Key Insights

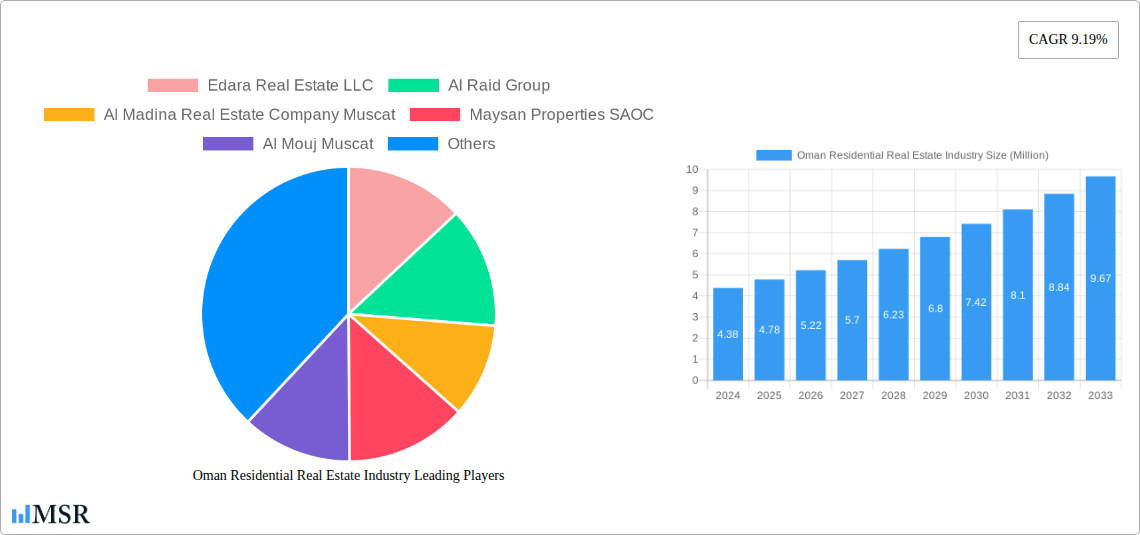

The Oman Residential Real Estate Industry is poised for significant expansion, currently valued at $4.38 million and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 9.19% through 2033. This dynamic market is fueled by several key drivers, including increasing foreign direct investment in the real estate sector, government initiatives aimed at diversifying the economy beyond oil, and a growing expatriate population seeking quality housing solutions. Furthermore, the demand for modern living spaces, particularly in key cities like Muscat and Dhofar, is on the rise, spurred by infrastructural development and a burgeoning tourism sector. The market is segmented into distinct property types, with Apartments and Condominiums catering to urban professionals and smaller families, while Villas and Landed Houses attract those seeking more space and privacy. These segments are experiencing varied growth rates, influenced by evolving lifestyle preferences and investment opportunities within specific geographic hubs.

Oman Residential Real Estate Industry Market Size (In Million)

The industry's upward trajectory is also supported by a focus on developing integrated lifestyle communities and smart city initiatives, enhancing the appeal of residential properties. However, certain challenges, such as fluctuating construction costs and evolving regulatory frameworks, could temper rapid growth. Despite these, the overall outlook remains highly positive. Major players like Al Mouj Muscat, Edara Real Estate LLC, and Savills are actively shaping the market landscape through innovative projects and strategic expansions. The trend towards sustainable and eco-friendly housing is also gaining traction, aligning with global environmental consciousness and presenting new avenues for development. The market's substantial growth potential underscores its importance as an investment destination and a key contributor to Oman's economic diversification goals.

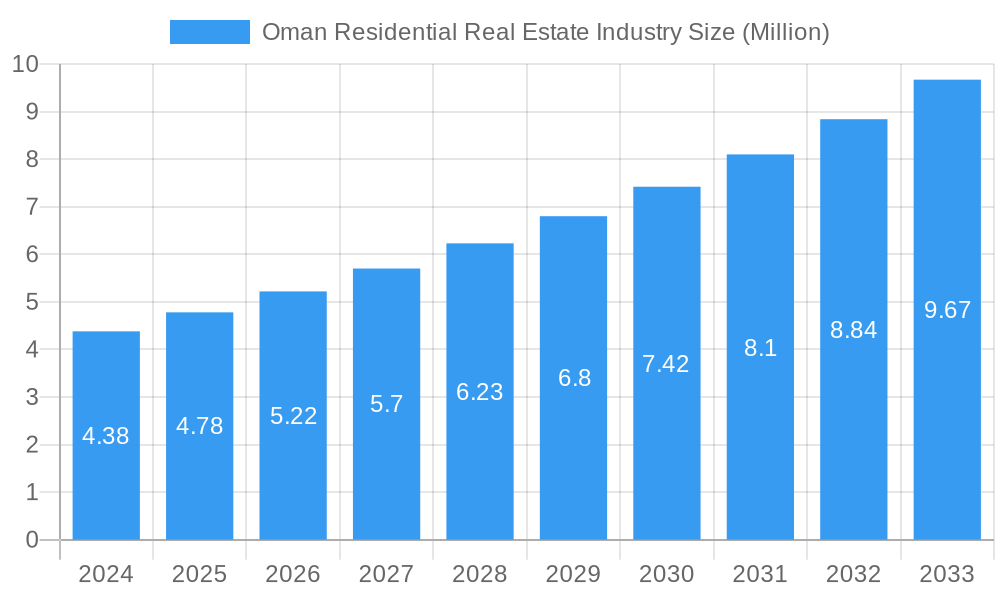

Oman Residential Real Estate Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Oman residential real estate market, providing critical insights for real estate developers, investors, property consultants, and industry stakeholders. Delving into market dynamics, growth drivers, and emerging opportunities, this report leverages a robust study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025–2033. Explore the Oman property market's evolution, segmentation, and the impact of key developments on its trajectory.

Oman Residential Real Estate Industry Market Concentration & Dynamics

The Oman residential real estate industry exhibits a moderate level of market concentration, with a few dominant players alongside a growing number of smaller, specialized firms. Innovation is primarily driven by developers focusing on luxury apartments and condominiums and exclusive villas and landed houses. The regulatory framework, overseen by governmental bodies, aims to foster investor confidence and streamline property transactions, though evolving policies continue to shape the landscape. Substitute products, such as rental markets and alternative investment avenues, exert some influence, but the desire for homeownership remains a strong end-user trend. Mergers and acquisitions (M&A) activities are anticipated to increase as established companies seek to expand their portfolios and market share. While specific M&A deal counts are still emerging, recent trends suggest strategic consolidations and partnerships are becoming more prevalent to capitalize on growth segments within the Oman real estate sector. Market share distribution is dynamic, with leading companies like Al Mouj Muscat and Edara Real Estate LLC consistently demonstrating strong performance in prime locations.

Oman Residential Real Estate Industry Industry Insights & Trends

The Oman residential real estate industry is poised for significant growth, driven by robust economic diversification initiatives, a burgeoning expatriate population, and increasing disposable incomes. The market size, estimated at approximately xx Million OMR in the base year of 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. Key growth drivers include government investments in infrastructure development, particularly in Muscat, and the introduction of attractive visa schemes aimed at foreign investors and skilled professionals. Technological disruptions are transforming the industry, with increased adoption of digital marketing platforms, virtual property tours, and PropTech solutions enhancing buyer engagement and operational efficiency. Evolving consumer behaviors are shifting towards sustainable living, smart home technologies, and flexible living spaces, particularly in the apartments and condominiums segment. The demand for premium villas and landed houses also continues to be strong, fueled by a desire for privacy and larger living areas. The Oman property market's resilience is further underscored by a growing focus on community-centric developments and lifestyle amenities.

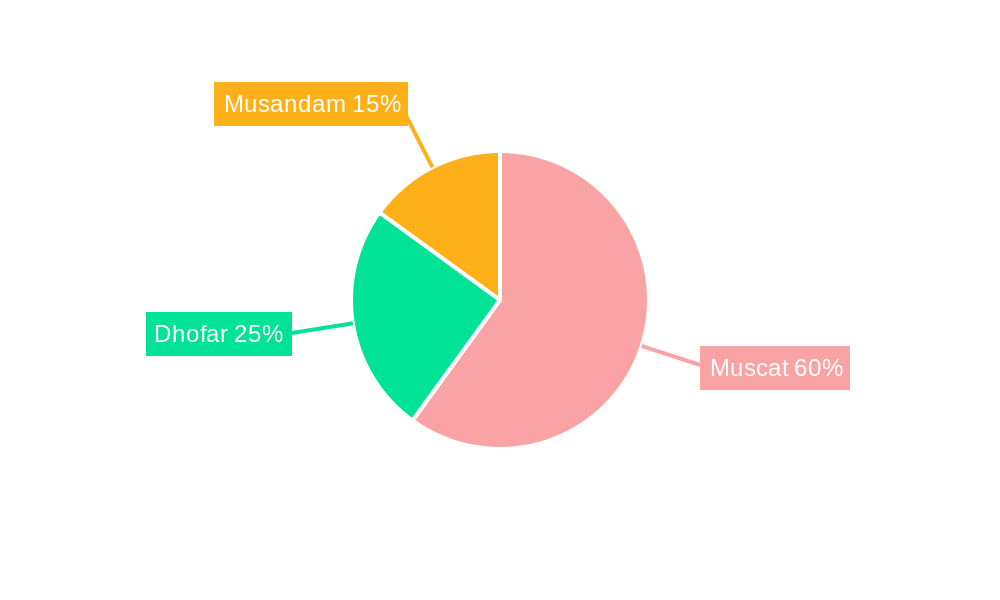

Key Markets & Segments Leading Oman Residential Real Estate Industry

The Oman residential real estate industry is prominently led by the capital city, Muscat, which consistently outperforms other regions in terms of transaction volumes and property values. This dominance is attributed to its status as the primary economic hub, offering extensive employment opportunities and a high concentration of expatriates. Dhofar is emerging as a significant growth region, particularly for tourism-related real estate and lifestyle developments, attracting both local and international interest. Musandam is also gaining traction, with its unique coastal appeal and potential for niche luxury developments.

Dominance of Apartments and Condominiums in Muscat:

- Economic Growth: Muscat's status as the economic engine of Oman attracts a significant influx of professionals, fueling demand for modern and conveniently located apartments and condominiums.

- Infrastructure Development: Ongoing investments in urban infrastructure, public transport, and commercial centers within Muscat make apartment living an attractive and practical choice.

- Expatriate Population: A large expatriate workforce actively seeks rental and ownership opportunities in apartments and condominiums, contributing substantially to market liquidity.

- Developer Focus: Major developers like Al Raid Group and Maysan Properties SAOC are actively launching new apartment and condominium projects, catering to diverse buyer preferences in terms of size, amenities, and price points.

Growth of Villas and Landed Houses in Affluent Districts and Emerging Suburbs:

- Lifestyle Preferences: A segment of the Omani population and affluent expatriates prioritize space, privacy, and family-oriented living, driving demand for villas and landed houses.

- Premium Developments: Projects like those spearheaded by Al Mouj Muscat and Saraya Bandar Jissah offer exclusive villa communities with integrated lifestyle amenities, commanding premium prices and attracting high-net-worth individuals.

- Investment Potential: Larger land parcels and villas are also viewed as long-term investment assets, particularly in developing areas with potential for capital appreciation.

- Strategic Land Acquisition: Companies like Wujha Real Estate, in partnership with Oman Post and Asyad Express, are strategically acquiring and developing land for comprehensive housing projects, including villas, to meet evolving demand.

Oman Residential Real Estate Industry Product Developments

Recent product developments in the Oman residential real estate sector highlight a clear trend towards luxury, sustainability, and integrated living. Al Mouj Muscat’s launch of phase 2 of Zunairah Mansions in the Shatti District exemplifies this, offering opulent six-bedroom mansions with expansive built-up areas, extensive garage space for up to six automobiles, and dedicated servant quarters. This caters to a discerning clientele seeking unparalleled comfort and privacy. Furthermore, there's a growing emphasis on smart home integration, energy-efficient designs, and community-centric amenities, such as landscaped gardens, recreational facilities, and retail spaces, enhancing the overall living experience and competitive edge for developers.

Challenges in the Oman Residential Real Estate Industry Market

The Oman residential real estate market faces several challenges that could impact its growth trajectory. Regulatory hurdles, including lengthy approval processes for new developments and potential changes in property ownership laws for foreign investors, can lead to delays and increased costs. Supply chain disruptions, while easing, can still affect construction timelines and material availability, impacting project delivery. Intense competition among developers, particularly in established segments like apartments and condominiums in Muscat, can put pressure on profit margins. Furthermore, economic fluctuations and global market uncertainties can influence buyer confidence and investment appetite, potentially slowing down sales and price appreciation. The estimated impact of these challenges on market growth is approximately xx% reduction in projected sales volume in the short term.

Forces Driving Oman Residential Real Estate Industry Growth

Several key forces are propelling the Oman residential real estate industry forward. Government initiatives, such as the introduction of the Green Visa and the focus on economic diversification through Vision 2040, are attracting skilled expatriates and investors, directly boosting demand for housing. Infrastructure development, including new road networks and urban expansions, enhances connectivity and desirability of various locations. The growing young Omani population entering the housing market, coupled with an increasing expatriate workforce, provides a consistent and expanding customer base. Furthermore, the availability of attractive financing options and competitive mortgage rates from local banks is making property ownership more accessible.

Challenges in the Oman Residential Real Estate Industry Market

Long-term growth catalysts for the Oman residential real estate industry lie in continued innovation and strategic market expansion. The ongoing development of integrated communities that offer a blend of residential, retail, and recreational facilities, akin to successful models globally, will be crucial. Embracing advanced construction technologies, such as modular building and 3D printing, could significantly improve efficiency and reduce costs. Strategic partnerships between local developers and international real estate firms, bringing global expertise and capital, are vital for uplifting the market. Furthermore, focusing on niche segments like affordable housing and specialized senior living facilities can unlock new avenues for sustained growth and market diversification.

Emerging Opportunities in Oman Residential Real Estate Industry

Emerging opportunities within the Oman residential real estate industry are abundant, driven by evolving consumer preferences and technological advancements. The burgeoning demand for sustainable and eco-friendly properties presents a significant opportunity for developers focusing on green building practices and renewable energy integration. The rise of remote work is creating demand for larger homes with dedicated office spaces and for properties in more serene, less urbanized locations. The growth of the tourism sector also opens avenues for resort-style residences and vacation homes. Furthermore, the implementation of PropTech solutions, including AI-powered property management and blockchain for secure transactions, will streamline operations and enhance customer experience, creating competitive advantages.

Leading Players in the Oman Residential Real Estate Industry Sector

- Edara Real Estate LLC

- Al Raid Group

- Al Madina Real Estate Company Muscat

- Maysan Properties SAOC

- Al Mouj Muscat

- Coldwell Banker

- Better Homes

- Harbor Real Estate

- Hilal Properties

- Al-Taher Group

- Abu Malak Global Enterprises Muscat

- Savills

- Wujha Real Estate

- Saraya Bandar Jissah

- Orascom Development Holding AG

- Engel & Voelkers

Key Milestones in Oman Residential Real Estate Industry Industry

- October 2022: Al Mouj Muscat launched phase 2 of Zunairah Mansions in the Shatti District. The new phase features six opulent bedrooms, a built-up area of 933 square meters, a garage, covered parking for up to six automobiles, and roomy servant quarters, setting a new benchmark for luxury residential properties.

- April 2022: Oman Post and Asyad Express signed a partnership agreement with WUJHA Real Estate to invest, design, and develop land aligned with the land investment plan, signifying a strategic move to optimize land utilization and drive new real estate projects.

Strategic Outlook for Oman Residential Real Estate Industry Market

The strategic outlook for the Oman residential real estate industry is highly optimistic, driven by a confluence of favorable economic policies, growing investor confidence, and a sustained demand for quality housing. The Oman property market is expected to benefit from continued government support for foreign investment and initiatives to diversify the economy beyond oil. Key growth accelerators will include the development of smart cities, the expansion of integrated lifestyle communities, and a focus on sustainable construction practices. Strategic opportunities lie in tapping into the growing expatriate workforce and catering to the aspirational needs of local homebuyers seeking modern, well-equipped residences. The market's ability to adapt to technological advancements and evolving consumer preferences will be crucial for sustained success.

Oman Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Muscat

- 2.2. Dhofar

- 2.3. Musandam

Oman Residential Real Estate Industry Segmentation By Geography

- 1. Oman

Oman Residential Real Estate Industry Regional Market Share

Geographic Coverage of Oman Residential Real Estate Industry

Oman Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urabanization4.; Increasing government investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market

- 3.4. Market Trends

- 3.4.1. Supply of Residential Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Muscat

- 5.2.2. Dhofar

- 5.2.3. Musandam

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Edara Real Estate LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al Raid Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Madina Real Estate Company Muscat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Maysan Properties SAOC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Al Mouj Muscat

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coldwell Banker

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Better Homes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harbor Real Estate

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hilal Properties

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al-Taher Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Abu Malak Global Enterprises Muscat

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Savills

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Wujha Real Estate

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Saraya Bandar Jissah**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Orascom Development Holding AG

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Engel & Voelkers

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Edara Real Estate LLC

List of Figures

- Figure 1: Oman Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Oman Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Oman Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Oman Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Oman Residential Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Oman Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Oman Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Oman Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Residential Real Estate Industry?

The projected CAGR is approximately 9.19%.

2. Which companies are prominent players in the Oman Residential Real Estate Industry?

Key companies in the market include Edara Real Estate LLC, Al Raid Group, Al Madina Real Estate Company Muscat, Maysan Properties SAOC, Al Mouj Muscat, Coldwell Banker, Better Homes, Harbor Real Estate, Hilal Properties, Al-Taher Group, Abu Malak Global Enterprises Muscat, Savills, Wujha Real Estate, Saraya Bandar Jissah**List Not Exhaustive, Orascom Development Holding AG, Engel & Voelkers.

3. What are the main segments of the Oman Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.38 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urabanization4.; Increasing government investments.

6. What are the notable trends driving market growth?

Supply of Residential Buildings.

7. Are there any restraints impacting market growth?

4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market.

8. Can you provide examples of recent developments in the market?

October 2022, Al Mouj Muscat launched phase 2 of Zunairah Mansions in the Shatti District. The new phase of the mansions comes in different styles and features six opulent bedrooms with a built-up area of 933 square meters, a garage, covered parking for up to six automobiles, and roomy servant quarters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Oman Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence