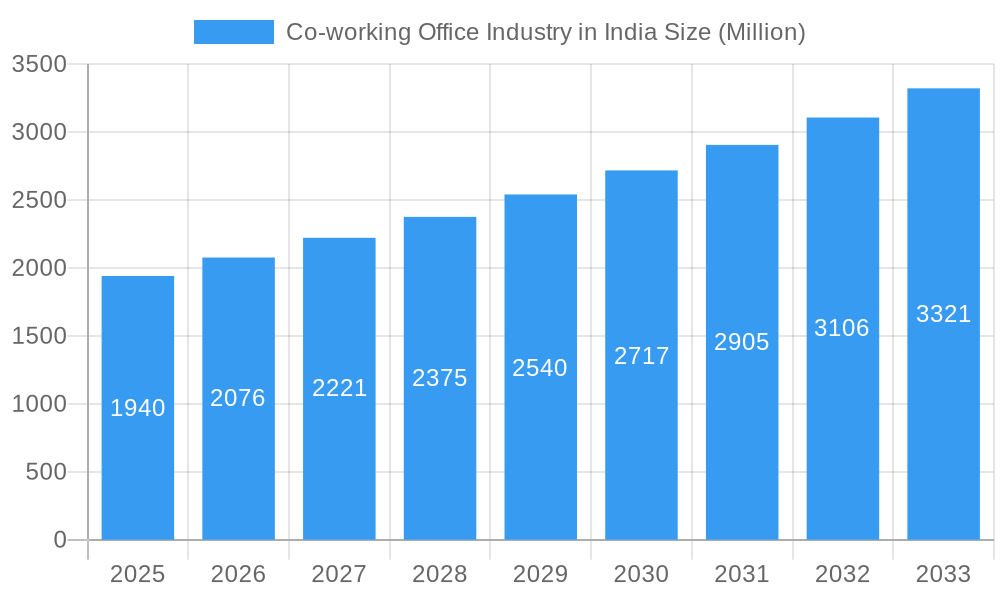

The Indian co-working office industry is poised for substantial growth, projected to reach approximately INR 1.94 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.00% expected to continue through 2033. This expansion is primarily driven by the increasing adoption of flexible work models, particularly among IT and ITES, legal services, BFSI, and consulting sectors. The demand for flexible managed offices and serviced offices is escalating as businesses, from burgeoning startups to established large-scale enterprises and even individual users, seek agile and cost-effective workspace solutions. Key metropolitan areas like Delhi, Mumbai, and Bangalore are leading this transformation, establishing themselves as vibrant hubs for co-working ecosystems. The dynamic nature of the modern workforce, coupled with a growing emphasis on collaboration and community within professional environments, further fuels this upward trajectory.

Co-working Office Industry in India Market Size (In Billion)

The market, however, navigates certain restraints. While the convenience and cost-effectiveness of co-working are significant advantages, factors such as the perceived need for greater privacy in highly sensitive industries or the challenges of long-term commitment for certain organizational structures may present hurdles. Nonetheless, the overwhelming trend towards hybrid work models and the continuous influx of startups and SMEs are creating a fertile ground for co-working spaces to thrive. Innovations in service offerings, such as enhanced amenities, integrated technology, and specialized industry-focused co-working environments, are expected to broaden their appeal. The competitive landscape features established players like Awfis, Smartworks, and We Work-BKC, alongside emerging entities, all vying to capture a significant share of this expanding market. This dynamic competition is likely to drive further innovation and service improvement within the sector.

Co-working Office Industry in India Company Market Share

India's Co-working Office Market Report: Unlocking Flexible Workspace Opportunities

This comprehensive report offers an in-depth analysis of the burgeoning Co-working Office Industry in India, a dynamic sector projected to experience substantial growth. Covering the period from 2019 to 2033, with a base year of 2025, this research provides actionable insights for investors, operators, and industry stakeholders seeking to capitalize on the evolving landscape of flexible workspaces. Explore market dynamics, key trends, leading segments, and strategic opportunities within India's rapidly expanding co-working ecosystem.

Co-working Office Industry in India Market Concentration & Dynamics

The Indian co-working office industry exhibits a moderate market concentration, with a mix of established players and emerging startups driving innovation. The ecosystem is increasingly characterized by venture capital investment and strategic partnerships, fostering rapid expansion and service diversification. Regulatory frameworks are evolving to support flexible workspace models, though navigating regional compliance remains crucial. Substitute products, such as traditional office rentals and home-based work setups, continue to exist, but the unique value proposition of co-working—community, flexibility, and cost-efficiency—is increasingly resonating with end-users. Merger and acquisition (M&A) activities are expected to rise as companies seek to scale their operations and expand their geographical footprint. The market share of key players is dynamic, with recent funding rounds indicating strong investor confidence.

- Market Concentration: Moderate, with a growing number of organized players.

- Innovation Ecosystems: Vibrant, fueled by technology integration and service enhancements.

- Regulatory Frameworks: Evolving, with increasing clarity and support for flexible workspaces.

- Substitute Products: Traditional office leases, home offices.

- End-User Trends: Strong demand for flexibility, hybrid work models, and community-driven environments.

- M&A Activities: Anticipated to increase as consolidation and expansion strategies take hold.

Co-working Office Industry in India Industry Insights & Trends

The Indian co-working office industry is poised for explosive growth, driven by a confluence of economic, technological, and societal factors. The estimated market size for 2025 is projected to reach USD 5,000 Million, with a robust Compound Annual Growth Rate (CAGR) of 25% forecast for the period 2025–2033. This expansion is primarily fueled by the increasing adoption of hybrid work models by corporations, the proliferation of startups and SMEs seeking agile workspace solutions, and the growing demand for serviced and managed office spaces. Technological advancements, including smart building technologies, integrated digital platforms for booking and management, and enhanced connectivity, are revolutionizing the user experience and operational efficiency of co-working spaces. Furthermore, evolving consumer behaviors, such as the desire for networking opportunities, professional amenities, and a work-life balance, are making co-working an attractive alternative to traditional office leases. The emphasis on community building, wellness programs, and curated events is also a significant trend, differentiating co-working spaces beyond mere desk rentals. The IT and ITES sector, BFSI, and consulting firms are leading the charge in adopting flexible office solutions, recognizing the benefits of agility and cost optimization. The market is also witnessing a rise in specialized co-working spaces catering to niche industries and specific professional needs.

Key Markets & Segments Leading Co-working Office Industry in India

The Flexible Managed Office segment is the dominant force within the Indian co-working landscape, outperforming the Serviced Office category due to its tailored solutions and comprehensive management offerings. By application, the Information Technology (IT and ITES) sector remains the largest consumer, followed closely by Consulting and BFSI (Banking, Financial Services, and Insurance). This dominance is attributed to the inherent need for agility, scalability, and cost-effective infrastructure within these knowledge-intensive industries. Small Scale Companies and Personal Users constitute a significant portion of the end-user base, attracted by the affordability and flexibility co-working provides. However, Large Scale Companies are increasingly adopting co-working for their distributed workforce and project-specific needs. Geographically, Bangalore leads the market, driven by its status as India's IT hub, followed by Delhi and Mumbai, all experiencing substantial demand. The "Other Cities" category is rapidly growing, indicating a pan-India adoption of flexible workspace solutions.

- Dominant Segments:

- Type: Flexible Managed Office

- By Application: Information Technology (IT and ITES)

- End User: Small Scale Company, Personal User

- Key Drivers for Dominance:

- Economic Growth: Robust economic expansion fuels business creation and expansion.

- Startup Ecosystem: Thriving startup culture necessitates flexible and affordable office spaces.

- Technological Advancements: Enabling seamless remote and hybrid work models.

- Urbanization & Talent Concentration: Concentration of skilled talent in major cities drives demand.

- Corporate Flexibility Needs: Increasing demand for agile workspace solutions from large enterprises.

- Geographical Leaders:

- Key Cities: Bangalore, Delhi, Mumbai.

- Emerging Markets: Hyderabad, Chennai, Pune, and Tier-II cities are witnessing significant traction.

Co-working Office Industry in India Product Developments

Product developments in the Indian co-working industry are rapidly evolving to meet the sophisticated demands of a diverse clientele. Innovations are centered around creating seamless user experiences through integrated digital platforms for booking, access control, and amenity management. Smart building technologies are being deployed to optimize energy consumption and enhance occupant comfort. Many co-working spaces are now offering a wider array of value-added services, including specialized meeting rooms, advanced AV equipment, high-speed internet, and dedicated IT support. The focus on community building is leading to the development of networking events, workshops, and collaboration zones. Furthermore, there is a growing trend towards customizable office solutions that blend managed services with dedicated private spaces, offering the best of both worlds. These advancements are crucial for maintaining a competitive edge and attracting a wider range of businesses and individuals.

Challenges in the Co-working Office Industry in India Market

The co-working office industry in India, while experiencing robust growth, faces several challenges. High real estate costs in prime urban locations can impact profitability and scalability. Intense competition from both established players and new entrants necessitates continuous innovation and service differentiation. Regulatory hurdles and varying compliance requirements across different states can add complexity to expansion efforts. Ensuring consistent service quality and maintaining member satisfaction across multiple locations is an ongoing operational challenge. Supply chain issues related to furniture, IT infrastructure, and maintenance can also affect the smooth operation of co-working spaces.

Forces Driving Co-working Office Industry in India Growth

The growth of the co-working office industry in India is propelled by several powerful forces. The increasing adoption of hybrid and remote work models by corporations is a primary driver, as businesses seek flexibility and cost savings. The thriving startup and SME ecosystem relies on co-working for its scalable and affordable workspace solutions. Technological advancements, such as cloud computing and enhanced connectivity, facilitate remote work and the efficient management of co-working spaces. Government initiatives supporting entrepreneurship and ease of doing business also indirectly contribute to the demand for flexible workspaces. The desire for community and networking opportunities among professionals and entrepreneurs further fuels the co-working trend.

Challenges in the Co-working Office Industry in India Market

- High Operational Costs: Maintaining premium amenities and service levels can lead to significant operational expenditure.

- Scalability and Expansion: Rapid scaling in a cost-effective manner while maintaining quality across diverse locations poses challenges.

- Talent Acquisition and Retention: Attracting and retaining skilled staff to manage operations and member relations is crucial.

- Market Saturation in Prime Locations: Certain popular micro-markets are experiencing high density, leading to increased competition.

- Economic Downturns: While resilient, the industry can be impacted by broader economic slowdowns affecting business growth and office space demand.

Emerging Opportunities in Co-working Office Industry in India

Emerging opportunities in the Indian co-working sector are abundant. The expansion into Tier-II and Tier-III cities presents a vast untapped market. The development of niche co-working spaces catering to specific industries (e.g., healthcare, creative arts) or user groups (e.g., women entrepreneurs) offers differentiation. Increased focus on ESG initiatives and sustainable workspaces will attract environmentally conscious businesses. Partnerships with corporate real estate firms and developers can unlock larger, long-term managed office mandates. The integration of AI-powered analytics for space optimization and member engagement is another significant opportunity. Furthermore, the growing demand for on-demand meeting rooms and virtual office services expands the revenue streams.

Leading Players in the Co-working Office Industry in India Sector

- Awfis

- Smartworks

- Cowrks

- Skootr

- We Work

- 91 springboard

- Goodworks

- Spring House Coworking

- Innov8

- Hive

- Indi Qube

- Mumbai Coworking

Key Milestones in Co-working Office Industry in India Industry

- April 2023: Stylework, a co-working marketplace, raised USD 2 million at a USD 20 million valued deal. Stylework's impressive growth and innovative approach caught the industry's attention, leading to a successful Series A1 funding of USD 2 million at a USD 20 million valued deal from institutional investors, including Capriglobal Holdings, QI Ventures, and some undisclosed family offices.

- February 2023: WeWork India, a co-working significant, started a new center in Pune with 1,500 desks and a 96,000-square-foot area amid rising demand for flexible office space from corporations. The new facility is located at Raheja Woods IT Tower, developed by K Raheja Corp. This is an asset-light deal, and the company has leased the entire building comprising five floors in this Kalyani Nagar property, with a desk space of 1,500. This is the company's third facility in Pune. WeWork India has a portfolio of over 6.5 million sq. ft across 44 locations in Delhi-NCR, Mumbai, Bengaluru, Pune, and Hyderabad.

Strategic Outlook for Co-working Office Industry in India Market

The strategic outlook for India's co-working office industry is exceptionally promising, driven by sustained demand for flexible and hybrid work solutions. Future growth will be accelerated by strategic expansions into emerging urban centers and a deeper penetration into corporate managed office solutions. Companies that focus on delivering exceptional member experiences through technological integration, community building, and personalized services will gain a significant competitive advantage. Strategic partnerships with real estate developers and technology providers will be crucial for scaling operations and enhancing service offerings. The industry is also expected to witness a rise in specialized co-working offerings, catering to niche market segments and specific industry needs, thereby driving innovation and market segmentation. Continuous adaptation to evolving work trends and a commitment to operational excellence will be key to long-term success.

Co-working Office Industry in India Segmentation

-

1. Type

- 1.1. Flexible Managed Office

- 1.2. Serviced Office

-

2. ByApplication

- 2.1. Information Technology (IT and ITES)

- 2.2. Legal Services

- 2.3. BFSI (Banking, Financial Services, and Insurance)

- 2.4. Consulting

- 2.5. Other Services

-

3. End User

- 3.1. Personal User

- 3.2. Small Scale Company

- 3.3. Large Scale Company

- 3.4. Other End Users

-

4. Key Cities

- 4.1. Delhi

- 4.2. Mumbai

- 4.3. Bangalore

- 4.4. Other Cities

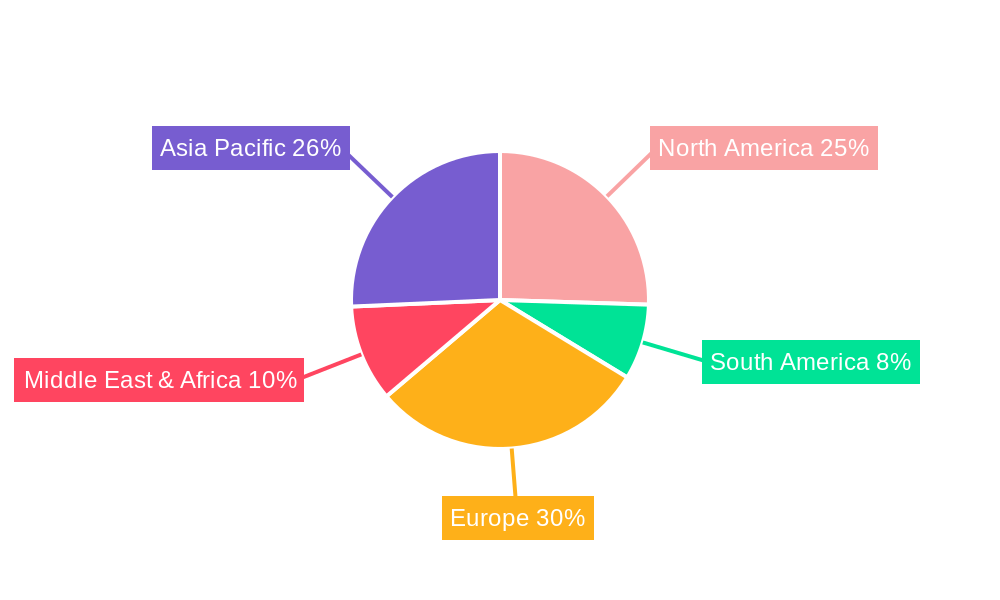

Co-working Office Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Co-working Office Industry in India Regional Market Share

Geographic Coverage of Co-working Office Industry in India

Co-working Office Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Number of Startups4.; The Development of Sustainable Co-working Spaces

- 3.3. Market Restrains

- 3.3.1 4.; A Rise in Remote Work4.; Traditional Work Culture in India

- 3.3.2 Which May Not Align Well With the Open and Collaborative Environment of Co-working Spaces

- 3.4. Market Trends

- 3.4.1. Cost Optimization is Driving the Significant Growth in the Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flexible Managed Office

- 5.1.2. Serviced Office

- 5.2. Market Analysis, Insights and Forecast - by ByApplication

- 5.2.1. Information Technology (IT and ITES)

- 5.2.2. Legal Services

- 5.2.3. BFSI (Banking, Financial Services, and Insurance)

- 5.2.4. Consulting

- 5.2.5. Other Services

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Personal User

- 5.3.2. Small Scale Company

- 5.3.3. Large Scale Company

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Key Cities

- 5.4.1. Delhi

- 5.4.2. Mumbai

- 5.4.3. Bangalore

- 5.4.4. Other Cities

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flexible Managed Office

- 6.1.2. Serviced Office

- 6.2. Market Analysis, Insights and Forecast - by ByApplication

- 6.2.1. Information Technology (IT and ITES)

- 6.2.2. Legal Services

- 6.2.3. BFSI (Banking, Financial Services, and Insurance)

- 6.2.4. Consulting

- 6.2.5. Other Services

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Personal User

- 6.3.2. Small Scale Company

- 6.3.3. Large Scale Company

- 6.3.4. Other End Users

- 6.4. Market Analysis, Insights and Forecast - by Key Cities

- 6.4.1. Delhi

- 6.4.2. Mumbai

- 6.4.3. Bangalore

- 6.4.4. Other Cities

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flexible Managed Office

- 7.1.2. Serviced Office

- 7.2. Market Analysis, Insights and Forecast - by ByApplication

- 7.2.1. Information Technology (IT and ITES)

- 7.2.2. Legal Services

- 7.2.3. BFSI (Banking, Financial Services, and Insurance)

- 7.2.4. Consulting

- 7.2.5. Other Services

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Personal User

- 7.3.2. Small Scale Company

- 7.3.3. Large Scale Company

- 7.3.4. Other End Users

- 7.4. Market Analysis, Insights and Forecast - by Key Cities

- 7.4.1. Delhi

- 7.4.2. Mumbai

- 7.4.3. Bangalore

- 7.4.4. Other Cities

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flexible Managed Office

- 8.1.2. Serviced Office

- 8.2. Market Analysis, Insights and Forecast - by ByApplication

- 8.2.1. Information Technology (IT and ITES)

- 8.2.2. Legal Services

- 8.2.3. BFSI (Banking, Financial Services, and Insurance)

- 8.2.4. Consulting

- 8.2.5. Other Services

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Personal User

- 8.3.2. Small Scale Company

- 8.3.3. Large Scale Company

- 8.3.4. Other End Users

- 8.4. Market Analysis, Insights and Forecast - by Key Cities

- 8.4.1. Delhi

- 8.4.2. Mumbai

- 8.4.3. Bangalore

- 8.4.4. Other Cities

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Flexible Managed Office

- 9.1.2. Serviced Office

- 9.2. Market Analysis, Insights and Forecast - by ByApplication

- 9.2.1. Information Technology (IT and ITES)

- 9.2.2. Legal Services

- 9.2.3. BFSI (Banking, Financial Services, and Insurance)

- 9.2.4. Consulting

- 9.2.5. Other Services

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Personal User

- 9.3.2. Small Scale Company

- 9.3.3. Large Scale Company

- 9.3.4. Other End Users

- 9.4. Market Analysis, Insights and Forecast - by Key Cities

- 9.4.1. Delhi

- 9.4.2. Mumbai

- 9.4.3. Bangalore

- 9.4.4. Other Cities

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Co-working Office Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Flexible Managed Office

- 10.1.2. Serviced Office

- 10.2. Market Analysis, Insights and Forecast - by ByApplication

- 10.2.1. Information Technology (IT and ITES)

- 10.2.2. Legal Services

- 10.2.3. BFSI (Banking, Financial Services, and Insurance)

- 10.2.4. Consulting

- 10.2.5. Other Services

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Personal User

- 10.3.2. Small Scale Company

- 10.3.3. Large Scale Company

- 10.3.4. Other End Users

- 10.4. Market Analysis, Insights and Forecast - by Key Cities

- 10.4.1. Delhi

- 10.4.2. Mumbai

- 10.4.3. Bangalore

- 10.4.4. Other Cities

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Awfis CBD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mumbai Coworking

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smartworks

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cowrks

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Skootr

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 We Work-BKC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 91 springboard

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goodworks

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Spring House Coworking

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Innov8-Vikhroli

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hive**List Not Exhaustive 6 3 Other Companie

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Indi Qube

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Awfis CBD

List of Figures

- Figure 1: Global Co-working Office Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Co-working Office Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Co-working Office Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Co-working Office Industry in India Revenue (Million), by ByApplication 2025 & 2033

- Figure 5: North America Co-working Office Industry in India Revenue Share (%), by ByApplication 2025 & 2033

- Figure 6: North America Co-working Office Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Co-working Office Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Co-working Office Industry in India Revenue (Million), by Key Cities 2025 & 2033

- Figure 9: North America Co-working Office Industry in India Revenue Share (%), by Key Cities 2025 & 2033

- Figure 10: North America Co-working Office Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Co-working Office Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Co-working Office Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 13: South America Co-working Office Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America Co-working Office Industry in India Revenue (Million), by ByApplication 2025 & 2033

- Figure 15: South America Co-working Office Industry in India Revenue Share (%), by ByApplication 2025 & 2033

- Figure 16: South America Co-working Office Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 17: South America Co-working Office Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 18: South America Co-working Office Industry in India Revenue (Million), by Key Cities 2025 & 2033

- Figure 19: South America Co-working Office Industry in India Revenue Share (%), by Key Cities 2025 & 2033

- Figure 20: South America Co-working Office Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Co-working Office Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Co-working Office Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 23: Europe Co-working Office Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Co-working Office Industry in India Revenue (Million), by ByApplication 2025 & 2033

- Figure 25: Europe Co-working Office Industry in India Revenue Share (%), by ByApplication 2025 & 2033

- Figure 26: Europe Co-working Office Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 27: Europe Co-working Office Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 28: Europe Co-working Office Industry in India Revenue (Million), by Key Cities 2025 & 2033

- Figure 29: Europe Co-working Office Industry in India Revenue Share (%), by Key Cities 2025 & 2033

- Figure 30: Europe Co-working Office Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Co-working Office Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Co-working Office Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East & Africa Co-working Office Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East & Africa Co-working Office Industry in India Revenue (Million), by ByApplication 2025 & 2033

- Figure 35: Middle East & Africa Co-working Office Industry in India Revenue Share (%), by ByApplication 2025 & 2033

- Figure 36: Middle East & Africa Co-working Office Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 37: Middle East & Africa Co-working Office Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East & Africa Co-working Office Industry in India Revenue (Million), by Key Cities 2025 & 2033

- Figure 39: Middle East & Africa Co-working Office Industry in India Revenue Share (%), by Key Cities 2025 & 2033

- Figure 40: Middle East & Africa Co-working Office Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa Co-working Office Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Co-working Office Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 43: Asia Pacific Co-working Office Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 44: Asia Pacific Co-working Office Industry in India Revenue (Million), by ByApplication 2025 & 2033

- Figure 45: Asia Pacific Co-working Office Industry in India Revenue Share (%), by ByApplication 2025 & 2033

- Figure 46: Asia Pacific Co-working Office Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 47: Asia Pacific Co-working Office Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 48: Asia Pacific Co-working Office Industry in India Revenue (Million), by Key Cities 2025 & 2033

- Figure 49: Asia Pacific Co-working Office Industry in India Revenue Share (%), by Key Cities 2025 & 2033

- Figure 50: Asia Pacific Co-working Office Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific Co-working Office Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 3: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 5: Global Co-working Office Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 8: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 10: Global Co-working Office Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 16: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 17: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 18: Global Co-working Office Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 24: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 26: Global Co-working Office Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 37: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 38: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 40: Global Co-working Office Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global Co-working Office Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global Co-working Office Industry in India Revenue Million Forecast, by ByApplication 2020 & 2033

- Table 49: Global Co-working Office Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 50: Global Co-working Office Industry in India Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 51: Global Co-working Office Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Co-working Office Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Co-working Office Industry in India?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Co-working Office Industry in India?

Key companies in the market include Awfis CBD, Mumbai Coworking, Smartworks, Cowrks, Skootr, We Work-BKC, 91 springboard, Goodworks, Spring House Coworking, Innov8-Vikhroli, Hive**List Not Exhaustive 6 3 Other Companie, Indi Qube.

3. What are the main segments of the Co-working Office Industry in India?

The market segments include Type, ByApplication, End User, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.94 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Number of Startups4.; The Development of Sustainable Co-working Spaces.

6. What are the notable trends driving market growth?

Cost Optimization is Driving the Significant Growth in the Sector.

7. Are there any restraints impacting market growth?

4.; A Rise in Remote Work4.; Traditional Work Culture in India. Which May Not Align Well With the Open and Collaborative Environment of Co-working Spaces.

8. Can you provide examples of recent developments in the market?

April 2023: Stylework, a co-working marketplace, raised USD 2 million at a USD 20 million valued deal. Stylework's impressive growth and innovative approach caught the industry's attention, leading to a successful Series A1 funding of USD 2 million at a USD 20 million valued deal from institutional investors, including Capriglobal Holdings, QI Ventures, and some undisclosed family offices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Co-working Office Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Co-working Office Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Co-working Office Industry in India?

To stay informed about further developments, trends, and reports in the Co-working Office Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence