Key Insights

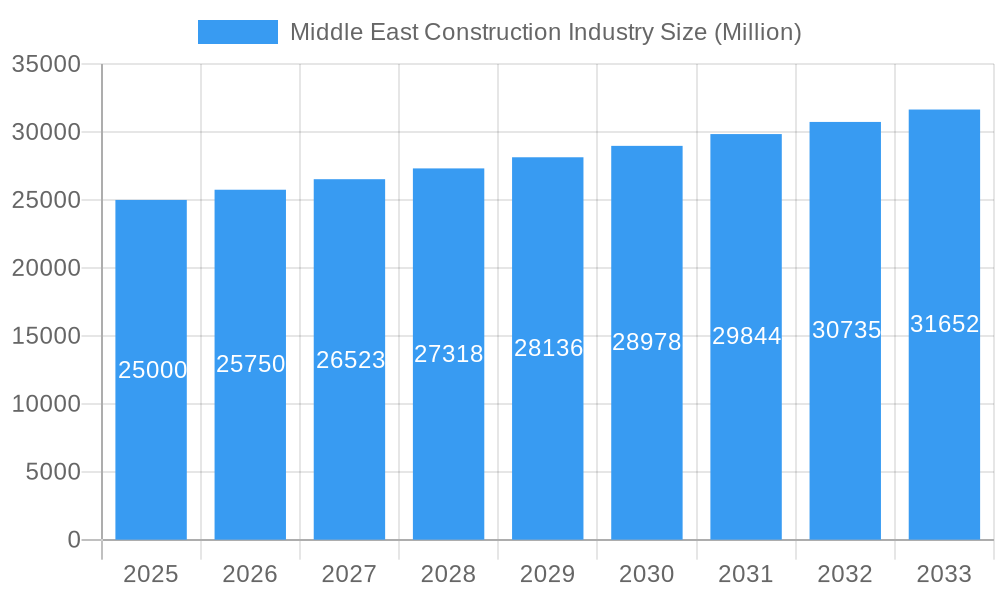

The Middle East construction industry is experiencing robust growth, driven by significant investments in infrastructure projects across the region. A compound annual growth rate (CAGR) exceeding 3% indicates a consistently expanding market, projected to reach substantial value over the forecast period (2025-2033). Key drivers include large-scale government initiatives focused on urban development, tourism expansion, and diversification of national economies away from oil dependence. The increasing adoption of sustainable building practices and advanced construction technologies, such as prefabrication and Building Information Modeling (BIM), further fuels market expansion. While challenges exist, such as material price fluctuations and regional geopolitical uncertainties, the overall outlook remains positive. Segmentation analysis reveals a diverse market, with significant contributions from residential, commercial, and industrial construction. Material-wise, the demand for bitumen, steel, and polymer-based materials is particularly strong, reflecting the varied construction needs of the region. Countries like Saudi Arabia and the UAE represent major market segments, benefitting from robust economic growth and ambitious infrastructure development plans. The consistent influx of foreign investment, particularly in mega-projects, reinforces the industry's positive trajectory. Competitive landscape is dynamic, with both local and international players vying for market share. The industry is expected to witness further consolidation and increased strategic partnerships in the coming years as companies seek to leverage economies of scale and technological advancements.

Middle East Construction Industry Market Size (In Billion)

The long-term growth prospects for the Middle East construction industry remain promising, fueled by ongoing urbanization, population growth, and government initiatives aimed at enhancing infrastructure. However, mitigating risks related to geopolitical instability and supply chain disruptions remains crucial for sustained expansion. The industry’s focus on sustainable and technologically advanced construction methods is likely to shape future market dynamics, with increased demand for eco-friendly materials and digitally driven project management techniques. The continued diversification of the regional economies will further contribute to the growth of the construction sector, creating opportunities for both established and emerging market players. This necessitates strategic adaptation and investment in innovative technologies to ensure competitiveness and sustained growth within this dynamic and evolving sector.

Middle East Construction Industry Company Market Share

Middle East Construction Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East construction industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market dynamics, key trends, and future opportunities within this rapidly evolving sector. The report delves into market segmentation by material (bitumen, rubber, metal, polymer), end-user (residential, commercial, industrial), and country (Saudi Arabia, UAE, Iran, South Africa, Rest of Middle East & Africa), offering granular data and actionable insights. Leading players like Gautruss Pty Ltd, Corrugated Sheet Ltd, Clotan Steel, Ampa Plastics Group Pvt Ltd, Safintra Rwanda Ltd, Algoa Steel & Roofing, Kirby International, Al Shafar Steel Engineering, Palram Industries Ltd, and Youngman are profiled, highlighting their market position and strategies. The report's detailed analysis of market size (valued at xx Million in 2025), CAGR, and future projections provides a clear understanding of the industry's growth trajectory.

Middle East Construction Industry Market Concentration & Dynamics

This section assesses the competitive landscape, innovation dynamics, and regulatory frameworks impacting the Middle East construction industry. Market concentration is analyzed through market share data for key players, revealing a moderately consolidated market with xx% held by the top 5 players in 2025. The report explores the impact of M&A activities, with an estimated xx number of deals occurring between 2019 and 2024, driving consolidation and influencing market share. Further analysis focuses on:

- Innovation Ecosystems: The report examines the role of research and development, technological advancements, and the adoption of sustainable building practices.

- Regulatory Frameworks: An in-depth analysis of building codes, permits, and environmental regulations impacting construction projects across the region.

- Substitute Products: Evaluation of alternative materials and technologies challenging traditional construction methods.

- End-User Trends: Analysis of shifting demands from residential, commercial, and industrial sectors influencing material and construction choices.

Middle East Construction Industry Industry Insights & Trends

This section provides a detailed analysis of the Middle East construction industry's growth drivers, technological disruptions, and evolving consumer behaviors. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Key growth drivers include:

- Rapid Urbanization: The continuous expansion of major cities across the region fuels the demand for housing and infrastructure development.

- Infrastructure Development: Massive investments in transportation networks, energy projects, and public facilities are stimulating growth.

- Tourism Boom: The burgeoning tourism sector in several Middle Eastern countries is driving investment in hospitality and related infrastructure.

- Government Initiatives: Government policies supporting construction and infrastructure development play a pivotal role in shaping market growth.

- Technological Advancements: The adoption of Building Information Modeling (BIM), 3D printing, and other technologies enhances efficiency and productivity.

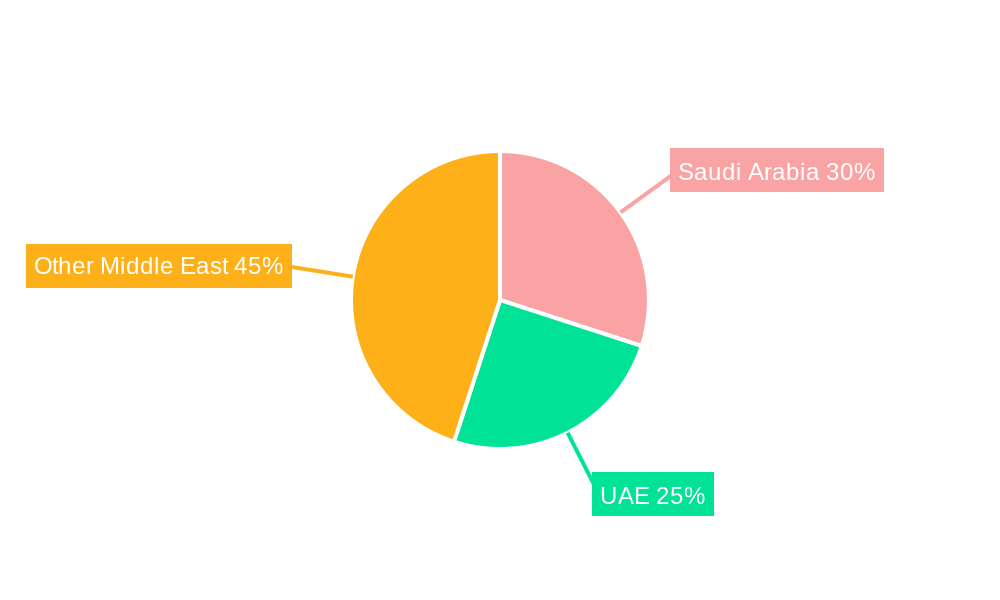

Key Markets & Segments Leading Middle East Construction Industry

This section identifies the dominant regions, countries, and segments within the Middle East construction industry. The analysis reveals that Saudi Arabia and the UAE represent the largest markets, driven by strong economic growth and substantial infrastructure projects.

By Material:

- Metal: High demand driven by the construction of skyscrapers, bridges, and industrial facilities.

- Polymer: Increasing adoption in residential and commercial projects due to cost-effectiveness and versatility.

- Bitumen: Remains crucial for road construction and infrastructure development.

- Rubber: Niche applications in waterproofing and specialized construction elements.

By End User:

- Residential: Strong growth due to population increase and urbanization.

- Commercial: Driven by rising business activity and the need for modern office spaces and retail developments.

- Industrial: Fueled by large-scale industrial projects and manufacturing facilities.

By Country:

- Saudi Arabia: Dominant market due to Vision 2030 initiatives and mega-projects.

- UAE: Strong growth driven by diversification efforts and tourism development.

- Iran: Significant market potential despite economic challenges.

- South Africa & Rest of Middle East & Africa: Showcasing growth opportunities in specific sub-sectors.

Middle East Construction Industry Product Developments

Recent years have witnessed significant product innovation in the Middle East construction industry. The introduction of high-performance materials, prefabricated construction techniques, and sustainable building solutions has improved efficiency and reduced environmental impact. This includes advancements in lightweight concrete, smart building materials, and innovative roofing systems. These developments are improving project timelines, reducing costs, and enhancing the overall quality of construction projects.

Challenges in the Middle East Construction Industry Market

The Middle East construction industry faces several challenges, including:

- Regulatory Hurdles: Complex bureaucratic processes and permit approvals cause project delays.

- Supply Chain Issues: Fluctuations in material prices and logistics complexities disrupt project timelines.

- Labor Shortages: A shortage of skilled labor impacts project execution and efficiency.

- Competitive Pressures: Intense competition among contractors requires efficient cost management. The impact of these challenges on project costs is estimated at xx Million annually.

Forces Driving Middle East Construction Industry Growth

Several factors are driving growth in the Middle East construction industry:

- Government Investments: Massive investments in infrastructure projects, particularly in Saudi Arabia and the UAE, propel market growth.

- Economic Diversification: Efforts to diversify economies beyond oil are leading to investments in various sectors.

- Technological Advancements: Adoption of advanced technologies improves productivity and efficiency.

- Rising Population: Population growth increases the demand for housing and infrastructure.

Long-Term Growth Catalysts in the Middle East Construction Industry

Long-term growth will be driven by ongoing infrastructure development, technological advancements like BIM and 3D printing, and strategic partnerships between local and international companies. Investments in sustainable construction practices and the development of smart cities will also play a major role in shaping the future of the industry.

Emerging Opportunities in Middle East Construction Industry

Emerging opportunities include the growth of green building practices, the increasing demand for prefabricated construction, and the adoption of smart building technologies. Further expansion into renewable energy projects and the development of resilient infrastructure will also offer significant opportunities for growth.

Leading Players in the Middle East Construction Industry Sector

- Gautruss Pty Ltd

- Corrugated Sheet Ltd

- Clotan Steel

- Ampa Plastics Group Pvt Ltd

- Safintra Rwanda Ltd

- Algoa Steel & Roofing

- Kirby International

- Al Shafar Steel Engineering

- Palram Industries Ltd

- Youngman

Key Milestones in Middle East Construction Industry Industry

- 2020: Launch of several mega-projects across the region.

- 2022: Increased adoption of sustainable building practices.

- 2023: Significant investments in smart city infrastructure.

- 2024: Several major M&A deals reshape the market landscape.

Strategic Outlook for Middle East Construction Industry Market

The Middle East construction industry is poised for continued growth, driven by substantial infrastructure investment and technological advancements. Strategic partnerships, adoption of sustainable practices, and focus on innovation will be critical for success. The market presents significant opportunities for companies that can adapt to the evolving dynamics and capitalize on the region's growth trajectory.

Middle East Construction Industry Segmentation

-

1. Material

- 1.1. Bitumen

- 1.2. Rubber

- 1.3. Metal

- 1.4. Polymer

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Middle East Construction Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Construction Industry Regional Market Share

Geographic Coverage of Middle East Construction Industry

Middle East Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urabanization4.; Increasing government investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market

- 3.4. Market Trends

- 3.4.1. Construction Activities Playing a Significant Role in the Construction Sheets Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Bitumen

- 5.1.2. Rubber

- 5.1.3. Metal

- 5.1.4. Polymer

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gautruss Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Corrugated Shhet Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Clotan Steel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ampa Plastics Group Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Safintra Rwanda Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Algoa Steel & Roofing

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kirby International**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Al Shafar Steel Engineering

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Palram Industries Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Youngman

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Gautruss Pty Ltd

List of Figures

- Figure 1: Middle East Construction Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East Construction Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Middle East Construction Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Middle East Construction Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Middle East Construction Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 5: Middle East Construction Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Middle East Construction Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East Construction Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East Construction Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East Construction Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East Construction Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East Construction Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East Construction Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East Construction Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East Construction Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East Construction Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Construction Industry?

The projected CAGR is approximately 5.89%.

2. Which companies are prominent players in the Middle East Construction Industry?

Key companies in the market include Gautruss Pty Ltd, Corrugated Shhet Ltd, Clotan Steel, Ampa Plastics Group Pvt Ltd, Safintra Rwanda Ltd, Algoa Steel & Roofing, Kirby International**List Not Exhaustive, Al Shafar Steel Engineering, Palram Industries Ltd, Youngman.

3. What are the main segments of the Middle East Construction Industry?

The market segments include Material, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urabanization4.; Increasing government investments.

6. What are the notable trends driving market growth?

Construction Activities Playing a Significant Role in the Construction Sheets Market.

7. Are there any restraints impacting market growth?

4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Construction Industry?

To stay informed about further developments, trends, and reports in the Middle East Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence