Key Insights

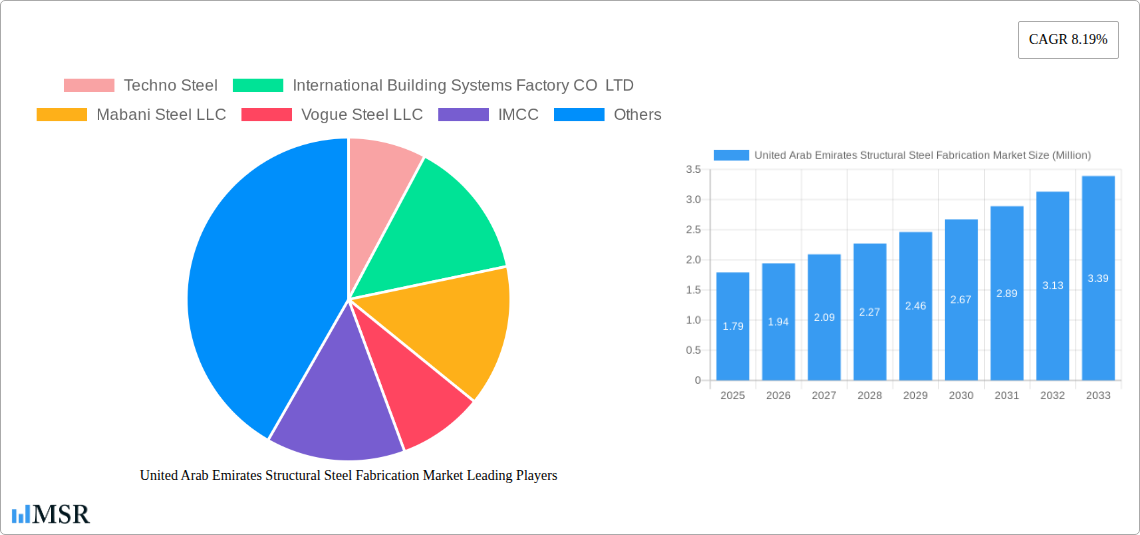

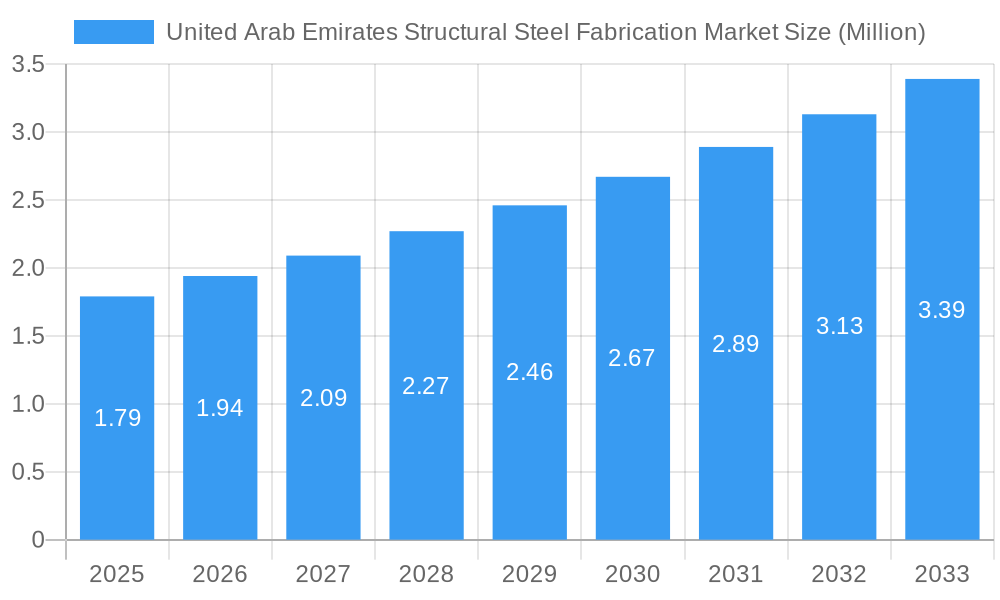

The United Arab Emirates (UAE) structural steel fabrication market is poised for robust expansion, projected to reach an estimated value of USD 1.79 million by 2025. This growth is underpinned by a significant Compound Annual Growth Rate (CAGR) of 8.19% anticipated over the forecast period of 2025-2033. The primary drivers fueling this upward trajectory are the nation's ambitious infrastructure development projects, including ambitious plans for new cities, transportation networks, and expansion of existing facilities. The burgeoning construction sector, driven by government initiatives and a strong demand for commercial and residential spaces, is a major catalyst. Furthermore, the sustained growth in the Power & Energy sector, encompassing both traditional and renewable energy projects, along with ongoing activity in the Oil & Gas industry, which heavily relies on steel structures for its operations, are significant contributors. The manufacturing sector's expansion, supported by diversification strategies and increased industrial output, also presents substantial opportunities.

United Arab Emirates Structural Steel Fabrication Market Market Size (In Million)

The market is characterized by a dynamic segmentation. In terms of product type, Heavy Sectional Steel is expected to dominate due to its application in large-scale infrastructure and industrial projects, while Light Sectional Steel will cater to smaller construction needs. The end-user industry breakdown reveals a strong reliance on Manufacturing and Construction, closely followed by Power & Energy and Oil & Gas, all demanding specialized steel fabrication solutions. Key players like Techno Steel, Mabani Steel LLC, and IMCC are actively shaping the competitive landscape, innovating and expanding their capacities to meet the escalating demand. Emerging trends include a greater emphasis on sustainable fabrication practices, the adoption of advanced manufacturing technologies like automation and BIM (Building Information Modeling), and a growing preference for prefabricated steel structures to enhance efficiency and reduce project timelines. While the market shows immense promise, potential challenges such as fluctuating raw material prices and a skilled labor shortage could present strategic considerations for stakeholders.

United Arab Emirates Structural Steel Fabrication Market Company Market Share

This comprehensive report offers an in-depth analysis of the United Arab Emirates structural steel fabrication market, providing critical insights into market dynamics, growth drivers, challenges, and emerging opportunities. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an indispensable resource for industry stakeholders seeking to understand the evolving landscape of UAE steel construction, structural steel demand in Dubai and Abu Dhabi, and the broader Middle East structural steel industry.

United Arab Emirates Structural Steel Fabrication Market Market Concentration & Dynamics

The United Arab Emirates structural steel fabrication market exhibits a moderate to high concentration, with a few key players dominating significant market share. Innovation ecosystems are actively developing, driven by demand for advanced fabrication techniques and sustainable building materials in the UAE construction sector. The regulatory framework, while supportive of industrial growth, influences project timelines and material sourcing. Substitute products, such as pre-fabricated concrete and modular construction, pose a competitive threat, necessitating continuous innovation in structural steel solutions. End-user trends highlight a strong preference for durable, cost-effective, and rapidly deployable construction materials, particularly in the oil & gas infrastructure, power & energy projects, and manufacturing facilities within the UAE. Merger and acquisition (M&A) activities, though not extensively documented, are anticipated to increase as companies seek to consolidate market presence, expand capabilities, and capitalize on burgeoning project pipelines. Key market players are strategically positioning themselves to leverage government initiatives promoting local manufacturing and infrastructure development.

United Arab Emirates Structural Steel Fabrication Market Industry Insights & Trends

The United Arab Emirates structural steel fabrication market is poised for robust growth, driven by ambitious infrastructure development plans and diversification strategies across various key sectors. The market is projected to reach a valuation of approximately USD 2,500 Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of around 6.8% during the forecast period (2025-2033). This growth is fueled by significant investments in megaprojects, including new urban developments, transportation networks, and renewable energy installations. Technological disruptions are reshaping fabrication processes, with an increasing adoption of Building Information Modeling (BIM), automated welding, and advanced cutting technologies to enhance precision, efficiency, and cost-effectiveness in steel structure manufacturing. Evolving consumer behaviors, particularly in the construction industry, emphasize sustainability, safety, and faster project completion, directly influencing the demand for high-quality, pre-fabricated structural steel components. The UAE's vision for industrial growth and its commitment to becoming a global hub for business and tourism are creating sustained demand for advanced structural steel fabrication services. Furthermore, the oil & gas sector's ongoing expansion and modernization, coupled with significant investments in the power & energy industry for both traditional and renewable energy sources, represent substantial growth avenues for the market. The manufacturing sector's expansion, driven by government initiatives to boost local production and reduce import reliance, also contributes significantly to the demand for structural steel for industrial buildings and facilities.

Key Markets & Segments Leading United Arab Emirates Structural Steel Fabrication Market

The United Arab Emirates structural steel fabrication market is segmented across various end-user industries and product types, with specific sectors and product categories demonstrating dominant growth.

Dominant End-User Industry:

- Construction: This segment leads the market, driven by substantial investments in residential, commercial, and infrastructure projects across the UAE. The development of smart cities, iconic architectural landmarks, and extensive transportation networks necessitates large-scale use of structural steel. Government initiatives promoting affordable housing and tourism infrastructure further bolster this segment.

- Oil & Gas: The UAE's prominent position in the global energy market ensures continuous demand for structural steel in offshore platforms, refineries, processing plants, and associated infrastructure. Projects related to oil exploration, production, and refining, along with investments in liquefied natural gas (LNG) terminals, are key growth drivers.

- Power & Energy: With a strong focus on expanding both conventional and renewable energy capacities, this sector is a significant consumer of structural steel. This includes steel for power plants (thermal, nuclear), substations, transmission towers, and particularly for solar farms and wind energy projects.

- Manufacturing: The UAE's drive towards industrial diversification and self-sufficiency is leading to the establishment and expansion of manufacturing facilities, creating a consistent demand for structural steel for factory buildings, warehouses, and industrial complexes.

Dominant Product Type:

- Heavy Sectional Steel: This category commands a substantial market share due to its application in large-scale construction projects, including high-rise buildings, bridges, industrial plants, and infrastructure such as stadiums and airports. Its strength and load-bearing capacity make it indispensable for critical structural elements.

- Light Sectional Steel: While a smaller segment, light sectional steel is crucial for framing in commercial buildings, warehouses, and for components in residential construction. Its versatility and ease of installation contribute to its steady demand.

The dominance of the Construction sector is intrinsically linked to the widespread use of Heavy Sectional Steel in large-scale infrastructure and iconic architectural projects that define the UAE's skyline. The Oil & Gas industry's ongoing capital expenditures also heavily rely on heavy sectional steel for its robust structural requirements. Economic growth, infrastructure development, and government support for local manufacturing are the primary catalysts propelling these segments forward.

United Arab Emirates Structural Steel Fabrication Market Product Developments

Recent product developments in the United Arab Emirates structural steel fabrication market focus on enhancing material performance, sustainability, and fabrication efficiency. Innovations include the development of high-strength steel alloys that reduce material weight while maintaining structural integrity, leading to cost savings and improved construction timelines. Advanced coating technologies are being implemented to improve corrosion resistance and extend the lifespan of steel structures, especially in the UAE's harsh environmental conditions. Furthermore, the adoption of smart fabrication techniques, such as robotic welding and laser cutting, is enabling greater precision, faster production cycles, and reduced waste, offering a competitive edge to fabricators.

Challenges in the United Arab Emirates Structural Steel Fabrication Market Market

The United Arab Emirates structural steel fabrication market faces several challenges, including:

- Fluctuating Raw Material Prices: Volatility in global steel prices directly impacts production costs and profit margins for fabricators.

- Skilled Labor Shortages: A consistent demand for skilled welders, fabricators, and engineers can lead to recruitment challenges and increased labor costs.

- Intense Competition: The presence of both local and international players creates a highly competitive environment, often leading to price-based competition.

- Stringent Quality Standards and Certifications: Meeting international quality standards and obtaining necessary certifications can be time-consuming and costly, acting as a barrier for smaller players.

- Logistical Complexities: Managing the transportation of large and heavy steel components across various project sites can present logistical hurdles.

Forces Driving United Arab Emirates Structural Steel Fabrication Market Growth

Several key forces are driving the growth of the United Arab Emirates structural steel fabrication market. Foremost is the UAE's continuous investment in ambitious infrastructure projects, including new airports, railways, and urban developments, all of which rely heavily on structural steel. Government initiatives aimed at diversifying the economy beyond oil and gas, coupled with a strong focus on manufacturing and industrial expansion, are creating sustained demand. Furthermore, the growing emphasis on sustainable construction practices and the increasing adoption of modular and pre-fabricated solutions in the construction industry favor the use of efficiently fabricated steel structures. The ongoing expansion and modernization of the oil & gas and power & energy sectors also represent significant growth drivers.

Challenges in the United Arab Emirates Structural Steel Fabrication Market Market

Long-term growth catalysts for the United Arab Emirates structural steel fabrication market lie in continuous innovation and strategic market expansion. The adoption of advanced digital fabrication technologies, such as AI-driven design optimization and automated production lines, will be crucial for maintaining competitiveness and improving efficiency. Strategic partnerships and collaborations between fabricators, engineering firms, and end-users can foster new project development and technological integration. Furthermore, exploring and capitalizing on emerging export opportunities within the MENA region and beyond, by showcasing the UAE's expertise in high-quality structural steel fabrication, presents a significant avenue for sustained growth.

Emerging Opportunities in United Arab Emirates Structural Steel Fabrication Market

Emerging opportunities in the United Arab Emirates structural steel fabrication market are shaped by evolving industry trends and government mandates. The growing demand for sustainable and green building solutions presents an opportunity for fabricators to offer materials with reduced environmental impact and implement energy-efficient fabrication processes. The UAE's commitment to developing smart cities and advanced infrastructure, including future-oriented transportation systems and renewable energy hubs, will continue to drive demand for specialized steel structures. Furthermore, the increasing focus on local content procurement by major entities like ADNOC creates a significant opportunity for domestic fabricators to secure long-term contracts and expand their capabilities. The potential for the UAE to become a regional hub for advanced steel fabrication, exporting expertise and products, is another promising avenue.

Leading Players in the United Arab Emirates Structural Steel Fabrication Market Sector

- Techno Steel

- International Building Systems Factory CO LTD

- Mabani Steel LLC

- Vogue Steel LLC

- IMCC

- Arabian International Company Ras Al Khaimah

- Aarya Engineering

- Standard Steel Fabrication Co LLC

- A S Husseini & Partner Contracting Company Ltd

- Atteih Steel

- Age Steel

- 6 Other Companies

Key Milestones in United Arab Emirates Structural Steel Fabrication Market Industry

- September 2023: Abu Dhabi-based EPC company Target forged a strategic alliance with the Abu Dhabi National Oil Company (Adnoc) as part of a broader initiative involving 25 local manufacturers signing a Strategic Collaboration Agreement (SCA). This collaborative venture is in line with Adnoc's ambitious vision to procure USD 19 billion worth of industrial products from UAE-based manufacturers by 2027. Under this agreement, Target will serve as the designated steel fabricator tasked with producing a diverse range of steel structural products crucial for various Adnoc EPC projects. Adnoc has committed to sourcing all its steel fabrication needs exclusively from local manufacturers.

- September 2023: A consortium comprising Emirati companies, including CIM Steel Industry LCC, Rhino Steel, Metal Care Center Factory LCC, and Aziz Steel, outlined plans to establish four steel plants in the United Arab Emirates (UAE) situated in the industrial city of Umm Al Quwain.

Strategic Outlook for United Arab Emirates Structural Steel Fabrication Market Market

The strategic outlook for the United Arab Emirates structural steel fabrication market is highly positive, driven by a confluence of factors including robust government support for local industry, sustained infrastructure development, and a growing emphasis on economic diversification. The market is expected to witness continued expansion as the UAE solidifies its position as a regional hub for construction and industrial activities. Strategic opportunities lie in embracing advanced fabrication technologies, focusing on high-value specialized steel structures, and capitalizing on the increasing demand for sustainable building solutions. Collaborations with major industrial players and a commitment to quality and innovation will be key growth accelerators. The market is well-positioned to leverage its existing capabilities and adapt to future demands, ensuring sustained growth and profitability for key stakeholders in the UAE steel fabrication industry.

United Arab Emirates Structural Steel Fabrication Market Segmentation

-

1. End-User Industry

- 1.1. Manufacturing

- 1.2. Power & Energy

- 1.3. Construction

- 1.4. Oil & Gas

- 1.5. Other End-User Industries

-

2. Product Type

- 2.1. Heavy Sectional Steel

- 2.2. Light Sectional Steel

- 2.3. Other Product Types

United Arab Emirates Structural Steel Fabrication Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Structural Steel Fabrication Market Regional Market Share

Geographic Coverage of United Arab Emirates Structural Steel Fabrication Market

United Arab Emirates Structural Steel Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Infrastructure; Vision; Increasing Tourism

- 3.3. Market Restrains

- 3.3.1. Increasing Price of Steel; Lack of Skilled Worker

- 3.4. Market Trends

- 3.4.1. Infrastructure Development Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Structural Steel Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Manufacturing

- 5.1.2. Power & Energy

- 5.1.3. Construction

- 5.1.4. Oil & Gas

- 5.1.5. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Heavy Sectional Steel

- 5.2.2. Light Sectional Steel

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Techno Steel

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Building Systems Factory CO LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mabani Steel LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vogue Steel LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IMCC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arabian International Company Ras Al Khaimah

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aarya Engineering

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Standard Steel Fabrication Co LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 A S Husseini & Partner Contracting Company Ltd**List Not Exhaustive 6 3 Other Companie

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atteih Steel

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Age Steel

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Techno Steel

List of Figures

- Figure 1: United Arab Emirates Structural Steel Fabrication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Structural Steel Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 5: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Structural Steel Fabrication Market?

The projected CAGR is approximately 8.19%.

2. Which companies are prominent players in the United Arab Emirates Structural Steel Fabrication Market?

Key companies in the market include Techno Steel, International Building Systems Factory CO LTD, Mabani Steel LLC, Vogue Steel LLC, IMCC, Arabian International Company Ras Al Khaimah, Aarya Engineering, Standard Steel Fabrication Co LLC, A S Husseini & Partner Contracting Company Ltd**List Not Exhaustive 6 3 Other Companie, Atteih Steel, Age Steel.

3. What are the main segments of the United Arab Emirates Structural Steel Fabrication Market?

The market segments include End-User Industry, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Infrastructure; Vision; Increasing Tourism.

6. What are the notable trends driving market growth?

Infrastructure Development Driving The Market.

7. Are there any restraints impacting market growth?

Increasing Price of Steel; Lack of Skilled Worker.

8. Can you provide examples of recent developments in the market?

September 2023: Abu Dhabi-based EPC company Target forged a strategic alliance with the Abu Dhabi National Oil Company (Adnoc) as part of a broader initiative involving 25 local manufacturers signing a Strategic Collaboration Agreement (SCA). This collaborative venture is in line with Adnoc's ambitious vision to procure USD 19 billion worth of industrial products from UAE-based manufacturers by 2027. Under this agreement, Target will serve as the designated steel fabricator tasked with producing a diverse range of steel structural products crucial for various Adnoc EPC projects. Adnoc has committed to sourcing all its steel fabrication needs exclusively from local manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Structural Steel Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Structural Steel Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Structural Steel Fabrication Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Structural Steel Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence