Key Insights

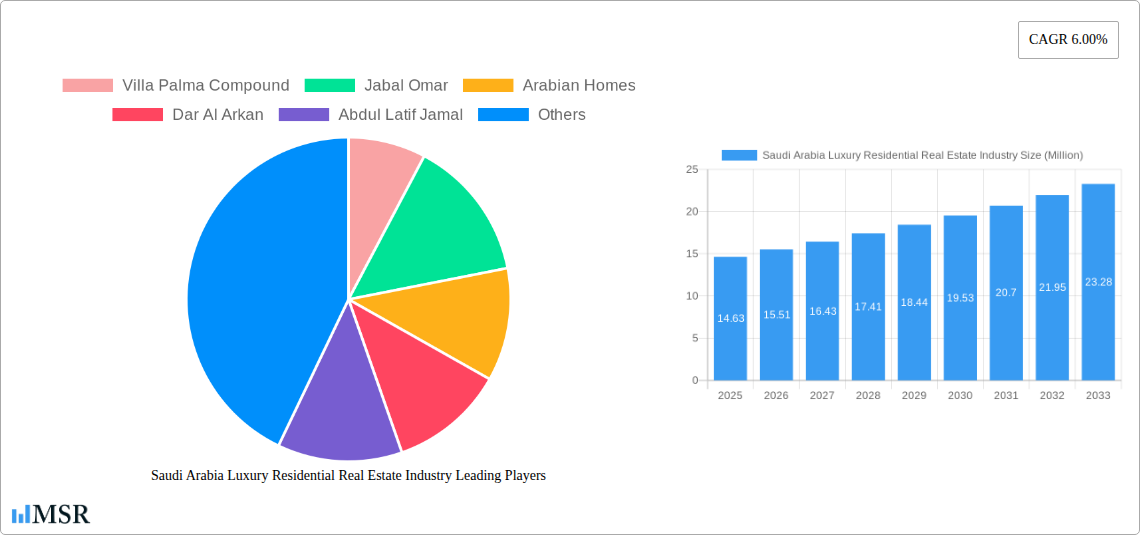

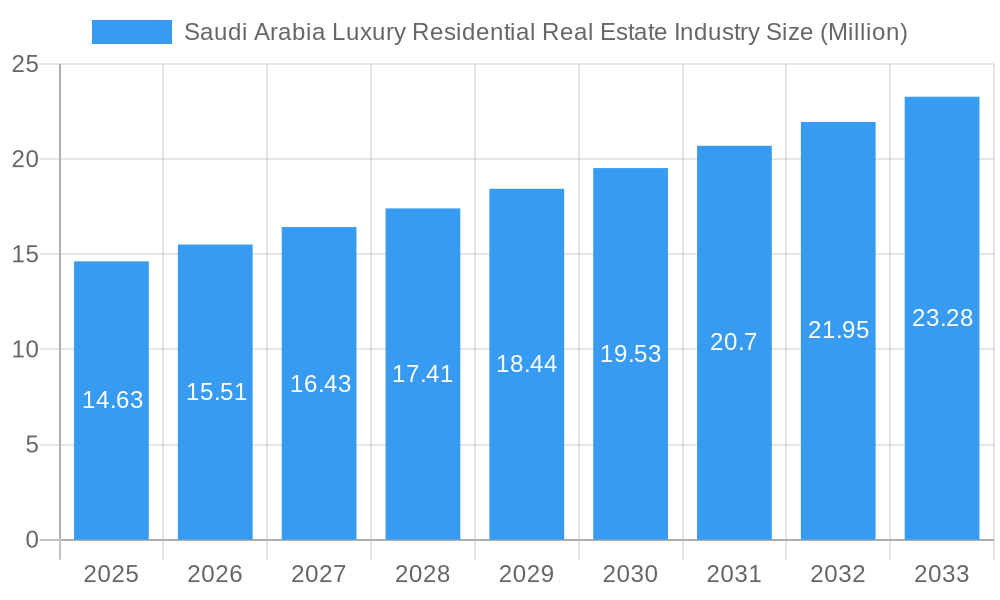

The Saudi Arabia Luxury Residential Real Estate Industry is poised for significant expansion, projected to reach a market size of $14.63 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 6.00% through 2033. This dynamic growth is fueled by several key factors, including the government's ambitious Vision 2030 initiatives aimed at diversifying the economy and attracting foreign investment, which directly stimulates demand for high-end residential properties. The increasing disposable income among affluent Saudi citizens and a growing expatriate population seeking premium living spaces also contribute substantially to market expansion. Furthermore, significant investments in infrastructure development and the creation of new lifestyle destinations, particularly in major cities like Riyadh, Jeddah, and Dammam Metropolitan Area, are enhancing the appeal and value of luxury residential real estate. The sector is also witnessing a trend towards branded residences, smart home technologies, and sustainable building practices, aligning with global luxury market expectations and attracting a discerning buyer base.

Saudi Arabia Luxury Residential Real Estate Industry Market Size (In Million)

Despite the promising outlook, the market faces certain restraints that could temper growth. The high cost of land acquisition and construction, coupled with stringent regulatory approvals, can impact project timelines and profitability. Economic fluctuations and a potential oversupply in certain sub-segments could also present challenges. However, the inherent demand for quality living spaces among the wealthy, coupled with ongoing government support for the real estate sector, is expected to largely outweigh these concerns. The market is segmented into Apartments and Condominiums, and Villas and Landed Houses, with a strong concentration of demand in the major metropolitan areas of Riyadh, Jeddah, and Dammam, though other cities are also emerging as attractive investment destinations. Key players such as Dar AI Arkan, Saudi Real Estate Company (Al Akaria), and Jabal Omar are actively shaping the luxury residential landscape, introducing innovative projects and setting new benchmarks for quality and design.

Saudi Arabia Luxury Residential Real Estate Industry Company Market Share

This comprehensive report delves into the dynamic Saudi Arabia luxury residential real estate industry, offering in-depth analysis of market concentration, key drivers, emerging trends, and future projections from 2019 to 2033. With a base year of 2025, the report provides critical insights for investors, developers, and industry stakeholders seeking to capitalize on the Kingdom's burgeoning luxury property market. Explore market size, CAGR, and strategic outlooks to inform your investment decisions.

Saudi Arabia Luxury Residential Real Estate Industry Market Concentration & Dynamics

The Saudi Arabia luxury residential real estate industry exhibits a moderate to high concentration, with a few dominant players controlling significant market share. Major developers like Dar Al Arkan and Saudi Real Estate Company (Al Akaria) consistently lead in project launches and market penetration. Innovation ecosystems are rapidly evolving, fueled by Vision 2030 initiatives promoting smart city development and sustainable living. Regulatory frameworks are becoming more investor-friendly, encouraging foreign direct investment and streamlining development processes. Substitute products, such as high-end serviced apartments, are gaining traction but have yet to significantly challenge the prevalence of traditional luxury villas and condominiums. End-user trends indicate a growing demand for exclusive amenities, smart home technology, and prime urban locations. Mergers and acquisitions (M&A) activities are on the rise as larger entities seek to consolidate their market position and acquire prime land assets. For instance, the recent partnership between Sedco Development and Hamad M.AlMousa Real Estate Co. signifies strategic consolidation. While specific M&A deal counts are proprietary, the increasing pace of such collaborations points to a maturing market.

Saudi Arabia Luxury Residential Real Estate Industry Industry Insights & Trends

The Saudi Arabia luxury residential real estate industry is poised for substantial growth, driven by robust economic expansion and ambitious government initiatives. The Kingdom's Vision 2030 blueprint is a primary catalyst, focusing on diversifying the economy away from oil, fostering tourism, and enhancing the quality of life for its citizens. This translates into a significant demand for premium residential properties that cater to the aspirations of a growing affluent population and an increasing number of expatriates. The estimated market size for luxury residential real estate in Saudi Arabia is projected to reach tens of billions of Saudi Riyals, with a Compound Annual Growth Rate (CAGR) of approximately 7-9% during the forecast period of 2025–2033. Technological disruptions are transforming the industry, with the integration of smart home systems, AI-powered property management, and virtual reality property tours becoming standard expectations. Evolving consumer behaviors are characterized by a preference for integrated communities offering comprehensive lifestyle amenities, including wellness centers, entertainment zones, and green spaces. The demand for sustainable and eco-friendly developments is also gaining momentum as awareness grows. Furthermore, the liberalization of foreign ownership laws and the introduction of attractive investment schemes are drawing in international buyers and developers, further stimulating market activity. The current market size is estimated at approximately 80,000 Million SAR, with a projected CAGR of 8.2% for the forecast period.

Key Markets & Segments Leading Saudi Arabia Luxury Residential Real Estate Industry

The Saudi Arabia luxury residential real estate industry is predominantly led by major metropolitan areas, with Riyadh emerging as the undisputed frontrunner. Its status as the capital city, a burgeoning economic hub, and a center for government and corporate activities positions it as the prime destination for luxury residential developments. Jeddah, with its historical significance, coastal allure, and status as a gateway for pilgrims, also commands a significant share of the luxury market, attracting both local and international clientele seeking waterfront properties and exclusive residential enclaves. The Dammam Metropolitan Area, encompassing key cities like Dammam, Khobar, and Dhahran, is another vital market, driven by its industrial importance and the presence of a highly skilled expatriate workforce.

- Riyadh:

- Drivers: Vision 2030 initiatives transforming it into a global business and tourism hub, significant foreign direct investment, rapid infrastructure development, and the establishment of high-net-worth individuals' residences.

- Dominance Analysis: Riyadh's luxury market is characterized by a proliferation of large-scale integrated developments, including high-rise apartments, luxury condominiums, and expansive villas. Developers like Dar Al Arkan and Rafal Real Estate Development Company are actively shaping its skyline with prestigious projects. The demand is driven by both end-users seeking premium living experiences and investors capitalizing on the city's rapid appreciation potential.

- Jeddah:

- Drivers: Unique coastal location, historical charm, strong tourism sector, and a preference for spacious, well-appointed villas and beachfront apartments.

- Dominance Analysis: Jeddah's luxury segment often features opulent villas and exclusive apartment complexes, many offering stunning Red Sea views. Arabian Homes and Villa Palma Compound are known for their distinctive offerings in this region. The market caters to a discerning clientele seeking privacy, exclusivity, and a relaxed yet sophisticated lifestyle.

- Dammam Metropolitan Area:

- Drivers: Thriving oil and gas industry, growing expatriate population, significant infrastructure projects, and a demand for modern, convenient living spaces.

- Dominance Analysis: The Dammam Metropolitan Area sees demand for a mix of luxury apartments, townhouses, and villas, often located within master-planned communities that provide amenities for families and professionals. Saudi Real Estate Company (Al Akaria) and Abdul Latif Jamal are active in developing projects that cater to this segment.

While Other Cities are showing increasing potential with targeted luxury developments, Riyadh, Jeddah, and the Dammam Metropolitan Area currently represent the core of the Saudi Arabia luxury residential real estate industry, attracting the lion's share of investment and demand.

Saudi Arabia Luxury Residential Real Estate Industry Product Developments

Product developments in the Saudi Arabia luxury residential real estate industry are increasingly focused on creating integrated, smart, and sustainable living experiences. Innovations include the incorporation of advanced smart home technology for seamless control of lighting, climate, security, and entertainment systems. Developers are also prioritizing eco-friendly construction materials and energy-efficient designs, aligning with global sustainability trends and the Kingdom's environmental goals. The market relevance of these developments is high, as discerning buyers seek not only luxury finishes and spacious layouts but also a commitment to well-being and a reduced environmental footprint. Examples include the AI Sedan project, which emphasizes modern design and amenities. This competitive edge is crucial for developers to attract and retain high-net-worth individuals seeking exclusive and forward-thinking residential solutions.

Challenges in the Saudi Arabia Luxury Residential Real Estate Industry Market

The Saudi Arabia luxury residential real estate industry faces several challenges, including:

- Regulatory Hurdles: While improving, navigating complex permitting processes and land acquisition regulations can still present delays and add to project costs.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and cost of high-quality construction materials and specialized finishes, potentially affecting project timelines and budgets.

- Competitive Pressures: The increasing number of domestic and international developers entering the market intensifies competition, requiring developers to offer unique value propositions and superior quality to stand out.

- Economic Sensitivity: The luxury market, while resilient, can be susceptible to broader economic downturns or shifts in disposable income.

Forces Driving Saudi Arabia Luxury Residential Real Estate Industry Growth

Several powerful forces are propelling the growth of the Saudi Arabia luxury residential real estate industry. Economic Diversification under Vision 2030 is creating wealth and attracting foreign investment, leading to increased demand for premium housing. Government Support and Infrastructure Development are transforming cities into modern, liveable hubs with enhanced connectivity and amenities. The Growing Affluent Population, including a rising class of Saudi nationals and a significant expatriate workforce, directly fuels the demand for high-end properties. Furthermore, Technological Advancements in construction and smart home integration are enhancing the appeal and functionality of luxury residences, making them more attractive to sophisticated buyers.

Challenges in the Saudi Arabia Luxury Residential Real Estate Industry Market

Long-term growth catalysts in the Saudi Arabia luxury residential real estate industry are multifaceted. Continued Investment in Mega-Projects like NEOM and other giga-projects are creating new economic centers and attracting a high-caliber workforce, necessitating a robust supply of luxury residences. Innovation in Sustainable and Smart Living will be crucial, as demand for eco-friendly and technologically advanced homes grows. Strategic Partnerships and Joint Ventures, such as the one between Sedco Development and Hamad M.AlMousa Real Estate Co., are vital for large-scale developments and market expansion. The Development of Integrated Lifestyle Communities that offer comprehensive amenities beyond just housing, will also be a key driver for sustained growth.

Emerging Opportunities in Saudi Arabia Luxury Residential Real Estate Industry

Emerging opportunities in the Saudi Arabia luxury residential real estate industry are vast. The increasing focus on Tourism and Entertainment is creating demand for luxury holiday homes and branded residences. The Growth of the Tech Sector is attracting a new generation of affluent professionals seeking modern, connected living spaces. Sustainable and Wellness-Focused Developments present a significant opportunity as consumer preferences shift towards health and environmental consciousness. Furthermore, the Expansion into Secondary Cities with emerging economic potential, driven by government decentralization efforts, offers untapped markets for luxury properties. The integration of Artificial Intelligence and IoT in property management and living experiences will also open new avenues for innovation and premium service offerings.

Leading Players in the Saudi Arabia Luxury Residential Real Estate Industry Sector

- Villa Palma Compound

- Jabal Omar

- Arabian Homes

- Dar Al Arkan

- Abdul Latif Jamal

- AL Nassar

- AI Sedan

- Rafal Real Estate Development Company

- Sedco Development

- Alfirah United Company for Real Estate

- Saudi Real Estate Company (Al Akaria)

Key Milestones in Saudi Arabia Luxury Residential Real Estate Industry Industry

- May 2023: Sedco Development partnered with Hamad M.AlMousa Real Estate Co. to develop a new 1.9 million square meter land development in Al-Qadisiyah, Riyadh. This initiative underscores SEDCO'S strategic focus on establishing Riyadh as a pivotal business, commercial, and residential hub.

- April 2023: Dar Al Arkan, a leading Saudi real estate developer, launched "Ai Masyuf," a new residential project in Riyadh, offering diverse housing options including villas, townships, and apartments, catering to a broad spectrum of luxury residential demands.

Strategic Outlook for Saudi Arabia Luxury Residential Real Estate Industry Market

The strategic outlook for the Saudi Arabia luxury residential real estate industry is exceptionally positive, driven by strong government backing and a rapidly evolving socio-economic landscape. The Kingdom's commitment to economic diversification and creating a high quality of life will continue to fuel demand for premium residential offerings. Key growth accelerators include the ongoing development of mega-projects, the increasing adoption of smart and sustainable technologies, and the expansion of integrated community living. Developers who focus on innovation, customer experience, and strategic partnerships will be well-positioned to capitalize on the substantial future market potential, ensuring sustained growth and profitability within this dynamic sector.

Saudi Arabia Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. Riyadh

- 2.2. Jeddah

- 2.3. Dammam Metropolitan Area

- 2.4. Other Cities

Saudi Arabia Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Luxury Residential Real Estate Industry Regional Market Share

Geographic Coverage of Saudi Arabia Luxury Residential Real Estate Industry

Saudi Arabia Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Disposable Incomes4.; Government Initiatives4.; Growing Expatriate Population

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Framework4.; The Risk of Oversupply

- 3.4. Market Trends

- 3.4.1. Demand for Apartments remains High due to Cultural Preferences in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Riyadh

- 5.2.2. Jeddah

- 5.2.3. Dammam Metropolitan Area

- 5.2.4. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Villa Palma Compound

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jabal Omar

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arabian Homes

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dar AI Arkan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abdul Latif Jamal

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AL Nassar**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AI Sedan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rafal Real Estate Development Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sedco Development

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alfirah United Company for Real Estate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Saudi Real Estate Company (Al Akaria)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Villa Palma Compound

List of Figures

- Figure 1: Saudi Arabia Luxury Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Luxury Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by City 2020 & 2033

- Table 3: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by City 2020 & 2033

- Table 6: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Luxury Residential Real Estate Industry?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Saudi Arabia Luxury Residential Real Estate Industry?

Key companies in the market include Villa Palma Compound, Jabal Omar, Arabian Homes, Dar AI Arkan, Abdul Latif Jamal, AL Nassar**List Not Exhaustive, AI Sedan, Rafal Real Estate Development Company, Sedco Development, Alfirah United Company for Real Estate, Saudi Real Estate Company (Al Akaria).

3. What are the main segments of the Saudi Arabia Luxury Residential Real Estate Industry?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.63 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Disposable Incomes4.; Government Initiatives4.; Growing Expatriate Population.

6. What are the notable trends driving market growth?

Demand for Apartments remains High due to Cultural Preferences in Saudi Arabia.

7. Are there any restraints impacting market growth?

4.; Regulatory Framework4.; The Risk of Oversupply.

8. Can you provide examples of recent developments in the market?

May 2023: Sedco Development has partnered with Hamad M.AlMousa Real Estate Co. to develop a new 1.9 million square meter land development in Al-Qadisiyah, Riyadh. The project is part of SEDCO'S real estate strategy to make Riyadh a key business, commercial, and residential hub.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence