Key Insights

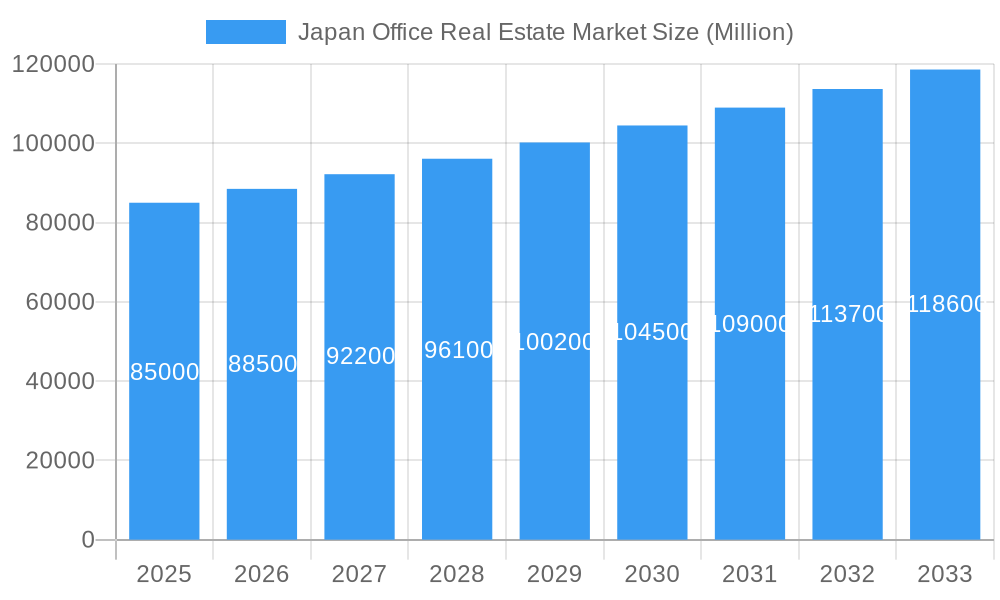

The Japan Office Real Estate Market is set for substantial expansion, projected to reach $21.5 billion by 2025. The market anticipates a Compound Annual Growth Rate (CAGR) of 4.57% between 2025 and 2033. Key growth drivers include ongoing urbanization and economic concentration in major metropolitan areas, alongside increasing demand for modern, flexible, and technologically advanced office spaces. The adoption of hybrid work models and smart city initiatives further fuels demand for adaptable and amenity-rich environments. Japan's stable economic climate and its role as a global innovation hub also support market growth.

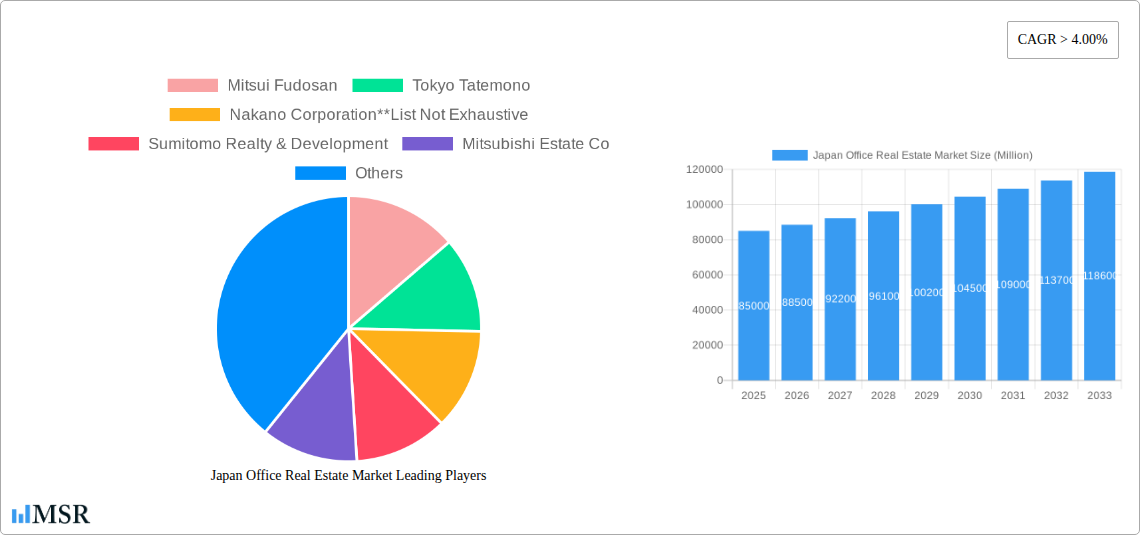

Japan Office Real Estate Market Market Size (In Billion)

Potential challenges include shifts in corporate real estate strategies due to economic volatility or geopolitical factors. However, the resilience of the Japanese economy and proactive developer strategies are expected to mitigate these risks. Leading market players like Mitsui Fudosan, Sumitomo Realty & Development, and Mitsubishi Estate Co. are actively investing in prime locations and high-quality developments. The market is segmented by key cities such as Tokyo and Kyoto, and the broader Rest of Japan, indicating concentrated demand in urban centers and emerging business districts. Evolving office designs for flexible workspaces and a growing emphasis on sustainability are critical market trends.

Japan Office Real Estate Market Company Market Share

This report offers an in-depth analysis of the Japan Office Real Estate Market, providing critical insights into market size, growth projections, and key trends for industry stakeholders.

Japan Office Real Estate Market: Comprehensive 2024-2033 Outlook

Unlock unparalleled insights into the dynamic Japan office real estate market with this definitive report. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves deep into market concentration, industry trends, key segments, product developments, challenges, growth drivers, and emerging opportunities. Gain a strategic advantage by understanding the forces shaping office space demand and supply across Tokyo, Kyoto, and the Rest of Japan. This report is essential for investors, developers, corporations, and real estate professionals seeking to navigate and capitalize on the evolving Japanese commercial property landscape.

Japan Office Real Estate Market Market Concentration & Dynamics

The Japan office real estate market exhibits a significant degree of concentration, with a few major players dominating development, investment, and leasing. Mitsui Fudosan, Mitsubishi Estate Co, and Mori Building are consistently at the forefront, driving innovation and shaping the urban office environment. The market concentration is further underscored by substantial M&A activities, with an estimated XX M&A deal count within the historical period (2019-2024), reflecting a strategic consolidation and expansion among key entities. Innovation ecosystems are thriving, particularly in Tokyo, fueled by a robust influx of technology and finance companies seeking premium office spaces. Regulatory frameworks are well-established, providing a stable operating environment, although evolving ESG (Environmental, Social, and Governance) mandates are increasingly influencing development and tenant preferences. Substitute products, such as remote work technologies and co-working spaces, continue to present a dynamic competitive landscape, forcing traditional office providers to adapt. End-user trends are shifting towards flexible layouts, smart building technologies, and amenity-rich environments designed to attract and retain talent. The market share of the top 3 players is estimated at over 60% for prime office assets in major business districts.

Japan Office Real Estate Market Industry Insights & Trends

The Japan office real estate market is poised for substantial growth, projected to reach an estimated market size of ¥XX,XXX Million by 2033, with a Compound Annual Growth Rate (CAGR) of XX.X% from the base year 2025. This expansion is underpinned by several key growth drivers. A primary catalyst is the sustained economic recovery and corporate expansion, particularly within the technology, finance, and life sciences sectors, which are actively seeking modern, well-located office spaces. Technological disruptions are transforming the office landscape; smart building technologies, AI-driven space management, and enhanced connectivity are becoming standard expectations, driving demand for Grade A and premium office assets. Evolving consumer behaviors, or rather, evolving tenant behaviors, are central to this transformation. Companies are prioritizing employee well-being and productivity, leading to increased demand for flexible workspace solutions, collaborative zones, and amenities that support a hybrid work model. The desire for sustainable and ESG-compliant buildings is also a significant trend, with tenants increasingly scrutinizing a property's environmental impact and social responsibility. Furthermore, the gradual return to office post-pandemic, coupled with the need for central hubs for collaboration and company culture, is reinforcing the demand for high-quality office environments. Foreign investment remains a steady contributor, attracted by Japan's stable economy and well-regulated market. The integration of mixed-use developments, combining office, retail, residential, and hospitality components, is also a growing trend, creating vibrant urban ecosystems and enhancing the appeal of office properties. The total office space supply is projected to grow by XX% across key cities during the forecast period (2025-2033).

Key Markets & Segments Leading Japan Office Real Estate Market

The Tokyo metropolitan area unequivocally leads the Japan office real estate market, serving as its undeniable epicenter for demand, supply, and innovation. Its dominance is driven by a confluence of powerful factors, including its status as Japan's political, economic, and cultural capital, attracting a disproportionately high concentration of multinational corporations, leading domestic companies, and burgeoning startups. The city's robust economic growth, fueled by sectors like technology, finance, and advanced manufacturing, continuously generates demand for sophisticated office spaces.

- Economic Growth: Tokyo's GDP contribution to Japan remains the highest, consistently driving corporate expansion and subsequent office space requirements.

- Infrastructure Excellence: An world-class public transportation network, including extensive subway and rail lines, ensures accessibility and connectivity, making central business districts highly attractive.

- Talent Pool: Access to a vast and highly skilled workforce is a critical draw for companies, necessitating proximity to prime office locations within the city.

- Innovation Hubs: Districts like Marunouchi, Otemachi, and Shinjuku are global innovation hubs, fostering collaboration and attracting companies at the forefront of technological advancement.

Kyoto, while smaller in scale compared to Tokyo, is emerging as a significant secondary market. Its strength lies in its unique blend of historical significance and a growing technology and research sector, particularly in areas like AI, robotics, and advanced materials. The city offers a more balanced lifestyle and has attracted companies seeking a different operational environment while still benefiting from Japan's robust economy. Infrastructure improvements and a focus on preserving its cultural heritage while fostering modern development are key drivers for Kyoto's office market.

The Rest of Japan, encompassing cities like Osaka, Fukuoka, and Nagoya, presents a more diverse market landscape. These regions benefit from strong industrial bases, specialized R&D centers, and regional economic development initiatives. Osaka, in particular, is a major commercial and financial hub, often seen as a complementary market to Tokyo. These cities are increasingly seeing investment in modern office stock to attract businesses looking for cost-effectiveness and access to regional talent.

Japan Office Real Estate Market Product Developments

Product developments in the Japan office real estate market are increasingly focused on creating intelligent, sustainable, and human-centric workspaces. Innovations include the integration of IoT sensors for optimizing energy consumption and space utilization, advanced HVAC systems for improved air quality, and flexible, modular interior designs that can adapt to evolving tenant needs. The rise of smart building technologies, offering seamless access control, integrated communication platforms, and real-time environmental monitoring, provides a significant competitive edge. Market relevance is driven by the demand for ESG-compliant buildings, with developers actively incorporating green building materials, renewable energy sources, and features that promote occupant well-being. These advancements are crucial for attracting and retaining top-tier tenants in a competitive market, offering tangible benefits in terms of operational efficiency and employee satisfaction.

Challenges in the Japan Office Real Estate Market Market

Despite robust growth prospects, the Japan office real estate market faces several challenges. Regulatory hurdles, particularly related to urban planning and building codes, can sometimes slow down development timelines. Supply chain disruptions, though easing, can still impact construction costs and material availability, affecting project budgets and schedules. Competitive pressures are intense, with a constant need to differentiate through premium amenities, cutting-edge technology, and superior tenant services. An estimated XX% of new developments face delays due to unforeseen regulatory reviews. The ongoing evolution of hybrid work models also presents a challenge, requiring developers and owners to continually reassess and adapt office space offerings to meet dynamic tenant demands for flexibility and collaboration.

Forces Driving Japan Office Real Estate Market Growth

Several key forces are propelling the growth of the Japan office real estate market. Technologically, advancements in smart building technology and digital infrastructure are enhancing the appeal and functionality of office spaces. Economically, sustained corporate profits and a generally positive economic outlook are driving demand for quality office accommodations. Regulatory factors, such as government initiatives promoting urban regeneration and sustainable development, are also creating favorable conditions for new office construction and modernization. The influx of foreign investment, attracted by Japan's stable political climate and robust economic fundamentals, further bolsters market activity. The increasing emphasis on ESG compliance by corporations globally is a significant driver, pushing demand towards green and sustainable office buildings.

Challenges in the Japan Office Real Estate Market Market

Long-term growth catalysts for the Japan office real estate market are firmly rooted in innovation and strategic market expansion. The continuous development of smart city technologies and their integration into office buildings will redefine workplace experiences. Partnerships between real estate developers, technology providers, and corporations are crucial for creating next-generation office environments that are adaptable, efficient, and conducive to employee well-being. Market expansion beyond traditional business districts into emerging urban centers, coupled with the development of transit-oriented developments (TODs), will unlock new growth avenues. The increasing focus on creating mixed-use environments that blend living, working, and leisure will also sustain demand for commercial office spaces within vibrant communities.

Emerging Opportunities in Japan Office Real Estate Market

Emerging opportunities in the Japan office real estate market are diverse and promising. The growing demand for flexible office solutions and co-working spaces presents significant growth potential, catering to startups, SMEs, and large corporations seeking agility. The increasing adoption of ESG principles is creating a niche for green-certified and energy-efficient office buildings, commanding premium rents. Furthermore, opportunities exist in the redevelopment of aging office stock into modern, sustainable, and tech-enabled spaces, particularly in established business districts. The rise of regional hubs outside of Tokyo, driven by decentralization efforts and improved connectivity, offers potential for growth in secondary markets. Finally, the integration of proptech solutions to enhance property management, tenant experience, and data analytics represents a key area for innovation and value creation.

Leading Players in the Japan Office Real Estate Market Sector

- Mitsui Fudosan

- Tokyo Tatemono

- Nakano Corporation

- Sumitomo Realty & Development

- Mitsubishi Estate Co

- Mori Trust

- Hulic

- Mori Building

- Nomura Real Estate Holdings

- Tokyu Land Corporation

Key Milestones in Japan Office Real Estate Market Industry

- 2019: Increased focus on smart building technologies and ESG initiatives begins to gain traction.

- 2020/2021: Impact of the COVID-19 pandemic leads to a re-evaluation of office space needs and a rise in hybrid work discussions.

- 2022: Several major corporations announce return-to-office policies, signaling a steady demand for physical workspaces.

- 2023: Significant investment in urban redevelopment projects across Tokyo and other major cities, incorporating modern office components.

- 2024 (Estimated): Growing M&A activity and strategic partnerships aimed at consolidating market position and enhancing portfolio offerings.

Strategic Outlook for Japan Office Real Estate Market Market

The strategic outlook for the Japan office real estate market is one of continued evolution and opportunity. Growth accelerators will include the pervasive adoption of smart building technologies that enhance operational efficiency and tenant experience. The increasing demand for flexible workspace solutions, catering to the evolving needs of a hybrid workforce, will drive innovation in office design and leasing models. Furthermore, a strong emphasis on ESG compliance will continue to shape development trends, with sustainable and green-certified properties becoming increasingly valuable. Strategic partnerships between developers, technology providers, and corporate tenants will be crucial for unlocking future market potential, fostering collaborative environments, and ensuring long-term competitiveness. The market is expected to see sustained demand for prime office locations, coupled with a growing interest in well-connected, mixed-use developments.

Japan Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Tokyo

- 1.2. Kyoto

- 1.3. Rest of Japan

Japan Office Real Estate Market Segmentation By Geography

- 1. Japan

Japan Office Real Estate Market Regional Market Share

Geographic Coverage of Japan Office Real Estate Market

Japan Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Infrastructure4.; Shortage of Skilled Labours

- 3.4. Market Trends

- 3.4.1. Rise in Start-ups Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Tokyo

- 5.1.2. Kyoto

- 5.1.3. Rest of Japan

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsui Fudosan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tokyo Tatemono

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nakano Corporation**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sumitomo Realty & Development

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Estate Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mori Trust

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hulic

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mori Building

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nomura Real Estate Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tokyu Land Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mitsui Fudosan

List of Figures

- Figure 1: Japan Office Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Office Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 2: Japan Office Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Japan Office Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 4: Japan Office Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Office Real Estate Market?

The projected CAGR is approximately 4.57%.

2. Which companies are prominent players in the Japan Office Real Estate Market?

Key companies in the market include Mitsui Fudosan, Tokyo Tatemono, Nakano Corporation**List Not Exhaustive, Sumitomo Realty & Development, Mitsubishi Estate Co, Mori Trust, Hulic, Mori Building, Nomura Real Estate Holdings, Tokyu Land Corporation.

3. What are the main segments of the Japan Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities.

6. What are the notable trends driving market growth?

Rise in Start-ups Driving the Market.

7. Are there any restraints impacting market growth?

4.; Limited Infrastructure4.; Shortage of Skilled Labours.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Japan Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence