Key Insights

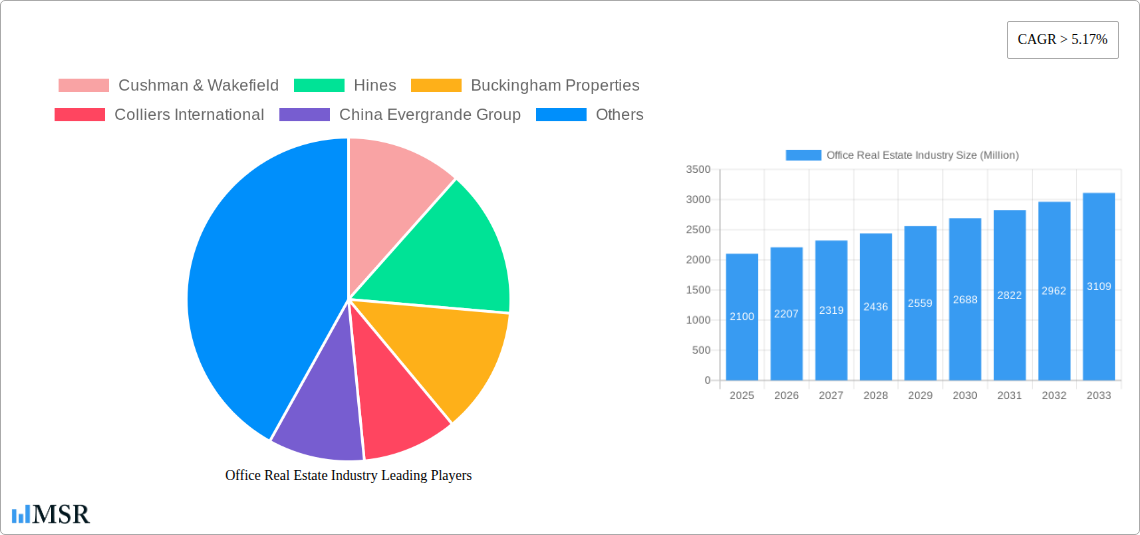

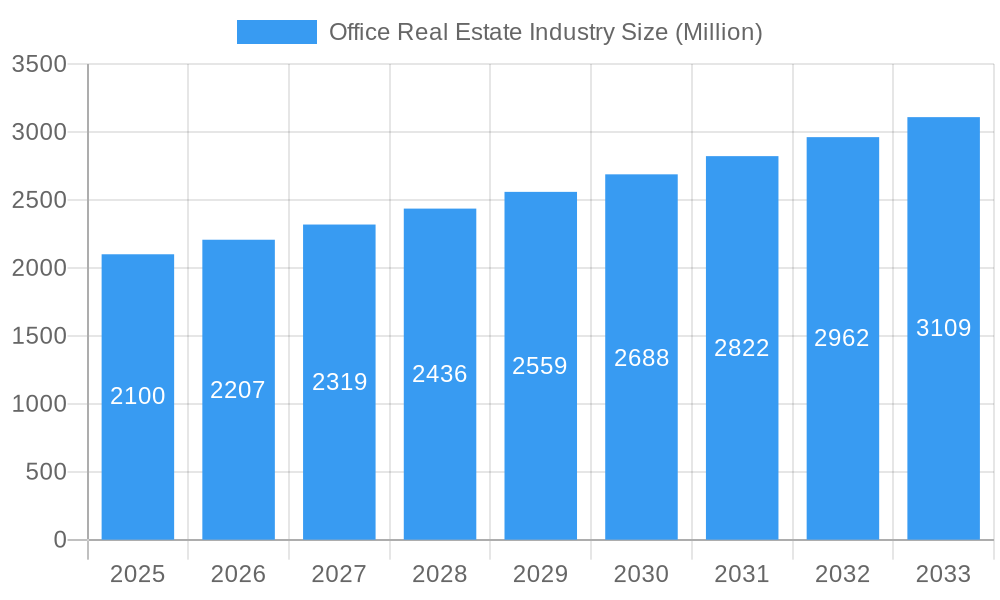

The global Office Real Estate industry is poised for robust expansion, with a current market size estimated at USD 2.10 billion. The sector is projected to witness a Compound Annual Growth Rate (CAGR) exceeding 5.17% during the forecast period of 2025-2033. This growth is underpinned by several dynamic drivers, including the sustained demand for modern, flexible workspaces, the ongoing urbanisation trends fueling the need for prime office locations, and significant investments in commercial property development, particularly in emerging economies. The increasing adoption of hybrid work models, while initially presenting a challenge, is now driving demand for more collaborative and amenity-rich office spaces, prompting a wave of renovations and new builds designed to attract and retain talent. Furthermore, a burgeoning startup ecosystem and the expansion of established corporations across various sectors continue to fuel the need for significant office footprints.

Office Real Estate Industry Market Size (In Billion)

The industry is characterized by evolving trends such as the rise of co-working spaces, the integration of smart building technologies for enhanced efficiency and employee experience, and a strong focus on sustainability and green certifications. These trends are not only shaping the design and functionality of office buildings but also influencing tenant preferences and investment strategies. However, the market also faces certain restraints, including potential oversupply in specific sub-markets due to rapid development cycles, evolving regulatory landscapes regarding zoning and building codes, and the ongoing economic uncertainties that can impact corporate leasing decisions. Despite these challenges, the strategic importance of central business districts and the continuous need for physical collaboration hubs for innovation and company culture are expected to maintain a healthy demand for office real estate across key global regions.

Office Real Estate Industry Company Market Share

This in-depth report provides a definitive analysis of the global Office Real Estate Industry, offering crucial insights for investors, developers, and occupiers. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study delves into market dynamics, key trends, and future projections. We meticulously examine Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis, equipping stakeholders with actionable intelligence for strategic decision-making.

Office Real Estate Industry Market Concentration & Dynamics

The Office Real Estate Industry is characterized by a moderate to high level of market concentration, with a few dominant players shaping investment strategies and development pipelines. Innovation ecosystems are rapidly evolving, driven by the integration of smart building technologies and sustainable design principles. Regulatory frameworks, while varying by region, are increasingly focused on ESG compliance, energy efficiency standards, and flexible workspace mandates. The threat of substitute products, such as remote work infrastructure and co-working spaces, continues to influence traditional office demand. End-user trends are shifting towards demand for amenity-rich, collaborative environments that foster employee well-being and productivity. Mergers and acquisitions (M&A) activities are a significant indicator of market consolidation and strategic repositioning, with an estimated XXX deal count and a market share distribution that sees key players like Cushman & Wakefield and JLL leading in brokerage and advisory services. Buckingham Properties and Hines are prominent in development and asset management, while Colliers International and Skanska represent significant construction and development forces. The emergence of agile workspace solutions is also a critical factor in shaping the competitive landscape.

Office Real Estate Industry Industry Insights & Trends

The Office Real Estate Industry is poised for significant transformation, driven by a confluence of technological advancements, shifting economic paradigms, and evolving societal expectations. The global market size is estimated to reach $XXX Billion by the end of the forecast period, with a projected Compound Annual Growth Rate (CAGR) of XX%. Key growth drivers include the increasing demand for high-quality, Class A office spaces in prime urban locations, fueled by corporate expansion and the return-to-office mandates being implemented by many organizations. Technological disruptions are fundamentally reshaping how offices are designed, managed, and utilized. The proliferation of AI-powered building management systems, the Internet of Things (IoT) for enhanced operational efficiency, and virtual/augmented reality for immersive property tours are becoming standard. Furthermore, the growing emphasis on sustainability and ESG (Environmental, Social, and Governance) principles is a major trend, pushing developers and owners to invest in green buildings, renewable energy sources, and water conservation measures. Evolving consumer behaviors, particularly among younger generations of employees, are prioritizing flexible work arrangements, well-being amenities, and collaborative spaces over traditional cubicle-style layouts. This has led to a rise in demand for flexible office solutions, coworking spaces, and strategically located satellite offices that reduce commute times. The impact of hybrid work models on space utilization and office design remains a critical area of focus. The increasing importance of data analytics in understanding space utilization patterns and tenant needs is also a significant trend, allowing for more efficient space planning and resource allocation. The integration of proptech solutions is further streamlining property management, tenant engagement, and investment decision-making processes. The ongoing evolution of the office as a hub for collaboration and culture, rather than just a place for individual work, will continue to shape demand for diverse and adaptable office environments.

Key Markets & Segments Leading Office Real Estate Industry

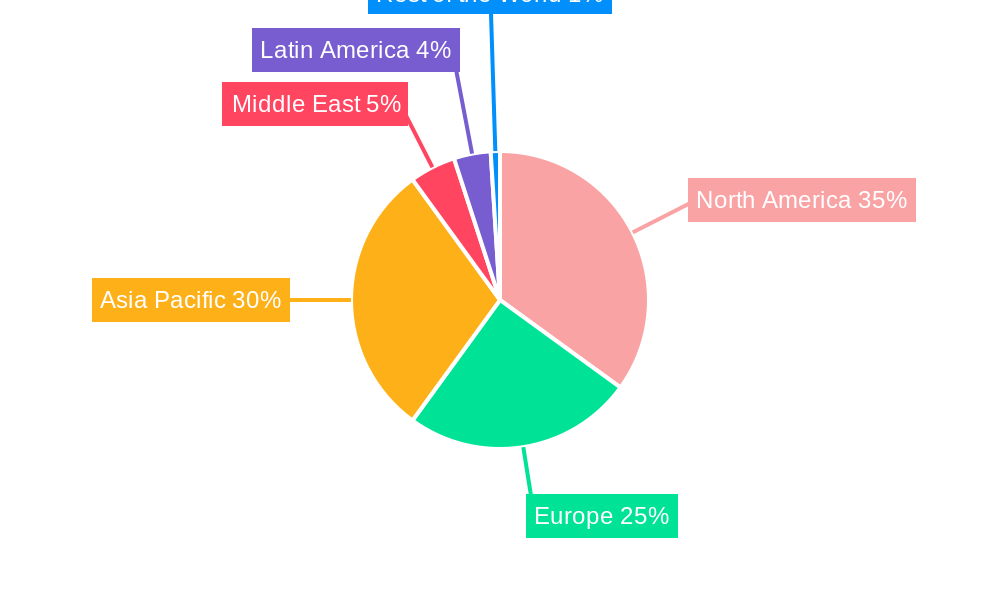

The Office Real Estate Industry exhibits strong regional variations in its dominance and growth trajectory. North America and Asia-Pacific are currently leading in terms of market size and investment activity, driven by robust economic growth, significant corporate presence, and ongoing urban development.

Production Analysis:

- Drivers: Robust economic growth in key metropolitan areas, significant foreign direct investment (FDI), and a high concentration of technology and finance sectors are primary drivers of office space production.

- Dominance: Major financial hubs like New York City, London, and Tokyo, alongside rapidly expanding tech centers in San Francisco, Austin, and various APAC cities, consistently see the highest levels of new office construction and speculative development. The focus is increasingly on prime, well-connected locations offering superior amenities.

Consumption Analysis:

- Drivers: The demand for office space is primarily driven by job creation, corporate expansion plans, and the evolving nature of work. The return-to-office trends, while varied, continue to exert influence on leasing decisions.

- Dominance: Sectors such as technology, financial services, and professional services remain the largest consumers of office space globally. However, there's a growing trend of diversified consumption, with the healthcare and life sciences sectors also expanding their footprints. The emphasis has shifted from quantity to quality, with tenants prioritizing spaces that enhance employee attraction, retention, and productivity.

Import Market Analysis (Value & Volume):

- Drivers: Global talent mobility, cross-border corporate expansion, and the need for strategic presence in key international markets drive the import of office space, particularly in gateway cities.

- Dominance: Emerging markets and developing economies often represent significant import destinations as multinational corporations establish or expand their operations. This import activity is measured not just by volume but also by the value of high-end, amenity-rich office leases secured by international firms. The estimated import market value is $XXX Billion, with an import volume of XXX Million Square Feet.

Export Market Analysis (Value & Volume):

- Drivers: Countries with strong real estate development sectors, attractive investment climates, and established global business networks act as exporters of office real estate opportunities.

- Dominance: Developed economies with stable political and economic environments are major exporters of office real estate investment opportunities to international investors. The estimated export market value is $XXX Billion, with an export volume of XXX Million Square Feet.

Price Trend Analysis:

- Drivers: Inflationary pressures, interest rate movements, construction costs, and demand-supply dynamics are the primary determinants of price trends in the office real estate market.

- Dominance: Prime office spaces in globally recognized cities continue to command premium rental rates and capital values. While some markets may experience price volatility, the long-term trend for high-quality, well-located, and sustainable office assets remains upward. The average price per square foot is estimated at $XXX.

Office Real Estate Industry Product Developments

Product developments in the Office Real Estate Industry are heavily influenced by technological integration and evolving user needs. We are witnessing significant innovation in smart building technologies, including advanced HVAC systems, intelligent lighting controls, and integrated security solutions, all aimed at enhancing efficiency and occupant comfort. The rise of flexible and modular office designs caters to the dynamic needs of businesses, allowing for easy reconfiguration of spaces. Furthermore, the development of sustainable building materials and net-zero energy designs are becoming paramount, driven by environmental regulations and tenant demand for green credentials. The market relevance of these developments is high, as they directly address key concerns around operational costs, employee well-being, and corporate social responsibility.

Challenges in the Office Real Estate Industry Market

The Office Real Estate Industry faces several critical challenges that impact its growth and stability. Regulatory hurdles, including complex zoning laws, evolving building codes for sustainability, and lengthy approval processes, can impede development timelines and increase costs. Supply chain disruptions, particularly for construction materials and specialized building components, can lead to project delays and inflated expenses. Competitive pressures from alternative workspace models, such as remote work and co-working solutions, continue to influence demand for traditional office leases. The increasing cost of capital and rising interest rates also pose a significant restraint, impacting investment feasibility and debt financing for new projects. Quantifiable impacts include potential XX% increases in project costs due to material shortages and an estimated XX% reduction in lease renewals due to the adoption of hybrid work models by some corporations.

Forces Driving Office Real Estate Industry Growth

Several powerful forces are propelling the growth of the Office Real Estate Industry. Technological advancements are a primary driver, with the adoption of AI, IoT, and proptech solutions enhancing building efficiency, tenant experience, and operational management. Economic growth in key global regions fuels corporate expansion and job creation, consequently boosting demand for office space. Favorable regulatory frameworks, particularly those supporting sustainable development and urban regeneration, create opportunities for new construction and office modernization. The ongoing redefinition of the office as a hub for collaboration, innovation, and company culture is also a significant catalyst, driving demand for amenity-rich and flexible workspaces.

Challenges in the Office Real Estate Industry Market

The Office Real Estate Industry market faces sustained growth catalysts that are shaping its long-term trajectory. These include ongoing urbanization trends that concentrate economic activity and talent in cities, thereby increasing the inherent demand for office infrastructure. Continuous innovation in building design and technology, such as the integration of advanced wellness features, smart building management systems, and sustainable energy solutions, makes new office spaces more attractive and efficient. Strategic partnerships between real estate developers, technology providers, and corporations are also fostering the creation of tailored workspaces that meet evolving business needs. Furthermore, market expansions into secondary and tertiary cities, driven by decentralization efforts and the desire for more affordable real estate, are opening up new avenues for growth.

Emerging Opportunities in Office Real Estate Industry

Emerging opportunities within the Office Real Estate Industry are primarily centered around evolving workplace strategies and technological integration. The increasing demand for flexible and hybrid office solutions presents a significant opportunity for landlords to offer adaptable lease terms and diverse space configurations. The growing emphasis on ESG (Environmental, Social, and Governance) factors is creating a robust market for green-certified buildings and sustainable office retrofits. Furthermore, the rise of the "office as a destination" concept, focusing on employee well-being, community building, and experiential amenities, opens doors for innovative office designs and service offerings. New markets, particularly in emerging economies experiencing rapid economic development, also offer untapped potential for office real estate investment and development.

Leading Players in the Office Real Estate Industry Sector

- Cushman & Wakefield

- Hines

- Buckingham Properties

- Colliers International

- China Evergrande Group

- Delhi Land & Finance

- JLL

- Skanska

Key Milestones in Office Real Estate Industry Industry

- 2019: Increased focus on smart building technology adoption and integration across major commercial properties.

- 2020: The COVID-19 pandemic significantly accelerated discussions around remote work and the future of the office, leading to initial shifts in leasing strategies.

- 2021: Growing investor interest in ESG-compliant office buildings and sustainable development practices.

- 2022: Rise in demand for flexible office solutions and co-working spaces as companies navigated hybrid work models.

- 2023: Major real estate firms began investing in proptech startups to enhance building management and tenant experience.

- 2024: Anticipated increase in new office construction projects in select global cities, focusing on high-quality, amenity-rich spaces.

Strategic Outlook for Office Real Estate Industry Market

The strategic outlook for the Office Real Estate Industry market is characterized by a strong emphasis on adaptability, innovation, and sustainability. Future market potential will be driven by the ability of stakeholders to cater to evolving tenant needs for flexible, technologically advanced, and environmentally conscious workspaces. Strategic opportunities lie in the continued development and integration of smart building technologies, the creation of amenity-rich environments that foster collaboration and well-being, and the expansion into growth markets with high demand for modern office infrastructure. The industry is projected to see continued investment in high-quality assets that offer resilience and long-term value, with a particular focus on ESG credentials to attract both tenants and investors.

Office Real Estate Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Office Real Estate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Middle East

-

5. United Arab Emirates

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East

-

6. Latin America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of Latin America

- 7. Rest of the World

Office Real Estate Industry Regional Market Share

Geographic Coverage of Office Real Estate Industry

Office Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Office Leasing Volume is Witnessing Significant Growth; Increasing Rental Prices of Office Spaces

- 3.3. Market Restrains

- 3.3.1. Remote Work and Hybrid Models; High vacancy rates can be a significant challenge in the office market

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Coworking Spaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Office Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Middle East

- 5.6.5. United Arab Emirates

- 5.6.6. Latin America

- 5.6.7. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Office Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Office Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Office Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East Office Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. United Arab Emirates Office Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Latin America Office Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 11.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 11.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 11.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 11.1. Market Analysis, Insights and Forecast - by Production Analysis

- 12. Rest of the World Office Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Production Analysis

- 12.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 12.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 12.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 12.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 12.1. Market Analysis, Insights and Forecast - by Production Analysis

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Cushman & Wakefield

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hines

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Buckingham Properties

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Colliers International

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 China Evergrande Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Delhi Land & Finance

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 JLL

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Skanska

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Cushman & Wakefield

List of Figures

- Figure 1: Global Office Real Estate Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Office Real Estate Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Office Real Estate Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Office Real Estate Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Office Real Estate Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Office Real Estate Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Office Real Estate Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Office Real Estate Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Office Real Estate Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Office Real Estate Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Office Real Estate Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Office Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Office Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Office Real Estate Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: Europe Office Real Estate Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Office Real Estate Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Office Real Estate Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Office Real Estate Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Office Real Estate Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Office Real Estate Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Office Real Estate Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Office Real Estate Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Office Real Estate Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Office Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Office Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Office Real Estate Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Office Real Estate Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Office Real Estate Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Office Real Estate Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Office Real Estate Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Office Real Estate Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Office Real Estate Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Office Real Estate Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Office Real Estate Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Office Real Estate Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Office Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Office Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East Office Real Estate Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East Office Real Estate Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East Office Real Estate Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East Office Real Estate Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East Office Real Estate Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East Office Real Estate Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East Office Real Estate Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East Office Real Estate Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East Office Real Estate Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East Office Real Estate Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East Office Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East Office Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: United Arab Emirates Office Real Estate Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: United Arab Emirates Office Real Estate Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: United Arab Emirates Office Real Estate Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: United Arab Emirates Office Real Estate Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: United Arab Emirates Office Real Estate Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: United Arab Emirates Office Real Estate Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: United Arab Emirates Office Real Estate Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: United Arab Emirates Office Real Estate Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: United Arab Emirates Office Real Estate Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: United Arab Emirates Office Real Estate Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: United Arab Emirates Office Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: United Arab Emirates Office Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Office Real Estate Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 63: Latin America Office Real Estate Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 64: Latin America Office Real Estate Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 65: Latin America Office Real Estate Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 66: Latin America Office Real Estate Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 67: Latin America Office Real Estate Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 68: Latin America Office Real Estate Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 69: Latin America Office Real Estate Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 70: Latin America Office Real Estate Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 71: Latin America Office Real Estate Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 72: Latin America Office Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 73: Latin America Office Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Rest of the World Office Real Estate Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 75: Rest of the World Office Real Estate Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 76: Rest of the World Office Real Estate Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 77: Rest of the World Office Real Estate Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 78: Rest of the World Office Real Estate Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 79: Rest of the World Office Real Estate Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 80: Rest of the World Office Real Estate Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 81: Rest of the World Office Real Estate Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 82: Rest of the World Office Real Estate Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 83: Rest of the World Office Real Estate Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 84: Rest of the World Office Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 85: Rest of the World Office Real Estate Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Office Real Estate Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Office Real Estate Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Office Real Estate Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Office Real Estate Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Office Real Estate Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Office Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Office Real Estate Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Office Real Estate Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Office Real Estate Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Office Real Estate Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Office Real Estate Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Office Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Office Real Estate Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Office Real Estate Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Office Real Estate Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Office Real Estate Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Office Real Estate Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Office Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: United Kingdom Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Office Real Estate Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 27: Global Office Real Estate Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 28: Global Office Real Estate Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Office Real Estate Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 30: Global Office Real Estate Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 31: Global Office Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: China Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: India Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Japan Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Korea Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Asia Pacific Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Office Real Estate Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 38: Global Office Real Estate Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 39: Global Office Real Estate Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 40: Global Office Real Estate Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 41: Global Office Real Estate Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 42: Global Office Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Global Office Real Estate Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 44: Global Office Real Estate Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 45: Global Office Real Estate Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 46: Global Office Real Estate Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 47: Global Office Real Estate Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 48: Global Office Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 49: Saudi Arabia Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Office Real Estate Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Office Real Estate Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Office Real Estate Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Office Real Estate Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Office Real Estate Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Office Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Brazil Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: Argentina Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Rest of Latin America Office Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Global Office Real Estate Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 62: Global Office Real Estate Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 63: Global Office Real Estate Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 64: Global Office Real Estate Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 65: Global Office Real Estate Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 66: Global Office Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Office Real Estate Industry?

The projected CAGR is approximately > 5.17%.

2. Which companies are prominent players in the Office Real Estate Industry?

Key companies in the market include Cushman & Wakefield, Hines, Buckingham Properties, Colliers International, China Evergrande Group, Delhi Land & Finance, JLL, Skanska.

3. What are the main segments of the Office Real Estate Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Office Leasing Volume is Witnessing Significant Growth; Increasing Rental Prices of Office Spaces.

6. What are the notable trends driving market growth?

Rise in Demand for Coworking Spaces.

7. Are there any restraints impacting market growth?

Remote Work and Hybrid Models; High vacancy rates can be a significant challenge in the office market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Office Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Office Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Office Real Estate Industry?

To stay informed about further developments, trends, and reports in the Office Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence