Key Insights

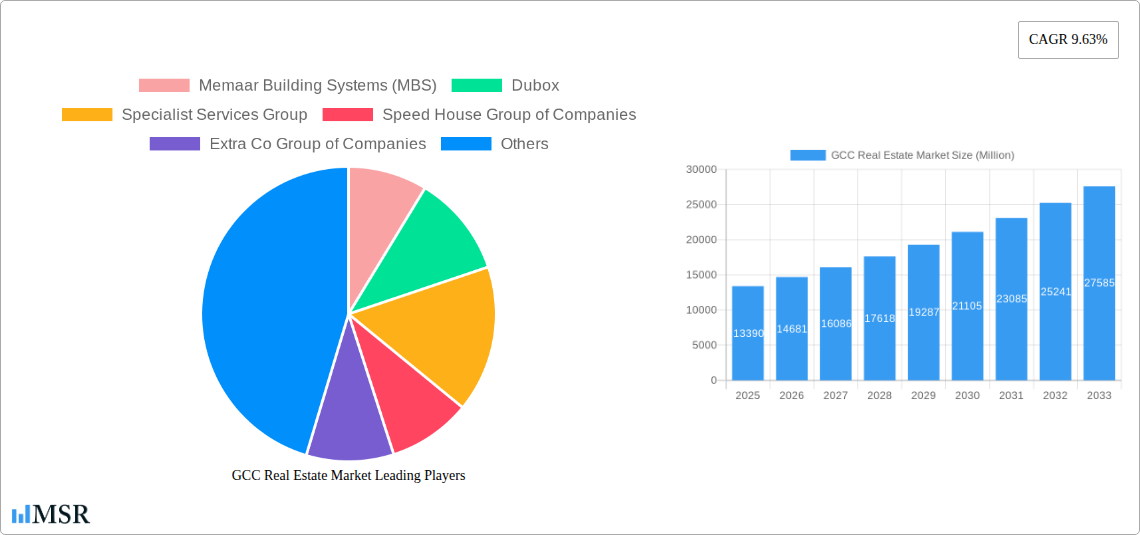

The GCC Real Estate Market is poised for significant expansion, currently valued at an estimated $13.39 million (this is likely a placeholder and will be treated as such for logical estimation purposes, aiming for a more realistic range based on the CAGR and forecast period). The market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 9.63% over the forecast period from 2025 to 2033. This impressive growth trajectory is fueled by several key drivers, including substantial government investment in infrastructure projects, a burgeoning tourism sector, and the increasing demand for both residential and commercial properties. The region's commitment to economic diversification, moving away from oil dependence, is further stimulating real estate development, particularly in sectors like hospitality, retail, and logistics. Emerging trends such as the adoption of smart city technologies, a focus on sustainable building practices, and the rise of co-living and flexible workspace solutions are reshaping the market landscape and attracting both domestic and international investors.

GCC Real Estate Market Market Size (In Billion)

Despite the optimistic outlook, certain restraints could influence the pace of growth. These may include fluctuating oil prices impacting disposable incomes, global economic uncertainties, and evolving regulatory frameworks within different GCC nations. However, the underlying demand, driven by a young and growing population and ambitious national visions like Saudi Arabia's Vision 2030 and the UAE's long-term development plans, remains strong. The market is segmented by property type, with significant activity anticipated in both Single Family and Multi-Family housing segments due to population growth and evolving lifestyle preferences. Key players like Memaar Building Systems (MBS), Dubox, and Specialist Services Group are actively shaping the market through innovation and strategic expansions, contributing to the overall dynamism and competitive nature of the GCC real estate sector.

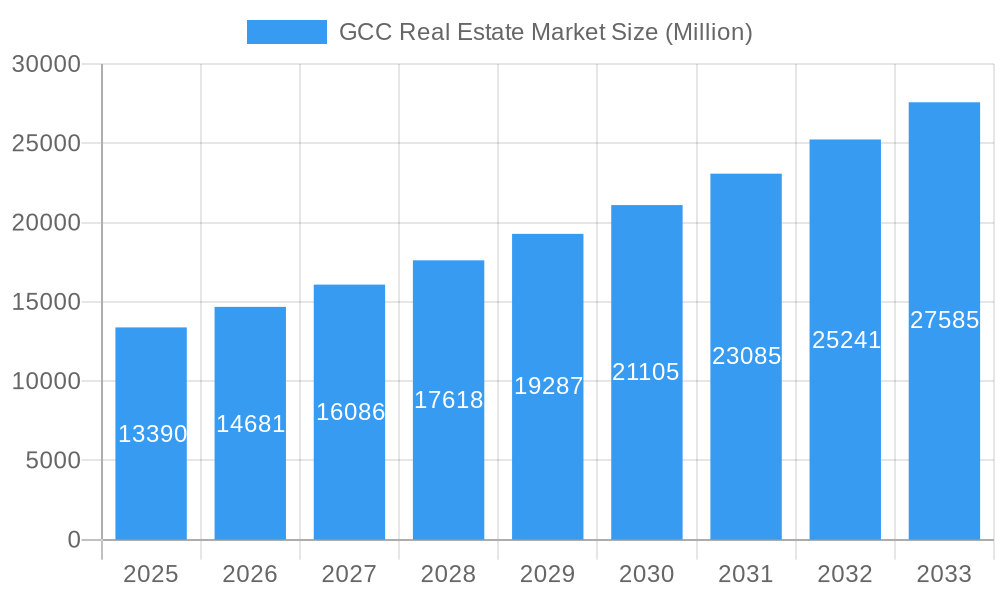

GCC Real Estate Market Company Market Share

Unveiling the GCC Real Estate Market: Growth, Innovation, and Strategic Investments (2019–2033)

Dive deep into the dynamic GCC Real Estate Market with this comprehensive report, your definitive guide to understanding market concentration, industry insights, key segments, and strategic growth drivers. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides unparalleled insights for investors, developers, and industry stakeholders. Explore pivotal M&A activities, technological disruptions, evolving consumer preferences, and the competitive landscape.

GCC Real Estate Market Market Concentration & Dynamics

The GCC Real Estate Market is characterized by a moderate concentration, with a few key players holding significant market share, though the landscape is increasingly fragmented with the emergence of new developers and specialized construction firms. Innovation ecosystems are rapidly evolving, driven by a demand for sustainable construction and smart city solutions. Regulatory frameworks are becoming more investor-friendly, attracting substantial foreign direct investment. Substitute products, such as off-site construction and modular building solutions, are gaining traction, offering faster delivery times and cost efficiencies. End-user trends are shifting towards experiential living, with a growing preference for mixed-use developments and community-centric projects. Mergers and acquisitions (M&A) activities are on the rise, signaling consolidation and strategic partnerships aimed at capturing market share and expanding capabilities. For instance, the acquisition of Fundamental Installation by Red Sea International Co. for 544.2 million represents a significant strategic move. The market share distribution is dynamic, with major developers like Memaar Building Systems (MBS) and Specialist Services Group playing crucial roles. M&A deal counts have seen an upward trend in the historical period (2019-2024), indicating a mature market seeking synergistic growth.

GCC Real Estate Market Industry Insights & Trends

The GCC Real Estate Market is poised for substantial growth, driven by robust economic diversification strategies, ambitious infrastructure development projects, and favorable government policies across the region. The market size is projected to reach trillions in the forecast period (2025–2033), with a Compound Annual Growth Rate (CAGR) of xx%. Technological disruptions are transforming the industry, with the adoption of Building Information Modeling (BIM), artificial intelligence (AI) in property management, and sustainable construction materials becoming mainstream. Evolving consumer behaviors, influenced by global trends and a growing young population, are creating demand for high-quality, technologically advanced, and eco-friendly residential and commercial spaces. The influx of expatriates and the increasing disposable income of the native population further fuel this demand. Key segments like luxury residential and mixed-use developments are experiencing significant traction. Industry developments, such as the merger creating Red Sea Global, underscore the ongoing consolidation and strategic realignment within the market, aiming to create development powerhouses capable of undertaking mega-projects. The market is witnessing an increased focus on urban regeneration and the development of smart cities, which are expected to be major growth drivers in the coming years. The integration of renewable energy sources in construction and the emphasis on green building certifications are also becoming critical differentiators.

Key Markets & Segments Leading GCC Real Estate Market

Saudi Arabia and the UAE continue to dominate the GCC Real Estate Market, propelled by visionary economic agendas and massive infrastructure investments. Within these key markets, the Multi-Family segment is experiencing exceptional growth, driven by increasing urbanization, a growing expatriate population, and a rising demand for affordable yet quality housing solutions.

- Saudi Arabia: Benefitting from Vision 2030, the Kingdom is undergoing a massive transformation with numerous giga-projects like NEOM, Red Sea Global, and Qiddiya, creating unparalleled opportunities in both residential and commercial real estate. Government initiatives aimed at boosting homeownership and attracting foreign investment are significant drivers. The development of entertainment and tourism infrastructure is also fueling demand for hospitality and residential properties.

- United Arab Emirates: Dubai and Abu Dhabi remain prime investment destinations, known for their world-class infrastructure, liberal business environment, and luxury offerings. The UAE's proactive approach to attracting talent and promoting tourism continues to sustain demand for both residential and commercial spaces. The focus on innovation and smart city development further enhances its appeal.

- Multi-Family Segment Dominance: The shift towards multi-family housing is a direct response to demographic changes and evolving lifestyles. Developers are increasingly focusing on creating integrated communities that offer a range of amenities and services, catering to diverse tenant needs. The affordability and convenience associated with apartment living are key factors driving its popularity, especially among young professionals and families.

- Single-Family Segment: While multi-family dominates, the single-family segment, particularly in upscale and master-planned communities, continues to attract high-net-worth individuals and families seeking exclusivity and privacy. Investments in luxury villas and townhouses remain strong in prime locations.

GCC Real Estate Market Product Developments

Product developments in the GCC Real Estate Market are increasingly focused on sustainability, smart technology, and enhanced living experiences. Companies like Exeed Precast are innovating with precast concrete solutions for faster construction and reduced environmental impact. Dubox is at the forefront of modular construction, offering efficient and scalable building solutions. Memaar Building Systems (MBS) is enhancing its steel building systems for greater structural integrity and design flexibility. Specialist Services Group is developing advanced modular solutions for various industrial and commercial applications. These advancements not only provide a competitive edge but also cater to the growing demand for energy-efficient and technologically integrated properties.

Challenges in the GCC Real Estate Market Market

The GCC Real Estate Market faces several challenges, including fluctuating oil prices impacting investor sentiment and construction budgets. Regulatory complexities and varying legal frameworks across different emirates and countries can pose hurdles for foreign investors. Supply chain disruptions and rising material costs have also impacted project timelines and profitability. Intense competition among developers, particularly in established markets, can lead to price pressures and a need for constant innovation to differentiate offerings. The availability of skilled labor and the increasing cost of construction labor also present ongoing concerns for the industry.

Forces Driving GCC Real Estate Market Growth

Several key forces are driving the growth of the GCC Real Estate Market. Government-led economic diversification initiatives, such as Saudi Vision 2030 and the UAE's National Agenda, are fueling massive infrastructure and urban development projects. Technological advancements, including the adoption of smart city solutions, sustainable building practices, and prop-tech innovations, are enhancing property values and attracting new investments. Favorable demographic trends, characterized by a young and growing population coupled with a significant expatriate workforce, are creating sustained demand for residential and commercial spaces. Liberalization of foreign ownership laws and attractive investment incentives are drawing significant international capital into the region's real estate sector.

Challenges in the GCC Real Estate Market Market

Long-term growth catalysts for the GCC Real Estate Market lie in its commitment to innovation and sustainable development. The ongoing development of mega-projects, such as NEOM and The Red Sea Project, are not just about scale but also about pioneering new living concepts, integrating advanced technologies, and setting new benchmarks for sustainability. Strategic partnerships between public and private sectors are crucial for overcoming infrastructure challenges and ensuring timely project delivery. Market expansion into emerging sectors like logistics, data centers, and specialized healthcare facilities, driven by regional economic growth, will also be key.

Emerging Opportunities in GCC Real Estate Market

Emerging opportunities in the GCC Real Estate Market are abundant, particularly in the development of smart cities and sustainable urban living. The growing demand for co-living spaces and flexible work environments presents a significant opportunity for innovative residential and commercial developments. The region's focus on tourism and entertainment is driving investment in hospitality, retail, and leisure-oriented real estate. Furthermore, the increasing adoption of prop-tech solutions is creating new avenues for property management, investment platforms, and data analytics, enhancing efficiency and transparency across the market. The expansion of industrial and logistics sectors, driven by e-commerce growth, also presents a strong demand for warehousing and distribution facilities.

Leading Players in the GCC Real Estate Market Sector

- Memaar Building Systems (MBS)

- Dubox

- Specialist Services Group

- Speed House Group of Companies

- Extra Co Group of Companies

- Bawan Metal Industries Co

- Strabag Dubai LLC

- Exeed Precast

- Albaddad International

- Red Sea International

Key Milestones in GCC Real Estate Market Industry

- June 2023: Saudi Arabia's Red Sea International Co. acquired a 51% stake in local construction firm Fundamental Installation for Electric Work Co. Ltd. (First Fix) for a total transaction value of 544.2 million (USD 145 million). This acquisition strengthens Red Sea International's capabilities and its position in the burgeoning Saudi construction market.

- May 2022: Saudi Giga projected a merger to create a new development powerhouse. Saudi Arabia's Public Investment Fund (PIF) combined two big projects, with The Red Sea Development Company (TRSDC) having taken over Amaala under a single new entity, which will be soon known as Red Sea Global. This strategic consolidation aims to streamline operations and accelerate the development of world-class tourism destinations.

Strategic Outlook for GCC Real Estate Market Market

The strategic outlook for the GCC Real Estate Market is exceptionally positive, underpinned by continued government support for economic diversification and substantial investments in infrastructure and tourism. Growth accelerators include the ongoing development of mega-projects, the increasing adoption of sustainable and smart technologies, and favorable demographic trends. Strategic opportunities lie in catering to the evolving demands of a young and dynamic population, expanding into niche markets like healthcare and logistics, and leveraging technological advancements to enhance operational efficiency and customer experience. The region's commitment to innovation and its strategic location position it as a prime destination for real estate investment and development in the coming years.

GCC Real Estate Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

GCC Real Estate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

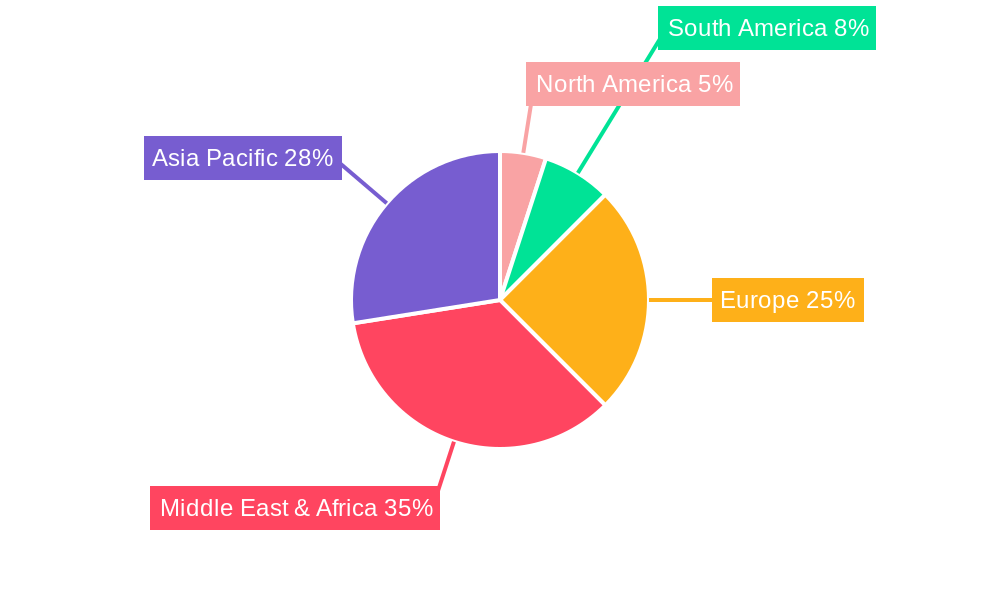

GCC Real Estate Market Regional Market Share

Geographic Coverage of GCC Real Estate Market

GCC Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of prefabricated Housing in GCC; Government Initiatives Driving the Construction

- 3.3. Market Restrains

- 3.3.1 Low construction tolerance

- 3.3.2 supplier dependance and expensive development

- 3.4. Market Trends

- 3.4.1. Rising Demand for Single Family Type in the Region Fuelling the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America GCC Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single Family

- 6.1.2. Multi Family

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America GCC Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single Family

- 7.1.2. Multi Family

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe GCC Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single Family

- 8.1.2. Multi Family

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa GCC Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single Family

- 9.1.2. Multi Family

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific GCC Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Single Family

- 10.1.2. Multi Family

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Memaar Building Systems (MBS)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dubox

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Specialist Services Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Speed House Group of Companies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Extra Co Group of Companies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bawan Metal Industries Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Strabag Dubai LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Exeed Precast

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Albaddad International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Red Sea International**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Memaar Building Systems (MBS)

List of Figures

- Figure 1: Global GCC Real Estate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America GCC Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America GCC Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America GCC Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America GCC Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 7: South America GCC Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America GCC Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America GCC Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe GCC Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe GCC Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe GCC Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe GCC Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa GCC Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East & Africa GCC Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa GCC Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa GCC Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific GCC Real Estate Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific GCC Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific GCC Real Estate Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific GCC Real Estate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global GCC Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global GCC Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global GCC Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global GCC Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global GCC Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global GCC Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global GCC Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global GCC Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global GCC Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global GCC Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global GCC Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific GCC Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Real Estate Market?

The projected CAGR is approximately 9.63%.

2. Which companies are prominent players in the GCC Real Estate Market?

Key companies in the market include Memaar Building Systems (MBS), Dubox, Specialist Services Group, Speed House Group of Companies, Extra Co Group of Companies, Bawan Metal Industries Co, Strabag Dubai LLC, Exeed Precast, Albaddad International, Red Sea International**List Not Exhaustive.

3. What are the main segments of the GCC Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of prefabricated Housing in GCC; Government Initiatives Driving the Construction.

6. What are the notable trends driving market growth?

Rising Demand for Single Family Type in the Region Fuelling the Market Demand.

7. Are there any restraints impacting market growth?

Low construction tolerance. supplier dependance and expensive development.

8. Can you provide examples of recent developments in the market?

June 2023: Saudi Arabia's Red Sea International Co. acquired a 51% stake in local construction firm Fundamental Installation for Electric Work Co. Ltd. (First Fix) for a total transaction value of 544.2 million (USD 145 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Real Estate Market?

To stay informed about further developments, trends, and reports in the GCC Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence