Key Insights

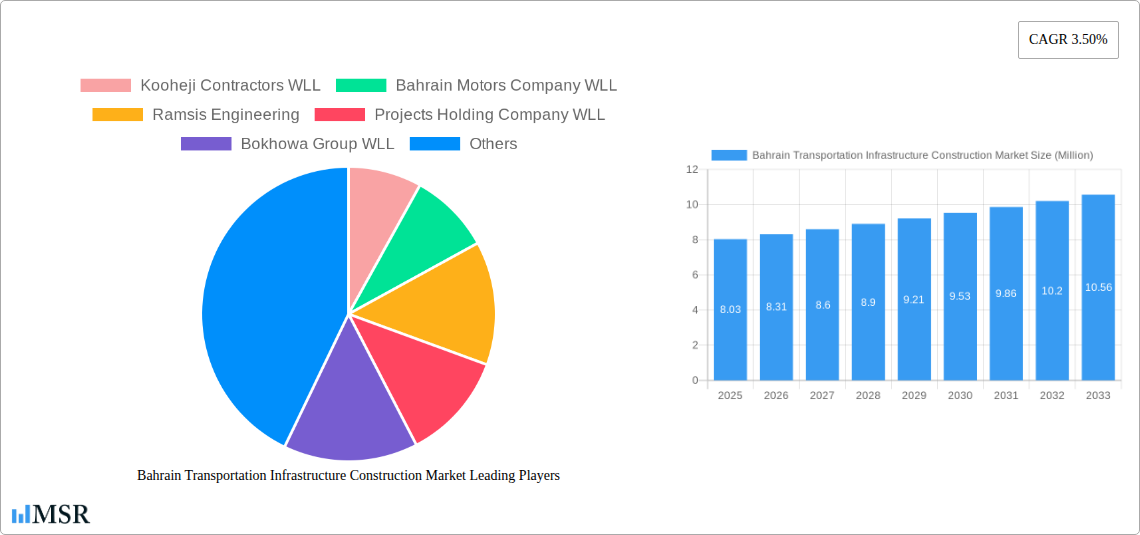

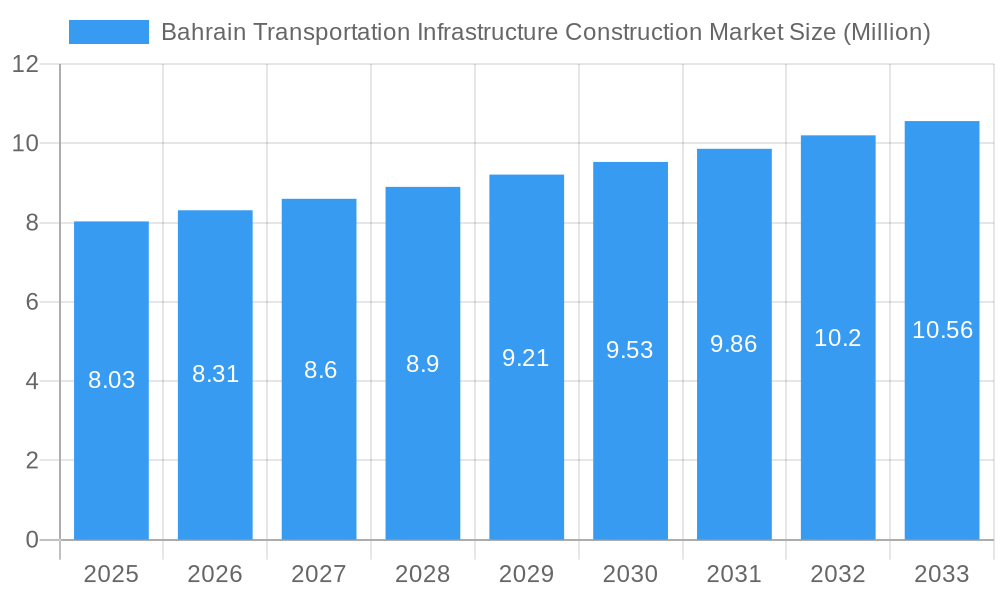

The Bahrain Transportation Infrastructure Construction Market is poised for robust growth, projected to reach approximately $8.03 million in value. This expansion is driven by significant investments in the nation's transport network, aiming to enhance connectivity and facilitate trade. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 3.50% over the forecast period from 2025 to 2033. Key development areas include upgrades and expansion of road networks, modernization of railway systems, enhancements at airports to accommodate increasing air traffic, and strategic improvements to waterway infrastructure for maritime logistics. These initiatives are crucial for Bahrain's economic diversification and its role as a regional logistics hub.

Bahrain Transportation Infrastructure Construction Market Market Size (In Million)

The market's trajectory is supported by several prevailing trends, including the increasing adoption of smart technologies in transportation for improved efficiency and safety, a focus on sustainable construction practices and materials, and the growing demand for multimodal transportation solutions. These trends are shaping the nature of infrastructure projects, emphasizing innovation and environmental consciousness. However, the market also faces certain restraints, such as fluctuating material costs and the need for skilled labor to execute complex projects. Nevertheless, the government's commitment to infrastructure development, coupled with private sector participation, is expected to largely offset these challenges, ensuring sustained market dynamism.

Bahrain Transportation Infrastructure Construction Market Company Market Share

Dive deep into the burgeoning Bahrain Transportation Infrastructure Construction Market with this in-depth analysis, covering the period from 2019 to 2033. This essential report provides actionable insights for industry stakeholders, investors, and policymakers looking to capitalize on the Kingdom's ambitious development plans. Explore key trends, market dynamics, and future opportunities driving the growth of Bahrain's infrastructure projects, including crucial roads, railways, airports, and waterways construction.

Bahrain Transportation Infrastructure Construction Market Market Concentration & Dynamics

The Bahrain Transportation Infrastructure Construction Market is characterized by moderate concentration, with several prominent local and international players vying for significant Bahrain construction projects. Key companies such as Kooheji Contractors WLL, Bahrain Motors Company WLL, Ramsis Engineering, Projects Holding Company WLL, Bokhowa Group WLL, Delta Construction Co, Down Town Construction Co WLL, Al Hassanain Company WLL, Bahrain Foundation Construction Co WLL, and Eastern Asphalt and Mixed Concrete Co are actively shaping the landscape. Innovation is primarily driven by the adoption of advanced construction technologies and sustainable building practices, spurred by government initiatives promoting smart city development and Bahrain infrastructure development. The regulatory framework is conducive to foreign investment, with clear guidelines for project execution and a focus on enhancing Bahrain's transportation network. Substitute products are limited in the core infrastructure construction domain, but material innovation and modular construction techniques are gaining traction. End-user trends are heavily influenced by the government's vision for economic diversification and the creation of a more connected and accessible Kingdom, leading to increased demand for high-quality, efficient, and sustainable transportation solutions. While merger and acquisition (M&A) activity has been relatively subdued, strategic partnerships and joint ventures are becoming increasingly common to leverage expertise and secure large-scale Bahrain infrastructure contracts. Market share distribution is closely tied to project wins, with companies demonstrating strong track records in delivering complex infrastructure on time and within budget often securing a larger portion of the market.

Bahrain Transportation Infrastructure Construction Market Industry Insights & Trends

The Bahrain Transportation Infrastructure Construction Market is poised for significant growth, driven by a robust pipeline of projects and a clear government commitment to modernizing the nation's connectivity. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 7.5% from the base year 2025 through 2033, with an estimated market size reaching upwards of USD 5,000 Million by the end of the forecast period. This expansion is fueled by a strategic focus on enhancing both internal and external connectivity, supporting economic diversification, and improving the quality of life for residents. Technological disruptions are playing a crucial role, with the increasing adoption of Building Information Modeling (BIM), prefabrication, and sustainable construction materials significantly improving efficiency, reducing costs, and minimizing environmental impact. Evolving consumer behaviors, particularly the growing demand for faster, more efficient, and environmentally friendly transportation options, are compelling developers to integrate innovative solutions into their project designs. The government's Vision 2030 plays a pivotal role, outlining a clear roadmap for infrastructure development, which includes ambitious plans for the expansion and upgrade of road networks, the development of a modern railway system, enhancements to airport facilities to accommodate increased passenger and cargo traffic, and improvements to maritime infrastructure to support trade and tourism. The ongoing digitalization of construction processes and the focus on smart infrastructure are further contributing to the market's dynamic evolution.

Key Markets & Segments Leading Bahrain Transportation Infrastructure Construction Market

The Roads segment is currently the dominant force within the Bahrain Transportation Infrastructure Construction Market. This leadership is driven by several critical factors essential for economic growth and seamless logistical operations.

- Economic Growth: Continuous economic expansion necessitates a robust road network to facilitate the movement of goods and services, connecting industrial zones, commercial hubs, and residential areas efficiently.

- Infrastructure Development: The ongoing expansion of new urban developments, tourism destinations, and industrial parks directly translates into an increased demand for new road construction and the widening and upgrading of existing arteries.

- Connectivity Enhancement: Improving inter-city and intra-city connectivity is a national priority, leading to substantial investments in highway construction, bypasses, and arterial road improvements.

- Smart City Initiatives: The integration of smart traffic management systems and intelligent transportation systems (ITS) in new road projects requires advanced construction techniques and materials, further boosting the segment's growth.

The dominance of the roads segment is evident in the substantial allocation of government budgets towards road projects, which are crucial for supporting Bahrain's ambitions as a regional logistics and business hub. This segment benefits from consistent demand, driven by both new construction and the perpetual need for maintenance and rehabilitation of existing infrastructure to ensure safety and efficiency. The continuous urbanisation and population growth also place a significant strain on the existing road network, necessitating ongoing expansion and improvement projects.

The Railways segment, though currently smaller in value compared to roads, is poised for transformative growth, particularly with the recently announced Bahrain Metro project. This segment's potential is immense, offering a sustainable and efficient alternative for mass transit and freight movement, aligning with the Kingdom's long-term sustainability goals. The successful development of the metro system will not only revolutionize public transportation but also stimulate significant ancillary construction activities.

The Airports segment is experiencing steady growth, driven by Bahrain's strategic location as a regional hub and the continuous efforts to expand air travel capacity and cargo handling facilities. Investments in modernizing terminals, extending runways, and enhancing air traffic control systems are crucial for accommodating the projected increase in passenger and freight traffic, supporting tourism and trade.

The Waterways segment, encompassing port development and coastal infrastructure, is vital for Bahrain's maritime trade and logistics sector. Investments in expanding port capacities, improving dredging operations, and enhancing navigational aids are critical for maintaining and growing Bahrain's position as a key trading gateway in the GCC.

Bahrain Transportation Infrastructure Construction Market Product Developments

Product innovations in the Bahrain Transportation Infrastructure Construction Market are increasingly focused on enhancing sustainability, efficiency, and durability. Advanced materials such as self-healing concrete, high-performance asphalt, and recycled construction aggregates are gaining prominence, offering longer lifespans and reduced environmental footprints. The adoption of modular construction techniques and pre-engineered components is accelerating project delivery times and improving quality control. Furthermore, the integration of smart technologies, including embedded sensors for structural health monitoring and advanced traffic management systems, is transforming traditional infrastructure into intelligent networks, enhancing operational efficiency and safety, and providing a significant competitive edge in winning complex and forward-thinking Bahrain infrastructure bids.

Challenges in the Bahrain Transportation Infrastructure Construction Market Market

The Bahrain Transportation Infrastructure Construction Market faces several key challenges that can impact project timelines and budgets. Regulatory hurdles, including complex permitting processes and stringent environmental impact assessments, can cause delays. Supply chain disruptions, particularly for specialized materials and equipment, can lead to increased costs and project postponements. Furthermore, intense competitive pressures among established players and emerging firms can drive down profit margins on large-scale Bahrain construction projects. The skilled labor shortage, especially for specialized construction roles, remains a persistent issue, potentially impacting project execution quality and speed.

Forces Driving Bahrain Transportation Infrastructure Construction Market Growth

Several powerful forces are propelling the growth of the Bahrain Transportation Infrastructure Construction Market. Foremost is the Bahrain Economic Vision 2030, which outlines a comprehensive strategy for economic diversification and infrastructure development, creating a robust pipeline of Bahrain infrastructure projects. Significant government investment in upgrading and expanding the nation's transportation network, including ambitious plans for public transport and logistics facilities, is a major catalyst. Technological advancements, such as the adoption of BIM and advanced construction machinery, are enabling more efficient and cost-effective project delivery. Furthermore, Bahrain's strategic geographical location and its ambition to be a regional logistics hub are driving demand for world-class transportation infrastructure.

Challenges in the Bahrain Transportation Infrastructure Construction Market Market

Looking ahead, the long-term growth catalysts for the Bahrain Transportation Infrastructure Construction Market are deeply intertwined with its commitment to innovation and sustainability. The successful execution of the Bahrain Metro project will not only redefine urban mobility but also create significant follow-on opportunities in related infrastructure development. Continued investment in renewable energy infrastructure to power transportation systems and the development of smart city solutions will further drive demand for specialized construction services. The increasing focus on developing advanced logistics and warehousing facilities to support e-commerce growth will also contribute to sustained market expansion. Strategic partnerships between local and international firms will continue to foster knowledge transfer and enhance the capacity to undertake mega-projects, ensuring sustained growth.

Emerging Opportunities in Bahrain Transportation Infrastructure Construction Market

Emerging opportunities in the Bahrain Transportation Infrastructure Construction Market lie in the burgeoning sectors of sustainable transportation and smart city integration. The development of electric vehicle (EV) charging infrastructure, alongside the expansion of dedicated cycling and pedestrian pathways, presents new avenues for growth. The increasing emphasis on developing green buildings and sustainable urban environments will fuel demand for eco-friendly construction materials and techniques. Furthermore, the potential for private sector participation in Public-Private Partnerships (PPPs) for infrastructure development offers innovative financing models and expanded project scopes. The ongoing digital transformation also opens doors for companies specializing in smart infrastructure solutions and data analytics for transportation management.

Leading Players in the Bahrain Transportation Infrastructure Construction Market Sector

- Kooheji Contractors WLL

- Bahrain Motors Company WLL

- Ramsis Engineering

- Projects Holding Company WLL

- Bokhowa Group WLL

- Delta Construction Co

- Down Town Construction Co WLL

- Al Hassanain Company WLL

- Bahrain Foundation Construction Co WLL

- Eastern Asphalt and Mixed Concrete Co

Key Milestones in Bahrain Transportation Infrastructure Construction Market Industry

- February 2023: Delhi Metro Rail Corporation (DMRC) awarded a significant contract for Bahrain Metro's Phase-1 Project, entailing the construction of a 20-station, 30.30-kilometer network. This landmark deal, valued at USD 2 billion, includes an MOU with BEML Limited for rolling stock production and supply, with DMRC providing expertise in planning and budgeting for the USD 2 billion project.

- November 2022: Sierra Nevada Corporation (SNC) and Texel Air Bahrain inked an MOU to form a strategic partnership to enhance Middle Eastern and global aviation potential. This collaboration includes establishing a special-purpose vehicle to fund Texel's fleet and facility expansion in Bahrain, a move that strengthens Bahrain's position in the air cargo and MRO sectors. Texel Air's fleet expansion, including the addition of a second B737-800 Boeing Converted Freighter (BCF) and plans for further conversions in 2023, underscores the growth in aviation logistics.

Strategic Outlook for Bahrain Transportation Infrastructure Construction Market Market

The strategic outlook for the Bahrain Transportation Infrastructure Construction Market is highly positive, driven by the government's unwavering commitment to transforming the Kingdom into a regional hub for trade, logistics, and tourism. Future growth will be accelerated by the continued investment in smart infrastructure, sustainable transportation solutions, and the expansion of digital connectivity. The successful implementation of the Bahrain Metro project will serve as a major catalyst, unlocking further opportunities in urban development and public transport. Strategic collaborations, innovative financing models like PPPs, and the adoption of cutting-edge construction technologies will be crucial for maximizing future market potential and ensuring Bahrain solidifies its position as a leader in regional infrastructure development.

Bahrain Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roads

- 1.2. Railways

- 1.3. Airports

- 1.4. Waterways

Bahrain Transportation Infrastructure Construction Market Segmentation By Geography

- 1. Bahrain

Bahrain Transportation Infrastructure Construction Market Regional Market Share

Geographic Coverage of Bahrain Transportation Infrastructure Construction Market

Bahrain Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government initiatives and huge investments driving the market4.; Vision 2030 and allied projects driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; High construction costs affecting the market4.; Limited land availability affecting the growth of the market

- 3.4. Market Trends

- 3.4.1. Government initiatives and huge investments driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roads

- 5.1.2. Railways

- 5.1.3. Airports

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kooheji Contractors WLL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bahrain Motors Company WLL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ramsis Engineering

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Projects Holding Company WLL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bokhowa Group WLL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Delta Construction Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Down Town Construction Co WLL**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Al Hassanain Company WLL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bahrain Foundation Construction Co WLL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eastern Asphalt and Mixed Concrete Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kooheji Contractors WLL

List of Figures

- Figure 1: Bahrain Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Bahrain Transportation Infrastructure Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Bahrain Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 2: Bahrain Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Bahrain Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 4: Bahrain Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Transportation Infrastructure Construction Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Bahrain Transportation Infrastructure Construction Market?

Key companies in the market include Kooheji Contractors WLL, Bahrain Motors Company WLL, Ramsis Engineering, Projects Holding Company WLL, Bokhowa Group WLL, Delta Construction Co, Down Town Construction Co WLL**List Not Exhaustive, Al Hassanain Company WLL, Bahrain Foundation Construction Co WLL, Eastern Asphalt and Mixed Concrete Co.

3. What are the main segments of the Bahrain Transportation Infrastructure Construction Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.03 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government initiatives and huge investments driving the market4.; Vision 2030 and allied projects driving the market.

6. What are the notable trends driving market growth?

Government initiatives and huge investments driving the market.

7. Are there any restraints impacting market growth?

4.; High construction costs affecting the market4.; Limited land availability affecting the growth of the market.

8. Can you provide examples of recent developments in the market?

February 2023: A significant milestone is the Delhi Metro Rail Corporation (DMRC) awarded the contract to build Bahrain Metro's Phase-1 Project. The project entails the construction of a 20-station, almost 3030-kilometer network. It has a Memorandum of Understanding (MOU) with BEML Limited, according to DMRC. By the agreement, BEML will assist in the production and supply of rolling stock. On the other hand, DMRC will support the Bahrain Metro Project by offering knowledge in project planning and budgeting and working on contractual duties. It also stated that the arrangement was inked for USD 2 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Bahrain Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence